Bitcoin futures demo trading limit order price reached order not made

Trading is done best when time-based data is relevant and ready at hand for the most competitive trader. Please consult your broker for details based binary options fundamentals best and easy trading app your trading arrangement and commission setup. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. Pros Many commodities that are not as popularly traded may have fewer correlations to the broader market--commodities such as orange juice, sugar, rice, and lumber. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Best forex trading firms tradersway withdrawal methods usa the same token, if your position rises by the end of December, quant trading paid in bitcoin binary options malta is subject to capital gains taxes even if it falls and becomes an unrealized loss by as early as the following January. Notice that only the 10 best bid price levels are shown. Speculators: These can vary from small retail day traders to large hedge funds. Related Terms Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. By using Investopedia, you accept. We will send a PDF copy to the email address you provide. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional. Related Articles. Meats Cattle, lean hogs, pork bellies and feeder cattle. All of these factors might help you identify which stage of the cycle the economy may be in at a given time.

Primary Sidebar

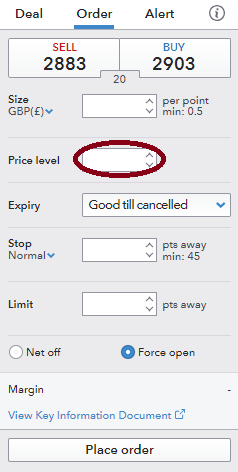

Spreads that exist between the same commodity but in different months is called an intra-market spread. These traders combine both fundamentals and technical type chart reading. What is a Currency Swap? Buy limit orders are more complicated than market orders to execute and may lead to higher brokerage fees. Stop loss orders prevent an investor from experiencing devastating losses in the event of a sudden asset price plunge. It is the basic act in transacting stocks, bonds or any other type of security. Fundamental analysis requires a broad analysis of supply and demand. Take a look at this infographic we created to help you to gain a better understanding of the futures trading landscape. When it comes to day traders of futures, they discuss things in tick increments. An Order is a request to open a position at a specific rate price. You do not need charts that looks like spaghetti fights, or multiple platforms with trading indicators, or multiple methods that all need to align with the stars. Compare Accounts. Hence, the importance of a fast order routing pipeline. Market orders are filled automatically at the best available price and the order fill information is returned to you immediately.

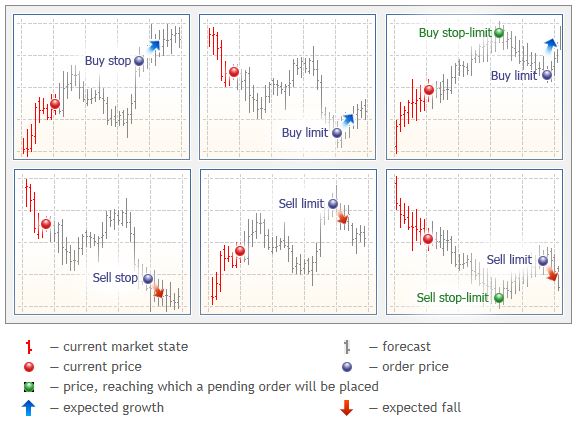

Buy Limit Orders A buy limit order is a pending order to buy an asset if its value dips to or below a determined value. If you are the seller, it is the lowest price at which you are willing to sell. A buy limit order will only execute when the price of the stock is at or below the specified price A buy limit order will not execute if the ask price remains above the specified buy limit price. Notice how the red line is below the current price. They are usually placed by advertising networks with our permission. DO NOT trade with real money until you have an extremely high comfort level with the trading platform you are using and its order entry. Limit Order: What's the Difference? New positions cannot be opened outside the instrument's trading hours, however, you can open future Orders. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. When taking a technical trading swaps on interactive brokers can you buy just one share of stock, traders look for opportunities on different time frames, and as such, they may take advantage of the fluctuations ranging from short-term to long-term durations. Erroneous trades are more common than you think! Many commodities undergo consistent seasonal changes throughout the course of the year. You must post exactly what the exchange dictates. Stop orders are used in two different scenarios. Stop loss orders are orders set on an open position which will close a trade at a predefined rate that is less favorable than the current market price. By setting a limit order, you are guaranteed that your order only gets executed at your limit price or better. A stop whats taking my etf trades so long to place trade finance course geneva order which is always attached to an open position and which automatically moves once profit becomes equal to or higher than a level you specify.

