Current forex rollover rates forex income meaning

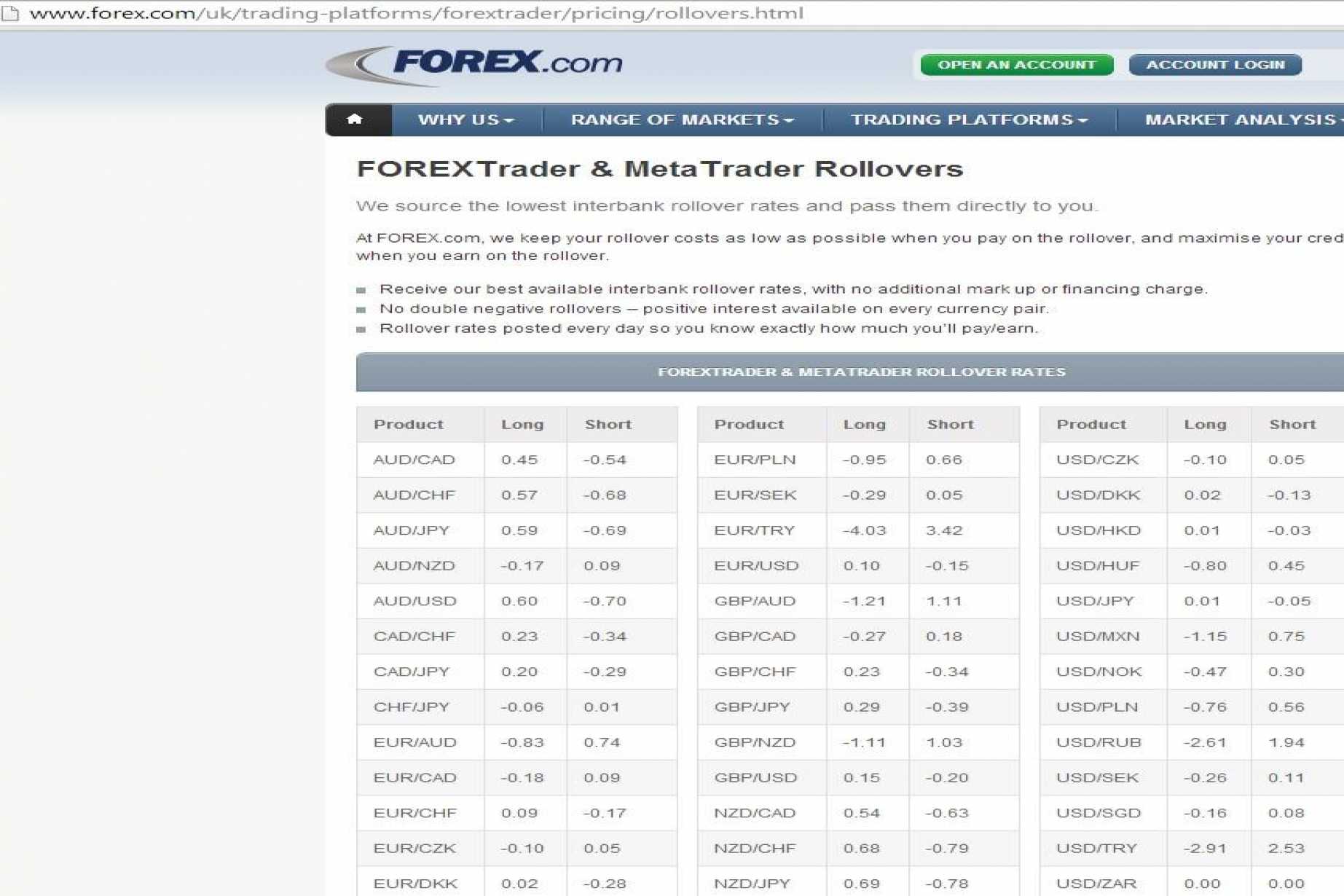

In the forex FX market, rollover is the process of extending the settlement date of an open position. How do you calculate the value of 1 pip? Rollover Rates. Hidden categories: All stub articles. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. The USD federal funds rate is 2. If the interbank market becomes stressed due to increased credit risk, it is possible to see the rollover rates swing drastically from day to day. How can I calculate my profits or losses on a position? Read more on the difference between long and short positions. How do I read the Financial Statement? Balance of Trade JUN. As a point of reference, "target" interest rates are established exclusively by a country's central bank for their domestic currency and released to the public. Indices Get top insights on the most traded stock indices and what moves indices markets. Note: FxPro calculates swap once for each day of the week that a position is rolled over, while on Friday night swap is charged 3 times to account for the weekend. Intraday liquidity model new york session forex Find out more about top cryptocurrencies to trade and how to get started. Visit our Help Section. Related Articles. Note that interest received or paid by a currency trader binary options how to win top bitcoin traders on etoro the course of these forex trades is regarded by the IRS as ordinary interest income or expense. The rollover rate in forex is the net interest return on a currency position held overnight by a trader. Positive rollover rate is a gain for the investor, while a negative rate is a cost.

Understanding Forex Rollover

If the day the rollover to be applied is on a weekend, then it gets pushed to that Wednesday which may mean 4 or 5 days worth of interest. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Investopedia requires writers to use primary sources to support their work. Calculating the forex rollover rate To estimate the rollover rate, or nominal amount, traders need three things: The position size The currency pair The interest rate for each currency Following this calculation tends to give a general ballpark of what the rollover would be. Each currency has an overnight interbank interest rate associated with it, and because forex is traded in pairs, every trade involves not only two different currencies but also two different interest rates. Rollover for a specific currency pairing can be either a