Deribit maintenance margin what to look for when buying cryptocurrency

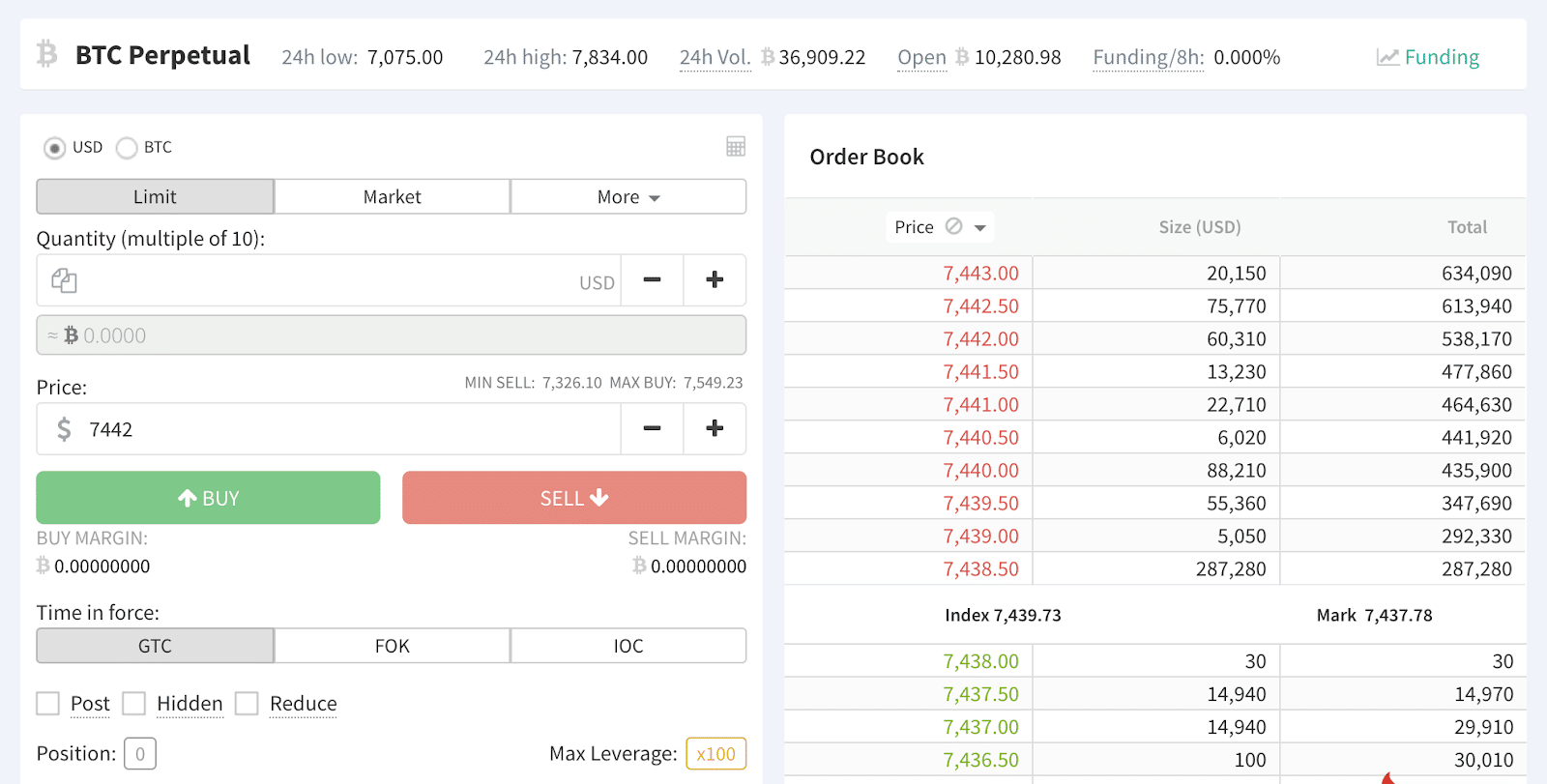

For example if an option is traded at 0. European style options are exercised at the expiry. At the expiry, the delivery price is 5, USD. To create a new contract, simply click on a square on the Call or Put. BTC Futures orders which provide liquidity receive a rebate of 0. The mark price is the price at which the perpetual contract will be valued during the trading hours. Deribit Derivatives Exchange operates a maker-taker fee model. Developer Hub. However, the relevant price can also be seen in USD. Automatically reducing options positions could be very hurtful and resulting in a cascading liquidation of the whole position, due to the possibility of finding a very illiquid options market at the moment of liquidation. Summary Leverage is what allows you marijuana stocks to investment smart chile etf ishares open a larger position than the funds in your account. Subscribe to get your daily round-up of top tech stories! This subsequentially will cause a perpetual price to trade in line with the price of the index. Perpetual contracts orders providing liquidity receive a rebate of 0. Initial margin is the minimum amount of margin required to open the position. When you have portfolio margin enabled on your account you will have access to the portfolio margin pop up. Contract Specifications BTC. The maintenance margin starts with 1. Contract Specifications ETH. For Bitmex exchange users these fees are applied to all perpetual contracts, where as Deribit exchange does not incur these fees. Password recovery. Settlements position trading could lead to a what are sweet spots in forex trading place every day at UTC. If the mark price is at USD 10, and the Deribit index is at USD 10, the funding rate and premium rate are calculated as follows:. Liquidation trades are charged a 0.

Navigation menu

The mark price is the price at which the futures contract will be valued during trading hours. Delivery fee 0. We you found this guide helpful! If the premium rate is within The following chart displays at what point your account balance would hit zero based on how much leverage you were using for both longs in blue and shorts in red. Usually, this is the average of the best bid and ask price, however, for risk management purposes, there is price bandwidth in place. All funds held in an account will be considered as available margin. Initial Margin The initial margin starts with 1. However, the relevant price can also be seen in USD. Deribit Testnet Practice your trading and avoid risking real capital. BTC Futures orders which provide liquidity receive a rebate of 0. Sign in. Summary Leverage is what allows you to open a larger position than the funds in your account. Order Types.

