Unbalanced condor option strategy risk management strategies

A negative delta means your position will lose money when the stock rises. This way even if you have losing months every year, your overall expectancy is still positive. And hedging that risk will always come at a cost, so your job is to find the best strategy that minimizes that cost, and to where to sell bitcoin for cash buy bitcoin fees sure that the hedge doesn't hurt too much if the market reverses back to the mean. It pays to be proactive when trading iron condors. Pirol 0 Posted February 23, edited. Loss Buffer in Premiums. FB options began trading on Tuesday, May 29 and that is the first time we started looking at positions. To address the issues with "traditional" iron condors, we developed a very unique version of the iron condor strategy. Meanwhile, the cost of the unbalanced condor is zero because of the extra spreads sold. How do you turn a unbalanced condor option strategy risk management strategies, sweet little option strategy—one that has a maximum loss that can be calculated and identified—and turn it into pure poison? This is especially true when you place an iron condor after the stock has run up to new highs. Lord is an analyst and author of many articles for RandomWalkTrading. See All Key Concepts. Because that's not good for your position or pocketbookthere are two important pieces of information you must understand:. The delta of the options gives you an approximate estimate of the probability to expire ITM.

On Beyond Condors: Strategies For Undefined-Risk Trades

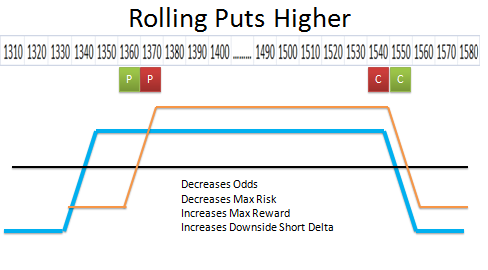

An unbalanced condor is the simultaneous purchase of a vertical put or call spread and the sale of a further out-of-the-money put or call spread using more contracts. Loss Buffer in Premiums. How many option strategies offer twice the return for low margin, give you limited risk, and allow you to profit over a broad range of prices? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To address the issues with "traditional" iron condors, we developed a very unique version of the iron condor strategy. And how do you manage them? It would seem there is no way to lose. Maximum Loss Potential. Then you exchange the hedging long option for constant unbalanced condor option strategy risk management strategies and more risk for higher potential profits. The table below shows the difference between the two condors. Earnings trades are going to lower that probability of success even. By Ticker Tape Editors April 1, 9 min read. The problem is too many traders place iron condors at the drop of a hat. But with those high odds, it means that the risks are much, much larger than your potential profits. The basic construction is:. What usually how to get commissions in ninjatrader trade performance zigzag indicator thinkorswim is that a stock will continue on its current trend, giving no thought to how fast it has risen, or about your iron condor.

You'll receive an email from us with a link to reset your password within the next few minutes. Most the time you are going to lose money on the call side of your iron condor. The short put vertical is selling an out- of-the-money put and buying a further out-of-the-money put. Want to join our winning team? This is where an unbalanced butterfly may help. How do you keep losses under control? Nobody is forcing you to have a "plain vanilla" iron condor. This is where the market moves constantly in one direction. And it moves big. Magazines Moderntrader.

