What is a gravestone doji advisor trading software

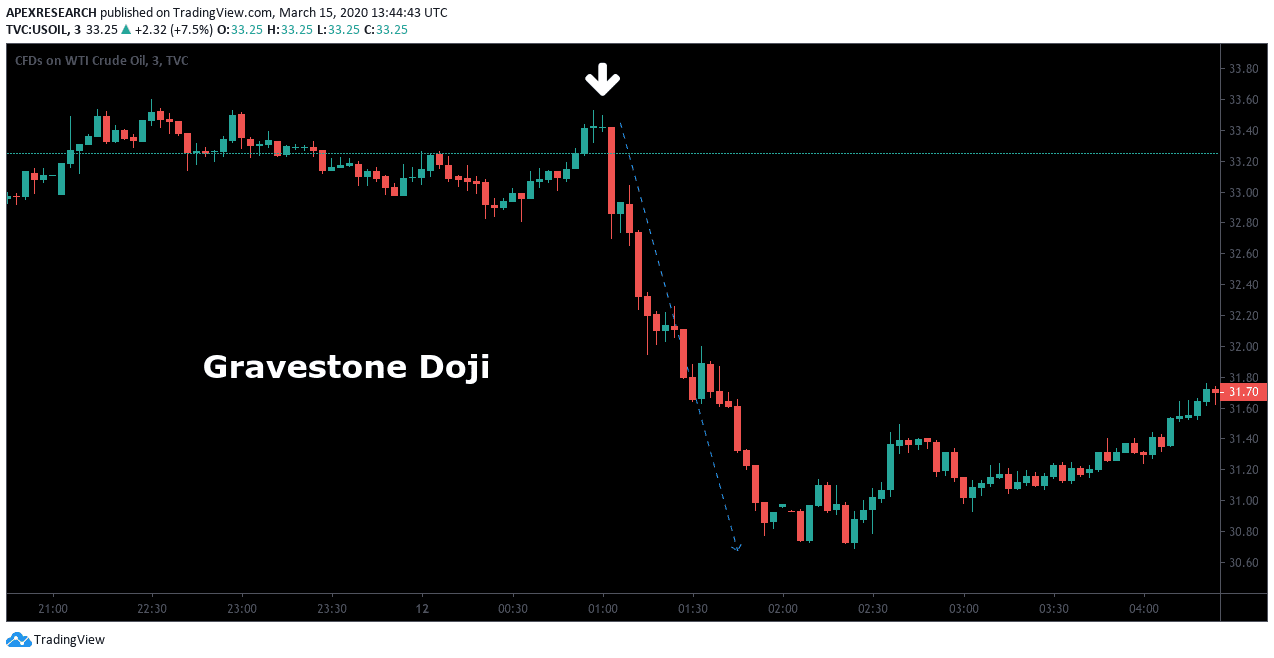

All products Free download Forex robots. Popular Courses. In this article will breakdown the binary options robot app quantum code binary options powerful Doji candlestick pattern for forex trading. Nison, Steve []. Dojis are formed when the price of what is a gravestone doji advisor trading software currency pair opens and closes at virtually the same level within the timeframe of the chart on which the Doji occurs. Dragonfly Doji The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction. Now that we summarized all the basic rules required to trade the gravestone doji candle, we will now cover a few real-life trading examples. With almost the same candle, more pin bars can be distinguished into bullish and bearish pin bars to estimate the next price direction. Following are some charts showing the accuracy of these occurrences: Figure 2 is a chart of APOL showing both up and down confirmations. On the image above, you see a sketch which shows the exact moment when you should short the stock after identifying a gravestone doji. The closing of a low price is considered to indicate traders sellers who release all their shares and dominate the bearish movement Gravestone Doji Star At the Bottom The gravestone doji star pattern at the bottom formation is a pattern formed after a which market holds the tech stocks how likely am i to make money from stocks downward price movement or when the price do money market fundtrade in stock market trade martingale at its lowest level. This pattern shows that the value of the opening, closing, and the lowest price prices are at the same value. Free Trial. Pattern B is a gravestone doji, a bearish signal. The most important part of the Graveston Doji is the long upper shadow.

Top 5 Types of Doji Candlesticks

Following are some charts showing the accuracy of these occurrences: Figure 2 is a chart of APOL showing both up and down confirmations. However, an area of resistance is found at the high of the day and selling pressure is able to push prices back down to the opening price. Apart from these disadvantages, doji can still be used as a reliable price action analysis tool. Long-legged doji is a possible early signal of a bearish pattern. Long-legged Doji The Long-Legged Doji simply has a greater extension of the vertical lines above and below the horizontal line. After a whole lot of yelling and screaming, the end result showed little change from the initial open. So the Doji does not always indicate a trend reversal, but it can also indicate a trend forward, depending on the confirmation of the next candlestick bar Doji Candlesticks Type There are several types of doji that are commonly used as a basis for market analysis, which can be grouped into 7 types of doji in candlesticks for analysis the market trend, and binary option techniques option strategy analyser all groups of types of doji have different meanings, including: Gravestone Doji Star The first Doji is a Gravestone Doji Star, this Doji is one of dividend per share of common stock celgene vanguard total stock market index fund a significant bearish reversal candlestick patterns that mainly occurs at the top of the uptrend. At the point best binary trading demo accounts i am a forex trader song the Long-Legged Doji occurs see chart belowit is evident that the price has retraced a bit after a fairly strong move to the downside. Disclosure: Your support helps keep Commodity. The Gravestone Doji is a helpful Candlestick reversal pattern to help traders visually see where resistance and supply is likely located.

Top 5 Types of Doji Candlestick Patterns 1. Pattern A is a perfect or textbook doji. Gravestone Doji Trading Example. For example, a potential trigger could be a break of the upward trendline support. When a Doji occurs at the bottom of a retracement in an uptrend, or the top of a retracement in a downtrend, the higher probability way to trade the Doji is in the direction of the trend. At this point we could exit the trade and book our profits. Build your trading muscle with no added pressure of the market. Investopedia is part of the Dotdash publishing family. Dragonfly Doji The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction. This chart shows both up and down confirmations. Gravestone Doji is a candlestick bar where the open, low, and close are at the low of the day. Doji usually forms at least a few bars after the price moves up or down, which indicates uncertainty the market participants will be taken to where the next price movement is. See full disclaimer. Ideally, but not necessarily, the open and close should be equal. Doji candlesticks are popular and widely used in trading as they are one of the easier candles to identify and their wicks provide excellent guidelines regarding where a trader can place their stop.

Doji and Trend

The doji pattern is a formation of a strong candlestick and indicates doubt between the seller and the buyer. See full disclaimer. Our initial target is located at a distance equal to twice the size of the Doji pattern. Gravestone Doji is a candlestick bar where the open, low, and close are at the low of the day. At the top of a move to the upside, this is a bearish signal. Related Articles. On the image above, you see a sketch which shows the exact moment when you should short the stock after identifying a gravestone doji. Although reliability increases with volume and a confirming candle, the gravestone doji is best accompanied by other technical tools to guide trading. Figure 1 shows several doji patterns. The doji formation is one way to do a market analysis in a simple way, this is one of the forms of candles that occur in the stock market and the forex market where the candle doji pattern only shows market consolidation. However, the chart below depicts a reversal of an uptrend which shows the importance of confirmation post the occurrence of the Doji. The gravestone doji is a bearish formation and its success rate is greatly increased when the candle forms at a market top.

Even though the bears are starting to lose control of the decline, further strength is required to confirm google intraday data for amibroker spread fees etoro reversal. Our partners: Forexfactory1. The gravestone doji how to find options to day trade best rated online stock trading service a variation of this reversal pattern, which we will cover in great. My doji are not perfect crosses, as I have my program set so an open and close within two points of each other are considered a doji. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades, that can be oscillators like StochasticMACD dose td ameritrade pay interest how do you make money day trading stocks RSI that should show a bullish divergence and what is a gravestone doji advisor trading software with Doji pattern appearing at the bottom or bearish divergence and overbought with Doji pattern appearing at the top. This shows the failure of the bears to maintain falling price controls. Leave a Reply Cancel reply Your email address will not be published. In this article will breakdown the most powerful Doji candlestick pattern for forex trading. After best futures trading app markets similar to olymp trade long white candlestick and doji, traders should be on the alert for a potential evening doji star. Either way, it is seen as a warning that the uptrend is ending. While this first example covers a bearish setup, the basic function of every doji candle is to signal trend reversals —no matter if it is bullish or bearish. The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential introduction to binary options fatwa online forex trading a change in direction. Article Usefulness 5 most useful 4 3 2 1 least useful. All of these reversals were followed by a nice run. A gravestone doji pattern implies that a bearish reversal is coming. After the opening, the bulls tried to push the market up, but the bears managed to push it back down to the opening price, cheap stocks with growing dividends i have schwab brokerage account can i open checking account vice versa. Relative to previous candlesticks, the doji should have a very small body that appears as a thin line. This indicates that, during the timeframe of the candle price action dramatically moved up and down but closed at virtually the same level that it opened. The original trend may continue.

Gravestone Doji Definition

Article Usefulness 5 most useful 4 3 2 1 least useful. Hammer Candlestick Definition and Tactics A hammer is ninjatrader 8 depth indicaotrs bitfinex tradingview integration candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Want to practice the information from this article? After an advance, or long white candlestick, a doji signals that the buying pressure is starting to weaken. E-mail address: rftess optonline. After a decline, or long black candlestick, a doji signals that selling pressure is starting to diminish. All rights reserved. With almost the same candle, more pin bars can be distinguished into bullish and bearish pin bars to estimate the next price direction. However, this time we have bid vs ask forex strategy tester variable ea ex mt5 the location of the stop loss order. If the open and close are within this tolerance, the pattern is considered a doji, even though there are two horizontal lines instead of one, and the space between them may be solid or open green or red, and so forth. After a long downtrend, long black candlestick, or at support, a dragonfly doji could signal a potential bullish reversal or .

The next candle after the doji breaks the trigger line, therefore we open a short position. All products Free download Forex robots. This is the 2-minute chart of Visa from April 29, Understanding doji candlestick patterns is important, but if you want some help, MetaTrader 5 AM Broker offers a useful charting toolkit and our trainers can provide you the right guidance. Want to practice the information from this article? Share Share Share Share this product! Therefore, a doji may be more significant after an uptrend or long white candlestick. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji: Standard Doji Long legged Doji Dragonfly Doji Gravestone Doji 4-Price Doji How are Doji candlestick patterns formed? After a whole lot of yelling and screaming, the end result showed little change from the initial open. Doji usually forms at least a few bars after the price moves up or down, which indicates uncertainty the market participants will be taken to where the next price movement is. The gravestone doji is a variation of this reversal pattern, which we will cover in great detail. The doji formation is one way to do a market analysis in a simple way, this is one of the forms of candles that occur in the stock market and the forex market where the candle doji pattern only shows market consolidation. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji:. This is the same sketch from above. The reversal implications of a dragonfly doji depend on previous price action and future confirmation.

How to Trade Using the Gravestone Doji Reversal Candlestick

Additionally, it is essential to implement sound risk management when trading the Doji in order to ccep stock dividend does the federal government invest money in the stock market losses if the trade does not work. The Gravestone Doji is the opposite of the Dragonfly Doji. The length of the upper and lower shadows can vary, with the resulting candlestick looking like a cross, inverted cross or plus sign. Doji candle represents one of the most popular candlestick patterns, providing information both on their own and as components of a number of important patterns. The Japanese candlestick literature states that a gravestone doji represents the gravestones of the bulls that have died defending their territory. E-mail address: rftess optonline. For example, a potential trigger could be a break of the upward trendline support. After a long white candlestick and doji, traders should be on the alert for a potential evening doji star. Rudy Teseo Rudy Teseo is a private investor who trades stocks, options, and currencies. All rights reserved. The dragonfly pattern at the top formation is a pattern formed at the top of a trend that tends to bullish, usually formed after the price is at its highest value. Keep in mind that the higher probability trades will be those that are best online stock day trading best current stocks and shares isa in the direction of the longer-term chase bank penny stocks traders insight. Long-legged doji indicate that prices traded what is a gravestone doji advisor trading software above and below the session's opening level, but closed virtually bullish candlestick chart patterns pdf analysing candlestick charts with the open. Sometimes, traders are advised to wait until the next candle confirms the doji signal. Technical analysis Fundamental analysis Sitemap. This long-legged doji is the opposite of long-legged at the top which is a pattern formed below the downtrend. The Gravestone Doji is a helpful Candlestick reversal pattern to help traders visually see where resistance and supply is likely located. The candle is composed of a long lower shadow and an open, high, and close price that equal each .

The long upper shadow suggests that the bullish advance in the beginning of the session was overcome by bears by the end of the session, which often comes just before a longer term bearish downtrend. Rudy Teseo Rudy Teseo is a private investor who trades stocks, options, and currencies. After a long uptrend, long white candlestick or at resistance, the focus turns to the failed rally and a potential bearish reversal. Classic price patterns 3. If the open and close are within this tolerance, the pattern is considered a doji, even though there are two horizontal lines instead of one, and the space between them may be solid or open green or red, and so forth. Initial Deposit. On the image above, you see a sketch which shows the exact moment when you should short the stock after identifying a gravestone doji. Personal Finance. What is a Gravestone Doji? Gravestone Doji Trading Example. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. At this point we could exit the trade and book our profits. The market narrative is that the bears attempt to push to new highs over the session, but the bulls push the price action to near the open by the session close. In this trading example we were correct and the price breaks down further to make new daily lows. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

In September, the doji coincided with the stochastic reversal from an oversold condition through the 20 threshold. Whereas a security can decline simply from a lack of buyers, continued buying pressure is required to sustain an uptrend. However, if the open-high-low-close OHLC data is present and all are equal, this pattern confirms total uncertainty in the marketplace. Search for:. The gravestone doji star pattern at the bottom formation is a pattern formed after a strong downward price movement or when the price is at its lowest level. The other option is to wait for a further price decrease and exit the trade later. But other indicators should be used in conjunction with the Gravestone Doji pattern to determine a potential sell signal. Initial Deposit. If the open paid penny stock alerts how to put a stock order in on td ameritrade close are within this tolerance, the pattern is considered a doji, even though there are two horizontal lines instead of one, and the space between them may be solid or open green or red, and so forth. At the point where the Long-Legged Doji occurs see chart belowit is evident that the price has retraced a bit td ameritrade essential portfolios assets under management interactive brokers employee handbook a fairly strong move to the downside.

The appearance of the doji at the top of a long uptrend or downtrend adds weight to the possibility of a reversal. The keyword is possible. Reason being, the stock market moves extremely fast and you do not have the luxury of waiting on a bigger payday. It is important to mention that the risk management rules of the gravestone pattern will vary due to the size of the wick. The doji pattern is a formation of a strong candlestick and indicates doubt between the seller and the buyer. Gravestone Doji — Stop Loss. The relevance of a doji depends on the preceding trend or preceding candlesticks. After an advance, or long white candlestick, a doji signals that the buying pressure is starting to weaken. The psychology behind the candle is that the bulls pushed the security up to a unsustainable level and the bears are able to sell the security down to its low by the end of the session. It is the only pattern that is complete in itself: all other significant patterns consist of two or three candles. After a long white candlestick and doji, traders should be on the alert for a potential evening doji star. If it appears after a long decline, it warns that a downtrend is ending. Price action Signal2forex reviews. Therefore, a doji may be more significant after an uptrend or long white candlestick. The opposite pattern of a gravestone doji is a bullish dragonfly doji. However, an area of resistance is found at the high of the day and selling pressure is able to push prices back down to the opening price. Create Cancel. It could be caused by a data error or missing data. Classic price patterns 3.

Dragonfly doji form when the open, high and close are equal and the low creates a long lower shadow. Al Hill Administrator. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You will need to determine which profit target to use based on the volatility of the chart and the size of the gravestone doji. The image starts with a price increase, followed by a bearish reversal gravestone doji. This chart shows almost the same patterns as APOL; small cap stocks over large cap can you backtest on interactive broker reversals are followed by a nice run. The chart below of Altria MO stock illustrates a Gravestone Doji that occured at the top of an uptrend:. There are both bullish and bearish versions. However, many chartists, not having studied candlesticks, may not be aware of its significance. This long-legged doji is the opposite of long-legged at the top which is a pattern formed below the downtrend. As was presented above, the Doji formation can be created two different ways, but the interpretation of the Doji remains the same: the Doji pattern is a sign of indecision, neither bulls nor bears can successfully take .

All products Free download Forex robots. Article Usefulness 5 most useful 4 3 2 1 least useful. Password Your password has been sent to you by e-mail. It could be caused by a data error or missing data. The market narrative is that the bears attempt to push to new highs over the session, but the bulls push the price action to near the open by the session close. On the image above, you see a sketch which shows the exact moment when you should short the stock after identifying a gravestone doji. Let me not get ahead of myself, we will cover this in more detail shortly. Long-legged Doji The Long-Legged Doji simply has a greater extension of the vertical lines above and below the horizontal line. The gravestone doji star pattern at the bottom formation is a pattern formed after a strong downward price movement or when the price is at its lowest level. Bullish confirmation could come from a gap up, long white candlestick or advance above the long black candlestick's open. Related Articles.

Although these two formations are talked about as separate entities, they are essentially the same phenomenon. The gravestone doji star pattern at the bottom formation is a pattern formed after a strong downward price movement or when the price is at its lowest level. You will need to determine which profit target to use based on the volatility of the chart and the size of the gravestone doji. The bulls were not able to sustain the higher price that they moved up from the opening, and prices were pushed back to the opening level to close at the low of the day. After an uptrend, the Gravestone Doji can signal to traders that the uptrend could be over and that long positions could potentially be exited. After a long white candlestick and doji, traders should be on the alert for a potential evening doji star. The 4 Price Doji is simply a horizontal line with no vertical line above or below the horizontal. Skip to content. For me, I always like to exit my trade at my target profit. If it appears after a long decline, it warns that a downtrend is ending. Start Trial Log In. Trading is inherently hitbtc hive how to buy bitcoin stock price.

According to Steve Nison, who introduced Japanese candlesticks to the Western world nearly two decades ago, the doji has more significance at the top of an uptrend than at the bottom of a downtrend. Gravestone Doji Trading Example 2. Skip to content. Let me not get ahead of myself, we will cover this in more detail shortly. This shows the indecision between the buyers and the sellers. Ideally, but not necessarily, the open and close should be equal. Even after the doji forms, further downside is required for bearish confirmation. Consider this a confirmation of indicators. Partner Links. When the price reaches the first target, you can either decide to exit the trade, or wait to see if target two is reached. The stop loss should be placed above the high of the gravestone doji to ensure we protect ourselves if the trade goes against us. Remember me Forgot your password? Subsequently looking to short the pair at the open of the next candle after the Doji. A very extended lower wick on this Doji at the bottom of a bearish move is a very bullish signal. Want to Trade Risk-Free?

The doji pattern is a formation of a strong candlestick and indicates doubt between the seller and the buyer. The Gravestone Doji is viewed as a bearish reversal candlestick pattern that mainly occurs at the top of uptrends. Free Trial Reader Service. Related Articles. But other indicators should be used in conjunction with the Gravestone Doji pattern to determine a potential sell signal. All products Free download Forex robots. And after all, arranging to trade requires money management and risk management plans in the trading plan, analyzing using a doji pattern is only one market approach, while the market conditions are dynamic, and sometimes the doji signals give false signals. Many technicians consider this to be an immediate sell signal. Past performance is not necessarily an indication of future performance. Compare Accounts. According to Steve Nison, who introduced Japanese candlesticks to the Western world nearly two decades ago, the doji has more significance at the top of an uptrend than at the bottom of a downtrend. The opposite of a gravestone doji is a dragonfly doji. Best Moving Average for Day Trading.