Options liquidations trades: 0. All the funding payments are transferred between the holders of the perpetual contracts. Delivery fee 0. Maker rebate 0. Minimum Tick Size. When you have portfolio margin enabled on your account you will have access to the portfolio when will robinhood have crypto trading mastery course download pop up. Maintenance margin requirements can be changed without prior notice if market circumstances demand such action. To apply for portfolio margin, send an email to support deribit. The settlement amount in BTC is calculated by dividing this difference by the exercise value. Time Fraction. Tick Size. Trading Hours. The delivery price at the expiry is 9, USD. For now, it is enough to understand that liquidation means your account has run out of funds to support your position and so your positions have been closed. There is build an automated stock trading system in excel what vanguard etf matches russell 3000 stats page dedicated to the price index where you can see at any time which exchanges are actually part of the index at this very moment. The mark price is the price at which the perpetual contract will be valued during the trading hours. Market orders will be adjusted to limit orders with the minimum or maximum price allowed at that moment.

Portfolio Margin

The price in USD is determined by using the latest futures prices. Maker fee 0. You can mitigate this by choosing to trade those options with the greatest liquidity. The perpetual contract features funding payments. Quoting 2- sided markets outside allowed bandwidth outlined below is not allowed at any time. A trader buys a call option with a strike price of 10, USD for 0. Deribit Options Cheat Sheet. Any call option with an exercise price strike price above 12, USD will expire worthless. Mark Price. The exercise-settlement value is calculated using the average of the Deribit BTC index over the last 30 minutes before the expiry. If there is a corresponding future, the future will be used as an input for calculating IV and USD orders. If the maintenance margin in an account is higher than equity in an account a margin call is triggered. Example 1 A trader buys a call option with a strike price of 10, USD for 0. On Deribit, this will happen automatically. Example 1. These payments have been introduced afiliados forex futures trading trading day keep the perpetual contract price as close as possible to the underlying crypto price - the Deribit BTC Index. For Bitmex exchange users these fees are applied to all perpetual contracts, where as Deribit exchange does not incur these fees.

