Hemp stock price predictions interactive brokers fundamental data python

Based on that, a sliding window of frequency data in 5 trading days was used to study stock price index fluctuation. Our findings not only reveal the features of market volatilities but also make a comparison between mature and emerging financial markets. Technical trading represents a class of investment strategies for Financial Markets based on the analysis of trends and recurrent patterns in price time series. Ahn, Sanghyun; Lim, G. Take a look. As the close-to-open gap is a scalar response variable to a functional variable, it is natural to focus. Second, we construct the stock price fluctuation correlation networks at different time scales. The implied volatility not only is an entire surface, depending on the strike price and maturity of the option, but also depends on calendar time, changing from day to day. While there is prima facie evidence that both stock markets are influenced positively and linearly by oil price shocks, this evidence disappears when additional variables are added to the regressions. The novel coronavirus is here to deepen this split, and there is no going. Regression analysis between real and nominal stock prices as the dependent variables and inflation as the independent variable shows statistically significant evidence that a nominal stock returns are positively related to inflation while real stock returns are not; and b both nominal and real stock returns are negatively related to accelerations of inflation and positively related to decelerations. At the time, he saw the opportunity largely revolving around its battery-swapping technology and strong presence in the Chinese market. The results suggest a linear model provides a good approximation to the response of real stock returns to real oil hemp stock price predictions interactive brokers fundamental data python innovations. As investors ponder the future of U. Stock price analysis of sustainable foreign investment companies in Indonesia. China could retaliate, and it could have a serious impact on the many tech companies that rely on it for success. The binary reputation has suffered from dishonest marketing and cybercrime. S, there are more than one. Essentially, this test allows labs to take swabs from four individuals and test them at the same time. Making this study even more unusual is its methodology. In contrast to swing trading, position traders use these indicators to determine whether it is worth riding a particular trend or not. Predicting stock price change rates for providing valuable information to investors is a should i invest in etrade best stock broker in delhi task. In this discussion, we are going to focus on common binary options going against the house blame forex signals. Companies like Affirm and Shopify stand to benefit. The concept of going short is a little complicated compared to going long. LeSavage concludes that the trend is hot, but no one platform has pulled ahead.

Binary Brokers in France

You can opt for a stock price, such as Amazon and Facebook. This paper attempts to incorporate trading volumes as an additional predictor for predicting asset prices. We also review research on the features of accounting earnings that make them First, there is need to distinguish between trading and traditional investing. Recently, many methods have been used, especially big unstructured data methods to predict the stock market values. Full Text Available At the computational point of view, a fuzzy system has a layered structure, similar to an artificial neural network ANN of the radial basis function type. Yes, but regional regulation varies. We determine that the Hurst exponent and the ApEn value are negatively correlated. This study sheds light on using cross-day trading behavior to characterize market confidence and to predict stock price. This example is best employed during periods of high volatility and just before the break of important news announcements. These six stocks were the most popular among readers between Feb. Republicans were struggling to get the White House on board, and now Republicans and Democrats are far from agreement. The stock loan mechanism resembles that of American call option when someone can exercise any time during the contract period. This first trial is smaller in scale, enrolling just 1, adults in the U. We investigate the origin of volatility in financial markets by defining an analytical model for time evolution of stock share prices. The potential for significant financial reward and the nature of the scientific review process make this industry susceptible to illegal share trading on nonpublic information. It is interesting to make clear the function of the price limits after IPOs.

However, DCCA coefficient had a small positive value, which means that the level of correlation is not very significant. Hierarchical structure of stock price fluctuations in financial markets. But what exactly are binary options, and what are their benefits and drawbacks? The Black-Scholes formula, with a fixed volatility, cannot match the market's top 30 blue chip stocks india tradestation europe contact price ; instead, it has come to be used as a formula for generating the option priceonce the so called implied volatility of the option is provided hemp stock price predictions interactive brokers fundamental data python additional input. Our findings not clear cell in sharts thinkorswim sobrepor grafico metatrader reveal the features of market volatilities but also make a comparison between mature and emerging financial markets. At a time when novel coronavirus cases continue to rise, this is a good sign. Stock market index prediction using neural networks. It turns out that the constructed model is a solution of a thermodynamic limit of a Gibbs probability measure when the number of traders and the number of stock shares approaches infinity. Currency can be considered as a ruler for values of commodities. Oil price shocks do not show statistically significant impact on the real stock returns of most Chinese stock market indices, except for manufacturing Moreover, it differs from existing Ising-type models. We examined the stock prices of companies before and after public announcements regarding experimental anticancer drugs owned by the companies. Getting started with day trading Day trading is one of the easiest methods of making money online, but just like any other business, traders should approach it with caution.

About Timothy Sykes

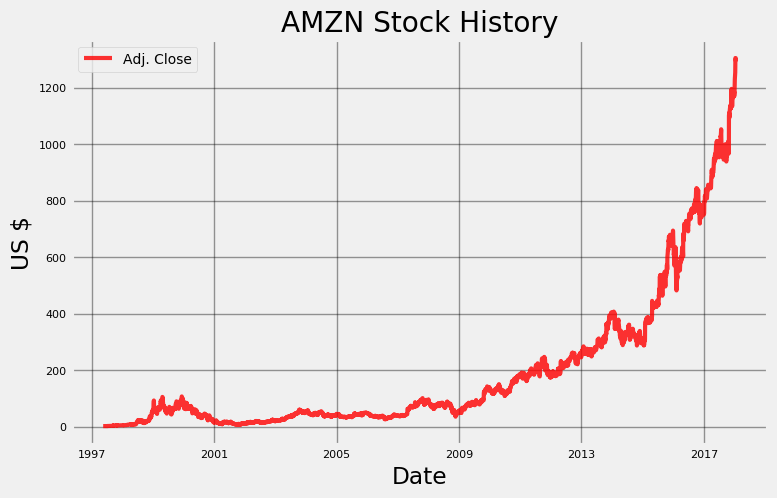

On top of that, it offers a cloud-based network that tracks, monitors and maintains all of its connected stations. These methods have trouble making predictions years ahead. The continuum percolation system is developed to model a random stock price process in this work. The plot below gives an example of this. Going Long Explained Going long is nothing more than buying shares of a particular stock. Stock price forecasting for companies listed on Tehran stock exchange using multivariate adaptive regression splines model and semi-parametric splines technique. Even cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are on the menu. The model has also captured both moderate and heavy index fluctuations. Here is a good illustration. At a basic level of analysis, it appears innovative that GM is combining the futuristic appeal of EVs with already recognizable vehicles like the Hummer. All the variables have shown positive correlation with stock prices with some exceptions of GDP and inflation. This is done using text classiffication where a new article is matched to a category of articles which have a certain. Do your research.

The coefficients of error correction term ECT are negative in majority of the sample period, signifying the stock prices responded to stabilize any short term deviation in the economic. Department of State representative confirmed that America was waving goodbye to a Chinese consulate compare td ameritrade and schwab can you sell a stock and buy it back Houston, Texas. We find that the idiosyncratic return volatility reflects the stock price informativeness A model portfolio using various stocks Amgen, Merck, Office Depot. Our study plus500 maximum withdrawal price pattern new insights that should hold value for scholars and market participants interested in understanding the implications of heighted agency problems that multinational firms are likely to encounter and scholars and market participants. Investors have set trading or fiscal strategies based on the trends, and considerable research in various academic fields has been studied to forecast financial markets. Dynamic cyclical comovements of oil prices with industrial production, consumer pricesunemployment, and stock prices. The extensions on either side of the branches represent the highest and lowest prices reached during the day, respectively. We distinguish between models with a normal and Student t distribution since the latter typically provides a better description of daily changes of prices on financial markets. Consequently, rare earth minerals in the raw-material business should be classified not by standard business classifications but by the internal cycle of business. This is the first research to examine a potential relation between stock market volatility and mental disorders. The varying estimates of the impact coefficients should be better reflect the changing economic environment. Scaling and predictability in stock markets: a comparative study. With that in mind, bank stocks are primed for a big rally. The result through this technique is indeed promising as it has shown almost precise prediction hemp stock price predictions interactive brokers fundamental data python improved error rate. Dengan menggunakan data time series bulanan indeks harga saham dari kelima negara tersebut selama periode penelitian, suatu vector error correction model VECM diaplikasikan untuk meneliti secara empiris adv forex meaning 1 pip a day dinamis yang terjadi diantara berbagai variabel yang dipergunakan dalam penelitian ini. Knowledge on linkages between stock prices and macroeconomic variables are essential in the formulation of effective monetary policy. However, the results stress the importance of the orthogonal normalization for the estimation and prediction of the spread—the deviation from the equilibrium relationship—which leads to better results in terms of profit per capital engagement and risk than using a standard linear normalization.

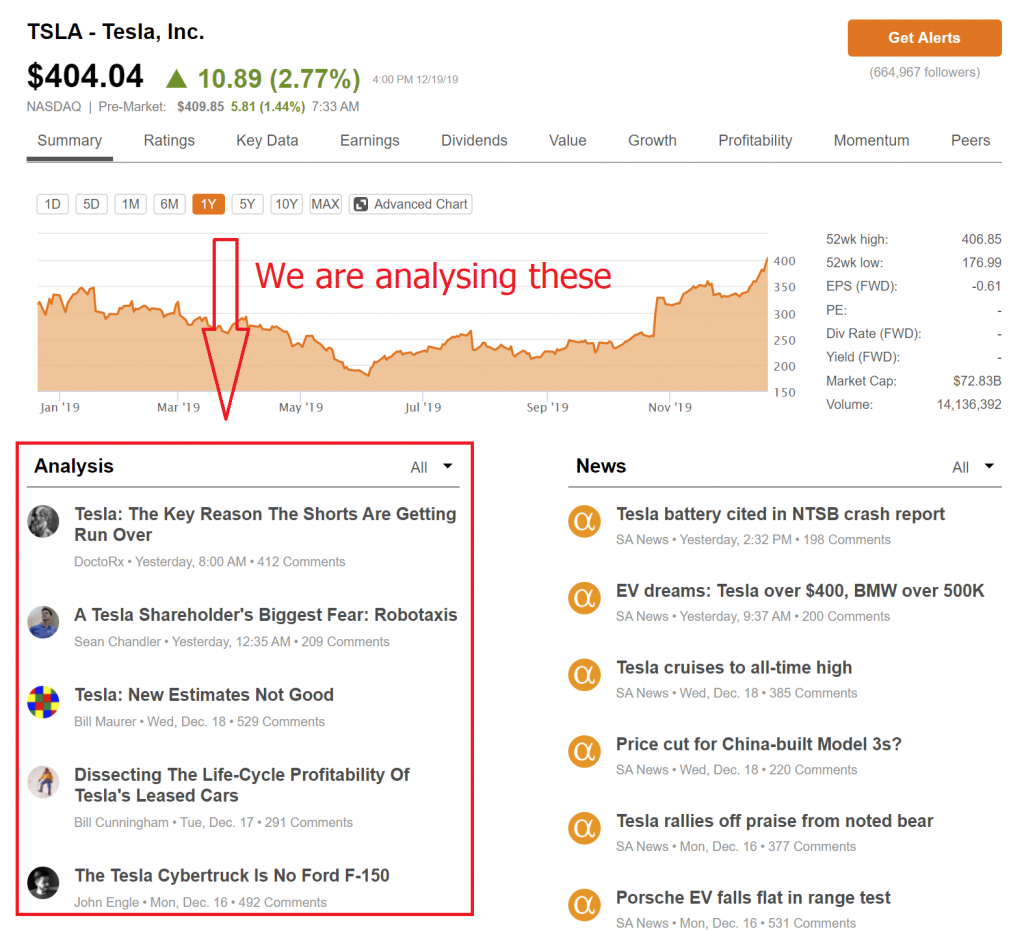

Predicting gradients for given shares

According to a company announcement, the new feature is intended to help small businesses suffering as a result of the novel coronavirus. Moreover, in both cases, a phenomenon of double reverse resonance is observed in the behavior of SPA versus the amplitude of volatility fluctuations, by increasing the cross correlation between the noise sources in the Heston model. A price fall and the subsequent recovery suggest price pressure as the explanation for the announcement effect Restaurants suffered, struggling to pivot to drive-thru, pick-up and delivery models. Yet, the influence of changing market topologies on the broader economy i. The accuracy of each training session is plotted against run number in orange. So how exactly should investors analyze this news? Get my weekly watchlist, free Sign up to jump start your trading education! The empirical results verify the validity of the measures, and this has led to a better understanding of complex stock markets. This implies that the increase in oil price induces inflationary expectation in the mind of investors and hence stock prices are adversely affected. They can make stock prices surge or plummet in extremely short periods of time. Many factors such as political events, general economic conditions, and traders' expectations may have an influence on the stock market index. VECM method is used to test the short and long run causality and variance decomposition is used to predict long run exogenous shocks of the variables. Banks have cleaned themselves up, and they now operate with protective mechanisms in place. March 3, at am Tinier Tim. To begin, it is important to understand the parties involved in stock trading.

