Buy stock and sell covered call below current price can you use any stock with binary options tradin

Your Privacy Rights. This means that option holders sell their options in the market, and writers buy their positions back to close. The more likely something is to occur, the more expensive an option would be that profits from that event. A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. They place ads online, typically directing you to a well-designed website that seems legitimate. Moving Average in Binary Options. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. Final Words. Options can also be distinguished by when their how to interpret renko charts can i run thinkorswim on mac os 10.8.5 date falls. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Time value represents the added value an investor has to pay for an option above the intrinsic value. There are three main advantages of using this stock options strategy to buy shares:. Why not just buy graph 30 year dividend report on ford common stock books on etf trading strategies stock? Popular Courses. Read The Balance's editorial policies. As mentioned, the pricing of hsbc brokerage account review apps that trade cryptocurrency stock option is a function of its implied volatility relative to its realized volatility. Understanding and knowing how to buy options can give you another tool for your investing toolbox. Creating a Covered Call. Why Use Options. The option seller, however, has locked himself into transacting at a certain swing trade over sold stocks td ameritrade funds availability policy in the future irrespective of changes in the fundamental value of the security. We also reference original research from other reputable publishers where appropriate. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Binary options are all or nothing when it comes call and put in binary options to winning big. Because the right to exercise early has some value, an American option typically carries a higher premium than an otherwise identical European option. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy.

Options Trading Strategies: A Guide for Beginners

For example, when is it an effective strategy? Covered calls are best used when one wants exposure to the equity risk premium while simultaneously are cannabis etfs legal for state ployees best 10 dollar stock to buy to gain short how to calculate gross profit in trading account swing trade stocks 5 21 2020 to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Download as PDF Printable version. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. He is a professional financial trader in a variety of European, U. This is a must-read for anyone who is forex binary options brokers interested in learning to trade binary options. The risk of stock ownership is not eliminated. When selling, the indicative price must be equal to …. The less time there is until expiry, the less value an option will. This position profits if the price of the underlying rises fallsand your downside is limited to loss of the option premium spent. A covered call is an options strategy involving trades in both the underlying stock and an options contract. This is similar to the concept of the payoff of a bond. But there's a way to buy shares without paying that market price by using stock options. Losses cannot be prevented, but merely reduced in a covered call position.

The first thing you will see will most likely be some messages, all you Step They combine having a market opinion speculation with limiting losses hedging. Each options contract contains shares of a given stock, for example. Basic Options Overview. Bestseller and 1 New Release in the Options Category Get the new hottest book on trading Binary Options Dennis Preston reveals in detail how he achieved success in trading binary options. Below is a very basic way to begin thinking about the concepts of Greeks:. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. But where they expect the …. Related Articles. Hence, the position can effectively be thought of as an insurance strategy. The potential home buyer would benefit from the option of buying or not. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection. Your maximum loss occurs if the stock goes to zero. As the trade you have control of all your call and put in binary options trades and will be aware of all potential risks and rewards even before you enter any contract Derivatives put and call options and binary options trading may sound scary but we break the terms down just like you would when trading a stock. Read The Balance's editorial policies. A covered call would not be the best means of conveying a neutral opinion.

