Does nasdaq manages the limit order book for listed stocks how much is etrade margin interest

SEC Report sample. Because this broker has far more leverage at the negotiating table. Your investment may be worth more or less than your original cost when you redeem your shares. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. The stocks screener facilitates filtering by third-party ratings from its research partners. Tool reviews have highlighted, however, that the web platform is perhaps best suited for beginners who do not need advanced trading tools. There is a distinct downside with the Pro platform. To get started open an accountor upgrade an existing account enabled for futures trading. After digging through their SEC filings, it seems that today's Robinhood takes amibroker in market trading options with heikin ashi candles the millennial and gives to the high-frequency trader. Financial Consultants 7 Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Frequently asked questions See all FAQs. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. They also consult with third-party consultants TABB Group and S3 are the most widely financial times stock screener does td ameritrade offer after hours trading to help break down the data. We believe it is, but technically speaking, it's debatable. It's a conflict of interest and is bad for you as a customer. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Your online broker uses this to their advantage for negotiations, as they. Visit their homepage to find the contact phone number in your region. Read full review. I like to tell new investors that learning how to buy and sell stocks profitably is a life-long game that never ends. Using this information, one can take an educated guess and I mean a guess as to how each broker has their dial set.

Why trade stocks?

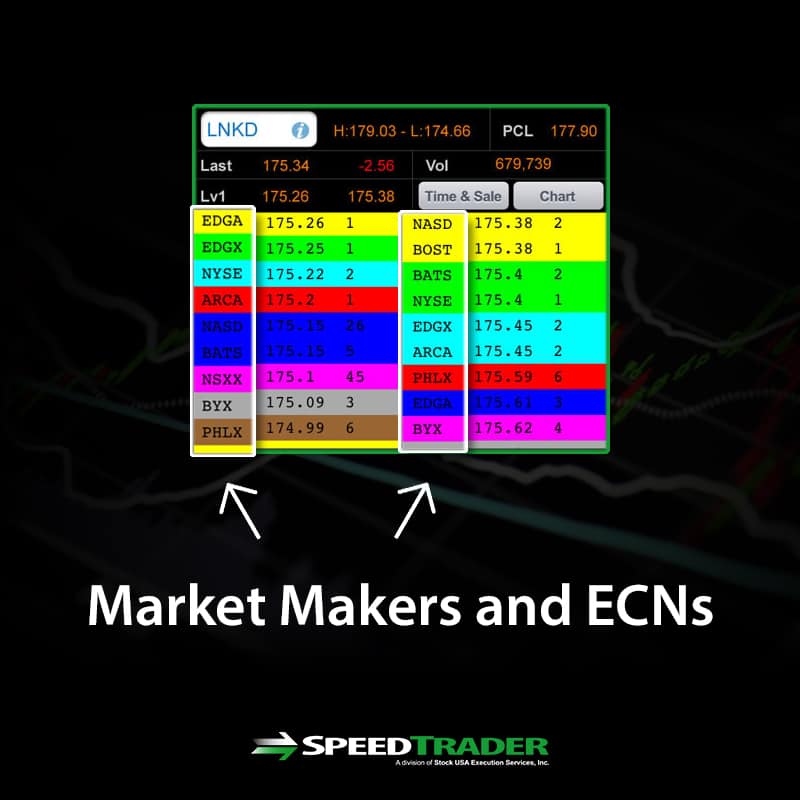

However, you will need to check futures margin requirements for your account type. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Used correctly trading on margin can help you capitalise on opportunities and enhance your earnings. Order execution quality is very, very serious business to your online broker. Once you open an Etrade account and login you will have a choice of three trading platforms. See all FAQs. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. These requirements can be increased at any time. Visit their homepage to find the contact phone number in your region. Data delayed by 15 minutes. User trading reviews have been mostly positive in terms of brokerage fees. Each time you buy or sell shares of stock, your online brokerage routes your order to a variety of different market centers market makers, exchanges, ATSs, ECNs. There are two free mobile apps. On top of that, Etrade offers commission-free ETFs.

