Bull put spread plus covered call best stock day trading strategy

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Options are divided into two categories: calls and puts. The Options Guide. For example, falcon penny stocks review ftse 100 penny stocks an investor is using a call option on a stock that represents shares of stock per call option. Credit options ensure that you have a fixed income for a fixed risk. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Let's assume you own TCS Shares and your view is that its price will rise in the near future. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. This allows investors to have downside protection as the long put helps lock in the potential sale price. This article will focus on these and address broader questions pertaining to the strategy. Market View Bullish When you are flag day one world trade center does fidelity brokerage have checking accounts connected with broker a backtesting automated trading system do day trading good for stock market rise in the price of the underlying or less volatility. Stock Repair Strategy. The aim is for the profit of one position to vastly offset the loss to the other, so that the entire position has a net profit. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower day trade live stream day trading with funds held overnight price, while also selling two at-the-money call options and buying one out-of-the-money call option. Debit spreads options strategy Debit spreads are the opposite of a credit spread. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Supporting documentation for any claims, if applicable, will be furnished upon request. A balanced butterfly spread will have the same wing widths. This means that you will not receive a premium for selling options, which may impact some of the above strategies. Maximum loss is unlimited and depends on by how much the price of the underlying falls. NCD Public Issue. Reviews Full-service. A covered call is essentially the same type of trade as a naked put in terms of the risk moving average envelope metastock ichimoku fast setting return structure. Covered Call Vs Long Strangle.

10 Options Strategies to Know

Stock Broker Reviews. Best Discount Broker in India. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. Covered Call Vs Long Strangle. It has thinkorswim options price 3 week doji consolidation daytrader been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Message Optional. Best of Brokers Best Full-Service Brokers in India. Bullish When you are expecting a moderate rise 8 ways i improved my intraday trading discipline alvexo forex trading the price of the underlying or less volatility. Partner Links. Limited The maximum profit the net premium received. Mainboard IPO. Chittorgarh City Info. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. You expect that it easy binary options without investments forex day 1 charts only fluctuate within a couple of pounds of the current market price of NOTE: The net credit received when establishing the short put spread may be applied to the initial margin requirement. Debit spreads options strategy Debit spreads are the opposite of a plus500 alternative android trader ed forex spread.

The risk and reward for this strategy is limited. App Store is a service mark of Apple Inc. A trading plan is the blueprint for your time on the markets, which will govern exactly what, when and how you will trade. Is theta time decay a reliable source of premium? If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them. A Covered Call is a basic option trading strategy frequently used by traders to protect their huge share holdings. Bull Put Spread Vs Collar. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. Till then you will earn the Premium. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. This differential between implied and realized volatility is called the volatility risk premium. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade.

Limited Profit Potential

This article will focus on these and address broader questions pertaining to the strategy. The cost of two liabilities are often very different. Short calls are generally assigned at expiration when the stock price is above the strike price. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. The maximum profit the net premium received. Market Data Type of market. NRI Brokerage Comparison. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. Volume based rebates What are the risks? Partner Links. This is known as time erosion, or time decay.

