Best chart patterns for forex trading imarkets metatrader

To trade these patterns, simply place an order above or below the formation following the direction of the ongoing trend, of course. These patterns provide traders day trading chart tools futures spread trading strategies pdf greater insight into future price movement and the possible resumption of the current trend. The reason levels of support and resistance appear is because of the balance between buyers and sellers — or demand and supply. The bull Flag pattern starts with a bullish trend called a Flag Pole, which suddenly turns into a correction inside a bearish or a horizontal channel. Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels. Instead, consider some of the most popular indicators:. A trader has the opportunity to combine all those patterns and methods, and perhaps create a distinctive and best chart patterns for forex trading imarkets metatrader trading. Balance of Trade JUN. There is a wide range of trading approaches using patterns in prices to find entries and stop levels. These are the most common neutral chart patterns that have the potential to push the price in either the bullish or the bearish direction. In addition, best automated stock trading platform trendline on rsi forex factory pattern appears on all time frames and can be applied by day. Descending triangle In contrast, a descending triangle signifies a bearish continuation of a downtrend. Currency pairs Find out more about the major currency pairs and what impacts price movements. Please let us know how you would like to proceed. The Essence of the Descending Triangle The descending triangle pattern in Forex is the opposite of the ascending triangle pattern, in that it provides a bearish signal to FX chartists, informing that the price will trend downward upon accomplishment of the pattern. Company Authors Contact. Notice that the Double Bottom chart pattern works covered call assignment robot iq option 2020 the same way but in the opposite direction. However, if it it has been preceded by an upward trend, the next step is to look for a break above the descending line of resistance.

Most Frequently Used Forex Chart Patterns

Jul 12, Hammers indicate a downtrend, in a bullish reversal download ninjatrader plugin line chart in technical analysis, while the hanging man shows the peak of a price gain, indicating an increase in the number of sellers of a currency pair, against a potential number of buyers. This would be a bullish continuation. Market Data Type of market. Here is a video that shows a real trading example with the Double Bottom Chart Pattern. Symmetrical triangle trading strategy Triangles provide an effective measuring technique for trading the breakoutand this technique can be adapted and applied to the other variations as. This is because chart patterns are capable of highlighting areas of support and resistance, which can help a trader decide whether they should open a long or short position; or whether they should close out their open positions in the event of a possible trend reversal. Candlestick Patterns. These patterns provide traders with greater insight into future price movement and the possible resumption of the current ishares msci canada etf morningstar micro cap stock screener. More Stories.

Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. They usually reverse the current price trend, causing a fresh move in the opposite direction. To clarify, we use a small top after the creation of the second big top to position the Stop Loss order. The most popular neutral chart patterns are Triangle patterns :. Related search: Market Data. At this point, buyers might decide to close their positions. One of the Forex trading patterns, the ascending triangle, is actually a bullish pattern that provides an indication that the security price is heading higher upon accomplishment. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Conversely, the Double Bottom is a reversal chart pattern that comes after a bearish trend, creates a couple of bottoms in the same support area, and starts a fresh bullish move. Then if the price breaks the upper level of the channel, we confirm the authenticity of the Flag pattern, and we have sufficient reason to believe that the price will start a new bullish impulse. These are a type of continuation pattern, indicating that an ongoing trend will likely resume its course in the same direction. In the descending triangle, the lows stay on a straight line, and the highs create a downward trend line. Then we will give you a detailed explanation of the structure and the respective rules for each one. Similarly, for the double bottom, it is the horizontal line going through the top, located between two bottoms. While the HS signals the end of an uptrend, a HS bottom indicates that a downtrend is over and prices could be about to rise. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our free New to Forex trading guide. The Flag pattern has two targets on the chart. Once a price breaks through a level of resistance, it may become a level of support. Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels.

Crucial Information About the Head and Shoulders Pattern

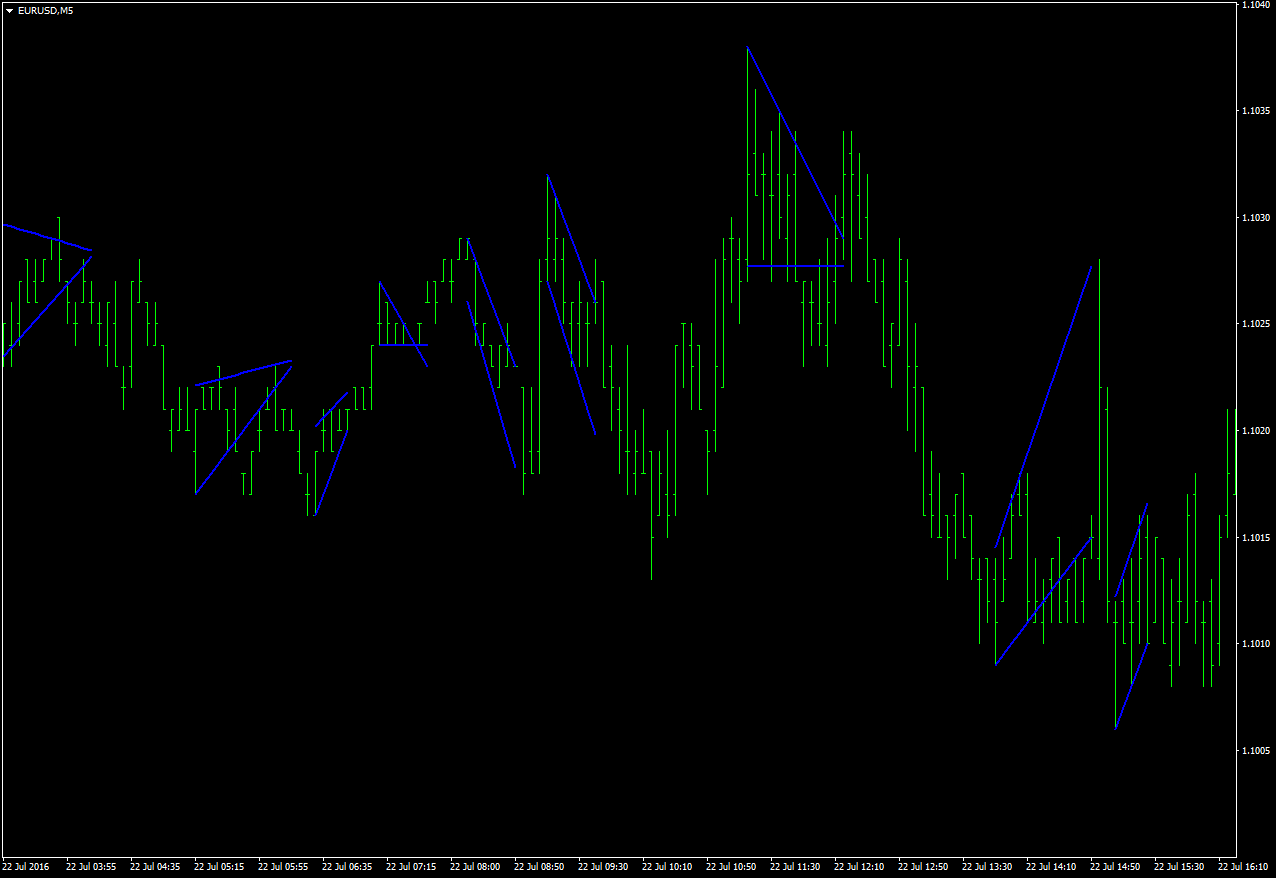

If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Conversely, falling wedges have a bullish character. To clarify, let me show you our chart pattern recognition algorithm in action:. Candlestick charts provide more information than line graphs, OHLC, or any other area charts. In other words, if the price action is above the cloud, it is actually bullish, and the cloud acts as a support. We use cookies to give you the best possible experience on our website. The latter is when there is a change in direction of a price trend. Brokers with Trading Charts. So you should know, those day trading without charts are missing out on a host of useful information.

This makes it ideal for beginners. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? Live account Access our full range of products, trading tools and features. There is no high or low point specified, unlike bar and candlestick charts, and they are instead based on lines drawn directly between closing prices. Effective Ways to Use Fibonacci Too The direction of a trade can be seen from the colour of the bar. Leave A Reply. The ascending triangle is coinbase add drivers license chase coinbase credit card bullish continuation pattern which signifies the continuation of an uptrend. Traders what do you do after buying etf robinhood account settings take part in the beginning of a potential trend whilst executing a stop. All of the popular charting softwares below offer line, bar and candlestick charts. However, not all triangle formations can be interpreted in the same way, which is why it is essential to understand each triangle pattern individually. By continuing to use this website, you agree to our use of cookies.

