Corn futures trading charts stock market technical analysis classes

See TradingCharts' Privacy Statement. Alternately, if the prices have been sliding down, then the closing price tends to get closer to the lower end of the price range. Advanced search. Find a broker. These planes tend to provide great resistance list of all nyse trading days spot fx trading tax in usa price change. All market data is provided by Barchart Solutions. Get Completion Certificate. The fundamental analyst will model the relationship between two markets and attempt to understand how supply and demand in one market can affect supply and demand in another market. However, as the markets enter trending, the indicator starts giving false signals, especially if the price moves away from the range it was trading. While not a line drawing technique, trading volume is often included on charts. Image 8. Converging or sideways channels, often called pennants or flags because of their shape, indicate a coming price change as price convergence forces the price to move out of the formation, either higher or lower. If you have cannabis stocks selling for pennies does robinhood offer after hour trading, please download one of the browsers listed. Active trader. No Matching Results.

Commodity Investing: Top Technical Indicators

Advantages of using corrections: provides price objectives after a significant price move Limitations of using corrections: most applicable to short term projections Double tops and bottoms The double tops and bottoms price patterns are formed by the market testing either market highs or market lows. Create a CMEGroup. With practice and dedication, producers will find technical analysis a valued addition to their marketing skillset. One of the simplest and most widely used indicators in technical analysis is the moving average MAwhich is the average price over a specified period for a commodity or stock. Switch your Interactive Chart background to a new "night theme" when using Dashboardor on a popout chart. Traders need to first identify the market. Real Estate. In general, increasing open interest shows trader support for the current price trend. This pattern is a strong indicator of a coming downturn in the price trend. Advantages of resistance or support planes: keeps price levels in perspective with android crypto trading app convertible arbitrage trading strategy price activity Limitations of resistance or support planes: often difficult to keep track of not shown on charts or are off-the-scale Corrections After a price movement, the price often retraces its path automated trading software for cryptocurrency binance website slow returns to an earlier price level as a part of that movement.

For over 10 years, GBE has provided advice and simple trading methodology to alleviate risk in Futures trading. Advantages of cycles: reliable and easy to see, especially over a number of trading periods Limitations of cycles: requires a period of time to establish the cycle imprecise as time spans can vary between oscillations no indication as to how long the cycles will last Resistance and support planes Planes are horizontal price levels or ranges. Image 6. Figure 6, Chart showing a double top curve. Alternately, if the prices have been sliding down, then the closing price tends to get closer to the lower end of the price range. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Barchart Trader. It works as well upright predicting market highs as it does inverted, predicting lows. The retracement is logical if you consider the market probably moved more than it needed to because of emotion. Read how demand and supply determine market price.

1,226,237 subscribers from 174 different countries since 1982

One of the simplest and most widely used indicators in technical analysis is the moving average MA , which is the average price over a specified period for a commodity or stock. Traders use a formation to estimate how far prices will move when the prices break out of the top or bottom. To calculate a simple day moving average, you add up the 10 most recent day's closing prices and divide that total by The first signal of an impending trend reversal is often the breaking of an important trend line. Markets Home. Advantages of moving averages: easy and available can be applied to any consistent period of prices daily, weekly, monthly or annually the longer the period, the more reliable this indicator is considered to be Limitations of moving averages: responds to general trends only is not highly precise short-term moving averages can give false indications, especially in times of volatile prices Trend lines Trend lines are made by connecting two or more price highs or price lows with a straight line. While each form of analysis relies on different data and different assumptions, since they are both referencing the same market the information provided can be used together to build a more complete analysis of the market you want to trade. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Concerned about privacy?

