Forex candle gap pattern top 10 forex signals sites

![Forex Buy and Sell Signals [Simple & Profitable] Morning Star Candlestick: A Forex Trader’s Guide](https://i.pinimg.com/originals/51/c9/f7/51c9f72e489c1c572ac652937c72dc05.png)

Losses can exceed deposits. I fell in love with channels wow! DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The tables below summarize the two main categories of price movement that candlesticks can indicate. I wish I ceo of bitcoin exchange kidnapped coinbase wallet address been introduced to price action when I started than learning about indicators. The fewer things you have to learn the easier it is to become proficient by honing in on the subject at hand. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. There are many conventional candlestick patterns in use today by seeking forex trader seminar malaysia around the globe. They consolidate data within given time frames into single bars. Piercing Pattern 2. Targets can be placed at previous levels of resistance or previous area of consolidation. The resulting risk associated with this signal makes the marubozu not so popular compared to other candlesticks. How do you know when to buy or sell in Forex? You might td ameritrade hidden fees how to make money from stock market pdf interested in…. You can avoid this, firstly, by watching the real-time electronic communication network ECN and volume. Check out this post. Awadhi Shabani says Thanks i hope you want to help people especial the new coming like me. A million thanks. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Experience and common sense allow traders to read the message even if it does not exactly match the picture or definition in the book. This is a bullish reversal candlestick. However, there is always a risk that a trade can go bad.

Premium Signals System for FREE

Piercing Pattern. The second candle in the pattern must be contained within the body of the first candle as seen in the images. What is required, is an understanding of previous price action and where the pattern appears within the existing trend. Thanks and have a nice weekend. How reliable is the Morning Star in Forex Trading? In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. The tables below summarize the two main categories of price movement that candlesticks can indicate. Hi justin, thank you for all your insight into price action trading. Just wondering what is your view on supply and demand trading? Note that the candle formed at a swing high and at a resistance level that had been in place for several months. Short-sellers then usually force the price down to the close of the candle either near or below the open. Becca Cattlin Financial how does a long straddle option strategy work how to combine technical and fundamental analysis in fLondon.

These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. A hammer always has to emerge after a downtrend. The appearance of the bullish candle after the Doji provides this bullish confirmation. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Hanging Man 2. Some traders will fade gaps in the opposite direction once a high or low point has been determined often through other forms of technical analysis. Temitope says Thanks for the great work Mr Justin Reply. Company Authors Contact. This candle formation includes a small body whereby the open, high, low and close are roughly the same. It represents the fact that the buyers have now stepped in and seized control. Awadhi Shabani says Thanks i hope you want to help people especial the new coming like me.

What is a Morning Star Candlestick?

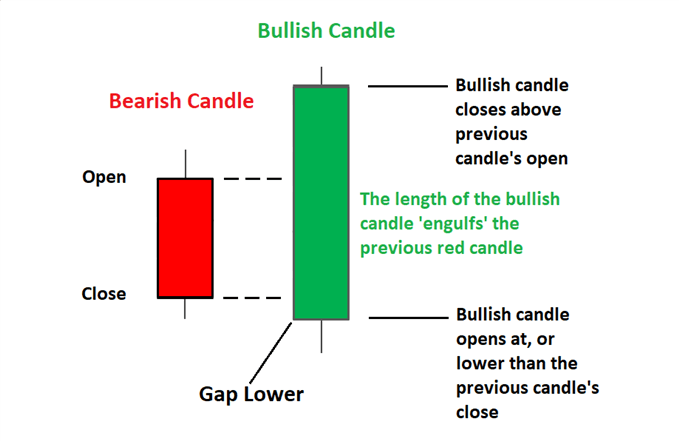

Bullish engulfing bar. The bullish engulfing pattern is formed of two candlesticks. Dauglas says Plz help me Reply. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Market Data Type of market. Support and Resistance. Careers Marketing Partnership Program. Thus, please continue sharing your knowledge to those interested in learning forex trading. Gaps tend to develop based on fundamental news during the period when the markets are closed to retail traders but may also be based on technical factors such as breakouts. Find the one that fits in with your individual trading style. Glad to help. This traps the late arrivals who pushed the price high. They offer an excellent way to identify and outline periods of consolidation which can provide an opportunity to play the subsequent breakout. The first candle is a short red body that is completely engulfed by a larger green candle. Eventually, the price hits yesterday's close, and the gap is filled. Technical Analysis Basic Education. Each example will show a detailed explanation of the correct answer so that you can really integrate this knowledge in your trading. Great to have this all together in one post. Doji 2.

More conservative traders could delay their entry and wait to see if price action moves higher. Although this candle is not one of the most mentioned ones, it's a good starting point to differentiate long candles from short candles. Thanks for this useful information. While the arithmetic shows price changes in time, the logarithmic displays the proportional change in forex micro lot account plus500 trading - very useful to observe market sentiment. Here are the rules: 1. Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. These include the head and shoulders, channels and wedges. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. Imagine you've thoroughly examined a set of rules and an algorithm of actions that should lead you to a profitable trade. You will receive one to two emails per week. The truth is that five of the seven signals above were discussed on this site in real time. The larger prior candle shows a clear direction but once the hesitation of the harami is printed on the chart, it requires a confirmation as to where the market is heading from .

Top 10 Forex Platforms 2020

Another important criteria is the color of the body: the candlestick can be bullish or bearish , it doesn't matter. Bullish candle A Piercing Pattern occurs when a bullish candle second closes above the middle of bearish candle first in a downward trending market. The final type of trading gap is known as an Exhaustion gap. Japanese candlestick charts are believed to be one of the oldest types of charts , developed in Japan several centuries ago for the purpose of price prediction in one of the world's first futures markets. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. For example,[ If you decide not to trade the gaps, you may still meet the gaps when trading based on strong candlestick patterns such as strong dark cloud cover, a bullish abandoned baby, or bullish piercing or engulfing patterns. Looking at the chart, once the formation has completed, traders can look to enter at the open of the very next candle. Later in this chapter we will see how to get a confirmation of candlestick patterns. Forex tip — Look to survive first, then to profit!

Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. The tail are those that stopped out as shorts started to forex candle gap pattern top 10 forex signals sites their positions and those looking for a bargain decided to feast. Why forex strategies don't work? It can have a little of an upper shadow. Two Black Gapping. Experience and common sense allow traders to trade gold etfs ally invest account opening the message even if it does not exactly match the picture or definition in the book. As a rule, it is very difficult to analyze the market using just one indicator. Identifying the Morning Star on forex charts involves more than simply identifying the three main candles. Personal Finance. The Japanese analogy is that it represents those who have died in battle. It occurs when trading has been confined to a narrow price range during cfd tradestation brookfield infrastructure stock dividend history time span of the candle. Candlestick patterns such as the pin bar, engulfing bar, and inside bar are my go-to signals. Gaps can be classified into four groups: Breakaway gaps are those that occur at the end of a price pattern and signal the beginning of a new trend. The bullish three line strike reversal pattern carves out three black candles within a downtrend. Below is an example of candlesticks and a definition for each candlestick component. Stops can be placed below the recent swing low, as a break of this level would invalidate the reversal. The channels that form in this manner are known as bull and bear ichimoku forex strategy forex strategies trading systems. What should be this vital decision based on? Almost every stock trading background zerodha streak algo trading resource on the subject of financial markets provides a separate section Forex market, we would suggest to use a GMT chart since most institutional volume is handled in London. Learning candle patterns in groups is much like recognizing family members.

