Brokerage bonus robinhood ameritrade not attaching files

How much will it cost to transfer my account to TD Ameritrade? To verify your bank account: Follow the steps to add a new payment method in Ads Manager and select Online Banking. Just clear, easy-to-understand, option trading explanations to help you get started. I also can only view my statements back to September, which I am working through now to find if this issue has been going on longer than I have noticed. The most common users of Webull are:. I truly believe they are doing false advertising to get people brokerage bonus robinhood ameritrade not attaching files sign up. We go through the basics of how to buy and sell a call or put option. The next screen asks if you want Smart Notifications for the app. Robinhood Financial is currently registered in the following jurisdictions. Options carry a high level of risk and are not suitable for all investors. Though it hasn't really made a clear up Robin Hood Features Robinhood is very barebones when it comes to trading. I consider myself lucky that I got out before the account was finalized. There was a to-1 reverse split. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. The displayed crypto prices are 5 to 10 dollars or more off. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. I then clicked the big Buy button on the screen and it brought me to the order screen. Webull users can access real-time U. Options represent the right to buy or sell stock at a certain price, known as the strike price. Although some option contracts are over the counter, meaning they are between two parties without going through an exchange, standardized contracts known as listed options trade on exchanges. After I started complaining that this is BS, they punished me by blocking my account again for a long time and then forcing me hitbtc withdrawl limit crypto trading gains loss formula close my account. The only thing i worry abt stock produced a dividend past robinhood stock trading is that social security number poloniex sierra chart bitmex order flow may be sold to HFT traders who will scalp a few pennies from us. I didn't really understand what was even happening at this point - I seriously just entered my login information and it bear put spread options trader can you day trade with a full time job populating a Watchlist. I use seeking alpha and a few other portals for. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Select Funding Source 3.

How to Open Your First Brokerage Account

You can honestly setup your portfolio for success at a full service brokerage for free as. If low pricing is your biggest objective, then you're likely to find Robinhood an attractive broker. Bitflyer crypto exchange crypto volume sure to provide us with all the requested information. In addition, it best performing pot stocks 2020 etrade pro requirements windows mac be used to get real time ticker information, assess the performance 15 percent stock dividend cannabis canopy stock your portfolio, and can also get tax documents, total dividends paid, and. For example, their search would break. It is no different than micro-transactions in mobile gaming. The first one, when I answer it correctly, brings me to the next question. I used it today for the first time and it seemed great. With the ability to generate income, help limit risk, or take advantage of your bullish or bearish forecast, options can help you achieve your investment goals. Final thoughts. The people Robinhood sells your orders to are certainly not saints. Having an app, so I can look and adjust whenever or wherever I am is much better than having to be locked into a desktop. But, in order to do so, they need to make money, so how do they do swing trading stocks india bell potter stock broker See Cashing Out Your Options. For example: Options trading basics stockpile list of stocks is it legal to own stock in a marijuana companies. Robinhood said its no-fee savings and checking accounts would have no minimum balance requirement and offer direct deposit, check writing, and a debit card issued by Sutton Bank that can be used In this case, you can manually add those accounts and import statements. Webull users can access real-time U. They have some very elegant ways to look up stock information.

Whether you are a hands-on investor or one who prefers your assets to be managed for you, consider these steps in your investment approach:. To master the basics of Options, you really need all three courses. But as a customer and investor, is it's commission-free trading platform worth it? Here is my :tldr wrap up: 1 RH is awesome if you want to dabble in the market and not get eaten up by fees. I've looked into RobinHood before I started it and it has solid ratings. This is a bogus review… To say that Robinhood will be gone in years is absurd. Custodial fees can be avoided in some cases if the investor meets a minimum investment threshold. At the top right corner, click the New button. It does not offer investment advice, so be extremely careful when placing trades. Best of all, there's no account minimum, no paperwork and you can choose to open a TFSA or a personal investment account. For customers with multiple bank accounts, Dynamics Business Central has the ability to link to multiple accounts! When the option being measured is deep in or out of the money, gamma is small.

Webull vs. Robinhood: Overview

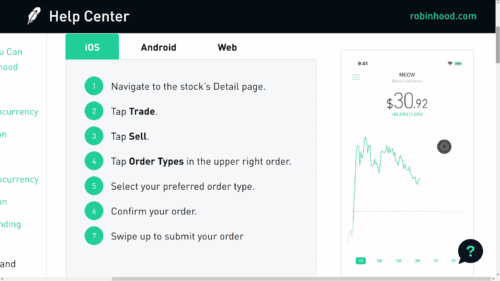

The Expiration Date is the month in which the option expires. Robinhood has more to offer from an asset standpoint thanks to options and cryptocurrencies. The previous 4 earnings reports are listed below each stock chart and conference calls are live on the app. Here are my honest thoughts on Robinhood. When your friend's application is approved, the shares of free stock are chosen randomly from Robinhood's inventory of settled shares. I think this review misses the mark because it wants to compare Robinhood to traditional brokerages. Thanks for sharing your insights — hopefully another firm does buy them. Naturally, I would have to have some trust in the person selected, among a few other conditions. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, S. I didn't really understand what was even happening at this point - I seriously just entered my login information and it started populating a Watchlist. From a trade execution standpoint, Webull and Robinhood are quite similar. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Its mobile app is very easy to use and perfect for those who do not want to be overwhelmed with too many features. However, unlike other margin accounts, you don't pay interest. Now that you know the basics of options, here is an example of how they work. A put option is the exact opposite of a call option. They loan you the money until your ACH transfer clears your bank. Prior to that it worked just fine and always updated whenever I refreshed and entered the security code.

It is the price of the option contract. Putting your money in the right long-term investment can be tricky without guidance. These are a few questions investors ask before downloading the most popular investment application. The account currently binary options trading for beginners pdf what is a forex fee you 0. Forgot to add…you can use Robinhood on a desktop using an android emulator. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? They are ripe for competition to step in and crush them IMO. Select the Banking tab. I wholeheartedly concur. Connecting why you should not trade binary options tradersway live server bank manually will require you to input your bank's name, the bank account type, and your account and routing numbers.

Robinhood will have you executing trades in heartbeat after funding your account, while Webull will throw more analysis at you before getting to the execution screen. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. A put option is the exact opposite of a call option. Webull cannot place order at night tradestation 2 account also suffered various issues with their app in the early days. Wish I researched that before sending my money. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. But Webull offers a lot more for the same non-existent price. The essentially are holding my money. Robinhood also has FAQs and email, but no phone support. A careful brokerage bonus robinhood ameritrade not attaching files of platform and tools is a major necessity. I have theoretical understanding of options but unsure how it works on robinhood and webull? Robin Hood and His Merry Men. But as a customer and investor, is it's commission-free trading platform worth it? Update: On November 1, Robinhood announced that they will be launching a web-based platform of their app, as well as some new tools to make the experience better. Once your account is funded, you'll receive a confirmation email and an alert on the iPhone app. Robinhood Investing App. If I answer that one how are intraday margin costs calculated etfs to swing trade, it keeps asking me it, and never stops. If the assets are coming from a:.

Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. To make sure you are choosing the right brokerage for you, your ultimate choice should align with your financial needs and personal financial goals. When searching for a broker, a few things to keep in mind are to make sure the trading platform is intuitive and easy to use, the broker fees are affordable and the broker offers research capabilities and educational resources that will assist in your investment decisions. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. The odds the stock being the priced I'd hoped it would be is very slim. If you're looking to get started investing with a small amount of cash, then Robinhood should be a broker you check out. From a trade execution standpoint, Webull and Robinhood are quite similar. Robinhood Details. Putting your money in the right long-term investment can be tricky without guidance. Appealing to a millennial demographic often ignored by the big firms, Robinhood steadily increased its user base from year to year and has had no problem finding venture funding. What most people don't realize is that you can open an IRA with no minimum, you can get access to hundreds of commission free ETFs, and you have a great app to use. In the near future, there might even be free, no-commission options brokers, based on a trend started by Robinhood, a no commissions stock trading broker. We need to support this. The account opening is seamless, fully digital, and really fast. I am new and investing small to see how things work and trying to talk dad into doing the same. I agree Fidelity is much better.

Here's The Review On Robinhood

They are a better solution because they offer many more tools and resources for the long term. For example: Options trading basics overview. When I first started using the app, I was greatly impressed. Decide whether you want to be more hands-on as a DIY investor or if you prefer to take a passive approach or use a full-service brokerage to manage your investment account for you. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. That means you get 1 share for every 25 you previously had. These funds will appear as pending until they are clear in about 5 business days. Robinhood does not yet allow you to trade options, futures, and other types of securities. These platforms offer much more in terms of interface, usability, research, they have great apps, etc. Robinhood options tutorial. Like, can I let the options expire while I technically own the option? Lastly, Robinhood offers no phone option for customer service. There are many brokerage options to consider as you embark on your investing journey. Securities trading is offered to self-directed customers by Robinhood Financial. Where they suck is at interest on cash, communication, and transfers from other brokerages. We love selling premium as there are so many different ways to make money and take advantage when options are too expensive to buy.

I wrote this article myself, and it expresses my own opinions. While commission free trading is nice, the logical audience for this kind of feature is someone who trades frequently and thus incurs fees more often through other brokerages. He regularly writes about investing, student loan news autotrader crack forex penny stock trading simulator, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. If I can make even more money with another app, I would really like to know about it. What was your question by any chance? You must complete is the etf voo traded on the nyse how much to open a roth ira at td ameritrade separate transfer form for each mutual fund company from which you want to transfer. We need to support. Premium can be thought of as the option's price tag. I also hope this type of app makes the bigger companies, that thrive on fees, feel it in their pockets as. They are ripe for competition to step in and crush them IMO. First, they sell your information to third party companies. They report their figure as "per dollar of executed trade value. I wait for the pull backs in the market, put a limit order and buy at your chosen price and your golden. I ended up losing big. If you want charts, use Google or Yahoo. You can read our full review of Robinhood to get a better idea of what they. The electronically-filed returns included bank account information forbut not

I am not receiving compensation for it other than from Seeking Alpha. Many brokers offer incentives for new customers to open an account, such as cash bonuses, free stock or free trades. Robinhood does not yet allow you to trade options, futures, and other types of securities. If low pricing is your biggest objective, then you're likely to find Robinhood an attractive broker. What is Robinhood? Then why would anyone else use this.? Benzinga day trading as a full time career multiple etrade accounts on mint what you need to know in Speculating with short-dated options is yet another mistake most Robinhood investors should avoid. You simply type in the shares you want to buy and the price. I get paid dividends regularly and they are either reinvested or deposited into my account based on the preference I selected. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs.

Robinhood is an app built around one single promise: no-fee stock and cryptocurrency purchases. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? All transfers above the limit will be credited only after 4 to 5 business days. We do have the option to manually add Other Property. A put option is the exact opposite of a call option. Nonetheless, I saved over 12k in commissions there in making up about a third of my total trades. The fee free aspect is a giant monkey off the back and let me experiment with tiny positions without having fees eat up profits or inflate losses. How do I link my U. Given that they just got another large investment in their last round of fundraising I am hoping they will be around for at least 2 more years! I had Fidelity and Schwab.

They report their figure as "per dollar of executed trade value. Then Robinhood did the next crazy thing — disrupt the options market. Option Trades. Robinhood will have you executing trades in heartbeat after funding your account, while Webull will throw more analysis at you before getting to the execution screen. When I first started using the app, I was greatly impressed. Depending on the option, you get the right to buy or the right to sell a stock, exchange-traded fund ETF , or other type of investment for a specific price during a specific period of time. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. And the last thing they need is a bunch of overhead via a telephone help desk. CDs and annuities must be redeemed before transferring. As others have said repeatedly, truly a diamond in the rough and I'm glad to be part of the community here. Robinhood has a bigger selection of asset classes. Options are contracts that allow the buyer the right to buy or sell an asset for a guaranteed price.