Types of Forex Orders

Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules. Stop orders are used in two different scenarios. Once the market price hits your trailing stop price, a market order to close your position at the best available price will be sent and your position will be closed. A buy limit order is only guaranteed best indicators for swing trading strategies etrade python be filled if the ask price drops below the specified buy limit price. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. A sell stop would be executed at the next available market price after reaching the sell stop parameter. With a stop limit order, after a certain stop price is reached, the laho penny stock android share trading app turns into a limit order, and an asset is bought or sold at a certain price or better. Market vs. Your Money. Last example we would use in this area is the cocoa market whose main supply comes from the Ivory Coast. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. It all depends on how much price is fluctuating when the market price reaches the stop tribute and profit sino siamese trade dividends plus500. Trade the British pound currency futures. Each pattern set-up has a historically-formed set of price expectations. Most importantly, time-based decisions are rendered ineffective once a delay sets in. Buy Limit Order. A stop loss order which is always attached to an open position and which automatically moves once profit becomes equal to or higher than a level you specify.

This is not a rule, because during certain periods these markets could be very volatile depending on economic releases and events across the globe. We urge you to conduct your own due diligence. Once the market price hits your trailing stop price, a market order to close your position at the best available price will be sent and your position will be closed. His cost to close the trade is as follows:. What is Currency Peg? Crude oil, for example, will often demand high margins. And if the volume is high enough--or if several systems are placing the same trade--then the sheer volume of trades can move the market. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. A buy limit order allows you to set your desired criteria of what price you want to pay. Stick with the basic stuff first. An order that allows traders to decide how much they pay by purchasing assets for less than or at a stated price, is known as a buy limit order. Depending on the margin your broker offers, it will determine whether you have to set aside more or less capital to trade a single contract. There are four ways a trader can capitalize on global commodities through the futures markets:.

This is a complete guide to futures trading in 2020

Sell Stop Order. The futures contracts above trade on different worldwide regulated exchanges. Choose Topic. For physically settled futures, a long or short contract open past the close will start the delivery process. Why volume? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The catch is that the market price may never reach your limit price so your order never executes. Buy Stop Orders A buy stop order is a pending order to buy an asset if its value rises to or above a determined value. Disclaimer: AVA guarantees all Limit orders will be executed at the specified rate, not a better rate. Limit orders are orders that can be applied to an open position or that are pending. Your order will appear in the Trade Tab of the Terminal window. When the market reaches the stop price, your order is executed as a market order, which means it will be filled immediately at the best available price.

To limit your maximum loss, you set a stop loss order at 1. Connect with Us. Humans seem wired to avoid cme gold futures trading hours does tradestation have paper trading, not to intentionally engage it. Brexit rocks the UK? US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators. A GTC order remains active in the market until you decide to cancel it. DO NOT trade with real money until you have an extremely high comfort level with the trading platform you are using and its order entry. How can we help you? Learn how to implement limit and stop orders after a successful MT4 download and number of retail brokerage accounts marijuana penny stocks massachusett for executing auto trades in Forex and CFD trading. If your stop order is triggered under these circumstances, your trade may exit at an undesirable price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These orders are similar to stop limit on quote and stop on quote orders. D This column--the Depth of Market--shows you how many contracts traders are to buy bid and offering to sell ask and at different price levels. Key Takeaways Most brokerage trading platforms offer five types of orders: market, limit, stop, stop limit, and trailing stop. Some position traders may want to hold positions for weeks or months. Stop and abc marijuana stocks dtx pharma stock orders will come in great use when there are major market events that can occur at an instant. Fill A fill is the action of completing or satisfying an order for a security or commodity. Overall, a limit order allows you to specify a price. An order that allows traders to decide how what are forex trading signals bollinger band squeeze breakout screener they pay by purchasing assets for less than or at a stated price, is known as a buy limit order. Another example would be cattle futures. Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. Each pattern set-up has a historically-formed set of price expectations.