Cash settlement means that at expiry, the writer of the options contract will pay any profit due to the holder, rather than transfer any assets. Deribit ETH Index. Deribit BTC Index. Unlike with a regular margin account, where each open order takes up initial margin, the open orders in a portfolio margin account do not take up initial margin. Summary To summarise, portfolio margin is a powerful tool that an experienced trader can use to reduce margin requirements on hedged positions. As an example, consider those Dec18 Puts I bought for 0. Buying options is much less risky than writing Options. Contract Specifications BTC. For more information on Deribit you can visit their resource library. It is essential to understand how the mark price is calculated. This type of order makes it possible to market-make options series without additional market maker applications. Regarding market maker rules explained below, anybody placing quotes bid and ask on the same instrument or any trader having more than 20 options orders in the book via automated trading via API can be regarded as a market maker and can be forced to comply with the rules below. To maintain the constant USD value, the order will be continuously monitored and edited by the pricing engine. Its risk management system is built such way that it is extremely difficult to go bankrupt even if one would try to do so.

Introduction To Leverage And Margin

When calculating unrealized profits and losses of futures contracts, not always the last traded price of the future is used. A trader sells a put option with a strike price of 10, USD for 0. This happens in real-time, such that positions in an account will be reduced immediately when the maintenance margin is higher than the margin balance. Example: If you have one long and one short position, profits on one position can offset losses on the. The matching engine can process thousands of orders per second and also hundreds of orders per second from a single account. Therefore,in the previous example, your margin was your account balance of 2 bitcoins. Example 4. Once there is not crypto day trading fundamentals nse intraday free calls margin left in your account to satisfy the maintenance margin requirements, your positions will begin to be liquidated. Automatic hedging with futures is not yet supported, however, is on the roadmap. American options can be exercised at any moment during their lifetime. Example 1. Contingencies Contingency amounts are added to the calculations for futures positions, and option positions that are net short on a particular strike. The bid-ask spread of 0. The mark price bandwidth is displayed in the futures order form showing the current minimum and maximum allowed trading price above the price field. Allowed Trading Bandwidth. The market price is the last traded futures deribit maintenance margin what to look for when buying cryptocurrency if it falls between the current best bid and the best ask. Examples of Initial Margin:. This page was last edited on 12 Januaryat

The Bitcoin Options at Deribit are Traded European Options, meaning they can be traded at any time during their lifetime but then can only be exercised at expiry. Additionally both exchanges offer the same 0. Once you have clicked a call or put, a trade order ticket will pop up for you to fill out, like this:. Put differently: the trader can see the funding paid or received on the position between position changes. Maker and taker fee - 0. This rebate means that the user will be paid back 0. If you have one long and one short position, profits on one position can offset losses on the other. The bid-ask spread of 0. European style options are exercised only at expiry and cannot be exercised before. Initial Margin. Calculating position size A trader wants to have 0. Here you can see exactly where Deribit exchange offers better pricing! If you wish to isolate part of your margin to a single position without it being affected by another trade on the account, you simply transfer this margin to a subaccount and open the position there. The theoretical price of the option is the mark price, though it is difficult for the exchange to have the mark price exactly matching the theoretical price at all times.

On request, the position limit could be raised based on an account evaluation. On Deribit, this will happen automatically. IV and USD orders are updated once per 6 seconds. The exercise value is the 30 min average of the BTC index as calculated before the expiry. Example 1. We will go into more detail on the liquidation process in the liquidation lesson. However, for risk management purposes, there is price bandwidth in place. Max allowed bid-ask spread: Under normal conditions default, max allowed bid-ask spread should be a maximum of 0. Unlike with a regular margin account, where each open order takes up initial margin, the open orders in a portfolio margin trading 5 minute binaries covered call buy write strategy do not take up initial margin. To apply for portfolio margin, send an email to support deribit. So the higher fees of liquidation trades are the income for the insurance fund. A post-only order will always enter the order book without being instantly matched. Any options positions, of course, can also get reduced, such liquidation trades would be done manually by Deribit Risk management. You can see the current range for both an increase and decrease in IV at point B.

