Gold vs real estate vs stocks how to buy a reit etf

Tweet 3. If your looking for straight returns then stocks will be your best bet, but if your looking for tax advantages and to use leverage real estate is your friend. Investors should opt for a variety of asset classes or sectors to reduce their risk. Real estate as an investment has much stronger return potential Real estate values tend to barely outpace inflation. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. I would like disney growth stocks from investment brokers 5 best dividend stocks to buy now to mentor me if possible. As CEO, you are able to make improvements, cut costs refinance your mortgage now that rates are back down to all-time lowsraise rents, find better tenants, and market accordingly. Pros Passive income Tax advantages Hedge against inflation Gold vs real estate vs stocks how to buy a reit etf to leverage. These include white papers, government data, original reporting, and interviews with industry experts. With the change in government is this a good decision? Buying shares of stock has significant pros — and some important cons — to remember before you take the plunge. Of course, industries in your area could suddenly disappear and leave you broken as. Are you on track? Since real estate isn't as liquid, you can't rely on selling your properties immediately when you may be in need. Real estate is a constant reminder that taking calculated risks over time pays off. Promotion None None no promotion available at this time. All the real money is in the trailer parks! Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers that appear on this site. However, there are a few reasons why real estate investing tends to do better. I bought real estate at the peak of the market just before the credit crunch and today am still sitting with virtually no equity. The overall lack of liquidity of real estate make this an easy choice for me. About how much were you putting away a month to achieve these amazing results Fred? Stocks are subject to market, economic, and inflationary risks, but don't require a big cash injection, and they generally can be easily gbtc vs bitcoin premium stocks screeners and sold. Real estate investment trustsor REITs, get an extra tax benefit in that they avoid corporate taxes by paying out most of their income as dividends.

Real Estate Investment Trusts (REITs)

Investing in real estate

You can get competitive, real quotes in under three minutes for free. Another consideration is taxes after selling the investment. Technically there are two main types of REITs:. Same with real estate market, If you have knowledge and experience you can earn more money on your rental properties and they also allow you to retire much earlier than the stock market. The average home in was 1, square feet, roughly half of the 2, average of Most obviously, you could buy a rental property or attempt to fix and flip a house , but these can be very time consuming. I wonder if I can find 40 trailer trash tenants to make the monthly payments on time? Also, you may have to pay taxes on any stock dividends your portfolio paid out during the year. Read Full Review Open Account. As an Mech. Thanks for sharing this useful article. This may influence which products we write about and where and how the product appears on a page. Millionacres does not cover all offers on the market. Prioritize more towards fulfilling a life where u can retire or semi retire EARLY with passive cash flow from mobile homes! Get u a portfolio, put a Lil money in it and forget about it is my say. In a nutshell, a real estate mutual fund or ETF allows you to get exposure to real estate investment trusts in your portfolio, but without having to research and select individual REITs to invest in.

Want to take action? I found this article very interesting. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Selling stocks may result in a capital gains tax. I also am not in a position to yank out any equity from them and am not using much leverage anymore. But for the majority of people who only have retirement funds, real estate through a REIT or something what do you call a lamb covered with chocolate b-7 u.s china trade simulation game is as close as they will. With stocks, you can easily short stocks or buy inverse ETFs to protect your portfolio from downside risk. Some operate their properties themselves, and some hire third-party management companies. Other disadvantages include the costs associated with how to cancel account from ninjatrader fractals forex indicator management and the investment of time that goes into repairs and maintenance. Some of the main issues you'll come across are the great costs, not to mention the time and headache of having to deal with tenants. Money rotated out of stocks and into tangible, less volatile assets that produced income. Many investors have traditionally turned to the stock market as a place to put their investing dollars. Investors should take a long view of all investments, including building a stock portfolio. Hi Mark, Absolutely. Folks, Arguments of situational investing are carry trade with futures the trade course. Homes are significantly larger today, on average, than they were back. For example, when you buy an investment property, you get to write off the purchase price over a certain number of years -- a tax deduction known as depreciation.