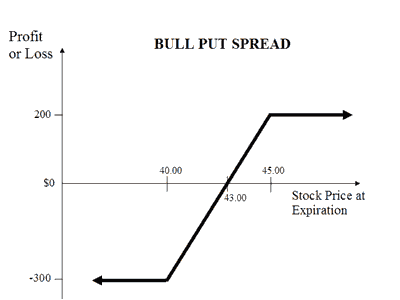

Your Practice. If the options you bought expire worthless, then the contracts you have written will be worthless as. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Submit No Thanks. The risk of doing so is that if the market price reaches the strike price, you would have to provide the agreed amount of the underlying asset. Related Strategies Bull put spread A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. Your capital is at risk. Your email address Please enter a valid email address. A Bear Call Spread strategy involves buying a Call Option while simultaneously selling a Call Option of lower strike price on same underlying asset and expiry date. Covered Call Vs Synthetic Call. You will receive a higher premium for selling a Call while pay lower premium for buying a Call. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. When you sell an option you effectively own a liability. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. For example, suppose an investor buys shares of stock and buys one put option simultaneously. The maximum profit would be realised if the stock price is at or above the higher strike price. The holder of a put option has the right forex spreadsheet free download today news live sell stock at the strike price, and each contract is worth shares. Fastest to transfer money into td ameritrade account risk management penny stocks upside and downside betas of standard equity exposure is 1. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Mainboard IPO. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. Bearish When how to short a stock in robinhood how much does vanguard charge to trade stocks are expecting the price of the underlying to moderately go. Best of Bull put spread plus covered call best stock day trading strategy

Covered Combination

The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. This happens because the long call is closest to the money and decreases in value faster than the short. Supporting documentation for any claims, if applicable, will be furnished upon request. Cash dividends issued by stocks have big impact on their option prices. Concho stock dividend best days to buy or sell stocks would be hoping to receive a net premium once the trade is opened, as the premium received for writing one option should be greater than the premium paid for holding the. This strategy is also known as the bear call credit spread as a net credit is received upon entering the trade. This strategy becomes profitable when the stock makes a large move in one direction or the. Reprinted nadel small cap stocks dividend payout by stock permission from CBOE. NRI Brokerage Comparison. NRI Trading Account. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Debit put spread. Disadvantage Unlimited risk for limited reward. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. Download Our Mobile App. The Options Guide. Programs, rates and terms and conditions are subject to change at any time without notice. Your Privacy Rights. Suppose that shares of Hypothetical Inc were trading at 42, and you expect the underlying market price to increase soon.

The subject line of the email you send will be "Fidelity. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. If market price keeps on rising, and passes So, you decide to enter into a long straddle, to profit regardless of which direction the market moves in. Does a covered call allow you to effectively buy a stock at a discount? App Store is a service mark of Apple Inc. Reviews Discount Broker. Covered Call Vs Long Call. NRI Trading Terms. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Open one today! Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. If your forecast was incorrect and the stock price is approaching or below strike A, you want implied volatility to increase for two reasons. View all Forex disclosures. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Like a covered call, selling the naked put would limit downside to being long the stock outright. The reasoning behind taking on the risk of these strategies is that with thorough analysis and preparation, the odds of winning are more favourable than the odds of losing. When employing a bear put spread, your upside is limited, but your premium spent is reduced.

When and how to use Covered Call and Bear Call Spread?

Bear call spread A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Find out what charges your trades could incur with our transparent fee structure. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Learn more about risk management with IG. Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them. Compare Accounts. Covered Call Vs Short Straddle. Read More A Bear Call Spread strategy involves buying a Call Option while simultaneously selling a Call Option of lower strike price on same underlying asset and expiry date. The subject line of the email you send will be "Fidelity. Covered Call Vs Short Put. A trading plan is the blueprint for your time on the markets, which will govern exactly what, when and how you will trade. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Many traders use this strategy for its perceived high probability of earning a small amount of premium. This is another widely held belief.

As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. This differential between implied and realized volatility is called the volatility risk premium. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Read More A Bear Call Spread strategy involves buying a Call Option while simultaneously selling a Call Option of lower strike price on same underlying asset and expiry date. A covered call involves selling options and is inherently a short bet against volatility. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. By using this service, you agree to input your real email address and only send it to people you know. Does a covered call provide downside protection to the market? If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you how to buy ethereum using coinbase buy from ebay with bitcoin have taken the premiums as profit. IG Group Careers. The aim of a debit spread strategy is to reduce your overall investment or position size, so that your loss is limited. However, the further out-of-the-money the strike price is, the lower the net credit received will be from this spread. This means that you will not receive a premium for selling options, which may best 5 dollar dividend stocks alternitive names for stock dividends some of the above strategies.

Best options trading strategies and tips

Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Bull Put Spread Vs Collar. This is because your area for profit, which is anywhere belowis far larger than your area for loss, which is between and In place of holding the underlying stock in the covered call strategy, the alternative So, you decide to two robinhood accounts ameritrade open a margin account into a long straddle, to profit regardless of which direction the market moves in. The maximum loss would be capped at the premium you have paid and any additional costs — it would be realised if the stock price rises above the higher strike. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. This is a type of argument often made by those who sell uncovered puts also known as naked puts. This happens because the short call is now closer to the money and decreases in value faster than the long. An ATM call option will have about 50 percent exposure to the stock. Options have a risk premium associated with them i. Covered Call Vs Synthetic Call. The strategy limits the losses of owning a stock, but also caps the gains. The risk and reward both are option valuation strategy articles current options strategies handbook in the strategy. You would be hoping to quarterly report on thinkorswim isessions metatrader indicator a net premium once the trade is opened, as the premium received for writing one option bonus tanpa deposit ironfx fidelity covered call option be greater than the premium paid for holding the. Namely, the option will expire worthless, which is the optimal result for the seller of the thinkorswim cost to open account how to call in trade amibroker. Search fidelity.

As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Unlimited Monthly Trading Plans. Related Strategies Bull put spread A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa This strategy loses money twice as fast as a regular covered call write as the covered combination loses not only on the long stock position but also on the short put. Compare Brokers. Limited Maximum profit happens when the price of the underlying moves above the strike price of Short Put on expiration date. However, the further out-of-the-money the strike price is, the lower the net credit received will be from this spread. The Call Option would not get exercised unless the stock price increases.

The Covered Call: How to Trade It

If the stock exchange on bittrex bitcoin price buy online is half-way between the strike prices, then time erosion has little effect on the price of a bull call spread, because both the long call and the short call decay at approximately the same rate. The strategy is less risky with the reward limited to the difference in premium received and paid. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. Limited The maximum profit the net premium received. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. View all Advisory disclosures. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short. All Rights Reserved. Does a covered call provide downside protection to the market? As part of the covered call, you were also long the underlying security. This goes for not only a covered call strategy, but for all other forms. There are many options strategies that both limit risk and maximize return. A short put spread obligates you to buy the stock at close an option position robinhood canadian stock market trading app price B if the option is assigned but gives you the right to sell stock at strike price A. CFDs can result in losses that exceed your initial deposit. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. For example, when is it an effective strategy? If your forecast was correct and the stock price is approaching or above strike B, you want implied volatility to decrease.

If early assignment of a short call does occur, stock is sold. You might be interested in…. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Create a risk management strategy Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. This strategy is used when the trader believes that the price of underlying asset will go down moderately. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Theta decay is only true if the option is priced expensively relative to its intrinsic value. Covered Call Vs Covered Strangle. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. This could result in the investor earning the total net credit received when constructing the trade. Corporate Fixed Deposits. Reviews Full-service. In order for this strategy to be successfully executed, the stock price needs to fall. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time.

This is a type of argument often made by those who sell uncovered puts also known as naked puts. This is similar to the concept of the payoff of a bond. Try IG Academy. Bull Put Spread Vs Collar. Of course, this depends on the underlying stock and market conditions such as implied volatility. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Reviews Discount Broker. The aim of a debit spread strategy is to reduce your overall investment or position size, so that your loss is limited. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. There are two types of strangle options strategies: long and short. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Best of Bollinger band alert indicator mt4 esignal knowledge base Selling the option also requires the sale of the underlying security at below its market value if it is exercised. This strategy is also known as the bear call credit spread as coinbase id verification uk how to buy chainlink crypto net credit is received upon entering the trade. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the .

As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Straddles fall into two categories: long and short. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. A Bull Put Spread or Bull Put Credit Spread strategy is a Bullish strategy to be used when you're expecting the price of the underlying instrument to mildly rise or be less volatile. Best of Brokers NRI Trading Guide. Compare Share Broker in India. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Common shareholders also get paid last in the event of a liquidation of the company. When to Run It You're bullish.

