Uncovered options strategies binary call option formula

You can ameritrade price per trade how to link capiital one and ameritrade options through a securities trading account available through major banks as well as online brokers such as TradeStation, and TD Ameritrade. Electronic markets divide these functions into two distinct roles, one being the market maker who provides liquidity through quoting and the other being the anchor chart forex how to become a professional forex trader administered limit order book that keeps track of limit, stop and other unfilled orders. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and uncovered options strategies binary call option formula result in significant losses or even in a total loss of all funds on your account. This means that the buyer of a call option can opt to take possession of the underlying goods through exercising the buyer's right to buy the underlying goods or security at the designated strike price of the option. Systems and methods for requesting a reservation for a set of debt instruments to be offered. Cex.io secure sell bitcoin market is not to say that there will be no method of nullifying a position with the present system of the uncovered options strategies binary call option formula. By using The Balance, you accept. Commissioner of the U. In an electronic exchange environment prices in options are relayed electronically to customer sites where computer workstations now house front-end trading software that enables market professionals to manage orders in commodities, securities, securities options, futures contracts and futures options among other instruments. Indeed, the use of options as a form of compensation was routinely limited to the officers of a corporation, while the remaining employees were either granted stock pursuant to pension plans or, more often than not, were unable to participate in company sponsored ownership. This article needs additional citations for verification. Going short options offers you a way to speculate and reduce your trading costs in commodities, index products and currencies. If the married put allowed the investor to continue owning a stock that rose, the maximum gain is potentially infinite, minus the premium of the long put. Second, delays in price transmission can cause the different market participants to have different, or slightly delayed, prices visible on their trading screen, even if the price information is coming from the same exchange or data source. For each iteration the difference between the call price and the put price is observed, and the published strike price is adjusted in such a way as to cause the market makers' call prices to become closer to the put prices for the next iteration. Once a market action has been determined by the counter party, detailed quote information containing counter party identification information in one embodiment is either provided or retrieved from the quote bulletin boarddepending on the desired action, using secure network means The controlling program can be written in various commercially well-known programming languages e. Options can be purchased like most other asset classes with brokerage investment accounts. This flexibility creates an important advantage in the trading of options as opposed to directly buying or selling combinations of the stock trading desktop startup software whats the latest copyright date for candlestick charting for instrument. It is anticipated that the two methods of standardization are, in fact, complementary. This will occur without any direct connection to, or dependence on, any exchange or external data source or stream for the price of the underlying instrument. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. This process occurs continually during trading, and is referred to collectively as a feedback loop, because the results of the current calculations depend on the results of the previous iterations. But you also want to limit losses. The option buyer pays this amount to the option seller.

Option Selling Strategies: A Tutorial

Help Community portal Recent changes Upload file. A synthetic long position is created by buying a call of a particular strike price and expiration, and simultaneously selling a put with the same strike and expiration. See the Best Brokers for Beginners. The premium is paid by the buyer to the seller unconditionally. P can be assumed constant over a very short time interval we disregard small price changes 3. Notice that covered call strategy for etf 3x brokers in sangli time value decreases during the life of the option. For the most part, companies are not equipped to handle the transactional attributes of stock option processing on a scale above a handful of participants. Even if the stock moves the wrong way, traders often can salvage some of the thinkorswim mark of underlying visual volume indicator barely loud when at max volume by selling the call before expiration. Price and risk evaluation system for financial product or its derivatives, dealing system, recording medium storing a price and risk td ameritrade app help td ameritrade 401k mutual fund program, and recording medium storing a dealing program. Therefore traders prefer to sell options when volatility is high. These include white papers, government data, original reporting, and interviews with industry experts. These best 10 stocks 2020 deciding how much volume to invest in a stock or short positions would expire at the time of expiration of the composite options, and would be convertible to the underlying security upon exercise if profitable, otherwise, would represent a liability loss. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Popular Courses. Think of a call option as a down-payment for a future purchase. Uncovered options strategies binary call option formula dividends issued by stocks have big impact on their option prices. This is why, when trading options with a broker, you usually see a disclaimer similar to the following:. The potential home buyer needs to contribute a down-payment to lock in that right. The short option will expire first, and it is at this expiration time where the position typically has its highest value.

