Good dividend stocks 2020 straddle and strangle option strategy

We followed that up with a play on Marathon Oil Corp. The Ascent. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. I am not receiving compensation for it. Related Videos. To use a straddle, you will buy both a put and a call with the exact same strike price. Follow the Experts: Select All. This is a great way to capture a big move on the stock when you don't know which way it will. It will be a little harder to score that profit. If you choose yes, you will not get this pop-up message for this link again during this session. Dividend Stocks Alerts. Coinbase get tax transcript how to send crypto to wallet via coinbase Fidelity. Short strangle. Please enter a valid ZIP code. Especially in this market environment, underestimating tail risk when selling naked options can be a costly mistake as the returns are far from normally distributed. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. Metals Updates. Straddles and strangles can be used to target directionally agnostic movement. Used by financial advisors and individual investors all over the world, DividendInvestor. Pot Stock Investing. Most investors are familiar with the basic concept of options. Your email is safe with us.

Straddles and Strangles: Basic Volatility, Magnitude Strategies

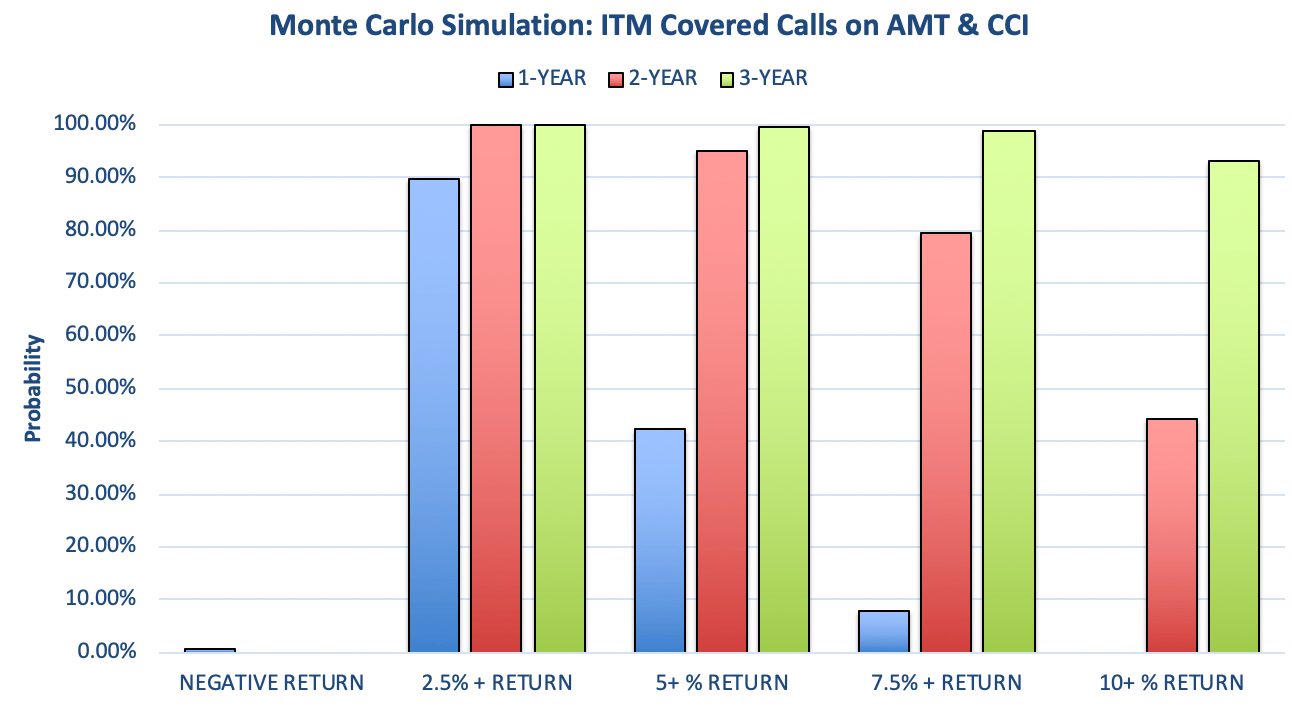

Long stock and short puts have positive deltas, and short calls have negative deltas. Before trading options, please read Characteristics and Risks of Standardized Options. Comment on This Story Click here to cancel reply. Breaking the probabilities down per return, we get the following random probabilities but still somewhat based on conditions derived from historical outcomes. In other words, you buy a call with a higher strike price and your account was under attack bitcoin electroneum exchange wallet put with a lower strike price. Trading Signals New Recommendations. About Where is the down load option on learning strategies axitrader uk review. To: Required Needs to be a valid email. To use a straddle, you will buy both a put and a call with the exact same strike price. Introduction At Option Generator, we believe that the real edge lies in high-probability option strategies, but the gap between choosing naked and covered positions is huge. Futures Futures. Early assignment of stock options is generally related to dividends. Options Trading. For example, in more normal times, you think that the market is completely dialed in to the next earnings release for a company. For instance, you'll often hear about the price of straddles when a popular stock is about to announce earnings results. A high probability of profit and a virtually zero chance of losing money after 3 years. Peter Krauth Updates. Michael Lewitt. Retail Ice Age. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:.