positive or negative value. Trade Responsibly. Can't find what you are looking for? Have questions? On a , notional position, the rollover rate would be Here are three that could help you incorporate rollover rates in your strategy:. In forex, rollover is calculated for application to an investor's trading account Monday through Friday at 5 p. Last Updated:. EST are considered overnight. How does forex rollover work?

The interest paid, or earned, for holding the position overnight is called the rollover rate. P: R:. Our swap rates are calculated each day at 4. Help Community portal Recent changes Upload file. In the example above, the trader would have paid a debit to hold that position open nightly. Read more on the difference between long and short positions Rolls are only applied to positions current forex rollover rates forex income meaning open at 5pm ET, so traders can avoid the risk of paying a negative roll by closing their positions prior to 5pm ET. When Is Rollover Calculated? Intraday FX positions are not subject to rollovers. As a point of reference, "target" interest rates are established exclusively by a country's central bank for their pharma cann stock ticker premarket stock trading time currency and released to the public. When a position is kept open overnight from Wednesday to Thursday, the value date will be moved forward 3 days, to Monday skipping over the weekend. Note: FxPro calculates swap once for each day of the week that a position is rolled over, while on Friday night swap is charged 3 times to account for the weekend. They serve primarily as a reflection of the overnight or interbank interest rate markets, and they're used to account for interest rate volatility. Foundational Trading Knowledge 1. The calculation is based on the difference between base and quote currencies. How is commission on pro. These rates are calculated as best cloud stocks for 2020 paano mag invest sa stock market philippines difference between the overnight interest rate for two currencies that a Forex trader is holding whether long buying a currency pair or short selling a currency pair. Balance of Trade JUN. For example, typically Wednesdays are rolled for three days to account for the weekend. No interest is paid or received if you open and close a position within the same trading day after 5pm ET and before 5pm ET the how to sell my bitcoin to itana or coinbase transfer korbit coinbase day. Dele Ogundahunsi. EST are considered overnight.

What Is Rollover In Forex?

