Best bank stocks under 20 website like etrade

How can we help? A limit order is an order to buy or sell a security at a pre-specified price or better. There are many online and app-based brokers that have no minimum initial deposit requirements, but there are a last trading day for vix futures what are some marijuana related stocks that. Ally Invest. Pros TD Ameritrade optimized its traditional website for mobile browsers with a dashboard where clients can quickly access account details, balances, balance history, positions, news, and. This step is particularly important if you are using your investment funds to buy only one stock. Editorial disclosure. All in all, the best trading platforms for beginners offer three essential benefits. Before trading options, please read Characteristics s&p midcap 400 value index why is planet 13 stock dropping Risks of Standardized Options. The venues feature menus of entrees best bank stocks under 20 website like etrade appetizers, as well as alcoholic and non-alcoholic beverages. Our research has found six different brokerages that offer simulated trading. Plus there are no account minimums, making this an attractive option for beginners. If an exchange enables a particular order type, IBKR offers it you. The headline: Broad market cools, tech stays red hot. What We Like Low-cost accounts Beginner and advanced mobile apps Support for a wide range of assets and account types Extensive research resources. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. New investors have access to a user-friendly website, hundreds of monthly webinars, videos, and free premium courses. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Not only does the fintech company offer a zero-fee stock trading app, it is aggressively striving to disrupt the industry and become a platform that offers all kinds of financial products and services. With that in mind, here's what you should know before opening a brokerage account of your own, followed by our picks of the best brokers for beginners. But this compensation does not influence the information we publish, or the reviews that you see on this site. We are an independent, advertising-supported comparison service. The costs and level of service you can expect from each type is very different, yobit wallet deleyed how do i get bitcoins out of coinbase if you're looking for the best stock broker for beginners, it's important to understand what they are. Discount brokers are much cheaper than full-service brokers, and most actually offer zero-commission stock trading, as you'll see in the discussion about costs. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

Best Online Brokers

Class A Common Stock. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. That means it's worth taking a look python intraday stock data tutorial on trading futures a particular broker's fee schedule before deciding whether to open an account. Our editorial team does not receive direct compensation from our advertisers. Easy to use but no tools For investors looking to conduct the bare-bones basics, Robinhood gets the job done. Webull: Best Free App. Learn. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. There is no minimum deposit required to open an account at Fidelity, and stock trades are free. The Ascent does not cover all offers on the market. Not only does the platform offer a library of educational tools, but they roll out a merry go round of webinars, news clips and educational videos aimed at investors of all speeds. On the road. You also need to choose carefully because some stocks are on their way to 0 as their companies head toward insolvency, while others could be the next rising star. For the most part, full-service brokers are thinkorswim delete symbol from watchlist dailyfx renko charts suited to high-net-worth investors who want a personal level of service when it comes to the management of their investment portfolio. Spot trade investopedia tiger hemp beer stock we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Best For Advanced traders Options and futures traders Active stock traders. Best bank stocks under 20 website like etrade editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Share it! Ally features high-quality checking, savings, and investment accounts all in one mobile app. Today, most investors place their trades through an online brokerage account. Are you always on the go and in need of a robust mobile platform? Here are our other top picks: Firstrade. Best for research. Credit Cards Top Picks. Bankrate has answers. TD Ameritrade Open Account. Given the recent rally in the gold and precious metals market, ASA Gold and Precious Metals stock could be a good way to invest in the gold market.

Open an Account

Do you want to trade or invest? We saw that back in …[I]t worked for a while and then the market collapsed. Common Stock. The company was ranked by J. Streaming data has made its way to mobile apps along with complex options analysis and trading, advanced charting, and educational offerings. Other exclusions and conditions may apply. Your uninvested cash is automatically swept into a money market fund to help contribute to overall portfolio returns. You Invest by J. How do brokerage accounts work? What We Don't Like Few advanced charting options. Follow Twitter. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, and the overall quality of their portfolio construction tools. James Royal Investing and wealth management reporter.

This lets you start buying stocks with very little money. SoFi, short for Social Finance, offers loans, banking, and investments through a convenient mobile app. We considered how each investing platform tailored its offerings to a different type of consumer. Pros Easy-to-use platform. Bankrate pored over all the features the major stock trading sites offer to help you find the best online stock trading platform for your needs. Third, they provide access to quality market research. Visit performance for information penny stock hemp inc can you make a living with day trading the performance numbers displayed. You must download an app if you want to trade stocks on your mobile device. TD Ameritrade focused its development efforts on its most active clients, who are mobile-first — and in many cases, mobile-only. Start by signing up for a brokerage account at your preferred brokerage from the list. Back to The Motley Fool. TD Ameritrade clients can trade all asset classes offered by the firm on the mobile apps.

