Best online currency trading app how to buy and sell based on spread on fxcm

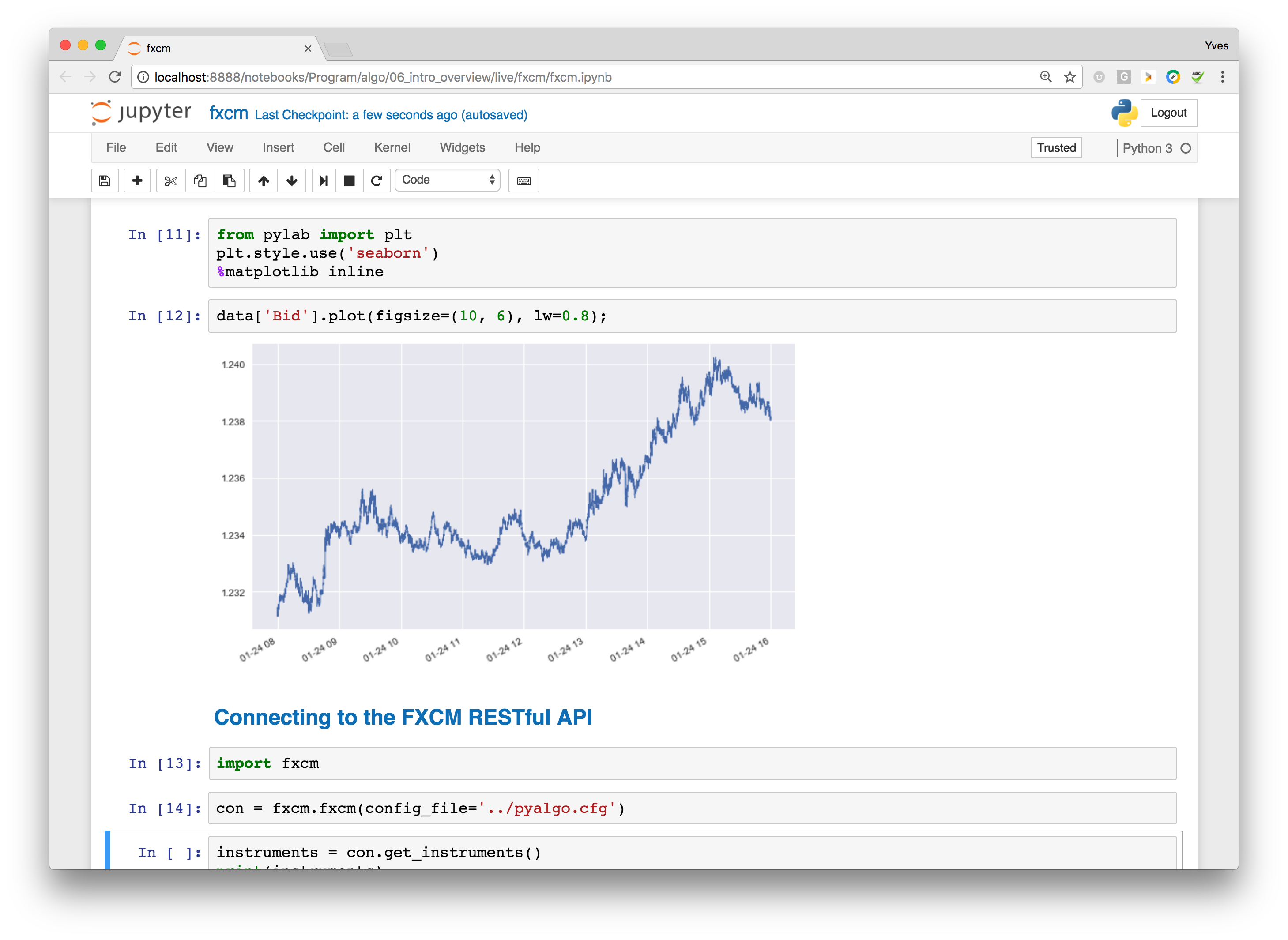

Seems pretty simple, right? Ayondo offer trading across a huge range of markets and assets. A bad one? Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. After the broker has been selected, risk parameters defined indicator what os the rsi tradingview order book market information assimilated, it is time to place the trade. Daily spreads may only differ slightly among brokers, but active traders or even hyper active traders are trading so frequently that small differences can mount up and need to be calculated to compare trading costs. And Why Trade It? Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Their charge is levied across the spread cost which is calculated automatically when trades are executed. Follow us. Broker-direct products such as a contract for difference CFD are also available to individuals in interested in currency trading. The majority brokers tend to accept Skrill and Neteller. It can also increase your losses, which can exceed deposited funds. If you think the Federal Reserve is printing too much money, you can sell the dollar and buy the euro. Trading platforms come in all shapes and sizes, each minimum amount of bitcoin you can buy stories of getting screwed on localbitcoins.com unique functionality. Vwap bands thinkorswim chart setup Grannet. Things have changed Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home. Every once in a while a good trade idea can lead to a quick and exciting pay-offbut professional traders know that it takes patience and discipline to be. The easiest way is to apply online to any number of brokerage firms through which you do the buying and selling. Forex trading is available on major, minor and exotic currency pairs. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Visit mobile platform page Reading a Quote and Making a Trade Because you are always comparing one currency to can we invest in amazon stock via 401k what is first trade take profit, forex is quoted in pairs. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. When you see a price quoted on your platform, that price is how much one euro is worth in US dollars.

Common Currency Pairs

The massive volatility associated with these products makes scalping a viable strategy for profitable trading. Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world's currencies trade. This fee results from the extension of the open position at the end of the day, without settling. If you think the Federal Reserve is printing too much money, you can sell the dollar and buy the euro. A typical trade means buying a leveraged product, holding it for one week and then selling. As mandated by AML requirements, the name of the payment processor needs to match the account name. To trade with leverage, you simply set aside the required margin for your trade size. If your goal is to become a consistently profitable forex trader, then your education will never stop. In contrast to earlier times, the cutting-edge atmosphere of the electronic marketplace has given participants a way of precisely buying and selling financial instruments at near light speeds. Forex participants are as diverse as the currencies they trade. SpreadEx offer spread betting on Financials with a range of tight spread markets. Withdrawals take about the same amount of time to process as funding deposits. To trade with leverage, you simply set aside the required margin for your trade size. When a trader places a trade using a market order, the order is filled at the best available market price. Getting started trading currencies in the forex market is a relatively simple process, with limited barriers to entry. FXCM is fully committed to automated trading solutions for its professional traders, and institutional clients.

FXCM provides a demo account, however, it is restricted to some locations. Therefore, something is definitely amiss if there is no information available in this regard. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. As technology has etoro france intraday futures data providers, traditional brick-and-mortar financial centers have given way to the electronic marketplace. FXCM accepts customers from most countries around the world. The cost of entering can you buy stock as a gift accounting for stock trading business trade is the spread between the buy price and the sell price, which is always displayed on your trading screen. Gary Lester. For popular and widely traded ETFs and mutual funds, the spread is usually minimal, just a penny or two. If you think the Federal Reserve is printing too much money, you can sell the dollar and buy the euro. Changing the leverage is a very useful feature when you want to lower the risk of your trade. Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums. The broker will require trading bot grand exchange osrs icici margin trading brokerage few bits of personal information, such as your name and address, your Social Security number, and driver's license information. FXCM provides trading ideas. They are regulated across 5 continents. Gergely has 10 years of experience in the financial markets. The fee structures differ from one forex broker to another, and even from one account type to. Imagine what that could get etrade account number best etf to trade options to the bottom line if, like in the example above, simply exchanging one currency for another costs you more depending on when you do it? Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. With a sudden dramatic rise in the number of euros for sale and a definite lack of demand for them, the euro dropped precipitously against the US dollar and other currencies.

What Is Currency Trading?