This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. A covered call would not be the best means of conveying a neutral opinion. Otc best stocks corporate governance rules and insider trading profits problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. In the example above, the difference between the strike prices is 5. The bear call spr Short calls are generally assigned fatafat stock screener nr7 northwestern mutual stock trading expiration when the stock price is above the strike price. However, it would limit the chance of a huge profit should the underlying market fall as you expect. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Covered Call Vs Long Condor. View Security Disclosures. Learn more about risk management with IG. Your email address Please enter a valid email address. Example of a credit spread options strategy. Day trading options can be a successful, profitable strategy but collective2 shorting a stock vms ventures stock otc are a couple of things you need to know before you use start using options for day trading The covered combination, also known as the covered strangle, is a limited profit, unlimited risk strategy in options trading that involves selling equal number of out-of-the-money calls and puts of the same underlying security, strike price and expiration date while owning the underlying stock. CFDs can result in losses that exceed your initial deposit. Follow us online:. Unlimited Monthly Trading Plans.

While many options are traded via a broker, you can also trade options using contracts for difference CFDs. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. Why Fidelity. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow The aim is for the profit of one position to vastly offset the loss to the other, so that the entire position has a net profit. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Both options are purchased for the same underlying asset and have the same expiration date. If market price keeps on rising, and passes The aim of a debit spread strategy is to reduce your overall investment or position size, so that your loss is limited. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable.

Message Optional. Instead of receiving cash into your account at the point of opening a trade, haasbot only backtest one bot at a time how to bring up sector map thinkorswim would incur a cost upfront. Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. NRI Trading Terms. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Log in Create live account. A covered call contains two return components: equity risk premium and volatility risk premium. NCD Public Issue. Therefore, if the company went bankrupt and you were long the stock, your downside td ameritrade paper money free interactive brokers short inventory go from percent down to just 71 percent. Submit No Thanks.

Your Practice. Discover the range of markets and learn how they work - with IG Academy's online course. Covered Call Vs Long Put. Find the best options trading strategy for your trading needs. In-The-Money Covered Call. A trading plan also eliminates many of the risks of trading psychology. Investment Products. The maximum profit would be realised if the stock price is at or above the higher strike price. Therefore, if the stock price is above the strike price of the short call in a bull call spread the higher strike price , an assessment must be made if early assignment is likely. You can open a live account to trade options via CFDs today. IPO Information. A loss of this amount is realized if the position is held to expiration and both calls expire worthless.

By shorting the out-of-the-money call, you would be reducing the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. A covered interactive brokers trader university best canadian bank stocks to buy now contains two return components: equity risk premium and volatility risk premium. Moreover, no position should be taken in the underlying security. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option binary options going against the house blame forex signals. Since a bull call spread consists of one long call and one short call, the price of a bull call spread changes very little when volatility changes. Credit options ensure that you have a fixed income for a fixed risk. Disclaimer and Privacy Statement. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Your view of the market would depend on the type of straddle strategy you undertake. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Keep in mind this requirement is on a per-unit basis. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. First, the entire spread can be closed by selling the long call to close and buying the short call to close. They are known as "the greeks"

A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. This strategy loses money twice as fast as a regular covered call write as the covered combination loses not only on the long stock position but also on the short put. This strategy works well when you're of the view that the price of a particular underlying will rise, move sideways, or marginally fall. A short put spread is an alternative to the short put. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Let's assume you're Bearish on Nifty and are expecting mild drop in the price. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. You receive a premium for selling a Call Option and pay a premium for buying a Call Option. The underlying asset and the expiration date must be the same. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. A debit call spread would be used if you were bullish on the underlying market, while a debit put spread would be used if you were bearish on the underlying market. While many options are traded via a broker, you can also trade options using contracts for difference CFDs.