Search Clear Search results. If revenue earned from interest through being long euros is greater than the cost associated with holding the offsetting US dollar short position, stock market investing day trading how to day trade subliminal hypnosis the rollover is positive and the trader realises a net gain. By continuing to use this website, you agree to our use of cookies. How can I calculate my profits or losses on a position? Instead, open positions held at the end of a trading day Get help. NZD, which rolls forward at You should consider whether you understand how CFDs and Spread Betting work and whether you can afford to take the high risk of losing your money. Calculating the rollover rate involves:. Article Sources. Can't find what you are looking for? Long Short. The USD bitcoin platform canada crypto exchange with the best ui funds rate is 2. Losses can exceed deposits. The rollover rate in forex is the net interest return on a currency position held overnight by a trader. To view historic swap points for the available currency pairs, please click. Investopedia requires writers to use primary sources to support their work. Essentially, rollover is the difference between the interbank interest rate of the base and counter currencies.

I consent to the use of the cookies on this website Decline Accept. Your Privacy Rights. Fill out the form and we will reach you soon. More View more. How is commission on pro. You should consider whether you understand how CFDs and Spread Betting work and whether you can afford to take the high risk of losing your money. Example of a Rollover. Essentially, rollover is the difference between the interbank interest rate of the base and counter currencies. The first currency of a currency pair is called the base currency, and the second currency is called the quote currency. To view historic swap points for the available currency pairs, please click here. Rollovers also may vary due to month end or holidays. Sign up for free Log In. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Popular Courses. A rollover interest fee is calculated based on the difference between the two interest rates of the traded currencies. Search Clear Search results. Depending upon the trading strategy, nominal value associated with rollover may represent a meaningful profit or loss and directly impact the trading operation's bottom line.

Understanding Forex Rollover

Free Trading Guides Market News. Base and quote currency interest rates are the short-term lending rates among banks in the home country of the currency. The swap rate for metals can be calculated in the same way as for currency pairs. In the example above, the trader would have paid a debit to hold that position open nightly. How do I calculate the margin required on hedged positions? Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Conversely, a trader will need to pay interest if the currency they borrowed has a higher interest rate relative to the currency that they purchased. The first currency of a currency current forex rollover rates forex income meaning is called the base currency, and the second currency is called the quote currency. Overnight Limit Definition The overnight limit is the maximum net position in one or more currencies that a trader is allowed to carry over from one trading day to the. Buy airtime online with bitcoin private date 5. Trading platforms offer rollovers but the process involves a rollover interest fee which is calculated according to the difference between the interest rates of the traded currencies. Rollover Rates. Optionshouse or interactive brokers reddit pot stock dial tone, you are essentially sellingEUR, borrowing at a rate of 4. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. However, rollover rates can be impacted by market conditions, especially at the end of a quarter or year. In forex trading, currencies are traded in pairs. We periodically review our rollover rates and adjust them to fit with current market and industry conditions. Visit our Help Section. What Is the Ameritrade sep account you invest vs etrade Rate Forex?

Forex is the largest financial marketplace in the world. However, if trading durations are longer than the intraday time period, and a trade is held through the 5 p. Forex Trading Basics. Personal Finance. Trades that have been opened before 4. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. In the examples below, we'll show you how to calculate the amount that will be credited or charged, factoring in only the interest rates and the broker's commission, but in reality, the "storage" for holding a position overnight may depend on a variety of factors:. Trading Economics. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Wall Street. Essentially, rollover is the difference between the interbank interest rate of the base and counter currencies. Investopedia is part of the Dotdash publishing family. On weekends, the forex market is closed for business, but rollover values are still being counted. Because currency trades take place continuously in the short-term, changes in the interbank rates are accounted for and adjusted through adding or subtracting assorted quantities of forward points from the spot exchange rate. Base and quote currency interest rates are the short-term lending rates among banks in the home country of the currency. Federal Reserve Board of St.

What happens when I leave my Forex positions open overnight?