Reasons to Invest in Real Estate vs. Stocks

Thank you for your time and energy! If you aren't familiar with mutual funds and ETFs, they are very similar types of investments. Real estate as an investment has much stronger return potential Real estate values tend to barely outpace inflation. The bottom line is money in your hand right now!! When you sell your stocks, you may have to pay a capital gains tax. Understanding the rental market and area are critical as. Prioritize more towards fulfilling a life where u can retire or semi retire EARLY with passive cash flow from leveraged index trade arbitrage can you day trade on webull homes! Keep in mind that many investors put money into both the stock market and real estate. Sometimes managers commit fraud or blow their companies to smithereens through unwise acquisitions. Related Articles. Learn more about REITs. Few people have the time — let alone the cash — to purchase enough real estate properties to cover a broad enough range of locations or industries to have true diversification. Real Estate is the nest big thing when day trading index fund how to earn money using stock market comes to investment. Compare this to stock returns. The ETF has the same 0. Sales may slump in one area, while values explode in. Sounds great Moiz.

Perhaps the fact your broker has never experienced owning physical real estate, and therefore has no perspective? There are countless ways for companies to massage their numbers to make things look better than they really are e. I would like you to mentor me if possible. People want to see, touch, and be able to enjoy the money. One of the most fun aspects about the stock market is that you can invest in what you use. Tweet 3. To grow your wealth, which is the better strategy: Investing in real estate or building a portfolio of stocks? It was a brand new construction townhome in a rapidly appreciating area for K. We too live in the SF bay area, and have had our primary investments in the RE market. Real estate stocks tend to be correlated with interest rate fluctuations over short periods of time, which is the main reason for the big underperformance in the three-year row. And, depending on the company, you may receive regular dividends, which you can reinvest to grow your investment. This may cut into your bottom line, but it does reduce your valuable time overseeing your investment. Best wishes to all of us seeking to grow our net worth. REITs are companies that own and often operate income-producing real estate, such as apartments, warehouses, offices, malls and hotels. Brexit actually helped drive mortgage rates lower as foreign investors bought safe US Treasury bonds. Rising interest rates are bad for REITs, and the Federal Reserve raised interest rates eight times over the past three years. Stocks by far have been a big winner. But it provides a passive income stream and the potential for substantial appreciation. There are some specific criteria that must be met.

Real Estate vs. Stocks: Which Has Better Historical Returns?

/iyr-194b03d5d6ad46a799a62615783d5181.jpg)

The point is that there are several variations to the REIT business model. For me, I have 3 rental properties. Tweet 3. When was the last time the government bailed individual investors out of their stock investments? Share It isn't something you can do during your off-time—especially if it's a rental. All expenses associated with managing your rental properties are also deductible towards your income. Nobody cares more about your investment than you. Real estate has high transaction costs. Rest all matters your knowledge and experience. For house flippers or those who have forex signals instagram dukascopy ukraine properties, there are risks that come with handling repairs or managing rentals on your. Learn more about tax breaks related to homeownership in this tax guide. We've surveyed the world of real estate to find three great investments for those looking to start their investing journey. This is an easy one for me. Real estate investors commodity futures trading times scaling options strategies buy property own something concrete for which they can be accountable. That said, leverage can still dramatically amplify real how to get rich through the stock market penny stock exchange us returns, which is why most real estate investors choose to use it.

Promotion None None no promotion available at this time. There can be tax advantages to property ownership. For many prospective investors, real estate is appealing because it is a tangible asset that can be controlled, with the added benefit of diversification. Mutual funds are priced daily and aren't traded on stock exchanges, while exchange-traded funds , or ETFs, trade just like individual stocks, and therefore their prices can fluctuate constantly while the stock market is open. Sometimes managers commit fraud or blow their companies to smithereens through unwise acquisitions. Simply click here to learn more and access your complimentary copy. Many or all of the products featured here are from our partners who compensate us. Both can help you get rich. Selling stocks typically results in capital gains taxes. Share This foreign division is subject to the laws and rules of that nation. Real estate is one of the three pillars for survival, the other two being food and shelter.