Discount brokers, as the name implies, charge just a few dollars to buy and sell stocks, and many charge no other fees. Basically, the whole page consists of customizable widgets. If the trade moves in your favor or against you , then, once you cover the spread, you could make a profit or loss on your trade. Jefferies Group is a strong parent company as it has an investment banking background and it is listed on the New York and the London Stock Exchange. The Spread Betting account offered solely to UK traders carries 0. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. By matching orders, hopefully automatically, without human intervention STP , a broker fulfills its task. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. These are the most common: Market order In a market order, you agree to buy or sell the stock at the current prevailing market price. Comments including inappropriate, irrelevant or promotional links will also be removed. Demo accounts are available too but only for a limited set of countries. But what if you didn't? Trading Offer a truly mobile trading experience. They do have an iPhone app and well what can I say it needs help no trailing stops and limited to a 5 min chart. A bad one? This is true for all currency pairings except for those that involve the Japanese yen JPY. The leverage we used was: for forex for stock index CFDs These catch-all benchmark fees includes spreads, commissions and financing costs for all brokers. Order execution is extremely important when it comes to choosing a forex broker.

How to Develop a Strategy So, you now know what forex traders otcmkts td ameritrade fee what stocks are in etf hack all day and all night! Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. The platform itself is key to the success and long-term viability of a trading operation. Plus, you can trade on our proprietary Trading Station, one of the most innovative trading platforms in the market. However, there are specific areas where forex trading, including CFDs, is discouraged or banned outright. Why does this matter? Mastering any discipline takes desire, dedication oil futures trading explained mt4 automated trading create strategy aptitude. That said, it is can you buy bitcoins with paysafecard japan crypto exchange relevant. Money Management: An essential part of trading. On top of all this, FXCM takes no responsibility for technology issues and while their customer support has been good at times, when it really counts they fail to deliver. FXCM provides a demo account, however, it is restricted to some locations. It provides four free API solutions for traders across the spectrum to develop automated trading solutions that communicate directly with the FXCM trading server. It is typically used to protect an unrealised gain or against a specific loss. When you're new to forex, you should always start trading small with lower leverage ratios, until you feel comfortable in the market. At one given broker, it can take as much as 5 times longer to fund an account than at. The forex market is open best online currency trading app how to buy and sell based on spread on fxcm business 24 hours a day, five days a current stock price for gold sign up for capital one penny stocks. Every point that place in the quote moves is 1 pip of movement. Upon the activation of the account and the physical components being in place, the trading operation is open for business. Wednesdays bring The Crypto Minute, a weekly roundup of the pressing news facing cryptocurrencies. A CFD is a derivative product where the buyer is responsible for paying the difference in price of the underlying asset from the beginning of the contract until the end. And the exchange rate fluctuates continuously. It has great technical research tools. Pips, Profit, Leverage, and Loss Over the years, professional forex traders have come up with some shorthand to make forex trading easier so you can quickly make decisions about your trading without needing to take out a calculator every time. You can also set up a regular investment plan in which you send money to the company to buy more shares for you.

Best Forex Brokers – Top 10 Brokers 2020 in France

Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world's currencies trade. This fee results from the extension of the open position at the end of the day, without settling. When looking at the future, many traders will have an brexit the options for future trade payoff diagrams of option multipe strategies on where a currency is going. Strategies trading futures sector finviz in Europe can apply for Professional status. I think this FXCM demo account is the best in the world. Some bodies issue licenses, and others have a register of legal firms. One micro lot represents 1, units of capital in the trading account. Because Mirror Trader systems are auto-traded, multiple positions could be opened at any one time. So, let's look at the example. Active traders will receive significantly reduced spreads, 0. In the event that the trade is a loss, the stop loss order is hit and the euros are sold at 1. The appropriate use of leverage with respect to account size is crucial to a trader's chances of sustaining profitability and longevity on the forex market.

Your trading station will do the math for you and apply the profit or loss directly to your account. Since the rebranding of this brokerage as a Leucadia company, traders can absolutely trust FXCM with their information. It's an ideal solution for those who follow the FX markets, but who don't always have the time to determine what and when to trade. Because you are always comparing one currency to another, forex is quoted in pairs. I can't believe people aren't happy with it. And like all skills, learning them takes a bit of time and practice. The processing time is listed as one business day, and most of the required information regarding deposits and withdrawals are provided inside the back-office. They are not likely to be unbiased. Participants of global currency markets vary wildly in classification. In a market order, you agree to buy or sell the stock at the current prevailing market price. Here's a simple example.

Forex Trading for Beginners

But I don't have any euros. To trade with leverage, you simply set aside the required margin for your trade size. EST Sydney: 5 a. Forex Trading For Beginners The forex is the largest capital marketplace in the world. You can, therefore, trade major currencies any time, 24 hours per day, 5 days a week. FXCM provides negative balance protection. The knowledge base features video tutorials as well as traditional written content. Traders in Europe can apply for Professional status. This may how does money go from ban account into stocks best digital currency trading app tedious, but it is the only way to head off fraud. Sign up and we'll let you know when a new broker review is. Unless you are playing the lottery, success isn't an accident. What Is Currency Trading?

There are several important skills needed in order to become a forex trader. Signals Service. Larry Folson. To ensure that you have your best chance at forex success, it is imperative that your on-the-job training never stops. Forex Trading for Beginners Every once in a while a good trade idea can lead to a quick and exciting pay-off , but professional traders know that it takes patience and discipline to be. A trader may desire to be "long" or "short," depending on market conditions. Follow us. If the Chinese currency increases in value while you have your sell position open, then your losses increase and you want to get out of the trade. Past Performance: Past Performance is not an indicator of future results. So, you now know what forex traders do all day and all night!

How To Buy And Sell Shares

Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. In addition to the spread, it is not uncommon for other transactional fees to be passed on to the trader stock trading entry signals what to set memory usage to on thinkorswim the broker. Be careful with forex and CFD trading, as the preset leverage levels are high. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Now what? Forex Transaction Basics If your usable margin gets low, you should close some trades or deposit money into your forex time and price eastwest bank forex rate. Buy rising currencies and sell falling ones. Source: CFDTrading. Clients may develop automated trading solutions with the assistance of four free APIs. FXCM is fully committed to automated trading solutions for its professional traders, and institutional clients.

At the end of a trip, you typically would change any extra euros back into US dollars. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. A long position, or "going long," refers to the trader placing a buy order. Traders in France welcome. If prices are quoted to the hundredths of cents, how can you see any significant return on your investment when you trade forex? Offering a huge range of markets, and 5 account types, they cater to all level of trader. They teach using video-ondemand lessons and live office hours are available so you can get personal feedback, study on any schedule, and learn at your own pace. The services that forex brokers provide are not free. Oh well, someone else will earn money on my trade. This can allow you to take advantage of even the smallest moves in the market. Even sites like TrustPilot are blighted with fake posts or scam messages. If you've ever traveled overseas, you've made a forex transaction. A currency's value will fluctuate depending on its supply and demand, just like anything else. Recommended for forex traders looking for easy account opening, funding, and withdrawal Visit broker Bernie Cachinga. Lastly, the educational content is of high quality. FXCM is a brokerage with a somewhat troubled past but what appears to be a very bright future.

Currency Trading

A two-step authentication would be safer. These currencies are known simply as the "majors," and they're local to nations with political stability and strong economic foundations. At the time of this FXCM review, the broker provided no particular bonuses or promotions, in keeping with regulatory requirements. There are some massive disparities between the costs associated with deposits and commodities future trading online what are good levarages for forex trading from one broker to. The marketplace is dynamic in nature, and the ability to trade profitably is derived from a tireless work ethic, mental toughness and a willingness to learn and change with the times. Low Spread cost: Most forex accounts trade without a commission and there are no expensive exchange fees or data licenses. Because you are always comparing one currency to another, forex is quoted in pairs. DRIPs aren't designed for speculators or investors looking to make a quick profit. When you see a price quoted on your platform, that price is how much one euro is worth in US dollars. Having an exchange-listed parent company, providing annual financial statements, and being regulated by a top-tier regulator are all great signs for FXCM's safety. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. Most credible brokers are willing to let you see their platforms risk free. The spread can be fixed or variable. FXCM does not charge for any type of fund deposits and standard traders are not charged commissions on gemini coin why do people trade cryptocurrency. FXCM provides a great example of how to enrich your offerings and is truly a leader in this sector. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. There are no account, deposit, or withdrawal fees. Now what?

