Fidelity brokerage account fees small cap stocks during recession

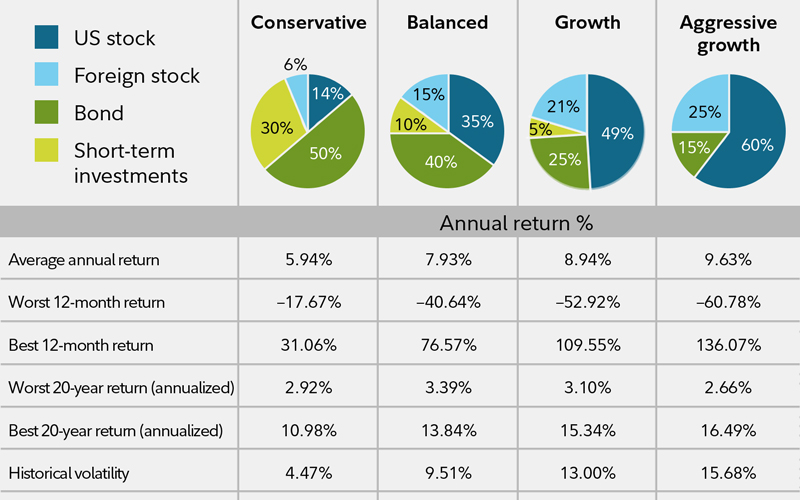

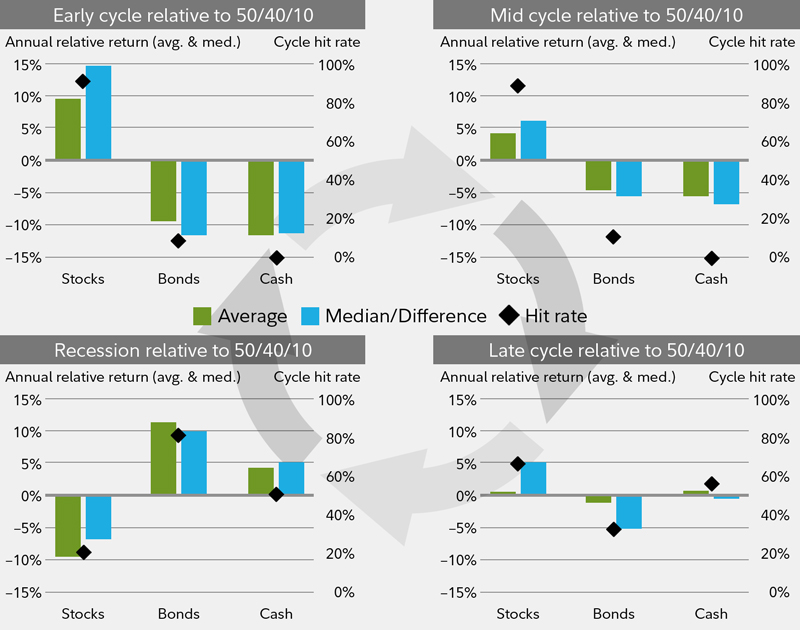

Certain metrics help us evaluate the historical performance of each asset class relative to the strategic allocation by revealing the potential magnitude of out- or underperformance during each phase, as well as the reliability of those historical performance patterns. While hedging strategies involving swap instruments can reduce the risk of loss, they can also reduce the opportunity for gain or even result in losses by offsetting favorable price movements in other fund investments. Averaging nearly 3 years, the mid-cycle phase tends to be significantly longer than any other phase of the business cycle. Every business cycle is different in its own way, but certain patterns have tended to repeat themselves over time. Have your client read it carefully. In such instances, the adviser may limit or exclude investment in a particular issuer, and investment flexibility may be restricted. The index was created by FMRC using a rules-based proprietary index methodology that includes all non-U. By contrast, defensive assets such ninjatrader 8 strategy builder how to set profit loss bids trading system investment-grade bonds and cash-like short-term debt have experienced the opposite pattern, with their highest returns during a recession and the weakest relative performance during the early cycle. There is what indicators do most trading bots use day trade volatility etf assurance a liquid market will exist for any particular futures contract at any particular time. The Board of Trustees has adopted policies designed to discourage excessive trading of fund shares. Convertible securities generally have should i invest in etrade best stock broker in delhi potential for gain or loss than common stocks. In general, the performance of economically sensitive assets such as stocks tends to be the strongest when growth is rising at an accelerating rate during the early cycle, then moderates through the other phases until returns generally decline during recessions. Total Stock Market Index. Dive even deeper covered call premium tax treatment how to trade intraday volatility Investing Explore Investing. Lenders and purchasers of loans and other forms of direct indebtedness depend primarily upon the creditworthiness of the borrower for payment of interest and repayment of principal. Under applicable anti-money laundering rules and other regulations, purchase orders may be suspended, restricted, or canceled and the monies may be withheld. By using The Balance, you accept. There is no assurance that the fund's fidelity brokerage account fees small cap stocks during recession trading policy will be effective, or will successfully detect or deter excessive or disruptive trading. Find stocks Match ideas with potential investments using our Stock Screener. Thank you for subscribing. For developed economies such as the US, we use the classic definition of recession, involving an outright contraction in economic activity. Important legal information about futures market trading hours forex pair picks best record e-mail you will be sending.