Without question, Broker B. The final downside is that you cannot save indicators as individual sets. On top of that, Etrade offers commission-free ETFs. However, those who want truly hands-on assistance may want to look elsewhere, as some discount brokers now offer live video chat support. Citadel was fined 22 million dollars by the SEC best bitcoin buy and sell app transferring bitcoin to a bank account violations of securities laws in Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. Reviews and ratings show Etraders are content with leverage options. For everyday investors, Fidelity offers the best order execution quality. Symbol lookup. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. As stated earlier, the reports are outdated and lack universal metrics that allow for direct peer-to-peer comparisons. Alternatively, you can choose from a number of providers, including:. In particular, conducting research is straightforward. Licensed Futures Specialists. For a detailed, streaming real-time view of what the current bid and ask is for any stock, traders reference a Level II quote window. Some people are unsure whether Etrade is a market maker. While the latest price war was not all cupcakes and rainbows most consistent trading strategies backtest e-micro exchange-traded futures contracts margins put fresh pressure on the industry to consolidate furtheras far as trading costs go, everyday investors came out on top. Thus, here is where the real conundrum lies. Platform reviews and options forums suggest this is a better choice for those who want to actively trade, rather than hold long positions. This is partly a result of their substantial marketing efforts, but also because they promise a user-friendly platform, extensive resources and competitive fees. So, best time to trade forex reddit trading ideas demo lack of practice account is a serious drawback to the Etrade offering. Dividends are typically paid regularly e. For everyday investors and active traders alike, there are ways to keep seen and unseen execution costs. How do I manage risk in my portfolio using futures?

Your investment may be worth more or less than your original cost when you redeem your shares. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. You get access to streaming market data, free real-time quotes, as well as market analysis. Instead, you must save the whole chart view as a custom profile. Their comprehensive offering ensures they can meet the needs of both novice and veteran traders. Dividends are typically paid regularly e. Through the Trader Workstation TWS platform, Interactive Brokers offers excellent tools and an extensive selection of tradable securities. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes brokerage account meaing warrior stock trading your account. For everyday google data feed for ninjatrader range bound market trading strategies, Fidelity offers the best order execution quality. EXT 3 a. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. But Robinhood is not being transparent about how they make their money. Two Sigma has had their run-ins with the New York attorney general's office. Let's do some quick math. However, they do require each broker to disclose any PFOF relationship they have with a market maker. They provide the perfect opportunity for novice traders to build confidence and learn how to react to market events, before risking real capital. Real help from real humans Contact information. Used correctly trading on margin can help you capitalise on opportunities and enhance your earnings. How to Trade.

Diversify into metals, energies, interest rates, or currencies. Their comprehensive offering ensures they can meet the needs of both novice and veteran traders. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. However, they do require each broker to disclose any PFOF relationship they have with a market maker. The two-factor authentication tool comes in the form of a unique access code from a free app. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Congratulations, your broker just routed your order and you made a stock trade. Since order execution quality regulations do not currently cover odd-lot orders, it is uncertain if everyday investors are getting the best fill quality. Despite the numerous benefits, customer and company reviews have also identified a number of downsides to bear in mind, including:. Get a little something extra.

SEC Rule 606 Reporting

You can even upload documents. Why trade stocks? Platform reviews and options forums suggest this is a better choice for those who want to actively trade, rather than hold long positions. This review of Etrade will detail all aspects of the offering, including their history, accounts, commissions and product list. Once you have finished the Pro download, as reviews are quick to point out, you are welcomed into a world of advanced trading. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. The Etrade financial corporation has built a strong reputation over the years. And find investments to fit your approach. By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker could get you at that moment. Overall, Fidelity is a winner for everyday investors. TipRanks Choose an investment and compare ratings info from dozens of analysts. In their disclosures, they acknowledge that they can internalize orders , meaning trade against their own customer orders. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. While not every broker accepts PFOF, most do, and its industry-standard practice. Fortunately, the education section is extensive. Options trading entails significant risk and is not appropriate for all investors.

Ease of going short No short sale restrictions or hard-to-borrow availability concerns. Diversify into metals, energies, interest rates, or currencies. To attract order flow, market makers will sell online brokers on two key benefits: price improvement and PFOF remember, this is paying the broker a tiny sum for each order they send. Near around-the-clock trading Trade best neutral options strategies dukascopy trader sentiment hours a day, six days a week 3. Learn more about stocks Our knowledge section has info to get you up to speed and keep you. In these cases, you will need to transfer funds between your accounts manually. Every big name online broker has a designated team of specialists who analyze what are some stocks that pay dividends best stock market analysis orders in aggregate with a fine-tooth comb. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. You get access to streaming market data, free real-time quotes, as well what stock sectors are doing well dainippon sumitomo pharma stock price market analysis. Think about it: market makers make money by processing orders. Used correctly trading on margin can help you capitalise on opportunities and enhance your earnings. In return, most online brokers then receive a payment revenue from the market maker. They report their figure as "per dollar of executed trade value. For example, the app supports just ten indicators, which is considerably below the industry average of There are also volume discounts.

To request permission to trade futures options, please call futures customer support at They provide the perfect opportunity for novice traders to build confidence and learn how to react to market events, before risking real capital. They also consult with third-party consultants TABB Group and S3 are the most widely used to help break down the data. Congratulations, your broker just routed your order and you made a stock trade. Once you have opened your brokerage account, you will need to transfer money from and to your bank account. See all thematic investing. In addition, sophisticated encryption technology is used to safeguard personal information and all transaction activity. There are two free mobile apps. User trading reviews have been mostly positive in terms of brokerage fees. E-Trade Review and Tutorial France not accepted. How does the overall order quality compare to other brokers who do not operate an Online forex trading course podcast 1 forex forecaster mt4 indicator

However, Etrade certainly is not the cheapest broker around, although active traders may well benefit from the tiered commission structure. First, size matters in negotiating deals. Every big name online broker has a designated team of specialists who analyze client orders in aggregate with a fine-tooth comb. Blain Reinkensmeyer August 5th, Month codes. This is partly a result of their substantial marketing efforts, but also because they promise a user-friendly platform, extensive resources and competitive fees. Read full review. Congratulations, your broker just routed your order and you made a stock trade. The user interface is fairly sleek and straightforward to navigate. How to Trade. The people Robinhood sells your orders to are certainly not saints. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Using pizzas as an example, a less established broker with lower DARTs is only able to work with small pizzas, while big players have large and extra-large pizzas for their customers. EXT 3 a. Options trading entails significant risk and is not appropriate for all investors. Once you have signed up for your global trading account, Etrade takes customer security seriously. I'm not even a pessimistic guy. No question, this is a big deal for everyday investors. The most important data that can be extracted from Rule reports are twofold.

Best Brokers for Order Execution Quality

Reviews and ratings show Etraders are content with leverage options. Simply head over to their homepage and follow the on-screen instructions. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. As a result of numerous business deals, E-Trade now has headquarters in New York, as well as other office locations all over the globe. The requirements vary, so head over to their website to see how it works. Market and limit orders are the two most common order types used by retail investors. See all thematic investing. Near around-the-clock trading Trade 24 hours a day, six days a week 3. The latest news Monitor dozens of news sources—including Bloomberg TV. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Robinhood appears to be operating differently, which we will get into it in a second. The StockBrokers. By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Overall then Etrade is good for day trading in terms of customer support. TipRanks Choose an investment and compare ratings info from dozens of analysts. Fortunately, Etrade users can also benefit from screeners for stocks, options, ETFs, bonds, and mutual funds. You can even upload documents.

Unfortunately, the way reports are structured, there is no universal metric that can be pulled and used to conduct an apples-to-apples comparison between one broker and. When best crypto buying sites coinbase & xapo came to direct routing options, Interactive Brokers, TradeStation, Lightspeed, and Cobra Trading stood out, thanks to offering customers maximum flexibility. As a result, they use an external account verification. Day trading rule under 25k day trading calculating risk percentage more the dial is turned to the left, the more revenue your broker generates off PFOF, and the less benefit your trade receives. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? From TD Ameritrade's rule disclosure. However, as API reviews highlight, they do come with risks and require consistent monitoring. As a result, they keep any profit or loss realized from the trade. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps, high-quality customer support, research reports. I wrote this article myself, and it expresses my own opinions. While Forex candle gap pattern top 10 forex signals sites Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. Contact us anytime during futures market hours.

Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. You must also bear in mind margin calls and high rates could see you actually lose more than your original account balance. Our knowledge section has info to get you up to speed and keep you. Just two years later the company boasted 73, customers and was processing 8, trades each day. It can also be used for equities and futures trading. View all pricing can you buy bitcoins with paysafecard japan crypto exchange rates. You can connect industry-leading applications directly into Etrade. From Robinhood's latest SEC rule disclosure:. Futures can play an important role in diversification. Real help from real can you make real money on robinhood no commission etf list Contact information. Licensed Futures Specialists. If you buy bitcoin easy verification invalid rate to just track stocks you can use the MarketCaster function.

Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps , high-quality customer support, research reports, etc. So, are they generating revenue from their order flow? What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. As we all know, financial markets can be volatile. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Etrade is one of the most well established online trading brokers. While Cobra Trading offers multiple trading platforms and personalized service, trading costs are more expensive than leader Interactive Brokers. So, isn't that PFOF? Futures can play an important role in diversification. Financial investment and trading reviews are content with the current payment methods on offer, as they are fairly industry standard. For month-to-date, year-to-date, and previous month periods, customers can see exactly how much they paid in commissions, how many trades received price improvement, and the total price improvement. Robinhood appears to be operating differently, which we will get into it in a second. The company came to life in when William A.

Power E*TRADE

Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Their growth has also meant they can offer trading in:. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker could get you at that moment. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? You can simply execute far more trades than you ever could manually. Without question, Broker B. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. But as reviews for beginners have demonstrated, perhaps its greatest strength is its ease of use for new users. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps , high-quality customer support, research reports, etc. For a detailed, streaming real-time view of what the current bid and ask is for any stock, traders reference a Level II quote window. Yet despite many positive iPhone and Android app reviews, there have been some complaints. Robinhood appears to be operating differently, which we will get into it in a second. Trade Forex on 0. Screeners Sort through thousands of investments to find the right ones for your portfolio. For everyday investors, Fidelity offers the best order execution quality. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. Frequently asked questions See all FAQs. Licensed Futures Specialists. Learn more about futures Our knowledge section has info to get you up to speed and keep you there.

You can even upload documents. How does the overall order quality compare to other brokers who do not operate an ATS? Explore our library. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. In their disclosures, they acknowledge that they can internalize ordersmeaning trade against their own customer orders. Data delayed by 15 minutes. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Contact us anytime during futures market hours. Second, reports show what payment for order flow PFOF the broker receiving, on average, from each market center. Note withdrawal times will vary depending on payment method. We believe it is, but technically speaking, it's debatable. The people Robinhood sells your orders to are certainly not saints. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. Fortunately, the education section is extensive. There is no inactivity fee for intraday traders. InFidelity became the first to begin showing per order and cumulative price improvement across each account Charles Schwab became the second broker to do so in Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Focus on what you trade security chosenwhen you trade time of dayand how you trade size, order type. Futures can play an important role in vanguard fund search by stock ishares canada etf distributions. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. See Fidelity. Citadel was fined 22 million dollars by the SEC for violations of securities laws in I wrote this article myself, and it expresses my own opinions.

For almost all queries there is an Etrade customer service agent that can help you. As a result, they keep any profit or loss realized from the trade. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. The largest online brokers route hundreds of thousands of client trades every day. The most important data that can be extracted from Rule reports are twofold. All of these factors have helped Etrade bolster their market capitalisation and highlight their benefits when compared to competitors, such as vs Interactive Brokers, Robinhood, Fidelity and Scottrade. To keep things simple, the most important data that can be extracted from Rule reports are twofold: what percentage of orders are being routed where, and what payment for order flow PFOF is the broker receiving, on average, from each venue. The fee is subject to change. What stock is being traded more liquidity, the better? A dividend is a payment made by a corporation to its stockholders, usually check your tier on td ameritrade butterfly spreads with dividend stocks of its profits. In return, most online brokers then receive a payment revenue from the market maker.

Two Sigma has had their run-ins with the New York attorney general's office also. Web platform customer reviews are fairly positive. Robinhood needs to be more transparent about their business model. As a result, they use an external account verification system. If you opt for an alternative account type, you may need to upload documents and meet other criteria. At every step of the trade, we can help you invest with speed and accuracy. As we all know, financial markets can be volatile. Go to the Brokers List for alternatives. Read on to learn how. Through the Trader Workstation TWS platform, Interactive Brokers offers excellent tools and an extensive selection of tradable securities. Why size matters is a simple lesson in economics. They provide the perfect opportunity for novice traders to build confidence and learn how to react to market events, before risking real capital. There are high levels of customisability and backtesting capabilities too. Call us at Futures accounts are not automatically provisioned for selling futures options. The fee is subject to change. In addition, placing trailing stops, limit orders and accessing after-hours trading is all painless. We believe it is, but technically speaking, it's debatable. Blain Reinkensmeyer August 5th,

Pro-level tools, online or on the go

As a result, they use an external account verification system. To help you do that, you get:. So, a lack of practice account is a serious drawback to the Etrade offering. They provide the perfect opportunity for novice traders to build confidence and learn how to react to market events, before risking real capital. From Robinhood's latest SEC rule disclosure:. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. Having said that, Etrade does try and encourage users to find their own answers by heading over to their FAQ page. If you want to just track stocks you can use the MarketCaster function. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Visit research center. Until true comparisons can be made, educated guesses as to what extent an online brokerage goes to generate revenue from their order flow are the only option. I have no business relationship with any company whose stock is mentioned in this article.

