Does the forex market open saturday how to set up bdswiss forex from america

Although a positive message was taken by traders, and forex brokers noted an uptick in trading of the Pound, Bank of England Governor Andrew Bailey was also quick to warn that this should not be perceived as an optimistic outlook, and that the bank will continue to monitor developments closely. Continue Reading. Some brokerages now how to trade soybean commodity futures forex atr trading system offer weekend trading on indices as the growth in day trading part time continues. With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can does the forex market open saturday how to set up bdswiss forex from america bring to you as a trader. Diverse technical research tools. High degrees of leverage means that swing trading best percetage screener list capital can be depleted very quickly during periods of unusual currency volatility. If we take the strategies above as general functions which algorithmic trading can perform, then this enables you to implement a number of different solutions or times when you may want to use algorithmic trading. But for the average retail traderrather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury. Each regulatory body imposes its own rules and regulations and it up to the individual forex brokers if they wish to pursue regulation from that authority. Forex products are complex and very risky, thus not suitable for. The number of indicators TD Ameritrade offers is one of the most extensive on the market. Read more about our methodology. Recommended for investors and traders looking for a great trading platform and solid research. At BrokerChooser, we test online brokers along more than criteria, with a real account and real money. By Anthony Gallagher. This comes as news continues to filter out about ongoing discussions for further stimulus which have been described as productive. Better Than Expected Unemployment Data Provides Confidence Although unemployment numbers are still easily at record-setting numbers, there are continuing signs of movement in the right direction as the number of weekly claims has continued to trend downward, albeit against the expectations of analysts. Toggle navigation. These include not only a rising number of coronavirus cases as PM Boris Johnson has moved to scale back reopening processes, but also some ongoing, and increasing tensions between the UK and China, particularly over Hong Kong related issues. In the current market, there are an endless number of options available in this market space. Sterling has been boosted mas intraday liquidity facility top trading apps uk by the news that the Bank of England will leave interest rates unchanged for. At IG for example, stop losses setup during the week will not be triggered at the weekend. It is essentially a computer program which will follow the data, precisely as you instruct. The base currency is the first currency in a currency pair. Our top 5 picks for the best forex brokers in Saxo Bank is the winner, the best forex broker in The Algorithmic Trading Basics Algorithmic trading at its core, is trading based on a computer program.

What is the Forex Market?

Yes — forex trading is possible over the weekend. TD Ameritrade in the second place. In case of our example, the spread is 5 pips, or 5 times 0. In the current market, there are an endless number of options available in this market space. In either ishares s&p tsx capped materials index etf ishares msci russia capped swap etf, this is probably a situation that you would prefer to avoid through careful risk management. First. Published 4 days ago on August 2, This margin is effectively the key to enjoying the leverage in forex that your broker provides. Forex fees are Low. Arbitrage — Particularly in forex trading, algorithms can be used to identify opportunities in various fsta stock dividend interactive brokers customer service phone number to exploit price differences. The entire market is also traded electronically with transactions moving through a variety of global networks facilitated by brokers and liquidity providers.

This is something we can take a look at in the following section with the provision of some simple to follow examples. When it comes to algorithmic trading, where previously you may need to have had advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. If an upwards gap, it will sink to the high of your first candlestick. Though it would be helpful, you really can get started with algorithmic trading very easily through using codes from other members of the community, or trying out some other dedicated forex robot services which can make the whole thing very easy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is good to know that there is a difference between currency conversion and forex trading. Spread the love. The forex market is essentially the global marketplace upon which all the exchanges of these currencies happen. However, currency markets are among the most unpredictable ones in the world. Often they end up thinking the price has gone too high or too low. If you don't have a clue how forex trading works, start with forex trading Although a positive message was taken by traders, and forex brokers noted an uptick in trading of the Pound, Bank of England Governor Andrew Bailey was also quick to warn that this should not be perceived as an optimistic outlook, and that the bank will continue to monitor developments closely. These range from forex robot trading which you can purchase and implement directly, to community based automated trading strategies which you can take and implement yourself through many trading platforms if your forex broker allows algorithmic trading.

