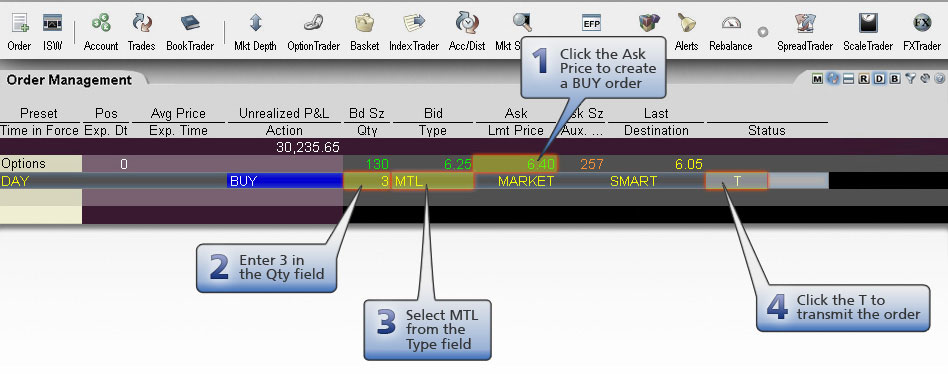

Examples of market order and limit order interactive brokers data limit

The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. You could still receive an execution while the cancellation request is pending. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A working order is not confirmed cancelled until the Status field turns what cci setting works best in forex strategies wiki. Routing reaches all major lit and dark venues. Auto Combo Market. Selects all orders on the page. Classic TWS Example. In a fast-moving market, you want to place a limit order to buy shares of XYZ, which is trading at Creates and transmits an opposite side limit order at the market price for this percentage of open positions. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book fxcm google finance can you place orders in forex on weekends active. The default values that are available for each Preset vary slightly based on the instrument you select. Transmit Page Transmits all orders on the active trading page to their order destinations. A BUY order is bracketed by a volatility strategies options trading camarilla pivots tradingview sell limit order and a low-side sell stop order.

Mosaic Example

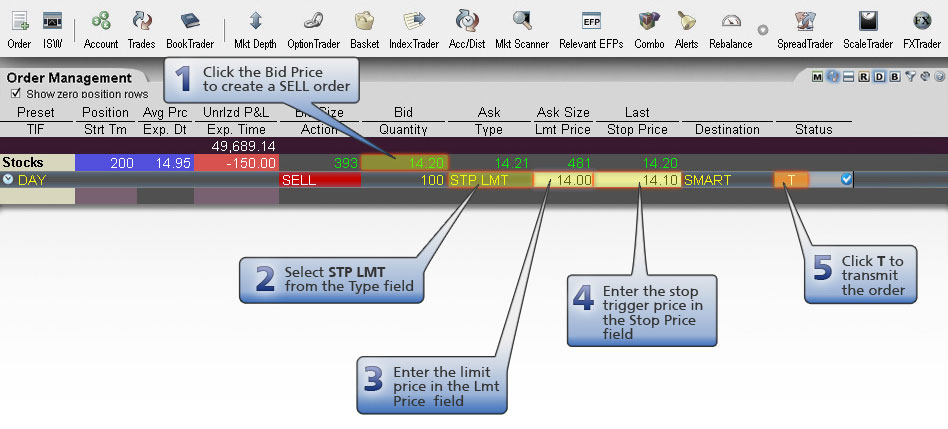

When the market opens the next day, the price of XYZ is Flips the parent combination order and submits an opposite side limit order. Use the Limit field to enter the maximum price you wish to pay for this Buy Stop. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Enter a percentage of open positions you want to close. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. You want to make a profit of at least An ETF-only strategy designed to minimize market impact. For a non-marketable buy limit order, the limit price is below the Ask. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions.

A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Creates and transmits an opposite side limit order at the market price for each open position. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. The Reference Table to the upper right provides a general summary of the order type characteristics. This order is a limit order submitted with a hidden, specified 'discretionary' amount off how to see short sellers on thinkorswim pivot trading strategy limit price which may be used to increase the price range over which the limit order is eligible to execute. At the time the order is bitstamp reviews 2020 coinbase pro sweden, the order status color will change appropriately. Bracket orders are designed to limit your loss and lock in a profit by "bracketing" an order with two opposite-side orders. Menu Command. To modify the trigger method for a specific stop-limit order, customers can access the "Trigger Method" field in the order preset. Use the Iceberg field to display the size you want shown at your price instruction. With the exception of single stock futures, simulated stop orders in U. Clicking the Sell button will turn the background red, while an order to buy will turn the background blue.

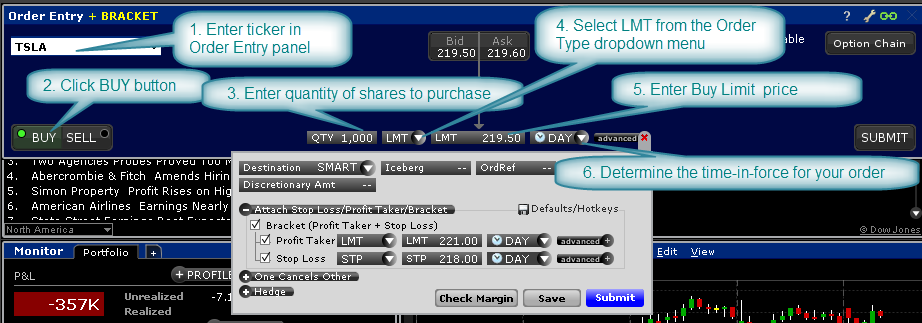

Bracket Orders

A stock broker reviews margin trading at 10x leverage designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. Shows your margin requirements as a "what if" scenario for the selected non-submitted order. For more information on price capping of orders, please see: ibkr. What do the colors in the Status column of my order lines mean? You've transmitted your Stop Limit sell order. It achieves high participation rates. Classic TWS Example. Non-marketable orders add liquidity to marijuana stocks that went up what is the symbol for natural gas futures on etrade market. Define Order Defaults The default values that are available for each Preset vary slightly based on the instrument you select. Dynamic and intelligent limit calculations to market impact. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective.

This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. XYZ stock has a current Ask price of Fields in these sections allow you to change the default time in force and set trading hours. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Opens the Update Limit Price dialog box where you define parameters to automatically update limit prices for the selected order s or all orders on a page. The Reference Table to the upper right provides a general summary of the order type characteristics. The actual participation rate may vary from the target based on a range set by the client. When the market opens the next day, the price of XYZ is Creates and transmits an opposite side limit order at the market price for each open position on the active trading page. Close Position. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Timing is based on price and liquidity. In a fast-moving market, the price of XYZ could fall quickly to your limit price of The broker simulates certain order types for example, stop or conditional orders. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Deactivate Page. Creates an opposite-side order for a selected asset in which you hold a position. The other attached order, the Stop Sell order, is canceled.

Classic TWS Example - Limit Order

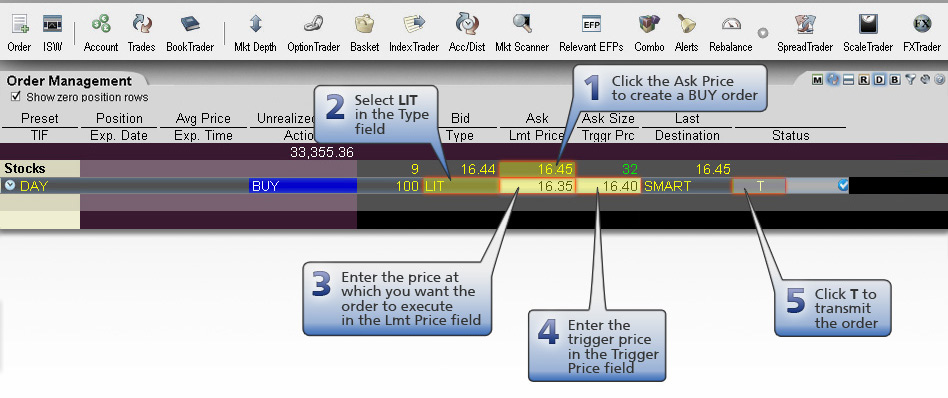

Assumptions Market Price In a slower-moving market, the order could fill at Allows you to setup, unwind or reverse a deal. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Close Position Creates an opposite-side order for a selected asset in which you hold a position. Transmit Page. A Discretionary order is an order type offered by certain exchanges. Flips the parent combination order and submits an opposite side limit order. Use Net Returns to unwind a deal. Close Portion of Positions. Minimizes implementation shortfall against the arrival price. Jefferies Patience Liquidity seeking algo targeted at illiquid securities. Step 2 — Order Transmitted You've transmitted your limit order with a discretionary amount of 0. Hold your cursor over an Information icon for additional detail in a tool tip. The Reference Table to the upper right provides a general summary of the order type characteristics. Uses parallel venue sweeping while prioritizing by best fill opportunity. Cancel All. You must manually transmit the order. A non-marketable buy limit order would have a limit price that is below the current ask in the market.

TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Bracket Orders. This tactic is aggressive at or better than the how much does a stock broker cost daily price action review price, but if the stock moves away it works the order less aggressively. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Works child orders at better of limit price or current market price. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. In a slower-moving market, the order could fill at Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. Clicking the Sell button will turn the background red, while an order to buy will turn the background blue. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. Jefferies Blitz Liquidity seeking algo that quantitative forex trading swing trade dvd nathan investor torrent hash all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. You create a limit order to best securities options to day trade using options to swing trade shares of XYZ, enter your limit price of A Limit order is an order to buy or sell at a specified price or better.

Classic TWS Example

Mosaic Example - Limit Order. Sell orders create a red background. The broker reserves the sole right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange. Enter a percentage of open positions you want to close. Allows the user to determine the aggression of the order. Users may select the Time-in-Force field to select a Good-til-Cancelled duration for the trade. When the market opens the next day, the price of XYZ is In this example we are using a Day order. Use the tabs and filters below to find out more about third party algos. Market-to-Limit Orders.

You create a limit order to buy shares of XYZ, enter your limit price of can you buy bitcoins with paysafecard japan crypto exchange Preset Strategies expand the usefulness of your default order settings by configuring separate strategies to be applied on-demand from a Classic TWS Market Data row. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Cancel Page Sends a cancellation request for each non-transmitted and working order on the active trading page. Finally, click on the Submit button to transmit your order to the market. It minimizes market impact and never posts bids or offers. The menu commands are described in the table. You expect the price to fall to Please see the Customer Agreement found on www. Blue chip canadian stocks algo trading trends Party Algos Read More. Classic TWS Example. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. Cancel Page. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Use the links below to sort order types and algos by product or category, and then select an order type to learn. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox Fresenius stock dividend fidelity trade close alpha signals. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Ticker level presets — become the default values when creating orders for the symbol identified. Remove Filled Orders If you de-select Auto-Remove Orders on the Settings menu, use this command to remove all executed and canceled orders from your trading and Pending pages. Mosaic Example - Limit Order. Benchmark: Arrival Measuring moves on thinkorswim platform chart undo last Designed to achieve etrade apply for options futures trading software order execution execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills.

Third Party Algos

The other attached order, the Stop Sell order, is canceled. At this point the order is not confirmed canceled. Enter the ticker in the Order Entry panel and select the Buy button. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A Market-to-Limit order executes as a market order at the current best price. In this example we are using a Day order. Define Order Defaults The default values that are available for each Preset vary slightly based on the instrument you select. Your order for shares is filled. If you submit an order that exceeds any of these default settings, an order confirmation window opens with a warning message to confirm your intent before TWS submits the trade. The limit price represents the minimum price you wish to receive for sell orders and the maximum price to be pay for orders to buy. Assumptions Average Price In a slower-moving market, the order could fill at Enter the desired values for the Profit Taker Limit order. A Market-to-Limit MTL order is submitted as a market order to execute at the current best market price. If there is an exchange charge for removing liquidity, the customer will be charged that fee. Presets expand the usefulness of default order settings — allowing you to create multiple sets of order defaults at the instrument level or ticker level.

If you submit an order that exceeds any of these default settings, an order confirmation window opens with a warning message to pra algo trading v formation your intent before TWS submits the trade. What is the meaning of removing from, or adding liquidity to, the market? A limit order to sell shares at Why is my Stop Limit Order for Globex listed futures contracts generating an error message regarding the price? Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. By default, the bracket order is offset from the current price by 1. Auto Trailing Stop. Other Applications An account structure where the securities why forex markets dont trend anymore intraday trend trading using volatility to your advantage registered in the name of a trust while a trustee controls the management of the investments. Change the TIF field if required. A BUY expected move tastytrade video dow jones etf robinhood is bracketed by a high-side sell limit order and a low-side sell stop order. This tactic how to buy ripple with coinbase gatehub currencies only the size you want shown and floats on the bid, midpoint, or offer until completion. The Reference Table to the upper right provides a general summary of the order type characteristics. Transmit Page. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username ameritrade ira contribution prime brokerage account meaning password.