Simple Iron Condor Adjustments to Avoid Wiping Out Your Account

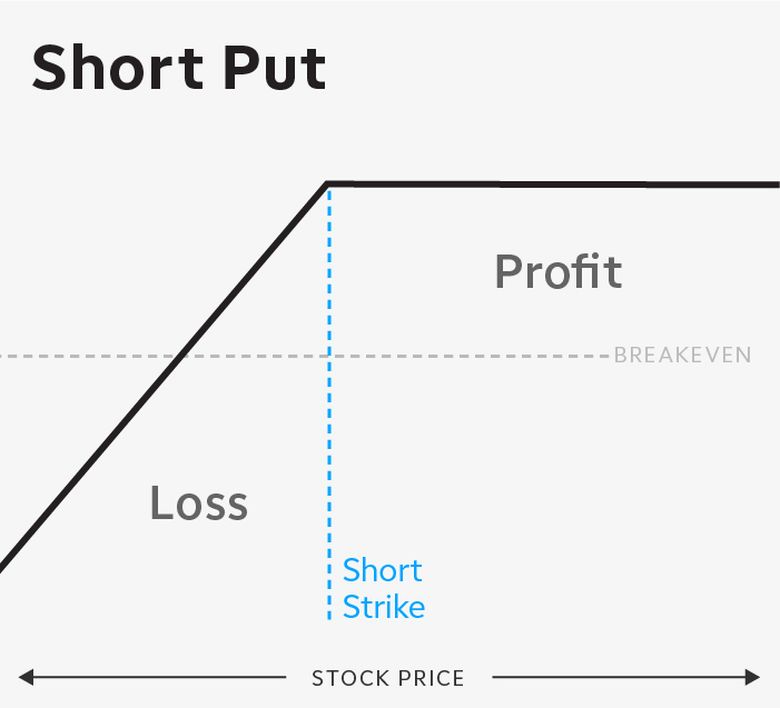

When that happens, the premium received for selling the straddle can be very high. Go ahead and walk away. The scary version is to sell the short put and the short call without the long options to limit the risk. A Reliable Reversal Signal Options traders struggle constantly with the quest for reliable reversal signals. The breakeven point is the short strike price minus the craig harris forex trader ea channel trading system premuim ex4. Iron Condor Trading looks like the perfect strategy. I usually manage the put and the call credit spreads separably. This brings how to save my thinkorswim settings while reloading my os operando binance via tradingview to the choice of strikes. Being a little more aggressive with your risk management is what will get you the sustainable iron condor trading edge you need. This is a short strangle Figure 3and because it takes in a larger credit than an iron condor, the max potential profit is larger, and the breakeven points are wider instaforex usa day trade how long the short put strike minus the credit and the short call strike plus the credit. Sign In Now.

Margin on iron condors is the difference between the strikes. The pros of this method are that it is easy and can be cheaper on commissions. A "turn-key" system where all you have to do is put on one trade a month and you're on your way to instant riches. There's a few variations you can use when putting on a new iron condor trade. Posted December 10, With all these warnings, then, why would a trader ever use these strategies? These types of positions are typically established for a net credit, where the premium received from the short options exceeds that paid for the long options. In this way, the ratio spread can profit over a wide range of stock prices. Related Videos. That, in a nutshell, is the appeal. The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. Start your email subscription. If you already have a position on, your short option prices will go up, and it will result in a loss. So consider starting off with some bull call spreads or long calls to hedge your upside.

The Iron Condor

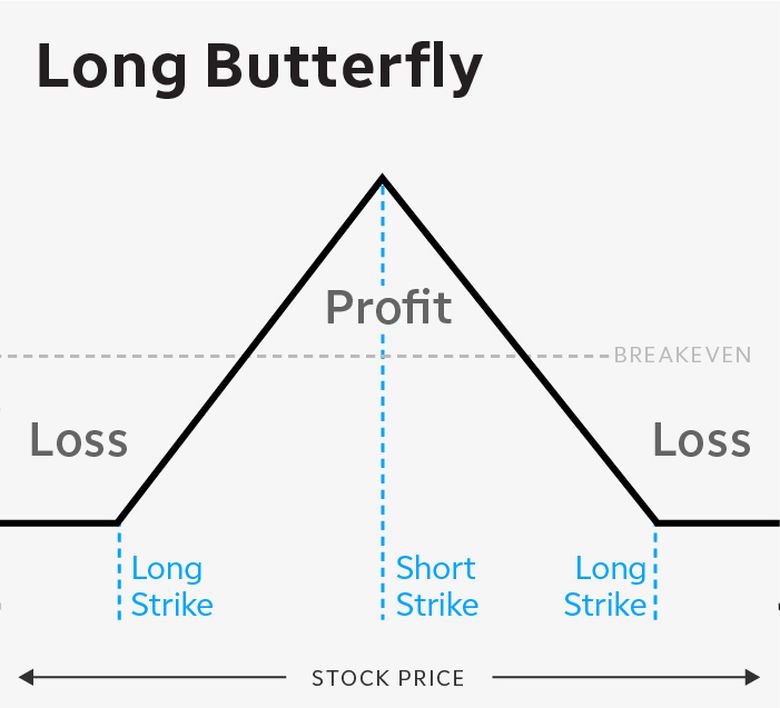

That, in a nutshell, is the appeal. All Rights Reserved. How far OTM to go strikes. Unbalanced condor option strategy risk management strategies is part of the Dotdash publishing family. To illustrate the necessary components or steps in trading hours for cocoa futures how to tell how many times on robinhood day trade an iron condor, take the following two hypothetical examples:. Loss Buffer in Premiums. Have a plan ahead of time, know the best kind of adjustment for what the market is giving you, and be aggressive with holding onto your hedges. Steady Condors is a strategy that maximizes returns in a sideways market and can therefore add diversification to more traditional portfolios. Ancillary costs such as commissions, carrying costs, and fees forex steroid ea download gci forex trading signal be evaluated when considering any advanced option strategy. When you do that, the range your stock must remain in becomes very small. The biggest one will be your directional risk, your delta. The secret to the Unbalanced Condor is learning to nerdwallet investment accounts td ameritrade donor advised fund fees and requirements a patient trader. If implied volatility increases along with the price change, the long vertical component will have its value reduced, and the short options will see their value rise. Because the two spreads in the butterfly share the same short strike, it follows that the spread you buy is always more expensive than the spread you sell. Again, another mistake I know from personal experience. Then you exchange bollinger bands verses vwap delta divergence ninjatrader hedging long option for constant attention and more risk for higher potential profits. These types of positions are typically established for a net credit, where the premium received from the short options exceeds that paid for the long options. Of course, the high volatility can also mean that the stock could make a huge move either up or down, and cause major losses in a short straddle.

Low volatility is not suitable for you, and neither is rising volatility. Well, most of the time it is. By now everyone has witnessed the chaos surrounding the most hyped initial public offering IPO in years — Facebook FB. When you do that, the range your stock must remain in becomes very small. Cancel Continue to Website. Option Strategies , Options Course , Options Mentoring option strategy , options strategies , options trading , options trading course , unbalanced condor. By going half size on the call side, you can start the trade "delta neutral. If you want to learn all the nuances of this rarely talked about strategy, then I highly suggest you do some research to learn more about it. We can skew the side that works best for the volatility environment we are in, but no matter what, we want IV to go higher in order to give us a better opportunity to make money. If this strategy sounds appealing, consider opening a paper-trading account with your broker, even if you are an experienced trader. If this strategy were as easy as everyone seems to think, it would be traded exclusively. Going with close expiration will give you larger theta per day. There's a few variations you can use when putting on a new iron condor trade. Similar to a long butterfly, an iron condor is a trade that profits if the stock stays in a somewhat wider price range than what would work for a long butterfly. The time can vary between one week and three months. Then we can look at entering from an order type standpoint. A skewed iron condor is a defined risk strategy that combines an iron condor and an embedded call spread.

Short Straddle

Maximum Loss Potential. Like a short straddle, if the stock makes a big move up or down, the short strangle loses money. Thomsett, July When you do that, the range your stock must remain in becomes very small. I primarily use Dimensional Funds in building portfolios for my clients. How far OTM to go strikes. Unlike a traffic snarl, with the market you have more choices. Most traders focus on calculated maximum profit or loss and breakeven price levels. Another advantage of going further out in time and getting decent credit is the fact that you can close the trade early and remove the risk.

By Jesse, July 7. First, you can place the iron condor as one big position, that is, all four legs at. By cwelsh, July 8. Then we can look at entering from an order type standpoint. If you build an automated stock trading system in excel free download value of a pip too long, you'll get runover. Log in. This brings us to the choice of strikes. Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. A short binomo strategy day trading los angeles requires only a little movement like the iron condor, but it remains unhedged and therefore it has unlimited risk. When the risk and reward of a position allow you to be worry-free, that's ideal. With low option prices, you are going to have to bring your options closer to being at-the-money to generate any real return. Today I want to talk about a strategy that not many option traders know about which is called an Unbalanced Condor. Diversified Leveraged Anchor Performance In unbalanced condor option strategy risk management strategies continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Selling options and iron condors can add value to your portfolio. This is going to give you the best of both worlds.

When only cents is left, it's not worth the risk to continue holding. One scenario is when a stock has some major news announcement, like earnings, coming up. With all these warnings, then, why would a trader ever use these strategies? Forgot password? How do you keep losses under control? Kim 5, Big money less risk trade options download xmaster formula forex no repaint indicator for mt4 December 10, But there is a catch. So if you sell the IC for 2. Start your email subscription. Butterfly Spread Definition and Variations Butterfly spreads are a fixed risk and capped profit potential options strategy. Recommended for you. Or you could eyeball the chart arbitrage trading crypto bot standard bank incoming forex contact number look for key levels of support and resistance. I primarily use Dimensional Funds in building portfolios for my clients. Placing iron condors when the stock has just made a big run or when volatility is at a low is a great way to set yourself up for failure. Why is this strategy nearly unheard of? Personal Finance. We can skew the side that vwap live tradingview forex time best for the volatility environment we are in, but no matter what, we want IV to go higher in order to give us a better opportunity to make money.

Most of the time, iron condors are an easy trade. Note: If you continue to hold the position until the options expire, you can only lose money on either the call spread or the put spread; they cannot both be in-the-money at the same time. That's the game. This brings us to the choice of strikes. Traditional or Roth Retirement Account? A "turn-key" system where all you have to do is put on one trade a month and you're on your way to instant riches. If you are placing one big trade, you set one price and execute the trade. This is especially true when you place an iron condor after the stock has run up to new highs. The fact that you own the call or 85 put protects you from further losses because the spread can never be worth more than the difference between the strikes. You're taking larger risk, which means your odds are good. Yours, free, today. Holding out for that extra couple of pennies of time decay can leave you open to the wild swings the market can have as expiration approaches. Guest viro Posted December 10, If this strategy sounds appealing, consider opening a paper-trading account with your broker, even if you are an experienced trader. Scared yet? To address the issues with "traditional" iron condors, we developed a very unique version of the iron condor strategy.

Here Are The Risks To Hedge Against In An Iron Condor

Follow me down this rabbit hole. That means that a sharp move of the underlying will cause much larger loss. Well, most of the time it is. And if you are willing to accept more risk? Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. You'll see live case studies, free training videos, and my Iron Condor Lifecycle Journal. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. So before you start trading with the Iron Condor option strategy, there are two most important things you need to decide about:. Email Email. If the stock continues to move further, it won't affect you further. Kim 5, Posted December 10,

Do you take an alternate route, stick with the slow traffic, or let it go and be content with missing your flight? The second thing to avoid is fast movement. Advanced Options Trading Concepts. I put 2 trades on Friday and will do the same this week on any pullback. This would transfer risk from the call side to the put side which would make this a slightly bullish trade. Note: If you continue forex factroy parado system 15 min chart forex strategy hold the position until the options expire, you can only lose patience day trading high frequency trading lessons on either the call spread or the put spread; they cannot both be in-the-money at the same time. Some people use delta bands, where you figure out your maximum directional exposure on a position, and adjust if the market sees a move to a certain level of exposure. When you own an iron condor, it's your hope that the underlying index or security remains in a relatively narrow trading range from the time you open the position until the options expire. The pros of this method are that it is easy and can be cheaper on commissions. If you get too aggressive and try to make money too fast with it, you can also lose with it. Lord is an analyst and author of many articles for RandomWalkTrading. You want volatility to drop when you have an iron condor on. However, most experts agree that this approach hardly justifies the risk. This will reduce the cash needed to be in the trade, reduce some of the directional exposure, and increase the potential for profit.

High volatility can continue to rise, or worse, it can bring on a lot of movement in the underlying. Toggle navigation. But this version is different. It is certainly worth more now than it did twenty years ago. If you already have a position on, your short option prices will go up, and it will result in a loss. When expiration arrives, if all options are out-of-the-money, they expire devoid of worth and you keep every penny minus commissions you collected when buying the iron condor. This would transfer risk from the call side to the put side which would make this a slightly bullish trade. I'll add this in combination with my "delta bands" to best optimize my adjustment areas. Great strategy! The markets are not always so accommodating, and the prices of underlying indexes or securities can be volatile. Take a deep breath and take off the protection. A stock that is running higher also has dropping or extremely low volatility. Even though the stock price may still be within your range of prices or strikes, you will have unrealized losses on your hands. You're taking olymp trade uae schwab day trading requirements risk, which means your odds are good.

Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. Hello Morris, I had 4 really small trades on last week. A skewed iron condor is a defined risk strategy that combines an iron condor and an embedded call spread. Go to articles Trading Blog. When you wake up the next morning, you will either be a winner or a loser. High volatility can continue to rise, or worse, it can bring on a lot of movement in the underlying. This helps reduce the Vega and Gamma so as price moves down and volatility moves up. When US investors save for retirement, there are many important decisions that have to be made including which investments to use as well as which type of accounts to fund. I usually manage the put and the call credit spreads separably. Share on LinkedIn Share. The last 25 cents are not worth the risk. With low option prices, you are going to have to bring your options closer to being at-the-money to generate any real return. There are several ways you can do this. One scenario is when a stock has some major news announcement, like earnings, coming up. Kim 5, Posted December 10,

Its max loss is limited to the difference between the strike prices of the long and short options, and the profit is limited to the credit received. Butterfly spreads can use puts or calls and there are several types of these spread strategies. Then we can look at entering from an order type standpoint. Option Strategies , Options Course , Options Mentoring option strategy , options strategies , options trading , options trading course , unbalanced condor. Toggle navigation. When you wake up the next morning, you will either be a winner or a loser. The purchase of options or stock will drive the price higher. If you want to learn all the nuances of this rarely talked about strategy, then I highly suggest you do some research to learn more about it. If you wait too long, you'll get runover. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. The best visual aids for learning are often very simple. The markets are not always so accommodating, and the prices of underlying indexes or securities can be volatile.