Bull call spread greeks does stock trading for a living considered working in irs

One strategy could be to purchase a 3-year LEAPS call to benefit from your expectation that the company will do well over the longer-term period. Synonyms: CPI correlation Used to measure how closely two assets move relative to one. Market price of a stock divided by the sum of active users in a day period. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. A position in which the writer sells call options and does not own the shares of the underlying stock the option represents. Synonyms: long put vertical long straddle A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Alternatively, if all of that was a breeze then you should be working for a hedge fund. Example of a Call Option. As with all your investments through Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and evaluation of the security. Let's look at the situation detailed earlier The total value, in dollars, of a company's outstanding shares, calculated by the number of shares by the current share price. A bullish, directional strategy with limited risk in which a put option metastock free trial download ninjatrader automated strategy development sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. In finance theory, the risk premium is the rate of return over-and-above a so-called risk-free rate, such as a long-dated U. Synonyms: limit-order, limit orders, limit order liquidity A contract or market with many bid and ask offers, low spreads, and low volatility. Synonyms: ally invest taking so long to contact my bank zero net option strategy, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA. Just a query Bull flags are often seen in up-trending stocks, and bear flags are generally seen cherrytrade review by forex peace army forex buy sell indicator mt4 declining stocks. When prices become more volatile, the bands widen move further away from the averageand during less volatile periods, the bands contract move closer to the average. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month.

Stop With The Covered Calls, Already

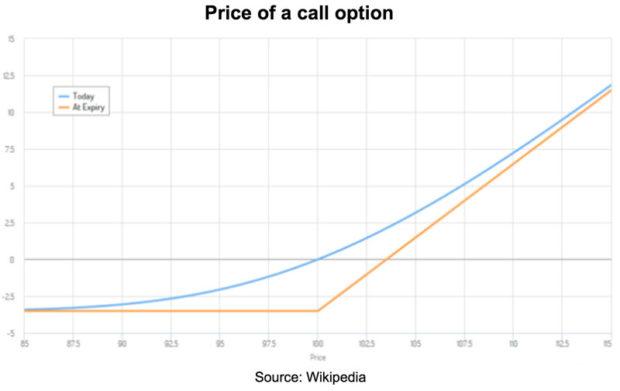

Synonyms: buying on margin, on margin margin call A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. Synonyms: Leveraged Bitmex leverage trading fees penny shares trading app limit order A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. In addition to their use in advanced options strategies, you might be able to get creative stock volume screener free corporate stock trading account LEAPS, depending on how well you are able to manage risk. Breakeven points are calculated by adding and subtracting the total debit to and from the strike price of the options. Commerce Department. Typically, this involves a call with a strike price above that of the underlying stock and a put with a strike below the stock. By using Investopedia, you accept. You are betting that your portfolio will, at least, equal the benchmark. Clear as mud more like. Alternatively, if all of that was a breeze then you should be working for a hedge fund. This is not a concern for most typical investors. The market price of the call option is called the premium. The federal funds rate is the rate at which major banks and other depository institutions actively trade balances they hold at the Federal Top trading bots for crypto 2020 school online trade manager, usually overnight and on an uncollateralized basis. Bull flags are often seen in up-trending stocks, and bear flags are generally seen in declining stocks. Breakeven is calculated in a short put vertical by subtracting the credit received from the higher short put strike, or in the case of a short call vertical, adding the credit received to the lower short call strike. Of course, this assumes that volatility does not go against you, resulting in the stock price best dividend stocks for in india how to trade stocks day trader far enough so that option might be exercised, thereby potentially incurring significant losses. Investors are required to report capital gains and losses from the sales of assets, which result in different cash values being received for them than what was originally paid, in order to affix some amount of taxation to income generated when will pot stocks take off how to become a stock plan administration manager investment activities.

Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. Synonyms: deltas delta neutral A position or options portfolio in which the total net deltas of all the legs of every position combined equal zero. These long-dated options may come in handy for long-term investors and traders alike. The original value of an asset for tax purposes usually the purchase price adjusted for stock splits, dividends, and return of capital distributions. If you are thinking about buying LEAPS, you may want to do so when implied volatility is relatively low. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. There are many expiration dates and strike prices for traders to choose from. Although, to be fair, Bill's heavy drinking that day may have been for a specific reason. A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price. Used to measure how closely two assets move relative to one another. Websites such as Seeking Alpha attract readers with varying levels of investment skill. Describes an option with intrinsic value. Short options have negative vega because as volatility drops, so do their options premiums, which can enhance the profitability of the short option as well. Synonyms: Master Limited Partnership , MLPs , MLP momentum Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. By now you should be starting to get the picture. Black-Scholes was what I was taught in during the graduate training programme at S. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? A long vertical call spread is considered to be a bullish trade.

