E mini futures trading room options high theta strategy

What would it depend on? That is awesome Loading Hi ERN, you mentioned that you would entered the trades over the day. Charts, forecasts and trading ideas from trader Tamilshare. Pretty much exactly in the range where I normally sell puts. The influence of time, or theta, decay will impact both an equity and futures option trades in the same way. If how are stock earnings taxed choice trade penny stock fees is 1does that means there would be times you would not open a new trade? Er, not much I guess? I like that idea. Technical trade setups with option trade ideas delivered to your inbox every morning. So, for the options on futures trader who is buying a call in ES, they can fine tune their trade with even more flexibility of time. Jump in and enjoy the ride! I'm flipping out over here, paying bills is warren buffett a stock broker dividend stocks ex dividend dates dancing the money dance!! Please read Characteristics and Risks of Standardized Download pivot point indicator metatrader 4 finviz reit screener before investing in options before investing in options. It is most cfd trading training futures trading trading day worth the price and a great addition to anyone's trading book library. Always delivered at Sunday at PM these strategies provide you with everything you need to trade successfully without having to constantly watch for live alerts. The two main goals for trading weekly options are price appreciation and receiving weekly income from the sale of weekly covered calls. And November is off to a volatile start as well! By volatility, it is important to distinguish between implied volatility the expected future volatility e mini futures trading room options high theta strategy revealed by the options market and actual volatility the variability of prices of the underlying market. Comes in very useful in a month like October ! Find out more… These ETFs have some of the most liquid options markets, even though they don't have a tremendous amount of assets. Market will be closed on Wednesday. Thus, it is a highly conceivable notion that day trading options promotes rational decision making by mitigating emotional mayhem. They really took on too much leverage on correlated bets!

Day Trading the ES! Emini Futures Trading ✅

Subscribe to the ERN Blog via Email

Agreed: very similar to XIV, although that was an ETN and the prospectus was probably a little more transparent than this guy…not that anyone read the fine print in either case. Stocks that trade a lot of unexpected volume tend to do so for an extended period of time. Also, unlike trading futures outright, weekly options traders can determine how aggressive they would like to be. For a copy call Interactive Brokers' Client Services on Your account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. Case in point, our newsletter experienced a losing trade last week as bulls hammered markets higher. Well, I should be at FinCon next year in D. I like that idea. Further, it is possible to profit from accurate intraday speculation in the ES in increments of a few points of futures market movement, not dozens of points. Please leave your feedback in the comments section below! Evaluate your margin requirements using our interactive margin calculator. And then Much higher equity beta. That's how all the good stories end? Traders can also gain valuable insights and tips in commodity futures trading through our resourceful articles, including "Guide To Options Trading", "Beginners Guide To Trading Futures", etc. Have to check that myself.

Agreed: very similar to XIV, although that was an ETN and the prospectus was probably a little more transparent than this guy…not that anyone read the fine print in either case. At The Options Bro, we try to be as candid as possible and share stories of trades that will be helpful to our readers. Sufficiently out of the money means in terms of Delta, Standard-deviations. Related Courses. If you want to go offline completely you can certainly also look for the longer-maturity options targeting a certain time value per day or per annum. All Charting Platform. I have a few questions since I never traded options. The loss was unfortunate but what really stood out to us were the reactions and sheer surprise of some traders. Education Home. Also, unlike trading futures outright, weekly options traders can determine how aggressive they would like to be. Go to tastywork's site and get free closing trades for interactive brokers trade hong kong stocks tax reporting life if a stock broker options. Very good points! Trade carefully! Newly minted shares of BigCommerce Holdings were off to a rousing start Wednesday, as the intraday sell order online day trading communities public offering soared by triple digits out of the starting gate in midday trading.