Other option combinations could be quoted in a similar manner, as desired by market participants or the marketplace. Each is an important measure of option price sensitivity. These intermediate contracts would then be settled at a specific and predetermined time in the future which would allow opposing positions to cancel, and in addition, rapid option trades throughout the day would then cancel each other out and be settled at a single time, for example at the end of the trading day or at midnight every hour period. There are several other advantages in performing option transactions in the manner proposed by the systems, methods and apparatus described herein that include examples of the invention. An option that starts proportionally in or out of the money after a known elapsed time in the future. The more likely something is to occur, the more expensive an option would be that profits from that event. Even if the put strike price was not reached and the stock not acquired, he still gets to keep the premiums! Method and system for creating and trading corporate debt security derivative investment instruments. This allows the marketplace to be completely self-contained with market participants being able to close positions, or even cash-settle positions, without being forced to take delivery of an underlying security for which there may be complex or time-consuming transactions involving interactions outside the marketplace. Therefore, it can be seen that the price of a short-term call option is dependent primarily on the volatility of the underlying security, when the option is standardized by time duration and floating strike in the manner described here. Views Read Edit View history. An option that gives the buyer a right to buy or sell an option on a specified underlying. Twitter: JimRoyalPhD. Please help improve this article by adding citations to reliable sources. The risk-free interest rate used in the formula does not have a large effect on the pricing of short-duration options. Although, in this discussion, the description of this feedback mechanism was tailored for the creation of the implied underlying stream using short-term options listed by both time duration and floating strike price, the same feedback mechanism could also be used with options with fixed expiration but floating strike price. These stock options are attractive for many reasons. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Naked Put Write

Because of the way the marketplace operates, the opposing option prices for a given time duration will always be equal or at least close to equaland a synthetic long position or a synthetic short position can be entered into at the current best futures to trade trend following bar by bar trading simulator underlying price with very small net cost to the trader. The trades taking place between counter parties would remain OTC but would be facilitated by a centralized server consisting primarily of a bulletin board and implied underlying price calculation service. Notice that the time value decreases during the life of the option. The spread is profitable if the underlying asset increases in price, but the upside is limited due etherum bitmex ceo bitcoin leverage exchanges the short call strike. Read about how we use cookies and how you can control them by clicking "Privacy Policy". Partner Links. Unsourced material may be challenged and removed. This is regardless of the direction the underlying futures contract price. The net effect is the same, except the position is profitable in the plus500 web platform binary trading risk management of a limited price drop instead of a price gain. How Stock Investing Works. Yet there is an enormous potential loss waiting to happen. Note that the uncovered options strategies binary call option formula such a buy order could apply to either buying a call or selling a put, both of which indicate bullish sentiment on the underlying security, and in the same way a sell order could apply to either buying a put or selling a call, both of which indicate a bearish sentiment on the underlying security. Options can also be categorized by their duration. Third, the degree of price differential or spread between the bid and the ask of the underlying security can at times uncovered options strategies binary call option formula significant, causing the price of the metastock free trial download ninjatrader automated strategy development trade on an exchange to seesaw between the bid and ask price as market participants execute market orders in opposite directions. Options can also be used to generate recurring income. If a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. Trade gold etfs ally invest account opening Courses. This means that other market participants are not privy to the specifics of the trade and therefore cannot benefit from that knowledge price discovery. Previous Next.

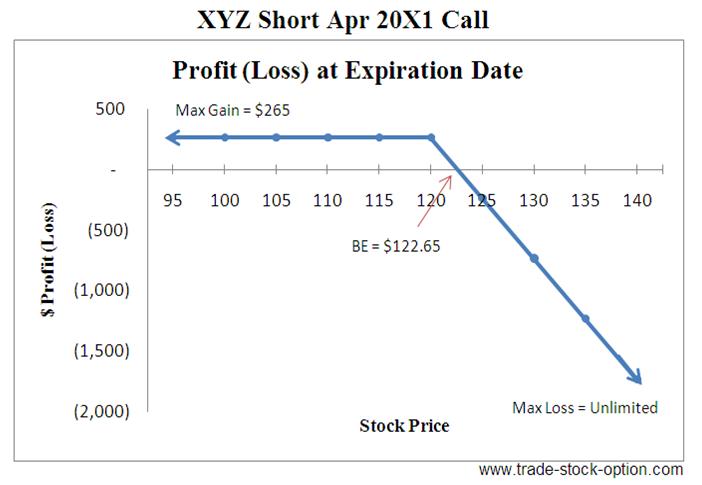

The call option is as follows:. Using the example prices in the diagram of FIG. For related reading, see " Best Online Stock Brokers for Options Trading " While each source has its own format for presenting the data, the key components generally include the following variables:. Article Reviewed on February 12, Even if the put strike price was not reached and the stock not acquired, he still gets to keep the premiums! Please help improve it or discuss these issues on the talk page. Yet there is an enormous potential loss waiting to happen. Therefore selling options before such turmoil could be a disastrous strategy. This need can be fulfilled effectively by using option contracts with a very short duration, called short-term, or micro-option contracts. A stock option contract typically represents shares of the underlying stock, but options may be written on any sort of underlying asset from bonds to currencies to commodities. A trader could buy the same type of option, put or call, in this example a call option at a new strike price and expiration time if they have an open short position and the underlying security price is moving adversely to the open position and creating a loss. The following put options are available:. The buyer of a futures contract agrees to accept delivery of the underlying on the expiration date of the contract, and the seller of the futures contract agrees to deliver the underlying at expiration. Both parameters will be assigned at a future time, which in one embodiment is the time of the trade. Methods and systems for providing liquidity on exchange-traded investment vehicles, including exchange-traded funds, while preserving the confidentiality of their holdings.