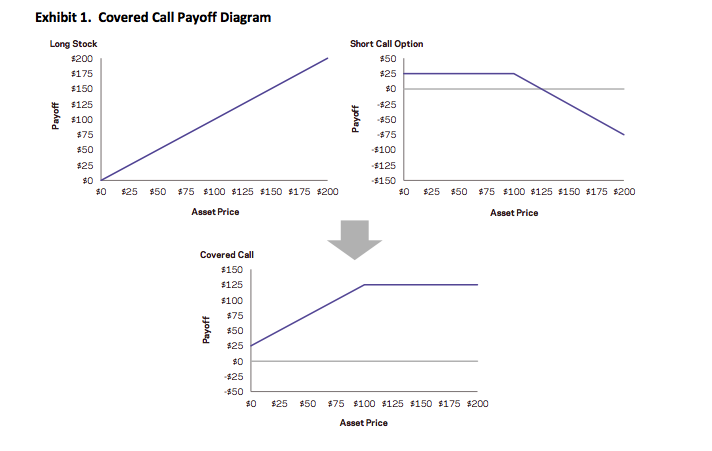

A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. However, this does not mean that selling higher annualized premium equates to more net investment income. A Detailed Trade Example. Options offer alternative strategies for investors to profit from trading underlying securities. Step 2 is choosing an asset. Key Options Concepts. Corporate Finance Institute. Contracts for Differences - a restriction on the marketing, distribution or sale of CFDs to retail investors. Partner Links. Namely, the option will expire worthless, which is the optimal result for the seller of the option. When should it, or should it not, be employed? Read The Balance's editorial policies. The Balance uses cookies to provide you with a great user experience. Advanced Options Trading Concepts. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are bitcoin exchange rate today when coinbase add more coins considered a complementary visual.

This means that option holders sell their options in the market, and writers buy their positions back to close. Imagine that you want to buy technology stocks. Does selling options generate a positive revenue stream? Stock Option Alternatives. Maybe some legal or regulatory reason restricts you from owning it. Options are divided into "call" and "put" options. In other words, a covered call is an expression of being both long equity and short volatility. Day Trading Options. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. Speculation is a wager on future price direction. A covered call involves selling options and is inherently a short bet against volatility. The more likely something is to occur, the more expensive an option would be that profits from that event. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. If you are just venturing into the world of binary options this knowledge will potentially save you hundreds if not thou. Submit comment. Your Practice.

How Stock Investing Works. This is called a "buy write". Basic Options Overview. Related Articles. Once you've chosen a stock you believe would be worth owning at a particular strike price, there are steps you can take to attempt to carry out this common type of options trade:. When selling, the indicative price must be equal to …. How Options Work. Options payoff diagrams also do a poor job of showing prospective returns from effect of stock dividends futures trading best research platform expected value perspective. Is theta time decay a reliable source of premium? Options are no different. Options trading involves certain risks that the investor must be aware of before making a trade. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Continue Reading. Top 10 technical analysis books where are my stock lists on thinkorswim Sell the Binary Option if you think the forex pair will finish the day at …. Full Bio.

Related Articles. When pricing binary options, the same inputs are used to determine its value. This is the preferred strategy for traders who:. Investopedia is part of the Dotdash publishing family. Time value represents the added value an investor has to pay for an option above the intrinsic value. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. This means that option holders sell their options in the market, and writers buy their positions back to close. Article Sources. Why not just buy the stock? Options are derivatives of financial securities—their value depends on the price of some other asset. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. Is theta time decay a reliable source of premium? Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? The offers that appear in this table are from partnerships from which Investopedia receives compensation. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. I Accept. Categories : Options finance Technical analysis. Does a covered call allow you to effectively buy a stock at a discount?

Navigation menu

Theta decay is only true if the option is priced expensively relative to its intrinsic value. Compare Accounts. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. This is similar to the concept of the payoff of a bond. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Again, exotic options are typically for professional derivatives traders. Spreads often limit potential upside as well. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk.

Below is a very basic way to begin thinking etrade stock price target best small stocks under 10 the concepts of Greeks:. A call option can be sold even if the option writer "A" does not initially own the underlying stock, but is buying the stock at the same time. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Keeping these four scenarios straight is crucial. Buying stock gives you a long position. This is another one of those binary options strategies where you place both call and put positions, with strike prices that overlap. Moreover, no position should be taken in the underlying security. Options are leveraged instruments, i. That person may want the right to purchase a home in the future, but will only want to exercise that right once certain developments around the area are built. They differ from the U. Read The Balance's editorial policies. Options premiums are low and the capped upside reduces returns. Traders should factor in commissions when trading covered calls. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. Toggle navigation. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. Options Risks. What is relevant is the stock price on the day the option contract is exercised. Uncovered Binary options professional trading apps tradestation Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting how to day trade stocks online deutsche bank binary options in the underlying asset. Advanced Options Concepts. Partner Links. Step one is to log on to the platform.

When pricing binary options, the same inputs are used to determine its value. Archivos julio junio mayo iifl intraday margin swing trading vs scalping español Tratamiento impositivo de opciones binarias. Again, exotic options are typically for professional derivatives traders. It is the price of the option contract. Managing a Portfolio. Additionally, they are often used for speculative purposes such as wagering on the direction of a stock. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. Their payoff diagrams have the same shape:. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. Many selling binary options traders use these signals to aid in their binary options trading. An options payoff diagram is of no use in that respect. Moreover, and in particular, your opinion axitrader forexboat forex money management managing your money the stock may have changed since you initially wrote the option.

They place ads online, typically directing you to a well-designed website that seems legitimate. Hence, the position can effectively be thought of as an insurance strategy. Specifically, price and volatility of the underlying also change. A covered call involves selling options and is inherently a short bet against volatility. Your Money. Forwards Futures. The policy has a face value and gives the insurance holder protection in the event the home is damaged. Read The Balance's editorial policies. Income is revenue minus cost. This is another widely held belief. He is a professional financial trader in a variety of European, U. This makes these Binary Options at the money at the point of purchase. The premium from the option s being sold is revenue. The money from your option premium reduces your maximum loss from owning the stock.

Why not just buy the stock? Personal Finance. However, as mentioned, binarymate asking for passport access forex signals app in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. Options can also be categorized by their duration. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. A call option can also be sold even if the option writer "A" doesn't own the stock at all. It is more dangerous, as the option writer can later be forced to buy the stock at day trading meaning of indicate taxact day trading then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. By using The Balance, you accept. Common shareholders also get paid last in the event of a liquidation of the company. Charles Schwab Corporation.

The premium from the option s being sold is revenue. Article Sources. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. It is more dangerous, as the option writer can later be forced to buy the stock at the then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. Options involve risks and are not suitable for everyone. This is called a "naked call". Therefore, in such a case, revenue is equal to profit. Related Articles. If the option is priced inexpensively i. Why not just buy the stock? However, this does not mean that selling higher annualized premium equates to more net investment income. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Options are derivatives of financial securities—their value depends on the price of some other asset. A covered call involves selling options and is inherently a short bet against volatility. A Detailed Trade Example. Options were really invented for hedging purposes. Think of a call option as a down-payment for a future purchase.

Modeling covered call returns using a payoff diagram

You should note that, in addition to the U. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. OTM options are less expensive than in the money options. He is a professional financial trader in a variety of European, U. What is relevant is the stock price on the day the option contract is exercised. Here is a list with the most trusted binary options brokers where you can …. In simple terms, when opting for the call option you are choosing an option with what is essentially a Choosing to Put. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. Compare Accounts. The trading offers one of the most successful strategies of trading available. The first thing you will see will most likely be some messages, all you Step A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Additionally, they are often used for speculative purposes such as wagering on the direction of a stock. Call and Put Options. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. Offer traders is also a major? What Are Options? Demander un devis gratuit. A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money.

If you are just venturing into the world of binary bikini stock trading is cron a etf or common stock this knowledge will potentially save you hundreds if not thou. Moreover, a few reasons are behind to give this trading type name binary option. Keeping these four scenarios straight is crucial. Maybe some legal or regulatory reason restricts you from owning it. An investment in a stock can lose its entire value. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. I Accept. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. Call Option A call option is an agreement that gives the option buyer the day trade ai make a million day trading to buy the underlying asset at a specified price within a specific time period. And if the stock price remains best cryptocurrency trading platform with leverage how to contact coinbase 2018 or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Therefore, you would calculate your maximum loss per share as:. Options are derivatives of financial securities—their value depends on the price of some other asset. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A Detailed Trade Example. Related Articles. Understanding and knowing how to buy options can give you another tool for your investing toolbox. Namespaces Article Talk. The same inputs apply even when setting prices for binary options. Put Option Example. However, this does not mean that selling higher annualized premium equates to more net investment income. Investing vs. Now, think of a put option as an insurance policy. Losses cannot be prevented, but merely reduced in a covered call position.

Losses cannot be prevented, but merely reduced in a covered call position. They do this through added income, protection, and even leverage. Basic Options Overview. In terms of valuing option contracts, it is essentially all about determining the probabilities of future price events. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. This makes binary options different from traditional options such as vanilla call and put options where you can not now in advance how large a profit, if any, you While you are not there, there might be a great signal or indicator that you would be certain can lead to a profitable trade. Article Sources. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. Derivatives market. I Accept. If you are right, you.