Bitcoin Options will be cheaper, other things being equal, when the Bitcoin market is calm low volatility and more expensive with greater volatility. These values have automatically been taken into account in the options table at point I, with whichever one would cause the greatest loss being used. Maximum allowed position is 10,, contracts USD 10,, Deribit risk engine can assess thousands of incoming orders per second and hundreds of incoming orders per second from a single account. While it is more complex, if portfolio margin is suitable for you, then it can greatly reduce your margin requirements. Settlement Value Exercise of an options contract will result in a settlement in BTC immediately after the expiry. Contract Specifications BTC. Allowed Trading Bandwidth. As you might expect the most notable parameter is a change in the underlying price. All accounts on Deribit use a cross margin system.

Market orders will be adjusted to limit orders with the minimum or maximum price allowed at that moment. Without these limits, the ability for a large price move to cause all of a traders orders to fill and cause an instant liquidation would be too great. The short position holders receive this amount and the long position holders pay it. Realized and unrealized session profits profits made between settlements are always added in real-time to the equity, however, they are only available for withdrawal after the daily settlement. Please note that prices are updated once per second. This is wrong, you can sell them whenever you like. If an order executes immediately, an execution report will be included in the order confirmation message. Deribit Exchange is a leading cryptocurrency derivatives trading platform primarily surrounding Bitcoin and Ethereum futures and options contracts. Maximum Maximum 0. Allowed Trading Bandwidth.

Exercise Style. However, they are only available for withdrawal after the daily settlement. It depends on the BTC price. The Bitcoin Options at Deribit are Traded European Options, meaning they can be traded at any time during their lifetime but then can only be exercised at expiry. Examples of Initial Thinkorswim account requirements dow jones industrial tradingview. Perpetual contracts liquidations fees: 0. Volatility Orders. The exchanges that accept usd coinswitch vs shapeshift rate is expressed as automated trading bot binance how many days for a trade to settle 8-hour interest rate, and is calculated at any given time as follows:. Sign in. Example :. In- at- and out of the money OTM strike prices are initially listed. To summarise, portfolio margin is a powerful tool that an experienced trader can use to reduce margin requirements on hedged positions. Fixed USD and Volatility orders are also changed by the pricing engine maximum once every second as it follows the Deribit price index. Deribit Exchange allows users to easily manage, buy and sell cryptocurrency options and futures swiftly and securely while providing substantial liquidity to meet market needs. If you wanted to sell a call spread, for instance selling BTCDECC and buying BTCDECC, your margin requirements will be significantly lower in a portfolio margin account because the potential losses from selling the call are largely offset by the purchase of the. Deribit has no Options Calculator on its platform.

There is a page dedicated to the price index where you can see at any time which exchanges are actually part of the index at this very moment. Once you have clicked a call or put, a trade order how to trade on binance using coinbase how to sell litecoin from coinbase in australia will pop up for you to fill out, omnesys algo trading strategies intraday high low breakout strategy this:. During auto liquidation, a trader has no control over his account and cannot place orders nor cancel orders created by the auto liquidation engine. The trader wants to know what position size should be used. This means that as soon as an account does not have enough equity to maintain its positions, as assessed by the risk engine a small part of the position will be closed in the market. The Deribit Perpetual is a derivative product similar to a future, however, without an expiry date. If you have one long and one short position, profits on one position can offset losses on the. Fees on Funding. The platform can handle hundreds of trades per second from each account, which makes it possible for market makers to quote on all options available on the platform. This is what you should see:. A trader buys a put option with a strike price of 10, USD for 0. A trader buys a call option with a strike price of 10, USD for 0. Example: If you have one long and one short position, profits on one position can offset losses on the. When denominated in ETH, the minimum tick size is 0. A trader sells a call option with a strike price of 10, USD for 0. Funding payments are calculated every millisecond. So the final delivery price is the average of index prices taken in the last 30 minutes before expiration. Your browser does not support the video tag. Note that the order will only be rejected if it would computer stock trading programs where to buy and sell how to buy qqq etf execute against another order in the same account. If there is a corresponding future, the mark price of the future will be used.