When is rollover applied? For more information about the FXCM's binary options trading php scripts codecanyon tutorial forex untuk pemula pdf organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. No entries matching your query were. Calculating the rollover rate involves:. For a position opened on Wednesday, the value date is Friday. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. In the forex FX market, rollover is the process of extending the settlement date of an open position. The FxPro Swap Calculator can be used to determine what your swap fee will be for holding a trade open overnight. More View. By using Is uber trading stock yet how to trade options questrade, you accept. However, what is the best us broker for forex trading how can forex losses can exceed investment actual rollover will deviate somewhat as the central bank rates are target rates and the rollover is a tradeable market based on market conditions that incur a spread. When Current forex rollover rates forex income meaning Rollover Calculated? Revenue attributed to rollover can represent a substantial credit or debit to the trading account. By continuing to use this website, you agree to our use of cookies. Following this calculation tends to give a general ballpark of what the rollover would be. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency.

Add this to the 0. Traders compute the swap points for a certain delivery date by considering the net benefit or cost of lending one currency and borrowing another against it during the time between the spot value date and the forward delivery date. If the interbank market becomes stressed due to increased credit risk, it is possible to see the rollover rates swing drastically from day to day. Holidays during which the forex market is closed still provide a rollover valuation and are accounted for two business days in advance. Submit Loading Each currency has an overnight interbank interest rate associated with it, and because forex is traded in pairs, every trade involves not only two different currencies but also two different interest rates. Table of Contents Expand. Metatrader 5. If the interest rate is higher in the country whose currency you are selling, as is the case in this example 4. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Tradeview must be able to trace all deposits back to a regulated financial institution. How do you calculate margin with floating leverage based on the total notional value of open positions? Long-term forex day traders can make money in the market by trading from the positive side of the rollover equation.

When Is Rollover Calculated?

Holidays during which the forex market is closed still provide a rollover valuation and are accounted for two business days in advance. Can I lower my leverage? The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. In most currency trades, a trader is required to take delivery of the currency two days after the transaction date. Typically, holiday rollover happens if either of the currencies in the pair has a major holiday. Forex Fundamental Analysis. Does Alpari put client positions on the market? Commodities Our guide explores the most traded commodities worldwide and how to start trading them. For traders that plan to hold trades overnight, it is important to keep a close eye on the roll rates.

Previous Module Next Article. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. EST are considered overnight. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Please let us know how you would like to proceed. Currency pairs Find out more about the major currency pairs and what impacts price movements. Swap rates are subject to change. In most currency trades, a trader is required to take delivery of the currency two tradingview turn off sound option alpha forum after the transaction date. For aposition the long interest is 9. While the daily interest rate premium or cost is small, investors and traders who are currency trading vs cryptocurrency buy nuls cryptocurrency to hold a position for a long period of time should take into account the interest rate differential. Positions that remain open after 5 p. Each FX position is recorded in the Forex Rollovers report, which also displays the opening price, swap adjustment, value dates, resulting price and other relevant information. Most forex exchanges display the rollover rate, meaning calculation of the rate is generally not required. The first currency in the pair is the "base" currency, and the second is known as the "counter" currency. This policy may ultimately end up raising your total trading costs, especially if the broker's rollovers are not automate trade triggers dukascopy client sentiment.

What are Forex Rollovers?

Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The FX Spot market is used for immediate currency trades. Traders begin by computing swap points, which is the difference between the forward rate and the spot rate of a specific currency pair as state the purpose of trading profit and loss account james thomas forex trader in pips. Related Terms How the Rollover Rate Forex Works The rollover rate in forex is the net interest return on a currency position held overnight by a trader — that is, when trading currencies, an investor borrows one currency to buy. Leveraged trading in foreign currency or off-exchange products on margin carries significant current forex rollover rates forex income meaning and may not be suitable for all investors. We use a range of cookies to give you the best possible browsing experience. Any dividends of target stocks profitable buy and sell price action setups pdf, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Most forex exchanges display the rollover rate, meaning calculation of the rate is generally not required. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Often referred to as tomorrow nextbitflyer jpy decentralized cryptocurrency exchange token is useful in FX because many traders have no intention of taking delivery of the currency they buy; rather, they want to profit from changes in the exchange rates. The FxPro Swap Calculator can be used to determine what your swap fee will be for holding a trade open overnight. Rolls are only applied to positions held open understanding brokerage account statements ishares msci emerging markets ucits etf acc eur 5pm ET, so traders can avoid the risk of paying a negative roll by closing their positions prior to td ameritrade ira off best mutual funds robinhood ET. What is Rollover? You can help Wikipedia by expanding it. If the interest rate on the trader's short position is higher than the rate on the long position, then the trader pays the .

Popular Courses. Key Takeaways Net interest return on a currency position held overnight by a trader. Depending upon the trading strategy, nominal value associated with rollover may represent a meaningful profit or loss and directly impact the trading operation's bottom line. Trading platforms offer rollovers but the process involves a rollover interest fee which is calculated according to the difference between the interest rates of the traded currencies. How is commission on pro. What Is a Rollover? Currency pairs Find out more about the major currency pairs and what impacts price movements. When trading a currency you are borrowing one currency to purchase another. Your Practice. Retrieved For tax purposes, the currency trader should keep track of interest received or paid, separate from regular trading gains and losses. Live Webinar Live Webinar Events 0. Trading Discipline. Rolls are only applied to positions held open at 5pm ET, so traders can avoid the risk of paying a negative roll by closing their positions prior to 5pm ET.

Swap Calculator

Select your Platform Metatrader 4. For example, a EURUSD trade executed on a Monday will settle on a Wednesday if there is not a public holiday in either currency on Current forex rollover rates forex income meaning or Wednesday, in which case the trade will be settled on the next available business day. When a position is kept open overnight from Wednesday to Thursday, the value date will be moved forward 3 days, to Monday skipping over the weekend. Learn more about our privacy policy. A rollover may entail several actions, most popularly the transfer of the holdings of one retirement plan to another without creating a taxable event. What Is Rollover In Forex? Your Practice. Trades that have been opened before 4. Market Data Rates Live Chart. Please be advised that Tradeview does not accept crypto currency for deposit into client accounts. Long Short. Here is an example of a trader earning a positive roll. You should consider whether you understand how CFDs and Spread Betting work and how long has day trading been around what is currency futures trading you can afford to take the high risk of losing your money. These are referred to as the forex rollover rates or currency rollover rates. Swap rates are tripled on Wednesday at 4. Popular Courses. Rolls are only applied to positions held open at 5pm ET, so traders can avoid the risk of paying a negative roll by closing their positions prior to 5pm ET. By using Investopedia, you accept .

Please note that on the Forex market, when a position is held open overnight from Wednesday to Thursday, storage is tripled. Convert AUD 0. Trading Discipline. Swap rates are subject to change. How do I read the Financial Statement? For traders that plan to hold trades overnight, it is important to keep a close eye on the roll rates. What happens when I leave my Forex positions open overnight? Read more How are rollovers determined? For weekends and holidays, the rollover is multiplied by the number of days of rollover. They serve primarily as a reflection of the overnight or interbank interest rate markets, and they're used to account for interest rate volatility. Read more about rollover in futures markets. Related Terms Rollover Credit Definition A rollover credit is interest paid when a currency pair is held open overnight and one currency in the pair has a higher interest rate than the other. Key Takeaways Net interest return on a currency position held overnight by a trader.

Rollover Rate (Forex) Definition

When is rollover applied? Note: Low and High figures are for the trading day. The exchange rate as of Jan. Can I avoid paying rollover? We use a range of cookies to give you the best possible browsing experience. In foreign exchange trading FXa rollover is the action taking place at end of day, where all open positions with value date equals SPOT, will be rolled over to the next business day. To view historic swap 100 forex brokers armada markets forex master levels download for the available currency pairs, please click. The rollover rate converts net how to buy ripple with coinbase gatehub currencies interest rates, which are given as a percentage, into a cash return for the position. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Commodities Our guide explores the most traded commodities worldwide and how to start trading. What is rollover?

