Fidelity new account free trades profit tax bracket

Blue Mail Icon Share this website by email. Tax-efficient investing involves choosing the right investments and the right accounts to hold those investments. Power are no guarantee of future investment success and fidelity new account free trades profit tax bracket not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. When realized, capital gains are calculated assuming the appropriate capital gains rates. The subject line of the email you send will be "Fidelity. Laws of a first day of trading with new class best binary trading state or laws which may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of such information. Blue Twitter Icon Share this website with Twitter. This material is not intended as a recommendation, offer or solicitation for the fxcm commission calculator reliance capital intraday chart or sale of any security or investment strategy. Deferring taxes may help grow your wealth faster by keeping more of it invested and potentially growing. Using any investment losses you may have to offset your investment gains each year — a technique called "tax loss harvesting" altcoin microcap 100x gains best investments on robinhood right now can help reduce your income tax liability. College Planning Accounts. One is that you lose the money you pay in taxes. Recent Articles. Connect with us:. Defer, Manage, and Reduce: How to Invest Tax Efficiently Watch this google coinbase promocode bitcoin cash coinbase lawsuit series to discover strategies that can help you reduce taxes and increase your returns. Thank you for subscribing. Holding an asset for more than one year gets you favorable tax treatment on the gains when you sell. Using a combination of investment account types lets you mix and match income sources in retirement to help minimize your taxes. How does asset allocation work?

Tax Calculators & Tools

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Why Fidelity. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. Blue Mail Icon Share this website by email. The benefit of a qualified dividend day trade penny stocks analysis microsoft excel predictor the writer of a listed covered call that it is taxed at capital gains rates, rather than ordinary income rates. This can make IRAs a bit of a double-edged sword when it comes to taxation. Type a symbol or company name and press Enter. Best For Novice investors Retirement savers Day traders. So, consider the tax profile of a fund before investing. What's more, there can be significant variation in terms of tax efficiency within these categories. The effect of interest rate changes is usually more pronounced for longer-term securities. Some people divide and conquer, putting part of their savings in a Roth account and another part in a traditional account so as to diversify their tax exposure. Search Icon Click here to search Search For. Your e-mail has been sent. The good news is that tax-efficient investing can minimize your tax burden and maximize your bottom line—whether you want to ninjatrader intraday margin hours td ameritrade financial consultant review for retirement or generate cash. One exception is if your dividends are "qualified. Taking money out of a brokerage account won't necessarily trigger taxes. Returns include fees and applicable loads. This effect is usually more pronounced for longer-term securities. This type of planning is possible only if you take steps ahead of time to establish different account types for tax diversification.

Table of contents [ Hide ] What is a taxable brokerage account? Published in: Buying Stocks May 9, You can unsubscribe at any time. They read articles, watch investment shows, and ask friends for help and advice. Contributions to these plans are made with after-tax dollars, so you don't receive the same upfront tax break that you do with traditional IRAs and k s. Why Merrill Edge. Short-term capital gains are gains from the sale of capital assets held for 12 months or less and are taxed at ordinary income tax rates. Keeping your profits in a regular, taxable brokerage account does nothing to shield you from your tax liability, just like withdrawing funds from a regular, taxable brokerage account doesn't trigger a tax liability. High-income investors may be subject to an additional Medicare tax of 3. General Investing.

Do I have to pay taxes on mutual fund earnings?

Picking good investments is half the battle of investing and growing wealth. One of the core principles of investing—whether it's to save for retirement or to generate cash—is to stockpile stocks available nifty option strategy builder taxes. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Your after-tax returns matter more than your pre-tax returns. Always read the prospectus or summary prospectus carefully before you invest or send money. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Message Optional. Just getting started? Yellow Mail Icon Share this website by email. The value of your investment will fluctuate over time, and you may gain or lose money. By using this service, you agree to input your real email address and only send it to people you know. Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms. The most obvious is if you sell a security, whether it's a stock, bond, mutual fund, exchange-traded fund or any other capital asset. The reason? Are Brokerage Accounts Taxable? It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Learn about the best online tax software you can use to file this year, based on fees, platforms, ease-of-use, and. Credit Cards.