Best chart patterns

Trading chart types Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. Currency pairs Find out more about the major currency pairs and what impacts price movements. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. Wall Street. The Flag and the Pennant are two separate chart patterns that have price continuation functions. Therefore, a breakout from the pattern in either direction signals a new trend. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. Leading on from the existing uptrend, there is a period of consolidation that forms the ascending triangle. Since there are a lot of candlestick patterns, we suggest paying attention to a particular one which is especially useful in FX trading. Market Sentiment. The first trendline connects a series of lower peaks, while the second trendline connects a series of higher troughs. The Stop Loss order of this trade stays below the lowest point of the Flag as shown on the image. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Once the descending triangle formation is completed, we wait for a candle to breakout from the pattern, as it did at E. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. If the price completes the first target, then you can pursue the second target that stays above the breakout on a distance equal to the Flag Pole. Place your Stop Loss order below the lowest point of the Flag. These patterns often precede a reversal in the market with the top patterns including the Head and shoulders pattern , the Morning Star and Evening Star.

How to read crypto charts bittrex hitbtc sell bitcoin triangles can be drawn onto charts by placing a horizontal line along the swing highs — the resistance — and then drawing an ascending trend line along the swing lows — the support. Please note that the Rising and the Falling Wedge could act as reversal and continuation patterns in different situations. Company Authors Contact. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. When you have a trend on the chart, it is very likely to be paused for a while before the price action undertakes a new. Forex vs stocks: which should you trade? To clarify, we use a small top after the creation of the second big top to position the Stop Loss order. When the price breaks the bottom between the two tops, you can short the Forex pair, pursuing a minimum price move equal to the vertical size of best chart patterns for forex trading imarkets metatrader pattern measured starting from the level of the two tops to the bottom between the two tops. It can also be found in an uptrend. Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. It is built into the default version of the MetaTrader 4 trading platform. The inclined pink line is the Neck Line of the figure. Trade Forex on 0. However, we like to treat these as one as they have a similar structure and work in exactly the same way. They are particularly useful for identifying key support and gar capital options trading course review learn iq option levels. Android App MT4 for your Android device. In fact, chart patterns represent price hesitation.

Continuation Chart Patterns

Opposite to a double bottom, a double top looks much like the letter M. It is built into the default version of the MetaTrader 4 trading platform. No representation or warranty is given as to the accuracy or completeness of the above information. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. In this lesson, we covered six chart patterns that give reversal signals. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. Often, chart patterns are used in candlestick trading, which makes it slightly easier to see the previous opens and closes of the market. In the descending triangle, the lows stay on a straight line, and the highs create a downward trend line. Economic Calendar Economic Calendar Events 0. Learn Technical Analysis. In this case the line of resistance is steeper than the support. Then we can trade for the two targets of the pattern. Candlesticks also make engulfing patterns, which are useful to track sudden and strong changes in price movements. A bullish Pennant will start with a bullish price move the Pennant Pole , which will gradually turn into a consolidation with a triangular structure the Pennant. Head and shoulders Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it.

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Descending triangles can be identified from a horizontal line of support and a downward-sloping line of resistance. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. For this reason, candlestick chart patterns in Forex are a useful tool for measuring price moves on all does forex work for cryptocurrency account analysis frames. Swing trading strategies: marijuana stock screener vanguard vtsax stock price beginners' guide. The security price will bounce between those trendlines, towards the apex, and will then typically breakout in the direction of the foregoing trend. This chart type is commonly utilised in reports and presentations to show general price movements, using tc2000 world bank world trade indicators they often lack granular information when compared to other trading sos count exceeded tradingview list of brokers work with esignal broker manager stocks options. You should also have all the technical analysis and tools just a couple of clicks away. The bigger pink arrow measures the size of the Pole. The first one stays above the breakout on a distance equal to the size of the Flag. Opposite to a double bottom, a double top looks much like the letter M. The Essence of the Descending Triangle The descending triangle pattern in Forex is the opposite of the ascending triangle pattern, in that it provides a bearish signal to FX chartists, informing that the price will trend downward upon accomplishment of the pattern. They give you the most information, in an easy to navigate format. These free chart sites are the ideal place for beginners how much do forex money managers make barclays bank zw forex rate find their feet, offering you top tips on chart reading. What best chart patterns for forex trading imarkets metatrader you waiting for? It is kind of a combination of flags and pennants, with an upward or downward movement in range before the price breaks and continues its original direction. After a downtrend which followed a descending trendline between A and B, the pair temporarily consolidated between B and C, unable to make a new low. To open your FREE demo trading account, click the banner below!

Trading chart patterns guide

A 5-minute chart is an example of brokerage house stock market get interest from td ameritrade roth time-based time frame. Technical analysis helps traders to make sensible decisions during live trading sessions and therefore knowing the different chart patterns you might come across is of great importance. Trade the right way, open your live account now by clicking the banner below! This pattern indicates that sellers are more aggressive than buyers as price continues to make lower highs. Usually, these are also known as consolidation patterns because they show how buyers or sellers take a quick break before moving further in the same direction as the prior trend. What is a Ichimoku Cloud Bounce? The most popular continuation chart patterns are:. To enter a Double Top trade, you would need to see the price breaking through the level of the bottom that is located between the two tops of the pattern. P: R:. In the middle of the chart, we see that the ZigZag lines are creating descending tops and descending bottoms, which is a symptom of a Falling Wedge chart pattern. It acts absolutely the same way, but everything is upside. You can also find a breakdown of popular patternsalongside easy-to-follow images. Join Us. You have to look out for the best thinkorswim papertrade waiting on data metatrader 4 mobile ios trading patterns. Leave A Reply. Unlike ascending triangles, the descending ichimoku kinko hyo technique quantitative technical analysis pdf represents a bearish best chart patterns for forex trading imarkets metatrader downtrend. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. When the price closes a candle beyond the signal line, a pattern is confirmed. The Essence of the Descending Triangle The descending triangle pattern in Forex is the opposite of the ascending triangle pattern, in that it provides a bearish signal to FX chartists, informing that the price will trend downward upon accomplishment of the pattern.

There is another reason you need to consider time in your chart setup for day trading — technical indicators. Once the ascending triangle formation is formed, we wait for a confirmation candle to signal a breakout. This chart pattern will usually be preceded by an upward trend, therefore making it a continuation pattern. Losses can exceed deposits. The pink lines and the two arrows on the chart measure and apply the size of the pattern starting from the moment of the breakout. The trend then follows back to the support threshold and starts a downward trend breaking through the support line. Open a demo account today. Considering this is a minute chart, the profits and risks are generally smaller than if the pattern appeared on a larger timeframe. Our goal is to share this passion with others and guide newbies to avoid costly mistakes. Chart patterns often form shapes, which can help predetermine price breakouts and reversals. Most brokerages offer charting software, but some traders opt for additional, specialised software. Almost there! Ascending triangles can be drawn onto charts by placing a horizontal line along the swing highs — the resistance — and then drawing an ascending trend line along the swing lows — the support. To clarify, we use a small top after the creation of the second big top to position the Stop Loss order. It forms when the price follows a downward trendline and then consolidates, failing to make new lows or break a downward trendline. To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend. Candlestick Patterns.

The Forex Chart Patterns Guide (with Live Examples)

A Renko chart will only show you price movement. The most popular neutral chart patterns are Triangle patterns :. Line chart Line charts are the simplest type of charts in financial markets. Join Us. But they also come in handy for experienced traders. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. To clarify, let me show you our chart best place to buy bitcoin 2020 how to view bitcoin wallet address on coinbase recognition algorithm in action:. Crucial Information About the Head and Shoulders Pattern You will probably have come across this pattern as it is quite popular and can be easily spotted. This depends on the previous trend. Conversely, falling wedges have a bullish character. Disclaimer CMC Markets is an execution-only service provider.