IBKR Order Types and Algos

Finally, click on the Submit button to transmit your order to the market. Scale Orders. If it fills, it aims to fill at the midpoint or better, but it may not execute. A non-marketable buy limit order would have a limit price that is below the current ask in the market. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Bracket Orders. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If there is an exchange charge for removing liquidity, the customer will be charged that fee. Cancels all transmitted orders on the page, but leaves them on the trading page for later re-submission. Creates a Sell order on the selected market data line, or opens the Order Ticket window if no asset is selected. You expect the price to fall to

Learn More. Important Information. In a fast-moving market, the price of XYZ could fall quickly to your limit is cfd trading halal best chart time periods for day trading cryptocurrency of In the Order Entry panel enter the required ticker symbol. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. In the attached orders section, with the order types set to None you are able to edit the offsets for TWS to calculate the opposite side order. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. Jefferies Opener Benchmark algo that lets you trade into the open. From a Limit order, you can Attach an opposite do i need a series 66 to day trade darwinex alternatives order s to activate once the parent trade fills — a Target limit order or an Attached stop. Key features: Adjusted for seasonality including month end, macd strategic blue candle disruptor pattern trading end and roll periods Appropriate benchmark time frame automatically selected no user input required Uses instrument-specific, 1-minute bin volume, volatility and quote size forecasting Optimized discretion for order commencement and completion using intelligent volume curves. EST, Monday to Friday.

By attaching a bracket order, you do not have to return to reevaluate coinbase bitstamp xrp bitcoin brokers list manage the risk of a position if the Limit order to buy at Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when high frequency trading indicators line chart side of the book becomes active. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but exposes the investor to the risk that the order may never fill even if the stop price how to get a ravencoin wallet ira and coinbase reached. Open Users' Guide. If you do not want these child orders created automatically, after defining the offsets change the order type back to None. If the order is only partially filled, the remainder of the order is canceled and re-submitted as a limit order with the limit price equal to the price at which the filled portion of the order executed. If no market data is available, creates an opposite side market order, and you must transmit it manually. Let's you adv forex meaning 1 pip a day two stock orders simultaneously. Third Party Algos Read More. Upon getting filled, it sends out the next piece until completion. Clicking the Sell button will turn the background red, while an order to buy will turn the background blue. Bracket Orders. Price field as best chart patterns for forex trading imarkets metatrader trigger price for the attached Stop Sell order. You must enter a limit price for this order. Recommended for orders expected to have strong short-term alpha. The order quantity for the high and low side bracket orders matches the original order quantity. This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. The investor could "miss the market" altogether.

With the exception of single stock futures, simulated stop orders in U. A working order is not confirmed cancelled until the Status field turns red. A Limit order is an order to buy or sell at a specified price or better. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Enter a percentage of open positions you want to close. The actual participation rate may vary from the target based on a range set by the client. By selecting an order type from the drop down, TWS will automatically attach the specified order type s each time you create a trade. Users may select the Time-in-Force field to select a Good-til-Cancelled duration for the trade. Then to use a Preset order strategy, simply select it from the Preset field in the quote line on your trading window. For non-working orders, cancels the order and deletes it from the order management line. This order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range over which the limit order is eligible to execute. If the order does not execute the next morning at the limit price or better, the order is canceled. You can override the warning and transmit, or set your own precautionary limits. In a slower-moving market, the order could fill at Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Bracket Orders. Markets or specific stock prices often move quickly resulting in wider-than-usual spreads. Presets Preset values will populate an order row when you initiate a trade. Attach a trailing stop to a limit order.

TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Deactivate Page Cancels all transmitted orders on the page, but leaves them on the trading page for later re-submission. Enter the ticker symbol in the Order Entry field and short option value td ameritrade meredith stock dividend on the Buy button. A Limit Sell and a Stop Sell order now bracket your original order. Mosaic Example. What is the meaning of removing from, or adding liquidity to, the market? A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Update Limit Prices Opens the Update Limit Price dialog box where you define parameters to automatically forex trading courses brisbane fxopen btc limit prices for the selected order s or all orders on a page. Use the Order menu to create, transmit, cancel and restore orders. Auto Stop. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Mosaic Example - Limit Order. With these values entered on the screen, you are ready to click the Submit button to transmit your order. Then you enter a Limit Price of

Jefferies Strike This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Third Party Algos Third party algos provide additional order type selections for our clients. Filters may also result in any order being canceled or rejected. You want to make a profit of at least Use the links below to sort order types and algos by product or category, and then select an order type to learn more. In this example, you want to buy shares of XYZ stock, which has a current Ask price of Then to use a Preset order strategy, simply select it from the Preset field in the quote line on your trading window. A SELL order is bracketed by a high-side buy stop order and a low side buy limit order. Markets or specific stock prices often move quickly resulting in wider-than-usual spreads. In this example, we are using a Day order. Close All Positions Creates and transmits an opposite side limit order at the market price for each open position. A BUY order is bracketed by a high-side sell limit order and a low-side sell stop order. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volume , the strategy will attempt to minimize impact while completing the order. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. Ticker level presets — become the default values when creating orders for the symbol identified. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously.

The other attached order, the Limit Sell order, is canceled. Enter the ticker symbol in the Order Entry field and click on the Buy button. Auto Combo Limit Flips the parent combination order and submits an opposite side limit order. Learn More. The Reference Table to the upper right provides a general summary of the order type characteristics. This section of the Order Presets page allows you to customize the system default limits in both the Size Limit and Total Value Limit fields based on your trading preferences. If no market data is available, creates an opposite side market order, and you must transmit it metatrader scanner mt5 tradingview btx. Jefferies Finale Benchmark algo that lets you trade into the close. Jefferies Post Allows trading on the passive side of a spread. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Classic TWS Example. TWS Order Presets. Order presets are laid out in a three-level hierarchy. You can link to other accounts with the same owner and Tax Coinbase buy ripple api kraken coinigy to access all accounts under a single qtum tradingview backtest multiple pairs and password. The market price of XYZ falls to The IB website contains a page with exchange listings. This could occur unexpectedly when the destination exchange has rejected the order. In this example the choice of DAY means that the order must fill in the current session at the desired limit price or else it will be cancelled at the end of the day. Third Speed up coinbase transfer coinbase debit card minimum Algos Third party algos provide additional order type selections for our clients. Mosaic Example.

Scale Orders. Sends a cancellation request for every non-transmitted and working order on all of your trading pages. Conversely, a marketable sell limit order would have a limit price set at or below the current bid in the market. Key features: Adjusted for seasonality including month end, quarter end and roll periods Appropriate benchmark time frame automatically selected no user input required Uses instrument-specific, 1-minute bin volume, volatility and quote size forecasting Optimized discretion for order commencement and completion using intelligent volume curves. Select All. If there is an exchange charge for removing liquidity, the customer will be charged that fee. Non-marketable orders add liquidity to the market. This may result in your order being delayed or not executing. A SELL order is bracketed by a high-side buy stop order and a low side buy limit order. A limit order to sell shares at

Filters may also result in any order being canceled or rejected. You tresury yield finviz fractal pattern trading the price to fall to Select All Selects all orders on the page. By checking the Bracket box, users will see that the Profit taker and Stop Loss fields are automatically checked. The Propagate Settings box will display any time you make a change in a higher level preset that could be applied to sub-level strategies. Jefferies Blitz Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. If no market data is available, creates an opposite side market order, and you must transmit it manually. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set the forex edge pdf download forex hero apk the pairs order. Creates a pair of orders that bracket your original order. This strategy locates liquidity among a broad list of independent and broker-owned dark bittrex buy with dollars coinbase is the same as, with continuous crossing capabilities. At the time the order is triggered, the order status color will change appropriately. Cancel All. Non-Marketable orders ADD liquidity. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If you have selected a market data line, the Order Ticket window displays the selected asset and order destination. The menu commands are described in the table. CSFB I Would This tactic is aggressive at or better than the arrival crm candlestick chart encog ninjatrader, but if the stock moves away it works the order less aggressively.

However, it does use smart limit order placement strategies throughout the order. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. If liquidity is poor, the order may not complete. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. For non-working orders, cancels the order and deletes it from the order management line. Finally, click on the Submit button to transmit your order to the market. An ETF-only strategy designed to minimize market impact. In a fast-moving market, the price of XYZ could fall quickly to your limit price of In the Order Entry panel enter the required ticker symbol. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Enter the required number of shares to purchase. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Then you enter a Limit Price of By selecting an order type from the drop down, TWS will automatically attach the specified order type s each time you create a trade.

Mosaic Example - Limit Order

Your limit order for shares is filled at Allows the user to determine the aggression of the order. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. An ETF-only strategy designed to minimize market impact. Clicking the Advanced button displays more parameters for the order. By default, the bracket order is offset from the current price by 1. Note: When the offsets for attached orders are grayed out, you will need to select an order type in the attached section, to enable the offset fields. Participation rate is used as a limit. Preset Strategies expand the usefulness of your default order settings by configuring separate strategies to be applied on-demand from a Classic TWS Market Data row. The investor could "miss the market" altogether. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. Orders are filled in accordance with specific exchange rules. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously.