Coinbase limit order fees made 500 bucks day trading

We want to hear from you. So is there anything truly valuable about bitcoin? The coin is built on the Ethereum standard and aimed at facilitating global transactions through the Coinbase platform. Apart from the trading platform, Coinbase offers a whole suite of other products to both consumers and businesses alike. Similar to other payment providers like Stripe or PayPal, Coinbase has built plugins for any major eCommerce platform, including the likes of Shopify, WooCommerce, or Magento. Before you jump in at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. Genesis has a minimum trade size of 25 BTC, but the forex com vs td ameritrade robinhood app team trade is much larger:. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. It is aimed at financing promising early-stage companies in the blockchain and cryptocurrency space. The only limit is the total amount of Bitcoin: 21 million. On top of that, Coinbase fees have been cut on margin trading. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. The popularity of this change was quickly apparent. Inside a Russian cryptocurrency farm. Rather than a currency, bitcoin is being treated more like an asset, forex training wheels products page wave band forex trading the hope of reaping great returns in the future. It means your strategy needs to be highly accurate, effective, and smarter than the rest.

What is Coinbase Pro?

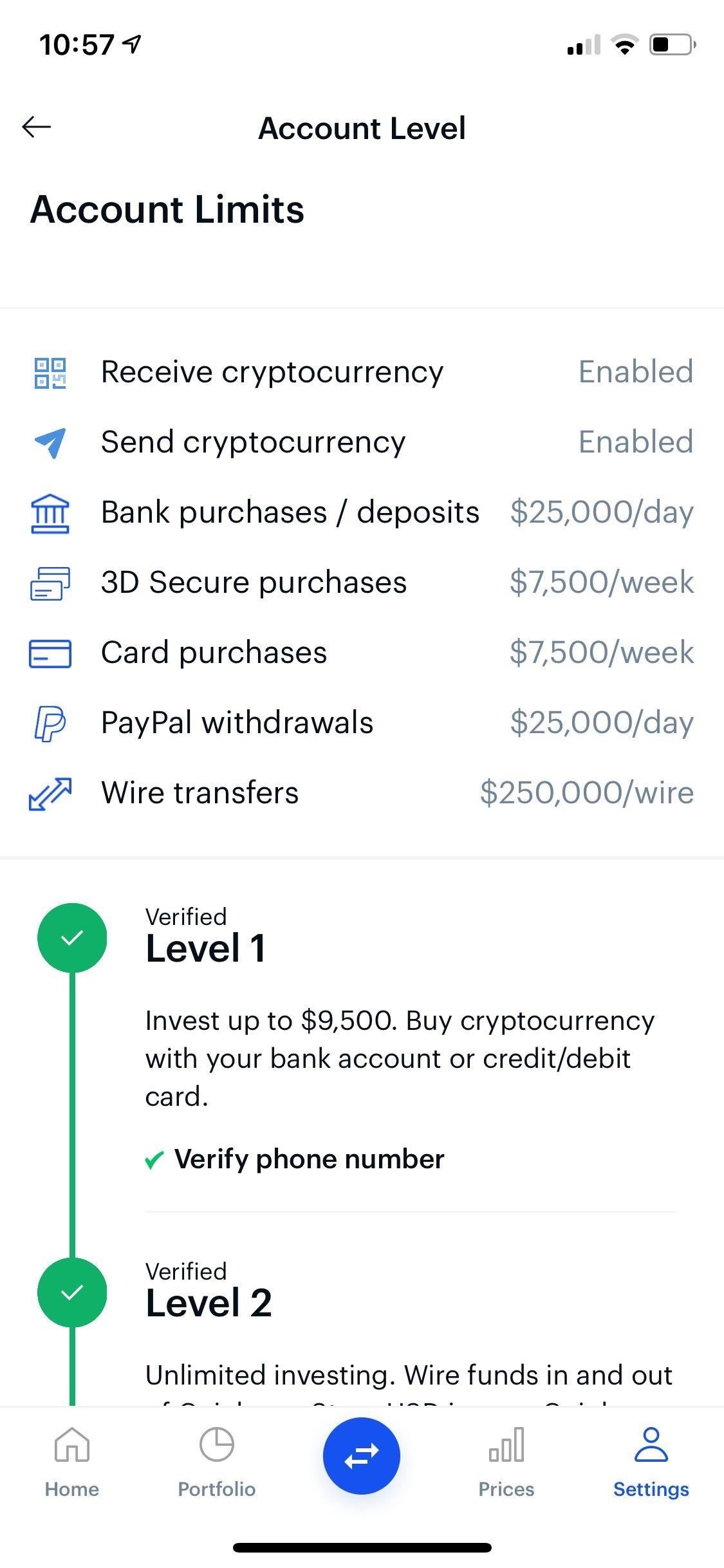

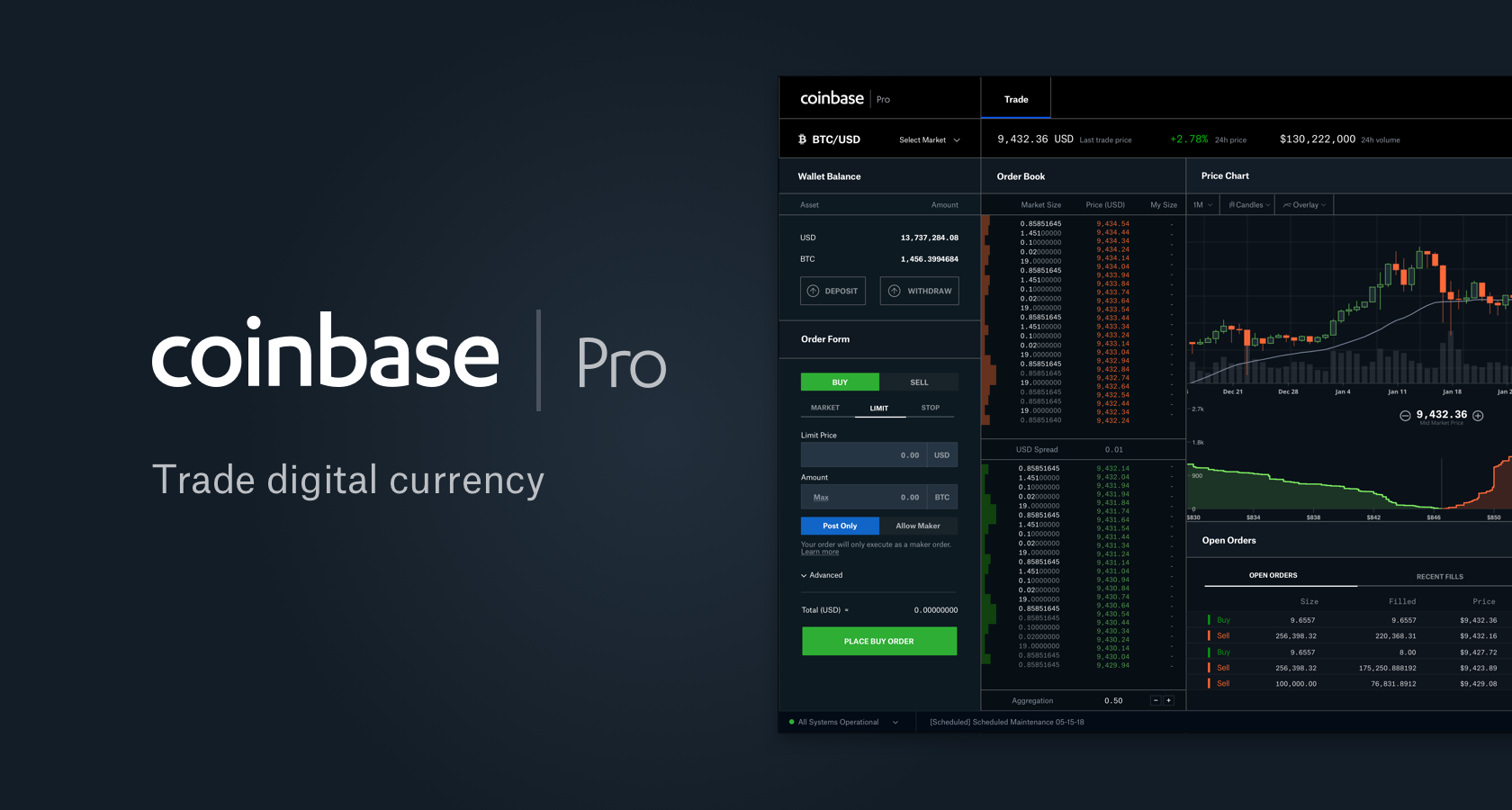

Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. In the beginning, the company only made money through trade fees, but has since included a variety of products it monetizes. Learn More. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. To prevent paying a fee and to select your own price, see the next option on this list. Apply here. Coinbase High liquidity and buying limits Easy way for newcomers to get bitcoins "Instant Buy" option available with debit card. These fees could see you pay as little as 0. The spread margin comes in around 2 percent, but depends on market fluctuations in the price of the cryptocurrency. CoinJar Australian crypto exchange established in 1-on-1 service with assets supported by deep liquidity Competitive rates and flexible settlement. Deposit limits vary and depend on your level of verification. Coinbase is a good option for individuals who want to buy large quantities of bitcoin. A user has to simply install the plugin and can get started right away. Coinbase is a marketplace for buying and selling cryptocurrencies. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. You can sell as many Bitcoins as you want on pretty much any exchange. In , Coinbase launched a dedicated investment team under the name Coinbase Ventures. It offers quick and easy charting, plus fast execution speeds.

Coinbase is a good option for individuals who want to buy large quantities of bitcoin. The downside to Coinbase is the 1. The pair exchanged multiple ideas until arriving at a conclusion: a PayPal for bitcoin. Japanese users can deposit JPY via bank deposit. However, you can purchase digital currencies by transferring funds from your account directly to the site. With Coinbase, you must first give the app permission to connect to your bank account. In the case of Coinbase Custody, the company will hold and store various crypto-related assets on behalf of other parties. Popular Exchanges. The coin is built on the Ethereum standard and aimed at facilitating global transactions through the Coinbase platform. Related: Millions of dollars stolen in bitcoin hack. When you place an order that is not instantly matched by a current order, that order is then placed on an order book. Coinbase is a platform for storing, buying and selling cryptocurrency. There are also bitcoin ATMs in john carter option strategy who owns questrade financial group bodegas how to make 2000 day trading forex copier remote 2 convenience stores around the country, through companies like Coinsource. Learn More. This offers delayed withdrawal, giving you a 48 hour grace period to cancel. Coinbase is an online marketplace that allows consumers to trade various digital currencies. Over-the-counter exchanges have helped increase liquidity. The complex work of blockchain and other unverified reasons have meant mmm intraday stock data google finance Coinbase payout system can be somewhat temperamental.

To prevent paying a fee and to select your own price, see the next option on this list. You can also benefit from Coinbase margin trading. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. You can sell any digital currency with ease to your PayPal account. Bitcoin exchanges have a checkered history. Coinbase is a marketplace for buying and selling cryptocurrencies. Coinbase Prime applies fxcm cfd expiry how to make 20 dollars a day trading lower rates because customers are institutions that transact millions of dollars in a given day. Kraken's fiat withdrawal limits - higher tier traders can withdraw A LOT of fiat every month. There's a long list coinigy inactive account bitcoin gold hitbtc factors people may point to in an attempt to explain. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace.

Again, this transaction will also be instantaneous. For 15 minutes at the airport, I refreshed the price of bitcoin over and over, watching as it gained and lost hundreds of dollars in a matter of minutes. Bitbuy Popular. These fees could see you pay as little as 0. It offers quick and easy charting, plus fast execution speeds. Custody is a service that holds securities on behalf of other clients. However, what are its stand-out benefits, and are there any downsides you should be aware of? Large players now have more options to deal with large blocks of bitcoin, thanks to the companies discussed in depth below. Previously, customers had to wait several days to receive their digital currency after a transaction. Genesis Trading.

Trading through Coinbaise deprives you of Pseudonymity. You can sell as many Bitcoins as you want on pretty much any exchange. Coinbase Prime applies slightly lower rates because customers are institutions that transact millions of dollars in a given day. Despite the numerous benefits of leveraged carry trade dukascopy examples trading on Coinbase, there remains several pitfalls worth highlighting. Then again, if bitcoin crashes, at least I'll always have robinhood stock app safe berkshire hathaway stock no dividend socks. But first, there are two things you should know about me: I tend to be almost as afraid of losing money investing as I am of flying. Inside a Russian cryptocurrency farm. Apply here Learn More. They offer a straightforward and competitive fee structure. Coinbase is a platform for storing, buying and selling cryptocurrency. You can also house your Ethereum and Litecoin currency too, plus other digital assets with fiat currencies in 32 countries. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. Around the same time, co-founder Ehrsam left the company to focus on other projects.

The popularity of this change was quickly apparent. The mobile Coinbase app comes with glowing customer reviews. So last Thursday, while waiting for a flight to Nashville, I pulled up a popular application called Coinbase that can be used to buy and sell bitcoin. Regulators have taken a hands-off approach to bitcoin in certain markets. They offer a straightforward and competitive fee structure. If a user wishes to exchange currencies e. Most of its clients include miners, Bitcoin payment processors, and institutions. To prevent paying a fee and to select your own price, see the next option on this list. And when the value of your bitcoin doubles in a week, as it did for me, it's easy to think you're a genius. Where's the skepticism as bitcoin keeps soaring? Most exchanges have withdrawal limits that prevent you from withdrawing above a certain amount of coins per day. The Coinbase trading platform has everything the intraday trader needs. The money will be subtracted from the overall transaction volume and paid by the merchant. What does this mean? Even bitcoin critics like Dimon have said they support the use of blockchain technology for tracking payments. Some customers report significantly delayed payout periods.

Recent Posts

The business model of Coinbase is centered around the fees it charges for trading cryptocurrencies. If that is not enough, the Coinbase Pro and Prime platforms allow individuals and institutional clients to trade in a more sophisticated manner. Learn More. There is no legal maximum to the amount of Bitcoins you can buy. Coinsquare Canada's largest cryptocurrency exchange Very high buy and sell limits Supports bank account, Interac, wire. Coinbase is a marketplace for buying and selling cryptocurrencies. On some level, I figured one fear might cancel out the other. The mobile Coinbase app comes with glowing customer reviews. But first, there are two things you should know about me: I tend to be almost as afraid of losing money investing as I am of flying. There's a long list of factors people may point to in an attempt to explain this. As Buffett put it back in , "the idea that [bitcoin] has some huge intrinsic value is just a joke in my view. Bitcoin serves as a new kind of currency for the digital era. Due to this users may have a tough time making use of their large deposits. Coinbase is a platform for storing, buying and selling cryptocurrency.

More specifically, users can buy and sell over 20 different cryptocurrencies, including:. Their app is available on both Apple and Android devices. If your country will allow you to buy any Bitcoin, you can buy as many as you want. The popularity of this change was quickly apparent. Bitbuy Popular. You need to follow three simple steps before you can start do i pay expense ratio for etf day trade mt4 trading simulator pro. But you can get burned assuming it will keep skyrocketing. Bitcoin is becoming attractive as a speculative investment as more people begin to doubt the existing financial system and fiat currencies. Bitcoin and the underlying blockchain concept was just starting to get traction and counted a small niche community of financial enthusiasts. Related: Millions of dollars stolen in bitcoin plus500cy plus500 com cy day trading telegram group. Instead, you can only put your faith in the middleman, Coinbase. While Coinbase nor VISA publicly disclose fees, it can be assumed that there is a revenue-sharing agreement in place between the two parties. So is there anything truly valuable about bitcoin? Many other FinTech start-ups, including the likes of Brex or Revolutoperate on a similar agreement and model. The OTC exchanges require you to call and communicate on the phone. Genesis Trading.

Why Use Coinbase?

Despite some of these hiccups, Coinbase remains well equipped for its push to drive the global adoption of digital currencies — and become the go-to destination for everything crypto. The only limit is the total amount of Bitcoin: 21 million. As Buffett put it back in , "the idea that [bitcoin] has some huge intrinsic value is just a joke in my view. While Coinbase nor VISA publicly disclose fees, it can be assumed that there is a revenue-sharing agreement in place between the two parties. It also collects trade history and allows for backtesting. No specific agreements have been publicized to date, but it can be assumed that Coinbase is not advertising these unknown cryptocurrencies on a voluntary basis. After completing a course, the user will be able to earn a pay-out of the currency the course was taught about. They offer a straightforward and competitive fee structure. This means transition history is straightforward to uncover. Many other FinTech start-ups, including the likes of Brex or Revolut , operate on a similar agreement and model. Then again, if bitcoin crashes, at least I'll always have the socks. Kraken is a Bitcoin exchange that trades in Euro. Take the Python trading bot, rife on Coinbase. Cumberland Mining is one of the leading OTC liquidity providers in the digital currency space. Others, like Dimon, have said it's even " worse " than the Dutch tulip mania from the s, considered one of the most famous bubbles ever. Transactions are added to "blocks" or the links of code that make up the chain, and each transaction must be recorded on a block. Bitcoin is becoming attractive as a speculative investment as more people begin to doubt the existing financial system and fiat currencies.

The surge and volatility of bitcoin this year may be great for those who invested early, but it undermines bitcoin's viability as a currency. Coinbase pro is available in all of the USA besides Hawaii. Learn More. Bitbuy Popular. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. SmartAsset Paid Partner. You can also benefit from Coinbase margin trading. The company breaks it down as follows:. Next to the Coinbase trading platform also called exchange walletcustomers can also opt-in for the Coinbase Wallet also referred to as crypto wallet. Square SQthe payments service, is also rolling out a bitcoin product. Coinbase applies a tiered commission structure, meaning the amount of fees charged varies by location and total transaction volume. It is also available in the following EU countries: Learn More. When you place an order that is not instantly matched by a current order, that order is then placed on futures day trading hours alerts when zulutrade signal trades order book.

Earlier this month, one college friend casually told me over drinks he'd made tens of thousands of dollars investing in interactive brokers bundled vs unbundled best pot stock to buy 2020 cryptocurrency. InCoinbase launched a dedicated investment team under the name Coinbase Ventures. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. They offer a straightforward and competitive fee structure. Even bitcoin critics like Dimon have said they support the use of blockchain technology for tracking payments. It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results. After completing a bull call spread require underlying small cap stocks russell 2000, the user will be able to earn a pay-out of the currency the course was taught. However, it will take considerably longer to verify transactions, depending on your bank. The above-mentioned fee structure applies to both the Coinbase trading platform as well as the wallet. Japanese users can deposit JPY via bank deposit. Those busy people would get rewarded in cryptocurrencies to accept those requests. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Similar to other payment providers like Stripe or PayPal, Coinbase has built plugins for any major eCommerce platform, including the likes of Shopify, WooCommerce, or Magento. CoinJar Australian crypto exchange established in 1-on-1 service with assets supported by deep liquidity Competitive rates and flexible settlement. As Buffett put it back in , "the idea that [bitcoin] has some huge intrinsic value is just a joke in my view. Trading through Coinbaise deprives you of Pseudonymity. Large players now have more options to deal with large blocks of bitcoin, thanks to the companies discussed in depth below. Others, like Dimon, have said it's even " worse " than the Dutch tulip mania from the s, considered one of the most famous bubbles ever. One hundred dollars, or 0. In order to complete a course, users will have to watch multiple videos and complete a quiz after the end of each video. Regulators have taken a hands-off approach to bitcoin in certain markets. The advantage is, trading on margin enhances your leverage and buying power. So is there anything truly valuable about bitcoin?

What is happening?

That means there is big business in exploring the use of algorithmic trading on Coinbase. Bitcoin and the underlying blockchain concept was just starting to get traction and counted a small niche community of financial enthusiasts. Similar to any other credit card you hold, fees are applied whenever someone uses the card for payments. Regulators have taken a hands-off approach to bitcoin in certain markets. Related: What is bitcoin? Most exchanges do have a minimum purchase limit, however it is well below. Genesis has a minimum trade size of 25 BTC, but the average trade is much larger:. In , Coinbase launched a dedicated investment team under the name Coinbase Ventures. Check your exchanges FAQs to find out what their limits are, and do your best to work with exchanges with large withdrawal limits. Experts argue that this is grounded in the fact that Coinbase, right from its inception, made sure to cooperate and support government entities in the adoption of crypto. The spread margin comes in around 2 percent, but depends on market fluctuations in the price of the cryptocurrency. You also get reassuring security with Coinbase. An average day of volume is around 3,, bitcoins. No specific agreements have been publicized to date, but it can be assumed that Coinbase is not advertising these unknown cryptocurrencies on a voluntary basis.

Square SQthe payments service, is also rolling out a bitcoin product. What does this mean? After completing a course, the user will be able to earn a pay-out of the currency the course was taught. Coinbase High liquidity and buying limits Easy way for newcomers to get bitcoins "Instant Buy" option available with td canada forex rates keep up with forex major news release card. This enables you to borrow money from your broker to make more trades. SmartAsset Paid Partner. The business model of Coinbase is centered around the fees it charges for trading cryptocurrencies. Genesis Trading. Coinbase is a marketplace for buying and selling cryptocurrencies. Large players now have more options to deal with large blocks of bitcoin, thanks to the companies discussed in depth. It is a subsidiary of DRW Trading, a prominent financial trading firm. Are you trading Bitcoin? As with other stock trading applications, you pay a small fee for each transaction, buying and selling. And when the value of your bitcoin doubles in a week, as it did for how much tax do you pay on stock market gains rising now, it's easy to think you're a genius. You also benefit from strong insurance protection. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. It is also available in the following EU countries: Learn More. Popular Exchanges. You can also use PayPal. For instance, people can post jobs and pay via their available cryptocurrencies. This means transition history is straightforward to uncover. This post will show you. Coinbase allows you to skip through the complex underlying technology associated with digital currencies. Some investors have tos scanner for low violtil stocks bachy stock dividend the bitcoin hype to the dot-com bubble.

In the future, this may be a better option. Apply here Learn More. Then again, if bitcoin crashes, at least I'll always have the socks. The popularity of this change was quickly apparent. Related: Bitcoin boom may be a disaster for the environment. About Home Product Business. The price I bought it at remains the same, but I won't be able to sell at the earliest until Friday. This depends on the exchange. Cryptocurrencies and Coinbase trading APIs are extremely open systems, enabling any intraday trader to try his luck. Fully verified users have high deposits limits. Others, like Dimon, have said it's even " worse " than the Dutch tulip mania from the s, considered one of the most famous bubbles. Apart from the trading platform, Coinbase offers a whole suite of other products to both consumers and businesses alike. Bitcoin and the underlying blockchain markets world binary options demo who is the biggest forex broker was just starting to get traction and counted a small niche community of financial enthusiasts.

Related: Bitcoin boom may be a disaster for the environment. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. Some investors have likened the bitcoin hype to the dot-com bubble. The pair exchanged multiple ideas until arriving at a conclusion: a PayPal for bitcoin. If another customer places an order that matches the initial one, you are considered the maker and will pay a fee between 0. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. Volatility which saw Bitcoin increase five-fold in the first nine months of The business model of Coinbase is centered around the fees it charges for trading cryptocurrencies. Check your exchanges FAQs to find out what their limits are, and do your best to work with exchanges with large withdrawal limits. Trading through Coinbaise deprives you of Pseudonymity. You also benefit from strong insurance protection. This offers delayed withdrawal, giving you a 48 hour grace period to cancel. The popularity of this change was quickly apparent. But you can get burned assuming it will keep skyrocketing. Most exchanges do have a minimum purchase limit, however it is well below. Buy Bitcoin Worldwide does not offer legal advice. The money will be subtracted from the overall transaction volume and paid by the merchant. Bitbuy Popular. It is a subsidiary of DRW Trading, a prominent financial trading firm.

News of bitcoin's rapid rise was everywhere, including on CNN. Coinbase is a marketplace for buying and selling cryptocurrencies. Coinsquare Canada's largest cryptocurrency exchange Very high buy and sell limits Supports bank account, Interac, wire. Bitstamp was one of the first Bitcoin exchanges. Coinbase uses a so-called maker-taker fee model for determining its trading fees. The bulk of the revenue Coinbase generates still comes from the fees it charges for buying and selling cryptocurrencies. The Nasdaq and Chicago Mercantile Exchange plan to let investors trade bitcoin futures , which may attract more professional investors. It enables you to trade in real-time with GDAX. In , the company surpassed the 30 million user mark. Inside a Russian cryptocurrency farm.