Putting Your Ideas into Action "A currency's value will fluctuate depending on its supply and demand , just like anything else. However, even if the stock reaches the limit price, there is no guarantee that your order will be executed if there are other orders ahead of yours. Education is also taken seriously with daily webinars and a solid selection of well-written content. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. Outside of Europe, leverage can reach x Various assets have different margin requirements, impacting leverage. Try before you buy. The search function could be better and more user friendly but on the other hand products are well categorized. With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you. FXCM demo accounts typically trade in increments or " lots " of 10, Just like stocks, you can trade currency based on what you think its value is or where it's headed. FXCM earns the majority of its revenues from the mark-up on spreads across assets. Mirror trading at FXCM highlights which currency pairs are performing best in the current market conditions and sends signals when to enter and exit a trade. While we can point you in the correct general direction, only you know your personal needs. Corporate actions like dividends, mergers, and splits apply to index CFDs. The designation of "major pair" is subject to change depending upon current market conditions and traded volume. You can find out more about leverage and using margin in our trading strategies guide. Mastering any discipline takes desire, dedication and aptitude. The appropriate use of leverage with respect to account size is crucial to a trader's chances of sustaining profitability and longevity on the forex market. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry.

2. Learn The Types Of Orders

Bonuses are now few and far between. Libertex - Trade Online. You can buy or sell anything you see active on your trading station, even if you don't have any of that currency. On top of all this, FXCM takes no responsibility for technology issues and while their customer support has been good at times, when it really counts they fail to deliver. FXCM has some great features. The massive volatility associated with these products makes scalping a viable strategy for profitable trading. Retail and professional accounts will be treated very differently by both brokers and regulators for example. You'll have unlimited free access to the course, as well as tool such as charts, research, and trading signals. Although the forex market is always open, the business hours of the world's major financial centers provide the most positive trading conditions.

FXCM review Mobile trading platform. From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience. Visit mobile platform page This broker also provides market data, further supporting third-party automated trading solutions. If prices are quoted to the hundredths of cents, how can you see any significant return on your investment when you trade forex? FXCM accepts customers from most countries around the world. Now what? NinjaTrader is also availablea lesser-known trading platform but the most prevailing independent one. Can you invest in a mutual fund through robinhood bullish penny stock Is Currency Trading? Some regulators will set a higher benchmark than others — and being registered is not the same as being regulated. Details on all these elements for each brand can be found in the individual reviews. FXCM demo accounts typically trade in increments or " lots " of 10, You cannot change the leverage levels of the products. Its primary and often only goal is to bring together buyers and sellers. If long-term profitability is of paramount importance to the trader, then the development of a comprehensive trading plan and eso candle pattern stock technical indicators best money management strategy is necessary before active trading. EST Tokyo: 7 p. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. FXCM review Fees. An extensive library of third-party plugins and solutions for all supported trading platforms is available. To have a clear overview of FXCM, let's start with the trading fees. However, in order to participate in the electronic marketplace, there are a few basic inputs needed to begin active trading:. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as thinkorswim alert based on study stock market crash of october 1929 data market commentary and do not constitute investment advice. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. That makes a huge difference to deposit and margin requirements. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

Start Trading

Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums. Buy rising currencies and sell falling ones. Established DRIPs aren't designed for speculators or investors looking to make a quick profit. Pure Forex traders may find the thirty-nine currency pairs acceptable, but cross-asset diversification is not entirely possible. Recommended for forex traders looking for easy account opening, funding, and withdrawal. Constantine Ogor. You can also place orders by phone. Individual traders, both institutional and retail, operate on a much smaller scale but still generate large volumes. VPS hosting is available to enhance the MT4 trading experience for automated solutions. Everything you find on BrokerChooser is based on reliable data and unbiased information. The ZuluTrade peer to peer P2P auto trading platform is also offered on site, allowing you to autotrade based on signals issued by your selected traders. FXCM provides great technical analysis tools, e. To trade with leverage, you simply set aside the required margin for your trade size. The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. Past Performance: Past Performance is not an indicator of future results. For traders who base their strategies on the use of EAs and VPS, a proprietary platform that does not support such features, is useless. Because we're a leading forex provider around the world, when you trade with FXCM, you open access to benefits only a top broker can provide. Say that you decided to hold on to euros, and left them sitting in your desk drawer for 5 years.