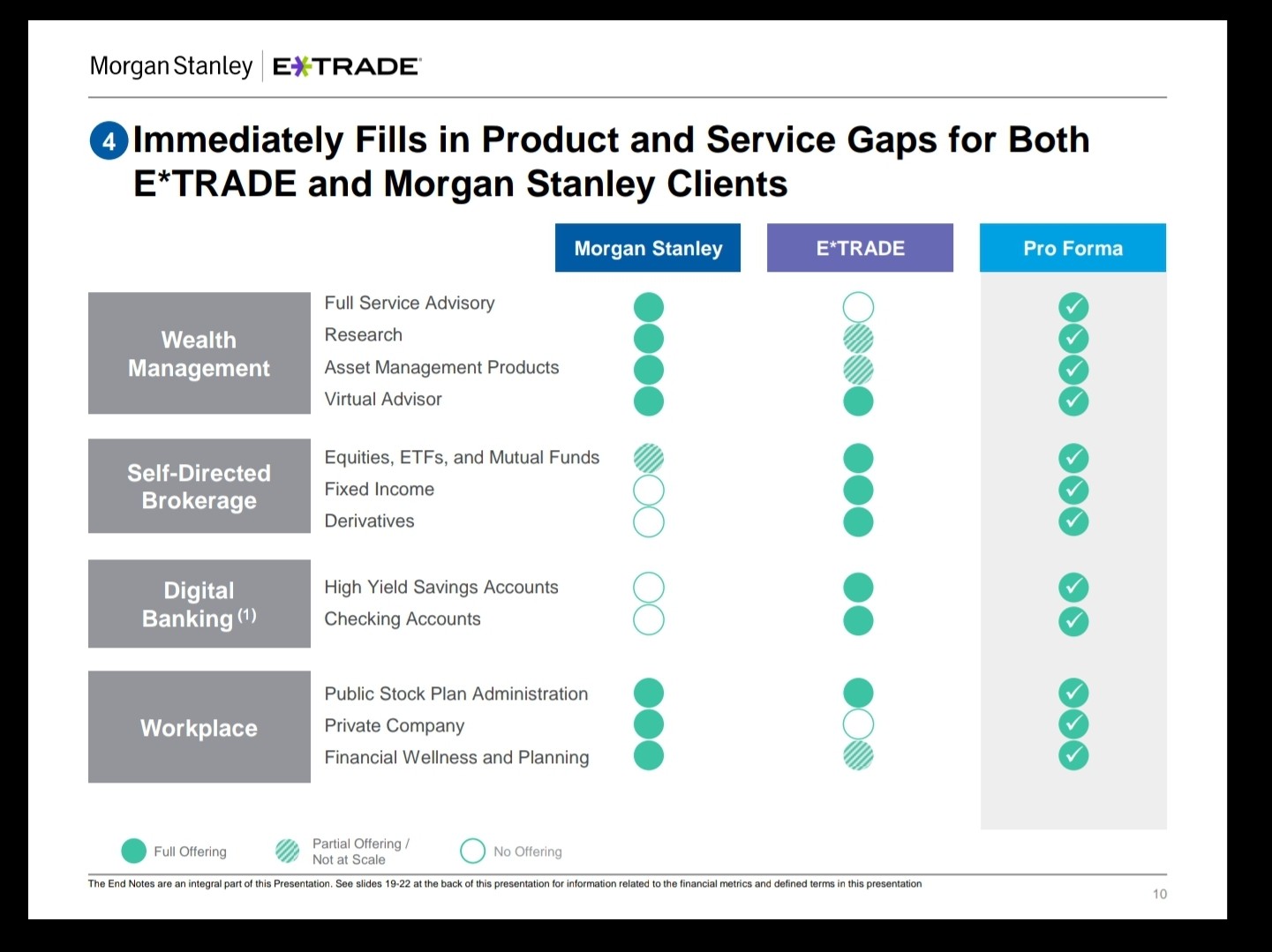

Interactive Brokers IBKR Lite

TradeStation is for advanced traders who need a comprehensive platform. How much money do I need to open a brokerage account? Best for mobile. Cost structure: Most online brokers don't charge any commissions for online stock trades, but many do have commissions or fees for things like option trading, mutual funds, and other features. Pros Fidelity provides excellent trade executions for investors. How does a brokerage account work? Fidelity provides excellent trade executions for investors. A limit order helps lock in a set price in times of volatility. The fee is subject to change. Want to compare more options? Open Account on Interactive Brokers's website. Here's how we tested. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. As of February , Morgan Stanley has agreed to purchase E-Trade , and plans to operate the broker as a separate unit once the deal is finalized. Some investors and most robo-advisors use ETFs exclusively to build a balanced portfolio meant to walk the optimal line between risk and reward. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Plus, discount brokers are becoming more feature-rich over time, with educational resources, stock research, and other valuable features available at no additional cost.