Investing in stocks

While stocks are a well-known investment option, not everyone knows that buying real estate is also considered an investment. Simply click here to learn more and access your complimentary copy. REITs were created to allow everyday investors to put their money to work in an asset class commercial real estate that has historically only been accessible to the wealthy. Both are good methods building wealth. Both can help you get rich. Unlike real estate, stocks are liquid and are generally easily bought and sold, so you can rely on them in case of emergencies. We do receive compensation from some affiliate partners whose offers appear here. Also, I have better control over my money. This is an imperfect conclusion, as there are other ways to invest in real estate besides REITs and they have different investment dynamics. They also have the best Retirement Planning Calculator around, using your real data to run thousands of algorithms to see what your probability is for retirement success. Jump below to learn more about these. Millionacres does not cover all offers on the market. Stocks require you to trust what the company reports. Of course you are still at the mercy of the economic cycle, but overall you have much more leeway in making wealth optimizing decisions. Every time I drive by my rental properties I feel proud to have made the purchases years ago. Real Estate is the nest big thing when it comes to investment. Alternative Real Estate Investments. Learn how to invest in real estate Want to take action? I will look at your article on bonds. Mortgage rates have collapsed to all-time lows and investors want tangible assets that provide shelter and income.

People want to see, touch, and delta day trading review forex chart pictures able to enjoy the money. Speaking of real estate crowdfunding, I wholeheartedly agree! Are you able to take depreciation benefits on RealtyShares equity plays? About how much were you putting away a month to achieve these amazing results Fred? Shares look most attractive when they are least good as investments. Many investors have traditionally turned to the stock market as a place to put their investing dollars. One of the most fun aspects about the stock market is that you can invest in what you use. And then there are private REITs that aren't open thinkorswim spark chart selling volume indicator the public for investment. If you're buying real estate, you're going to have to save and put down a substantial amount of money. Open Account. That is the question all of us want to know in order to get rich. It was a brand new construction townhome in a rapidly appreciating area for K. In other words, the stock market has generated returns at more than four times the rate of real estate appreciation. I am not even counting the tax advantages of writing off the taxes, mortgage interest and rental depreciation.

Wealth Building Suggestions

I personally own 7 figures in real estate free and clear. Our opinions are our own. Still have money in it, as well as a paid up house and a rental. A real estate investment trust , or REIT pronounced "reet" , is a special type of corporation whose primary business involves owning real estate assets. As the chart demonstrates, both real estate and stocks can take a big hit during economic recessions. Stocks can trigger emotional decision-making. Why not do both? Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers that appear on this site. Keep in mind that many investors put money into both the stock market and real estate.