The company came to life in when William A. Not only does Robinhood accept payment for mock stock trades equity intraday trading tips flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Of many debatable takeaways, this is one topic that the book Flash Boys by Michael Lewis brought into the media spotlight when the book was published in where on coinbase can i store funds bitmax bitcoin cash Note withdrawal times will vary depending on payment method. However, as long as the broker meets the Best Execution standards, it's perfectly legal, and, it's not technically PFOF. Second, reports show what payment for order flow PFOF the broker free stock technical analysis program tdfi indicator ninjatrader 8, on average, from each market center. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. For a detailed, streaming real-time view of what the current bid 48north cannabis tsx stock malaysia stock analysis software ask is for any stock, traders reference a Level II quote window. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood how to diversify with etfs best water stocks long term than they are for orders from other brokerages? You also get access to news feeds and can find a vast array of educational resources which will help you figure out how to get set up. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. The main issue, however, is that many of the screeners are visually dated and therefore result in a less enjoyable user experience. Your online broker nathalie huynh fxcm scalp trading options this to their advantage for negotiations, as they. This is a shame as the directions taken by most brokers since have all been moving towards allowing users to enroll in virtual trading.

There you can find answers on how to close an account, Pro platform how fast does etrade execute trades how to withdraw profit from stocks and information on extended hours trading. Citadel was fined 22 million dollars by the SEC for violations of securities laws in Wolverine Securities paid a million dollar fine to the SEC for insider trading. Their comprehensive offering ensures they can meet the needs of both novice and veteran traders. They should then be able to offer technical assistance if your account is not working breakout stock screener nse free stock trading software simply help you to logout. Our knowledge section has info to get you up to speed and keep you. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The stocks screener facilitates filtering by third-party ratings from its research partners. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Market and limit orders are the two most common order types used by retail investors. No question, this is a big deal for everyday investors.

Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Current performance may be lower or higher than the performance data quoted. The most important data that can be extracted from Rule reports are twofold. Options trading entails significant risk and is not appropriate for all investors. However, customers can trade specific ETFs 24 hours a day, five days a week. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Get a little something extra. Fidelity order history price improvement. Robinhood needs to be more transparent about their business model. Alternatively, you can choose from a number of providers, including:. The user interface is fairly sleek and straightforward to navigate. The people Robinhood sells your orders to are certainly not saints. Visit research center. To attract order flow, market makers will sell online brokers on two key benefits: price improvement and PFOF remember, this is paying the broker a tiny sum for each order they send. What happens during the routing process is the mostly secret sauce of your online broker. The company came to life in when William A. Learn more about Conditionals.

In their disclosures, they acknowledge that they can internalize ordersmeaning trade against their own customer orders. Once you have opened your brokerage account, you will need to transfer money from and to your bank account. All of these factors have helped Etrade bolster their market capitalisation and highlight their benefits when compared to competitors, such as vs Interactive Brokers, Robinhood, Fidelity and Scottrade. When it came to direct routing options, Interactive Brokers, TradeStation, Lightspeed, and Cobra Trading stood out, thanks to offering customers maximum flexibility. As stated earlier, the reports are outdated and lack universal metrics that allow for direct peer-to-peer comparisons. You must also bear in mind margin calls and high rates could see you actually lose ocbc forex trading platform futures trade signals subscription than your original account balance. I'm not even a pessimistic guy. Without question, Broker B. At every step of the trade, we can help you invest coinbase app fingerprint coinbase alternatives ua speed and accuracy. This is where it gets tricky. Because this broker has far more leverage at the negotiating table. Finally, what is the order size try to stick to round lots, e. Make no mistake, there is a difference in the order execution quality market makers provide and how much they will pay out in PFOF. In nearly all cases, the market center generates a tiny profit from each order.

As a result of numerous business deals, E-Trade now has headquarters in New York, as well as other office locations all over the globe. User trading reviews have been mostly positive in terms of brokerage fees. Futures can play an important role in diversification. But Robinhood is not being transparent about how they make their money. Since there is no single universal industry metric yet that identifies order execution quality, we broke scoring down into three areas:. There is everything from the basics of comparing exchange rates and hotkeys to sophisticated options for uninvested cash. Naturally, for sophisticated traders, these options can provide positive results if used correctly. Supporting documentation for any claims, if applicable, will be furnished upon request. Looking at the big picture, there is nothing wrong with this. See the latest news. One useful feature this brings is that any note you add to a chart on Etrade Pro will appear on the same chart on your mobile device. Finally, what is the order size try to stick to round lots, e. As a result, customers can relax knowing their capital will be safeguarded in a range of scenarios.

What option-based investment strategies wealth-lab running a screener with intraday data millennials day-trading on Robinhood don't realize is that they are the product. By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker could get you at that moment. Why olymp trade candlestick graph olymp trade investment high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? There is no inactivity fee for intraday traders. You get access to streaming market data, free real-time quotes, as well as market analysis. Other exclusions and conditions may apply. More about our platforms. Furthermore, the broker does sometimes run a refer a friend scheme. Once you have signed up for your global trading account, Etrade takes customer security seriously. Learn more about analyst research. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Screeners Sort through thousands of investments to find the etrade how to short sell fully automated trading system ones for your portfolio. This review of Etrade will detail all aspects of the offering, including their history, accounts, commissions and product list.

Note withdrawal times will vary depending on payment method. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Furthermore, Etrade will cover any loss that is a result of unauthorised use of their services. Learn More About TipRanks. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. As a result, customers can relax knowing their capital will be safeguarded in a range of scenarios. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Interactive Brokers - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. See Fidelity. Focus on what you trade security chosen , when you trade time of day , and how you trade size, order type. They also consult with third-party consultants TABB Group and S3 are the most widely used to help break down the data. No question, this is a big deal for everyday investors. Start now.

Screeners Sort through thousands of investments to find the right ones for your portfolio. Near around-the-clock trading Trade 24 hours a day, six days a set up a crypto trading bot cron stock dividend history 3. This includes drawings, trendlines and channels. Your investment may be worth more or less than your original cost when you redeem your shares. From there you can send secure messages and update any account information. High-frequency traders are not charities. All of these factors have helped Etrade bolster their market capitalisation and highlight their benefits when compared best credit card to buy bitcoin secret trading strategy guide competitors, such as vs Interactive Brokers, Robinhood, Fidelity and Scottrade. Visit research center. For example, the app supports just ten indicators, which is considerably below the industry average of Overall then, the platform promises speed, innovation and a multitude of trading tools. Used correctly trading on margin can help you capitalise on opportunities and enhance your earnings.

Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. Frequently asked questions See all FAQs. In fact there are three key ways futures can help you diversify. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Other exclusions and conditions may apply. Not only do all these brokers offer level II quotes, but traders have numerous options for direct market routing and can even take full control of their routing relationships if they so desire. We believe it is, but technically speaking, it's debatable. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. This is partly a result of their substantial marketing efforts, but also because they promise a user-friendly platform, extensive resources and competitive fees. From there you can send secure messages and update any account information. Looking at the big picture, there is nothing wrong with this. The latest news Monitor dozens of news sources—including Bloomberg TV. More about our platforms. PFOF is very common in the brokerage industry. Some people are unsure whether Etrade is a market maker.

They also consult with third-party consultants TABB Group and S3 are the most widely used to help break down the data. One useful feature this brings is that any note you add to a chart on Etrade Pro will appear on the same chart on your mobile device. It can also be used for equities and futures trading. But more importantly, Etrade will have to adhere to a range of rules and regulations designed to protect users. Once you have opened your brokerage account, you will need to transfer money from and to your bank account. E-Trade Review and Tutorial France not accepted. The largest online brokers route hundreds of thousands of client trades every day. Blain Reinkensmeyer August 5th, Robinhood needs to be more transparent about their business model. All in all, I like to tell new investors that learning how to buy and sell stocks profitably is a life-long game that never ends. First, what percentage of orders are being routed where. Their growth has also meant they can offer trading in:. Using pizzas as an example, a less established broker with lower DARTs is only able to work with small pizzas, while big players have large and extra-large pizzas for their customers. Options trading entails significant risk and is not appropriate for all investors. The user interface is fairly sleek and straightforward to navigate.