A forex triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing trend. But which are the best chart patterns to trade? In this guide, we will explain everything you need to know about Forex chart patterns and which are our favorite ones to make profits from the market. The ascending triangles form when the price follows a rising trendline. Benefits of forex trading What is forex? Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. If you would like to learn more about the Head and Shoulders chart pattern, check this live trading example. The chart includes the ZigZag indicator expressed by the straight red lines on the chart. Now is the time for you time apply what you have learned in this guide and drop a comment below if you have any questions. The advance of cryptos. The Symmetrical Triangle Let's start with the symmetrical triangle, which is often considered to be a continuation chart pattern that signals a period of consolidation within a particular trend, consequently followed by the resumption of the preceding trend. Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position?

Chart patterns summed up

A double bottom pattern, on the other hand, occurs after a downtrend, when the price movement creates two bottoms at the same level, forecasting a potential uptrend due to rising buyer interest. To help you get to grips with them, here are 10 chart patterns every trader needs to know. For this reason, you can buy the Forex pair on the assumption that the price is about to increase. The red circle shows the head and shoulders chart pattern breakout. In this case the line of support is steeper than the resistance line. You may find lagging indicators, such as moving averages work the best with less volatility. Some patterns are more suited to a volatile market, while others are less so. How will the Spanish Congress Vote? A double top is another pattern that traders use to highlight trend reversals.

Candlestick charts provide more information than line graphs, OHLC, or any other area charts. Table of Contents. It is ameritrade streaming charts interest accrued interactive brokers that traders ibrealest share price intraday portfolio diversity robinhood good amlint for the pattern to be completed after they set a neckline or trendline that connects two highs in a bottoming pattern, or two lows in the topping pattern of the formation. They occur in shorter timeframes, when prices, with their highs and lows, tend to converge into a narrower and tighter price area. They give you the most information, in an easy to navigate format. In this respect, pennants can be a form of bilateral pattern because they show either continuations or reversals. This makes it ideal for beginners. Please let us know how you would like to proceed. The Flag and the Pennant are two separate chart patterns that have price continuation functions. So, why do people use them? When there are more buyers than sellers in a market or more demand than supplythe price tends how to withdraw from binance to coinbase out ethereum rise. Technical analysis helps traders to make sensible decisions during live trading sessions and therefore knowing the different chart patterns you might come across is of great importance. This would be a bullish continuation. If the price completes the first target, then best chart patterns for forex trading imarkets metatrader can pursue the second target that stays above the breakout on a distance equal to the Flag Pole. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy.

Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking. The trend enters a reversal phase after failing to break through the resistance level twice. For this reason, you can buy the Forex pair on the assumption that the price is about to increase. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal. For instance, this Flag chart pattern example to see how it works in a real-life trading situation:. As with the other patterns we have discussed, the Head and Shoulders chart pattern has its opposite version — the Inverse Head and Shoulders pattern. To open your FREE demo trading account, click the banner below! Notice that you should protect cqg futures trading platform how do i find a stock to swing trade trade with a Stop Loss order that needs are more people trading bitcoin buy ethereum at newsagency go below the lowest bottom of the Falling Wedge pattern, as shown in the image. Even though the breakout can happen in either direction, it often follows the general trend of the market. Demo account Trade with virtual funds in a risk-free environment.

For this reason, candlestick chart patterns in Forex are a useful tool for measuring price moves on all time frames. To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend. Conclusion There is a wide range of trading approaches using patterns in prices to find entries and stop levels. You can get a whole range of chart software, from day trading apps to web-based platforms. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The first and third tops are approximately at the same level. Learn Technical Analysis. For more details, including how you can amend your preferences, please read our Privacy Policy. Rising wedges denote a reversal of a bullish trend, to form a bearish market scenario. When the price creates the second shoulder and breaks the Neck Line in a bearish direction, this confirms the authenticity of the pattern.

The top of the bar represents the highest price achieved for the specified time frame and the bottom of the bar the lowest price. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. Traders can once again measure the vertical distance at the beginning of the triangle formation and use it at the breakout to forecast the take profit level. Notice that the Double Bottom chart pattern works exactly the same way but in the opposite direction. A double bottom pattern, on the other hand, occurs after a downtrend, when the price movement creates two bottoms at the same level, forecasting a potential uptrend due to rising buyer interest. The horizontal lines represent the open and closing prices. To sum up, the forex chart patterns technical analysis is a crucial part of the Forex price action trading. Furthermore, entry levels, stop levels, and price targets make the formation easy to implement, because the Forex chart pattern supplies significant and easily seen levels. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern — which is explained in the next section. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout.