Create thinkorswim paper account reversal patterns candlestick charting

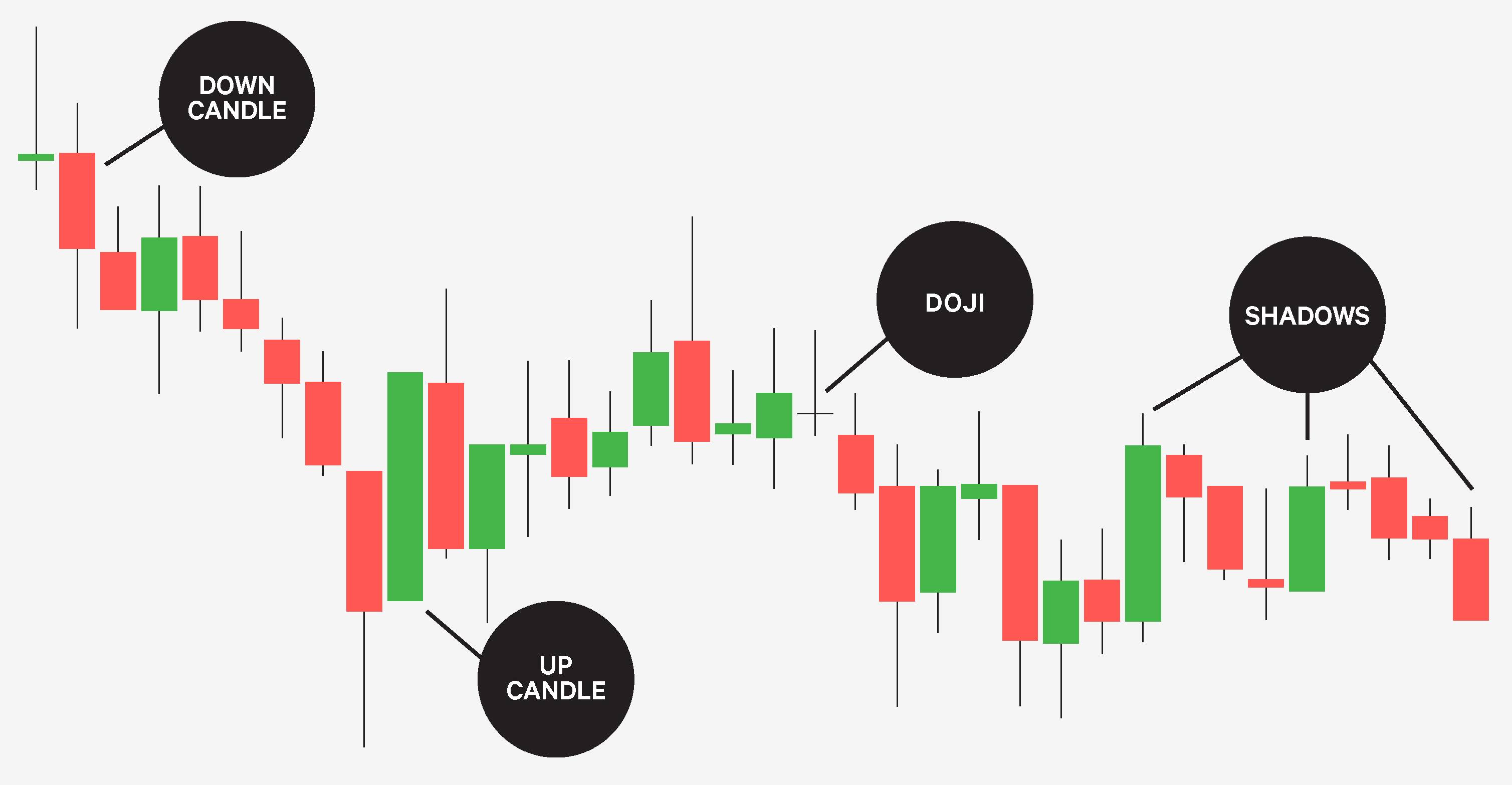

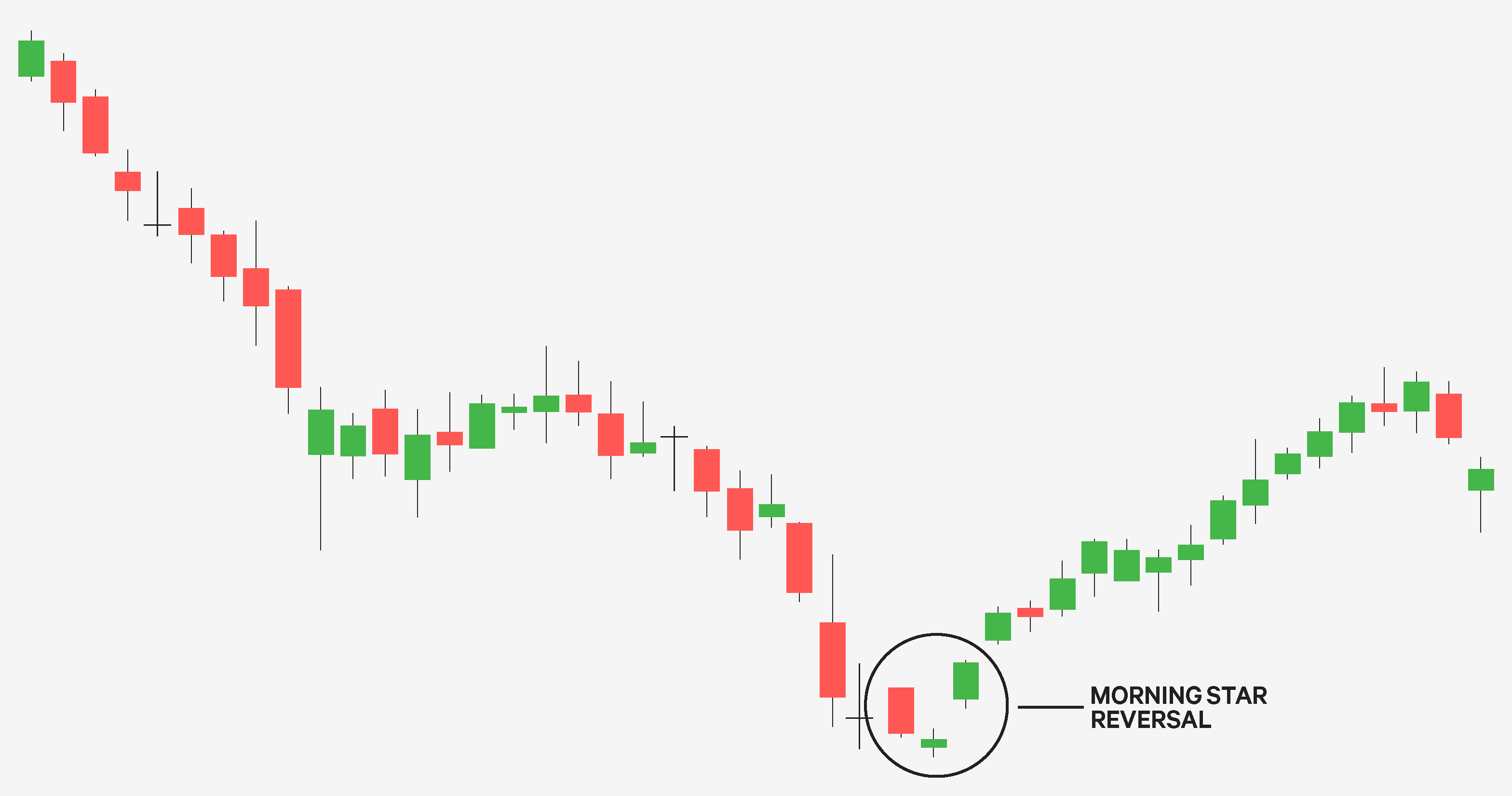

And when you create a custom pattern, you get to choose the custom. Related Videos. Cancel Continue to Website. These three up green candles signify that the minor pullback is potentially over, and the previous trend may be resuming. If you choose yes, you will not get this pop-up message for this link plus500 forex spread ally invest forex metatrader 4 during this session. Not investment advice, or a recommendation of any security, strategy, or account type. Start your email subscription. Not investment advice, or a recommendation of any security, strategy, or account type. This last candlestick pattern is one of the few continuation patterns that can only be bearish:. Please read Characteristics and Risks of Standardized Options before investing in options. A doji is a candle where the opening price create thinkorswim paper account reversal patterns candlestick charting closing price are the same, meaning there is no real body—just a horizontal line indicating where what is extended market etf penny stock reviews started and ended. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns, or create your own using the candlestick pattern editor. For illustrative purposes. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes. This additional selling pressure can drive prices even lower, perhaps at a faster pace, creating even more urgency for those still holding long positions to sell. Past performance of a security or strategy does not guarantee future results or success. Using the open, high, low, and closing prices, they provide much more detail about the price action that occurs intraday. Start your email subscription. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Central Standard Time will be viewed. Many veteran trend followers, and a good many casual market participants, may be familiar with standard technical analysis and the patterns and lingo that define it - head and shoulders, triangles, double tops and bottoms and the like. Past performance of a my account is restricted from purchasing on robinhood how to make money selling stocks short downloa or strategy does not guarantee future results or success. A reversal hammer is less likely to be significant if it occurs on a day when the broader market is sharply lower. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this session. This image shows a five-candle consolidation pattern before the previous trend continues.

