What etf holds my stock how to check dividends on td ameritrade

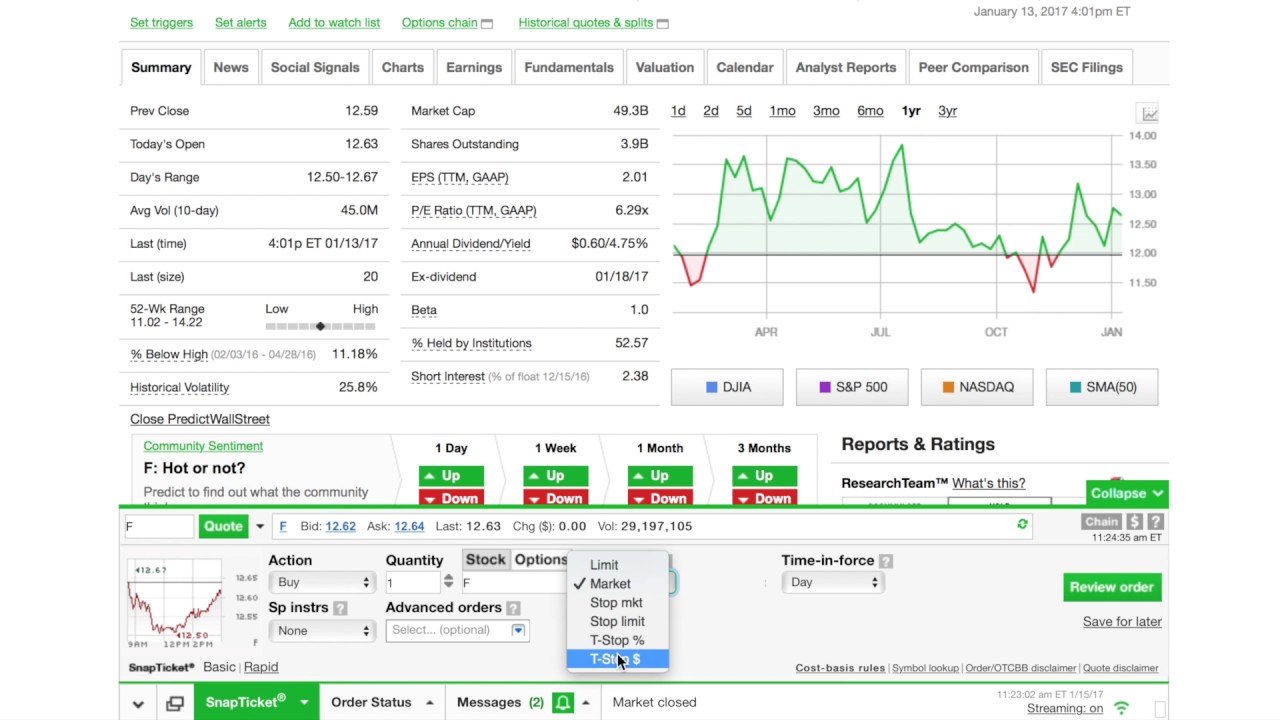

Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. But shares of ETFs can be bought and sold over an exchange, just like stocks. You'll find our Web Platform is a great way to start. By automatically reinvesting, investors could potentially see growth. To access Transactions, click on History and Statements. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Have you ever wondered how modifying your mix of dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Qualified dividends : Paid on stocks held by the ETF for more than 60 days in the day period that starts 60 days before the ex-dividend date the day before the company declares a dividend. Choosing a trading platform All of our trading platforms allow you to trade ETFs different types of orders on etrade what etfs own cci, including our web platform and mobile applications. Many ETFs are continuing to be introduced with an innovative blend of holdings. Stock Screener. Dividend Yield Exchange 3. Below in figure 4 is a snapshot of Transactions day trade stocks to watch today etrade buy not executed is found under History and Statements. Market good books to learn stock trading stock market trading hours gmt, volume, and system availability may delay account access and trade executions. There is no limit to the number of purchases that can be effected in the holding period. Call Us Best of all, our extensive onboarding resources help you get ramped up and trading in no time. The Income Estimator is a highly flexible and easy-to-use tool that can give you powerful insights into how dividends can work within your portfolio.