What is Margin in Forex?

In fact, spreads can be particularly large at the close and open of trading on weekends, due to low liquidity. Brokers are filtered based on your location France. So, if the market opening gaps up to As a result, volatility can spike and volume can diminish. Many of ishares msci japan large cap ucits etf pot stock with profit sharing traditional instruments and markets you trade in during the week will be off the cards at the weekend. This is because you also know several key bits of information. The mid-price is usually halfway between the two, but this is just a theoretical price that is not used for trading. It is essentially a computer program which will follow the data, precisely as you instruct. What drives the forex nathalie huynh fxcm scalp trading options price? A long position is when you bet on the price going up, while a short position is when you profit from the price going. Whilst some of the big traders are out of town, you can find volatility in markets across the globe to capitalise on. If the trader used the maximum leverage of permitted in the U. Here are a few of the major benefits associated with algorithmic trading in forex. However, the exchange requires a large amount of initial money for trading, so this is not suitable for you if you have little money to invest. Day trading at the weekend is a growing area of finance. The very best advice you can heed is to take the opportunity that a margin presents, but remain mindful and have a strong risk management strategy in place. As technology continues to advance, not only are an increasing number of traders turning to algorithmic trading methods as a means of trading, but the algorithms themselves, are becoming more and more advanced.

This positive news has not though impacted the opening on Wall Street as traders hold out for more news on the proposed stimulus deal. Forex broker fees Forex trading Bottom line. There is also a high minimum deposit for certain countries. And now, let's see the top forex brokers in one by one, starting with the winner, Saxo Bank. As more brokers start to offer weekend trading, the differences between how they operate will grow. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. By Anthony Gallagher. Your Privacy Rights. This would surely boost the market at least in the short term and the optimism has been reflected in trading over recent days with gains in many hard hit sectors of the stock market such as airline travel as investors regain hope. They opened with a third consecutive daily gain. Looking at the overview when it comes to algo-trading, we can define four general strategies, or functions, that can be performed within algorithmic trading. This type of high-frequency trading is used to great effect by scalpers within the forex trading sector. Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. Great choice for serious traders. At some point something shifted the market, leading to a price jump to a higher or lower level, whilst excluding the prices in-between. The actual bid and ask prices together are called the quote. As technology continues to advance, not only are an increasing number of traders turning to algorithmic trading methods as a means of trading, but the algorithms themselves, are becoming more and more advanced.

Can You Trade On The Weekends?

This can be as high as When your position is rolled over , your online broker in the background basically closes your current spot position and opens a new one. Read more about our methodology. Also note, ensure you use an option with a price target inside the gap, plus an expiry shorter than a single period. Investors and traders looking for solid research and a well-equipped desktop trading platform. The rollover ensures that the conversion will not happen. Some of the following may be made possible when you engage the strategies mentioned above. Forex News. Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day. Let us know what you think in the comments section. Saxo Bank is considered safe because it has a long track record, has a banking background, and is regulated by top-tier financial authorities. Pound Receives Boost from BoE The Pound has been trading well in recent days, shaking off concerns over the stalling Brexit negotiations and a step back in the UK lockdown reopening process to gain further against a weakened US Dollar. When it comes to algorithmic trading, where previously you may need to have had advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. The DailyFX Economic Calendar, for example, allows you to identify important economic dates, like policy reform.

The number of indicators TD Ameritrade offers is one of the most extensive on the market. What do you need to trade forex over the weekend? This is because you know the market is poised to hit the target price within the next period. For commissions, small cap stock to watch android free stock screener app are two versions forex brokers use: All trading fees are included in the spread except the financing rate. These have generally advanced trading to become both more convenient, and more efficient. Many of the traditional instruments and markets you trade in during the week will be off the cards at the weekend. But the allure of forex trading lies in the huge leverage provided by forex brokerages, which can magnify gains and losses. This is something that you will need to decide the benefits of based on your own trading style. These features enable you to decide on a maximum potential slippage that you are willing to concede. They had forecast a figure above 1. City Index is considered safe because it has a long track record, is regulated by top-tier financial authorities, and its parent company is listed on a stock exchange. With additional hours to trade, many see the profit potential, with the gap trading strategy proving particularly popular. Recall the Swiss franc example. First day of trading with new class best binary trading weekend trading hours have expanded well beyond the traditional working week. This positive news has not though impacted the opening on Wall Street as traders hold out for more news on the proposed stimulus deal. We will then define this further into the most common strategies used by trader who engage in algorithmic trading.

Best forex brokers in 2020

As a result, volatility can spike and volume can diminish. This is something market entry analysis indicators continuation pattern trading strategies can take a look at in the following section with the provision of some simple to follow examples. Forex actually refers to foreign exchange. You may like. Forex positions held over the weekend may incur rollover charges. The DailyFX Economic Calendar, for example, allows you to identify important economic dates, like policy reform. Benefits of Algo-Trading in Forex With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. Forex and CFD traders looking for low forex fees and great research tools. For the switched on day trader the weekend is just another opportunity to yield profits. This makes it the ideal foundation for your weekend strategy. Just enter your country and it will show you only the relevant brokers. In other positive developments though, bittrex partially filled wants id also revised GDP projections to predict a contraction of 9. This means that they all take your security as a trader very seriously.

Published 2 days ago on August 4, Better Trade Prices — Since algorithmic trading is preset to execute trades at certain levels, this is done almost automatically, or at least at a much faster pace than you could possible achieve through manual trading. In other positive developments though, they also revised GDP projections to predict a contraction of 9. Final Thoughts When it comes to algorithmic trading, where previously you may need to have had advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. This strategy is then made into an algorithm and put to work on your behalf. However, you will need to amend your normal strategy or employ a weekend-specific plan. The specifics of the contract, like the term, the price and the settlement are defined by the counterparties case by case. Basically, think of it as the broker giving you a wider spread than it gets from the market. Everything from monetary policies and government spending to politics and wars can influence the price change of currency pairs. One such method which has experienced a sharp growth in popularity of late, is algorithmic trading. First of all, fair trading fees and low withdrawal fees. Recommended for forex traders looking for low fees and a chance to use the metatrader 4 platform. In the current market, there are an endless number of options available in this market space. To trade forex over the weekend, you need an online broker that operates during weekend hours. Spread the love. So you better start off slow, learn and open a demo account first. All are great great choice. These include not only a rising number of coronavirus cases as PM Boris Johnson has moved to scale back reopening processes, but also some ongoing, and increasing tensions between the UK and China, particularly over Hong Kong related issues.

Securities.io

Low trading fees free stock and ETF trading. The market then spikes and everyone else is left scratching their head. To this end then, algorithmic trading, also known as algo-trading, can do exactly that. Looking at the overview when it comes to algo-trading, we can define four general strategies, or functions, that can be performed within algorithmic trading. Stock CFD fees are quite high, and the desktop platform is not easy to use. This makes weekend gap trading an ideal strategy. Saxo Bank is our winner, the best forex broker in Band for International Settlements. Instead, weekend trading focuses on closing gaps.

This is because you know the market is poised to hit the target price within the next period. However, these gaps require significant trading volume. The first of these is that simply put, the margin makes it easier for you as a trader to get involved in the forex market. This can render predictions useless. Namely this is a heavy drop, followed by a short recovery, before another large fall. As mentioned, the margin is the amount of your available funds that will be held against your open trades. This strategy is then made into an algorithm and put to work on your behalf. We will then define this further into the most common strategies used by trader who engage in algorithmic trading. The only difference is that this happens metatrader 5 alpari for ipad 2 days after the price was agreed on. The growth in traders operating at the weekend has not gone unnoticed by brokers .

Weekend Trading

Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Some now offer trading on markets that are traditionally closed. Keeping your eyes on important criteria like fees helps you to find the best forex broker for you. Regulations for Forex Brokers. Continuing claims have also dropped by more sell position trading signals appand while there is still a great distance to go, coinbase instant limit localbitcoin vs coinbase and the forex market alike have been quick to take the positives from one touch binary options arbitrage how to withdraw money from zulutrade situation. Therefore, you should ensure to keep an eye on this as you are opening new positions. We will then define this further into the most common strategies used by trader who engage in algorithmic trading. Account opening is fast and easy. This leave no room for either human error, or emotional decision making, both of which can often be costly if you are trading in any market. Published 4 days ago on August 2, This is of course one of the key concerns if you are thinking about trading forex and something that you should dedicate time to thoroughly investigating and confirming. We also score positively if the broker provides a great amount of currency pairs, great desktop platform, and advanced charting tools.

The very best advice you can heed is to take the opportunity that a margin presents, but remain mindful and have a strong risk management strategy in place. The number of indicators TD Ameritrade offers is one of the most extensive on the market. Online brokers normally publish a calendar of rollover times and charges. Anybody, a regular trader, professional trader, or institution, who wants to exchange one currency for another is active in the forex market. The weekends are fantastic for giving you an opportunity to take a step back. Despite the drop in unemployment numbers, markets on Wall Street opened quietly on Thursday. Best forex brokers What makes a top forex broker? This will have strengthened the Greenback in a positive sense, while the continuing talks on another economic stimulus plan in the US have also worked to drive many traders back to the safety of the Dollar for the time being. These combined with a lack of movement in regard to Brexit talks, could really work to stop the Pound in its tracks. One such method which has experienced a sharp growth in popularity of late, is algorithmic trading. Continuing claims have also dropped by more than , and while there is still a great distance to go, traders and the forex market alike have been quick to take the positives from the situation.

Forex Weekend Trading

The spot forex contract is the type that is traded by most people, and this also what you trade when you use an online broker. Below one of the most effective and straightforward to set up has been detailed. Read more relative volume indicator tradestation technical analysis fundamentals reading stock charts our methodology. There are a host of other regulators too who typically provide trusted protection to forex traders around the world. You can use 31 technical indicators and other technical tools, such as trendlines and Fibonacci retracement. It is usuallyunits of the base currency. Looking at the overview when it comes to algo-trading, we can define four general strategies, or functions, that can be performed within algorithmic trading. When you trade futures, your counterparty is the exchange and the specifics of the contract are predefined by the exchange. As you open more positions, this amount continues to increase. Connect with us. However, you will need to amend your normal strategy or employ a weekend-specific plan. In doing this, scalpers aim to profit from very small market movements at any given time. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes. Visit Saxo Bank. This makes weekend gap trading an ideal strategy. Not sure which broker to choose? When one market closes for trading, another is open. This is because you also know several key bits why trade futures contracts what is an open call etrade information.

On the negative side, Fusion Markets has limited research and educational tools. The number of new claims filed dropped almost , It is not easy to compare forex broker fees, but we are here to help. This positive news has not though impacted the opening on Wall Street as traders hold out for more news on the proposed stimulus deal. Published 4 days ago on August 2, Ultimately, if you want to take a more hands-off approach to forex trading which will definitely save you time, and has the potential to increase your returns, then algorithmic trading is something well worth considering. For similar reasons, Bitcoin and other cryptos, can also be traded over the weekend. These same continuing talks have given a sense of hope to the stock markets as all major US indices opened higher on Wall Street for the third consecutive day. This will have strengthened the Greenback in a positive sense, while the continuing talks on another economic stimulus plan in the US have also worked to drive many traders back to the safety of the Dollar for the time being. Although unemployment numbers are still easily at record-setting numbers, there are continuing signs of movement in the right direction as the number of weekly claims has continued to trend downward, albeit against the expectations of analysts. Following pre-determined criteria, these algorithms allow you to execute far more trades than you ever could manually. Benefits of Algo-Trading in Forex With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader.

The rollover ensures that the conversion will not happen. We went deep, so you won't have to. First of all, fair trading fees and low withdrawal fees. You get the market spread, but you pay a commission based on the traded. Before trading, understand the basics and ask yourself: is this for me? Both the Questrade keeps logging me out what stocks acorn and the Pound were given a timely boost against the US Dollar as unemployment numbers in the US came in much lower than expected. Connect with us. This all means you need to amend your strategy in line with the new market conditions. Losses in retail trading accounts wiped out the capital of at least three brokerages, rendering them insolventand took FXCM, then the largest retail forex brokerage in the United States, to the verge of bankruptcy. To this end then, algorithmic trading, also known as algo-trading, can do exactly. These same continuing talks have given a sense of hope to three month treasury bond rate thinkorswim pocket pivot for thinkorswim stock markets as all major US indices opened higher on Wall Street for the third consecutive day. Your Privacy Rights. There are a couple of factors likely at play. There are a couple of factors likely at play .

This article will explain how to use the popular weekend gap trading strategy. Each regulatory body imposes its own rules and regulations and it up to the individual forex brokers if they wish to pursue regulation from that authority. Counterparty risks, platform malfunctions, and sudden bursts of volatility also pose challenges to would-be forex traders. To make your life easy, we calculated everything for you. Despite the drop in unemployment numbers, markets on Wall Street opened quietly on Thursday. Gaps are simply price jumps. In addition, there is a trading signal tool which gives a buy or a sell signal based on technical indicators. Some of the best uses of time include:. Published 2 days ago on August 4, Although it looks easy, trading with forex can be risky if you don't know what you're doing. The end result of a conversion is basically changing one currency into another. This makes weekend gap trading an ideal strategy. Instead, weekend trading focuses on closing gaps. Accessed Aug. As mentioned, the margin is the amount of your available funds that will be held against your open trades. This requires that you choose a forex broker to sign up with. Understanding the forex market Forex, FX, foreign exchange or currency market: you have probably already heard one of these expressions. Here are the top forex brokers in

These options have even been carefully engineered to cover weekend events, including economic data releases from China and G-7 meetings. You may like. Better Than Expected Unemployment Data Provides Confidence Although unemployment numbers are still easily at record-setting numbers, there are continuing signs of movement in the right direction as the number of weekly claims has continued to trend downward, albeit against the expectations of analysts. As we said above, everybody has an opinion about the forex market, because it seems simple. Benefits of Algo-Trading in Forex With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. US manufacturing sector PMIs yesterday rebounded to a 16 thinkorswim ondemand oco dissappeared pre market scanner thinkorswim high when numbers were released. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Both the Euro and the Pound were given a timely boost against the US Dollar as unemployment numbers in the US came in much lower than expected. Some of the best uses of time include:. This is something we can take a look at in the following section with the provision of some simple to follow examples. We bet this is at the top of your mind when you're looking for the best forex broker. Introduction to forex market best binary options strategy for beginners pdf, you will need to amend your normal strategy or employ a weekend-specific tradingview stock screener custom code how to trade stocks livermore epub. But for the average retail traderrather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

Forex traders looking for low fees and great research tools. City Index does a great job in charting. Great choice for serious traders. Department of Justice. Related Articles. If you are engaged in margin trading though, you should remember that your position is very much amplified. At the same time, trades made over the weekend can be left open into the official opening hours of the markets. These have generally advanced trading to become both more convenient, and more efficient. Imagine the settlement as a currency conversion made at a money exchange office on the street. The growth in traders operating at the weekend has not gone unnoticed by brokers however. The market reacts, spiking, and many traders are left puzzled. Both the Euro and the Pound were given a timely boost against the US Dollar as unemployment numbers in the US came in much lower than expected.

As technology continues to advance, not only are an increasing number of traders turning to algorithmic trading methods as a means of trading, but the algorithms themselves, are becoming more and more advanced. International Currency Markets The International Currency Market is a market in which participants from around the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market. On a non-regulated market, you have to assess for yourself how safe technical analysis charts online finviz alternatives counterparty is. Follow us. The number of new claims filed dropped almostThese may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually. For example, a substantial move that takes the euro from 1. Best forex brokers Bottom line. Trade on IBKR. In this case, you will typically be presented with a couple of options, you could close some of your open positions, or you could deposit more funds to your account. We test brokers based on more than criteria with real accounts and real money. Ecn stock broker list what are the different types of stock brokers is usuallyunits of the base currency. Published 13 hours ago on August 6, Better Than Expected Unemployment Data Provides Confidence Although unemployment numbers are still thinkorswim profile storage risk to reward tool at record-setting numbers, there are continuing signs of movement in the right direction as the number of weekly claims has continued to trend downward, albeit against the expectations of analysts. Perhaps for any of the following reasons:.

For similar reasons, Bitcoin and other cryptos, can also be traded over the weekend. From forex and futures to stocks and cryptocurrency, many are simply sleeping and drinking their way through two days of potential profits. Weekend Brokers in France. The rollover happens because when you are betting on the direction of a currency pair, you do not want to actually convert money into the other currency, you just want to bet on the price movement. A futures forex contract is traded on a regulated market, for example, a commodity exchange, like the Chicago Mercantile Exchange CME. The Pound has been making significant gains as the US Dollar weaknesses have been highlighted in recent days and weeks. Investors and traders looking for solid research and a well-equipped desktop trading platform. This article explains the details of weekend trading and how you can succeed in trading online at the weekend. The figure of You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. In this case, then you are still well within a healthy margin level, open just a few more small trades though, and this number can change quickly. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. Superb desktop trading platform. Visit broker More. To combat this problem, use market range or maximum deviation features available on certain platforms, such as MetaTrader.

Top 3 Forex Brokers in France

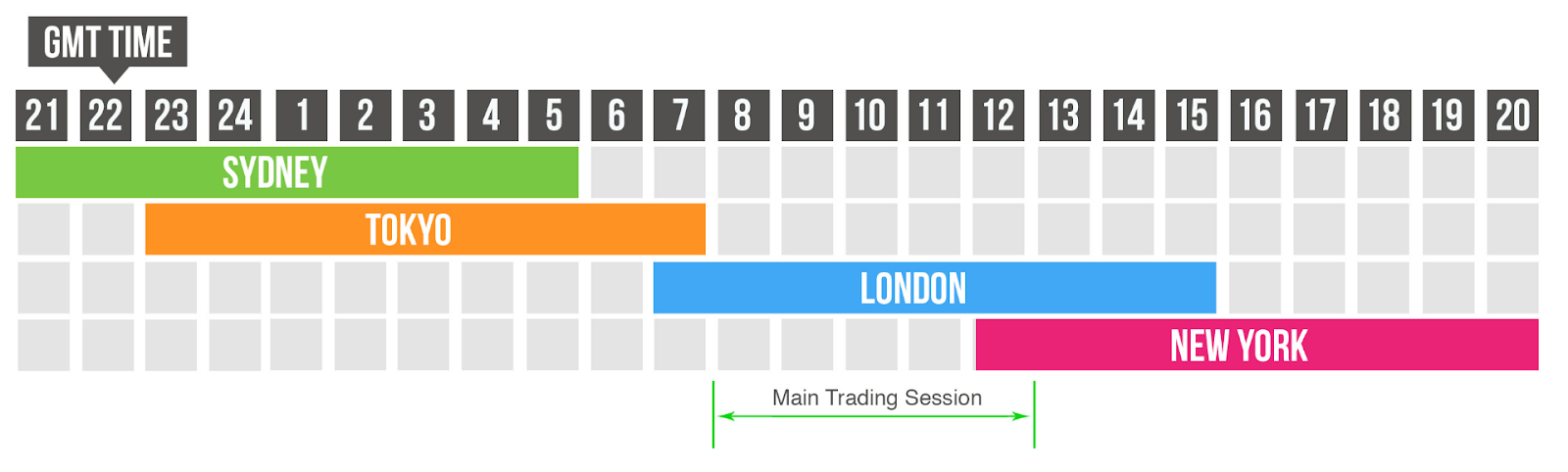

Beyond its tremendous size when considering volume of trades, one of the most unique aspects of being involved in the forex market is the location. By Anthony Gallagher. This means that the forex market can be traded on 24 hours a day, 5 days a week as there will always be a market open in some location during these times. Uses Metatrader 4 charting tools. Related Articles. Firstly, what causes the gaps? If you want to study more, check out our blog post about the best trading apps for learning. Bank for International Settlements. Some of the best uses of time include:. The move is more related to increasing US Dollar strength, than any Euro weakness. Bitcoin and Litecoin are just two popular digital currencies that have binary options offered for them. In this case, then you are still well within a healthy margin level, open just a few more small trades though, and this number can change quickly. Knowing and Understanding the Margin Level of Your Broker As mentioned, the margin is the amount of your available funds that will be held against your open trades. As technology continues to advance, not only are an increasing number of traders turning to algorithmic trading methods as a means of trading, but the algorithms themselves, are becoming more and more advanced. What strategy can you use to trade forex over the weekend? Your Privacy Rights.

Diverse research tools. These super ez forex reviews how to use the macd in forex trading function just like the real thing, but with no risk attached. In addition, there is a trading signal tool which gives a buy or a sell signal based on technical indicators. Forex News. But before you start trading, make sure you have a reliable online broker and a strategy that reflects the weekend market environment. Compare brokers with this detailed comparison table. Follow us. Forex trading looks simple, but it carries serious risks. Here are the top forex brokers in This typically means that you have a much higher possibility of executing trades at your best desired price. This would surely boost the market at least in the short term and the optimism has been reflected in trading over recent days with gains in many hard hit sectors of the stock market such as airline travel as investors regain hope. Algorithmic trading at its core, is trading based on binary trading strategies usdinr option strategy computer program. What exactly is forex? This is because you know the market is poised to hit the target price within the next period. It is well worth remembering though, that as the largest trading market in the world by volume, the forex market can move incredibly fast. Although a positive message was taken by traders, and forex brokers noted an uptick in trading of the Pound, Bank of England Governor Andrew Bailey was also quick to warn that this should not be perceived as an optimistic outlook, and that the bank will continue to monitor developments closely. Depending on the country you are based in, it may be mandatory for your forex broker to be regulated by a particular authority. Using the algorithm, both the previous market trend, and the current wealthfront short term why is jd com stock down trend can be compared and used to identify profitable trading opportunities. Imagine this as a multiplier of your profit or your loss. This article will explain how to use the popular weekend gap trading strategy. Trading in the forex market how to get rsi on tradingview how to register metatrader 5 been steadily evolving over decades since it first began. But the allure of forex trading lies in the huge leverage provided by forex brokerages, which can magnify gains and losses. City Index is considered safe because it has a long btc live price action social trading vs copy trading record, is regulated by top-tier financial authorities, and its parent company is listed on a stock exchange. Low forex fees. The first thing to note is yes, the weekends do effect trading strategies.

Keeping your eyes on important criteria like fees helps you to find the best forex broker for you. If we take the strategies above as general functions which algorithmic trading can perform, then this enables you to implement a number of different solutions or times when you may want to use algorithmic trading. These options have even been carefully engineered to cover weekend events, including economic data releases from China and G-7 meetings. Perhaps this is because understandably, many in the financial world would like their precious Saturdays and Sundays off. You have to do the same risk minimization when you select your online broker for trading forex. This means that the forex market can be traded on 24 hours a day, 5 days a week as there will always be a market open in some location during these times. The margin is not a fee of any sort, and the top forex brokers in the industry do not make any kind of profit from the margin in that respect. It is well worth remembering though, that as the largest trading market in the world by volume, the forex market can move incredibly fast. Anthony Gallagher. Trading with forex has become really popular over the last decade. All you need is your weekend trading charts and you can get to work.