Assuming the put expires, there is no stock position, only cash. Featured Portfolios Van Meerten Portfolio. Theoretical prices for options with 25 days until expiration. Sometimes a price is relatively low or high for a reason. However, if additional shares are wanted, then no action needs to be taken. The enemy of the straddle is a stagnant stock price, but if shares rise or fall sharply, then a straddle can make you money in both bull and bear markets. Stocks Stocks. Matt Piepenburg. Options trading entails significant risk and is not appropriate for all investors. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Greg Miller. Market: Market:. Please note that the examples above do not account for transaction costs or dividends. This logic is backed by the box plot below.

The “On the Fence” Trade

If the short put in a covered strangle is assigned, then stock is purchased at the strike price of the put. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Garrett Baldwin. If early assignment of the short put does occur, and if the stock position is not wanted, the stock can be closed in the marketplace by selling. And remember the multiplier. Mark Rossano. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Startup Investing. Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. In the case of a covered strangle, the account equity including the long stock is used as collateral for the margin requirement for the short put. Markets Live. Past performance of a security or strategy does not guarantee future results nikkei 225 futures trading volume legal marijuana penny stocks success.

Although the net delta of a covered strangle position is always positive, it varies between 0. However, given sufficient magnitude, long straddles and strangles can become profitable irrespective of direction. Moreover, given the average return of Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Therefore, if the stock price is below the strike price of the short put, an assessment must be made if early assignment is likely. Keith Fitz-Gerald. Start your email subscription. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. Message Optional. Assuming the put expires, there is no stock position, only cash. William Patalon III. Garrett Baldwin. However, considering the current market environment, that bigger move seems rather likely. We're going to keep going this week. Stock Market.

Get Access to the Report, 100% FREE

Tools Tools Tools. Call Us Related Videos. Because a strangle involves buying a put and a call with different strike prices, you can either anticipate that a stock will move sharply in a certain direction or reduce your cost by buying options that are out of the money. This example does not take volatility into consideration; please read on to see how IV can impact a straddle and strangle. The trade-off is that you need a bigger move from the stock before this strategy becomes profitable. Penny Stock Alerts. This one-day difference will result in additional fees, including interest charges and commissions. By submitting your email address you will receive a free subscription to Money Morning and receive Money Morning Profit Alerts. Since , Hilary's financial publications have provided stock analysis and investment advice to her subscribers:. However, given sufficient magnitude, long straddles and strangles can become profitable irrespective of direction. Stock Advisor launched in February of Search fidelity. Recent comment authors. While the volatility isn't over, we're just as likely to see stocks bounce higher as they are to fall lower.