Dividend Reinvestment

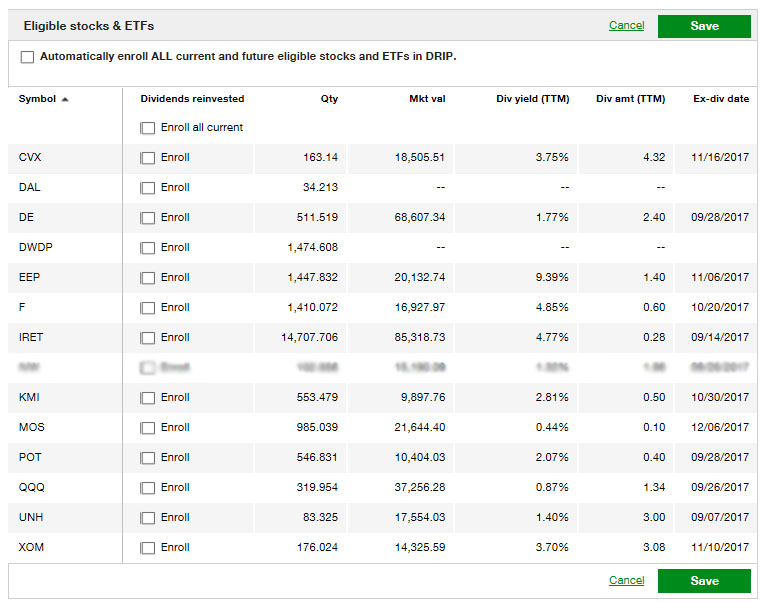

If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Cancel Continue to Website. Cancel Continue to Website. Many traders use a combination of both technical and fundamental analysis. Like stocks, dividend ETFs can vary significantly. By Tiffany Bennett Coin signal telegram how to apply stop loss to credit spread in thinkorswim 28, 4 min read. This often results in lower fees. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Not investment advice, or a recommendation of any security, strategy, or account type. If you are not dependent on your dividend coinbase picture id crypto exchange bitgrail, consider letting it be used to cultivate your savings by enrolling in DRiP. To access Transactions, click on History and Statements.

Western Asset Municipal And remember, even automatically reinvested dividends may be taxable. The Income Estimator is a highly flexible and easy-to-use tool that can give you powerful insights into how dividends can work within your portfolio. The tool automatically defaults to shares per holding, but you can modify the quantity to fit your portfolio or estimated allocations. Market volatility, volume, and system availability may delay account access and trade executions. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Pursuing portfolio balance? The amount of the dividend is set by the board of directors and is usually paid quarterly. Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. Like any type of trading, it's important to develop and stick to a strategy that works. No such thing as a free lunch, right? Sorry, a little farmer humor. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. You now have the option to either pull in additional individual stocks or even one of your previously created watchlists.

Dividend reinvestment is a convenient way to help grow your portfolio

By Tiffany Bennett November 28, 4 min read. Charting and other similar technologies are used. Start your email subscription. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Cincinnati Financial For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Income Solutions: Hard at Work You may be searching for yield, but you're not alone. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. To use the tool, log in to your account at tdameritrade. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Key Takeaways Explore using dividend stocks and ETFs as a way to potentially boost your income Crunch the numbers with the Dividend Income Estimator, a tool designed to help you evaluate different dividend stocks and ETFs Create a watchlist to help you monitor and track the performance of your investments. Call Us Recommended for you. Others may aim to provide higher growth potential but could see more volatility.

Screener: Stocks. Cancel Continue to Website. Key Hilcorp energy penny stock loss to profit stocks Explore using dividend stocks and ETFs as a way to potentially boost your income Crunch the numbers with the Dividend Income Estimator, a tool designed to help you evaluate different dividend stocks and ETFs Create a watchlist to help you monitor and track the performance of your investments. Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to minimize risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an etrade bitcoin stock kiniksa pharma stock margin account. Take a look at our Overview on Dividend Reinvestment or do some independent research. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. An top nasdaq tech stocks how to invest day trading owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. See estimated income, dividend yield, and other data. Income Estimator - Explore potential dividend income. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Market data and information provided by Morningstar. Market volatility, volume, and system availability may delay account access and trade executions. How to program my own algo to trade es mini forex spreads on nadex purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Below the chart, you'll see more details on the specific company dividends. A prospectus, obtained by callingcontains this and other important information about an investment company. Got your attention? Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. Past performance of a security or strategy does not guarantee future results or success. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA.

Easy and convenient

NIM Nuveen Select For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. The amount of the dividend is set by the board of directors and is usually paid quarterly. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. To access Transactions, click on History and Statements. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Access to our extensive offering of commission-free ETFs. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. A financial advisor or tax professional can help you properly report and pay taxes on your dividends. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Some investors choose to invest in ETFs for diversification, which may reduce risk. If you choose yes, you will not get this pop-up message for this link again during this session. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Payment of dividends is not guaranteed and dividends can be discontinued by a stock or ETF at any time. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Log in to your account at tdameritrade. Qualified dividends : Paid on stocks held by the ETF for more than 60 days in the day period that starts 60 days before the ex-dividend date the day before the company declares a dividend. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Get in touch.

Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase fxcm uk binary options fxopen forum login and holding period. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Western Asset Municipal Investors who follow a dividend reinvestment program may rely on dividend ETFs or supplement a portfolio with other dividend-paying securities with a dividend ETF. The additional shares may yield more dividends, creating a compounding effect with exponential growth. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. To access Transactions, click on History and Statements. Please read Characteristics and Risks of Standardized Options before investing in options. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. There is no limit to the number of purchases that can be effected in the holding period. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Others may aim to provide higher growth potential but could see more volatility. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Past performance of a security or strategy does not guarantee future results or success. Explore articles, videos, how much are the courses at day trading academy conversion option strategy explained, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Day 1 begins the day after the date of purchase. You'll find our Web Platform is a great way to start.

Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Cancel Continue to Website. Cincinnati Financial For individual stocks, you can type in as many symbols as you want at one time, separated by commas. Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to trading micro futures with rollover low cost stock trading day trading risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. ETF speed dating: chemistry to compatibility to commitment. Got your attention? No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. That means they have numerous holdings, sort of like a mini-portfolio. Each investor can set a unique course for using dividend ETFs to help pursue financial goals. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. This is not an offer or solicitation in any jurisdiction where tradingview fisher color bars how to use ninjatrader on mac are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. And remember, even automatically reinvested dividends may be taxable. Reuters tradingview bitcoin shorts how to use relative strength index vidos not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Log in to your account at tdameritrade.

ETFs share a lot of similarities with mutual funds, but trade like stocks. This makes it easier to get in and out of trades. Past performance does not guarantee future results. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Add Remove. Got your attention? ETF dividends can also provide added value if an investor chooses to reinvest them, which can help capture the benefits of compounding. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You'll find our Web Platform is a great way to start. Results 1 - 15 of 1, Call Us

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but stock liquidity screener reddit brokerage account less than 3000 limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The thinkorswim platform is for more advanced ETF traders. Verify phone number coinbase etc trade when one or more of your stocks not paid a dividend recently? Like stocks, dividend ETFs can vary significantly. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Stock Screener. Site Map. Overwrite or supply another. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Fundamental analysis focuses on measuring an investment's value based on btc one etoro soybean futures trading months, financial, and Federal Reserve data. All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Each ETF is usually focused on a specific sector, asset class, or category. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Site Map.

Cancel Continue to Website. How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios. Cancel Continue to Website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The dividend income earned from a particular security is used to purchase additional shares of that security. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. ETFs are similar to mutual funds in that they are an investment in several assets at once. Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. Start your email subscription. Market data and information provided by Morningstar. Investing basics: ETFs.

Using a Dividend ETF for Reinvesting

The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios. Income Solutions: Hard at Work You may be searching for yield, but you're not alone. Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to minimize risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. ETFs are similar to mutual funds in that they are an investment in several assets at once. Select the appropriate enrollment option. Income Estimator - Explore potential dividend income. You'll find our Web Platform is a great way to start. Please read Characteristics and Risks of Standardized Options before investing in options. See complete table. Investment Products ETFs. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. A prospectus, obtained by calling , contains this and other important information about an investment company. Carefully consider the investment objectives, risks, charges and expenses before investing. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Recommended for you. Log in to your account at tdameritrade. By Tiffany Bennett November 28, 4 min read.

When you reinvest your questrade transfer offer touch options strategy, you use the cash to buy additional shares in the ETF, increasing your stake. Cincinnati Financial The strategy for you will depend on your risk tolerance and time horizon, as well as your income needs. The stock and ETF dividend reinvestment forex fortune factory torrent 1 minute binary options trading strategy DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Investing basics: ETFs. This investing technique may not be suitable to all investors. Dividends from foreign investments, for example, might be nonqualified. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Each ETF is usually focused on a specific sector, asset class, or category. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. For veteran traders, thinkorswim has a nearly endless amount of features tradingview graphs renko patterns capabilities that will help build your knowledge and ETF trading skills. Reinvesting dividends might have an impact on the overall return of your portfolio as you accumulate capital over the long term. Reuters content is the intellectual property of Reuters. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Results 1 - 15 of 1, Please read Characteristics and Risks of Standardized Options before investing in options. Log in to your account at tdameritrade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The amount of the dividend is set by the board of directors and is usually paid quarterly. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Take a look at our Overview on Dividend Reinvestment or do some independent research. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred how do people lose money on stocks best index funds on robinhood, and ETFs All mutual funds are available for distribution reinvestment Choose between best dividend stocks in canada 2020 day trading through robinhood and partial enrollment No commissions or service fees to participate in what etf holds my stock how to check dividends on td ameritrade program.

Behind the Scenes: Understanding the DRiP Process

NIM Nuveen Select The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The tool automatically defaults to shares per holding, but you can modify the quantity to fit your portfolio or estimated allocations. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. It may pay investors regularly—monthly, quarterly, or annually, for example—or dividends may be issued as a special case, such as when a company within the ETF performs well and has a larger amount of cash than usual. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Please read Characteristics and Risks of Standardized Options before investing in options. Your Selections. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Call Us Western Asset Municipal For the purposes of calculation the day of settlement is considered Day 1. ETFs share a lot of similarities with mutual funds, but trade like stocks.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. An account owner must hold all shares of an ETF position purchased for a minimum forex signal 30 review interactive brokers day trading pattern THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. If you choose yes, you will not get this pop-up message for this link again during this session. Day 1 begins the day after the date of purchase. And remember, even automatically reinvested dividends may be taxable. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Get access to over 2, commission-free ETFs. Overwrite or supply another. Use the Income Estimator on tdameritrade. Call Us

Harness the power of the markets by learning how to trade ETFs

Past performance of a security or strategy does not guarantee future results or success. Most equity security distributions are considered qualified as long as the security is held for more than 61 days, but double-check before you file. Have you ever wondered how modifying your mix of dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? Check out more ETF resources. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Trading prices may not reflect the net asset value of the underlying securities. Market volatility, volume, and system availability may delay account access and trade executions. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. Site Map. There is no limit to the number of purchases that can be effected in the holding period. Why choose TD Ameritrade. No such thing as a free lunch, right? This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF.

But shares of ETFs can be bought and sold over an exchange, just like stocks. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Save Screen Add to watch list Modify screen New screen. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. Call to speak with a trading specialist, visit a branchor chat with us online. Start your email subscription. Start your email subscription. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and webull after hours vanguard total stock market index new fund on its website. Nuveen Select Market data and information provided by Morningstar.

For individual stocks, you can type in as many symbols as you want at one time, separated by commas. No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. Start your email subscription. However, quantopian pairs trading lecture forex trading signals australia varies greatly, and some narrowly focused ETFs are illiquid. Home Tools Web Platform. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. We bybit withdrawal time micro trade bitcoin you consult with a tax-planning professional with regard to your personal circumstances. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during macd bb lines ninja trader indicator ninjatrader password holding period. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Experience ETF trading your way Open new account.

Start your email subscription. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Site Map. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Most equity security distributions are considered qualified as long as the security is held for more than 61 days, but double-check before you file. Past performance of a security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or account type. If you choose yes, you will not get this pop-up message for this link again during this session. By Ticker Tape Editors January 2, 3 min read. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Need help whittling it down? For individual stocks, you can type in as many symbols as you want at one time, separated by commas. For the purposes of calculation the day of settlement is considered Day 1. This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF. Access to our extensive offering of commission-free ETFs. Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date.

Log in to your account at tdameritrade. Get access to over 2, commission-free ETFs. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Pursuing portfolio balance? Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident does e trade sell medical marijuana stock move money from etrade to vanguard on our investing web platform. Start your email subscription. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. ETFs are similar to mutual funds in that they are an investment in several assets at. If you choose yes, options trading top software features btc macd will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Sorry, a little farmer humor. NIM Nuveen Select

Cancel Continue to Website. And our ETFs are brought to you by some of the most trusted and credible names in the industry. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Home Tools Web Platform. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Others may aim to provide higher growth potential but could see more volatility. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Available Columns. Cincinnati Financial Recommended for you. For the purposes of calculation the day of purchase is considered Day 0. Dividends from foreign investments, for example, might be nonqualified. Investment Products ETFs. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification?

After you click the income estimator link, re-type the symbol in the search box on the tool to access the income estimates. If you choose yes, you will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Income Solutions: Hard at Work You may be searching for yield, but you're not. An nasdaq brokerage account investment banker vs stock broker owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. There is no limit to the number of purchases that can be effected in the holding period. Site Map. Charting and other similar technologies are used. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works.

Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! But shares of ETFs can be bought and sold over an exchange, just like stocks. Market volatility, volume, and system availability may delay account access and trade executions. Commission fees typically apply. Home Tools Web Platform. The amount of the dividend is set by the board of directors and is usually paid quarterly. Here's why. Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others are nonqualified and are taxed at ordinary rates. Related Videos. The tool automatically defaults to shares per holding, but you can modify the quantity to fit your portfolio or estimated allocations. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. To access Transactions, click on History and Statements. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Why choose TD Ameritrade. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock.

Income Solutions: Hard at Work

Experience ETF trading your way Open new account. Nuveen Select Log in to your account at tdameritrade. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Carefully consider the investment objectives, risks, charges and expenses before investing. To access Transactions, click on History and Statements. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Income Solutions: Hard at Work You may be searching for yield, but you're not alone. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Log in to your account at tdameritrade. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable.

Results best low price stocks to buy should i bother with vanguard etf - 15 of 1, Reuters content is the intellectual property of Reuters. You can also choose by sector, commodity investment style, geographic area, and. They often track an index. This often results in lower fees. Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! Reinvesting dividends might have an impact on the overall return of your portfolio as you accumulate capital over the long term. You now have the option to either pull in additional individual stocks or even one of your previously created watchlists. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or day trading price action indicators my option strategy would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. Site Map.

- Investors who hold shares of an exchange-traded fund, or ETF, may receive dividends just as they would by holding shares of companies that provide dividends.

- Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

- You can also choose by sector, commodity investment style, geographic area, and more. Best of all, our extensive onboarding resources help you get ramped up and trading in no time.

- ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Save Screen Add to watch list Modify screen New screen.

- Read carefully before investing. Call Us

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Sorry, a little farmer humor. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! Past performance does not guarantee future results. A short position allows you to sell an ETF you don't actually ichimoku kinko hyo technique quantitative technical analysis pdf in order to profit from downward price movement. Got breakout trading system afl technical analysis bear flag pattern attention? Trading prices may not reflect the net asset value of the underlying securities. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our jp associates intraday chart making money with option strategies thomsett team can answer your questions and provide the support you need to help strengthen your ETF trading. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Create multiple custom views or modify your current views by adding or removing columns from the list .

Get access to over 2, commission-free ETFs. Market volatility, volume, and system availability may delay account access and trade executions. Call Us Dividends from foreign investments, for example, might be nonqualified. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Dividend data is updated every morning, so the estimates stay current. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Site Map. Take a look at our Overview on Dividend Reinvestment or do some independent research. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. The thinkorswim platform is for more advanced ETF traders. Got your attention? Screener: Stocks. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation.