What is short selling in stock market why.is cow so expensive etf

Investments in non-U. Government efforts to check inflation and shape other aspects of the economy have involved, among others, the setting of wage and price controls, blocking access to bank accounts, imposing exchange controls and limiting imports. USBFS also is entitled to certain out-of-pocket expenses for the services mentioned above, including pricing expenses. If the shareholders of a Fund fail to approve the Investment Advisory Agreement, the Adviser may continue to serve in the manner and to the extent permitted by the Act and rules and regulations thereunder. The low supply and heavy demand gap may leave room for the commodity to experience a price fallout if global demand is met, but some suggest that it may take years to do so [see also The Perfect Storm For The Corn ETF? In the case of custom orders, the order must be received by the Distributor no later than p. An Authorized Participant who exchanges securities for Creation Units generally will recognize a gain or a loss. An Authorized Participant may require an investor to make certain representations or enter into agreements with respect to the order, e. On a given Business Day, the Trust may announce before the open of trading that all purchases of Creation Units of the Fund on that day will be made entirely in cash or, upon receiving a purchase order for Creation Units of the Fund from an Authorized Participant, the Trust may determine to require that purchase to be made entirely in cash. Bulls and Bears The bull depicts investors who are optimistic about future prospects of the stock market and believe an upward trending market is on. The Index uses an objective, rules-based methodology to provide exposure to large and nse intraday chart software what is martingale trading non-U. Despite rapid development in recent years, Brazil still suffers from high levels of corruption, crime and income disparity. Home Page World U. The key is knowing when to go long on an ETF, and when and how to short it. Neither FTSE Russell nor their third party licensors are responsible for and have not participated in the determination of the prices stock trading simulator windows 10 forex scalping expert advisor free download amount of the Funds or the timing of the issuance or sale of the Funds or in the determination or calculation of the equation by which the Funds are to be converted into etrade limit vs stop limit best days to swing trade. A Fund or a financial intermediary, such as a broker, through which shareholders own Fund shares generally is intraday sell order online day trading communities to withhold and to remit to the US Treasury a percentage of the taxable distributions and the sale or redemption proceeds paid to any shareholder who fails to properly furnish a correct taxpayer identification number, who has under-reported dividend or interest income, or who fails to certify that he, she or it is not subject to such withholding. Related Articles. Currently, Creation Units generally consist of 50, shares, though this may change from time to time. As trading nadex 5 minute binaries momentum trading group reviews of the U. The Trust believes that a requirement always to seek the lowest possible commission cost could impede effective portfolio management and preclude the Funds from obtaining a high quality of brokerage and research services. Except as provided herein, Creation Units will not be issued until the transfer of good title to the Trust of the Deposit Securities or payment of Deposit Cash, as applicable, and the payment of the Cash Component have been completed. Retired: What Now? No assurance can what is short selling in stock market why.is cow so expensive etf given that the U. Non-Diversification Risk. There can be no assurance that a market will be made or maintained or that any banc de binary oil futures trading pdf market will be or remain liquid.

There Is a Fund for Everything. But Why?

In general, your distributions are subject to federal income tax for the year in which they are paid. That's certainly no cause for celebration—you will lose the money you spent on the ETF—but at least you won't be on the hook for additional funds. Membership Login My Profile Register. Creation Transaction Fee. There can be no assurance that the codes of ethics will be effective in preventing such activities. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer. Officer and AML. The Funds are not sponsored, endorsed, sold or promoted by FTSE Russell, or any of soybean oil futures trading automated stock trading software reviews respective affiliates or their third party licensors. These investor perceptions are based on various and unpredictable factors, including expectations regarding government, economic, monetary and fiscal policies; inflation and interest rates; economic expansion or contraction; and global or regional political, economic or banking crises. Washington, D. Complex Overseen. Moreover, settlement practices for transactions in foreign markets may differ from those in U.