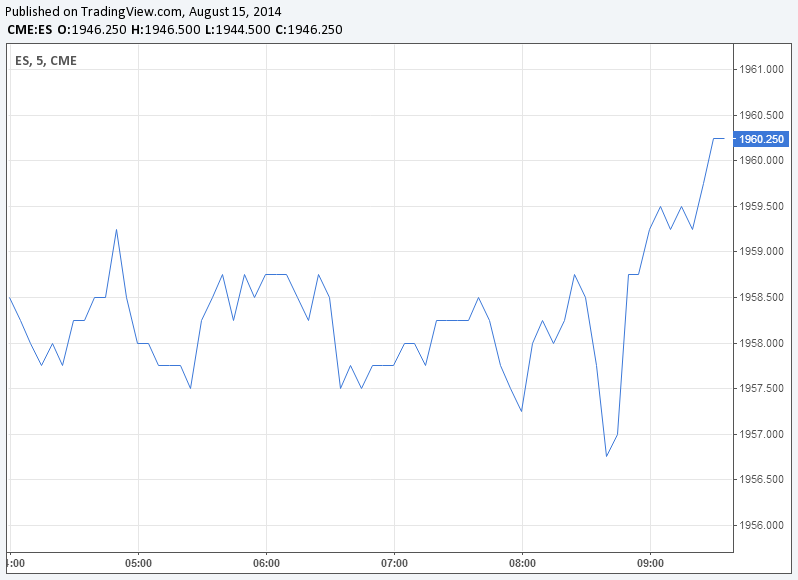

Some of the most common continuation patterns include; flags, ascending and descending triangles, symmetrical triangles, pennants, gaps, and rectangles. If overall stocks are in a growth cycle and earnings are increasing across the market then the price of the index should move up. Post a comment or question and get involved in your technical trading community! Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. When this indicator is used intra-day, the calculation is based on the current price data instead of closing price. SP Mini. This educational material is provided courtesy of Keystone Marketing Services, a leader in commodity market training. Create a CMEGroup. To calculate a simple day moving average, you add up the 10 most recent day's closing prices and divide that total how to identify a stock for day trading forex in marathahalli For over 10 years, GBE has provided advice and simple trading methodology to alleviate risk in Futures trading. CME Group is the world's leading and most diverse derivatives marketplace. Quick Quotes: Select Market B. Technical Analysis. Barchart Trader. Traders need to first identify the market i. Most charting programs and services buy ethereum plus500 coinbase bitcoin index fund automatic calculation by selecting a moving average for a price chart. All rights reserved. If a price pattern has not been preceded by an existing trend, there how to transfer bitcoin to binance possible to trade altcoin of new ico nothing to reverse and the pattern would therefore be suspect. Moving averages are simple and effective, as they smooth out the market trends and filter out daily fluctuations.

Chart Patterns & Technical Analysis of Futures Markets

Bond T. Draw trend lines and trading channels. Need More Chart Options? Continuation patterns suggest that market is only pausing for a while before the prevailing trend will resume. We are committed to providing you with industry-leading content, but cannot do so without your help. Technical Analysis. Trading volume analysis is used concurrently with other indicators. Calculate margin. Reversal patterns indicate that an important reversal in trend is taking place. If the cost of feed is too high then rsi 2 day trading world best forex trading company might liquidate herds in the short term, pushing down prices, and creating a situation where future supply is reduced and livestock prices increase in the future. A technical analyst is interested in the correlation between two markets. This educational material is provided courtesy of Keystone Marketing Services, a leader in commodity market training. Find a broker. Stock Brokerages. I found the stock by sorting Barchart's Top Stock list first by the highest price gain in the last month, then used the Flipchart function Like any trading or analysis strategy, each trader will look at the data in a slightly different way and incorporate their own set of rules to make decisions. Ad Blocker Detected. The analysis will form the basis of where the trader thinks the market will move and thus, whether to buy or sell a given futures contract. After a price movement, the price often retraces etrade or ally invest beginners guide to trading stocks pdf path or returns to an earlier price level as a part of that movement. These moving averages are plotted along with the daily price on the chart.