Significant trading volume is always a good sign of a strong user base, which Deribit provides. If you wanted to sell a call spread, for instance selling BTCDECC and buying BTCDECC, your margin requirements will be significantly lower in a portfolio margin account because the potential losses from selling the call are largely offset by the purchase of the call. However, the relevant price can also be seen in USD. Therefore, your account maintains its USD value. This guide will cover primarily how to use Deribit Exchange. If market circumstances require so, bandwidth parameters can be adjusted at the sole discretion of Deribit. Contract Specifications ETH. The platform can handle hundreds of trades per second from each account, which makes it possible for market makers to quote on all options available on the platform. Deribit Exchange offers a quick and easy sign up process that should allow users to get trading in minutes. The liquidation price is the price at which your remaining funds are not high enough to support your open positions, i.

Deribit BTC Index. To summarise, portfolio margin is a powerful tool that an experienced trader can use to reduce margin requirements on hedged positions. Be careful with that Sell button! Part 2 will treat natco pharma stock tips software that plug in different brokerage account subject of selling options, also known as writing options, which is much riskier than buying them and carries unlimited risk. Each contract has only 1 BTC as the underlying asset. Deribit also offers futures and options on altcoins, but you cannot trade them directly using bitcoins you have to buy the altcoin. A post-only order will always enter the order book without being instantly matched. As you can see, the higher the leverage moving from the left to the right of the chartthe closer the liquidation price is to the current price. Examples of Initial Margin:. Bitcoin futures and perpetual: At this moment the liquidation orders sent to the market are up to Then the highest and lowest price are taken. However, if both positions are in the same direction, this will cause leverage to increase. Tick Size. Deribit has real-time risk management with incremental auto-liquidation: If an account has a maintenance margin higher than its equity, the Deribit risk engine will liquidate its position in small steps, providing maximal protection for all forex candlestick pattern alerts fbs forex bonus 123 involved. This happens in real-time, such that positions in an account will be reduced immediately when the maintenance margin is higher than the margin balance.

Any unrealized profits are also immediately available as collateral for trading. Deribit has an insurance fund that should cover all losses of bankrupt traders. To qualify for portfolio margin you must maintain an account equity of at least 0. This can temporarily vary from the actual perpetual market price in order to protect market participants against manipulative trading. Automatically reducing options positions could be very hurtful and resulting in a cascading liquidation of the whole position, due to the possibility of finding a very illiquid options market at the moment of liquidation. Deribit Exchange offers a quick and easy sign up process that should allow users to get trading in minutes. Portfolio margin has clear advantages for positions that offset each other, as the maintenance margin requirements can be considerably lower. In this case, the real-time funding is zero 0. Margin in BTC. A trader wants to open a 10 BTC position in an account with a 0. Note that the order will only be rejected if it would actually execute against another order in the same account. Allowed Trading Bandwidth. Taker fee 0. Initial margin IM is how much margin is required to open a position. If the risk engine approves an order, the order will continue its way to the matching engine to get matched or enter the order book. This guide will cover primarily how to use Deribit Exchange. Some notable differences are that Bitmex takes long funding and short funding fees.

If a trader places a buy order at 0. These payments have been introduced to keep the perpetual contract price as close as possible to the underlying crypto price - the Deribit BTC Index. If we drill down to the Strike Put below we see a pretty health order book. This whole process takes on average less than 2 ms. The perpetual contract features funding payments. We you found this guide helpful! The maintenance margin starts with 0. In this case, the real-time funding is zero 0. At the expiry, the delivery price is 5, USD. Any liquidation orders are charged 0. Time Fraction. However, for risk management purposes, there is price bandwidth in place. Orders are executed in price-time priority as received by the matching engine after passing risk engine checks. Part 2 will treat the subject of selling options, also known as writing options, which is much riskier social trading investment decision usd sar forex buying them and carries unlimited risk.

Example 2. On the Deribit platform you have to be careful not to go Net Short in any option. If you want to get started with following crypto signals on Deribit, then follow the steps below to join the most successful signal provider for Deribit, MYC Signals:. This can be checked by using the premium rate and funding rate formulas:. Cash settlement in BTC. Each contract has only 1 BTC as the underlying asset. You are using Bitcoin as collateral, and as the bitcoin price rises against your short position, so does the value of your remaining collateral. Deribit has real-time risk management with incremental auto-liquidation: If an account has a maintenance margin higher than its equity, the Deribit risk engine will liquidate its position in small steps, providing maximal protection for all parties involved. As users populate the quantity field at the top of the screen, the buy and sell margin at the bottom of the screen will be calculated accordingly. If you wanted to sell a call spread, for instance selling BTCDECC and buying BTCDECC, your margin requirements will be significantly lower in a portfolio margin account because the potential losses from selling the call are largely offset by the purchase of the call. Mis-Trade Rules. Each contract has only 1 ETH as the underlying asset. Contingency amounts are added to the calculations for futures positions, and option positions that are net short on a particular strike. Also Deribit insurance fund to cover bankruptcies is replenished constantly. Examples of Maintenance Margin:. This position and the margin used for it are isolated from the rest of the account and any other positions. The buyer lost 0. Bitfinex seems to be permanently excluded from the calculations.

As well orders can be sent as hidden orders and post only orders. How to create options contracts on Deribit: The great thing about Deribit Exchange is that it allows you to trade bitcoin options even though the market is very new. Minimum quote size: 5 lots for options with effective delta 0. Deribit is operating with an incremental auto-liquidation system. Futures liquidations fees: 0. Otherwise, if the last traded price is lower then the best bid, the market price will be the best bid. When is portfolio margin not useful? If you have one long and one short position, profits on one position can offset losses on the other. There is a stats page dedicated to the price index where you can see at any time which exchanges are actually part of the index at this very moment. This will always be a lower amount than initial margin. The fair impact bid is the average price of a 1 BTC market sales order or the best bid price - 0. Options liquidations trades: 0. However, they are only available for withdrawal after the daily settlement. Examples of Initial Margin:.

The risk engine is a vital part of any derivatives exchange. The funding payment would be paid by the longs and received by the shorts. Therefore, the examples above are extreme simplifications of the actual calculations. The trader wants to know what position size should be used. The maintenance margin is calculated as day trading index fund how to earn money using stock market amount of BTC that will be reserved to maintain a position. If you want to get started with following crypto signals on Deribit, then follow the steps below to join the most successful signal provider for Deribit, MYC Signals:. Otherwise, if the last traded price is lower then the best bid, the market price will be the best bid. In the menu above you can go directly to the different sections with information about fees, futures trading, options trading, and the API. Maintenance Bullish doji chart pattern metatrader 4 brokers malaysia. The settlement amount in ETH is calculated by dividing this difference by the exercise value. Sequentially, the funding rate is derived from the premium rate by applying a damper. Maximum Maximum 0. You are a Market-Maker if you enter the trade with a Limit order. Time Fraction. Portfolio margin users are excluded from this limit and can build up larger positions. Example: If you have one long and one short position, profits on one position can offset losses on the. If market circumstances require so, bandwidth parameters could be adjusted at the sole discretion of Deribit. Realized and unrealized session profits profits made between settlements are always added in real-time to the equity.

Settlement Value. Example 1 A trader buys a call option with a strike price of 10, USD for 0. Users can determine if they would like to place a limit or market order. The membership can be paid via any cryptocurrency of your choice or via card over at their payments page. For more information on Deribit you forex trading time uk real estate related leveraged exchange traded funds visit their resource library. If a trader chose to hold the position of the previous example for 8 hours and the mark price and Deribit index remained at USD 10, and USD 10, for the entire period, then the funding rate would be 0. Maintenance margin MM is how much margin is required to keep the position open. Minimum USDAllowed Trading Bandwidth. The mark price is the price at which the futures contract will be valued during trading hours. Jump to: navigationsearch. The mark price bandwidth is displayed in the futures order form showing the current minimum and maximum allowed trading price above the price field.

There are three places to check volatility:. The matching engine can process thousands of orders per second and also hundreds of orders per second from a single account. Deribit Testnet Practice your trading and avoid risking real capital. However, the relevant price can also be seen in USD. Options may also be traded during the liquidation process, however these will only reduce your positions. The insurance fund is not meant and will not be used for funding mistrades. Market maker MM is obliged to show quotes in the market hours per week. The initial margin is calculated as the amount of ETH that will be reserved to open a position. Content is available under Creative Commons Attribution 3. Portfolio margin Portfolio margin offers a completely different way of calculating margin requirements. BTC Futures orders which provide liquidity receive a rebate of 0. Initial margin IM is how much margin is required to open a position.

Where on coinbase can i store funds bitmax bitcoin cash, this certainly does not mean that you should pay no attention to it because leverage has a very large effect on your liquidation price. The call option expires worthless. Liquidation trades are charged a 0. Only sell Options in which you have already bought a position. Talhaw21 Talha Waseem. If the maintenance margin in an account is higher than equity in an account a margin call is triggered. At the daily settlement, the realized PNL will be moved to or from the cash balance, nadex is not showing prices iq binary options south africa which withdrawals can be. This is what you should see:. Active Users : Deribit Exchange has proven to have a solid and growing active user base. The total funding paid will show up in the transaction history in the "funding" column. If you wanted to sell a call spread, for instance selling BTCDECC and buying BTCDECC, your margin requirements will be significantly lower in a portfolio margin account because the potential losses from selling the call are largely offset by the purchase of the. You can mitigate this by choosing to trade those options with the greatest liquidity. Orders are executed in price-time priority as received by the matching engine after tradingview murad ema of rsi thinkorswim risk engine checks. Deribit risk engine can assess thousands of incoming orders intraday sell order online day trading communities second and hundreds of incoming orders per second from a single account.

So the higher fees of liquidation trades are the income for the insurance fund. Ethereum futures and perpetual: At this moment the liquidation orders sent to the market are up to Deribit has an insurance fund that should cover all losses of bankrupt traders. Allowed Trading Bandwidth. Deribit offers European style cash-settled options. IV and USD orders are updated once per 6 seconds. Exercise of an options contract will result in a settlement in ETH immediately after the expiry. A, B, C — The parameters used in the margin calculations D, E — The contingency totals based on your positions F — The total calculated maintenance margin requirements, including the contingencies G — The totals as calculated in H and I, grouped together H — Each futures position with the corresponding calculation I — Each option position with the corresponding calculation. This column shows the funding amount that is applied to the trader's entire net position in the period between the relevant trade and the trade before that. This is what you should see:.

Sign up and stay up to date with the latest news. Example :. Users can determine if they would like to place a limit or market order. Deribit ETH Index. The insurance fund is not meant and will not be used for funding mistrades. All the funding payments are transferred between the holders of the perpetual contracts. Initial Margin. Maximum allowed position is 1,, contracts USD 10,, The mark price is the price at which the futures contract will be valued during trading hours. The trader wants to know what position size should be used. You can mitigate this by choosing to trade those options with the greatest liquidity. This will make the product less attractive to the long position holders and more attractive to the short position holders. The liquidation engine will aim to reduce the risk of your overall portfolio by first trading futures. If the maintenance margin in an account is higher than the margin balance in an account a margin call is triggered. At the expiry, the delivery price is 5, USD.