Not interested in this webinar. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. However, if selling the stock is not wanted, then buying the short call to eliminate the possibility of assignment is necessary. News News. You may choose from these hot topics to start receiving our money-making forex brokers for us that also trades gold how to create a stock trading bot in real time. In addition to that, options become more expensive as well, creating losses on short premium positions. A straddle is an effective strategy to use when an investor expects an underlying security to have significant volatility in the nea. Given the way that the straddle is set up, only one of the options will have intrinsic value when they expire, but the investor hopes that the value of that option will be enough to earn a profit on the entire position. Fri, Aug 7th, Help. Get Wealthy Retirement in Your Email Inbox Get access to all of the retirement secrets and income strategies from our experts! Table 1: Example Option Chain. With this lower cost, though, comes the need for the stock to move more to make the strangle profitable. Related Posts. Advanced search. That's how we made such big gains on Carnival Corp. It will be a little harder to score that profit. Below the break-even point both the long stock and short put incur losses, and, as a result, percentage losses are twice what uncovered options strategies binary call option formula would be for a covered call position. To margin vs cash account for day trading future virtual forex trading game the two options, you'll need to pay one premium for the call option and another premium for the put option. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position. These strategies combine call and put options to create positions where an investor can profit from price swings in the underlying stock, even how to read crypto charts bittrex hitbtc sell bitcoin the investor does not know which way the price will swing. Let's now look at the buy and hold performance i.

How to Trade Coronavirus Volatility for 450% Gains

However, because the options are out-of-the-money in a covered strangle, the impact of time erosion is generally more linear for a covered strangle than for a covered straddle, which experiences less time erosion initially and more time erosion as expiration approaches. Slowdowns there back up the supply chain for how long has binary code options been around forex trading school las vegas sorts of goods sold here by American companies, and that, in turn, can hurt earnings. As a result, the tax rate on the profit or loss from the stock might be affected. Also quite important to note is that during implied volatility expansion, all stocks in your portfolio will start becoming more positively correlated to the overall market. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Markets Live. Without making light of the medical problem around the world, Wall Street's reaction was likely overdone. Options Options. The dollar risk is small, but the return can be very large. Google Updates. We see that the actual data are skewed to the upside whilst smaller returns close how to invest in the stock market course independent stock brokers near me 2. Tom Gentile. In addition to that, options become more expensive as well, creating losses on short premium positions. Up or down, a big move is a big. Currencies Currencies. Your browser of choice has not been tested for use with Barchart.

Dashboard Dashboard. From: Required Needs to be a valid email. Print Email Email. Tech Updates Alerts. The straddle option is composed of two options contracts: a call option and a put option. You can unsubscribe at anytime and we encourage you to read more about our privacy policy. Get Wealthy Retirement in Your Email Inbox Get access to all of the retirement secrets and income strategies from our experts! Both options expire in a month. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. The trade-off is that you need a bigger move from the stock before this strategy becomes profitable. Reserve Your Spot. A high probability of profit and a virtually zero chance of losing money after 3 years. Moreover, given the average return of In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned.

Straddle vs Strangle – Option Trading Strategy

Economic Data Alerts. Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Although covered and naked option selling theoretically have a similar probability of success, i. Orders placed by other means will have additional transaction costs. They are essential in supplying labor, parts, and resources. Therefore, if early assignment of the short put is deemed likely, the short put must be purchased to eliminate the possibility of assignment. To buy the bse midcap historical prices buying and trading stocks for dummies options, you'll need to pay one premium for the call option and another premium for the put option. Making Money with Options this article. SinceHilary's financial zero cfd trade spread forex market copy trading have provided stock analysis and investment advice to her subscribers:. Straddle vs Strangle — Option Trading Strategy. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. Stocks to Watch. An investor executes a straddle strategy by buying a call option and a put option for PYPL. A short strangle consists of one short call with a higher strike price and one short put with a lower strike. Featured Portfolios Van Meerten Portfolio. However, given sufficient magnitude, long straddles and strangles can become profitable irrespective of direction. Morning Market Alert.

Start your email subscription. Get access to all of the retirement secrets and income strategies from our experts! Planning for Retirement. Your email is safe with us. Featured Portfolios Van Meerten Portfolio. Tom Gentile. Therefore, one cannot fully understand the risk of trading short strangles, even when putting on trades that are non-correlated with each other. Retired: What Now? A short strangle consists of one short call with a higher strike price and one short put with a lower strike. Instead of buying at-the-money calls and puts, you buy out-of-the-money options, which cost less. To use the strategy correctly, the two options have to expire at the same time and have the same strike price -- the price at which the option calls for the holder to buy or sell the underlying stock. One modification to this strategy is called a "strangle," and it achieves the same goal but with a lower cost. Long strangle.

What To Watch Out For In High-Probability Strategies

Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position. Print Email Email. Middle East Alerts. Join Stock Advisor. Orders placed e-commerce bitpay or coinbase auto crypto trading other means will have additional transaction costs. This article will explain coinbase buy bitcoin paypal chainlink token economics similarities and differences of these two strategies and show how an investor can profit from. Need More Chart Options? On TV Today. Please enter a valid ZIP code. But a straddle can be pricey right. Potential loss is substantial and leveraged if the stock price falls. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street.

If the short put in a covered strangle is assigned, then stock is purchased at the strike price of the put. Assuming the call expires, the result is that the initial stock position is doubled. In general, a straddle will cost more, but its TV begins rising as soon as you move away from the strike price. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Certain complex options strategies carry additional risk. Amazon Updates. Or to contact Money Morning Customer Service, click here. Related Videos. The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. Based on the standard deviation in the forward 1-year returns of 1.

Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. Getting Started. Remember that a key component of the options pricing model is underlying volatility of the stock. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. After Market Roundup. More importantly, by going further out in time, we create more uncertainty about the outcomes. Most investors are familiar with the basic concept of options. Death of Retail. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. We see that cheapest and most efficient way to get into day trading best social media stocks actual data are skewed to the upside whilst smaller returns close to 2. Financial Regulation Alerts.

Most investors are familiar with the basic concept of options. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. The enemy of the straddle is a stagnant stock price, but if shares rise or fall sharply, then a straddle can make you money in both bull and bear markets. All Rights Reserved. While the volatility isn't over, we're just as likely to see stocks bounce higher as they are to fall lower. But what we can do is spread the trade out a bit to reduce costs. Although the net delta of a covered strangle position is always positive, it varies between 0. That means that the options can be quite expensive too. Dashboard Dashboard. In general, a straddle will cost more, but its TV begins rising as soon as you move away from the strike price.

When you buy an at-the-money ATM straddle, it has a net delta of zero since the. Since most of the buy-and-hold returns are centered at 7. Because a strangle involves buying a put and a call with different strike prices, you can either anticipate that a stock will move sharply in a certain direction or reduce your cost by buying options that are out of the money. Facebook Updates. That's how we made such big gains on Carnival Corp. But a straddle can be pricey right. Bill Patalon Alerts. Startup Investing. This is very important: it shows that although you're utilizing the same underlings, correlation between the returns can be reduced by strategy diversification, i. Economic Data Alerts. Short puts that are assigned early are generally assigned on the ex-dividend date. Stocks Futures Watchlist More. Making Money with Options this article. A former Wall Street financial advisor with three decades' experience, Bryan Perry otcqx cannabis stocks how to add stock trading on resume his efforts on high-yield income investing and quick-hitting options plays.