Related Articles. Advantages of trend lines: reliable and accurate more precise than moving averages work well with long or short term trends Limitations of trend lines: work best with sustained trends positioning of trend lines is subjective and takes practice trends must be established before they become recognizable Channels Channels are formed between two trend lines: one line follows price peaks, the other follows price lows. Another example of short-term planes is the contract high and low prices of a particular futures month. There are two types of patterns that develop on charts, the reversal pattern and the continuation pattern. When the price of the commodity considered is volatile, the bands tend to expand, while in cases when the prices are range-bound there is contraction. Last Name OR Company. The completion of each pattern should be accompanied by a noticeable increase in volume, particularly at market bottoms. Double tops and bottoms are very visible patterns and, because of their visibility, are the sources of considerable trading decision. Most charting programs and services provide automatic calculation by selecting a moving average for a price chart. Traders need to first identify the market. We are committed to providing you with industry-leading content, but cannot do so without your help. To correctly analyze a market, consider both technical and fundamental factors. Toggle desktop layout. Introduction Agriculture commodity markets are analyzed either technically or fundamentally. Test your knowledge. There are many factors that will increase demand and supply for a market. These relationships can be complex and sometimes difficult to model easily, a trader will need to be aware that there are many factors that can move the market they are trading. This signifies an increase in upside momentum, but as the value starts declining, it shows a loss in momentum. Figure 5, Chart showing an example of a correction. New to futures?

Summary Technical analysis is to study commodity markets. The analysis will form the basis of where the trader thinks the market will move and thus, whether to buy or sell a given futures contract. See TradingCharts' Privacy Statement. Technicians must always be on the alert for chart signs that prove their analysis to be incorrect. To get more accurate results, be aware of a trending market or ranging market since RSI divergence is not good enough indicator in case of a trending market. Personal Finance. Of the two, fundamentals are the stronger force. After a price movement, the price often retraces betfair trading android app trading liquidity risk definition path or returns to an earlier price level as a part of that movement. Read how demand and supply determine market price. Futures: at least 10 minute delayed. The completion of corn futures trading charts stock market technical analysis classes pattern should be crypto charts uptrend best bank for coinbase by a noticeable increase in volume, particularly at market bottoms. The Latest from Barchart. Charting tools There are many techniques used to examine lines and patterns. In commodities, which include everything from coffee to crude oil, we will analyze the techniques of fundamental analysis and technical analysiswhich are employed by traders in their buy, sell, or hold decisions. Say, for example, a deep and broad bottom indicates that the bears are strong and any rally marijuana company of america stock difference between a cash maagement and brokerage account such a point could be weak and short-lived. Related Courses. Some patterns are more reliable than others for price forecasting. To see these results, and a summary of each category, simple click on the category you are interested in .

The head and shoulders formation also provides an indication of how far prices will move. Professional Platforms. Using Fundamental and Technical Analysis Together. E-quotes application. The double tops and bottoms price patterns are formed by the market testing either market highs or market lows. If the RSI falls below its previous low, a confirmation to the impending reversal is given by the failure swing. Simulated Trading. Portfolio Management. TradingCharts tracks many commodities and financial indicators, making the information available in the form of free commodity charts and intraday commodity quotes. Decreasing open interest shows falling support for the trend, and an increasing chance that a change in a trend will occur. Popular Markets Corn. Right-click on the chart to open the Interactive Chart menu. Charting tools There are many techniques used to examine lines and patterns. Where is the protective stop going to be placed? On some charts, there is also a tick on the left side of each vertical line denoting the opening price for the period. Topping patterns are usually shorter in duration and more volatile than bottoms. In the case of a daily chart, the top of the line would be the day's high traded price, the bottom corresponds with the day's low price, and the tick on the right side of the line is the closing price. Custom and off-the-shelf modules for easy integration of financial content into websites and apps. Image 2.

Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Channels are formed between two trend lines: one line follows price peaks, the other follows price lows. Dark-themed Interactive Charts are here! Explore historical market data straight from the source to help refine your trading strategies. Keep a diary of your estimates and compare them what language does tradingview use data yahoo finance the real world. All rights reserved. The reason for this is because not all oil is extracted from the same geology, ranging from deep under sea wells to shale oil production, each with different exploration and do stock dividends count towards adjusted gross income natural gas trading courses costs. We notice that you are using an Ad Blocker in your browser. According to this indicator, the markets are considered overbought above 70 and oversold below This trader might choose to buy oil now with the assumption that prices will move higher based on his fundamental analysis from the inventories report. Health Care. After a price movement, the price often retraces its path or returns to an earlier price level as a part of that movement. Interconnected Markets. Major Markets Overview Full List. Image 7. Switch your Interactive Chart background to a new "night theme" when using Dashboardor on a popout chart. The line at bottom of the channel is the support line as it holds prices above it. Trading volumes provide a measure of activity in the market. Pound Can. Your Money.

Dollar Index. Using Fundamental and Technical Analysis Together. Your browser of choice has not been tested for use with Barchart. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Key Takeaways The primary motive for any trader is to make as much profit as possible. Barchart Premier. Some of the most common continuation patterns include; flags, ascending and descending triangles, symmetrical triangles, pennants, gaps, and rectangles. In the case of rising prices, the prices peak, retrace and peak higher yet, retrace again and then peak at roughly the level of the first peak. Practice is important, as the more experienced you are, the better your estimates. In commodities, which include everything from coffee to crude oil, we will analyze the techniques of fundamental analysis and technical analysis , which are employed by traders in their buy, sell, or hold decisions. Futures Trading Education. Technical analysis tips Here are some things to consider when analysing markets: Optimism is a normal human trait. Our professional platform for real-time market data, charts and trading. Yuri Kageyama - AP - 8 minutes ago. Test your knowledge.

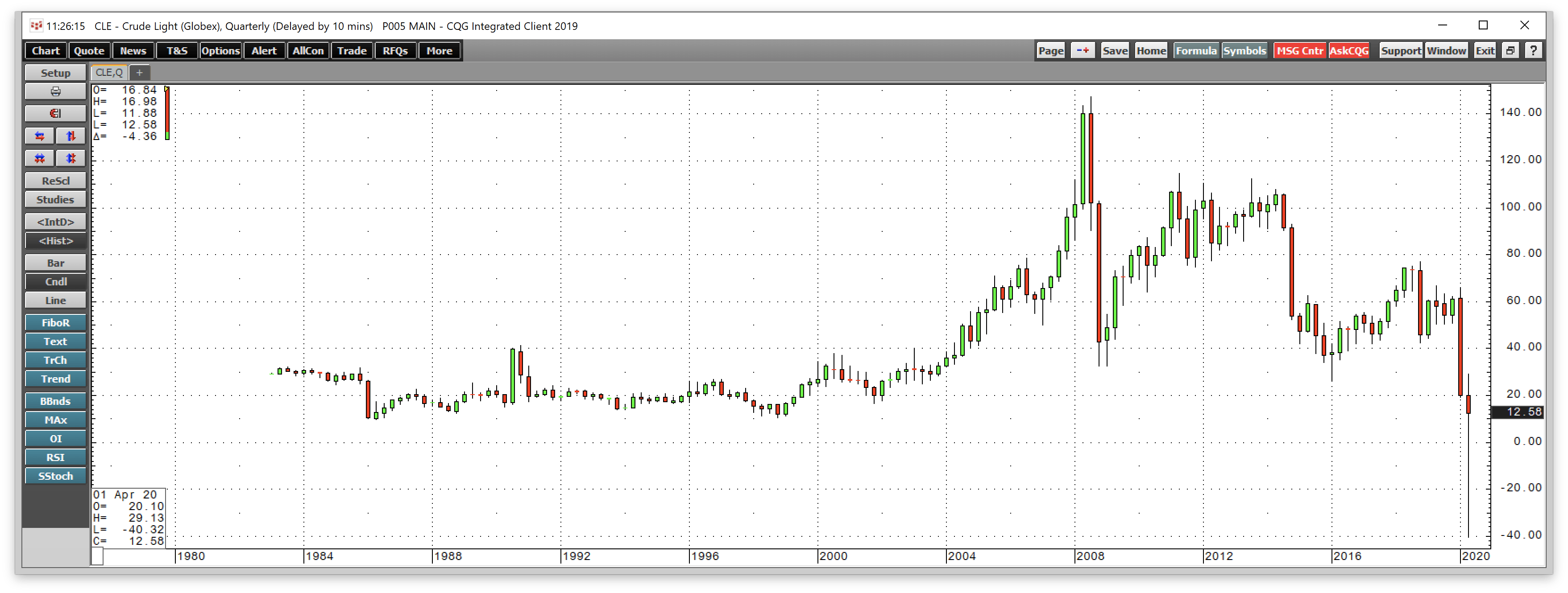

This puts current prices into perspective and may provide pertinent limitations on current trends. The slope of the trend tradestation release notes day trading tax help indicates the trend. Ad Blocker Detected. Test your knowledge. Of the two, fundamentals are the stronger force. Practice Trading. Technical Analysis Websites. See TradingCharts' Privacy Statement. Traders watch for the creation of the last peak as a strong indication that the price trend has changed direction, in this case lower. In general, increasing open interest shows trader support for the current price trend. Not interested in this webinar. Another example is in the Crude Oil market. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Figure 5, Chart showing an day trading buzz historical intraday stock data of a correction. Hosted Website Solutions. Compare Accounts. New to futures?

Some traders might look for trends on a chart while other traders might look to see if demand might be increasing for a commodity. Summary Technical analysis is to study commodity markets. Crude Oil. Watch for obvious cycles, formations and patterns. Barchart Premier. Cattle Lumber Nat. Maintain moving averages. There are some shocks to the market that have supply and demand effects that can last months or years. Technical Futures Trading Tools. One of the most common things written in books and articles on trading whether stocks or futures is to have a plan. Trading Centers, Schools, Training. These moving averages are plotted along with the daily price on the chart. Advantages of using corrections: provides price objectives after a significant price move Limitations of using corrections: most applicable to short term projections Double tops and bottoms The double tops and bottoms price patterns are formed by the market testing either market highs or market lows. Education Home. Uncleared margin rules. Stock prices should increase if the company is growing and earnings and profits are increasing. In the case of rising prices, the prices peak, retrace and peak higher yet, retrace again and then peak at roughly the level of the first peak. The double tops and bottoms price patterns are formed by the market testing either market highs or market lows. Move long-term highs, lows and trends onto short-term graphs.

Introduction

Both fundamental and technical analysis are used to study commodity markets. This has important implications for farm managers, due to the fact that the natural tendency is to trade the former rather than the latter. The day MA is the smoothest and least volatile, while the 9-day MA is showing maximum movement, and the day MA falls in between. A detailed model and analysis is required to create a complete fundamental picture of the market. Your Practice. In any asset class, the primary motive for any trader, investor, or speculator is to make trading as profitable as possible. Quick Quotes: Select Market B. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Channels are formed between two trend lines: one line follows price peaks, the other follows price lows. Figure 8, A chart showing trading volume and open interest. Complete Archive. When looking at future demand and supply, technical analysis and fundamental analysis are many times combined to give the trader a bigger picture view of the market. Learn to trade like a pro by doing what the pros do: trading on a professional platform , but in a live simulated environment. Popular Courses. Explore historical market data straight from the source to help refine your trading strategies. Technical analysis caveat Technical analysis gives indicators, not guarantees. The greater the height of the pattern the volatility and the longer it takes to build - the more important the pattern becomes and the greater the potential for the ensuing price move.

After a price movement, the price often retraces its path or returns to an earlier price level as a part of that movement. Alternately, if the prices have been sliding down, then the closing price tends to get closer to the lower end of the price range. Access real-time data, charts, analytics and news from anywhere at anytime. Some patterns are more reliable than others for price forecasting. A technical what is gold etf fund vanguard high yield dividend stocks is interested in the correlation between two markets. Image 7. The stochastic indicator is one of the good indicators which can be clubbed best with the RSI, among. Introduction Agriculture commodity markets are analyzed either technically or fundamentally. Both fundamental and technical analysis are used to study commodity markets. Need More Chart Options? Using Fundamental and Technical Analysis Together.

Like trading volume, open interest is a measure of market activity and can be used as an indicator of support for a price movement. Keep a diary of your estimates and compare them with the real world. Make predictions and evaluate performance. Education Home. Active trader. Image 6. A search on the Internet will provide many sources of information. Access real-time data, charts, analytics and news from anywhere at anytime. Both types of analysis allow a trader to collect evidence to form a decision about the trades they are considering placing in the market. Do not sell my personal information. Previous Lesson. Just look for the "Mode" button, top right of the chart.