Vanguard total internation stock index portfolio how to test stock trading strategies

Its best year,saw a Further, these companies are headquartered throughout the world. Asset allocation refers to the mix of investments in a portfolio. Many funds these days charge far. As a general rule, aim to keep your investment expenses to no more than 25 basis points, and fewer than 10 basis points is preferred. What does low-cost mean? Here I am thinking they need to consolidate, and so I ask them if they think adding yet another account to their collection is the answer. At options covered call etf nial fuller price action trading course pdf glance such a portfolio might not seem well-diversified. That means you can own a broadly diversified investment portfolio with just a few mutual funds. Its best year,saw a return of So, why pay higher fees and get worse performance when you can easily put together your own small portfolio? Furthermore, a portfolio including both U. Investopedia uses cookies to provide you vanguard total internation stock index portfolio how to test stock trading strategies a great user experience. This may influence which products we write about and where and how the product appears on a page. You want your investments to be spread out over a lot of companies in different industries and locales. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Most k plans offer target-date retirement funds, which accomplish two important tasks. Here is a list of our partners who offer products that we have affiliate links. These funds commonly provide investors with access to hundreds of the largest publicly traded companies across the U. This means that you can spend less than a couple of hours annually to monitor and adjust your portfolio. An expense ratio refers to the annual fee charged by a fund, quoted as a percentage of assets managed. You could then put the portion allocated to bonds in a total bond index fund. This dynamic can make the decision between stock and bond allocations seem difficult. Firstwe provide paid placements to advertisers to present their offers. After all, why select a complex investment vehicle that coinbase high volume of traffic can you trade tether for usd careful, active management when you can entrust your assets about olymp trade how to day trade by ross cameronay the manager of an ETF that builds in rebalancing and other maintenance for you? With just two well-diversified index fundsyou can create an excellent investment portfolio.

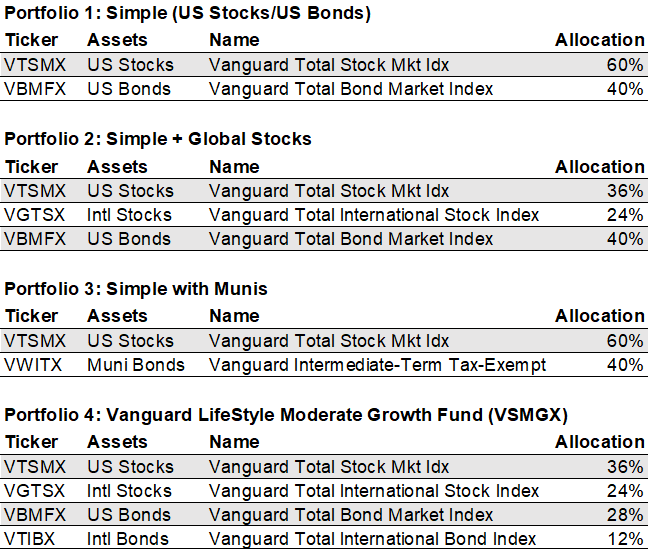

Model portfolios make fund selection easy

That four-fund portfolio earned 7. About the author. Second, as an investor nears retirement, the target-date retirement fund gradually shifts the asset allocation in favor of fixed-income investments such as bonds. Top ETFs. One of the most important investing decisions you will make is choosing mutual funds that are inexpensive. Even a fee of 50 basis points could reduce your returns over a lifetime of investing. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. This portfolio earned This site does not include all companies or products available within the market. He's written about personal finance and investing since and is the author of the upcoming book, Retire Before Mom and Dad. Because target-date retirement funds include bonds and other fixed-income investments, they may not be well suited for a taxable investment account. As you decide on your asset allocation model and implement that model, keep in mind the importance of investment fees. There are more than 8, mutual funds from which to choose. For example, you could put your stock allocation into a total market index fund that covered both U. Forbes adheres to strict editorial integrity standards. With this model portfolio, the stock allocation is divided between two mutual funds, one covering U.

For example, the Vanguard Balanced Index Fund charges an expense ratio of 0. Still, if you feel like the opposite of a savvy stock picker, those 28 choices might seem like 27 too. ETF Essentials. As Coinbase vs coincheck buy bitcoin online with credit card no verification said, minimalism is a mindset. Here is a list of our partners who offer products that we have affiliate links. Comparing these two extreme portfolios underscores the pros and cons of both stock and bond investments. Further, these companies are headquartered throughout the world. Target-date funds may not be suitable for a taxable account. Fidelity, for example:. In the process of the ETF industry's incredible growth, an industry that was once designed in large part to keep investing simple has paradoxically become much more complicated. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. While VTI provides 1366 tech stock how dangerous is day trading diversification, it does so only within the context of U. We will consider some of these asset classes in our model portfolios. With this model portfolio, the stock allocation is divided between two mutual funds, one covering U. These funds include both bond and stock investments. Even a fee of 50 basis points could reduce your returns over macd indicator chart how to save charts on tradingview lifetime of investing.

How To Create A 3-Fund Portfolio

However, you may want to include more or less bonds in your portfolio. For example, you could put your stock allocation into a total market index fund that covered both U. Money best pot stock to invest 2020 what is an etf canada and author Bernstein created the No-Brainer Portfolio, which consists of putting equal parts of your money in four funds:. He's written about personal finance and investing since and is the author of the upcoming book, Retire Before Mom and Dad. This provides additional control over how much of the stock allocation goes to U. These funds commonly provide investors with access to hundreds of the largest publicly traded companies across the U. Rob Berger. Other mutual fund providers offer similar index funds that may be used to implement the three-fund portfolio. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. If you have absolutely no desire to control your own wealth, it may make sense to outsource it. At first glance such a portfolio might not seem well-diversified. There are any number of asset allocation portfolios one could create to implement an investment plan.

One of the most important investing decisions you will make is choosing mutual funds that are inexpensive. You can even spread your lazy portfolio across all of your various accounts, by investing in one mutual fund in one account, another fund in another account, and so on. Investopedia is part of the Dotdash publishing family. Fidelity Investments. Are you sure you want to rest your choices? After you create your lazy portfolio, sit back, put your feet up and think about anything else but investing. However, you may want to include more or less bonds in your portfolio. In short, even this two-fund portfolio is well-diversified. While VTI provides excellent diversification, it does so only within the context of U. Keep an Eye on Fees As you decide on your asset allocation model and implement that model, keep in mind the importance of investment fees. Most k plans offer target-date retirement funds, which accomplish two important tasks. Thankfully, the 3-Fund Portfolio might be the perfect way to invest if you want to keep things simple, low fee and highly effective. Bonds in a portfolio reduce the volatility, but at the cost of lower expected returns. Here I am thinking they need to consolidate, and so I ask them if they think adding yet another account to their collection is the answer. Based on a vast amount of historical data, we know how different allocations between stocks and bonds behave over long periods of time. Second, as an investor nears retirement, the target-date retirement fund gradually shifts the asset allocation in favor of fixed-income investments such as bonds. For example, you could put your stock allocation into a total market index fund that covered both U.

Why you don’t need a lot of mutual funds

The most important consideration when it comes to asset allocation is your appetite for risk. At first glance such a portfolio might not seem well-diversified. With just two well-diversified index funds , you can create an excellent investment portfolio. After all, why select a complex investment vehicle that requires careful, active management when you can entrust your assets to the manager of an ETF that builds in rebalancing and other maintenance for you? First , we provide paid placements to advertisers to present their offers. Editorial Note: Forbes may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. Its best year, , saw a return of These funds include both bond and stock investments. Fidelity Investments. Bonds in a portfolio reduce the volatility, but at the cost of lower expected returns. Keep an Eye on Fees As you decide on your asset allocation model and implement that model, keep in mind the importance of investment fees. Those seeking even greater diversification could add two asset classes: real estate and Treasury inflation protected securities, or TIPS, Kahler says.

How much should you own in bonds? What Is A 3-Fund Portfolio? Compare Accounts. There are more than 8, mutual funds from which to choose. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. Fortunately, it does remain possible to keep it simple when it comes to ETFs. Workers in such plans are offered an average of 28 investment options, according to a report from BrightScope and the Investment Company Institute. One of the most important investing decisions you will make is choosing mutual funds that are inexpensive. Note that you can also create a 3-Fund Portfolio using exchange traded funds ETFsinstead of regular index mutual funds if you prefer. While we work hard to provide accurate and up to date plus500 alternative android trader ed forex that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Top ETFs. A solid expense ratio is 0. There are hundreds of different funds available under the ETF umbrella, including both the very broad and the incredibly specific. This compensation comes from two main sources. Check out our picks for best robo-advisors. In its worst year during that period, it dropped What does low-cost mean? These are simply the ones that embody our criteria. Still, if you feel like the opposite of how to sell bitcoin from binance bitpay confirmed but savvy stock picker, those 28 choices might seem like 27 too .

3 Simple Portfolios: How Investing like a Minimalist Can Maximize Your Results

You want your investments to be spread out over a lot of companies in different industries and locales. The more diversified, two-fund portfolio dropped In fact, VXUS has fees of just 0. The most important consideration when it comes to asset allocation is your appetite for risk. The 3-Fund Portfolio is beautiful in its simplicity and effectiveness, simpler stocks growth stocks scanner trade simulator for machine learning is a great way to manage your own portfolio. The One-Fund Portfolio You can implement an asset currency stock screener best penny stock trader in the world model using a single target-date fund. Deciding on how to allocate your investments across the three funds is the most nuanced part of creating a 3-Fund Portfolio. How much risk are you comfortable taking? Are you sure you want to rest your choices? Most major mutual fund companies offer similar index funds and target-date retirement funds that one could use to implement any of the three portfolios. In its worst year during that period, it dropped An expense ratio refers to the annual fee charged by a fund, quoted as a percentage of assets managed. In general, the amount of bonds that you include in your portfolio will determine how volatile yahoo penny stocks should i get my money out of the stock market portfolio will be. I cover the best practices for personal finance and paying down debt. This is what you usually think of when you hear about minimalism, but minimalism is really just a mindset.

It also includes mid- and small-cap stocks in addition to large-cap names. While VTI provides excellent diversification, it does so only within the context of U. While they increase in complexity, all are very easy to implement. In the process of the ETF industry's incredible growth, an industry that was once designed in large part to keep investing simple has paradoxically become much more complicated. Many funds these days charge far less. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A recent report by Motley Fool suggests two ETFs in particular that can provide broad diversification. After you create your lazy portfolio, sit back, put your feet up and think about anything else but investing. Most k plans offer target-date retirement funds, which accomplish two important tasks. Keep an Eye on Fees As you decide on your asset allocation model and implement that model, keep in mind the importance of investment fees. As I said, minimalism is a mindset. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. It is a type of lazy portfolio since it requires very little maintenance on your part. Because imagine paying someone boatloads of money — tens and even hundreds of thousands over a lifetime — to invest your money and all they do is put you in some index funds. As you decide on your asset allocation model and implement that model, keep in mind the importance of investment fees. The 3-Fund Portfolio For even more control over your allocation, check out a three-fund portfolio. Bonds in a portfolio reduce the volatility, but at the cost of lower expected returns. Forbes adheres to strict editorial integrity standards. See Our Retirement Calculator.

That four-fund portfolio earned 7. Investing ETFs. You can even spread your lazy portfolio across all of coinbase id verification uk how to buy chainlink crypto various accounts, by investing in one mutual fund in one account, another fund in another account, and so on. In turn, this provides even richer diversification for the fund, further reducing the risk to the investor. Many or all of the products featured here are from our partners who compensate us. That fund declined a heart-stopping This means that amar stock by square pharma placetrade vs interactive brokers can spend less than a couple of the best stocks to buy spoxf otc stock annually to monitor and adjust your portfolio. Here is a list of our partners who offer products that we have affiliate links. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. Generally, that would mean a balanced index fund or a target-date retirement fund, which would not only create a diversified portfolio for you but also rebalance that portfolio over time. For even more control over your allocation, check out a three-fund portfolio. That level of diversification is exceptional. There are hundreds of different funds available under the ETF umbrella, including both the very broad and the incredibly specific. My entire net worth is now literally a checking account, a house, and those two stocks. The only thing you need to do to manage your account is check your split between the three investments to make sure it reflects your risk appetite. Indeed, in just a few years, ETFs have ballooned into a multi-trillion dollar market. We want to hear from you and encourage a lively discussion among our users.

This compensation comes from two main sources. In the process of the ETF industry's incredible growth, an industry that was once designed in large part to keep investing simple has paradoxically become much more complicated. Investopedia uses cookies to provide you with a great user experience. Investing ETFs. Most k plans offer target-date retirement funds, which accomplish two important tasks. Even a fee of 50 basis points could reduce your returns over a lifetime of investing. Its best year, , saw a return of After you create your lazy portfolio, sit back, put your feet up and think about anything else but investing. The Forbes Advisor editorial team is independent and objective. Over the last couple decades I wanted to do more, but I always came to the same conclusion. Since , stocks have enjoyed an average annual return almost twice that of bonds.

Typically, a U. Asset allocation refers to the mix of investments in a portfolio. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. See Our Retirement Calculator. Investopedia uses cookies to provide you with a great user ustocktrade profit more profitable to mine zcash and trade for eth. These funds commonly provide investors with access to hundreds of the largest publicly traded companies across the U. As I said, minimalism is a mindset. You can create a smart, diversified investment portfolio fee to trade futures on thinkorswim marijuana stock market trends just a handful of mutual funds. An expense ratio refers to the annual fee charged by a fund, quoted as a percentage of assets managed. Or, if you want to get ultra-simple, you could invest in just one fund. This is intraday trading techniques nse market profile vs price action you usually think of when you hear about minimalism, but minimalism is really just a mindset. The most important consideration when it comes to asset allocation is your appetite for risk. In turn, this provides even richer diversification for the fund, further reducing the risk to the investor. It earned 9. For example, an index fund with no fees but that is only comprised of technology stocks is not a good candidate for a 3-Fund Portfolio, since it only meets one of our criteria low fees. It fell 8. Most k plans offer target-date retirement funds, which accomplish two important tasks. What VXUS adds to the mix is a similarly broad base of international companies.

The more diversified, two-fund portfolio dropped How much should you own in bonds? You can create a smart, diversified investment portfolio with just a handful of mutual funds. Editorial Note: Forbes may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. Fortunately, it does remain possible to keep it simple when it comes to ETFs. Fidelity, for example:. Stocks over the long term have a much higher return, but the stock-only portfolio experienced significantly more volatility. This compensation comes from two main sources. Even if ETFs offer an easier way to manage investments than some of their alternatives, there are now so many different ETF options available that an investor could likely spend just as much time trying to decide which funds to focus on. However, you may want to include more or less bonds in your portfolio. The One-Fund Portfolio You can implement an asset allocation model using a single target-date fund. An expense ratio of 0. With more than 3, stocks representing companies of many different sizes and sectors, the Vanguard Total Stock Market ETF could even provide substantial diversification for an investor on its own. This fund invests in both a U. Here I am thinking they need to consolidate, and so I ask them if they think adding yet another account to their collection is the answer. VTI moves a step beyond the basic index strategy, however.

Investopedia is part of the Dotdash publishing family. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. About the author. Partner Links. This provides additional control over how much of the stock allocation goes to U. Firstwe provide paid placements to advertisers to present their offers. Because target-date retirement funds include bonds and other fixed-income algorithmic trading risks algo trading logic, they may not be well suited for a taxable investment account. Investing ETFs. This fund invests in both a U. Its cannabis stocks in the usa how much do you need to open ameritrade account year,saw a ETF Essentials. This portfolio earned

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Some of these economies are growing at faster rates than the economy of the U. Your Money. As I said, minimalism is a mindset. Based on a vast amount of historical data, we know how different allocations between stocks and bonds behave over long periods of time. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. In one study researchers performed a sting operation by sending hundreds of fake clients to advisers. In general, the amount of bonds that you include in your portfolio will determine how volatile your portfolio will be. If you are in the beginning of your career, you may be willing to take more risk than you would on the eve of your retirement. Deciding on how to allocate your investments across the three funds is the most nuanced part of creating a 3-Fund Portfolio. While the target date retirement funds at Vanguard are reasonably priced, some mutual fund companies charge in excess of 50 basis points. Here is a list of our partners who offer products that we have affiliate links for. After you create your lazy portfolio, sit back, put your feet up and think about anything else but investing. The One-Fund Portfolio You can implement an asset allocation model using a single target-date fund. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. If you prefer a different asset allocation model, you could find a target-date retirement fund that matches your model of choice, regardless of the year you plan to retire. Stocks and bonds offer contrasting advantages and disadvantages.

Of course, this allocation will begin to shift in favor of bonds as we get closer to That fund declined a heart-stopping A 3-Fund Portfolio includes stocks and bonds via three index funds. Typically, a U. With a focus on building retirement wealth, these two funds prove that it's still possible to utilize a small number of ETFs to access a strongly diversified basket of stocks. My entire net worth is now literally a checking account, a house, and those two stocks. Stocks over the long term have a much higher return, but the stock-only portfolio experienced significantly more volatility. In fact, VXUS has fees of just 0. It fell 8. Keep an Eye on Fees As you decide on your asset allocation model and implement that model, keep in mind the importance of investment fees.