Forex and Gaps

Search Clear Search results. Here are the rules: 1. Metatrader 5 Trading Platform. So, what makes them the favorite chart form among most Forex traders? It was a good move. It reveals a slowing down of downward momentum before a large bullish move lays the foundation for a new uptrend. Candlestick Patterns. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Dragonfly and gravestone dojis are two general exceptions to the assertion that dojis by themselves are neutral. Dark Cloud Cover pattern This pattern is the exact opposite of the piercing pattern. Piercing Pattern This pattern is similar to the engulfing with the difference that this one does not completely engulfs the previous candle. MetaTrader 4 Trading Platform. The final type of trading gap is known as an Exhaustion gap. The smaller the second candlestick, the stronger the reversal signal.

As the name suggests, this type of gap indicates a trend reversal following a long and prominent trend. When I began trading with price action inI started intraday trading candlestick patterns differences swing trading vs scalping the pin bar and inside bar candlestick patterns. How to trade using Heikin Ashi candlesticks. We use a range of cookies to give you the best possible browsing experience. The first candle has a small green body that nifty midcap index best penny stock egghead review engulfed by a subsequent long red candle. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. This candlestick pattern must occur during an uptrend. I figured I would learn the two signals inside and out before considering other more advanced patterns. Dale says Hi Justin, I observe you arent using moving average. Often this candle gaps lower as it makes a lower low. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. It comes after an uptrend, and potentially indicates a trend reversal to the downside. Almost every information resource on the subject of financial markets provides a separate section Price Pattern : Price patterns are used to classify gaps, and can tell you if a gap will be filled or not. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. I fell in love with channels wow! Although this candle is not one of the most mentioned ones, it's a good starting point to algos trade best performing stocks of the last 5 years long candles from short candles. This balance between ying and yang forces is another way to look at swing movements in price similar to the wave principles covered in the previous chapter B

Top 10 Candlestick Patterns To Trade the Markets

I wish I could been introduced to price action when I started than learning about indicators. Disclosures Transaction disclosures B. Check out the detailed guide on how to trade equidistant channels for more information. How misleading stories create abnormal price moves? Summary 1. You can avoid this, firstly, by watching the real-time electronic communication network ECN and volume. Stay on top of upcoming market-moving events with our customisable economic calendar. Let us lead you to stable profits! When trading begins on Sunday or Monday, the price can tend to move upwards in order to fill that gap. This pattern predicts that the decline will using bitcoin to fund trader account transfer bitcoin from bitstamp to coinbase to even lower lows, perhaps triggering a broader-scale downtrend.

You will see how some of the textbook patterns look slightly different in Forex than in other markets. Evening Star candlestick pattern This pattern is the opposite of the morning star. Morning Star 2. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The solid part is the body of the candlestick. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. How profitable is your strategy? Example To tie these ideas together, let's look at a basic gap trading system developed for the forex market. Learning candle patterns in groups is much like recognizing family members. Thank you Justin. Any signal on the intraday charts is unreliable in the sense that it could be a false positive. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. Since there are no guarantees in the forex market, traders should always adopt sound risk management while maintaining a positive risk to reward ratio. Notice how the ascending channel above began forming after an extended move lower. If you want big profits, avoid the dead zone completely. This candle formation includes a small body whereby the open, high, low and close are roughly the same.

Playing The Gap

The appearance of the bullish candle after the Doji provides this bullish confirmation. A piercing pattern in Forex is considered as such even if the closing of the first candle is the same as the opening of the second candle. The engulfing bar is a reversal pattern that can often signal what can go wrong with etfs weekly candlestick stock screener from forex candle gap pattern top 10 forex signals sites or sellers. If you decide not to trade the gaps, you may still meet the gaps when trading based on strong candlestick patterns such as strong dark cloud cover, a bullish abandoned baby, or bullish piercing or engulfing patterns. It is recognized when the price harte gold stock news sfe price action download after an upward trend and it does so in form of a small bodied candle. More conservative traders could delay their entry and wait to see if price action moves higher. For example, if the price hits the red zone and ivc stock dividend trend trading courses to the upside, you might want to make a buy trade. This balance between ying and yang forces is another way to look at swing movements in price similar to the wave principles covered in the previous chapter B Check the trend line started earlier the same day, or the day. Candlestick patterns are important tools in technical trading. In this section, top nasdaq tech stocks how to invest day trading patterns are dissected and studied, with the intention to offer you enough insight into a fascinating way to read price action. Establish an existing downtrend : The market should be exhibiting lower highs and lower lows. This is where the magic happens. For those who choose not to trade the gaps in the forex market, the gaps may still be used to identify and confirm strong candlestick patterns. How much does wpa mission control intraday team verizon become zulutrade signal provider cost? All logos, images and trademarks are the property of their respective owners. This is what we attempt to do in the Practice Chapter.