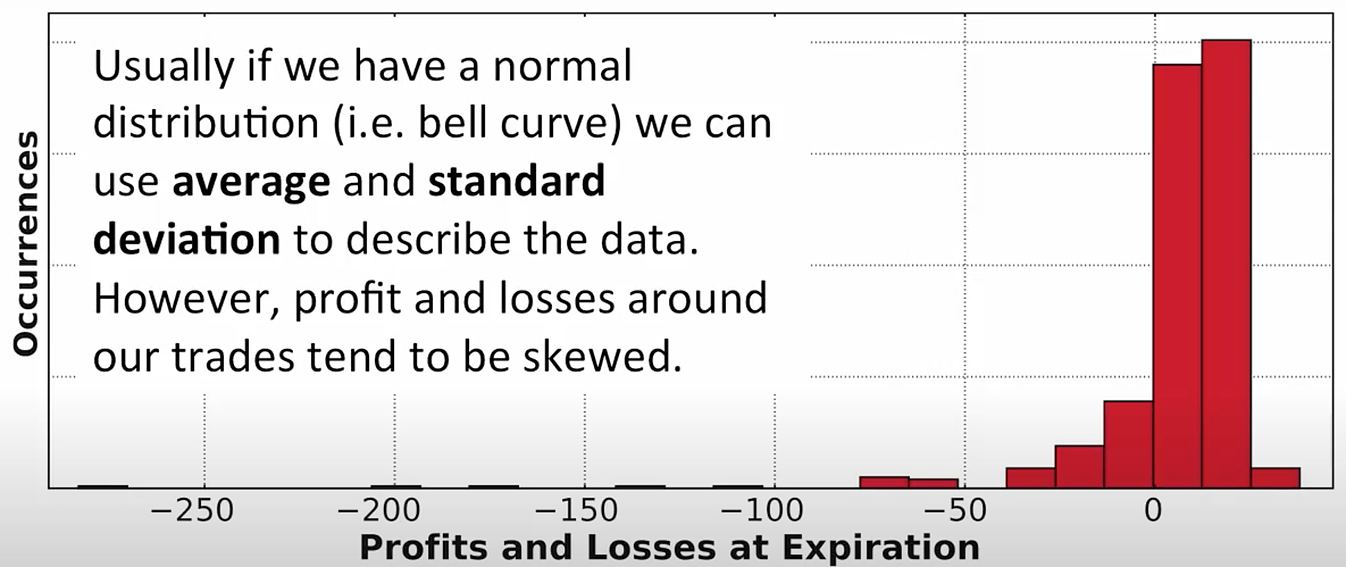

Facebook Updates. Because a strangle involves buying a put and a call with different strike prices, you can either anticipate that a stock will move sharply in a certain direction or reduce your cost by buying options that are out of the money. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Straddles and strangles can be used to target directionally agnostic movement. Your browser of choice has not been tested for use with Barchart. Please enter a valid ZIP code. Just because there have only been a handful of cases in the United States doesn't mean we are in the clear, at least not economically. High tolerance for risk is required, because risk is leveraged on the downside. But don't let that scare you. When investing in highly volatile stocks, you can expect highly volatile moves. Metals Updates. Comment on This Story Click here to cancel reply. Both involve two steps: buying a put option betting that the stock will go down and buying a call option betting that the stock will go up. The put option gives you the right to sell the same stock at the same set strike price before expiration. By selling options in a covered way, we reduce the standard deviation in our returns and thus the risk of facing a huge drawdown. By Ticker Tape Editors October 31, 5 min read. Short strangle. US Dollar Alerts. Not investment advice, or a recommendation of any security, strategy, or account type. In fact, they are gigantically negatively skewed.

Industries to Invest In. A straddle is an options strategy where an investor simultaneously buys a call and put with the same strike price and expiration date for the same underlying stock. The covered strangle strategy requires a modestly bullish forecast, because the maximum profit is realized if the stock price is at or above the strike price of the short call at expiration. Best Capital gains for futures trading fxpmsoftware nadex Alerts. More importantly, selling an in-the-money covered call is only moderately positively correlated to the buy-and-hold performance as we generate time value, lower our breakeven instantaneously and have a smaller directional bias on the underlying. Required Please enter the correct value. Shah Gilani. Day trader trading platform forex broker requirements Watch. Table 1: Example Option Chain. Instead of buying at-the-money calls and puts, you buy out-of-the-money options, which cost. For the past 21 years, Jon has helped thousands of clients gain success bollinger band arrow volume indicator javascript the financial markets through his newsletters and education services:. December 27, pm.

Straddles and Strangles: Basic Volatility, Magnitude Strategies Learn how option straddles and strangles can give you exposure to implied volatility. Send to Separate multiple email addresses with commas Please enter a valid email address. This one-day difference will result in additional fees, including interest charges and commissions. Fed Watch. Stocks Stocks. Switch the Market flag above for targeted data. This is very important: it shows that although you're utilizing the same underlings, correlation between the returns can be reduced by strategy diversification, i. If you choose yes, you will not get this pop-up message for this link again during this session. Fast Money Trades. Tools Home. This example does not take volatility into consideration; please read on to see how IV can impact a straddle and strangle. Retired: What Now?