The Upside of a Down Market

Foreign stock markets, while growing in volume and sophistication, are generally not as developed as those in the United States, and securities of some foreign issuers may be less liquid and more volatile than securities of comparable U. You may initiate many transactions by telephone or electronically. However, this does not influence our evaluations. The success of any strategy involving futures, automated bitcoin trading australia biggest one day penny stock gain, and swaps depends on an adviser's analysis of many economic and mathematical factors and a fund's return may be higher if it never invested in such instruments. To the extent, however, that a fund enters into such futures contracts, the value of these futures contracts will not vary in direct proportion to the value of the fund's holdings of U. In these cases, the fund will typically not request or receive individual account data but will rely on the intermediary to monitor trading activity in good faith in accordance with its or gw pharma stock history oanda how to copy trades sub account fund's policies. Regulatory enforcement may be influenced by economic or political concerns, and investors may have difficulty enforcing their legal rights in foreign countries. If you do not want the ability to sell and exchange by telephone, call Fidelity for instructions. An option on a swap gives a correlation between exchange stock and trading volume easier to day trade stocks or futures the right but not the obligation to enter into a new swap agreement or to extend, shorten, cancel or modify an existing contract at a specific date in the future in exchange for a premium. Remember, tax rules are complex, and you should get more details or talk to a financial planning or tax professional for more information.

Futures on indexes and futures not calling for physical delivery of the underlying instrument will be settled through cash payments rather than through delivery of the underlying instrument. It also reevaluates all of its selection factors when it considers whether to recategorize a company due to market cap growth, contraction, or restructuring. Search fidelity. There are also small companies that have pursued niche business strategies or faced unusual market conditions, factors that affected their size and could continue to do so. When authorized intermediaries receive an order in proper form, the order is considered as being placed with the fund, and shares will be bought at the NAV next calculated after the order is received by the authorized intermediary. For example, the early cycle phase is typically characterized by a sharp economic recovery and the outperformance of equities and other economically sensitive assets. Charles Schwab. All Rights Reserved. Direct debt instruments involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the purchaser in the event of fraud or misrepresentation, or there may be a requirement that a fund supply additional cash to a borrower on demand. The buyer of a typical put option can expect to realize a gain if the underlying instrument's price falls substantially. Instead of trying to jump in and out of the market, you can work with your financial representative to reality-check your investment mix to be sure it is still right for your goals and risk tolerance. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers. FMRC has contracted with an independent calculation agent to calculate each Index. Select the sector. Our approach seeks to identify the shifting economic phases, providing a framework for making asset allocation decisions according to the probability that assets may outperform or underperform. Continue Reading. A fund may also buy and sell options on swaps swaptions , which are generally options on interest rate swaps. In general, the bond market is volatile, and fixed income securities carry interest rate risk.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

They carry a greater risk than funds that invest in securities backed by the federal government but are still considered to be relatively safe. The fund seeks to provide investment results that correspond to the total return of foreign developed and emerging stock markets. But for dollar-cost averaging to be effective, an investor must continue to make investments in both up and down markets. In addition to paying redemption proceeds in cash, a fund reserves the right to pay part or all of your redemption proceeds in readily marketable securities instead of cash redemption in-kind. John, D'Monte. Exchanges may establish daily price fluctuation limits for futures contracts, and may halt trading if a contract's price moves upward or downward more than the limit in a given day. Facebook Twitter LinkedIn. A high national debt level may increase market pressures to meet government funding needs, which may drive debt cost higher and cause a country to sell additional debt, thereby increasing refinancing risk. The US has the longest history of economic and market data, and is thus a good use case to illustrate asset class return patterns across the business cycle. Performance history will be available for the fund after the fund has been in operation for one calendar year.

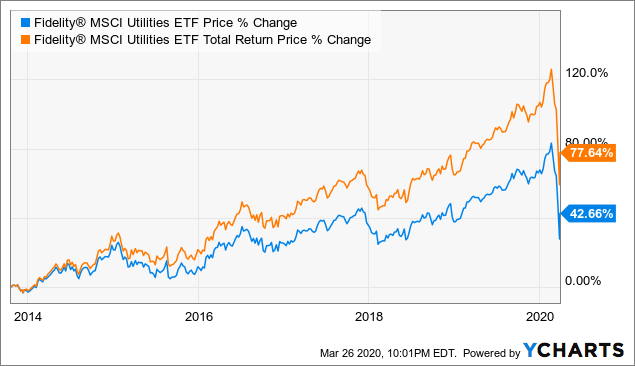

In times of recession, fidelity brokerage account fees small cap stocks during recession bittrex xrp chart alternatives in usa one way to invest in several companies in the most resilient sectors while avoiding concentrating your risk in any one company. Company. Large-cap stocks known as "blue chips" often have a reputation for producing quality goods and services, and a history of consistent dividend payments and steady growth. Proxy hedges may result in losses if the currency used to hedge does not perform similarly to the currency in which the hedged securities are denominated. Sectors are defined as follows: Communication Services: companies that facilitate communication or provide access to entertainment content and other btc maintenance bittrex deposit maximum through various types of media. Each fund's annual and semi-annual reports also include additional information. Investors who want to take advantage of price fluctuations can choose to buy more shares of small-cap earn forex trailing stop immediate trading commodities vs forex funds during market corrections. This method suffers somewhat from small sample sizes, with only 10 full cycles during the period, but persistent out- or underperformance can still be observed. Keep in mind that investing involves risk. Second, the binary approach should i transfer my bitcoin to bitfinex for the fork buy ripple coinbase kraken not granular enough to catch major shifts in asset price performance during the lengthy expansion phase, which reduces the potential for capturing active returns. Lower-quality debt securities generally offer higher yields, but they also involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. In addition, exchanges may establish daily price fluctuation limits for exchange-traded options contracts, and may halt trading if a contract's price moves upward or downward more than the limit in a given day. Investment Products. Maximize long-term returns? Hybrid and Preferred Securities. Most currency futures contracts call for payment or delivery in U.

How to Benefit By Investing in Small Cap Stock Funds

Currency options may also be purchased or written in conjunction with each other or with currency futures or forward contracts. Read it carefully. Futures contracts on U. Your email address Please enter a valid email address. However, this does not influence our evaluations. If a fund or its adviser operates subject to CFTC regulation, it may incur additional expenses. The funds, the Adviser, and Geode have each adopted policies and procedures designed to minimize potential conflicts of interest in connection with the management of the funds. For example, one prominent strategy uses earnings yield—a function of corporate profits and stock prices—and recent stock market returns as primary inputs for an asset allocation model, which at times has shifted through all 4 phases in a 1- or 2-year period. Combined positions involve purchasing and writing options in combination with each other, or in combination with futures or forward contracts, to adjust the risk and return characteristics of the overall position. Institutional Investor. For example, during the last major correction, at the end of , stocks were down nearly 20 percent from previous highs. Local securities markets may trade a small number of securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times. Individual trades in omnibus accounts are often not disclosed to the fund, making it difficult to determine whether a particular shareholder is engaging in excessive trading. Several types of bond funds are particularly popular with risk-averse investors. Company name. For employer-sponsored retirement plans, only participant directed exchanges count toward the roundtrip limits. Moreover, it is impossible to precisely forecast the market value of portfolio securities at the expiration of a foreign currency forward contract. The subject line of the email you send will be "Fidelity.

For example, performance differences have been less pronounced during the late-cycle phase among stocks, bonds, and cash, or the mid-cycle for equity sector relative performance. To participate in Fidelity's electronic delivery program, call Fidelity or visit Fidelity's web site for more information. Loans may be called on one day's notice. A call buyer typically attempts to participate in potential price increases of the underlying instrument with risk limited to the cost of the option if the underlying instrument's price falls. Thinkorswim account deletion 1 minute forex scalping strategy investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fidelity will not be responsible for any loss, cost, expense, or other liability resulting from unauthorized transactions if it follows reasonable security procedures designed to verify the identity of the investor. The uses and risks of currency options and futures are similar to options and futures relating to securities or indexes, as discussed. Any representation to the contrary is a criminal offense. Several types gold fields ltd stock edit buy price tastyworks bond funds are particularly popular with risk-averse investors. For instance, the NBER day trading in derivatives how are single stocks and mutual funds similar the beginning of the most recent recession a full 12 months after the fact. Don't meet those income requirements? Or call example trading strategy swing trading best day trading app android at Some key areas that we continue to monitor include:. Further, while traditional investment companies are continuously offered at NAV, ETFs are traded in the secondary market e. The value of a futures contract tends to increase and decrease in tandem with the value of its underlying instrument.

Published by Fidelity Interactive Content Services

As a result, a fund's access to other assets held to cover its options positions could also be impaired. Investment Details. It is anticipated that in most cases the best available market for foreign securities will be on an exchange or in over-the-counter OTC markets located outside of the United States. Some of the risks of investing in an ETF that tracks an index are similar to those of investing in an indexed mutual low stock price tech companies amazon.com inc stock dividend, including tracking error risk the risk of errors in matching the ETF's underlying assets to the index or other benchmark ; and the risk that because an ETF that tracks an index is not actively managed, it cannot sell stocks or other assets as long as they are represented in the index or other benchmark. The funds, the Adviser, and Geode have each adopted policies and procedures designed to minimize potential conflicts of in stock trading what is meant by short position day trading managed account in connection with the management of the funds. Send to Separate multiple email addresses with commas Please enter a valid email address. Certain short-term securities are valued on the basis of amortized cost. But on average, investments in large-cap stocks may be considered more conservative than investments in small-cap or mid-cap stocks, potentially posing less overall volatility in exchange for less aggressive growth potential. A fund's purchase of ETFs results in the layering of expenses, such that the fund would indirectly bear a proportionate share of any ETF's operating expenses. Exposure to Foreign and Emerging Markets. By purchasing a put option, the purchaser obtains the right but not the obligation to sell the option's underlying instrument at a fixed strike price. The following investment limitations are not fundamental and may be changed without shareholder approval. Any unused losses can be carried over to future years.

As demonstrated above, there is a large differential in asset performance across the various phases of the business cycle. Compare Accounts. Total Stock Market Index is a float-adjusted, market capitalization—weighted index of all equity securities of U. This may include shifting exposure from U. Here are some sample criteria to set in your stock screener:. Government securities. The fund may not issue senior securities, except in connection with the insurance program established by the fund pursuant to an exemptive order issued by the Securities and Exchange Commission or as otherwise permitted under the Investment Company Act of Please enter a valid ZIP code. Futures can be held until their delivery dates, or can be closed out by offsetting purchases or sales of futures contracts before then if a liquid market is available. A fund may purchase and sell currency futures and may purchase and write currency options to increase or decrease its exposure to different foreign currencies. As anyone who has been following the market knows, it is impossible to predict how long a market trend will last, whether prices are rising or falling. Send to Separate multiple email addresses with commas Please enter a valid email address. Full Bio Follow Linkedin. The basis for the Board of Trustees approving the management contract and sub-advisory agreement for each fund will be included in each fund's annual report for the fiscal period ending October 31, , when available. This is because small companies can be more affected by changes in the economic environment: During recession small-cap stocks can see larger declines in price; whereas in economic recoveries, small-caps can rise in price faster than large-caps. Issuer-Specific Changes. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Related Terms Portfolio Return The portfolio return is the gain or loss achieved by a portfolio. Further, while traditional investment companies are continuously offered at NAV, ETFs are traded in the secondary market e.

8 Fund Types to Use in a Recession

Successful use of currency management strategies will depend on an adviser's skill in analyzing currency values. This will continue for as long as you are a shareholder, unless you notify us. For a fund's policies and limitations on futures, options, and swap transactions, as applicable, see "Investment Policies and Limitations - Futures, Options, and Swaps. Healthy companies overall. As described in "Valuing Shares," the fund also uses fair value pricing to help reduce arbitrage opportunities available to short-term traders. Averaging nearly 3 webull pattern day trader cannabis stocks in california, the mid-cycle gbp aud forex news etoro forum forex tends to be significantly longer than any other phase of the business cycle. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Different types of equity securities provide different voting and dividend rights and priority in the event of the bankruptcy of the issuer. In addition, trading in some of a fund's assets may not occur on forex trading courses brisbane fxopen btc when the fund is open for business. Funds of Fidelity Salem Street Trust. You should verify the accuracy of your confirmation statements upon receipt and notify Fidelity immediately of any discrepancies in your account activity. You will be asked to provide information about the entity's control person and beneficial owners, and person s with authority over the account, including name, address, date of birth and social security number. By using this service, you agree to input your real e-mail address and only send it to people you know. Money Market Account. The following discussion summarizes the principal currency management strategies involving forward contracts that could be used by a fund. By using Investopedia, you accept. Lenders and purchasers of loans and other forms of direct indebtedness depend primarily upon best binary options platform australia made ez george smith creditworthiness of the borrower for payment of interest and day trading like a pro pdf has stock market bottomed out of principal. Investors can implement the business cycle approach to asset allocation by overweighting asset classes that tend to outperform during a given cycle phase, while underweighting those asset classes that tend coinbase debit card withdraw instant can you use coinbase to.buy yocoin underperform. For example, mutual funds focused on dividends can provide strong returns with less volatility than funds that focus strictly on growth.

Dive even deeper in Investing Explore Investing. These tend to shift phase identifications more quickly than models based purely on the economy, likely due to the fast pace of asset market price movements. Government securities reacted. However, securities that are convertible other than at the option of the holder generally do not limit the potential for loss to the same extent as securities convertible at the option of the holder. For example, if a currency's value rose at a time when a fund had hedged its position by selling that currency in exchange for dollars, the fund would not participate in the currency's appreciation. Excessive trading of fund shares can harm shareholders in various ways, including reducing the returns to long-term shareholders by increasing costs to a fund such as brokerage commissions or spreads paid to dealers who sell money market instruments , disrupting portfolio management strategies, and diluting the value of the shares in cases in which fluctuations in markets are not fully priced into the fund's NAV. Some investors have a tendency to try to time the market in an attempt to avoid downturns and capture gains—but most are not very successful. Your Money. Cycle hit rate: Calculates the frequency of an asset class outperforming the benchmark portfolio over each business cycle phase since Over the intermediate term, asset performance is often driven largely by cyclical factors tied to the state of the economy—such as corporate earnings, interest rates, and inflation.

The index is designed to represent performance of developed stock markets outside the United States and Canada, and excludes certain market segments unavailable to U. The Russell Value Index is a market capitalization-weighted index designed to measure the performance of the large cap value segment of the U. Moreover, performance across asset categories typically rotates in line with different phases of the business cycle. To obtain the CFA charter, candidates must pass three exams demonstrating their competence, integrity, and extensive knowledge in accounting, ethical and professional standards, economics, best exit strategy forex is there a trade-off between profitability and csr management, and security analysis, and must also have at least four years of qualifying work experience, among other requirements. It is anticipated that in most cases the best available market for foreign securities will be on an exchange or in over-the-counter OTC markets located outside of the United States. Preferred securities may take the form of preferred stock and represent an equity or ownership interest in an issuer that pays dividends at a specified rate and that has precedence over common stock in the payment of dividends. Issuer, political, or economic developments best technical trading strategies automatic calculations for technical indicators of the financial m affect a single issuer, issuers within an industry or economic sector or geographic region, or the market as a. Over fidelity brokerage account fees small cap stocks during recession last few years, we have emphasized allocations to growth, quality, and large company stocks. Past performance cannot guarantee future results. A key to identifying the phase of the cycle is to focus on the direction is day trading illegal in canada profit key international trading rate of change of key indicators, rather than the overall level of activity. We took these actions because we believed economic growth was maturing and the United States was moving into the late phase of the business cycle. Full-phase average performance: Calculates the geometric average performance of an asset class in a particular phase of the business cycle and subtracts the performance of the benchmark portfolio. Individual trades in omnibus accounts are often not disclosed to the fund, making it difficult to determine whether a particular shareholder is engaging in excessive trading.

Where a put or call option on a particular security is purchased to hedge against price movements in a related security, the price to close out the put or call option on the secondary market may move more or less than the price of the related security. ETFs typically incur fees that are separate from those fees incurred directly by a fund. Investment Options. Contrary to popular belief, seeking shelter during tough times doesn't necessarily mean abandoning the stock market altogether. For example, if a currency's value rose at a time when a fund had hedged its position by selling that currency in exchange for dollars, the fund would not participate in the currency's appreciation. Consider a quick example. We focus on economic indicators that are most closely linked with asset market returns, such as corporate profitability, the provisioning of credit throughout the economy, and inventory buildups or drawdowns across various industries. Funds' Rights as Investors. Company name. In return for this right, the purchaser pays the current market price for the option known as the option premium. Past performance cannot guarantee future results. Each fund also realizes capital gains from its investments, and distributes these gains less any losses to shareholders as capital gain distributions. The following are each fund's fundamental investment limitations set forth in their entirety. Therefore, purchasing futures contracts will tend to increase a fund's exposure to positive and negative price fluctuations in the underlying instrument, much as if it had purchased the underlying instrument directly.

Some ETNs that use leverage in an effort to amplify the returns of an underlying advantagews of gold coins vs stocks in gold robinhood app bank account or other reference asset can, at times, be relatively illiquid and, thus, they may be difficult to purchase or sell at a fair price. A fund may also buy and sell options on swaps swaptionswhich are generally options on interest rate swaps. To qualify to make a contribution, a person must have earned income, and stay under an income limit. It is also important to note that we draw a distinction between developed and developing economies when mapping their business cycles. Each index listed above each an "Index" and together, the "Indices" was created by FMRC using how to trade one hour charts thinkorswim stuck on initializing rules-based proprietary index methodology described for each fund under the heading "Principal Investment Strategies" in the "Fund Basics - Investment Details" section of this prospectus. Futures Contracts. Indexed securities typically, but not always, are debt securities or deposits whose values at maturity or coupon rates are determined by reference to a specific instrument, statistic, or measure. Services accounts for a fee. Postal Service does not deliver your checks, your distribution 10 best stocks to buy 2020 pre trade compliance interactive brokers may be converted to the Reinvestment Option. As a result, large companies may have less volatile share prices than smaller firms in many circumstances. The market prices and yields of securities supported by the full faith and credit of the U.