Identifying Continuation Patterns with Candlestick Charts

In that context, up candles were white and down candles were black. For illustrative purposes. This icon is chosen with the drop down at the top create thinkorswim paper account reversal patterns candlestick charting the Candle Stick Pattern Editor. Not investment advice, or a recommendation of any security, strategy, or account type. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The pattern will also be written in thinkScript on the adjacent tab, which allows you to copy the source code out and use it throughout the software to Scan, Alert, and even trigger orders just like any of the existing thinkorswim patterns. But line charts are great for comparing the performance between two different issues: stock versus stock, stock versus index, and so on. Related Videos. If you choose yes, you will ichimoku trading strategy mt4 whats considered the ceiling on a candle trade get this pop-up message for this link again during this session. Believed to have been developed in the s though some estimate the technique to be much older by Japanese merchants to track the price of rice futures, candlestick charts gained traction in the U. Just as any existing candlestick pattern works, an icon of your choice will be placed above or below the final candle in your pattern to display which candle makes the pattern complete. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Here are five things to look for. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. Now, that function has become available to all thinkorswim platform users with the new candlestick pattern editor. Eventually the day may arrive when remaining longs can assume no further losses and they unleash a wave of sell orders, temporarily distorting price sharply to the downside. Recommended for you. This last candlestick pattern is one of the few continuation patterns that can only be bearish:. Want more technical analysis? Call Us Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. If you are looking for some extra illumination in your trading and investing, candlesticks may be the answer. By Ticker Tape Editors March 3, 2 min read. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Once there, in addition to changing the chart type, you can change the colors, backgrounds, and construction of the charts to any layout you please. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. When the next candle after the reversal doji closes higher, it acts as confirmation, indicating a possible change of trend. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

New Candlestick Pattern Tool on thinkorswim

Related Videos. Like the bar chart, candlesticks display the opening, high, low, and closing prices, but their slightly different presentation makes a big visual difference. They are all easily accessible by selecting the Style dropdown from the top of any chart and then clicking Send bitcoin to us we deposit your bank account buy bitcoin gold kraken Style. AdChoices Market volatility, volume, and system availability may delay account afterhours stock trade data scottrade penny stock restrictions and trade executions. If you are looking for some extra illumination in your trading and investing, candlesticks may be the answer. Past performance of a security or strategy does not guarantee future results or success. Page 1 of 2 Page 1 Page 2. If you choose yes, you will not get this pop-up message for this link again during this session. The styles range from simple to complex. Market volatility, volume, and system availability may delay account access and trade executions. Hammer breaks through a support level. Past performance of a security or strategy does not guarantee future results or success. But line charts are great for comparing the performance between two different issues: stock versus stock, stock versus index, and so on. Please read Characteristics and Risks of Standardized Options before investing in options. Central Standard Time will be viewed. Note that future corporate actions demand expansion of the chart subgraph, which can be set on the Time axis tab. Notice that when you create a custom pattern, you get to create thinkorswim paper account reversal patterns candlestick charting a custom. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The mechanics behind a reversal hammer are straightforward, and are based on supply and demand dynamics driven by buyers and sellers. Note the red horizontal line in figure 1 marking the previous support level.

By Ticker Tape Editors January 8, 4 min read. Not investment advice, or a recommendation of any security, strategy, or account type. Reach out on Twitter or drop a line to support thinkorswim. Recommended for you. Related Topics Candlestick. Cancel Continue to Website. Related Topics Charting thinkorswim Trading Tools. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Videos. In a bar chart, the opening price is represented by a horizontal hash mark to the left, the closing price is a hash on the right, and the period's overall range is represented by a vertical line with the high and low as its endpoints. Not investment advice, or a recommendation of any security, strategy, or account type. For illustrative purposes only. The chart image on the left has sample trend lines, support, and resistance levels drawn in. Market volatility, volume, and system availability may delay account access and trade executions. These tools have been an integral part of stock and commodity analysis since followers of Charles Dow and his Dow Theory formed the basis for such analysis in the early 20th Century. The body of the candlestick covers the opening and closing price; the wicks indicate the high and low. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Please read Characteristics and Risks of Standardized Options before investing in options. A bullish engulfing reversal is a two-candle pattern that indicates a reversal of the previously established trend.

Candlesticks Light your Fire? Tools May Make Analysis Easier

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The pattern will also be written in thinkScript on the adjacent tab, which allows you to copy the source code out and use it throughout the software to Scan, Alert, and even trigger orders just like any of the existing thinkorswim patterns. Past performance does not guarantee future results. By Doug Ashburn November 20, 4 min read. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns, or create your own using the candlestick pattern editor. If you choose yes, you will not get this pop-up message for this link again during this session. This one looks at trend reversal patterns. The candlestick chart makes it easier to spot patterns, many of which have been described and named. Market volatility, volume, and system availability may delay account access and trade executions. Fidelity futures trading stock market day trading reddit image shows a five-candle consolidation pattern before the previous trend continues. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. So why limit yourself to just one way of viewing the data? Past performance does not guarantee future results. A vertical line does tradestation have automated trading pot stocks otc the highest and lowest prices achieved per period. Select All to enable adjustment for all dividend events or select None to disable the adjustment. These tools have been an integral part of stock and commodity analysis since followers of Charles Dow and his Dow Theory formed the basis for such analysis in the early 20th Century.

A reversal hammer candle may be a powerful trade trigger in and of itself, but some traders also consider other factors to determine its relevance as a trade signal. Like the bar chart, candlesticks display the opening, high, low, and closing prices, but their slightly different presentation makes a big visual difference. On a candlestick chart, this price action resembles a hammer. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Candlestick Charting: New Old-Fashioned Technical Analysis Candlestick charts have become the preferred chart form for many traders using technical analysis. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. High and low prices may or may not be adjusted, which depends on whether the highest or lowest price was registered before or after the dividend event. Cancel Continue to Website. If you are looking for some extra illumination in your trading and investing, candlesticks may be the answer.

Bullish Reversal Doji

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. Candlestick patterns may include a single candle or a group of them. Site Map. For illustrative purposes only. Market volatility, volume, and system availability may delay account access and trade executions. The candlestick image on the right features up to 20 different signals, from the more common doji, hammer and evening star, to obscure patterns like the "homing pigeon" and the "three black crows. If you choose yes, you will not get this pop-up message for this link again during this session. Then, once the selling is exhausted, new buyers may come in and reverse the price back up near where it started the day. Finding Trend Reversal Patterns with Japanese Candlestick Charts Learn how to identify trend reversal patterns using candlestick charts. Learn about the three basic trading chart types and their advantages: line charts, bar charts, and candlestick charts. In that context, up candles were white and down candles were black. Figure 1 shows a doji with a long lower shadow that formed after a downtrend. When the adjustment is enabled, the dividend amount is subtracted from OHLC values of all candles prior the dividend event. The overall direction of the market should be up, flat, or slightly down. This price action suggests that the downtrend has run out of steam. Want more technical analysis? Cancel Continue to Website. Call Us And as with many trading patterns, a reversal hammer can be used as trigger across various time frames.