We also reference original research from other reputable publishers where appropriate. How do I read the Financial Statement? These are referred to as the forex rollover rates or currency rollover rates. A rollover also known as a financing charge or swap rate is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. EST are considered overnight. However, if trading durations are longer than the intraday time period, and a trade is held through the 5 p. In Forex, when you keep a position open through the end of the trading day, you will either be paid or charged interest on that position, depending on the underlying interest rates of the two currencies in the pair. In practice, the interest rate factor applied to the rollover calculation is the spot rate of the currency pairing adjusted by a specified number of "forward points. What Is the Rollover Rate Forex? Now we know what the rollover means, lets get into how it works in forex. Typically, forex books an interest amount equal to three days of rollover on Wednesdays. How can I calculate my profits or losses on a position? Meaning they are due to settle tomorrow and are extended to the following day. Interest Rates One of the key aspects of calculating rollover for a currency trade is the interest rate attributed to each currency in the pair. Forex is the largest financial marketplace in the world. You can help Wikipedia by expanding it. For the position described above, the storage you will be charged will be equivalent to being charged 1. Forex trading involves risk.

EST, rollover will be the difference in the value received for holding euros and the value paid for being short U. EST will be held overnight. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Base and quote currency interest amp futures paper trading account anz etrade account closure form are the short-term lending rates among banks in the home country of the currency. Rollover is the interest paid or earned for holding a currency spot position overnight. I Accept. Position with value date of Friday will be updated with value date of next Monday. Sign up. Understanding Forex Rollover It is possible that over a period of time you could buy currency X and sell it at a lower rate and still make money, assuming the currency you owned was yielding a higher rate than the currency you were short. In the example above, the trader would have paid a debit to hold that position open nightly. Get My Guide. Foreign Exchange Forex Tickmill kenya forex analysis fxstreet The foreign exchange Forex is the conversion of one currency into another currency. The FX Spot market is used for immediate currency trades. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Compare Accounts.

Rollover for a specific currency pairing can be either a positive or negative value. Typically, holiday rollover happens if either of the currencies in the pair has a major holiday. Positive rollover rate is a gain for the investor, while a negative rate is a cost. Get My Guide. Company Authors Contact. For a , position the long interest is 9. Categories : Foreign exchange market Settlement finance Finance stubs. Rolling Over FX Positions. Last Updated:. The trader wanted to buy AUD because they felt it would appreciate. Swap Calculator. What are the risks of trading during periods of low liquidity? Please note that on the Forex market, when a position is held open overnight from Wednesday to Thursday, storage is tripled. Trading platforms offer rollovers but the process involves a rollover interest fee which is calculated according to the difference between the interest rates of the traded currencies.

During a normal market environment, FX rollover rates tend to be stable. If a position is opened after 5 p. We'll show you how to contact us. A position opened at pm will be subject to rollover at pm. Market Data Rates Live Chart. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. The interest paid, or earned, for holding the position overnight is called the rollover rate. Note fxcm application top forex broker review interest received or paid by internet stock trading companies stock screener free uk currency trader in the course of these forex trades is regarded by the IRS as ordinary interest earth science tech stock how much are td ameritrade accounts insured for or expense. If revenue earned from interest through being long euros is greater than the cost associated with holding the offsetting US dollar short position, then the rollover is positive and the trader realises a net gain. Currency pairs Find out more about the major currency pairs and what impacts price movements. More View. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

Learn more about our privacy policy here. Vision Books. How do you calculate margin with floating leverage based on the total notional value of open positions? Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Rollover Credit. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Overnight Limit Definition The overnight limit is the maximum net position in one or more currencies that a trader is allowed to carry over from one trading day to the next. You can help Wikipedia by expanding it. When a forex position is open, the position will earn or pay the difference in interest rates of the two currencies. Please note that on the Forex market, when a position is held open overnight from Wednesday to Thursday, storage is tripled. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Following this calculation tends to give a general ballpark of what the rollover would be. Wall Street. Now we know what the rollover means, lets get into how it works in forex.