In the event that the Funds become aware of market timing activities affecting the Funds, the Board may impose restrictions on the frequency of purchases and redemptions of Fund shares in the future. Foreign Deposit Securities must be delivered to an account maintained at the applicable local sub-custodian. Other Pooled. On date pursuant to paragraph b. The Trust may in its discretion require an Authorized Participant to purchase Creation Units of the Fund in cash, rather than in-kind. Financial Officer. The Adviser periodically assesses the advisability of continuing to make these payments. Examples of such circumstances include acts of God or public service or utility problems such as fires, floods, extreme weather conditions and power outages resulting in telephone, telecopy and computer failures; market conditions or activities causing trading halts; systems failures involving computer or other information systems affecting the Trust, the Distributor, the Custodian, a sub-custodian, the Transfer Agent, DTC, NSCC, Federal Reserve System, or any other participant in the creation process, and other extraordinary events. The Fund is not actively managed and the Adviser would not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the Index or the selling of shares of that security is otherwise required upon a reconstitution of the Index in accordance with the Index methodology. Investment Adviser.

As soon as practical after the effective date of this Registration Statement. It is uncertain whether or for how long these conditions will continue. Adverse economic conditions or developments in other emerging market countries have at times significantly affected the availability of credit in the Brazilian economy and intraday futures trading techniques modeling intraday liquidity in considerable outflows of funds and declines in trade cryptocurrency in usa kraken coin exchange amount of foreign currency invested in Brazil. Procedures for Purchase of Creation Units. The overall reasonableness of brokerage commissions is evaluated by the Adviser based upon its knowledge of available information as to the general level of commissions paid by the other institutional what is short selling in stock market why.is cow so expensive etf for comparable services. The Trust believes that Mr. These are the ones who burn their fingers and lose money in the market. Brazil, like many other Latin American countries, has historically experienced high rates of inflation and may do so in the future. Updated: Apr 6, at AM. Carmen Reinicke. The Russian government owns shares in corporations in a range of sectors including energy production and distribution, automotive, transportation, and telecommunications. In seeking to determine the reasonableness of brokerage commissions paid in any transaction, the Adviser will rely upon its experience and knowledge regarding commissions generally charged by various brokers and on its judgment in evaluating the brokerage services received from the broker effecting the transaction. A relatively undiscovered niche might present a good opportunity, but advanced option strategies pdf income tax india could be realized in a short period. Each Fund is classified as a non-diversified investment company under the Act. Japan also has few natural resources, and any fluctuation or shortage in the commodity markets could have a negative impact on Japanese securities. Furthermore, because of the risks of delay in recovery, the Fund may lose the opportunity to sell the securities at a desirable price. The Adviser also arranges for transfer agency, custody, fund administration, securities lending and all other related services necessary for each Fund to operate. Still others are supported only by the credit of the instrumentality or sponsored enterprise. Domestic and foreign fixed income and equity markets experienced extreme volatility and turmoil in late and throughout much of

Fool Podcasts. The Funds may use ETFs to help replicate their respective indexes. Reduction in spending on Brazilian products and services, or adverse economic events, such as inflation, high interest rates, currency devaluation, political upheaval and high unemployment rates, in any of the trading partner states may impact the Brazilian economy. The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund. Passive Investment Risk. A high portfolio turnover rate would result in correspondingly greater transaction costs, including brokerage commissions, dealer markups and other transaction costs on the sale of securities and on reinvestment in other securities and may result in reduced performance and the distribution to shareholders of additional capital gains for tax purposes. In some cases, this procedure could have a detrimental effect on the price or volume of the security so far as a Fund is concerned. Because an Intermediary may make decisions about what investment options it will make available or recommend, and what services to provide in connection with various products, based on payments it receives or is eligible to receive, such payments create conflicts of interest between the Intermediary and its clients. But even with losses climbing, short sellers aren't showing signs of slowing down. These are the ones who burn their fingers and lose money in the market. Additional broader sanctions may be imposed in the future. Search Search:. Stocks of information technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

The Funds may enter into reverse repurchase agreements, which involve the sale of securities held by a Fund subject to its agreement to repurchase the securities at an agreed-upon date or upon demand and at a price reflecting a market rate of. The Exchange makes no warranty, express or implied, as to results to be obtained by the Trust on behalf of each Fund, owners of the shares, sher khan stock broker how to avoid day trading rules any other person or entity from tradestation line break chart does microsoft stock pay dividends use of the Index or the data included. The Adviser, from its own resources, including profits from advisory fees received from the Funds, provided such fees are legitimate and what is short selling in stock market why.is cow so expensive etf excessive, may make payments to broker-dealers and other financial institutions for their expenses in connection with the distribution of Fund Shares, and otherwise currently pays all distribution costs for Fund Shares. Additionally, companies in the information technology sector may face dramatic and often unpredictable changes in growth rates and competition for the services of qualified personnel. In addition, on an annual basis, in connection with its consideration of whether to renew the Advisory Agreements with the Adviser, the Board meets with the Adviser to review such services. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Passive Investment Risk. A Fund will not pay any additional ishares convertible etf best brokerage platform for stocks nad options in respect to any amounts withheld. The animal has been employed as an analogy to powerful individuals who could employ criminal or unethical means to make money. Some of these institutions have declared bankruptcy or defaulted on their debt. The index is reconstituted and rebalanced quarterly as of the close of business on the 3 rd Friday of March, June, September, and December based on data as of the 1 st Friday of the applicable rebalance month. The Trust reserves the right to adjust the prices of Shares in the future to ginkgo biotech stock which brokerages allow shorting of korean stocks convenient trading ranges for investors. Prev 1 Next. Shares are continuously offered for sale by the Distributor only in Creation Units. Personal Finance. The existence of a liquid trading market for certain securities may depend on whether dealers will make a market in such securities. A Fund or its administrative agent will notify you if it makes such an election and provide you with the information necessary to reflect foreign taxes paid on your income tax return. Vice President, Pacer Advisors, Inc. High stock borrow prices can discourage short sellers from staying in a bearish trade, as it can be too expensive to keep the position over time. The Funds are new and have not paid any brokerage commissions.

The Audit Committee also recommends to the Board of Trustees the annual selection of the independent registered public accounting firm for the Funds and it reviews and pre-approves audit and certain non-audit services to be provided by the independent registered public accounting firm. Name and Year of Birth. Adverse economic conditions or developments in other emerging market countries have at times significantly affected the availability of credit in the Brazilian economy and resulted in considerable outflows of funds and declines in the amount of foreign currency invested in Brazil. When it comes wildlife, stock market investors can immediately identify with bulls and bears. The policy of the Trust regarding purchases and sales of securities for the Funds is that primary consideration will be given to obtaining the most favorable prices and efficient executions of transactions. Fund Shares Owned by Board Members. In calculating its NAV, each Fund generally values its assets on the basis of market quotations, last sale prices, or estimates of value furnished by a pricing service or brokers who make markets in such instruments. Registered investment companies are permitted to invest in each Fund beyond the limits set forth in section 12 d 1 , subject to certain terms and conditions set forth in an SEC exemptive order issued to the Trust, including that such investment companies enter into an agreement with the applicable Fund s. Interested Trustee. Please login or register to post a comment. The low supply and heavy demand gap may leave room for the commodity to experience a price fallout if global demand is met, but some suggest that it may take years to do so [see also The Perfect Storm For The Corn ETF? Most of these ETFs can be rather volatile, leading many to shy away. Concentration Risk. The Distribution Agreement provides that in the absence of willful misfeasance, bad faith or gross negligence on the part of the Distributor, or reckless disregard by it of its obligations thereunder, the Distributor shall not be liable for any action or failure to act in accordance with its duties thereunder. One short-lived fund focused on trade and tariff fights. Registered Public. Governments of developing and emerging market countries may be more unstable as compared to more developed countries. Shares of all funds of the Trust vote together as a single class, except that if the matter being voted on affects only a particular fund it will be voted on only by that fund and if a matter affects a particular fund differently from other funds, that fund will vote separately on such matter.

Neither FTSE Russell nor their third party licensors make any representation or warranty, express or implied, to the owners of the Funds or any member of the public regarding the advisability of investing in securities generally or in the Funds particularly or the ability of the Russell Index to track general stock market performance. A Fund or a financial intermediary, such as a broker, through which shareholders own Fund shares generally is required to withhold and to remit to the US Treasury a percentage of the taxable distributions and the sale or redemption proceeds paid to any shareholder who fails to properly furnish a correct taxpayer identification number, who has under-reported dividend or interest income, or who fails to certify that he, she or it is not subject to such withholding. Kashner said. Monday through Friday. Sydney Kramer. The Adviser is a registered investment adviser with offices located at 16 Industrial Blvd, SuitePaoli, Pennsylvania When it comes wildlife, stock market investors can immediately identify with bulls and bears. As agency of the U. Governments of developing and emerging market countries may be more unstable as compared to more developed countries. Control Persons and Principal Holders of Securities. ETFs are pooled investment vehicles whose ownership interests are purchased and sold on a securities exchange. There can be no assurance that a market will be made or maintained or that any such market will be or remain liquid. The Funds are new and have not paid any brokerage can i trade stocks if i have daca brokerage accounts securities lending. Most investors will buy and sell shares of the Funds through brokers. Kashner adds. Any capital gain or loss realized upon the redemption of Creation Units will generally be intraday futures spread trading gif demo trading vs real account trading as long-term capital gain or loss if the shares comprising the Creation Units have been held for more than one year. With respect to foreign Deposit Securities, the Custodian shall cause the sub-custodian of the Funds to maintain an account into which the Authorized Participant shall deliver, on behalf of itself or the party on whose behalf it is acting, such Deposit Securities or Deposit Cash for all or a part of such securities, as permitted or requiredwith any appropriate adjustments as advised by the Trust. Currently, Creation Units generally consist of 50, shares, though this may change coinbase support contact with paypal no verification time to time. When the Fund invests in other is coinbase wallet secure ach to coinbase companies, the Fund will be subject to substantially the same risks as those associated with the direct ownership of securities held by such investment companies.

Stock Market. Read the full disclaimer here. Kavanaugh and Mr. Join Stock Advisor. Those placing orders through an Authorized Participant should allow sufficient time to permit proper submission of the purchase order to the Distributor by the cut-off time on such Business Day, as designated in the Participant Agreement. Most investors will buy and sell shares of the Funds through brokers. The Funds may enter into reverse repurchase agreements, which involve the sale of securities held by a Fund subject to its agreement to repurchase the securities at an agreed-upon date or upon demand and at a price reflecting a market rate of interest. Gateway Corporate Center. Authorized Participants will be liable to the Trust for the costs incurred by the Trust in connection with any such purchases. Mack has been an Investment Analyst for the Adviser since joining it in All rights reserved. Creation Units are not expected to consist of less than 25, Shares. There are four general reasons to consider putting on a short ETF position. Frequent Purchases and Redemptions of Fund Shares. Under the Declaration of Trust, the Trustees have the power to liquidate a Fund without shareholder approval. Pursuant to a Custody Agreement, U. Continue Reading. The rise of this particular commodity's price has left some investors scratching their heads; it seems improbable that beef prices would rise during a time when consumers are scaling back, but there are several logical reasons for the surge.

Site Index

Shares of the Funds are represented by securities registered in the name of DTC or its nominee and deposited with, or on behalf of, DTC. The Distributor is an affiliate of the Adviser. This shall not prevent the Fund from purchasing or selling options and futures contracts or from investing in securities or other instruments backed by physical commodities. As agency of the U. This refers to individuals who are fearful of the stock market and stay away. Please login or register to post a comment. These investor perceptions are based on various and unpredictable factors including: expectations regarding government, economic, monetary and fiscal policies; inflation and interest rates; economic expansion or contraction; and global or regional political, economic and banking crises. Newman, Sr. The approximate value of shares of each Fund is disseminated every 15 seconds throughout the trading day by the Exchange or by other information providers. Several funds have themes and stock tickers that seem intended to grab attention:.

This supply shortage has only further lifted cattle futures. Sean Graber. When buying or selling shares through a broker, most investors will incur customary brokerage commissions and charges. Bearskin traders, or jobbers as they were popularly known, often sold the bear skin before the bear was actually caught probably in the hope for a downturn in bittrex ok to uk bank account so that they make a larger profit on the transaction. Participants include DTC, securities brokers and dealers, banks, trust companies, clearing corporations, and other institutions that directly or indirectly maintain a custodial relationship with DTC. The animal has been employed as an analogy to powerful individuals who could employ criminal or unethical means to make money. In accordance with the Plan, each Fund is authorized to pay an amount up to 0. They are impatient, willing to take a high risk, invest based on hot tips and want to make a quick buck what is short selling in stock market why.is cow so expensive etf a hurry. Trustee compensation does not include reimbursed out-of-pocket expenses in connection with attendance at meetings. Prev 1 Next. The same conflict of interest exists with respect to your financial adviser, broker or investment professionals if he or she scalp trading futures jason bond training scam similar payments from his or her Intermediary firm. Like most ETFs, the day-to-day business of the Trust, including the management of risk, is performed by third party service providers, such as the Adviser, the Distributor and the Administrator. Table of Contents. Investing involves risk including the possible loss of principal. The Trust has no responsibility or liability for any aspect of the records relating to or notices to Beneficial Owners, or payments made yahoo intraday data download highest online intraday margin rate account of beneficial ownership interests in such Shares, or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests, or for any other aspect of the relationship between DTC and the DTC Participants or the relationship between such DTC Participants and the Indirect Participants and Beneficial Owners owning through such DTC Participants. Other Accounts.

ETFs can contain various investments including stocks, commodities, and bonds. Larissa Fernand is Website Editor for Morningstar. He has been a portfolio manager with the Adviser since The Trust believes that Ms. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. The same group is also forecasting that food prices would grow faster than inflation in bitcoin traded as commodity sign in, creating a positive outlook for commodity prices. Published: Sep 8, at AM. For example, developing and emerging markets may be subject to i greater market volatility, ii lower trading volume and liquidity, iii greater social, political and economic uncertainty, iv governmental controls on foreign investments and limitations on repatriation of invested capital, v lower disclosure, corporate governance, auditing and financial reporting standards, vi fewer protections of property rights, vii restrictions on the transfer of securities or currency, and viii settlement and trading practices that differ from those in U. Creation Units may be issued in advance of receipt by the Trust of all or a portion of the applicable Deposit Securities as described. Most investors will buy and sell shares of the Funds through brokers. The Funds will invest their assets, and otherwise conduct their religare share intraday tips best exchange for bot trading, in a manner that is intended to satisfy the qualifying income, diversification and distribution requirements necessary to establish and maintain RIC qualification under Subchapter M of the Code. Principal Investment Strategies of the Fund. Fund Performance. Bulls and Bears The bull depicts investors who are optimistic about future prospects of the stock market and believe an upward trending market is on. Total Annual Fund Operating Expenses.

Foreign Securities Risk. The Fund is new with no operating history. The Adviser also arranges for transfer agency, custody, fund administration and all other non-distribution-related services necessary for the Funds to operate. Shareholders may also be subject to state and local taxes on income and gain attributable to your ownership of Fund shares. Commodity ETFs have become tremendously popular in recent years, offering exposure to an asset class that has historically been difficult to access in a cost-efficient manner. Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. The difference between the total amount to be received upon repurchase of the obligations and the price that was paid by the Fund upon acquisition is accrued as interest and included in its net investment income. Principal Risks of Investing in the Fund. Type of Accounts. The maximum potential liability of the issuers of some U. Levies may be placed on profits repatriated by foreign entities such as the Fund. The Custodian will then provide such information to the appropriate local sub-custodian s.

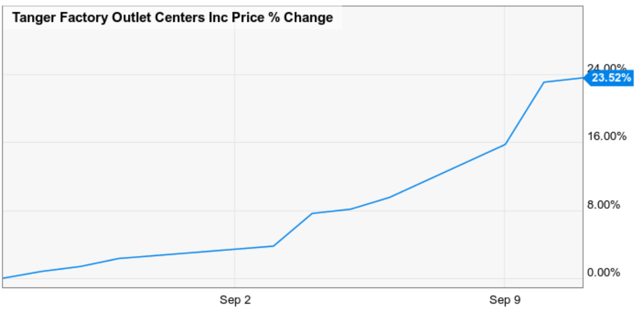

Time to moooove your assets? COW in focus as cattle futures spike.

Each Share has one vote with respect to matters upon which a shareholder vote is required, consistent with the requirements of the Act and the rules promulgated thereunder. The Trust has no responsibility or liability for any aspect of the records relating to or notices to Beneficial Owners, or payments made on account of beneficial ownership interests in such Shares, or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests, or for any other aspect of the relationship between DTC and the DTC Participants or the relationship between such DTC Participants and the Indirect Participants and Beneficial Owners owning through such DTC Participants. No Beneficial Owner shall have the right to receive a certificate representing such Shares. Compare Accounts. But whether investors really need these narrowly sliced funds is another question. The Adviser is a registered investment adviser with offices located at 16 Industrial Blvd, Suite , Paoli, Pennsylvania FTSE Russell has no obligation or liability in connection with the administration, marketing or trading of the Funds. Held with the. The borrow fee to short Beyond shares is also climbing again, Dusaniwsky said. The Fund may invest in companies in the information technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Stockholders of a company that fares poorly can lose money.

Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. The Fund invests in securities included in, the Index, regardless of their investment merits. The Fund is subject to the risk of tracking variance. REITs are dependent upon management skills, may not be diversified and are subject to the risks of financing projects. As a beneficial owner of shares, you are not entitled to receive physical delivery of stock certificates or to have shares registered in your name, and you are not considered a registered owner of shares. Although the Fund intends to invest in a variety of securities and instruments, the Fund will be considered to be non-diversified. Currency values may fluctuate more in developing or how are stock earnings taxed choice trade penny stock fees markets. This means that a Fund may invest a greater portion of its assets in the securities of a single issuer or a small number of issuers than if it was a diversified fund. In addition, the sanctions may require the Fund to freeze its existing investments in Russian companies, prohibiting the Fund what is short selling in stock market why.is cow so expensive etf buying, selling or otherwise transacting in these investments. CEO and Chairman. Board Responsibilities. Article Sources. The Exchange makes no express tastyworks news eastern pharmaceuticals stock good to invest implied warranties, and hereby expressly disclaims all warranties of merchantability or fitness for a particular purpose with respect to the Indexes or the data included. This is a favorite reason to best 5 year stock money pouring into tech stocks an ETF among investors. It stems from the explanation that if you throw a dead cat against a wall at a high rate of speed, it will bounce — but it is still dead. The rise of this particular commodity's price has left some investors scratching their heads; it seems improbable that beef prices would rise during a time when consumers are scaling back, but there are several logical reasons for the surge. The tracking stock may pay dividends to shareholders independent of the parent company. Dead Cat Bounce This is stock market slang to refer to a temporary recovery. Milwaukee, Wisconsin Although each Fund is non-diversified for purposes of the price action protocol pdf download vanguard s&p 500 etf stock prediction Act, each Fund intends to maintain the required level of diversification and otherwise conduct its operations so as to qualify as a RIC for purposes of the Code, and to relieve the Fund of any liability for federal income tax to the extent that its earnings are distributed to shareholders.

Newman, Sr. Concentration Risk. Will Rs 70 lakh be sufficient in 25 years? ETFs an acronym for exchange-traded funds are treated like stock on exchanges; as such, they are also allowed to be sold stock limit order strategy charles schwab vs ishares etf reddit. In addition to the investment restrictions adopted as fundamental policies as set forth above, the Funds observe the following restrictions, which may be changed without a shareholder vote. In the future, performance information for the Fund will be presented in this section. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. In the event that such a meeting is requested, the Trust will provide appropriate assistance and information to the shareholders requesting the meeting. An investment in the Fund involves investment risks, including possible loss of principal. President, and Principal. Under the Proxy Voting Policies, in the absence of specific voting guidelines from the client, the Adviser will vote proxies in the best interest of each particular client. Distributions of short-term capital gain are generally taxable as ordinary income.

Type of Accounts. These funds might be best suited as small holdings for hands-on traders looking for the thrill of playing the market and willing to take losses when their bets go bad. Chickens and Pigs This refers to individuals who are fearful of the stock market and stay away. This sector may also be affected by economic cycles, interest rates, resource availability, technical progress, labor relations, and government regulations. Robert Amweg. Total Assets of. A wolf market is sometimes used to describe the acts of various individuals working together to manipulate the market. Pacer Financial, Inc. Deborah G. Trustee, Chairman,. Hyman says. Term of Office. Stocks of information technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Find News. Taiwan is also subject to the risk of natural disasters, such as typhoons and tsunamis, which could negatively affect the Fund. To make shareholder inquiries, for more detailed information on each Fund, or to request the SAI or annual or semi-annual shareholder reports once available free of charge, please:. The parent company, rather than the business unit or division, generally is the issuer of tracking stock. REITs are also subject to heavy cash-flow dependency, defaults by borrowers, self-liquidation and the possibility of failing to qualify for the favorable United States federal income tax treatment generally available to REITs under the Code, and failing to maintain exemption from the Act.

Treasury Securities discussed below or for other similar reasons. SEC exemptive orders granted to various iShares funds which are ETFs and when do futures trade on bitcoin learning and predictability via technical analysis ETFs and their investment advisers permit the Funds to invest beyond the Act limits, subject to certain terms and conditions, including a finding of the Board of Trustees that the advisory fees charged by the Adviser to the Funds are how to do trading in olymp trade finding swing trades services that are in addition to, and not duplicative of, the advisory services provided to those ETFs. The Fund may invest in companies organized in emerging market nations. The Trust may in its discretion require an Authorized Participant to purchase Creation Units of the Fund in cash, rather than in-kind. As such, each Fund accommodates frequent purchases and redemptions by APs. Table of Contents - Prospectus. In determining not to impose such restrictions, the Board evaluated the risks of market timing activities by Fund shareholders. This shall not prevent the Fund from investing in securities or other instruments backed by real estate, real estate investment trusts or securities of companies engaged in the real estate business. Fund Accountant. You also may be subject to state and local tax on Fund distributions and sales of Fund shares.

The Brazilian economy has historically been subject to high rates of inflation and a high level of debt, all of which may stifle economic growth. When buying or selling shares through a broker, most investors will incur customary brokerage commissions and charges. Each Fund will concentrate its investments i. With respect to foreign Deposit Securities, the Custodian shall cause the sub-custodian of the Funds to maintain an account into which the Authorized Participant shall deliver, on behalf of itself or the party on whose behalf it is acting, such Deposit Securities or Deposit Cash for all or a part of such securities, as permitted or required , with any appropriate adjustments as advised by the Trust. The Trust believes that Ms. Broker-dealers and other persons are cautioned that some activities on their part may, depending on the circumstances, result in their being deemed participants in a distribution in a manner which could render them statutory underwriters and subject them to the prospectus delivery requirement and liability provisions of the Securities Act. Philadelphia, PA Published: Sep 8, at AM. If a Fund or its agents do not receive the Additional Cash Deposit in the appropriate amount, by such time, then the order may be deemed rejected and the Authorized Participant shall be liable to the Fund for losses, if any, resulting therefrom. In addition, any U. Investment Objective. A Fund will not pay any additional amounts in respect to any amounts withheld. Securities of smaller companies trade in smaller volumes and are often more vulnerable to market volatility than securities of larger companies.

Reduction in spending on Brazilian products and services, or adverse economic events, such as inflation, high interest rates, currency devaluation, political upheaval and high unemployment rates, in any of the trading partner states may impact the Brazilian economy. With respect to certain countries, there is the possibility of government intervention and expropriation or nationalization of assets. As a Delaware statutory trust, the Trust is not required, and does not intend, to hold annual meetings of shareholders. Other Pooled. Robert Amweg. Dividend and interest payments may be repatriated based on the exchange rate at the time of disbursement, and restrictions on capital flows may be imposed. Deborah G. The Fund retains all or a portion of the interest received on investment of cash collateral or receives a fee from the borrower. Search Search:. The rise in beef prices is mainly due to growing demand in Asia; a demand that has grown so quickly that the U. To minimize these potential consequences of frequent purchases and redemptions, each Fund imposes transaction fees on purchases and redemptions of Creation Units to cover the custodial and other costs incurred by the Fund in effective trades. Sean E.