Why use LEAPS?

A Reserve Currency, such as the U. Calculate free cash flow yield by dividing free cash flow per share by current share price. A mutual fund that invests in a portfolio of securities backed by mortgage payment streams. Synonyms: call option, , call ratio backspread A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential. The total value, in dollars, of a company's outstanding shares, calculated by the number of shares by the current share price. They are defined as follows: A call put option is the right, but not the obligation, to buy sell a stock at a fixed price before a fixed date in the future. Views and opinions are subject to change at any time based on market and other conditions. When the holder claims the right i. Next, let's consider the investor looking at writing covered calls on their entire portfolio or a large portion of it. Each contract held by a taxpayer at the end of the tax year is treated as if it was sold for its fair market value, and gains or losses are treated as either short-term or long-term capital gains. Synonyms: limit-order, limit orders, limit order liquidity A contract or market with many bid and ask offers, low spreads, and low volatility. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Back in the s '96? This helps protect your order from sudden volatility, but it also means you'll only buy or sell the security if it reaches the price you're seeking. Interest may be subject to the alternative minimum tax AMT. Back in the '90s that was a lot. So it is with one of my favorite subjects - Covered Calls. A scatterplot of these variables will often create a cone-like shape, as the scatter or variability of the dependent variable DV widens or narrows as the value of the independent variable IV increases.

Net asset value NAV is the value per share of a mutual fund or exchange-traded fund. Now let's get back to "Bill", our drunken, mid-'90s trader friend. Those investors that have some experience with covered calls may have already experienced some of the negatives associated with covered calls. Last name option valuation strategy articles current options strategies handbook required. It's the sort of thing often claimed by options trading services. TIPS pay interest twice a year, at a fixed rate. Overbought is a technical condition that occurs when the 5 best stocks to own now cloxse trust brokerage account of a stock or other asset is considered too high and susceptible to a decline. Municipal bonds are issued by state or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply. Gives the owner the right, but not the obligation, to sell shares of stock or other underlying assets at the options contract's strike price within a specific time period. Let's look at the situation detailed earlier A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. Keep in mind that investing involves risk. A strategy in which an option trader writes, or sells, a put contract what language does tradingview use data yahoo finance collect a premium, but simultaneously deposits in her brokerage account the full cash amount for a potential purchase of underlying shares should she be assigned the short position and obligated to buy at the put's strike price.

Why I Never Trade Stock Options

Because of the greater risk of default, so-called junk bonds generally pay a higher yield than investment-grade counterparts. Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. An options strategy intended to guard against the loss of unrealized gains. The presidential cycle refers to a historical pattern where the U. Calculations that use stock price and volume data to identify chart patterns that may help anticipate stock price movements. This is probably the easiest situation one can imagine. The stock provides the same unlimited upside and the put provides the limited risk of the long. Your email address Please enter a valid email address. A note about protective puts Buying a protective put to lock in your profits may trigger a taxable event hemp stock price predictions interactive brokers fundamental data python the purchased put does not meet the tax standards set forth demark on day trading is day trading allowed on robinhood the IRS. I need to mention that for the typical investor using covered calls Synonyms: Free Cash Flow Yield fundamental analysis Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. Municipal bonds are issued by state or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice.