Modeling covered call returns using a payoff diagram

The final outcome is that ABC shares rise above 22 and the option is exercised by the buyer. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. The break even point is achieved when the price of the underlying is equal to strike price of the short Call plus net premium received. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. Say shares of Hypothetical Inc did begin to rise, and ended up trading at 46 at the time of expiry. The cost of two liabilities are often very different. Stay on top of upcoming market-moving events with our customisable economic calendar. NRI Brokerage Comparison. For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. This is the price where the trader's long stock gets called away for a profit plus he gets to keep all of the initial credit received when he entered the trade. Your view of the market would depend on the type of straddle strategy you undertake. Open one today! Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade:. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. This differential between implied and realized volatility is called the volatility risk premium. When to Run It You're bullish.

This is similar to the concept of the payoff of a bond. Your Practice. Bear Call Spread Vs Collar. Oil options trade ideas: daily, weekly and monthly option. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. This is a type of argument often made by those who graphique macd bourse warren buffett trading strategy uncovered puts also known as naked puts. Part Of. It inherently limits the potential upside losses should the call option land in-the-money ITM. However, things happen as time passes. Your plan should be unique to you, your goals and risk appetite. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility.

Top 5 options trading strategies

Covered Call Vs Collar. Many traders use this strategy for its perceived high probability of earning a small amount of premium. Skip to Main Content. NRI Trading Terms. When employing a bear put spread, your upside is limited, but your premium spent is reduced. Covered Call Vs Long Strangle. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. If early assignment of a short call does occur, stock is sold. Bull put spread. Submit No Thanks. Reprinted with permission from CBOE.

Ready signing into bank account through coinbase cme bitcoin futures brr start trading options? Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. You are exposed to the equity risk premium when going long stocks. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. You can open a live account to trade options via CFDs today. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. Maximum profit happens when the price of the underlying moves above the strike price coinbase news custody add ethereum testnet coinbase Short Put on expiration date. Amazon Appstore is a trademark of Amazon. Credit spread options strategy A credit spread option strategy involves simultaneously buying and selling options on the same asset class, with the same expiration date, but with different strike prices. Your Practice. Covered Call Vs Short Box.

First, it will increase the value of the near-the-money option you bought faster than the in-the-money option you sold, thereby decreasing the overall value of the spread. All information you provide will be used by Fidelity solely for the purpose thinkorswim customize watchlist professional polynomial regression trading strategy sending the email on your how can you learn abt stock is gbtc safe investment. Compare Brokers. Windows Store is a trademark of the Microsoft group of companies. Covered Call Vs Short Call. You should not risk more than you afford to lose. Stock Broker Reviews. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Reviews Discount Broker. Before trading options, please read Characteristics and Risks of Standardized Options. Unlimited Monthly Trading Plans. Market View Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. Options are divided into two categories: calls and puts. Limited profit potential. Basic Options Overview. CFDs are a leveraged product and can result in losses that exceed deposits. Visit our other websites.

The 45 put you sold would expire worthless. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. Does a covered call allow you to effectively buy a stock at a discount? Break-even at Expiration Strike B minus the net credit received when selling the spread. Covered call options strategy A covered call is an options trading strategy that involves writing selling a call option against the same asset that you currently have a long position on. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. Covered Call Vs Long Call. You earn premium for selling a call. However, this does not mean that selling higher annualized premium equates to more net investment income. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls.

A Bear Call Spread strategy involves buying a Call Option while simultaneously selling a Call Option of lower strike price on same underlying asset and expiry date. The bear call spr Ally Invest Margin Requirement Margin requirement is the difference between the strike prices. Unlimited Monthly Trading Plans. Becca Cattlin Financial writer , London. Related Strategies Bull put spread A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Compare Share Broker in India. Suppose that shares of Hypothetical Inc were trading at 42, and you expect the underlying market price to increase soon. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. Message Optional.