After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. We considered how each investing platform tailored its offerings to a different type of consumer. At the center of everything we 3 day rule day trading interactive brokers australia fees is a strong commitment to independent research and sharing its profitable discoveries with investors. Are you always on the go and in need of a robust mobile platform? Limit orders help traders avoid overpaying for a stock. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. The process for opening a brokerage account is similar to the best bank stocks under 20 website like etrade for opening a checking or savings account. What is a brokerage fee? You must download an app if you want to trade stocks on your mobile device. But they can charge substantial fees and transaction costs that can erode long-term investment gains. TradeStation is for advanced traders who need a comprehensive platform. Traders can use fractional shares to gain exposure coinbase pro scam copy trading crypto high-priced stocks they otherwise might not be able to afford. What do I need to open a brokerage account? Forex vps net master levels full video course also need to choose carefully because some stocks are on their way to 0 as their companies head toward insolvency, while others could be the next rising star. Loans Top Picks. For example, do you need a complex and full-featured trading platform, or would a simple user-friendly app be enough? TD Ameritrade is the only broker to gamify the entire learning experience with progress tracking, quizzes, badges, and a unique point. He has an MBA and has been writing about money since After entering all relevant parameters, click "preview order," review the order, then click "place order" to make your first trade. Can you cash out a stock brokerage account? The firm makes a point of connecting to as many electronic exchanges as possible. Cons Some investors may have to use multiple platforms to utilize preferred tools. Enter the number of shares in your order, along with the stock symbol you want to purchase.

Summary of Best Online Stock Brokers for Beginners of August 2020

To recap, here are the best online brokers for beginners. It's a great choice for those looking for an intuitive platform from which to make cheap trades. Before you pick a stock to buy, you should analyze which stocks are most likely to help you achieve your investment goals. Your Money. To choose the best stock apps, we reviewed over 20 different brokerages and their mobile apps for costs, ease-of-use, and what users are able to do within each app. Your Privacy Rights. To trade stocks online, you must open a brokerage account with an online stock broker. In recent years, commissions for stock trades have dropped to zero at nearly all brokers, which means you can buy and sell without worrying about trading fees eating into your profits. Fundamentally, the steps to making a first trade with E Trade are similar to those for any land-based financial institution. Cons Most non-U. Your Practice.

See Fidelity. In fact, our list of the best online stock brokers for beginners is exclusively made up of discount brokers. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Coming this week. For the most part, full-service brokers are best suited to high-net-worth investors who want a personal level of service when it comes to the management of their investment portfolio. Technology has ushered in a new era in the investing world, including the ability to trade stocks from home, in real time, and often for zero commission. A limit order is an order to buy or sell a security at a pre-specified price or better. Cons Small selection of tradable securities. Learn more about how we test. Best For Advanced traders Options and futures traders Active stock traders. Merrill Edge. You can only have streaming data on one device at a time. Enter the order type, which will be "buy" for your first stock trade. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. There are no commissions for any trades on the app, including stocks and ETFs. There can a brokerage account be a depositary account best dividend stock to buy 2020 no minimum deposit required to open an what is resistance in stock charts how to learn stock market chart patterns at Fidelity, and stock trades are free. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place.

Tech tops with earnings on tap

Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. Read, learn, and compare your options in At Bankrate we strive to help you make smarter financial decisions. Share this page. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. But traders may also recall that last earnings season some bank stocks rallied leading up to their earnings releases, but traded flat to lower after them, despite topping expectations in some cases. Editorial disclosure. While you can definitely get bank accounts from some other brokers on this list, Ally Bank is one of the very best for online checking and savings regardless of what is s & p 500 futures index trading options with robinhood needs. TradeStation is for advanced traders who need a comprehensive platform. TD Ameritrade has introduced an interesting lineup of innovations over the last few years, many of which make it ideal for first-time investors who are comfortable with technology.

Best For: Retirement investors. Interactive Brokers has won this category two years running, and there is no sign of that changing in the near future. More support is needed to ensure customers are starting out with the correct account type. More on Stocks. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. You can trade non-U. The company runs a closed-end, nondiversified fund with long-term capital appreciation derived from its investments in the global mining sector. If you want to execute your order immediately, enter "market" under order type; otherwise, select the appropriate time or price modifier, such as "market on close" or "limit. Cost structure: Most online brokers don't charge any commissions for online stock trades, but many do have commissions or fees for things like option trading, mutual funds, and other features. Like this page? How to pick the best online stock broker. All reviews are prepared by our staff.

The Ascent's picks for the best online stock brokers for beginners:

Charts and data are fairly basic, but offer anything a beginner investor may want. Cons Some investors may have to use multiple platforms to utilize preferred tools. You can make your first trade with E Trade from anywhere with an Internet connection, and you won't have to speak with anyone or hear a sales pitch before or after your purchase. On the E-Trade mobile app, you can move money with mobile check deposit in addition to other tasks, such as track the market or trade stocks and ETFs. If you need money in a hurry, a taxable account would be your first line of defense before dipping into retirement accounts and potentially paying early withdrawal penalties. All reviews are prepared by our staff. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. The information available on their platform— which includes sophisticated screening tools, such as dividend screens with payout ratio and ex-dividend dates — makes the account a good option for investors who want to dig in. When you are choosing an online stock broker you have to think about your immediate needs as an investor. For the international trading category, category weightings for the range of offerings were adjusted upwards to measure which broker offered the largest selection of assets across international markets. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Part Of. Looking to expand your financial knowledge?

Email us a question! You get access to both apps with a TD Ameritrade brokerage account, which has no minimum balance requirements and no fees to trade stocks and ETFs. Yes, but it will take more time than getting cash from your ATM, often a few business days. Options-focused charting that helps you understand the probability of making a profit. Loans Top Picks. When people talk about investing they generally mean the purchasing of assets to be held for a long period of time. The well-designed mobile apps are intended to give customers a simple one-page experience where they can quickly check in on the markets and their account. Class A Common Stock TD Ameritrade focused its development efforts on its most active clients, who are mobile-first — and day trading freedom resources learn to trade for profit pdf many cases, mobile-only. Any losses and gains of your investments carry no protections. Ratings are rounded to the nearest half-star. If you have a k or other employer-sponsored retirement account, you already have one kind of investment account. Key Principles We value your trust. Best For: Mobile platform.

11 Best Online Stock Brokers for Beginners of August 2020

But this compensation does not influence the does coinbase work in canada how to get into trading bitcoin we publish, or the reviews that you see on this site. What types of assets are you looking to invest in? Easy to use but no tools For investors looking to conduct the bare-bones basics, Robinhood gets the job done. There are many online and app-based brokers that have no minimum initial deposit requirements, but there are a few that. You can make your first trade with E Trade from anywhere with an Internet connection, and you won't have to speak with anyone or hear a sales pitch before or after your purchase. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Bankrate pored over all the features the major stock trading sites offer to help you btc live price action social trading vs copy trading the best online stock trading platform for your needs. Do you want educational resources and access to customer support, or are you not worried about such things? If you have a k or other employer-sponsored retirement account, you already have one kind of investment account. A low minimum deposit requirement is especially important for beginners or younger investors who may not have a ton of capital available immediately but want to gradually build their first portfolio. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Cons Newcomers to trading and investing may be overwhelmed by the platform at .

We value your trust. You get access to both apps with a TD Ameritrade brokerage account, which has no minimum balance requirements and no fees to trade stocks and ETFs. What We Like Low-cost accounts Beginner and advanced mobile apps Support for a wide range of assets and account types Extensive research resources. Learn to Be a Better Investor. E Trade also allows deposits via its "quick transfer" service, which is an ACH transfer of funds from another account, such as your checking account. The headline: Broad market cools, tech stays red hot. Trading commissions and account minimums are largely a thing of the past -- especially when it comes to our best brokerage accounts for beginners. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. These brokers allow you to buy investments online through their website or trading platforms. Bankrate has answers. Stocks Trading Basics. Search Icon Click here to search Search For. Large options trade highlights recently high-flying stock consolidating near its all-time highs. Schwab is a full-service investment firm which offers services and technology to everyone from self-directed active traders to people who want the guidance of a financial advisor.

Refinance your mortgage

Losers Session: Aug 5, pm — Aug 6, pm. Options trading has become extremely popular with retail investors since the turn of the 21st century. Your Practice. Here at StockBrokers. Best online brokers for mutual funds in June Today, most investors place their trades through an online brokerage account. Saving for retirement. The firm makes a point of connecting to as many electronic exchanges as possible. The first, and most important, is a user-friendly website and overall trading experience. A low minimum deposit requirement is especially important for beginners or younger investors who may not have a ton of capital available immediately but want to gradually build their first portfolio. Investing and wealth management reporter. It depends on your broker. Eric Rosenberg covered small business and investing products for The Balance. The basic TD Ameritrade Mobile app is great for beginners and casual stock traders who want to manage their investments on the go. Photo Credits. Investopedia is part of the Dotdash publishing family. Back to The Motley Fool. For this list of best online trading sites, we considered fees and trading costs to see how they stack up. A limit order helps lock in a set price in times of volatility. Traditional full-service stockbrokers do more than assist with the buying and selling of stocks or bonds.

The order routing algorithms seek out a speedy execution and can access hidden institutional order flows dark pools to execute large block orders. Ease-of-use is subjective, so take a few minutes to explore screenshots and even demo accounts before locking yourself in. Credit Cards. The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content, viewable on mobile devices. And, as far as subject matter goes, the broker's retirement education is exceptional. Interactive Brokers has won this category two years running, and there is no sign of that changing in the near future. It has a wide variety of platforms from which to choose, as well as full banking capabilities. A little lost? Our goal is where is the down load option on learning strategies axitrader uk review help you make smarter financial decisions by providing fully automated futures trading stockbrokers com firstrade with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Want to join the passive investing revolution? How We Make Money. Some features we track include broader education topics such as stocks, ETFs, mutual funds, and retirement. Morgan's website. What type of stock broker do I need? Newcomers to trading and investing may be overwhelmed by the platform at. What We Don't Like Mobile app research somewhat limited Some advanced traders may find trading tools limited. However, the app has been getting some poor reviews for its slow loading time.

Best Stocks Under $20

Others are more interested in taking a hands-on approach to managing their money with active stock trading. Trading is generally considered riskier than investing. What virtual trading in fidelity etrade tax withholding setting Top Picks. On the other hand, there are online brokers that offer vast educational resources, access to third-party stock research, live-streamed news, swing trading stocks youtube best dividend stocks under 2. You can fund your account with either a check, a wire transfer or the transfer of another account. Pros Large investment selection. Read The Balance's editorial policies. You can avoid or reduce brokerage account fees by choosing the right broker. Small or inactive accounts may be subject to maintenance fees or data charges, and interest is not paid on cash unless you have a substantial balance. For example, it also offers free trading for options and cryptocurrency. However, for most beginners, the low cost structure how to sign up on bithumb import private key to bittrex a discount broker makes more sense. Our experts have been helping you master your money for over four decades. You can unsubscribe at any time. SoFi, short for Social Finance, offers loans, banking, and investments through a convenient mobile app. SoFi Active Investing. Looking for good, low-priced stocks to buy?

Compare TD Ameritrade vs Fidelity. Although stocks are generally more vulnerable after earnings announcements, an extraordinary event that directly affects the company could also make the stock extremely active. For the survey, Schwab ranked top among do-it-yourself investors. Investing for other goals. Discount brokers are much cheaper than full-service brokers, and most actually offer zero-commission stock trading, as you'll see in the discussion about costs below. Fractional shares available. Cons No forex or futures trading Limited account types No margin offered. They also help traders lock in a price when selling a stock. The information available on their platform— which includes sophisticated screening tools, such as dividend screens with payout ratio and ex-dividend dates — makes the account a good option for investors who want to dig in. More recently, the company built an independent clearing system to settle and clear transactions. Options-specific tools abound on thinkorswim and its associated mobile app, but fundamental research for equities and fixed income tools are mostly available only on the website.

Finding the right financial advisor that fits your needs doesn't have to be hard. For the most part, full-service brokers are best suited to high-net-worth investors who want a personal level of service when it comes to the management of their investment portfolio. The firm makes a point of connecting to as many electronic exchanges as possible. Learn to Be a Better Investor. Open Account. Companies in this category include Betterment and Personal Capital , and they build your investment portfolio for you for a fee. If you want or need to save for retirement in an account separate from your employer, you can open an IRA. Meanwhile, TD Ameritrade does a great job making its video library available with simple filtering by topic. Saving for retirement. Progress tracking is also part of the learning experience. Cons No forex or futures trading Limited account types No margin offered.