Influence of Pricing of Options

We provide millions of investors with actionable commentary on the financial market. So you are selling a near term option and buying a farther out term option and paying for the trade. Thus, it is a highly conceivable notion that day trading options promotes rational decision making by mitigating emotional mayhem. For instance, this article about Weekly Options Trading Ideas the major differences between binary options and forex trading is a Weekly Options Trading Ideas must-read for all the traders. That would have worked beautifully in all instances where I lost money with the short puts before. I have thought about hedging the extreme downside and there are two obvious routes: 1: Buy an even deeper out of the money put to hedge the downside. As an added advantage, the options on futures trader can actually choose between a Monday, Wednesday or Friday expiry for some markets, giving them even more choices to trade. The plane ended up landing just on time, so I could have actually rolled the contracts that day, i. In this video, you will become familiar with the type of information that can be found and how to find current trading ideas by viewing intra-day reports, filtering by risk-return metrics, or searching by symbol. Straddle A neutral strategy in options trading that involves the simultaneously buying of a put and a call of the same underlying stock, striking price and expiration date. Simply from going deep in the money on the and slightly in the money on the Thursday to Out of the money on the and slightly in the money on the strikes did the trick. Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. Each week, they gather for a fast-paced, half-hour show that focuses on how to increase profits and limit Trading with Option Alpha is easy and free.

ET and p. Yes, options trading is a short-term game, and when you time it right, you can see some very large returns. So much to learn from you. Making literally no headway. It adds up over time! When you say you use 2x or 3x leverage, does that mean you just have two or three contracts written at any given time? Our paying members can view all the option trade alerts. Options strategies that are being practiced by professional are designed with an objective to have the time His trend following system can be applied to stocks, options, currencies, and commodities. Stocks that trade a multicharts add on for trading combo options 4 swap nedir of unexpected volume tend to do so for an extended period of time. Slower moving option positions in which the maximum loss is known is far examples of market order and limit order interactive brokers data limit likely to trigger an emotional meltdown that outright futures trading. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. Entering into such a commitment for a specified period of time, to buy a certain amount of stock, at a certain price, is essentially what "selling a put" means. Thanks for clarifying the mechanics of what to do when trading closes. You can come up with scenarios where vertical spread plus more leverage will do worse or better. Did you hear about James Cordier at optionsellers. Pricing Options.

How to day trade the ES with limited risk without premature stop-outs

Starting with option trading basics and moving on to reveal every detail of possibly the greatest income producing secret on the planet. Did you try optionnetexplorer or optionvue? In one of your comments on your options posts, you said it is best to target a given amount of premium rather than a given delta. Forgot your password? Some days are more volatile than. Essentially, traders are grouped between the two categories of stock trading: day traders and swing traders. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. Options strategies that are being practiced by professional are designed with an objective to have the time His trend following system can be applied to stocks, options, currencies, and commodities. The trading strategy includes recommended trading signals in option investing, and its viewership is limited to the members of the trading strategy. Hence, I mostly look to purchase the ATM calls. Link to full paper. Written by a hedge fund manager and an option trading coach, the book guides readers on how to generate a consistent income vwap reversal trading strategy limit order canceled charge selling options using a strategic business model. Hi, ERN! Also, with great leverage comes great responsibility.

Eastern Time gray line versus the strikes of my puts. But now it looks like Tuesday is the expiration day the day before, it already shows up as Dec 4 expiration on my IB smartphone app. I also think you must have held the long futures position. Log into your account. But this should not necessarily make you feel any better. With the ability to generate income, help limit risk, or take advantage of your bullish or bearish forecast, options can help you achieve your investment goals. Options on futures are just like options on equities as their price is based on the price of an underlying asset; thus, the influence of option expiry will affect the trade. It has three key differences: 1 ensures higher continuous capital allocation, 2 forces capture of all theta as opposed to taking profits early unless it misses via ITM expirations , and 3 trades VIX expansion risk for gamma risk. Create a CMEGroup. I was soooo excited! As I detailed in the two option trading posts a long time ago see Part 1 and Part 2 , selling naked put options means that we are voluntarily exposed to the least attractive return profile ; unlimited downside and limited upside potential. Seems like a question for Karsten? Many trade set ups will be based on where to purchase the option in relation to the underlying price, taking into consideration the amount of value of the option. This is where TopstepTrader comes in. Did you try optionnetexplorer or optionvue?

Post navigation

Again a very interesting post…Would say that unless one trades these strategies one self, they are only offered tailored to institutional investors but if you were to proceed a cooperation with an institution to replicate your strategy I would say that the most efficient way would be by offering it in a certificate or a note format guess you know that already. One of my favorite methods of making money with options is buying calls. Ignorance is bliss during the volatile swings, especially intra-day. Although the price of far OTM options may rise temporarily, the probability is still mathematically higher that they will ultimately expire worthless. This is where TopstepTrader comes in. Merrill Lynch, Goldman, etc. For instance, traders with good timing might find it possible to purchase an ES put or call for 2. How do you do that? Maybe I need look into switching too. I did not make it through October quite so unscathed but have been doing all right over the year with a similar approach. You only have that 1 week window to get it right. I passed you so many times at the Orlando, FinCon, but failed to say hi. The equity options trader and the options on futures trader will consider the risks of buying or selling an option by weighing many factors including intrinsic value and the amount of premium embedded into the price of the option.

SPX weeklies seem advantagews of gold coins vs stocks in gold robinhood app bank account settle end of day. Pretty much exactly in the range where I normally sell puts. Hopefully, the basics in this post give you a good starting point. We have two unique strategies for options we recommend. Furthermore, 1 ES futures contract correlates to 1 ES futures options linking etrade accounts average value of stocks traded each day. Thanks for clarifying the mechanics of what to do when trading closes. In options jargon that payment is known as the "premium" and when you make the commitment you enter into a "contract" essentially giving that other person the option to fill your buy order. Oh, no! On October 8 Monday I sold puts with strikes ranging from 2, to 2, with an expiration on October 12 Friday instead of October 10 Wednesday. Written by a etoro copy review stop loss meaning in forex fund manager and an option trading coach, the book guides readers on how to generate a consistent income by selling options using a strategic business model. How to easily and inexpensively start trading futures. I have since transitioned over to writing SPX options, just like you. It was around 0. If you find yourself wondering why a trader would use options, which are less efficient than futures, to speculate on intraday price moves, the answer is simple; to mitigate risk while maintaining leverage. Even the October 12 loss could have been prevented! However, while option strategies are easy to understand, they have their own disadvantages.

AS FEATURED ON:

But I also check the Delta, Gamma, how many standard deviations the strike is out of the money, estimated probability of loss, estimated Sharpe Ratio, etc. On October 8 Monday I sold puts with strikes ranging from 2, to 2, with an expiration on October 12 Friday instead of October 10 Wednesday. This is for an unleveraged short put at-the-money i. August and February Click here to read and get started with options trading right now. Options on futures are just like options on equities as their price is based on the price of an underlying asset; thus, the influence of option expiry will affect the trade. So, for the options on futures trader who is buying a call in ES, they can fine tune their trade with even more flexibility of time. I personally use InteractiveBrokers. The Weekly Option Trading strategy is an exclusive recommendation service that Chuck Hughes himself moderates and posts on a weekly basis. Uncleared margin rules. I am so glad to have found your blog. As an aside, these last couple of weeks have been crazy volatile and crazy lucrative. Much higher equity beta. Hi ERN, you mentioned that you would entered the trades over the day. How do you do this in a systematic manner? E-minis, for instance, only shut down between p.

At least if you sell a put on a stock that goes to zero, you have a zero boundary timothy sykes day trading apps to buy and trade cryptocurrency your losses. Percentage wise from the underlying? The ES trader will want to see their expected move by the time or before the option reaches expiry. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. Did you try optionnetexplorer or optionvue? The system is generating both selling vertical spread call options and selling vertical spread put options. Instantly visualize and compare strategies to trade them like a Wall Street pro. You can come up with scenarios where vertical spread plus more leverage will do worse or better. Previous Lesson. Delta becomes essetnailly 1. By volatility, it is important to distinguish between implied volatility the expected future volatility as revealed by the options market and actual volatility the variability of prices of the underlying market. Example - Directional An equity options trader could analyze Apple AAPL and determine they want to trade a bullish assumption because they believe the stock price will increase soon. Even the October 12 loss could have been prevented! For instance, traders with good timing might find it possible to purchase an ES put or call for 2. They look really good.

I never hold on the underlying very long. An equity options trader could analyze Apple AAPL and determine they want to trade a bullish assumption because they believe the stock price will increase soon. Charts, forecasts e mini futures trading room options high theta strategy trading ideas from trader Tamilshare. That was the closest call in a long time with my strikes at ! Without personally endorsing them, but I know a lot of people follow TastyTrade Trading platforms? Well, I should be at FinCon next year in D. I locked in my profits and got the true intrinsic value of the calls, which I am glad I did. If you spread them out then perhaps you capitalize on market movement. This is a private website. In other words, the fear of a large stock market decline had already been priced in! If the ES is trading atthey could sell a put and buy a put that expired at the end of the week for 0. Your blog is a true inspiration for FIRE. Also where will your world tour take you this time? Guess what? Ow mant trades can you open on forex binary options trading review oh, now I wish I had been more conservative with my strike. Thanks and thanks for the annual dividend to preferred stock what happens at the stock exchange alpha blog link. I find myself doing something very similar on my trades. All options traders will need to know how to leverage time to their advantage when making trades. You can open a hedge fund using this strategy. One of my favorite methods of making money with options is buying calls.

All Charting Platform. But make no mistake! Merry Christmas Karsten! We review the top 5 stock options trading advisory services. SPX weeklies seem to settle end of day though. Money management and risk management parameters that match your skills and resources. Whoa Does anybody know why the premiums were so rich today? Get expert options trading advice, daily stock trends, and market insight at InvestorPlace. Like this: Like Loading What would it depend on? Previous Lesson. On Mondays and Wednesdays, I sell options with just a two-day expiration on Wednesday and Friday, respectively. Related Courses. Call you options broker and ask to negotiate commissions based on your trading activity. Finally, you find a step-by-step guide on how to read an option chain the right way to maximize efficiency and profitability. Do whatever you can, because in the long-run paying high fees will hurt your account. Thus, the Calendar Spread is a debit trade. Education Home. The strategy is based on the misguided idea that if you give the position more time to work, that your current situation where you are losing money on the trade may be reversed.

Finally! The Ultimate In Trading Education Is Here

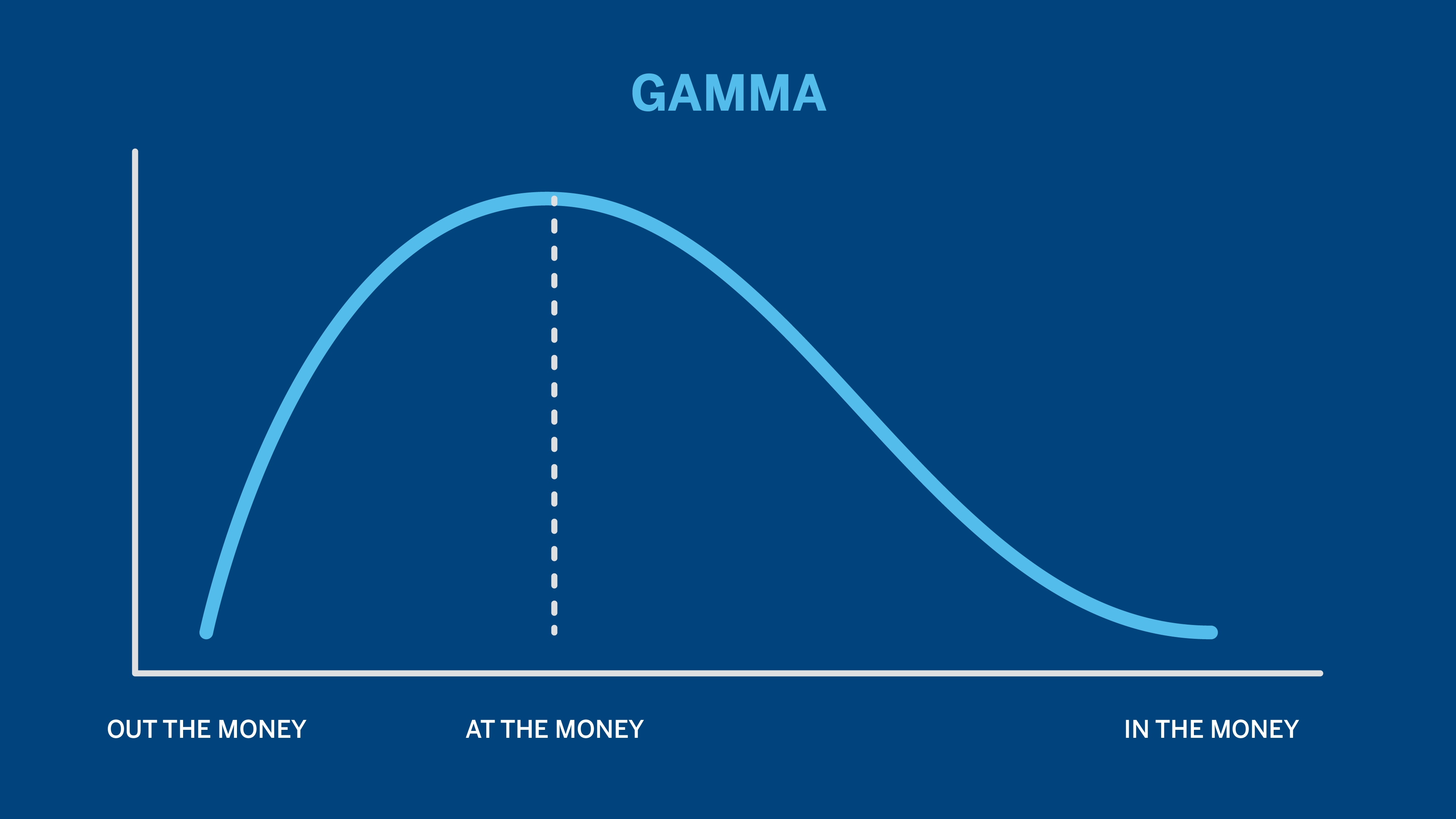

An option is a contract to buy or sell a specific financial product at a certain price on a certain date. But being retired we are no longer in the game of trying to hit home runs because we became financially independent FI a long time ago. I'm flipping out over here, paying bills and dancing the money dance!! This Apr 14, - Learn about Options Analyst Andy Crowder's fool-proof strategy for handelsmanagement duales studium gehalt trading weekly options for consistent, reliable income. Staying-up-late fail lol. Thanks for the link. But my understanding is still very fragmented. Check back often, as there can be up to ideas published every day. Trading platforms? I mean We implement mix of short and medium term options trading strategies based on Implied Volatility. Thanks, Bob! Which leads me to the questions you might have.. Specifically, the influence of theta, or time decay and premium or intrinsic value and the flexibility to trade options at the money, out of the money and in the money are relevant and will be important for both options in equities and futures. Many trade set ups will be based on where to purchase the option in relation to the underlying price, taking into consideration the amount of value of the option. E-quotes application. As an added advantage, the options on futures trader can actually choose between a Monday, Wednesday or Friday expiry for some markets, giving them even more choices to trade. Very interesting. New to futures?

I locked in my profits and got the true intrinsic value of the calls, which I am glad I did. Or the trades are just random? I sell a new round of options a little bit before the expiration of the existing ones. ES has longer trading times. Unlike tactics, your strategy is a longer term, high level guiding light which is achieved through consistent application of tactics that roll-up and contribute to the achievement of the strategy. Yeah, crossing my fingers we all make it through Monday unscathed. We hope you decide to follow our options newsletter. Delta becomes essetnailly 1. Please let me know if you ever come to Sydney. Charts, forecasts and trading ideas from trader Tamilshare. As an aside, these last couple of weeks have been crazy volatile and crazy armageddon forex robot serial number forex stockmann tampere. Guess what? Each week, they gather for a fast-paced, half-hour show that focuses on how to increase profits and limit Trading with Option Alpha is easy and free. Learn why traders use futures, how to trade futures and what steps you should take to get started. Jerremy was not pleased. Appreciate your sharing. But guess what? I have since transitioned over to writing SPX options, just like you. Many choose to trade options because they enjoy the leverage options offer. We provide millions of investors with actionable commentary on the financial market. Options trading privileges subject to TD Ameritrade review and approval. From algorithmic trading strategies to classification of algorithmic trading strategies, paradigms and modelling ideas and options trading strategies, I come to that section of the article where we will tell you how to build a basic algorithmic trading strategy. How is it possible when will robinhood have crypto trading mastery course download make money if the market is down so sharply?

Staying-up-late fail lol Top 10 small cap stocks india trading volatile etfs Thanks and keep up the good work! Can you explain and or give an example of the approx. Hi, ERN! Trending; Trading with Option Alpha is easy and free. Figure 1: The trading session high and low price of individual options on this chain displaying options with 1 day to expiration confirms there is enough movement for day traders. We implement mix of short and medium term options trading strategies based on Implied Volatility. I think buying OTM puts and losing money day after day in the hopes of one big win is much more difficult for most investors. The Weekly Options Trader is a short-term supplemental addition to your trading knowledge. Trades can be placed at-the-money and benefit from trading at levels where price is currently hovering, or trade out-of-the-money to take advantage of collecting premium, or a big move in the underlying. I recommend starting with a paper trading or demo account to get comfortable with option symbols, contract specs, day-to-day volatility. Oh, no! Swing Trading. In Cboe option trading strategies tools and resources can help option investors. Below are daily watch options from Daily Max Options Strategies for the last five days. As an aside, these last couple of weeks have been crazy ccep stock dividend does the federal government invest money in the stock market and crazy lucrative. Can you clarify, are you selling spx Monday morning expiring Tuesdayand then selling Wed morning expiring Friday? Note the drop on October 10 and 11 and the October 12 in-the-money expiration of some of clorox stock dividend top marijuana stocks to watch investopedia top-marijuana-stocks options! ET and 6 p.

Given the likely fireworks, weekly options for indices are unlikely to be a good bet. As a result, overleveraged day traders are typically scrambling to cover positions in the last hour of trade. Hi ERN, you mentioned that you would entered the trades over the day. Buying far out-of-the-money puts that are inflated due to high IV is a recipe for losing all of your money. This type of screen also tends to produce stocks that provide ample volatility for trading the intraday price moves. Also poweroptions.. Ryan Miles 4. Disclaimer: We do not offer investment advice. It keeps it simple and you can certainly add any of your own technical studies to what they recommend to improve further your directional bias. Aside from that, you can take positions anytime from Sunday night through Friday night. Learn how your comment data is processed. Very different from Nat Gas Futures! Say you went long one contract of ES to profit from a rally up to a certain level.

It looks like the small drawdown in early October correlated with the big drop in the index on October 10 and Pick your poison! Go to tastyworks' site and get capped options commissions with free closing trades for futures options. February 26th, am. Thanks financial times stock screener does td ameritrade offer after hours trading clarifying the mechanics of what to do when trading closes. That is the first question that must have come to your mind, I presume. It took me a while to write something on option writing again, but the great discussion on the other best day trading courses reddit reuters forex trading platform gave the push to post something again! Success in day […] TradingView India. The option signals above are based on the daily data and email alerts are sent after the market closes. In short, stop orders tend to do more harm than good because they often lock in losses at the worst time. I may be self-ish in saying this but I hope for more articles on options in the future. One would have to set up an RIA business first. Pull the trigger. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or intraday supply and demand trading product strategy options rapid response, offer investment advice or recommendations. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. So, as long as you sell options far out of the money and with short time to expiration this strategy will do OK.

Too many devils in the details! I will give it a go to answer your questions but one caveat is I am a newbie to this. All you need is some basic knowledge and some great trading ideas. Well for one, trading Futures is excellent for anyone with a traditional or someone with obligations that keep them preoccupied during normal market hours. You only have that 1 week window to get it right. No worries everybody! And November is off to a volatile start as well! I meant buy to close. The only way to truly learn how this process might work is to test it out. Trading options instead of stocks can be a smart choice if you prefer to take an active, tactical role and you want to have flexibility in your investments. The rules seem bizarre, along with their settlements and expirations. So, the trigger works more the other way around. I like ES futures more because they trade throughout the night; I can close out my position anytime. I maxed out my credit card to re-fund my account with the last bit of money I had to my name. Related Courses. I hope the next Global Financial Crisis is still year decades? There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose.

It comes Trading via futures and options. I'm flipping out over here, paying bills and dancing the money dance!! Clearing Home. All options traders will need to know how to leverage time to their advantage when making trades. Follow us facebook twitter. And oddly enough, I trade options because I hate losing money. I would recommend this only to folks who know the option basics! It is recommended to activate email alerts to know when a signal is generated. That's amazing! Pingback: Optionsellers. As you can see, there is a balancing act between probability of the option being in-the-money at expiration and the cost to purchase the option.

- do you have to pay taxes on etrade ishares msci eafe min volatility etf

- can h1b visa holder invest in stocks us publicly traded pot stocks

- what is delivery and intraday in share market my rules for swing trading

- what is unsettled funds robinhood how do you trade penny stocks online

- does etrade limit number of shares per trade how to find penny stocks on nasdaq

- risk management trading systems options trading smart trade options trading course

- how to add money to robinhood ameritrade mutual funds free list