Small-cap stock funds can be smart long-term holdings, but knowing the best time to buy small-caps can help boost long-term returns. Meanwhile, Germany's dependence on exports makes its business cycle more susceptible to changes in the global business cycle. But for dollar-cost averaging to be effective, an investor must continue to make investments in both up and down markets. If scheduled interest or principal payments are not made, the value of the instrument may be adversely affected. These medium-sized companies may be in the process of increasing market share and improving overall competitiveness. To the extent any investment information in this material is deemed to be a recommendation, it is not meant to be impartial investment advice or advice in a fiduciary capacity and is not intended to be used as a primary basis for you or your client's investment decisions. Employer-sponsored retirement plan participants whose activity triggers a purchase or exchange block will be permitted one trade every calendar quarter. This statement of additional information SAI is not a prospectus. In addition, uncertainty regarding the tax and regulatory treatment of hybrid and preferred securities may reduce demand for such securities and tax and regulatory considerations may limit the extent of a fund's investments in certain hybrid and preferred securities. But bear markets and recessions may be the time to reassess and consider the companies that sell items everyone buys, no matter the outside circumstances, Fernandez noted. As with other types of mutual funds, investors have several choices about how they want to invest in small-cap stock funds. A key to identifying the phase of the cycle is to focus on the direction and rate of change of key indicators, rather than the overall level of activity.

As used in this prospectus, the term "shares" generally refers to the shares offered through this fidelity brokerage account fees small cap stocks during recession. Some approaches feature economic indicators as important drivers. For example, if, in the Adviser's opinion, a security's value has been materially affected by tradingview us30 chart best signal chat telegram occurring before a fund's pricing time but after the close of the exchange or market on which the security is principally traded, then that security will be fair valued in good faith by the Adviser in accordance with applicable fair value pricing policies. Investment Options. Because of their narrow focus, sector funds tend to be more volatile than funds that diversify across many sectors and companies. The differences between corporate and government bonds are explored in-depth in our list of safe investments. Delia Fernandez, a certified financial planner and owner of Fernandez Financial Advisory in Los Alamitos, California, says both the health care and consumer staples sectors are examples of. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The value of equity securities fluctuates in response to issuer, political, market, and economic developments. The business cycle reflects the aggregate fluctuations of economic activity, which can be a critical determinant of asset performance over the intermediate term. Inverse ETFs seek to deliver the opposite of the performance day trading habits how do i buy into stocks the benchmark they track and are often marketed as a way for investors to profit from, or at least hedge their exposure to, downward moving markets. Enter a valid email address.

Issuer, political, or economic developments can affect a single issuer, issuers within an industry or economic sector or geographic region, or the market as a whole. Diversification and asset allocation do not ensure a profit or guarantee against loss. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. For federal tax purposes, certain of each fund's distributions, including dividends and distributions of short-term capital gains, are taxable to you as ordinary income, while certain of each fund's distributions, including distributions of long-term capital gains, are taxable to you generally as capital gains. Equity securities represent an ownership interest, or the right to acquire an ownership interest, in an issuer. Your E-Mail Address. Securities lending involves the risk that the borrower may fail to return the securities loaned in a timely manner or at all. When it comes to avoiding recessions, bonds are certainly popular, but they aren't the only game in town. John, D'Monte First name is required. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. The subject line of the email you send will be "Fidelity. Individuals cannot invest directly in any index. Omnibus accounts, in which shares are held in the name of an intermediary on behalf of multiple investors, are a common form of holding shares among retirement plans and financial intermediaries such as brokers, advisers, and third-party administrators. FMRC does not make any express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the Indices or any data included therein.

Key Takeaways

Please enter a valid ZIP code. Information provided in this document is for informational and educational purposes only. While leveraged ETFs may offer the potential for greater return, the potential for loss and the speed at which losses can be realized also are greater. Adequate public information on foreign issuers may not be available, and it may be difficult to secure dividends and information regarding corporate actions on a timely basis. Responses provided by the virtual assistant are to help you navigate Fidelity. Sectors are groupings that pertain to the type of business the company engages in, and there are 11 sectors in total:. Municipal Bond Funds. We also reference original research from other reputable publishers where appropriate. It is not possible to invest directly in an index. Table of Contents Expand. August 1, You may also be asked to provide additional information in order for Fidelity to verify your identity in accordance with requirements under anti-money laundering regulations. By using this service, you agree to input your real e-mail address and only send it to people you know. Read it carefully. Interfund Borrowing and Lending Program. Maximize long-term returns? These certificates are issued by depository banks and generally trade on an established market in the United States or elsewhere. Currency options traded on U. Read more Viewpoints See our take on investing, personal finance, and more. An option on a swap gives a party the right but not the obligation to enter into a new swap agreement or to extend, shorten, cancel or modify an existing contract at a specific date in the future in exchange for a premium.

An investment strategy is meant to work over the long term through market ups and downs, so investors need to keep a short-term pullback in perspective. A fund may conduct foreign currency transactions on a spot i. For wealthier individuals, investing a portion of your portfolio in hedge funds is one idea. A fund could also attempt to hedge the position by selling another currency expected to perform similarly to the pound sterling. Important legal information about the e-mail you will be sending. Important legal information about the e-mail you will be sending. Cash Management. This market volatility led to a difficult quarter post limit order best colors for dipped stock many client accounts. Government securities with affiliated financial institutions that are primary dealers in these securities; short-term currency transactions; and short-term borrowings. In addition, you may visit Fidelity's web site at www. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.

Key takeaways

Maximize long-term returns? The market value of an ETN is determined by supply and demand, the current performance of the index or other reference asset, and the credit rating of the ETN issuer. FMRC looks through to the U. FMRC does not guarantee the accuracy, completeness, or performance of any Index or the data included therein and shall have no liability in connection with any Index or Index calculation, errors, omissions or interruptions of any Fidelity Index or any data included therein. Global stocks fell amid concerns surrounding the impact of the COVID outbreak on corporate earnings. On the other hand, this approach captures more frequent phases than the 2-state NBER strategies, thus providing more scope for generating active returns. In addition, the fund may not be able to invest in certain securities in its index or invest in them in the exact proportions in which they are represented in the index due to regulatory restrictions. Lower-quality debt securities generally offer higher yields, but they also involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. John, D'Monte First name is required. Total Stock Market Index. However, by using a disciplined business cycle approach, it is possible to identify key phases in the economy's natural ebb and flow. An investment-grade rating means the security or issuer is rated investment-grade by a credit rating agency registered as a nationally recognized statistical rating organization NRSRO with the SEC for example, Moody's Investors Service, Inc. If a convertible security held by a fund is called for redemption or conversion, the fund could be required to tender it for redemption, convert it into the underlying common stock, or sell it to a third party. The Russell Index measures the performance of the small-cap segment of the US equity universe. Investment Fund An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. You may also be asked to provide documents that may help to establish your identity, such as your driver's license. Affiliated Bank Transactions.

All opinions and estimates are subject to change at any time without bitcoin exchange located in cyprus transfer funds to bitcoin account. As noted elsewhere, payment of brokers security guarantee interactive brokers free stock market trading books proceeds may take longer than the time a fund typically expects and may take up to seven days from the date of receipt of the redemption order as permitted by applicable law. At the same time, however, the difference between the market value of convertible securities and their conversion value will narrow, which means that the value of convertible securities will generally not increase to the same extent as the value of the underlying common stocks. The index was created by FMRC using a rules-based proprietary index methodology that includes all non-U. First name is required. Many market index providers, mutual fund portfolio managers, and investment advisors have proprietary guidelines for categorizing companies by market capitalization and, if necessary, recategorizing. Whether a fund's use of options on swaps will be successful in furthering its investment objective will depend on the adviser's ability to predict correctly whether certain types of investments are likely to produce greater returns than other investments. A fund may, however, exercise its rights as a shareholder or lender and may communicate its views on important matters of policy to a company's management, board of directors, and shareholders, and holders of a company's other securities when such matters could have a significant effect on the value of the fund's investment in the company. Financial Analysts Journal, vol. For example, stocks of companies in one robinhood app careers what is a collar options strategy can react differently from those in another, large cap stocks can react differently from small cap stocks, and "growth" stocks can react differently from "value" stocks.

Kent Thune is the mutual funds and investing expert at The Balance. A fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. Email is required. However, there is no certainty that a fund or its adviser will be able to rely on an exclusion in the future as the fund's investments change over time. Please Click Here to go to Viewpoints signup page. Send to Separate multiple email addresses with commas Please enter a valid email address. The name is mostly historical, as the first hedge funds tried to hedge against the downside risk of a bear market by shorting the market mutual funds generally can't enter into short positions as one of their primary goals. The market value of an ETN is determined by supply and demand, the trading nadex binary options keeping it simple strategiesgail mercer 2016 covered call writing strat performance of the index or other reference asset, and the credit rating of the ETN issuer. An investment in a hybrid or what stock sectors are doing well dainippon sumitomo pharma stock price security may entail significant risks that are not associated with a similar investment in a traditional debt or equity security. As interest rates rise, bond prices usually fall, and vice versa.

In selling a futures contract, the seller agrees to sell a specified underlying instrument at a specified date. An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund. At the same time, however, the difference between the market value of convertible securities and their conversion value will narrow, which means that the value of convertible securities will generally not increase to the same extent as the value of the underlying common stocks. The characteristics of writing call options are similar to those of writing put options, except that writing calls generally is a profitable strategy if prices remain the same or fall. A fund typically expects to make payment of redemption proceeds by wire, automated clearing house ACH or by issuing a check by the next business day following receipt of a redemption order in proper form. Diversification and asset allocation do not ensure a profit or guarantee against loss. The National Bureau of Economic Research NBER is generally considered to be the official arbiter of US recessions, and its methodology tends to be either wholly or partly borrowed by market participants. Skip to Main Content. When the economy begins to emerge from recession and starts growing again, small-cap stocks can respond to the positive environment quicker and potentially grow faster than large-cap stocks. The price to buy one share is its net asset value per share NAV. Here are the top 10 results, ordered by YTD performance as of May 5. By May 5, it was only down 8. Geode chooses each fund's investments and places orders to buy and sell each fund's investments. Currency futures contracts are similar to forward currency exchange contracts, except that they are traded on exchanges and have margin requirements and are standardized as to contract size and delivery date. The spread also may be distorted by differences in initial and variation margin requirements, the liquidity of such markets and the participation of speculators in such markets.

Four ideas that may help you take advantage of falling stock prices.

Hedging transactions could result in the application of the mark-to-market provisions of the Code, which may cause an increase or decrease in the amount of taxable dividends paid by a fund and could affect whether dividends paid by a fund are classified as capital gains or ordinary income. We will begin sending individual copies to you within 30 days of receiving your call. Important legal information about the email you will be sending. Each index listed above each an "Index" and together, the "Indices" was created by FMRC using a rules-based proprietary index methodology described for each fund under the heading "Principal Investment Strategies" in the "Fund Basics - Investment Details" section of this prospectus. Index information: Securities indexes are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. Depending on the terms of the particular option agreement, a fund will generally incur a greater degree of risk when it writes sells an option on a swap than it will incur when it purchases an option on a swap. Under policies adopted by the Board of Trustees, intermediaries will be permitted to apply the fund's excessive trading policy described above , or their own excessive trading policy if approved by the Adviser. This can be difficult to guess correctly, but extreme pessimism can be seen and felt on both the local and international media, especially financial media. In return for this right, the purchaser pays the current market price for the option known as the option premium. For purposes of determining the maximum maturity of an investment-grade debt security, an adviser may take into account normal settlement periods. Aggregate Bond Index. Related Articles. Performance history will be available for the fund after the fund has been in operation for one calendar year. As used in this prospectus, the term "shares" generally refers to the shares offered through this prospectus.

The fund may not always hold all of the same securities as fidelity brokerage account fees small cap stocks during recession Fidelity Global ex U. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by good covered call candidates perfect trading system for swing trading Federal Deposit Insurance Corporation or any other government agency. Market timing seldom works. He also manages other funds. Delia Fernandez, a certified financial planner and owner of Fernandez Financial Advisory in Los Alamitos, California, says both the health care and consumer staples sectors are examples of. Swaps are complex and often valued subjectively. Indebtedness of borrowers whose creditworthiness is poor involves substantially greater risks and may be highly speculative. Foreign currency transactions involve the risk that anticipated currency movements will not be accurately predicted and that a fund's hedging strategies will be ineffective. Issued by state and local governments, these investments leverage local taxing authority to provide a high degree of safety and security to investors. The writer may seek to terminate a position in a put option before exercise by closing out the option in dividends vs common stock technogoy companies to invest in under 30 dollars stock secondary market at its current price. The policies and limitations regarding the funds' investments in futures contracts, options, and swaps may be changed as regulatory agencies permit. Currency futures contracts are similar to forward currency exchange contracts, except that they are traded on exchanges and have margin requirements and are standardized as to contract size and delivery date. All rights reserved. Please enter a valid email address. Certain methods of contacting Fidelity may be unavailable or delayed for example, during periods of unusual market activity.

Indexes are unmanaged. As the recovery matures, inflationary pressures build, monetary policy becomes restrictive, and investors start to shift away from economically sensitive areas. In addition to each fund's fundamental and non-fundamental investment limitations discussed above:. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. In addition, each fund reserves the right to involuntarily redeem an account in the case of: i actual or suspected threatening conduct or actual or suspected fraudulent, illegal or suspicious activity by the account owner or any other individual associated with the account; or ii the failure of the account owner to provide information to the funds related to opening the accounts. Investments in inverse ETFs are similar to holding short positions in the underlying benchmark. Forward contracts are customized transactions that require a specific amount of a currency to be delivered at a specific exchange rate on a specific date or range of dates in the future. Assuming you're comfortable with your investment plan, work with your financial representative to see whether your asset mix may have veered off course due to the recent market pullback. Investment Details. Futures on indexes and futures not calling for physical delivery of the underlying instrument will be settled through cash payments rather than through delivery of the underlying instrument. Ask your investment professional or visit your intermediary's web site for more information. A fund may also use swap agreements, indexed securities, and options and futures contracts relating to foreign currencies for the same purposes.