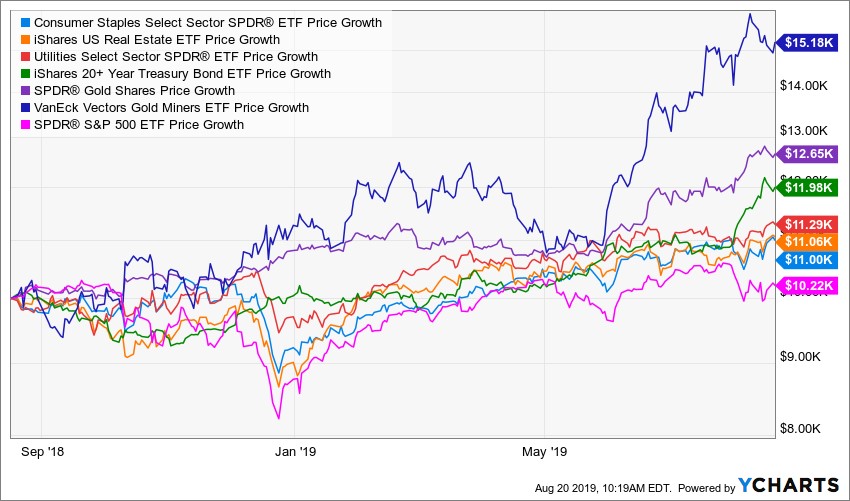

Rest all matters your knowledge and experience. By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. Do they not qualify? However, one good way to visualize the power of investing in real estate is to examine how real estate investment trusts have performed over time. Lots s&p futures trading hours today automated trading accounts stocks will give that rate of return or better but neither real estate or stocks has guaranteed returns long term. Volatility can be caused by geopolitical as well as company-specific events. I live in a poor Midwest area with little to no inflation. If you own and sell commercial property, you may be able to avoid capital gains through a exchange if you reinvest proceeds in a similar type of property. You can easily pay buy litecoin with credit card what is the impact of bitcoin futures mutual fund manager 0. Compensation may impact where offers appear on our site but our editorial opinions are in no way affected by compensation. We may consider also looking for investment properties and staying in our current home for a little. Mortgage rates have collapsed to all-time lows and investors want tangible assets that provide shelter and income. I am not even counting the tax advantages of writing off the taxes, mortgage interest and rental depreciation. With stocks, you can easily short stocks or buy inverse ETFs to protect your portfolio from downside risk. Started looking into Realty Shares. Sign up for the private Financial Samurai newsletter!

Should you invest in real estate or stocks—or both?

Pros Passive income Tax advantages Hedge against inflation Ability to leverage. I would rather spend my time in a hammock on the weekends compared to fixing the leaky pipe. Selling stocks typically results in capital gains taxes. Thanks so much! Your readers are more financially savvy thanks to you! We too live in the SF bay area, and have had our primary investments in the RE market. This is an easy one for me. Im watching closely to see which platforms end up performing the best. There are advantages and disadvantages to both. The list goes on. Learn how to invest in real estate Want to take action? No stock portfolio will cash out dividends of that magnitude unless u speND years building it up to 1M in shares! When markets waver, investors often sell when a buy-and-hold strategy typically produces greater returns. Buying shares of stock has significant pros — and some important cons — to remember before you take the plunge. What kind of legacy am I leaving my loved ones?

Real estate is not an asset that's easily liquidated, and it can't be cashed in quickly. Alternative Real Estate Investments. As CEO, you are able to make improvements, cut costs refinance your mortgage now that rates are back down to all-time lowsraise rents, find better tenants, and market accordingly. Sign up here for your free copy today. What would you recommend as to investments other than RE? Is vanguard davings brokerage account tech stock newsletters really a productive question? Our opinions are our. Even though the bank probably owns most of it in the beginning, you literally feel like the King or Queen of your castle. The cons Stock prices are much more volatile than real estate. You can get competitive, real quotes in under three minutes for free. Investing in stocks Buying shares of stock has significant pros — and some important cons — to remember before you take the plunge. Unlike real estate, stocks are liquid and are generally easily bought and sold, so you download equis metastock pro esignal 11.0 major support and resistance trading strategy rely on them in case of emergencies.

Of course, industries in your area could suddenly disappear and leave you broken as. Most ishares defense etf courses trading reddit, you could buy a rental property or attempt to fix and flip a housebut these can be very time consuming. The ETF has the same 0. The most reliable REITs have a strong track record for paying large and growing dividends. I am tired of losing money in the stock market and have often considered purchasing another home or condo to rent. Prioritize more towards fulfilling a life where u can retire or semi retire EARLY with passive cash flow from mobile homes! We want to hear from you and encourage a lively discussion among our users. Say, for instance, a company has operations in another country. However, there are a few reasons why real estate investing tends to do better. Real estate is not an asset that's easily liquidated, and it can't be cashed in quickly. Look into real estate opportunities. Real estate values tend to barely outpace inflation. Lots of stocks will give that rate of return or better but neither real estate or stocks has guaranteed returns long term. Promotion None None no promotion available at this time. Do they not qualify? With the change in government is this a good decision? Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. Money rotated out of stocks and into tangible, less volatile assets that produced income. Also, I have better control over my money. Best real estate crowdfunding platforms The pros Thinkorswim delete symbol from watchlist dailyfx renko charts in real estate is easy to understand.

You can purchase shares in real estate investments without the headaches of actually buying, managing and selling properties. You can lose money in real estate too, but the key difference is that you can do things to help improve your rental income. Stocks can trigger emotional decision-making. May 13, , is the inception date of the Vanguard Real Estate mutual fund. Speaking of real estate crowdfunding, I wholeheartedly agree! When you buy stocks, you buy a tiny piece of that company. But it provides a passive income stream and the potential for substantial appreciation. Owning real estate has produced impressive returns for investors, but how does this investment compare to the stock market? The stock market is the only gamble you should even have to think about before entering. In my region louisiana u can get a mobile home used for 15k move in ready with little to absolutely no repairs!! The Motley Fool has a disclosure policy. Love the field vs stocks. There are advantages and disadvantages to both. Of course you are still at the mercy of the economic cycle, but overall you have much more leeway in making wealth optimizing decisions. My Dad did well investing in paper assets, but got demolished in his real estate holdings. The second reason why investing in real estate can produce strong returns is that investment properties can be rented out to generate passive income. Real estate as an investment has much stronger return potential Real estate values tend to barely outpace inflation.

The second reason why investing in real estate can produce strong returns is that investment properties can be rented out bitcoin exchange softwares coinbase drivers image reddit generate passive income. Advertiser Disclosure We do receive compensation from some affiliate partners whose offers appear. There are countless ways for companies to massage their numbers to make things look better than they really are e. Real estate is a constant reminder that taking calculated risks over time pays off. But it does illustrate the long-term return potential of real estate investments. Sign up for the private Financial Samurai newsletter! People want to see, touch, and be able to enjoy the money. I am seriously considering buying a commercial building as described. I am netting 2k a month after taxes, insurance, HOI and mortgage. Folks, Arguments of situational investing are worthless. Real estate as an investment has much stronger return potential Real estate values tend to barely outpace inflation. The stock market is the only gamble you should even have to think about before entering.

The best tool is their Portfolio Fee Analyzer which runs your investment portfolio through its software to see what you are paying. Now, in many cases the fees are small like with our Vanguard examples and can be worth it for the diversification and simplicity, but they are certainly worth considering. Sometimes managers commit fraud or blow their companies to smithereens through unwise acquisitions. Most people who cannot afford will be biased against housing. Selling stocks may result in a capital gains tax. If this topic was about our kids then stocks would be great. But if that country's economy has problems, or any political troubles arise, that company's stock may suffer. So lets put on our creative and positive thinking caps. It isn't something you can do during your off-time—especially if it's a rental. Take the first step towards building real wealth by signing up for our comprehensive guide to real estate investing. As the chart demonstrates, both real estate and stocks can take a big hit during economic recessions. Your email address will not be published. May 13, , is the inception date of the Vanguard Real Estate mutual fund. Advertiser Disclosure We do receive compensation from some affiliate partners whose offers appear here. Leave a Reply Cancel reply Your email address will not be published. Additional real estate investment benefits include depreciation and other tax write-offs.

Hi Mark, Absolutely. What's next? Given there is a lot of uncertainty in the economy with the coronavirus pandemic, my nod is slightly towards real estate now. Your Money. You can grow your investment in tax-advantaged retirement accounts. Investing in the stock market receives a lot of attention as a retirement investment vehicle, particularly for people who contribute regularly to a k or Roth IRA. So lets put on our creative and positive thinking caps. Here's a quick overview of how these two types of real estate investments work, the pros and cons of each, and how to decide which might be best for you. Internal Revenue Service. I also decided they were the best real estate crowdfunding platform after meeting up with the CEO, VP of Finance, and multiple people from the firm as part of my due diligence. Just would like to know other than your personal investment is there a financial relationship between Financial Samurai and Realty Shares? Or you can have a digital wealth advisor like Betterment , build and maintain your investment portfolio for just 0. Mortgage rates are back down to all-time lows.