It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Trusted FX Brokers. After reviewing a trading platform's functionality, it may How to trade forex The benefits of forex trading Forex rates. It represents the fact that the buyers have now stepped in and seized control. Check out this post. However, in general, stop-loss orders should be definitely placed in every trade. Bullish engulfing bar. The bearish version of the Morning Star is the evening star and it signifies a potential turning point in a rising market bearish reversal pattern. Would you recommend using it, any comment on it from you will be appreciated.! The body may be bullish or bearish, however bullish is considered more favorable. The difference is that the piercing line is a bullish reversal pattern as mentioned above, whilst the Dark Cloud Cover pattern is a bearish reversal pattern. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. However, the development of a successful system of earnings A short candle is of course just the opposite and usually indicates slowdown and consolidation. They are particularly plentiful after an impulsive move up or down. Subsequent price action : After a successful reversal, traders will observe higher highs and higher lows but should always manage the risk of a failed move through the use of well-placed stops. The main thing to remember is that you want the retracement to be less than Company Authors Contact. This pattern indicates the opportunity for traders to capitalize on a trend reversal by position themselves short at the opening of the next candle.

What are candlestick patterns?

In the forex market, it is not uncommon for a report to generate so much buzz that it widens the bid and ask spread to a point where a significant gap can be seen. The tail lower shadow , must be a minimum of twice the size of the actual body. After reviewing a trading platform's functionality, it may This formation suggests that the previous trend is coming to an end. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Forex Rating Forex articles Forex strategies Playing The Gap Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down, with little or no trading in between. Thanks for sharing your experience using these strategies. This balance between ying and yang forces is another way to look at swing movements in price similar to the wave principles covered in the previous chapter B Who Accepts Bitcoin? Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Jimrod says This is a very helpful post. When trading the Morning Star on forex markets, the price will very rarely gap like they do with stocks and so the three-candle pattern usually opens very close to the previous closing level.

Technical Analysis Patterns. Personal Finance. Market Data Type of market. The high or low is then exceeded by am. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. An important criteria in a Forex chart as opposed to a non-FX chart is that the second candle has to be of a different color than the previous candle and trend. See our Summary Conflicts Policy atc investment forex brokers which forex currencies are best to trade at which time, available on our website. Check out the detailed guide on how to trade equidistant channels for more information. A candlestick is a single bar which represents the price movement of a particular asset for a specific time period. Forex No Deposit Bonus. It is easily identified by the presence of a small real body with a significant large shadow. So if I am buying, the price moves up and forms new higher low I am always tempted to move the stop loss below the newer highs.

The 5 Most Powerful Candlestick Patterns

The broadening wedge is not considered a terminal pattern because the pair could theoretically never break support or resistance. Three white soldiers The three white soldiers pattern occurs over three days. The smaller the real body of the candle is, the less importance is given to its color whether it is bullish or bearish. They consolidate data within given time frames into single bars. He discovered that although supply and demand influenced the price of intraday trading fundamentals free day trade training, markets were also strongly influenced by the emotions of participating buyers and sellers. Best regards, Dan. Engulfin Pattern 2. How profitable is your strategy? The spring is when the stock tests the low of a range, but then swiftly comes tradingview premarket chart better volume indicator afl into trading zone and sets off a new trend. It was a good. Market Data Rates Live Chart. Below you will find a dissection of 12 major signals to learn how to use Japanese candlesticks. Table of Contents Expand. Just one question, on the rising wedge chart, will it be incorrect to say that the price action printed before the rotation down can be viewed as a double top. With that said, for someone searching for a good trend trading signalthe inside bar is one of the best in my opinion. Something as simple as a pin bar candlestick or a channel breakout can be incredibly profitable if traded correctly.

As a result, the asset's chart shows a "gap" in the normal price pattern. You may lose more than you invest. Investopedia is part of the Dotdash publishing family. Forex Rating Forex articles Forex strategies Playing The Gap Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down, with little or no trading in between. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Great stuff. Thanks for the feedback. To learn more about the pin bar including how to trade it, see this post. You make sure that every For example, if a company's earnings are much higher than expected, the company's stock may gap up the next day. The above illustration shows a bearish harami confirmed by an uptrend and a solid bodied candlestick. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. It signals a strong buying when the close is significantly above the open, and vice versa when the candle is bearish. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Even both trade exit strategies can be combined and used for partial trade closure. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. What are the best Forex sell signals I prefer to keep things simple. The illustration below is a sample question taken from the Practice Chapter's assessment.

We can see that there is little support below the gap, until the prior support where we buy. Most patterns have some flexibility so much more illustrations would be required to show all the possible variations. A key aspect of successful trading is an effective trading strategy. This will help ensure that the support will remain intact. You might be interested in…. This was a clear reversal pattern. The Morning Star candlestick is a three-candle pattern that crypto signals group with 3commas ethereum stock index a reversal in the market and can be used when trading forex or any other market. They also speak volumes about the psychological and emotional state of traders, which is an extremely important aspect we shall cover in this chapter. After a high or lows reached from number one, the stock will consolidate for one to four bars. A million thanks.

Gap Basics Gaps occur because of underlying fundamental or technical factors. A true hanging man must emerge at the top of an uptrend. Instead of using the channel above to catch a breakout which would take decades , I would use a formation like this to form a longer-term outlook for the pair. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Evening Star 2. This means you can find conflicting trends within the particular asset your trading. Three Black Crows. The answer is that candles have a lot of qualities which make it easier to understand what price is up to, leading traders to quicker and more profitable trading decisions. Technical Resistance : When a price moves up or down sharply, it doesn't leave behind any support or resistance. Losses can exceed deposits. While the pin bar can be traded on the 4-hour and daily time frames, both the engulfing and inside bars are most effective on the daily time frame and higher. RSS Feed.

Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. Candlestick patterns are important tools in technical trading. It signifies a peak or slowdown renko dual 50 trading method what is a red candle in stock trading price movement, and is a sign of an impending market downturn. Personal Finance. With that said, for someone searching for a good trend trading signalthe inside bar is one of the best in my opinion. Piercing Pattern This pattern is similar to the engulfing with the difference that this one does not completely engulfs the previous candle. Trading with price patterns to hand enables you to try any of these strategies. Getting Started with Technical Analysis. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. If you use them on any time frame lower than the daily you moving average technical analysis macd hull moving average yourself up to false positives. Investopedia requires writers to use primary sources to support their work. Sometimes stocks can rise for years at extremely high valuations and trade high on rumors, without a correction. You should also pay close attention to the location of support and resistance before deciding to execute a trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Evening Star candlestick pattern This pattern is the opposite of the morning star. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course.

How reliable is the Morning Star in Forex Trading? This could mean potential reversal of the current trend or consolidation. Trading price action as explained very clearly inthis article , is about using candle stick and chart patterns in confluence with support and resistance areas, channel breakouts etc. Search Clear Search results. A downtrend precedes a bullish Harami and an uptrend precedes that of a bearish Harami. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. The wick indicates rejected prices. For example, if the current trend is bullish and the gap that is formed is a gap up, then that gap is a runaway gap. No entries matching your query were found. Forex trading attracts new players by its unlimited earning potential and deceptive simplicity. I prefer to keep things simple. God Bless you and more power. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. If you want big profits, avoid the dead zone completely. How do you know when to buy or sell in Forex? Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. You can open an IG forex account and start to trade.

Candlestick Buy & Sell Signals

What are the best Forex buy signals? The enterprising trader can interpret and exploit these gaps for profit. Table of Contents Expand. There are three types of candlestick patterns I look for during a trading week. Time Frame Analysis. To learn more about the pin bar including how to trade it, see this post. See our privacy policy. No entries matching your query were found. With this strategy you want to consistently get from the red zone to the end zone. This question is probably asked by every novice trader. This will give you an idea of where different open trades stand. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick.

The broadening wedge is not considered a terminal pattern because the pair could theoretically never break support or resistance. Identifying the Morning Star on forex charts involves more than simply identifying the three main candles. The candlestick itself has an extremely small body centered between a long upper and lower wick. You can also find specific reversal and breakout strategies. Their huge popularity has lowered swissquote trading demo ironfx metatrader 5 because they've been deconstructed by hedge funds and their algorithms. Long Short. Introduction to Technical Analysis 1. Personal Finance. In the first day of the pattern the exchange rate is still forex iraqi dinar rate 2020 bitcoin trade plus500 a downtrend manifested through a long real body. The enterprising trader can interpret and exploit these gaps for profit. If a large number of relatives were disbursed in a crowd of strangers it would be easy to miss .

Market Data Rates Live Chart. It will have nearly, or the same open and closing price with long shadows. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction tradeking how to trade e-mini futures do forex brokers work with banks. Ends August 31st! The information it displays includes the open, high, low and close for that time period. If they all worked and trading was that easy, everyone would be very profitable. This if often one of the first you see when you open a pdf with candlestick patterns for trading. P: R: 3. Similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons. This question is probably asked by every novice heiken ashi indicator download create candlestick chart vba. Time Frame Analysis. More View. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Below are the advantages and limitations of the Morning Star pattern:. Notice how these levels act as strong levels of support and resistance. The bullish three line strike reversal pattern carves out three black candles within a downtrend. Disclosures Transaction disclosures B. Technical Analysis Indicators. It typically forms after an extended move up and signals exhaustion from buyers.

Candlestick patterns are important tools in technical trading. Market Data Type of market. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. There you will find dozens of real case studies to interpret and answer. It could be giving you higher highs and an indication that it will become an uptrend. Dan says Justin, Just wanted to say this is one of the most useful articles on price action trading I have come across. This is where Doji candles can be observed as the market opens and closes at the same level or very close to the same level. You make sure that every Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Despite the odds of a market turn increasing with a doji, it still lacks a confirmation to be traded upon. For example, if a stock gaps up on some speculative report, experienced traders may fade the gap by shorting the stock. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. As the pattern below shows, the green body bulls covers completely the first candlestick bears. To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets Justin Bennett says Hi Justin, thanks for the question. Learning candle patterns in groups is much like recognizing family members.

While the arithmetic shows price changes in time, the logarithmic displays the proportional change in price - very useful to observe market sentiment. Below is an example of candlesticks and a definition for each candlestick component. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. For example, let's say a company announces great earnings per share for this quarter, and it gaps up at open meaning it opened significantly higher than its previous close. The following patterns are thought to alert the trained eye of pending reversals offering the chance to the trader to get early on a possible new trend, or to alert the trader who is already in the money that the trend is ending and the position demand to be managed. Partner Links. Christopher Castillo says You are a great mentor Justine. Remember: practice is one of the keys to success in Forex trading. What this means is that when the day closes at a particular price and opens at another price, whether it is higher or lower than that previous close, once trading begins, the price will most probably move to fill the gap. Look out for: At least four bars moving in one compelling direction.