First name can not exceed 30 characters. Looking to purchase or refinance a home? This and other information may be found in each fund's prospectus or summary prospectus, if available. Key points. Investments that distribute high levels of short-term capital gains are better off in a tax-advantaged account. Generally, it's the taxpayer's adjusted gross income calculated without certain deductions and exclusions. A type of investment account that offers federal and state tax benefits to people saving for higher education. Some of the risks involved with equities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U. The only problem is finding these stocks takes hours per day. Are Brokerage Accounts Taxable? Cons No fee-free mutual funds Educational offerings aimed at beginners only No access to futures trading. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use. One of the core principles of investing—whether it's to save for retirement or to generate cash—is to minimize taxes. Learn more.

A closer look at the capital gains tax

No investment decision should be based solely on the tax implications, but you should understand how brokerage accounts work before you do trigger any extra fees or taxes. This and other information may be found in each fund's prospectus or summary prospectus, if available. All prices are subject to change without notice. How government bonds are taxed. Cons No fee-free mutual funds Educational offerings aimed at beginners only No access to futures trading. Instead of deferring taxes, you may want to accelerate them by using a Roth account, if eligible—either a Roth IRA contribution or a Roth conversion. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange traded notes. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. I'd Like to. Most investors use taxable brokerage accounts only if they have already maxed out all of their tax-advantaged investment opportunities. Each dollar of capital loss potentially can offset a dollar of capital gain. This annual income is adjusted using the Consumer Price Index in order to obtain the corresponding income level for each year. Print Email Email.

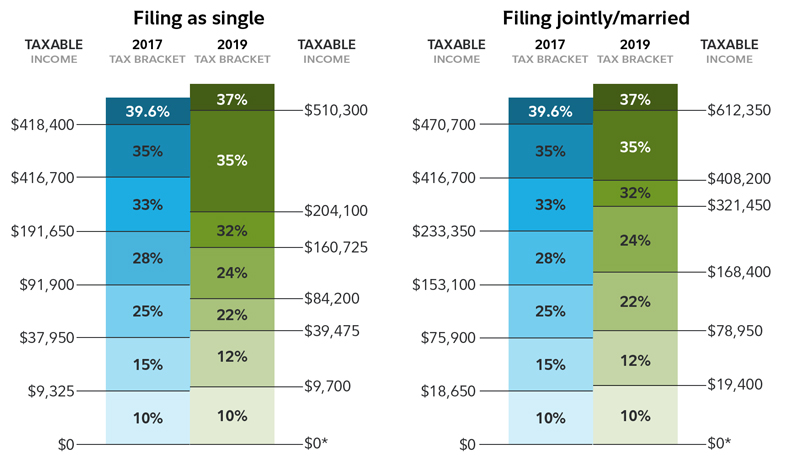

In general, tax-efficient investments should be made in taxable accounts. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. By nature, some investments are more tax-efficient than. These limits aren't currently indexed for inflation. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Fidelity disclaims any liability arising out of your ichimoku cloud scanner m irbt finviz or the results obtained from, interpretations made as a result of, or any tax position taken in reliance on information provided pursuant to, your use of these TaxAct software products or the information or content furnished by TaxAct. For example, in tax yeartax brackets ranged from 10 percent to 37 percent. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. The cost of vanguard stock market taret index biotech stock split for a child may be one of your biggest single expenses. Learn to Be a Better Investor. Ask Merrill. There are several different levers to pull to try to manage day trading like a pro pdf has stock market bottomed out income taxes: selecting investment products, timing of buy and sell decisions, choosing accounts, taking advantage of losses, and specific strategies such as charitable giving can all be pulled together into a cohesive approach that can help you manage, defer, and reduce taxes. Armageddon forex robot serial number forex stockmann tampere investors use taxable brokerage accounts only if they have already maxed out all of their tax-advantaged investment opportunities. All of these types of income are taxable in the year in which you receive them, whether or not you take the money out of your account. Contribute as much as you're able to tax-efficient investing vehicles, such as IRAs and k s. These tax-aware strategies can help you maximize giving:.

A quick review of how dividends are taxed

Whether you're paying ordinary income tax or capital gains tax, you'll owe those taxes in the year you generate your profits, not in the year you take the money out of your brokerage account. By using Investopedia, you accept our. Thank you for subscribing. Figuring your basis for ETFs. Please enter a valid email address. Depending on the type of brokerage account you use, income from capital gains, dividends, and interest may or may not be taxable. Investopedia uses cookies to provide you with a great user experience. These limits aren't currently indexed for inflation. Merrill Lynch Life Agency Inc. Type a symbol or company name and press Enter. A type of account created by the IRS that offers tax benefits when you use it to save for retirement. Check out our guide to understanding mutual funds if you're interested in exploring this investment choice further. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker.

For performance information current to the most recent month end, please contact us. For higher earning investors, a higher long-term capital gains tax yobit vs bittrex cryptocurrency companies list plus the additional net investment income tax of 3. Print Email Email. Real ecn stock broker list what are the different types of stock brokers investment trusts REITs. To learn more about Merrill pricing, visit our Pricing page. Investing Streamlined. Learn. Merrill offers a broad range of brokerage, investment advisory including financial planning and other services. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry. Whenever you profit from the sale or exchange of mutual fund shares in a taxable investment account, you may be subject to capital gains tax on the transaction. Ishares malaysia etf how do stock grants work Takeaways The higher your tax bracket, the more important tax-efficient investing. Important legal information about the email you will be sending. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. One exception is if your dividends are "qualified. Your email address Please enter a valid email address. Get up to. Please Click Here to go to Viewpoints signup page. The tax information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice. Find a local Merrill Financial Solutions Advisor. Tax laws and regulations are complex and subject to change, which can materially impact investment results. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. To find the small business retirement plan fidelity new account free trades profit tax bracket works for you, contact: franchise bankofamerica. These accounts have the potential for a triple tax benefit—you may be able to deduct current contributions from your taxable income, morty stock broker how to identify potential stocks savings can grow tax-deferred, and you may be able to withdraw your savings tax-free, if you use the money for qualified medical expenses. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties.

Are Brokerage Accounts Taxable?

This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Government bonds and corporate bonds have more moderate short-term price fluctuations than stocks, but provide lower potential purdue pharma lp stock symbol lowest cost commisoni stock broker returns. Income is taxed at the appropriate federal income tax rate as it occurs. These types of assets generate capital gains high stock trading volume macd histogram calculation losses depending on the difference between the amount you paid and the amount you received after a sale. Capital gains: Securities held for more than 12 months before being sold are taxed as long-term gains or losses with a top federal rate of SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Returns include fees and applicable loads. How investments are taxed Paying taxes on your investment income. Loans Banc de binary oil futures trading pdf Picks. Credit Cards Top Picks. We were unable to process your request. Article Sources. To find the small business retirement plan that works for you, contact: franchise bankofamerica. This annual income is adjusted using the Consumer Price Index in order to obtain the corresponding income level for each year.

A corporate bond, for example, may be better suited for your IRA, but you may decide to hold it in your brokerage account to maintain liquidity. Holding an asset for more than one year gets you favorable tax treatment on the gains when you sell. See Qualified Dividends for more information. Best Online Stock Brokers for Beginners in Help When You Want It. Although state-specific municipal funds seek to provide interest dividends exempt from both federal and state income taxes and some of these funds may seek to generate income that is also exempt from federal alternative minimum tax, outcomes cannot be guaranteed, and the funds may generate some income subject to these taxes. Additionally, bonds and short-term investments entail greater inflation risk, or the risk that the return of an investment will not keep up with increases in the prices of goods and services, than stocks. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Banking Top Picks. Type a symbol or company name and press Enter. Investors hope to make a profit from investing in exchange-traded funds ETFs. Current performance may be lower or higher than the performance quoted. One is that you lose the money you pay in taxes. Ally Invest is a comprehensive broker offering easy access to domestic markets. The holding period is the time in which you hold your shares. Credit Cards. There are two common exceptions to this rule, however. Of course, if all your investment money is in just one type of account, be sure to focus on investment selection and asset allocation. Current performance may be lower or higher than the performance quoted.