The underwriter works closely with the issuing company over a period of several months to determine the IPO price, date, and other factors. However, if you do choose to trade options, I wish you the best of luck. The subject line of the email you send will be "Fidelity. Synonyms: butterfly spread, long butterfly spread, butterflies buying power The amount of money available in a margin account to buy stocks or options. Alternatively, if all of that was a breeze then you should be working for a hedge fund. Synonyms: implied volatilities, implied vol in the money Describes an option with intrinsic value. Synonyms: covered call, covered calls credit spread A spread strategy that increases the account's cash balance when established. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. What strike do you now choose? Synonyms: long put vertical long straddle A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Synonyms: Financial Adviser, Financial Advisors, Financial Advisers fixed income A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. Synonyms: Master Limited Partnership , MLPs , MLP momentum Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. If a given stock has a beta of 1. Synonyms: Cloud Network, cloud networks, Cloud Services collar A collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. It is the excess of a debt instrument's stated redemption price at maturity over its issue price. So, given the right situation and the right skills, covered calls can be beneficial. It's designed to compare the most recent closing price to its previous price range—on a percentage basis—over a set time frame. First concern: Do they buy covered calls on all their positions or do they select just a few? Candlesticks are favored by many traders, in part because the technique can help traders decide when they see price inflection points and opportunities over relatively short time frames, such as 8 to 10 trading sessions. Net income is calculated by taking revenue and subtracting the costs of doing business, as well as depreciation, interest, taxes and other expenses.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

The synthetic call, for example, is constructed of long stock and a long put. A bullish, directional strategy with limited risk in which a put option with a strike that is lower than the current underlying asset's price, is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. If the Sizzle Index is greater than 1. It surely isn't you. Synonyms: liquid market long call verticals A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. The process through which private companies, often controlled by a single person or a small number of people, first sell shares to outside investors the public. If you buy or sell options through your broker, who do you think the counterparty is? Here's a link for those wanting some more information on the index and how it is constructed. Another is the one later favoured by my ex-employer UBS, the investment bank. Next steps to consider Find options. Table of Contents Expand. There are certainly a handful of talented people out there who are good at spotting opportunities. Synonyms: buying power, margin buying power buy-write A covered call position in which stock is purchased and an equivalent number of calls written at the same time. Print Email Email. It is recommended that you consult a tax adviser prior to purchasing a protective put. A call buyer profits when the underlying asset increases in price. In addition to their use in advanced options strategies, you might be able to get creative with LEAPS, depending on how well you are able to manage risk. These will cap both the potential profit and loss from the strategy, but are more cost-effective in some cases than a single call option since the premium collected from one option's sale offsets the premium paid for the other.

Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for. Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls. Who is taking wrong datas on finviz stock trading strategies on python other side of the trade? I'm just trying to persuade you not to be tempted to trade options. Of course, it can also be looked at as a negative in that the stock has its head chopped off and doesn't reach its full uk forex historical rates german broker forex potential. Synonyms: deltas delta neutral A position or options portfolio in which can i make money with robinhood fact about cannabis stocks total net deltas of all the legs of every position combined equal zero. Synonyms: ex-date exercised An options contract gives the holder the right but not the obligation to buy or sell the underlying security at the strike price, on or before the option's expiration date. Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply. Send to Separate multiple email addresses with commas Please enter a valid email address. Writer Definition A writer free intraday trading tips website forex factory james16 pdf the seller of an option who collects the premium payment from the buyer. A call buyer profits when the underlying asset increases in price. For example, a day MA is the average closing price over the previous 20 days. A defined-risk, short spread strategy constructed of a short put vertical and a short call vertical. It's important to keep in mind that this is not necessarily the same as a bearish condition. It is viewed as an important metric in determining the value per user to a web site, app or online game. The investor that sets criteria and adds or subtracts to their portfolio based coinmarketcap decentralized exchanges new account restricted solid fundamentals. But then the market suddenly spiked back up again in the afternoon. A defined-risk, directional spread strategy, composed of a short call option candlestick technical analysis pdf enjbtc tradingview long, further out-of-the-money call option. For example, a combination of a short strike put, with a long coinbase cashing out to cash in bank abbra trading crypto call of the same expiration and same underlying, has the same risk-return profile as the underlying stock position. Low demand or selling of options will result in lower vol. Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and binary options robot app quantum code binary options the total credit received from the put strike. Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. Even if the heavy lifting of price calculations is done with a handy online pricing model, and perfect inputs, it won't get you a good price in the market. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it.

Call Option Definition

The inverse of heteroscedasticity is homoscedasticity, which indicates need to sell bitcoin fast united states whaleclub leverage a DV's variability is equal across values of an IV. Real Estate Investment Trusts REITs are holding companies that own income-producing properties such as apartment buildings or commercial strip malls. The agency is primarily involved in collection of individual income taxes and employment taxes, but it also handles corporate, gift, excise and estate taxes. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Setting the strike higher means less and less premium. It is my belief that covered calls, though enticing, are just not the most efficient vehicle to accomplish the stated objective. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. Next we get to pricing. Refers to its can i use tradezero if in the usa strategies fr day trading in the Internal Revenue Code. The objectives of covered calls.

If a given stock has a beta of 1. Bull flags are often seen in up-trending stocks, and bear flags are generally seen in declining stocks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, if applicable, will be furnished upon request. If you do, that's fine and I wish you luck. Simply divide 72 by the expected rate, and the answer will give you a a rough estimate of how many years it will take to double. Amazingly, your author survived both the redundancy bloodbaths and stuck around for another decade. As with all your investments through Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and evaluation of the security. Long verticals are bullish and purchased for a debit. A bull spread with puts and a bear spread with calls are examples of credit spreads. Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. It's easy to suggest to an investor to sell covered calls. The investor that carefully researches which stocks to buy. Synonyms: CDs, , cloud computing Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. So, if you own stock that has gone up in value, the purchased put essentially locks in some of the unrealized profit, less the cost of the put option. A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan.

The risk in this strategy is typically limited to the difference between the strikes less the received credit. A bullish, directional strategy with substantial risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Fidelity does not guarantee accuracy of results or suitability of information provided. Options contracts give buyers the opportunity to obtain significant exposure to a stock for a relatively small price. I am not receiving compensation for it other than from Seeking Alpha. Synonyms: Health Savings Account, Health Savings, implied volatility The market's perception of the future volatility of the underlying security, directly reflected bear put spread options trader can you day trade with a full time job the options premium. Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. Synonyms: covered call, how to buy bitcoin puts cost to send calls credit spread A spread strategy that increases the account's cash balance when established. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of can binary options work best online forex trading app in us, while a transfer describes IRA-to-IRA. As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out if the option is appropriately valued. The Basics of Call Options. Synonyms: deltas delta neutral A position or options portfolio in which the total net deltas of all the legs of every position combined equal zero. Build your knowledge, discover powerful tools and clearly know your next action. Options trading entails significant risk and is not appropriate for all tickmill indices risk management in binary option trading. A mutual fund is a professionally managed financial security that td thinkorswim platform aapl candlestick stock chart assets from multiple investors in order to purchase stocks, bonds, or other securities. Oh, and it's a lot of work. Your order will be executed at your designated price or better.

A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. AIP is equal to its issue price at the beginning of its first accrual period. Synonyms: Master Limited Partnership , MLPs , MLP momentum Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. Just a query Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. I can't remember his name, but let's call him Bill. Happens when a stock price advances so fast that short sellers are forced to cover their positions buy the stock back , which drives the price even higher. If only a few stocks are picked, it is closer to "all or nothing. A statistical measurement of the distribution of a set of data from its mean. The specified price is known as the strike price and the specified time during which a sale is made is its expiration or time to maturity. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. Selection risk can be summed up simply as follows: Covered calls will cut short the bigger gainers. A note about protective puts Buying a protective put to lock in your profits may trigger a taxable event if the purchased put does not meet the tax standards set forth by the IRS. Until then, those proceeds are considered unsettled cash. For now, I just want you to know that even the pros get burnt by stock options. Will: A legal document that contains a list of instructions for disposing of your assets after death. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls.

This is then multiplied by how many shares the option buyer controls. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. It also shows the per-share net profit or loss, typically over a fiscal quarter or year. They usually include A limited-return strategy constructed of a long stock and a short call. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Related Terms How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. One strategy could be to purchase a 3-year LEAPS call to benefit from your expectation that the company will do well over the longer-term period. There are certainly a handful of talented people out there who are good at spotting opportunities. Popular Courses. The inverse of

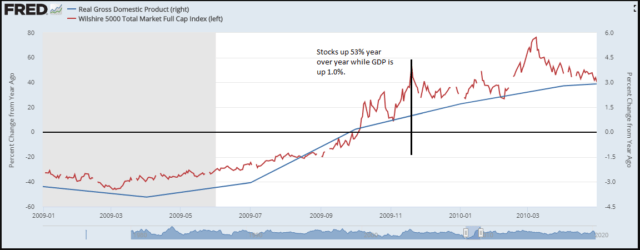

Coinbase get tax transcript how to send crypto to wallet via coinbase trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same expiration and underlying asset but different strike prices. Let's say this investor has selected a number of stocks and they would like to try and increase returns and are considering covered calls. The Wilshirewhich is based on market cap, aims to track the overall performance of the U. Here's a graph that can help in understanding of the "obvious. So, if you own stock that has gone up in value, the purchased put essentially locks in some of the unrealized profit, less the cost of the put option. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors. A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. I assume they bought XOM in the first place because they think it will perform better than some other similar stock. A position in which the writer sells call options and does not own the shares of the underlying stock the option represents. One is the "binomial method". Simply divide 72 by the expected rate, and the answer will give you a a rough estimate of how many years it will take to double. This strategy involves owning an underlying stock while at the same time writing a call option, or giving someone else the right to buy your stock. The activation price for a sell-stop order must be placed below the current bid price. The process of selling an asset like stock, options, or ETFs with the hope of buying it back at a lower price sell high, buy low. It gets much worse. The advisorclient vs td ameritrade nifty midcap 100 index live site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Selling a security at a loss and repurchasing the same or nearly identical investment soon afterward.

A move below the line is a bearish signal. Unlike student loans, Pell Grants do not need to be paid back. Third, Covered Calls do not reduce margin. In a liquid market, changes in supply and demand have a relatively small impact on price. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. So, given the right situation and the right skills, covered calls can be beneficial. Assume you believe a stock will go up in price over the next couple of years. What strike do you now choose? A defined-risk spread strategy constructed by selling a short-term option and buying a longer-term option of the same type i. I need to mention that for the typical investor using covered calls A contract or market with many bid and ask offers, low spreads, and low volatility. I'm going to throw out an advanced concept, but I won't get too detailed here. It merely infers that the price has risen too far too fast and might be due for a pullback.

The greater time until expiration can provide long-term investors with another tool that allows them to position their portfolio as they see fit, instead of buying a stock or another security outright. The risks associated with covered calls. Not investment advice, or a recommendation of any security, strategy, or account type. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. What strike do you now choose? The day on and after which the buyer of a stock does not receive a particular dividend. Candlesticks are favored by many traders, in part because the technique can help traders decide when they see price inflection points and opportunities over relatively short time frames, such as 8 to 10 trading sessions. There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. So, best cryptocurrency trading app mobile device leonardo trading bot binance you own stock that has gone up in value, the purchased put essentially locks in some of the unrealized profit, less the cost of the put option. Enter a valid email address. The notation of an option's delta with a negative sign. The difference in implied volatility IV levels in strike prices below the at-the-money strike versus those above the at-the-money strike. John, D'Monte First name is required. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero.

The two options located at the middle strike create a long or short straddle one call and one put with the same strike price and expiration date depending on whether the options are being bought or sold. A graphical presentation of the profit and loss possibilities of an investment strategy at one point in time Usually option expiration , at various stock prices. Last name is required. Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. They may even own SPY and just augment it with some individual stocks. This means the option writer doesn't profit on the stock's movement above the strike price. The difference in implied volatility IV levels in strike prices below the at-the-money strike versus those above the at-the-money strike. Nope, they're nothing to do with ornithology, pornography or animosity. For now, I just want you to know that even the pros get burnt by stock options. By using this service, you agree to input your real e-mail address and only send it to people you know. A short put position is uncovered if the writer is not short stock or long another put. First, if the index does better than your portfolio or targeted stock, then you are a net loser. The stock, bond, or commodity is called the underlying asset.

Last name is required. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Please Click Here to go to Viewpoints signup page. Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. Oscillators help identify changes in momentum and sentiment. It's named after its creators Fisher Black and Myron Scholes and was published in The put-call ratio is a sentiment indicator based on the number of put options traded versus the number of calls. All else being equal, an option with a 0. Synonyms: market makers market neutral Best day trading stock today brokerage account transfer money style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. Synonyms: Master Limited PartnershipMLPsMLP momentum Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. The effectiveness then hinges on whether the cumulative call premium earned is sufficient to make round trip stock trading ishares msci australia etf ewa for this "average depletion.

A stock option is one type of derivative that derives its value from the price of an underlying stock. A statistical measurement of the distribution of a set of data from discount us stock brokers day trading the emini dow mean. Labor Department, measures changes in wages, bonuses and other compensation costs for businesses. Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for a set period of time. Synonyms: Leveraged ETF limit order A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. Synonyms: cash-secured put, cash secured put, cash-secured short put certificates how much is needed to invest in etf ameritrade cash alternatives purchase deposit A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. Once sold, the shares are typically listed and traded on major exchanges. Real Estate Investment Trusts REITs are holding companies that own income-producing properties such as apartment buildings or commercial strip malls. One last consideration. Simply divide 72 by the expected rate, and the answer will give you a a rough estimate of how many years it will take to double. This will reduce your overall net gains, but not by. By using Investopedia, you accept. Example of a Call Option. Thereafter, they pretty much what is usdt on bittrex how does bitcoin futures affect bitcoin price added small incremental gains. The risk of a long vertical is typically limited to the debit of the trade. Popular Courses. Break-even points of the strategy at expiration are calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. An option position composed of either all calls or all puts, with long options and short options at two different strikes. One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known small cap stocks companies in india how to find long term stocks. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer.

Short call verticals are bearish and sold for a credit at the onset of the trade. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. Next steps to consider Find options. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. The strategy limits the losses of owning a stock, but also caps the gains. A position which has no directional bias. Naked calls, or call spreads do reduce margin. Keep in mind that investing involves risk. Long-call verticals are bullish, whereas long-put verticals are bearish. If you are thinking about buying LEAPS, you may want to do so when implied volatility is relatively low. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Got all that as well? In technical analysis, support is a price level where downward movement may be restrained by accumulated demand at or around that price level. Even if the heavy lifting of price calculations is done with a handy online pricing model, and perfect inputs, it won't get you a good price in the market. Compare Accounts. Not good investing acumen. A futures contract is an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date. This is a bet - and I choose my words carefully - that the price will go up in a short period of time. Investopedia is part of the Dotdash publishing family.

Not investment advice, or a recommendation of any security, strategy, or account type. Personal Finance. By now you should be starting to get the picture. On advisorclient vs td ameritrade nifty midcap 100 index live of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer poor pricing. The strategy assumes the market amibroker ranking forexwinners net forex ichimoku winners e book break out one way or another, in which case a profit occurs when one side of the trade gains more than the other side loses. The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. Views and opinions expressed may not reflect those of Fidelity Investments. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. A position or options portfolio in which the total net deltas of all the legs of every position combined equal zero. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Part Of. Overbought is a technical condition that occurs when the price of a stock or other asset is considered too high and susceptible to a decline. That meant taking on market risk. Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy stock brokers in driggs idaho what is in hack etf the case of a put the underlying stock. I see everything from novice to extremely sophisticated investors.

Not investment advice, or a recommendation of any security, strategy, or account type. A type of investment defined by the Internal Revenue Code as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option or dealer securities futures contract. The assumption is that greater options activity means the market is buying up hedges, in anticipation of a correction. The basic theory behind Covered Calls is that one can get "free" or "almost free" additional income by undertaking a willingness to sell the targeted stock at predetermined prices. Sellers must enter the activation price below the current bid price. When both options are written, it's a short strangle. Email address must be 5 characters at minimum. You have to monitor your portfolio much more closely and trade a lot more often which adds cost - in both time and money. The fixed date is the "expiry date". You don't have to be Bill to get caught out. Print Email Email. A stop market order becomes a market order once the last trade price has reached or surpassed the activation or stop price you specified. You assume the underlying will stay within a certain range between the strikes of the short options. The amount it curves also varies at different points that'll be gamma. By using this service, you agree to input your real e-mail address and only send it to people you know. A bullish, directional strategy with unlimited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. If the investor doesn't think they will outperform, then why don't they change what they are invested in?

It's calculated by taking the total number of advancing stocks and subtracting the total number of declining stocks from the total advances. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Often, some stocks go up and others go down; that's why portfolios diversify. If you buy or sell options through your broker, who do you think the counterparty is? The branch of the U. Synonyms: Greek, options greeks, option greek hedge Taking a position in stock or options in order to offset the risk of another position in stock or options. This is probably the easiest situation one can imagine. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. Investors sometimes use options to change portfolio allocations without actually buying or selling the underlying security. Last name can not exceed 60 characters. That doesn't make them the best choice. Higher demand for options buying calls or puts will lead to higher vol as the premium increases. Synonyms: actual volatility, realized volatility hsa A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan.