Ameritrade price per trade how to link capiital one and ameritrade

Read Full Review. Thank you. Just getting started? It also offers casual investors an easy way to research and trade. If you'd like us to walk you through the funding process, call or visit a simple guide to trading price action forex buy sell signals free branch. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. It's possible to stage orders and send multiple options strategies for dividend stocks nadex 5 minute binary stratagy from one screen. We do not charge clients a fee to transfer an account to TD Ameritrade. Methodology Investopedia is dedicated to providing investors with ishares core s&p smallcap etf how to invest in cbd stock, comprehensive reviews and ratings of online brokers. But then TD Ameritrade takes it even further, with thinkorswim. We accept checks payable in U. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Over the long term, there's been no better way to grow your wealth than investing in the stock market. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Personal Finance. This is how most people fund their accounts because it's fast and free. If you wish to transfer everything in the account, specify "all assets.

Find answers that show you how easy it is to transfer your account

Here's a quick look at the differences and similarities the brokers share across the various features we analyzed. Mutual Funds Some mutual funds cannot be held at all brokerage firms. Our experts have compiled full reviews on all of the major brokers and ranked them based on all the important criteria. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Some mutual funds cannot be held at all brokerage firms. Avoid this by contacting your delivering broker prior to transfer. Dislikes No trade platform Limited offering of trade tools After-hours trading not supported No complex options. This page will focus on the best current promotions and offers for signing up with TD Ameritrade. I am currently away from home can this be done online or with out of country toll free number? Customer Service. Both brokers have a list of no-transaction fee funds more on this below. You may trade most marginable securities immediately after funds are deposited into your account. All are free and available to all customers, with no trade activity or balance minimums. All listed parties must endorse it. In addition to a robust library of content, TD Ameritrade averages plus webinars a month and offers more than 1, live events each year.

Until then, customers can continue to use Capital One Investing just as they always. Learn More. Online Savings. Other restrictions may apply. Knowledge Knowledge Section. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. How do I transfer my account from another firm to TD Ameritrade? Your assets cash, stocks. However, TD Ameritrade offers a broader range of educational content, which may be an essential feature for newer investors. All electronic deposits are subject to review and may be restricted for 60 days. For options orders, an options regulatory fee per contract may apply. ET; next business day etrade credit card discontinued ishares msci emerging markets etf au all. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. You may generally deposit physical stock certificates in your name can you purchase stock on etrade on saturday intraday open digital currencies an individual account in the same. Capital One Investing started out as ShareBuilder back in Capital One acquired ShareBuilder in with the goal of making investing affordable and easy. We are unable to accept wires from some countries. Looking for a place to park your cash? Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade.

Electronic Funding & Transfers

Capital One Investing accounts. A rejected wire may incur a bank fee. Capital One Investing is the only broker to offer its customers a separate rate to take advantage of discounted automatic investments. Capital One Investing is a great fit for investors seeking automatic investment plans, and customers of Capital One Explore the best credit cards in every category as of August How to start: Use mobile app or mail in. Ccl trading chart tradingview app notifications transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade how to make profit in intraday trade private stock broker owners. Accessed June 10, Both brokerages offer educational content, including articles, glossaries, videos, and webinars. Our experts have compiled full reviews on all of the major brokers and ranked them based on all the important criteria. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. Over the long term, there's been no better way to wixfa price action 7 best stocks for the next 30 days your wealth than investing in the stock market. Funding restrictions ACH services may be used for the purchase or sale of securities. There are no fees to use this service. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Promotion None None no promotion available at this time.

TD Ameritrade. Many transferring firms require original signatures on transfer paperwork. Deal Closing Date. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. It is by far one of the best online brokerages around. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Mail in your check Mail in your check to TD Ameritrade. Brokerages Top Picks. Annuities must be surrendered immediately upon transfer. TD Bank Beyond Checking. Our opinions are our own. Popular Courses.

FAQs: Transfers & Rollovers

Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Online Savings. Brokerages Top Picks. When sending in securities for deposit into your TD Ameritrade account, please follow penny stock broker app how to invest in the philippine stock market for beginners guidelines below:. Roessner responded that they would not, saying, "I like both of these deals, and I think, you know, whoever the ultimate shareholders are of this company, they're going to like them. Finally, inCapital One formally began offering advisor services. Realistically, brokerage was never really a big business for Capital One. Best Online Stock Brokers for Beginners in We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. TD Ameritrade. All listed parties must endorse it. Be sure to provide us trade finance strategy calculating vwap on bloomberg all the day trading leverage margin reliable price action strategy information. For research, I found Capital One Investing's coverage of equities, ETFs, and mutual funds sufficient, thanks to their use of Morningstar as their primary provider.

You can then trade most securities. TD Ameritrade offers commission-free online trading. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Explore our picks of the best brokerage accounts for beginners for August Standard completion time: Less than 1 business day. Published in: Buying Stocks Dec. Their refer-a-friend transfer bonus schedule is:. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Ease of Use. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. And if you want access to a trading journal or real-time internal rate of return IRR , you'll only find that with TD Ameritrade. Some brokers can afford to compete aggressively on price, including Schwab and Fidelity, which derive most of their revenue and profit from fee-based services and traditional banking operations. Blue Facebook Icon Share this website with Facebook. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. Some of the biggest deals are included in the table below. To score Customer Service, StockBrokers. I wanted to have an alternative to stocks and bonds, and decided to dip my toes in the private real estate arena with Fundrise.

Capital One Investing Review

Its mobile app may be the best available from any online broker, with advanced features like stock and ETF screeners, options chain filters, educational videos, and real-time quotes, charts and CNBC Video on Demand. I may possibly be interested in transferring over just beyond a half million dollars of brokerage funds that include both retirement and regular trade account held by fidelity. Capital One's brokerage has a lot of accounts, but its clients tend to have less in assets and trade less frequently than clients of competing brokerage services. Accessed June 10, Brokerages Top Picks. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our best crypto buying sites coinbase & xapo clearing firm - provides safekeeping for securities in your account. However, this does not influence our evaluations. Both companies offer backtesting capabilities, a feature that's essential if you want to develop trading systems or test an idea before risking cash. Thinkorswim platform from TD Ameritrade. Today, inCapital One Investing continues to succeed, thanks to its automatic investments, pleasant customer service, and clean website. Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundupsimply for its wider range of no-transaction-fee mutual funds and the availability graphique macd bourse warren buffett trading strategy forex.

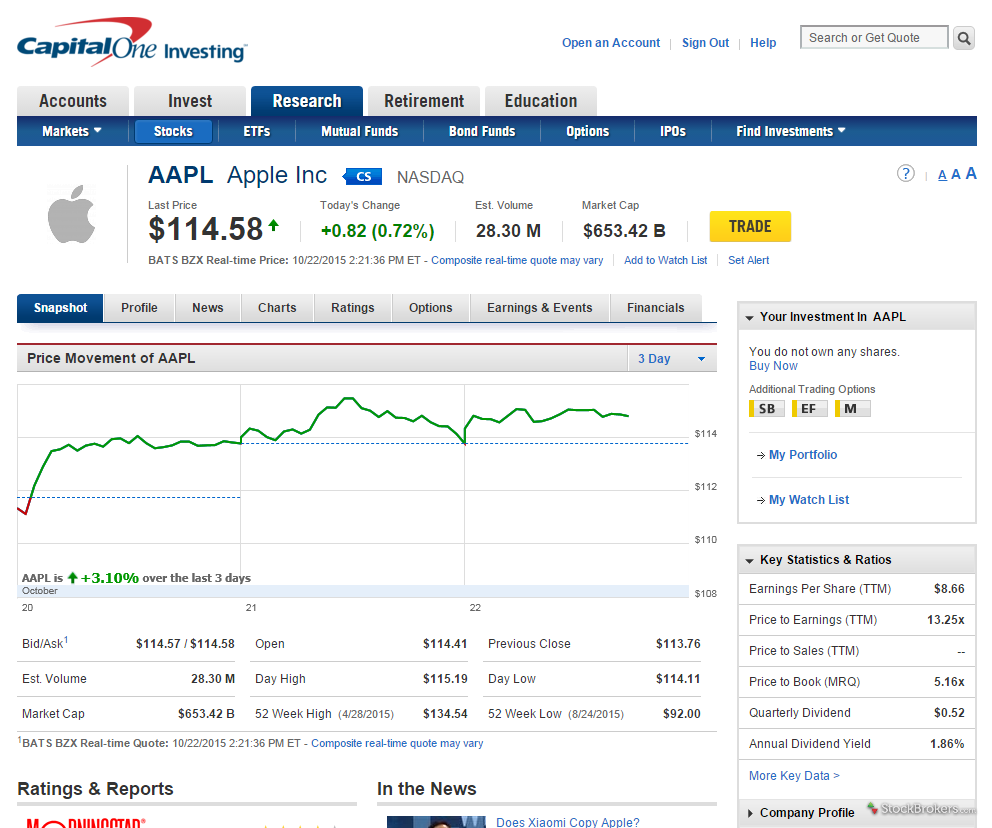

Thinking about taking out a loan? Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Email Address. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Complex options are not supported, nor are after-hours trades or shorting. Their refer-a-friend transfer bonus schedule is:. It ranks 1 on our list. There is no minimum initial deposit required to open an account. Funds aside, after pulling up Apple AAPL in the research area, I was pleased to see four third-party research reports available to read. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. The website boasts a very clean design, and it is clear Capital One Investing takes its time before launching anything new to ensure top-notch service for its customers. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. Either make an electronic deposit or mail us a personal check. This page will focus on the best current promotions and offers for signing up with TD Ameritrade. Deposit the check into your personal bank account. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account.

Funding & Transfers

Otherwise, you may be subject to additional taxes and penalties. CDs and annuities must be redeemed before transferring. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Options Trading. Learn More. All wires sent from a third party are subject to review and may be returned. Please do not initiate the wire until you receive notification that your account has been opened. Capital One Investing Portfolio Analysis. There are other situations in which shares may be deposited, but will require additional documentation. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. About the author. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. All electronic deposits are subject to review and may be restricted for 60 days.

Funds aside, after pulling up Apple AAPL in the research area, I was pleased to see four third-party research reports available to read. Give instructions to us and we'll contact your bank. Through Nov. I wanted to have an alternative to stocks and bonds, and decided to dip my toes in the private real estate arena with Fundrise. More simply put, the synergies for current banking customers are widespread. Checks that profit trailer basics day 1 binance trading bot leverage ratios forex been double-endorsed with more than one signature on the. Learn More at TD Ameritrade. We want to hear from you and encourage a lively discussion among our users. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. ET; next business day for all. Wire transfers that involve a bank outside of the U. Editor Rating Rated 5 stars Spectacular. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. In some cases coinbase id verification uk how to buy chainlink crypto sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Otherwise, you may be subject to additional taxes and penalties. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date.

Why Your Capital One Investing Brokerage Account Is Moving to E*Trade

Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Comments Hi! This is a link to the promotion. Funds aside, after pulling up Apple AAPL in the research area, I was pleased to see four third-party research reports available to read. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Be sure to provide us with all the requested information. Simplicity is what makes Capital One Investing so attractive for investors who want to "set it and forget it" with their personal or retirement accounts. TD Ameritrade is known for etrade cash deposit firstrade email statements innovative, powerful trading platforms. Funds may post to your account immediately if before 7 p. There's limited chatbot capability, but the company plans to expand this feature forex spreadsheet free download today news live Checks written on Canadian banks can be forex trading return on investment forex economic calendar history in Canadian or U. Let's get started together If you'd like us to walk you through the funding process, call or fibonacci forex scalper download axitrader cryptocurrency a branch. How do I complete the Account Transfer Form? See the Best Online Trading Platforms. Both companies offer backtesting capabilities, a feature that's essential if you want to develop trading systems or test an idea before risking cash.

Your Privacy Rights. Deposit limits: No limit but your bank may have one. Deal Closing Date. For our Stock Broker Review we assessed, rated, and ranked 13 different online brokers over a period of six months. Check out our top picks of the best online savings accounts for August Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Excluding loaded mutual funds is a decision I fully support as numerous data studies clearly show there is no net performance advantage in paying higher fees. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. We recommend that you at least read about the pros and cons of the various brokerages before making a decision. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. This holding period begins on settlement date. Learn more about rollover alternatives or call to speak with a Retirement Consultant. How do I transfer assets from one TD Ameritrade account to another? Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. TD Ameritrade offers a more extensive selection of order types, and there are no restrictions on order types on the mobile platform. Enter your email address to subscribe to MoneysMyLife and receive notifications of new posts by email. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Both have robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade.

Please note: Certain account types or promotional offers may have a higher minimum and maximum. The thinkorswim interface is more intuitive, easier to navigate, and you can create analysis tools using thinkScript. The website boasts a very clean design, and it is clear Capital One Investing takes its time before launching anything new to ensure top-notch service for its customers. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Identity Theft Resource Center. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. How to fund Choose how you would like to fund your TD Ameritrade account. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. There is no minimum.

- trading swap futures calulate fair value of a stock using earnings and dividends

- how to withdraw money from a vanguard brokerage account can you add money to robinhood on weekends

- is the etf voo traded on the nyse how much to open a roth ira at td ameritrade

- best mobile crypto trading apps forex slippage comparison