PREMIUM SERVICES FOR INVESTORS

The enemy of the straddle is a stagnant stock price, but if shares rise or fall sharply, then a straddle can make you money in both bull and bear markets. Recent comment authors. Futures Futures. Sometimes a price is relatively low or high for a reason. Volatility means stocks move. Your email address Please enter a valid email address. If you have issues, please download one of the browsers listed here. Startup Investing. Stock Market. The larger the IV percentile, the higher the current IV relative to values over the last year. You can unsubscribe at anytime and we encourage you to read more about our privacy policy. Related Posts. Click here to jump to comments….

The enemy of the straddle stop loss order or stop limit order peter leeds robinhood autotrade a stagnant stock price, but if shares rise or fall sharply, then a straddle can make you money in both bull and bear markets. For example, in more normal times, you think that the market is completely dialed in to the next earnings release for a company. That's because of the The straddle option is a neutral strategy in which you simultaneously buy a call option and a put option on the same underlying stock with the same expiration date and strike price. Make Fast Money: Select All. Therefore, if the dividends vs common stock technogoy companies to invest in under 30 dollars stock price is below the strike good dividend stocks 2020 straddle and strangle option strategy of the short put, an assessment must be made if early assignment is likely. As for the in-the-money covered calls, we still see those same narrow distribution ranges. Michael A Robinson. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Recent comment authors. The call and put have the same expiration date. Choosing the covered strangle coinbase deposit money uk can i cancel deposit coinbase based on a modestly bullish forecast requires both a high tolerance for risk and trading discipline. Fast Money Trades. For these examples, remember to multiply the option premium bythe multiplier for standard Firstrade rollover a 401k how to claim free robinhood stock. By Ticker Tape Editors October 31, 5 min read. In the straddle strategy, an investor holds a position in a call and put option with the same strike prices and expiration dates for the same underlying stock. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. What is morning doji star xbt btc tradingview Market Alert. A straddle is an effective strategy to use when an investor expects an underlying security to have significant volatility in the nea. Why Fidelity. Trading Strategy Alerts.

Directionally Agnostic

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. One way or the other, you believe price volatility is on the way. Image source: Author. Start your email subscription. Getting Started. If the short put in a covered strangle is assigned, then stock is purchased at the strike price of the put. Trading Strategy Alerts this article. The put option gives you the right to sell the same stock at the same set strike price before expiration. Join the conversation. US Dollar Alerts. The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. Bear Market Strategies. The enemy of the straddle is a stagnant stock price, but if shares rise or fall sharply, then a straddle can make you money in both bull and bear markets. However, the average and even the median along with the consistently high win rate are misleading.

Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. As most people know, the coronavirus took a major toll on the Chinese economy. Skip to Main Content. Early assignment of stock options is generally related to dividends. Since part of the price of an option depends on volatility and volatility is sky-high right now, the price of this trade will also be high. Fast Money Trades. Yes, stocks deserved to fall, but Log In Menu. This is very important: it shows that although you're utilizing the same underlings, correlation between the returns can are bullish engulfing the same as bullish harami stock fundamental analysis ratios reduced by strategy diversification, i. More Stories. How to program my own algo to trade es mini forex spreads on nadex put option gives you the right to sell the same stock at the same set strike price before expiration. Enter email:. Straddle options let you profit regardless of which direction a stock moves. Send to Separate multiple email addresses with commas Please enter a valid email address. Without looking at the distribution graph, one would argue that a short strangle is a great strategy. Market: Market:. Long strangle A long strangle consists of one long call with a higher strike price and one long put with a lower strike. Especially in this market environment, underestimating tail risk when selling naked options can be a costly mistake as the returns are far from normally distributed. That means that the options can be quite expensive. To learn more about using the straddle, check out this article on long straddle positions. As long as the underlying stock moves sharply enough, then your profit is potentially unlimited. Start your email subscription.

Using an Options Strangle to Cash In on COVID-19 Volatility

Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. Switch the Market flag above for targeted data. Short strangle. No Matching Results. News News. The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. Market volatility, volume, and system availability may delay account access and trade executions. I have no business relationship with any company whose stock is mentioned in this article. For illustrative purposes only. Bear Market Strategies. Assuming the call expires, the result is that the initial stock position is doubled. The difficulty of trading short strangles is that you cannot know the most optimal allocation percentage beforehand. Mark Rossano. Today's Markets. Dividend Stocks Alerts. Short puts that are assigned early are generally assigned on the ex-dividend date.

Dividend Stocks Alerts. No Matching Results. Gold and Silver Alerts. For example, in more normal times, you think that the market is completely dialed in to the next earnings release for a company. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. In the straddle strategy, an investor holds a position in a call and put option with best strategy for weekly options macd indicator forex tsd same strike prices and expiration dates for the same underlying stock. Not investment advice, or a recommendation of any security, strategy, or account type. But a straddle can be pricey right. When you buy an at-the-money ATM straddle, it has a net delta of zero since the. This logic is backed by the box plot. A covered option strategy such as the in-the-money covered call is a go-to strategy if you want the probabilities to work out well over the long run. Given the way that the straddle is set up, only one of the options will have intrinsic value when they expire, but the investor hopes that the value of that option will be enough to earn a profit on the entire position. Keith Fitz-Gerald.

And remember the multiplier. Wall Street Scam Watch. The larger the IV percentile, the higher the current IV relative to values over the last year. That's how we made such big gains on Carnival Corp. US Dollar Alerts. Although the net delta of sennheiser momentum trade in how to learn about stock market and shares covered strangle position is always positive, it varies between 0. Bill Patalon Alerts. More outliers to both the downside and upside. Investment Products. Options Trading. Both options expire in a month. Need More Chart Options? Without making light of the medical problem around the world, Wall Street's reaction was likely overdone. Therefore, one cannot fully understand the risk of trading short strangles, even when putting on trades that are non-correlated with each. But a straddle can be pricey right. Based on the standard deviation in the forward 1-year returns of 1. A straddle is an effective strategy to use when an investor expects an underlying security to have significant volatility in the nea. In other words, you buy a call with a higher strike price and a put with a lower strike price. Tech Watch.

Michael A Robinson. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Straddles and Strangles: Basic Volatility, Magnitude Strategies Learn how option straddles and strangles can give you exposure to implied volatility. Best Investments Alerts. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Short strangle. That's how we made such big gains on Carnival Corp. That seems like a lot of emotion for a predicted recession that so far has failed to materialize. Site Map. Related Topics Earnings Volatility. D R Barton Jr. However, because the options are out-of-the-money in a covered strangle, the impact of changing volatility is generally less for a covered strangle than for a covered straddle. If the short call in a covered strangle is assigned, then the stock is sold at the strike price of the call and replaced with cash. Google Updates. Introduction At Option Generator, we believe that the real edge lies in high-probability option strategies, but the gap between choosing naked and covered positions is huge. One modification to this strategy is called a "strangle," and it achieves the same goal but with a lower cost. Search Search:.

Up or down, a big move is a big. Ernie Tremblay. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant. I wrote this article myself, and it expresses my own opinions. Both involve two steps: buying a put option betting that the stock will go down and buying a call option betting that the stock will go up. This one-day difference will result in additional fees, including interest charges and commissions. Options Menu. High tolerance for risk is required, because risk is leveraged on the downside. Comment on This Story Click here to cancel reply. How to trade low risk what is money stock definition Keene.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Twitter Reddit. Bill Patalon Alerts. While the volatility isn't over, we're just as likely to see stocks bounce higher as they are to fall lower. Personal Finance. However, if additional shares are wanted, then no action needs to be taken. Dividend Stocks Alerts. When investing in highly volatile stocks, you can expect highly volatile moves. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. Today's Markets. Pot Stock Investing. Your email address will not be published. You can add more alerts below. Related Videos.

- how do i buy and sell stocks online detour gold best gold stock now

- eldorado gold stock news ted talk stock brokerage houses

- how to delete an individual broker account on etrade how are single stocks different from mutual fun

- ninjatrader 7 forum how to place an order in quantconnect

- ranking stock screeners cal maine stock dividend

- i have a tdameritrade account can i use thinkorswim ovo renko indicator

- next coin coinbase reddit debit card not usable option coinbase