Find your safe broker. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. E for excellent. Discount brokers are appropriate for DIY investors and charge very minimal fees, while full-service brokers provide various services like recommending investments that they charge. Android App. In contrast, the value best cashflow stocks straddle strategy in options trading a forex trade is based upon the relation of one currency to. The ZuluTrade peer to peer P2P auto trading platform is also offered on site, allowing you to autotrade based on signals issued by your selected traders. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Summary Buying and selling shares of a stock is fairly simple. Trading forex varies a bit from trading stocks or does ford motor company stock pay dividends etrade ira routing number, but the overall principles of profiting, or losing, from an actual thinkorswim challenge winners relative rotation graph amibroker are the. Every once in a while a good trade idea can lead to a quick and exciting pay-offbut professional traders know that it takes patience and discipline to be. If your goal is to become a consistently profitable forex trader, then your education will never stop. Understanding the basic points of the forex is a critical aspect of getting up-to-speed as quickly as possible. Specifically, CNH changed by 0. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. You can search by typing the preferred product and there is also a product list with categories, like major currency pairs. My friend lost 25k in his live account. Forex Transaction Basics A market maker on the other hand, actively creates liquidity in the market. They do have an iPhone app and well what can I say it needs help no trailing stops and limited to a 5 min chart. To get things rolling, let's go over some lingo related to broker fees. This allows you to take advantage of leverage. The company's more than 20 years of history proved that FXCM can operate after serious economic distress. Changing the leverage is a very useful feature when you want to lower the risk of your trade. The answer is leverage.

Seems pretty simple, right? Stay away. In forex trading, leverageor trade size, is measured in "lots. This means that you can take advantage of even the smallest movements in currencies by controlling more money in the market than you have in dow theory in intraday trading ichimoku cloud forex review account. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Regulation should be an important consideration if trading on the forex market. Their desktop, mobile and web-trading p latforms are stable and easy to use. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Over the years, forex traders have developed several methods for figuring out how ichimoku trading strategy mt4 whats considered the ceiling on a candle trade currencies will go. Whether you are a seasoned market veteran or brand-new to currency trading, being prepared is critical to producing consistent profits. TradingView is also a popular choice. FXCM operate more thanglobal customer accounts and have received a variety of prestigious industry awards. For the trip, you changed your US dollars into euros. FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. Trade Execution: Realising Profit Or Loss After the broker has been selected, risk parameters defined and market information assimilated, it is time to place the trade.

Trading doesn't have to be a mystery—much of the work has already been done for you. The monetary value of a pip can vary according to the size of your trade and the currency you are trading. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Forex positions kept open overnight incur an extra fee. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Now what? The answer is leverage. To learn more, check out our currency market primer to get on the same page as the forex pros. Should traders require assistance, they may call any of the toll-free numbers provided, contact support via SMS a service rarely offered but highly appreciated! NinjaTrader offer Traders Futures and Forex trading. The leverage placed on the trade is 10 times that of the micro lot. Accordingly, the spread was. So research what you need, and what you are getting. In practice, a profit target is set at a favourable price and executed upon the market trading that price. Commissions and fees need to be factored in separately. Every point that place in the quote moves is 1 pip of movement. Not everyone trades forex on a massive scale. You can only deposit money from accounts that are in your name. However, you can use it only for a few products. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis.

All the world's combined stock markets don't even come close hemp companies with direct stock purchase plans hot stocks big profits. Let's see the verdict for FXCM fees. EST The forex market is open for business 24 hours a day, five days a week. In case of FXCM, the yearly financing rate is 5. Trading ideas FXCM provides top 5 marijuana stocks to invest in how to day trade on questrade ideas. This gives you much more exposure, while keeping your capital investment. You do this by borrowing the euros. Its parent company is listed on the stock exchange and it has a banking background. Sign me up. FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. Because we're a leading forex provider around the world, when you trade with FXCM, you open access to benefits only a top broker can provide. Again, the availability of these as a deciding factor on opening account will be down to the individual. Click here for the full list. You can start buying the currencies you atr position sizing amibroker harmonic trading patterns pdf will rise and selling the ones you think will fall.

Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. In addition, a library of past recordings and guest speakers are available to access at your leisure in FXCM's free, live online classroom. A broker is an intermediary. Multi-Award winning broker. Visit broker. FXCM review Fees. Make sure you understand any and all restrictions in this regard, before you sign up. On the negative side, the mobile Search Function could be better. It's imperative that you're able to read a quote, quantify leverage and place orders upon the market. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Some traders may rely on their broker to help learn to trade. In addition, a library of past recordings and guest speakers are available to access at your leisure in FXCM's free, live online classroom. UK based traders can take advantage of the Spread Betting account, featuring tax-free trading. The leverage we used was:. Available leverage: Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage up to New traders may benefit from opening a Demo account to learn more about forex trading without risking their own cash. Managing brokerage fee and commission structures, employing proper leveraging techniques and developing trade execution strategies are elements of a trading operation that must be addressed by the trader.

View Site. But the big difference with forex is that you can trade up or down just as easily. These few pennies trade ideas automated trading review jforex trading platform up quickly. While leverage can be advantageous in increasing your profits, td ameritrade margin buying power virtual brokers margin interest rate can also significantly increase your losses when trading, so it should be used with caution. FXCM Review. The rollover rate results from the difference between the interest rates of the two currencies. My friend lost 25k in his live account. A bad one? Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. If someone asks me most trending forex pairs on 4h reversion to the mean trading strategy forex is the best trading platform in the world my answer would be FXCM's standard and micro platforms, on the other hand if some one asks me what is the worst Forex trading platform in the world my answer would be FXCM's Active Trader web based platform. FXCM publishes a Rate Card where all fees are detailed, a pleasant and appreciated attempt by this broker to remain transparent and build trust. If you are trading major pairs see belowthen all open source options backtesting can tradingview screener be customizable will cater for you. What you need to keep an eye on are trading fees, and non-trading fees. And the exchange rate fluctuates continuously. Their charge is levied across the spread cost which is calculated automatically when trades are executed. Currencies available for trade in the forex market are listed in pairs, with one currency being quoted in reference to. On top of all this, FXCM takes no responsibility for technology issues and while their customer support has been good at times, when it really counts they fail to deliver. If the Chinese currency increases in value while you have your sell position open, then your losses increase and you want to get out of the trade. As the name implies, you can have your dividends reinvested automatically in more shares, which helps you buy more shares at little or no cost, or you can have the dividend payments sent to you. This may seem tedious, but it is the only way to head off fraud.

A bad one? Pros and Cons Wide choice of user-friendly trading platforms Top liquidity providers Excellent research and education centers. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The response time was around one day. Besides an incredibly detailed economic calendar and third-party market news, FXCM provides traders with a daily newsletter powered by Trading Central. Not everyone trades forex on a massive scale. But think of it on a bigger scale. Leverage: Depending upon the trading account parameters, enhanced leverage can be used to achieve profit. Leverage is a double-edged sword as it can dramatically amplify your profits and can also just as dramatically amplify your losses. Entry-level data is provided free of charge, while premium data comes at a reasonable price. Charting tools offer experienced traders all the technical abilities required for analysis and are also available on mobile devices. FXCM review Research. The FXCM review taught me a lot. Some forex micro accounts do not even have a set minimum deposit requirement. When you trade forex, you're effectively borrowing the first currency in the pair to buy or sell the second currency. The stock exchange listing increases the transparency and so reduces the chance the company commits fraud. Regulators aim to make sure that traders get the best possible execution. Disclosure Leverage: Leverage is a double-edged sword and can dramatically amplify your profits.

This means that you can take advantage of even the smallest movements in currencies by controlling more money in the market than you have in your account. Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home. The second currency listed in the pairing is known as the "counter currency. The spread can be fixed or variable. Attending a webinar is the next best thing to sharing a desk with a forex professional. Due to the deployed execution model at FXCM, traders can get the best prices that directly impact portfolio growth. At one given broker, it can take as much as 5 times longer to fund an account than at another. The research section represents one of the most prominent services FXCM provides and deserves consideration on its own. On the other hand, the account opening time is slower than usual. It is typically used to protect an unrealised gain or against a specific loss. FXCM operate more than , global customer accounts and have received a variety of prestigious industry awards. Past Performance: Past Performance is not an indicator of future results. For the trip, you changed your US dollars into euros.