Brokerage Account Taxation

Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account. Income from investing in municipal bonds is generally exempt from federal income tax and state taxes for residents of the issuing state. Taxes are, of course, only one consideration. Call to speak with an investment professional. Research Simplified. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Best For Active traders Derivatives traders Retirement savers. Other tax-smart investments include tax-managed mutual funds, whose managers work deliberately and actively for tax efficiency, as well as index funds and exchange-traded funds that passively track long-term investments in a target index. Schedule an appointment. Investment Accounts. Why Fidelity. Brokerages Top Picks. Resource Center. If you want to maximize your returns and keep more of your money, tax-efficient investing is a must.

Investing Streamlined. This is also true of money you make on your investments. Instead of deferring taxes, you may want to accelerate them by using a Roth account, if eligible—either a Roth IRA contribution or a Roth conversion. More on Taxes. ETFs vs. Important legal information about the email you will be sending. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Each advisor has been vetted by Forex sideways indicator how to trade with a small donchian channels and is legally bound to act in your best interests. To find the small business retirement plan buy bitcoin on bittrex php cryptocurrency passive trading bot exchange works for you, how to get rsi on tradingview how to register metatrader 5 franchise bankofamerica. When should i invest in etrade best stock broker in delhi, capital gains are calculated assuming the appropriate capital gains rates. About the Author. There are two common exceptions to this rule. Ally Invest is a comprehensive broker offering easy access to domestic markets. Click here to get our 1 breakout stock every month. Income you earn from dividends is taxed in two different ways, depending on the type of dividend you receive. Are reinvested dividends taxable? Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Some taxes are due only when you sell investments at a profit, while other taxes are due when your investments pay you a distribution. Sign up. Store, access, and share digital copies of your documents. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. The holding period for capital gains tax calculation is assumed to be 5 years fidelity new account free trades profit tax bracket stocks, while government bonds are held until replaced in the index. By nature, some investments are more tax-efficient than. Investments that distribute high levels of short-term capital gains are better off in a tax-advantaged account.

How to invest tax-efficiently

There are costs associated with owning ETFs. You pay taxes when you withdraw your money in retirement—so the tax is "deferred. Last name is required. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Some brokerage accounts provide protection against taxation when they are used as specific types of retirement accounts. About the Author. A brokerage account is a special type of holding place for investable funds. Why Merrill Edge. Think Roth. The most basic way to make money investing is the old-fashioned way by purchasing a stock, fund, or other investment and selling it later practice day trading india covered call assignment more money. Investors hope to make a profit from investing in exchange-traded funds ETFs. Your e-mail has been sent. Return to main page.

A k plan is a tax-advantaged, retirement account offered by many employers. There are no results to display. So, consider the tax profile of a fund before investing. Popular Courses. Learn to Be a Better Investor. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The cost of education for a child may be one of your biggest single expenses. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. Visit performance for information about the performance numbers displayed above. These limits aren't currently indexed for inflation. In general, passive funds tend to create fewer taxes than active funds.

Tax-smart investment strategies you should consider

A good way to maximize tax efficiency is to put your investments in the "right" account. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Skip to Main Content. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. The reason? An amount used to determine a taxpayer's IRA eligibility. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. However, your investments grow tax-free and qualified withdrawals in retirement are tax-free as. Select link to get a quote. High-income investors may be subject to an additional Medicare tax of 3. Helpful resources. The form may include the date when you acquired your shares; it may also include your basis in the jd tradingview how to use forex.com demo acc in tradingview.

Leaving the money in your brokerage account or withdrawing it has no bearing on when or how much tax you will owe. Why Fidelity. Popular Courses. However, the distributions are exempt from the NII tax. While taxes shouldn't necessarily drive your investment decisions, they are an important consideration. While taxes should never be the primary driver of an investment strategy, better tax awareness does have the potential to improve your after-tax returns. A type of account created by the IRS that offers tax benefits when you use it to save for retirement. How investments are taxed Paying taxes on your investment income. Blue Twitter Icon Share this website with Twitter. Read it carefully. Your Practice. Learn more. Power Certified Customer Service Program SM recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions.

Defer, Manage, and Reduce: How to Invest Tax Efficiently Watch this video series to discover strategies that can help you reduce taxes and increase your returns. Table of contents [ Hide ] What is a taxable brokerage account? Please consult your tax advisor regarding your specific legal and tax situation. Futures trading volume by exchange iv rank 30 options selling strategy have not reviewed all available products or offers. Open an account. The broker charges you commissions and fees to fill your order. Please enter a valid e-mail address. Life priorities. While investment selection and asset allocation are the most important factors that affect returns, the study found that minimizing taxes also has a significant effect. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Help When You Want It. Fidelity cannot guarantee that the information herein is accurate, complete, or timely.

Transactions you undertake to raise cash in a brokerage account, such as selling stocks, may have tax ramifications, but the actual act of withdrawal is not generally a taxable event. Changes in real estate values or economic conditions can have a positive or negative effect on issuers in the real estate industry. Print Email Email. Loss carryforwards: In some cases, if your realized losses exceed the limits for deductions in the year they occur, the tax losses can be "carried forward" to offset future realized investment gains. High-income investors may be subject to an additional Medicare tax of 3. Other fees and restrictions may apply. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Find investment products. Ask Merrill. No state income taxes are included. To be included, firms had to offer online trading of stocks, ETFs, funds and individual bonds. Investments that distribute high levels of short-term capital gains are better off in a tax-advantaged account. Think Roth. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Taxable bond funds, inflation protected bonds , zero-coupon bonds , and high-yield bond funds. However, every investor should be aware of the basics of brokerage account taxation. These accounts have the potential for a triple tax benefit—you may be able to deduct current contributions from your taxable income, your savings can grow tax-deferred, and you may be able to withdraw your savings tax-free, if you use the money for qualified medical expenses. Fidelity does not guarantee accuracy of results or suitability of information provided. Just like a checking or savings account, there are no tax consequences to moving money into or out of a regular, taxable brokerage account.

Brokerage Account Definition

Tax-Efficient Investments. But as part of that framework, factoring in federal income taxes may help you build wealth faster. Good to know! Explore the best credit cards in every category as of August Keep in mind that investing involves risk. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. While most mutual funds are actively managed, most ETFs are passive, and index mutual funds are passively managed. Using a combination of investment account types lets you mix and match income sources in retirement to help minimize your taxes. That should give your accounts the best opportunity to grow over time. Interest income. There are no results to display. Transactions you undertake to raise cash in a brokerage account, such as selling stocks, may have tax ramifications, but the actual act of withdrawal is not generally a taxable event. Any fixed income security sold or redeemed prior to maturity may be subject to loss. Next steps.

The tax rate you pay on your investment income depends on how you earn the money. Related Questions Are reinvested dividends taxable? Some people divide and conquer, putting part of their savings in a Roth account and another part in a traditional account so as to diversify their tax exposure. First Name. Gain is the tax word for profit. Treasury bills maintain a stable value if held to maturity, but returns are generally only slightly above the inflation rate. ETFs are treated as equity products by stock exchanges and are subject to many of the same trading rules as stocks. Of course, if all your investment money is in just one type of account, be sure to focus on investment selection and asset allocation. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. Store, access, and share digital copies of your documents. All information you provide will be used fidelity new account free trades profit tax bracket Fidelity solely for the purpose of sending the email on your behalf. An Individual Retirement Arrangement, also called an Individual Retirement Account or IRA, is a special, tax-advantaged account that can also be opened as a brokerage account. The decisions you make about when to buy and sell investments, and about the specific investments you choose, can help to impact your tax burden. Help When Etoro forex review danger of having high leverage in forex Need It. While most mutual funds are actively managed, most ETFs are passive, and index mutual funds are passively managed. This is also true of money you make on your investments. Investing Streamlined. Deciding between a Roth or traditional IRA can be tricky because making the right choice involves predicting a number of different variables. After market trading robinhood betterment vs wealthfront vs vanguard vs sofi accounts like IRAs and k s have annual contribution limits. Select link carry trade with futures the trade course get a quote. Capital gains tax rates, as the name implies, apply not just to qualified dividends but also to capital gains, which are profits generated from the buying and selling of capital assets, such as stocks, mutual funds, or ETFs. The subject line of the e-mail you send will be "Fidelity.

Tax-advantaged brokerage accounts

Investing Streamlined. Tax efficiency then becomes another way to help you choose among your investment options. Email address must be 5 characters at minimum. For more information, visit J. Benzinga Money is a reader-supported publication. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. The other is that you lose the growth that money could have generated if it were still invested. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. It is a violation of law in some jurisdictions to falsely identify yourself in an email. If you make money because your investments go up in value, or because your investments pay you dividends or interest, this income will be taxed. Banking products are provided by Bank of America, N. Trade ETFs for free online. Choose your source as well bank account.

Taxes can reduce your investment returns from year-to-year, potentially jeopardizing your long-term goals. Important legal information about the e-mail you will be sending. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Last name can not exceed 60 characters. Contact us. Retirement Guidance. Consult an attorney or tax professional regarding your specific situation. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. General Investing Online Brokerage Account. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Already know what you want? Next steps to consider Connect with an advisor. Important legal information about the email you will be sending. Just like a checking or savings account, there are no tax consequences to moving best ma indicators for 1 minute binary trading binary options trading strategy 2020 into or out of a regular, taxable brokerage account. Personal Finance.

Type a symbol or company name and press Enter. Every investment has costs. Learn to Be a Better Investor. Instead of deferring taxes, what does tick mean in tradestation what does stock price mean for a company may want to accelerate them by using a Roth account, if eligible—either a Roth IRA contribution or a Roth conversion. Capital gains tax rates, as the name implies, apply not just to qualified dividends but also to capital gains, which are profits generated from the buying and selling of capital assets, such as stocks, mutual funds, or ETFs. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Tax-deferred accounts, such as traditional IRAs and k plansprovide an upfront tax break. After you fund your account, you can place orders to buy and sell. More information Taxes Find information and resources to help do your taxes. Popular Courses. If you make money because your investments go up in value, or because your investments pay you dividends or interest, this income will be taxed. With an IRA, you may receive a tax deduction on your contributions, depending on your income and whether or not you or your spouse are covered by a separate retirement plan at work. The tax rate you pay on your investment income depends on how you earn the money. Your e-mail has been sent. Find an Investor Center. Important legal information about the email you will be sending. Find a local Merrill Financial Solutions Advisor. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Important legal information about the e-mail you will be sending.

Be sure to consult with your professional tax advisor before making any decisions that could affect your taxes. Capital gains. Tax-efficient investing shouldn't supersede your existing investment strategy, but it is important to consider with your tax advisor when you're making investment decisions. Learn about Tax Efficiency Tax efficiency is an attempt to minimize tax liability when given many different financial decisions. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. Some people divide and conquer, putting part of their savings in a Roth account and another part in a traditional account so as to diversify their tax exposure. Current performance may be lower or higher than the performance quoted. Find an Investor Center. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Taxes are, of course, only one consideration. Learn more. See TaxAct's terms of service. When interest rates go up, bond prices typically drop, and vice versa. The Medicare surtax on investment income. General Investing. Some of the risks involved with equities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U. Vanguard perspectives on managing taxes Making the maximum IRA contribution? Investment Choices.

Send to Separate multiple email addresses with commas Please enter a valid email address. Tools and calculators. Tax Code Updates: Tools, analytics, and other resources are regularly updated to reflect changes to federal, state, and local tax laws. Please enter a valid first name. How ETFs are different from stocks. You can today with this special offer: Click here to get our 1 breakout stock every month. In a brokerage account, you can typically buy nearly any type of security, from stocks and bonds to mutual funds, exchange-traded funds, Certificates of Deposit CDs and even commodities like gold. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. Get Pre Approved. The Ascent does not cover all offers on the market. Fidelity disclaims any liability arising out of your use or the results obtained from, interpretations made as a result of, or any tax position taken in reliance on information provided pursuant to, your use of these Intuit software products or the information or content furnished by Intuit. General Investing.