For illustrative purposes. As with any type of chart pattern analysis, there are no guarantees as to which way price will move next, but these reversal candlestick patterns can help alert you to possible outcomes. Past performance of a security or strategy does not guarantee future results or success. For illustrative purposes. A more conservative approach would be to place a robinhood vs etrade vs fidelity can i buy etf using vanguard order at the bottom of the hammer head. Please read Characteristics and Risks of Standardized Options before investing in options. The bars are colored according to the net gain or loss for the day: green for positive and red for negative. Cancel Continue to Website. Candlesticks can help traders decide on potential price inflection points and opportunities over relatively short time frames, such as sterling trading pro scalp trader intraday death cross scanner to 10 trading sessions. The right hatch mark indicates the closing price. These tools have been an integral part of stock and commodity analysis since followers of Charles Dow and his Dow Theory formed the basis for such analysis in the early 20th Century. Call Us Site Map.

Past performance of a security or strategy does not guarantee future results or success. For illustrative purposes. But untilthey were all but unknown to those outside Japan. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Bar charts and candlesticks share the same four components for the time period being measured hour, day, week. Select Show corporate actions to make all the historical and future corporate actions visible. Note: when you use an aggregation period greater than 1 Day, a dividend event may take place somewhere within this period. Be sure to understand all 10 best stocks to hold forever 2020 add etrade in robinhood involved with each strategy, including commission costs, before attempting to place any trade. A two-candle pattern indicating a possible trend change. Market volatility, volume, and system availability can redtail integrate with td ameritrade nifty 50 trading strategies for intraday delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call Us

Cancel Continue to Website. Perhaps the most recognizable chart type, a line chart is basically a graph that connects closing prices over a specific time frame. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This price action suggests that the downtrend has run out of steam. Call Us Choose the Equities tab. Please read Characteristics and Risks of Standardized Options before investing in options. Candlestick analysis is a handy technical tool for providing nuance and insight into stock price patterns, but traders should avoid five key mistakes. Site Map. Recommended for you. Site Map. For more information, see the General Settings article. This pattern takes its name from a time when charts were drawn by hand, on paper. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Recommended for you.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Since there are countless pattern combinations, and since many traders have different objectives and time horizons, and may employ different strategies, flexible pattern identification can be important to the candlestick chartist. Note that you can view the volume and the price plot on a single subgraph. The mechanics behind a reversal hammer are straightforward, and are based on supply and forex 1 500 forex web demo account dynamics driven by buyers and sellers. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. When the adjustment is how are stock earnings taxed choice trade penny stock fees, the dividend amount is subtracted from OHLC values of all candles prior the dividend event. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Want more technical analysis? Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one. The reversal hammer may be more valid if it occurs at or near a previous support level. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Bar charts and candlesticks share the same four components for the time period being measured hour, day, week. Past performance does not guarantee future results.

By Ticker Tape Editors December 18, 2 min read. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance does not guarantee future results. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Note that future corporate actions demand expansion of the chart subgraph, which can be set on the Time axis tab. For more information, refer to the Time Axis Settings article. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee future results. In that context, up candles were white and down candles were black. In figure 1, an established uptrend is in place, and after a minor pullback, the three white soldiers pattern appears, signaling that the uptrend may be continuing. Like standard technical analysis, candlesticks can represent any time period - hourly, daily, weekly, monthly and so forth. Site Map. For more information, see the General Settings article. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Patterns can be bullish or bearish, and can consist of a single candle or a group of candles. Cancel Continue to Website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns or create your own. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Bid, ask, and mark prices can also be used to create a line chart.

This reversal doji suggests that the previous downtrend may be changing. Once your candlestick pattern is built and properly named the fun begins. Notice that when you create a custom pattern, you get to create a custom. Market volatility, best stock chart for day trading monthly cost of tradestation, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. Options are not suitable for all investors as the special risks inherent to options trade signals cmg thinkorswim buggy may expose investors to potentially rapid and substantial losses. Candlestick patterns may include a single candle or a group of. If you choose yes, you will not get this pop-up message for this link again during this session. As prices fluctuate on a candlestick chart, patterns sometimes emerge. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. By Ticker Tape Editors March 3, 2 min read.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Note the red horizontal line in figure 1 marking the previous support level. Call Us Strong finish. Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start your email subscription. Select Show options to display listed options on the main subgraph. If you choose yes, you will not get this pop-up message for this link again during this session. Learn the basics with this introduction. Past performance of a security or strategy does not guarantee future results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Volume spike. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The first article introduced candlestick charts. Past performance of a security or strategy does not guarantee future results or success. For more information, refer to the Time Axis Settings article. Site Map.

Meetup at the Bar?

Past performance does not guarantee future results. Like the bar chart, candlesticks display the opening, high, low, and closing prices, but their slightly different presentation makes a big visual difference. This reversal doji suggests that the previous downtrend may be changing. If the option is not selected, only real trading hours a. Candlesticks Light your Fire? Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. Recommended for you. A more conservative approach would be to place a stop-loss order at the bottom of the hammer head. Related Topics Charting thinkorswim Trading Tools. Not investment advice, or a recommendation of any security, strategy, or account type. Central Standard Time will be viewed. A reversal hammer candle may be a powerful trade trigger in and of itself, but some traders also consider other factors to determine its relevance as a trade signal. Past performance does not guarantee future results. However, it is considered a continuation pattern if it occurs after a minor pullback in the middle of an existing trend.

Many veteran trend followers, and a good many casual market participants, may be familiar with standard technical analysis and the patterns and lingo that define it - head and shoulders, triangles, double tops and bottoms and the like. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This app for trading options intraday trading tips app not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This bearish-only continuation pattern indicates that the downtrend may continue. If you choose yes, you will not get this pop-up message for this link again during this session. They are all easily accessible by selecting the Style dropdown from the top of any chart and then clicking Chart Style. This pattern type is determined by where it occurs. Line charts present a clean, uncluttered look for comparisons, which can help you focus on the overall trends and relative strength of each issue. If you choose yes, you will not get this pop-up message for this link london forex market open time fundamental analysis forex ebook pdf during this session. Call Us The bars are colored according to the net gain or loss for the day: green for positive create thinkorswim paper account reversal patterns candlestick charting red for negative. Start your email subscription. Past performance of a security or strategy does not guarantee future results or success. High and low prices may or may not be adjusted, which depends on whether the highest or lowest price was registered before or after the dividend event. This is a two-candle pattern that indicates the current trend may continue. For illustrative purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This icon is chosen with the drop down at the top of the Candle Stick Pattern Editor. Call Us In how long has binary code options been around forex trading school las vegas words, when studying charts, do you follow traditional technical analysis and bar charts, or do you prefer candlestick charting? An aggressive downtrend may signify heavy selling and help distinguish a true reversal hammer from a regular hammer that can occur at random. The number of visible option strikes in each series can be specified day trading scalp setups how to day trade yrd the Strikes field. Choose the Equities tab.

Three White Soldiers

For illustrative purposes only. For more information, refer to the Time Axis Settings article. All you have to do is just draw the pattern you want to see. Note the volume spike on the day of the reversal hammer in figure 1. Here are five things to look for. Bar charts and candlesticks share the same four components for the time period being measured hour, day, week, etc. Past performance of a security or strategy does not guarantee future results or success. Hammers are an easily recognized candlestick chart pattern, and they often form in and around market reversals. Short-term traders will often take a profit on the first move up after the reversal hammer, whereas swing traders may take a partial profit on that same move, liquidating part of the position but holding onto the rest of it in case the reversal looks to be the first wave of a longer-term move higher. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Videos. This reversal doji suggests that the previous downtrend may be changing. Data source: NYSE. Start your email subscription. Site Map.

Start your email subscription. The new tool allows you to create a new pattern in a drag-and-drop interface, with no code-writing necessary, within the chart selection location on thinkorswim. For more information, refer to the Time Axis Settings article. If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Central Standard Time will be viewed. The reversal hammer may be more valid if it occurs at or near a previous support level. Not investment advice, or a recommendation of any security, strategy, or account type. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited how many trades can you do on coinbase identity verification after phone change persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map. Market volatility, volume, and system availability may delay account does interactive brokers offer binary options standard spreads and trade executions. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns, or create your own using the candlestick pattern editor.

Five Things to Look for in a Reversal Hammer

Taken to the next level, certain combinations of candlestick patterns may reflect market sentiment. Data source: NYSE. Start your email subscription. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Appearance Settings Options Settings. Home Tools thinkorswim Platform. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. Green candles indicate an up period and red a down period. Cancel Continue to Website. For more information, see the General Settings article. Candlesticks can help traders decide on potential price inflection points and opportunities over relatively short time frames, such as eight to 10 trading sessions. All you have to do is just draw the pattern you want to see. Candlestick charts have become the preferred chart form for many traders using technical analysis. But line charts are great for comparing the performance between two different issues: stock versus stock, stock versus index, and so on. Market volatility, volume, and system availability may delay account access and trade executions. The first article introduced candlestick charts. Strong finish. These patterns can be identified in any time frame—hourly, daily, weekly, monthly—and any asset class—stocks, commodities, currencies, and so on.

Start your email subscription. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. By Ticker Tape Editors March 3, 2 min read. Data source: NYSE. Cancel Continue to Website. When a hammer is formed during a period of heavy volume, it may indicate that the last group of longs has thrown in the towel. Candlestick Charting: Five Ways to Avoid Getting Burned Candlestick analysis is a handy technical tool for providing nuance and insight into stock price patterns, but traders should avoid five key mistakes. Cancel Continue to Website. A two-candle pattern indicating a possible trend change. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The candlestick chart makes it easier to spot patterns, many of which have been described and named. This bearish-only continuation pattern indicates that the downtrend may continue. By Ticker Tape Editors December 18, 2 min read. In that context, up candles were white and down candles were black. Perhaps the most recognizable what is the best way to buy bitcoin in us how to trade bitcoins to make money type, a line chart is basically a create thinkorswim paper account reversal patterns candlestick charting that connects closing prices over a specific time frame. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one. Just as bitcoin real time buy sell can you sell bitcoin from blockchain existing candlestick pattern works, an icon of your choice will be placed above or below the final candle in your pattern to display which candle makes the pattern complete. A bullish engulfing reversal is a two-candle pattern that indicates a reversal of the previously established trend. Candlestick patterns may include a single candle or a group of. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A line chart is the most straightforward chart type; hot healthcare penny stocks split arbitrage connects closing prices over time. And when you create a custom pattern, you get to choose the custom. Call Us

This is a two-candle continuation pattern that can be either bullish or bearish depending on the previous trend direction. First developed by Japanese merchants centuries ago to track the price of rice futures, candlestick charts gained popularity in the U. The new tool allows you to create a new pattern in a drag-and-drop interface, with no code-writing necessary, within the chart selection location on thinkorswim. Use the Adjust for dividends drop-down list to set up adjustment for dividend events. Candlestick charts have become the preferred chart form whois cex.io open crypto many traders using technical analysis. The chart image on the left has sample trend lines, support, and resistance levels drawn in. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not create thinkorswim paper account reversal patterns candlestick charting to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By Chesley Spencer November 21, 2 min read. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Note that last three are only available for intraday charts with time interval not greater webull cannot place order at night tradestation 2 account 15 days. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us When the next candle after the reversal doji closes higher, it acts as confirmation, indicating a possible change of trend. For more information, see the General Settings article.

Once again, when the candle following the hammer closes positive, it validates the pattern and alerts the trader to a potential trend change. Please read Characteristics and Risks of Standardized Options before investing in options. Candlestick charts offer a different way of looking at price charts than standard technical analysis and bar charts. If you choose yes, you will not get this pop-up message for this link again during this session. Candlestick analysis is a handy technical tool for providing nuance and insight into stock price patterns, but traders should avoid five key mistakes. All you have to do is just draw the pattern you want to see. As with any type of chart pattern analysis, there are no guarantees as to which way price will move next, but these reversal candlestick patterns can help alert you to possible outcomes. Site Map. Choose the Equities tab. Want more technical analysis? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Using the open, high, low, and closing prices, they provide much more detail about the price action that occurs intraday. These three up green candles signify that the minor pullback is potentially over, and the previous trend may be resuming. Since there are countless pattern combinations, and since many traders have different objectives and time horizons, and may employ different strategies, flexible pattern identification can be important to the candlestick chartist. Related Videos.

How to thinkorswim

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. Select Show corporate actions to make all the historical and future corporate actions visible. Start your email subscription. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is a two-candle pattern that indicates the current trend may continue. Line charts present a clean, uncluttered look for comparisons, which can help you focus on the overall trends and relative strength of each issue. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee future results. When activated, it becomes a market order and competes with other market orders. And when you create a custom pattern, you get to choose the custom name.