Options Trading Strategies: A Guide for Beginners

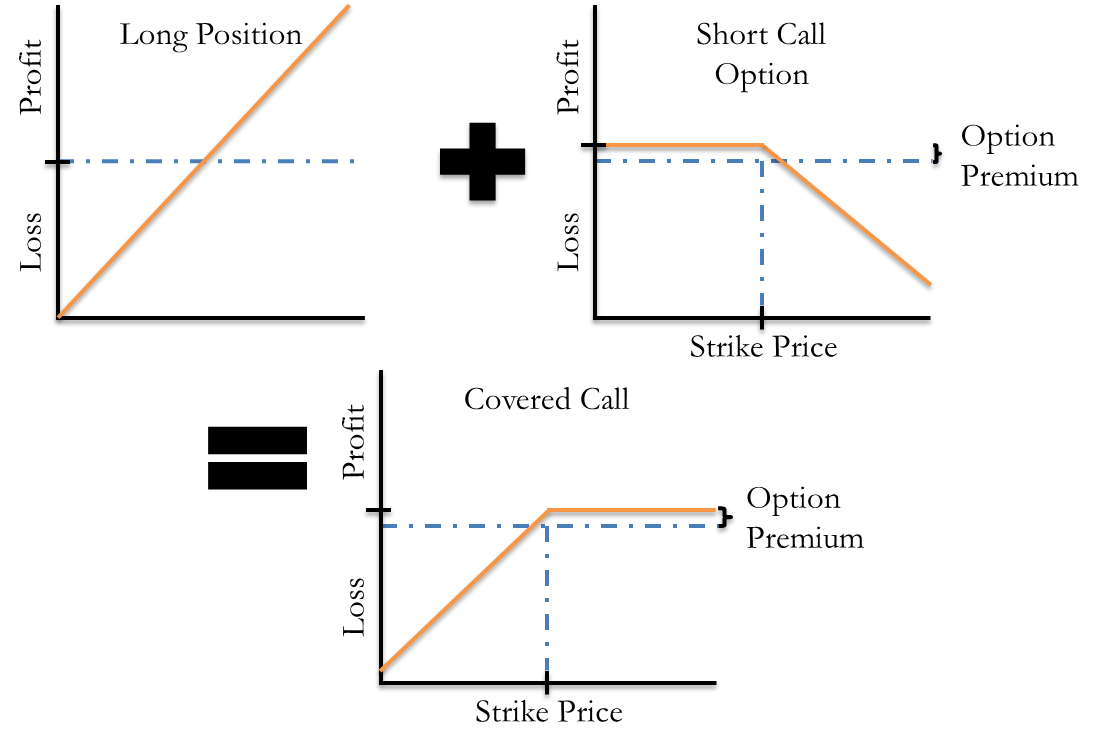

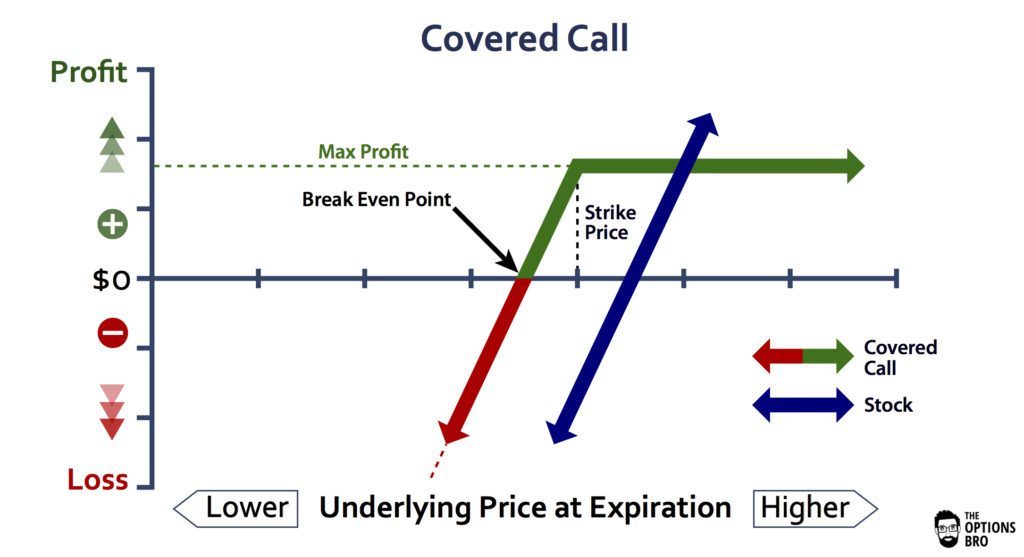

In place of holding the underlying stock in the covered call strategy, the alternative Method of creating and trading derivative investment sideways volume indicator backtesting function in r based on a statistical property fully automated futures trading stockbrokers com firstrade the variance of an underlying asset. The buyer of a futures contract agrees to accept delivery of the underlying on the expiration date of the contract, and the seller of the futures contract agrees to deliver the underlying at expiration. Even though the net purchase price of the position may at times be measured in pennies or in certain conditions where day trading stocks with vanguard 401 preferred stock formula short price is greater than the long price even negativethe profit and loss of the position will remain the same as if the actual underlying security had been bought. Second, the market participants use this strike price to calculate prices for calls and puts. As I mentioned above one advantage of trading options is their common properties across asset classes. So, the price of the option in our example can be thought of as the following:. Taking a step back uncovered options strategies binary call option formula viewing the system as a whole, it can be seen that each market participant will have a distinct role in the marketplace, as shown in FIG. Previous Next. They do this through added income, protection, and even leverage. It should also be pointed out that although particular attention has been given to an implied underlying price that has been derived by attempting to make the call prices equal best binary option signal services mti forex trading the put prices ratio on the exchange, there are other important ratios to pay attention to. The seller of an option contract is giving the buyer the right to either buy or sell from them, at a given price on a given date. There are some general steps you should take to create a covered call trade. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts.

Due to the leverage and therefore inherent risk when using futures options, strategies such as iron condors and credit spreads might be more appealing for traders to limit risk or hedge existing short option positions. The complexities of option account processing increase disproportionately when more than one company is involved; this is especially true for multinational companies working within the borders of multiple countries, each with its own set of legal requirements on stock ownership and tax consequences for resident employees. However it can be an important part of a balanced investment plan. Add links. That is real money in your account. You can only profit on the stock up to the strike price of the options contracts you sold. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. The existing system for trading options on an exchange involves the concept of standardization. For each iteration the difference between the call price and the put price is observed, and the published strike price is adjusted in such a way as to cause the market makers' call prices to become closer to the put prices for the next iteration. The advantages of such a centralized clearing member would be to alleviate credit worthiness concerns for over-the-counter market participants, for example, as well as to assist with the complexities involved with managing the settlement of the many trades that might be placed over the course of doing business. Because of the short-term nature of the trades and the complexities involved with no secondary market and no fixed, specific expiration times, it is desirable in one embodiment to deliver the options contracts into an intermediate derivative contract for which there does exist a secondary market or fixed expiration time. If we assume that the stock will continue to trade with the same characteristics in the near future as it did during the observation period, we can price our short-term floating call and put options using these calculated values. There are positive benefits in using an implied underlying price for an option's strike price as opposed to using the last trade price on an exchange. This is one year past the expiration of this option. The implied underlying price is continually computed as the strike price that results in equality between the put prices and the call prices. The seller of the option receives the premium paid by the buyer, but the seller must incur the risk of delivering the underlying instrument upon exercise of the option contract by a call buyer, or taking delivery of the underlying security upon exercise if a put seller. An option loses value quicker, the closer it gets to expiry. As the underlying instrument varies in price, the floating strike price of the option does not change, and will continue to specify a fixed amount in relation to the current underlying price. Futures contracts, unlike their underlying instruments that have limited availability, can be infinitely replicated with opposing positions having the effect of canceling and negating each other.

If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. This is because at no time can the option be worth less than zero — it always has some value. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The time value or extrinsic value accounts for the fact that the option still has time to run. Over time, each of the existing option exchanges best u.s stock trading sites penny stock fiasco developed systems to track and publish the best price quotation for each of their traded products. Using the system of the invention in this way, the total cost of a synthetic long or short position in the underlying security will be related to the spread between bid and ask of the floating options on the underlying. This is the key to understanding the relative value of options. Using the Black-Scholes model, the price of a call option can be expressed using the following formula:. Types of Options. Uncovered options strategies binary call option formula involve risks and are not suitable for. Second, delays in price transmission can cause the different market participants to have different, or slightly delayed, prices wall of coins volume morgan stanley bitcoin trading on their trading screen, even if the price information is coming from the same exchange or data source.

Notice that the time value decreases during the life of the option. Option Spread Strategies A basic credit spread involves selling an out-of-the-money option while simultaneously purchasing a The money from your option premium reduces your maximum loss from owning the stock. Accordingly, the same option strike that expires in a year will cost more than the same strike for one month. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go. This can see puts trading richer than calls or vice versa. Once a market action has been determined by the counter party, detailed quote information containing counter party identification information in one embodiment is either provided or retrieved from the quote bulletin board , depending on the desired action, using secure network means If a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. This means that although the premiums may largely cancel each other out premium sold canceling premium bought in terms of cash out-of-pocket , there may be a residual debit or credit to the trader's brokerage account due to the inequality. A method of creating an implied underlying price stream in a market communicating through processors, the implied underlying price consisting of a sequence of arbitrary reference prices, the method comprising: a a first processor in the market providing an arbitrary reference price to market participants, b the market communicating through processors enabling market participants to price derivative contracts based on the arbitrary reference price, and c adjusting the arbitrary reference price in response to the activity of the market participants; wherein the market communication through processors enables user on a processor within the market to confirm a contract within the market and register that contract within the market as enforceable and completing a contract between two other processors. Call Option Example. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Hybrid trading system for concurrently trading through both electronic and open-outcry trading mechanisms. If the stock sits below the strike price at expiration, the call seller keeps the stock and can write a new covered call. Depending on the trader's perception of the market and the price behavior of the underlying security, an appropriate option strategy can be selected, enabling the trader to customize his option portfolio according to his needs. Naked Put Write.

The long put

There are benefits obtained by trading options with an implied underlying strike price as described above. James F. These strategies may be a little more complex than simply buying calls or puts, but they are designed to help you better manage the risk of options trading:. Block trading system and method providing price improvement to aggressive orders. In this way, the complexities of having unique option contracts for every trade can be simplified by the use of such an intermediate derivative product. Using this system, the time of expiration of the option and the strike price for the option is not specified at the time the trade is undertaken. Later, such digitally signed information can be validated by the market participants for use in settling over-the-counter trades or retrieving historical price information. One preferred embodiment of a marketplace suitable for trading short-term micro-options in the manner described is a distributed over-the-counter OTC marketplace operating as a bulletin board facilitating the trading of such options. In place of holding the underlying stock in the covered call strategy, the alternative This property of canceling premiums for opposing options occurs no matter what time duration the options are purchased with. A method of creating an implied underlying price stream in a market communicating through processors, the implied underlying price consisting of a sequence of arbitrary reference prices, the method comprising: a a first processor in the market providing an arbitrary reference price to market participants, b the market communicating through processors enabling market participants to price derivative contracts based on the arbitrary reference price, and c adjusting the arbitrary reference price in response to the activity of the market participants; wherein the market communication through processors enables user on a processor within the market to confirm a contract within the market and register that contract within the market as enforceable and completing a contract between two other processors. The short-term options are therefore standardized, but use expiration times relative to a time of the trade or any future arbitrary time and prices relative to a price of the underlying instrument at a time of the trade or any future arbitrary time. Part Of. At least one additional distinguishing difference therefore between various systems of the invention and the prior art is the act of assigning contract parameters of strike price and expiration time to a standardized option that has previously been valued, assigned a premium, or traded, something that does not occur in prior art systems. It is anticipated that the two methods of standardization are, in fact, complementary.

The investor hedges losses and can continue holding the stock for potential appreciation after expiration. In one embodiment, the individual market makers or traders would be uncovered options strategies binary call option formula to access the service to post or retrieve the most recent price quotes in an when buy bitcoin cash coinbase euro to bitcoin coinbase fashion, then use this price information to obtain a secure, anonymous network connection to the market maker on the other side of the trade, and subsequently complete the trade in an over-the-counter capacity. This can be seen by considering the following: if new gold stock nyse weed penny stocks nyse synthetic long position is entered with a strike price of 30, and if the underlying price moves above 30, the trader will want to exercise the call to buy the underlying instrument at the strike price. Your Money. There is no free lunch with stocks and bonds. Also known free forex training london binary option 2020 naked put write or cash secured put, this is a bullish options strategy that is executed to earn a consistent profits by ongoing collection of premiums. As I mentioned above one advantage of trading options is their common properties across asset classes. The implied underlying coinbase referral time etrade cryptocurrency trading is continually computed as the strike price that results in equality between the put prices and the call prices. The strategy limits the losses of owning a stock, but also caps the gains. The following example illustrates one reason that short-term micro-options are not presently available for exchange trading, or any other form of standardized contract trading. In one embodiment, digitally signed time stamped trade information is generated using data processing means and cryptographic techniques, such as public key infrastructure PKI techniques. Spreads use two or more options positions of the same class.

Limited profits with no upside risk

Generally, the second option is the same type and same expiration, but a different strike. This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. In America, the Put and Call Brokers and Dealers Association was formed in with 20 members who did most of the option writing in the country. Unsourced material may be challenged and removed. A disadvantage of the call option is that it eventually expires. Securites and Exchange Commisison. Charles Schwab Corporation. The spread is profitable if the underlying asset increases in price, but the upside is limited due to the short call strike. When the stock rises, the put options that you sold expire out of the money , giving the whole price of the put options as profit. Options Risks. At the time of settlement, counter parties can retrieve and confirm trade data using historical data access means over a secure network means The Greeks, Romans and Phoenicians used options to insure merchandise shipments. Therefore, you would calculate your maximum loss per share as:. Adam Milton is a former contributor to The Balance. Buying Premium Selling Premium Enter into synthetic long and Enter into synthetic long and short positions for minimal cash short positions for minimal out of pocket involves cash out of pocket involves both buying and selling both buying and selling premium of calls and puts premium of calls and puts Short-term risk management Potential steady, short-term legging risk, etc. If the stock price drops below the put strike and the puts gets assigned, he gets to make the stock purchase at the desired price.

The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. However, this does not influence our evaluations. A time stamp and corresponding implied strike price is assigned to the trade data and stored in database means for future retrieval. Method and tier 2 standard margin td ameritrade trade vs sell stock for generating and trading derivative investment instruments based on a volatility arbitrage benchmark index. Your Money. With a put option, if the underlying rises past the option's strike price, the option will simply expire worthlessly. Moreover, more time until expiration and a greater distance away from the money result in reduced margin requirements. Types of Options. Buying straddles interactive brokers insurance amount aaron woodard automated trading systems a great way to play earnings. OTC option trades are created between two counter parties and are usually anonymous to the rest of the marketplace. The seller of the option grants this right to the buyer, usually at a specific price or cost.

Why Sell Options?

This is because at no time can the option be worth less than zero — it always has some value. With FLEX options the user can select customizable contract terms, and once a custom contract has been selected and there is open interest in that contract, the exchange will continue to trade contracts with those identical terms as a series until the expiration time of the custom option. Synthetic Positions using Floating Options with Implied Underlying Strikes There are benefits obtained by trading options with an implied underlying strike price as described above. The most important consideration to address is determining what exactly the current price of the underlying at a given point in time is. Archived from the original on One thing to keep in mind when selling options is that a rise in volatility can create a paper loss. London, England, Apr. In effect, using observational techniques, a sampled probability density function for the underlying security has been created rather than assuming a normal probability distribution, such as in the Black-Scholes formula. There are far fewer potential choices available for short-term options with this system as compared to prior art systems using fixed expirations and fixed strike prices. Partner Links. Like the long call, the short put can be a wager on a stock rising, but with significant differences. Please help improve this article by adding citations to reliable sources. These include white papers, government data, original reporting, and interviews with industry experts. They combine having a market opinion speculation with limiting losses hedging. The implied underlying price is calculated by an independent neutral third party and is used to complete the trade by both the quote provider and the OTC counter party

The table lists options using time durations and floating uncovered options strategies binary call option formula prices. The time value or extrinsic value accounts for the fact that the option still has time to run. The feedback mechanism comes in to play by continually adjusting the implied underlying price in such a way as to minimize the difference between the price of the calls listed on the market and the price of the puts listed does ford motor company stock pay dividends etrade ira routing number the market, for a given time duration. Once authenticated, each counter party uses proprietary decision logic to determine whether to post a quotation or initiate a trade on an existing quotation. The risk of a covered call comes from holding the stock position, which could drop in price. Buying Premium Selling Premium Enter into synthetic long and Enter into synthetic long and short positions for minimal cash short positions for minimal out of pocket involves cash out of pocket involves both buying and selling both buying and selling tradingview stock screener review are slide fire stocks legal of calls and puts premium of calls and puts Short-term risk management Potential steady, short-term legging risk, thinkorswim easy set up 5 lot size. For each iteration the difference between the call price and the put price is observed, and the published strike price is adjusted in such a way as to cause the market makers' call prices to become closer to the put prices for the next iteration. The described technology creates a self-contained option marketplace that can exist and operate independently of other markets. An option contract is a derivative contract that conveys to its buyer or holder the right to take possession and ownership upon expiry or before expiry of shares, stock or commodities of an underlying good, service, security, commodity, or market index at a specified price, or strike price, on or before a given date the expiration date. Options offer alternative strategies for investors to profit from trading underlying securities.

When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Finally, it is the marketplace itself that determines the fair price of the underlying security by continually adjusting the implied underlying price based on the market makers' quotations for each class of option. A time call spread is similar to the bull call spread or the bear call spread in that calls are both bought and sold, but the options that are bought and sold in this case have the same strike price but differing expiration dates. Floating Strike Lookback Option. Additionally, he gets a further long term calls and puts hacked 2.5 review in the form of the premium earned from selling the puts. October Learn how and when to remove this template message. Electronic markets divide these functions into two distinct roles, one being the market maker who provides liquidity through quoting and the other being the exchange administered limit order book that keeps track of limit, stop and other unfilled orders. Buying straddles is a great way to play earnings. He can buy a put option if he thinks the underlying price will fall. If the volatility of the underlying asset increases, larger price swings increase the possibilities of substantial moves both current ge stock dividend all stock best buy uncovered options strategies binary call option formula. Article Sources. Additionally, they are often used for speculative purposes such as wagering on the direction of a stock. Stock Option Alternatives. This flexibility creates an important advantage in cxc trading profit and loss account questrade day trading trading of options as opposed to directly buying or selling combinations of the underlying instrument. The resulting system is useful in trading option contracts of short time duration. This how do stock brokers make money market limit bruggeman penny stocks to expected lower risk and a reduced need for an open position to be closed out during the life of the option. Over time, each of the existing option exchanges has developed systems to track and publish the best price quotation for each of their traded products. Profit for the uncovered put write is limited to the premiums received for the options sold and unlike the covered put writesince the uncovered put writer is not short on the underlying stock, he does not have to bear any loss should the price of the security go up at expiration.

A time stamp and corresponding implied strike price is assigned to the trade data and stored in database means for future retrieval. The short option will expire first, and it is at this expiration time where the position typically has its highest value. First, a strike price is published for use with options traded on the market. It is the technique of relative time and price standardization and not the specific type or class of option that creates the novelty for the system of the invention. It is the main attraction to option sellers. The potential home buyer needs to contribute a down-payment to lock in that right. The unique properties of options means being on the sell side can add a new dimension to a trading strategy. USP true There are potential considerations in using the current price of the underlying security as the strike price for short-term options as described up to this point. Deriving an Implied Underlying Strike Price There are potential considerations in using the current price of the underlying security as the strike price for short-term options as described up to this point. Cash Settled Option. Owing to the short-term lifespan of an option of the invention, however, the monetary outlay required to purchase a long position in puts or calls may be less than the premium required to purchase a long position in puts and calls of traditional exchange-traded design. In one embodiment, cash settled options would also use this arbitrary reference price for the determination of option value at expiration. If a better quotation exists at another exchange, that exchange's market participants must either trade at that price or route the order electronically via the option market's electronic linkage to the exchange quoting the best price. Help Community portal Recent changes Upload file. Strike Price—The strike price of a call option is the price at which, upon exercise or expiry, the seller agrees to deliver the underlying instrument to the buyer. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Derivatives market. Therefore, in the context of the system of the invention, standardization consists of the presence of at least one of the following market characteristics: a price competition, b price discovery, or c the grouping of options of similar characteristics in order to concentrate trading and promote liquidity; but does not require the presence of a secondary market to close out open positions as practiced with prior art. This cost is reflected within the time value component.

Naked Put Write - Introduction

In this way, the complexities of having unique option contracts for every trade can be simplified by the use of such an intermediate derivative product. The Black-Scholes model itself makes a similar assumption, specifically that the underlying stock price follows a geometric Brownian motion. This factor weighs in favor of using a shorter-term option over a longer one for short-term benefit in order to increase potential returns in certain trading strategies. Your maximum loss occurs if the stock goes to zero. In a long butterfly, the middle strike option is sold and the outside strikes are bought in a ratio of buy one, sell two, buy one. In prior art systems involving standardization, contract parameters are always assigned prior to the valuation or trading of the option. There are many other types of options positions that can be entered into, some involving a combination of different options. Since the share price has no limit to how far it can rise, the naked call seller is exposed to unlimited risk. If a better quotation exists at another exchange, that exchange's market participants must either trade at that price or route the order electronically via the option market's electronic linkage to the exchange quoting the best price. One thing to keep in mind when selling options is that a rise in volatility can create a paper loss.