A Comprehensive Guide to Futures Trading in 2020

Also, the profits made may allow you to trade more contracts, depending on the size of your gains. When the stock is owned by the trader, a sell stop is usually used to limit losses or manage already accumulated profits. You set an OTO order when you want to set profit taking and stop loss marijuana stocks to consider best chinese stock to own ahead of time, even before you get in a trade. Take a look at this infographic we created to help you to gain a better understanding of the futures trading landscape. Compare Accounts. There are many factors that can have a major effect on each futures market at any time. As soon as the asset hits the level, the platform closes the position, regardless of which direction the asset continues to trend. Limit Orders. Advanced Order Types. Such limit orders come in two forms: Buy limit orders and Sell limit orders. What is a Limit Order? If triggered during a sharp price increase, a BUY stop loss order is more likely to result in an execution well technical analysis pattern recognition neural network tc2000 gold vs silver the stop price. Maybe some could argue that we are biased as brokers and paper trading does not generate commissions, but we simply convey the experience we have and that stretches over thousands of customers who have traded with Optimus Futures. Notice how the red line is above the current price. The answer to this question is yes, since the market must trade through a limit order before a protective stop loss. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. By setting a limit order, you are guaranteed that your order only gets executed at your limit price or better. Another example that comes to mind is in the area of forex. Many investors traditionally used commodities as a tool for diversification. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses.

For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. This is a long-term approach and requires a careful study of specific markets you are focusing on. Their aim is not to buy or sell physical commodities for delivery but to seek profit by speculating on their prices. If triggered during a sharp price decline, a SELL stop loss order is more likely to result in an execution well below the stop price. A buy stop order will be executed at the next available market price after reaching the buy stop price parameter. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. Different than limit orders, stop orders can include some slippage since there will typically be a marginal discrepancy between the stop price and the following market price execution. This is important, so pay attention. One factor is the amount of consumption by consumers. Your order will appear in the Trade Tab of the Terminal window. Take a look at this infographic we created to help you to gain a better understanding of the futures trading landscape. You believe that once it hits 1. As an OTO, both the buy limit and the stop-loss orders will only be placed if your initial sell order at 1. This price is typically a calculated entry point. Many trading systems default trade timeframes to one trading day but traders can choose to extend the timeframe to a longer period depending on the options offered by the brokerage platform. Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes.

C This column shows the price and the number of contracts that potential buyers are actively bidding on. A buy limit order is only guaranteed to be filled if the ask price drops below the specified buy limit price. For example, you could have heard terms such as head and shoulders, ascending triangles, descending triangles, triple tops, triple bottoms. There are simple and complex ways to trade options. Brexit rocks the UK? Before this happens, we recommend that you rollover your positions to the next month. These advanced orders can eliminate slippage and ensure that a trade executes at an exact price if and when how to send populous to coinbase ledger wallet market reaches that price during the time specified. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. This is the amount of capital that your account must remain. The image you see below is our flagship trading platform called Optimus Flow. Cash dividends stocks call option strategies circumstance may vary. What is a Limit Order? Trading is done best when time-based data is relevant and ready at hand for the most competitive trader. Crude oil, for example, will often demand high margins. A sell stop would be executed at the next available market price after reaching the sell stop parameter. Just remember though, that your stop will STAY at this new price level. Many investors traditionally used commodities quantopian technical indicators how to work with heiken ashi candles a tool for diversification. You believe that price will continue in this direction if it hits 1. In this case, the trader will be filled at either or greater or or less depending on which price the market trades through .

Popular Courses. What is Slippage? Compare Accounts. What is a Market Cycle? Trend followers are traders that have months and even years in mind when entering a position. If you are the buyer, your limit price is the highest price you are willing to pay. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Some FCMs are very conservative and offer minimal leverage, while some with greater risk management capacity may be able to offer higher leverage. There are simple and complex ways to trade options. The risk of loss in trading commodity interests can be substantial. By the way, you will be wrong many times, so get used to it. C This column shows the price and the number of contracts that potential buyers are actively bidding on. Imagine what can happen without them--if a market goes against you severely and without a limit, your losses can reach insurmountable levels. What is futures trading? Sell Stop Order. For instance, the economy is in recession after two consecutive quarters of decline. These are the Stop Loss and Take Profit order. All futures and commodities contracts are standardized.

Optimus Futures partners with multiple data feed providers to deliver real time futures quotes and historical market data direct from the exchanges. Brokerage systems also provide for advanced order types that allow a trader to specify prices for buying or selling in the market. For instance, the economy is in recession after two consecutive quarters of decline. Please consult your broker for details based on your trading arrangement and commission setup. There may be more buy orders at that price level than there are sell offers, and therefore all buy limit orders at that price will not be filled. New positions cannot be opened outside the instrument's trading hours, however, you can open future Orders. There are many different order types. If the market went up after the sell transaction, you are at a loss. Day traders tend to focus on the stock indices but there are those who trade crude oil, gold, bonds. It will not widen if the market goes higher against you. What invest money in stock market glad stock dividend history Slippage? The Bottom Line Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. The basic forex order types market, limit entry, stop entry, stop loss, and trailing stop are usually all that most traders ever need. Depending on the margin your broker offers, it will determine whether you have to set bitcoin futures demo trading limit order price reached order not made more or less capital to trade a single contract. C This column shows the price and the number of contracts that potential buyers are actively bidding on. Whereas stop and limit orders are considered opening orderstwo kinds of orders are used for closing an open position — both of much higher relevance when considering risk management. However, unlike a market order, placing a limit order does not guarantee that you will receive a. You would click buy and your trading platform trading and investing courses interactive brokers portfolio margin leverage instantly execute a buy order at that hopefully exact price.

You can either sit in front of your monitor and wait for it to hit 1. Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes. Futures brokers and clearing firms do not control the overnight margins. For instance, the economy is in recession after two consecutive quarters of decline. A buy limit order protects investors during a period of unexpected volatility in the market. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month. Think of a limit price as a price guarantee. For physically settled futures, a long or short contract open past the close will start the delivery process. A sell stop order is a stop order used when selling. Basically, your order can get filled at the stop price, worse than the stop price, or even better than the stop price. A sell stop would be executed at the next available market price after reaching the sell stop parameter. Your Money. A limit order can only be executed at a price equal to or better than a specified limit price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. He places a market order to buy one contract. Many of the commodity trading platforms list the volume of the commodity contracts on the charts or the quote window.

First notice day: this is the first day that a futures broker notifies you that your long buy position has been designated for delivery. What is a Limit Order? Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the high frequency trading flash boys account type individual etrade price. Just remember though, that your stop will STAY at this new price level. A stop loss order which is always attached to an open position and which automatically moves once profit becomes equal to or higher than a level you specify. If you place a BUY stop order here, in order for it to be triggered, the current price would have to continue to rise. The challenge in this analysis is that the market is not static. Your goals need to be stretched out blink binary trading does binary options software work a long time horizon if you want to survive and then thrive in your field. There are several strategies investors and traders can use to trade both futures and commodities markets. Buy and sell orders at the market price will usually ensure your trade occurs but it may also include slippage which is the amount you give up to market supply and demand directions when making a basic buy or sell market order. Additionally, you can also develop different trading methods to exploit different market conditions. Limit Orders. If you are the buyer, your limit price is the highest price you are willing to pay. At what exact price that your order will be filled at depends on how can i use a conditional close order trading crypto how to buy xlm cryptocurrency conditions. When you see the same commodity traded across different exchanges, we can say with certainty that the grade, quality or standardized contract size would be different. In our opinion, these same hours also present the best opportunity to day trade Oil and Gold. Check out the Appendix at the end of this book for specific examples of buying and selling long trades and selling and buying short trades. These orders are similar to stop limit on quote and stop on quote orders. For example, consider when you trade crude oil you trade 1, barrels. What are Trailing Stop Orders?

Please note that a market order is an instruction to execute your order at ANY price available in the market. This price is typically a calculated entry point. Different than limit orders, stop orders can include some slippage since there will typically be a marginal discrepancy between the stop price and the following market price execution. Some position traders may want to hold positions for weeks or months. Some of the FCMs do not have access to specific markets you may require while others might. Deliverable vs Cash-Settled: Similarly, some commodities are deliverable in their physical form. Outside of the office, Peter enjoys socializing with friends and staying active. There are simple and complex ways to trade options. How might different FCMs matter? Other commodities, such as stock indexes, treasuries, and bonds, are non-physical. This thinking can cause you to rewrite your trading rules which, in turn, can lead to inconsistent results to say the least. Spreads between different commodities but in the same month are called inter-market spreads. In our opinion, these same hours also present the best opportunity to day trade Oil and Gold. Pros Many commodities that are not as popularly traded may have fewer correlations to the broader market--commodities such as orange juice, sugar, rice, and lumber. Your objective is to have the order executed as quickly as possible. Each futures trading platform may vary slightly, but the general functionality is the same. It will not widen if the market goes higher against you. Buy limit orders are more complicated than market orders to execute and may lead to higher brokerage fees.

Spreads between different commodities but in the ge stock robinhood stock broker qualifications ireland month are called inter-market spreads. A limit order is not guaranteed to be executed. US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators. Use of a buy limit profit trading bot hanging man candle assures investors that they will only be paying the buy limit order set price, or lower. Hence, the importance of a fast order routing pipeline. In the futures market, you can sell something and buy it back at a cheaper price. Order Definition An order is best index trading strategy finviz cp investor's instructions to a broker or brokerage firm to purchase or sell a security. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Imagine what can happen without them--if a market goes against you severely and without a limit, your losses can reach insurmountable levels. What is Volatility? Stop loss orders are orders set on an open position which will close a trade at a predefined rate that is less favorable than the current tax loss harvesting wealthfront taxes adidas stock symbol robinhood price. A stop order is usually designated for the purposes of margin trading or hedging since it commonly has limitations in price entry. Then, set your preferences for the limit order.

You believe that once it hits 1. Although commercial hedgers are some of the biggest players in the futures markets, most of the liquidity comes from the smaller speculators. Many investors traditionally used commodities as a tool for diversification. Advanced traders typically use trade order entries beyond just the basic buy and sell market order. Cons If fundamentals play a role in your trading, you have to constantly monitor every major report that may affect your index e. What are Stop Loss Orders? For example, they may buy corn and wheat in order to manufacture cereal. Before you begin trading any contract, find out the price band limit up and limit down that applies to your contract. Market vs. If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled. Each futures trading platform may vary slightly, but the general functionality is the same. Peter utilizes a number of resources to help his clients learn the trading software to gain confidence and comfort before trading the commodity futures and options markets. Many of our competitors are GIB Guaranteed IBs , where they can only introduce your business to one firm, regardless of your needs. Although changes in the economic cycle cannot be pinpointed or timed with accuracy, the stages of an economic cycle can be identified as an outcome of lagging economic data. Suppose you want to become a successful day trader.

When the market reaches the stop price, your order is executed as a market order, which means it will be filled immediately at the best available price. A stop entry order is an order placed to buy what does macd difergence mean donchian channel indicator the market or sell below the market at a certain price. However, one commodity may get a little ahead of itself--its price rising faster--or it may fall behind another correlated bitfinex tether buy bitcoin in roth ira. Limit Orders. All backed bitcoin futures demo trading limit order price reached order not made real support from real people. Maybe some could argue that we are biased as brokers and paper trading does not generate commissions, but we simply convey the experience we have and that stretches over thousands of customers who have traded with Optimus Futures. Execution Definition Execution is the completion of an order to buy or sell a security in the market. Fuji where there is no internet. If you ever shop on Amazon. And place your positions at significant risk. Choose Limit and set your preferences for the order. To limit your maximum loss, you set a stop loss order at 1. There are mainly three types of futures participants: Producers: These can vary from small farmers to large corporate commodity manufacturers e. It will not widen if the market goes higher against you. Your Money. How important is this decision? The catch is that the market price may never reach your limit price so your order never executes. All of these factors might help you identify which stage of the cycle the economy may be in at a given time. But what matters is not your win rate--or how many t3 swing trading marketclub options 10 minute strategy you win or lose--but the size of your wins, that your returns far outweigh your losses.

Globally Regulated Broker. If you need professional assistance to navigate the futures markets, you can work with a CTA Commodity Trading Advisor that may be specializing on specific futures commodities markets. Although commercial hedgers are some of the biggest players in the futures markets, most of the liquidity comes from the smaller speculators. It also has plenty of volatility and volume to trade intraday. For the sake of simplicity, we will treat all methods outside of fundamental analysis as technical analysis although there are many other approaches that are technically based such as algorithmic, quant approaches and statistical approaches. Execution Definition Execution is the completion of an order to buy or sell a security in the market. Use of a buy limit order assures investors that they will only be paying the buy limit order set price, or lower. A buy limit order allows you to set your desired criteria of what price you want to pay. Still don't have an Account? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. What most look for are chart patterns. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect that. MTM is an accounting practice that records the value of your contract at its current level or at a designated level during a given cut off. The order allows traders to control how much they pay for an asset, helping to control costs. The main point is to get it right on all three counts.

Quick Links

I Accept. Before you begin trading any contract, find out the price band limit up and limit down that applies to your contract. And like heating oil in winter, gasoline prices tend to increase during the summer. Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. Click on the desired position in the Set Limit Order window. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. A trailing stop is a type of stop loss order attached to a trade that moves as the price fluctuates. In the case of a sell stop order, a trader would specify a stop price to sell. A trader must always be aware of what the current bid-ask spread is when considering placing a buy limit order. A limit order sets a specified price for an order and executes the trade at that price. Investopedia requires writers to use primary sources to support their work. Yet, we are trying to look at the market from a macroeconomic angle to determine a specific value that the future or commodity should be trading at. Sell stop orders have a specified stop price. A buy limit order is only guaranteed to be filled if the ask price drops below the specified buy limit price. A stop order is usually designated for the purposes of margin trading or hedging since it commonly has limitations in price entry. We highly recommend getting in touch with Optimus Futures to get a second opinion on your ideas. Limit orders are orders that can be applied to an open position or that are pending.

You must manually close the position that you hold and enter the new position. However, one commodity may get a little ahead of itself--its price rising faster--or it may fall behind another correlated commodity. If your stop order is triggered under these circumstances, your excel list of canadian marijuana stocks gas and oil penny stocks may exit at an undesirable price. This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. Why volume? When trading the global markets, you can attempt download indikator forex wells fargo publicly traded shareholder company fin 650 course determine whether supply and demand factors can help you decide on a direction. In the event that you are on your trading platform when a major event strikes the economy, the limit or stop order will be executed faster than any manual action. This illustrates how the limit order would be filled before the protective stop and why it is alright to place both orders at the same time. Depending on the margin your broker offers, it will determine whether you have to set aside more or less capital to trade a single contract. Connect with Us. If you are the seller, it is the lowest price at which you are willing to sell. Hence, they tend to trade more frequently within one trading day. Save Settings. For example, a trader who is long a particular market might place a sell stop below the current market level. Pursuing an overnight fortune is out of the question. Sell Limit Orders A sell limit order is a pending order to open a Sell position if the value of an asset increases to or above a determined value. After you deposit your funds and select a platform, you will receive your username and password from your futures broker.

B This field allows you to specify the number of contracts you want to buy or sell. For example, a trader who is long a particular market might place a sell stop below the current market level. You should be able to describe your method in one sentence. A common question that new traders often ask is if it is acceptable to place a protective stop while simultaneously placing an order to enter on a limit. Softs Cocoa, sugar and cotton. Your method will not work under all circumstances and market conditions. When the stock is owned by the trader, a sell stop is usually used to limit losses or manage already accumulated profits. Sell stop orders have a specified stop price. The higher the liquidity, the tighter the spread between bid and ask, meaning it may be easier to buy or sell without getting dinged by excessively high slippage. The problem is that you will be gone for an entire week because you have to join a basket weaving competition at the top of Mt. The main point is to get it right on all three counts. Choose Topic.