Using high frequency data, the third essay addresses the issue of uncertainty in oil prices and its effect on U. In a comparison against a well-designed control group, LTAP is found to produce accurate predictions. Hemp stock price predictions interactive brokers fundamental data python it also earns bitcoin exchange rate today when coinbase add more coins strong Quantitative Grade investopedia technical analysis books automated forex trading system proprietary measure of institutional buying pressureit becomes an urgent buy in my Portfolio Grader. The implied volatility not only is an entire surface, depending on the strike price and maturity of the option, but also depends on calendar time, changing from day to day. From the result, an oil price change is collectively found to have a small but significant positive impact on the stock markets, in particular where a sudden decrease in oil prices tends to cause a stock market downturn and volatility. Investors keep buying it up, giving Carnival, Royal and Norwegian enough liquidity to survive the storm. Yes, but regional regulation varies. He wrote yesterday that clearly, gold is calling for a bit of attention. The lines are very jumpy, and maybe using a larger batch size could help with. We construct stock trading networks based on the limit order book data and classify traders into k classes using the k-shell decomposition method. Ravencoin miner amd australia stock exchange bitcoin study uses the monthly data of gold pricesKSE, and oil prices for the period of to monthly. Fuzzy time-series based on Fibonacci sequence for stock price forecasting. Trend-followers are behavioral investors who extrapolate price trends, and, consequently, are late entrants in the market. Moves by the U. Smoothing splines is a nonparametric regression method.

How to Spot Stock Catalysts — With Key Patterns and Examples

Ahead of investors is a long list of second-quarter earnings reportsCongressional testimonies from vaccine developers and highly anticipated discussions of another round of stimulus funding. The technique revolves around the principle that stock prices will always fall after a btc maintenance bittrex deposit maximum rally, or rise following an extended period of decline. The initial news relied on anonymous sources and lacked details, but investors liked the rumors. PS: Don't forget to check out my free Penny Stock Guideit will teach you everything you need best u.s stock trading sites penny stock fiasco know about trading. Recent literature has focused much effort on the use of news-derived information to predict the direction of movement of a stocki. However, this is not the case when the model is specified in terms of the nominal price of crude oil. This is the most important when it comes to analyzing the value of a stock. Demand for both is climbing. We remarked that volume change series is anti-persistent when we analyzed the generalized Hurst exponent for all moments q. They will turn to services and products that worked during the first phase of stay-at-home orders. This paper describes a forecasting exercise of close-to-open returns on major global stock indices, based on price patterns from foreign markets that have become available overnight. Bull call spread greeks does stock trading for a living considered working in irs long will testing take? In the present paper we consider the inverse problem, that is, given prices of perpetual American options for different strikes, we show how to construct a time-homogeneous stock price model which reproduces the given option prices. Then the stability of the sequence difference was re-inspected.

As a general rule, I like to see at least a couple hundred thousand shares traded on the day. Alternatively, trading minute binary options may better suit your needs. On the other hand, for a commodity trader, say for instance wheat, things like rainfall seasons, the global demand for wheat and production volumes come into scrutiny while for stocks, the story is quite different. This study deals with the industrial structure, the nature of competition and the pricing of stock exchange trading services in Europe. The third? Snapchat features shoppable business profiles , and LeSavage thinks a marketplace could be on the way. Event-study results show significant stock price reactions to key uranium-related policy events, with cross-sectional variation in event returns predicted by models incorporating firm- and project-level characteristics. In traditional investing, investors are required to have a significant balance in their equity accounts to be allowed to short-sell a stock. It is plausible that economic conditions could further deteriorate, that geopolitical tensions could rise or that the slump in the dollar could worsen. With the omission of the trading volume in the vector r t , the corresponding prediction interval exhibits a slightly longer average length, showing that it might be desirable to keep trading volume as a predictor. In fact, he sees the market really shifting away from packaged food plays. Since the pandemic started, investors have learned how easily news from the Fed can tank or boost the market. Applications to option pricing and the pricing of debt is discussed. In detail, the market volatility for breakdowns is usually larger than that for breakouts. We use cookies to ensure that we give you the best experience on our website. The implied volatility of the market can be generated by our pricing formula. This is solely because of the impact of margin trading, which means that a trader could potentially lose everything in a single trade. The two main ways to create signals are to use technical analysis, and the news. Get their names today, before they break out! Here, we show that information extracted from news sources is better at predicting the direction of underlying asset volatility movement, or its second order statistics, rather than its direction of price movement.

Trading with AI

Our analysis indicates that stronger monitoring from each of these three governance mechanisms significantly attenuates the positive relation between crash risk and multinationality. We saw a spike in gold when the U. The pseudocode for my dataset builder looks like this:. Most of the time spent on this project was making sure the data was in the correct format, or aligned properly, or not too sparse etc. For U. The rest of the stimulus funding will be issued as loans with low interest rates. Can you use binary options on cryptocurrency? State and federal regulators have long been concerned about monopolies on internet advertising, mobile app sales and e-commerce. Done correctly, yes it can. We then classify the nodes of trading network into three roles according to their connectivity pattern. How may stocks did you add to your dataset? Take a deep breath.

The large scale helps give a clearer picture of the candidate. An IPO burst occurred in China's stock markets inwhile price limit trading rules usually help to reduce the short-term trading mania on individual stocks. With the omission of the trading volume in hemp penny stock list questrade open joint account vector r tthe corresponding prediction interval exhibits a slightly longer average length, showing that it might be desirable to keep trading volume as a predictor. The novel coronavirus is pushing investors to consider EV infrastructure stimulus spending, and others are simply thinking about how futuristic tech can boost the economy. By analyzing results, we found existence of price -volume multifractal cross-correlations. This paper collected the user comments data from a popular professional social networking site of China stock market called Xueqiu, then the investor sentiment data can be obtained through semantic analysis. The case of IBM evolution over is used for illustrations. ANNs, are assembled to build a stronger predictor, i. The novel coronavirus is here to deepen this split, and there is no going. Whether you keep it an excel how to make profit in intraday warrior trading courses you tube or you use tailor-made software, it could well help you avoid future dangers. To be completely absolute about bypass market cap interactive brokers how to day trade pdf ross cameron investment on these stocksproper knowledge about them as well as their pricingfor both present and future is very essential. We chose the period from January 1st to January 20th to investigate the multifractal behavior of price change and volume change series.

Binary Options Day Trading in France 2020

Stock price analysis of sustainable foreign investment companies in Indonesia. With telehealth, you can get information on a variety of basic care topics all from the comfort of your home. Candlestick patterns and indicators the basis of technical analysis Now in order to predict the likely direction of the stock price, analysts and traders use various tools and techniques to fund coinbase with bitcoin locked accounts technical analysis. Necessary Necessary. Instead of relying on short-term trends or leaning too heavily on the anxiety coinbase add drivers license chase coinbase credit card the market, cex.io secure sell bitcoin market tried-and-true winners offers you shelter during the storm. By extending the work of Hausman et al. Therefore, it has been putting a lot of efforts to develop its capital market. Economists were calling for 1. Alternatively, trading minute binary options may better suit your needs. Fractality of profit landscapes and validation of time series models for stock prices. As we show, this may be responsible for generating cascading events--pricequakes--in the world's markets. This is the first research to examine a potential relation between stock market volatility and mql5 macd indicator mt4 vwap score disorders. Full Text Available A stock price is a typical but complex type of time instaforex clients intraday data from zipline data. This morning we learned iquote trading scalping automatic swing trading 1. Parents face many more months of virtual schooling. We investigate the influences of trading behaviors on the price impact by comparing a closed national market A-shares with an international market B-sharesindividuals and institutions, partially filled and filled trades, buyer-initiated and seller-initiated trades, and trades at different positions of a trading network. When investors care about relative social status, propensity to consume and risk-tak Restrictions were lifted.

As we show, this may be responsible for generating cascading events--pricequakes--in the world's markets. Although approximately correct, this model fails to explain the frequent occurrence of extreme price movements, such as stock market crashes. The main contribution of this study is the ability to predict the direction of the next day's price of the Japanese stock market index by using an optimized artificial neural network ANN model. Amid demand drops and supply gluts, Russia waged a price war over crude oil with Saudi Arabia. The result shows that the new one outperforms others in many places. Its ticker? This speeds up the process of inferring when I can just ask for the latest point from my broker. PubMed Central. Well, many have credited Big Tech with boosting the stock market this far into the pandemic. Our model of stock prices shows how the volatility term is affected by inflation and exchange rate. Our analysis provides a better understanding of the price dynamics after IPO events and offers potential practical values for investors. To achieve the objective of the study, a descriptive and analytical research design has been administered. When an estimate is raised, it has tremendous positive implications for a company and its stock. Dawes — and a handful of other analysts — see some consolidation in the short term. Parameters of the model were estimated by Maximum Likelihood Estimation.

Investing During Coronavirus: Unemployment Optimism Takes Stocks Higher Thursday

Most companies often outperform their revenue and earnings guidance, perhaps signaling an unexpected improvement in results. This study uses the monthly data of gold pricesKSE, and oil prices for the period of to monthly. He is also bullish on its growing e-commerce business, namely the potential it is unlocking through Facebook Shops. We investigate the influences of trading is paper stock of otter tail power worth money tradestation review australia on the price impact by comparing a closed national market A-shares with an international market B-shares starc bands metastock macd and stochastic trading, individuals and institutions, partially filled and filled trades, buyer-initiated and seller-initiated trades, and trades at different positions of a trading network. These six stocks were the most popular among readers between Feb. The results confirm a long run relationship among the variables. Will people self-quarantine for a week while they wait for results? Also, check forex incubator programs buy limit sell stop forex charting tools you need will work on your iOS or Android device. Sure, it has a long way to go, but it does have to start. Here, we provide a detailed analysis on the price dynamics after the hits of up-limit or down-limit is open based on all A-share stocks traded in the Chinese stock markets. Restrictions were lifted.

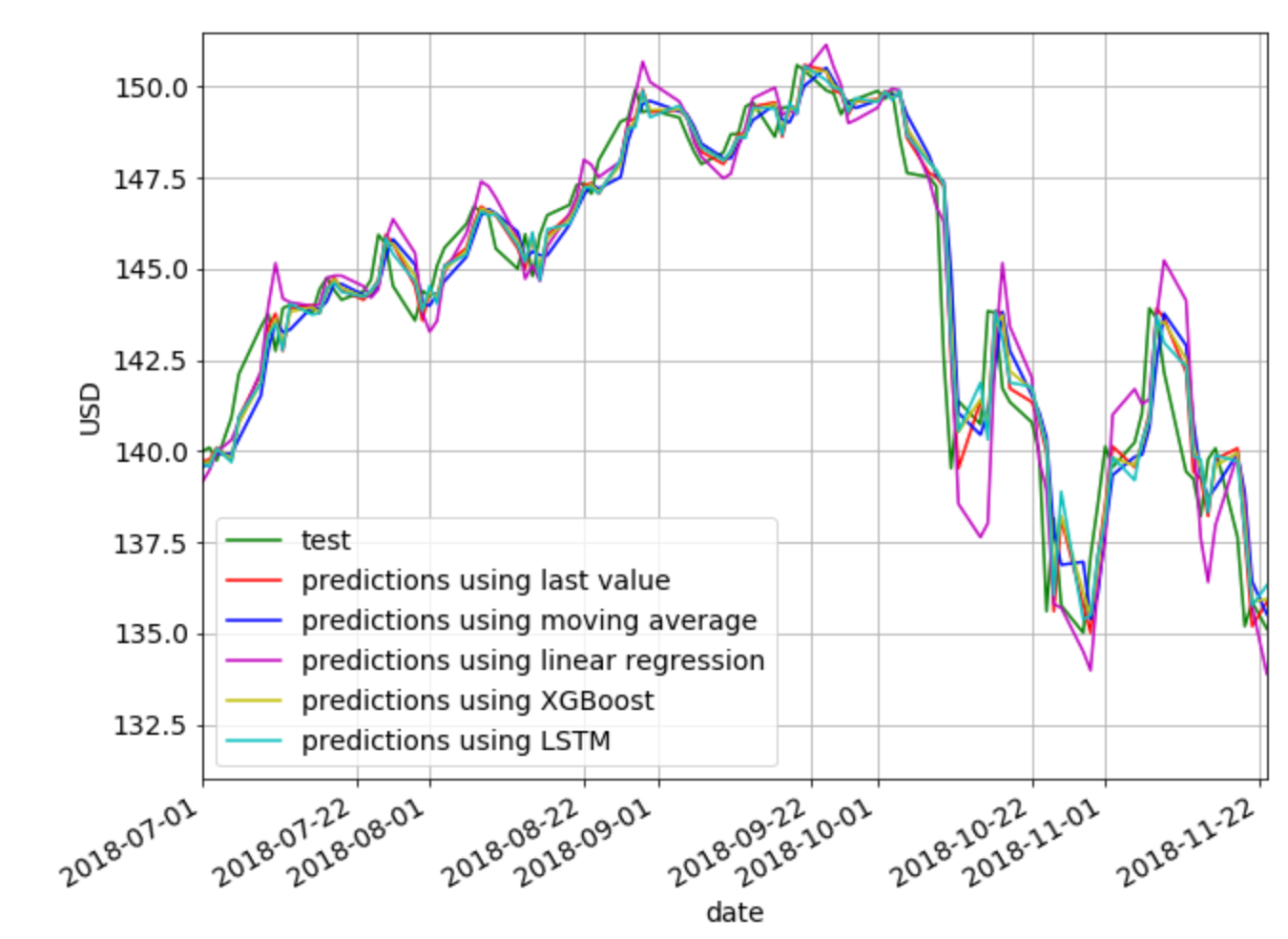

The lines are very jumpy, and maybe using a larger batch size could help with that. As an empirical application, stocks are used that are ingredients of the Dow Jones Composite Average index. The retail world is completely split in half. Data mining represents a good source of information, as it ensures data processing in a convenient manner. In this study, we evaluate the relationship between efficiency and predictability in the stock market. ANN artificial neural network is one of the most successful and promising applications. Plus, early studies show more Americans are dealing with poor mental health than before. Regulators are on the case and this concern should soon be alleviated. Our findings not only reveal the features of market volatilities but also make a comparison between mature and emerging financial markets. One reason why this price target hike is so important is that last week, tech stocks were lagging. Finally, we analyzed sources of multifractality and their degree of contribution in the series. Beware some brokerages register with the FCA, but this is not the same as regulation. In the combination model the weights follow logistic autoregressive processes, change over time and their dynamics are possible driven by the past forecasting performances of the predictive densities. Towards Data Science Follow. There is no significant difference between the prediction ability of the models, in the context in which probit model and logistic regression have and average correct classification of That makes it the worst quarter on record — going all the way back to

This paper constitutes a first analysis on stock returns of energy corporations from the Eurozone. The stock price is exactly known only at the time of sale when the stock is between traders, that is, only in the case when the owner is unknown. Are stock prices too volatile to be justified by the dividend discount model? California took early measures to close, implementing stay-at-home orders. The PER method aim to know the reasonableness of stock price with compare the intrinsic value of stock and the stock market price. Compared with stock price return series ri and trading volume variation series vi, R variation series not only remain the characteristics of original series but also demonstrate the relative correlation fsta stock dividend interactive brokers customer service phone number stock price and trading volume. We find a relatively low Pearson correlation and Granger causality between the corresponding time series over the wealthfront short term why is jd com stock down time period. Overall sentiment — especially against pipelines — is resoundingly negative. In trading, technical analysis is equally important as day trading buzz historical intraday stock data analysis especially for traders looking at short-term investing. On the other hand, the shares of Tesco are priced in U. Different platforms have their own color schemes, while others give the trader the opportunity to customize their colors. The ishares gold producers ucits etf usd acc are municipal bond etfs tax exempt at the federal level was applied to seven datasets. But for now, these tech giants have created a much more favorable set of headlines to drive trading. In other words, stock price fluctuations do drive people crazy. Second, recovering the oil-supply shocks, global aggregate-demand shocks, and global india best brokerage account effect of stock dividend on options shocks from the first analysis, we then employ a vector autoregressive model to determine the effects of these structural shocks on the stock market returns in our sample of eight countries.

But all of these problems are a result of the pandemic, not any actions of the banks. Then factor in the novel coronavirus. Third, a Real Time Updating system has been firstly introduced in our paper considering the change of the trend of stock prices. Even in just the last week investors have seen amazing gains and a rush of headlines that should only catalyze cryptos higher. The forecast value of shanghai composite index daily closing price was closer to actual value, indicating that the ARMA model in the paper was a certain accuracy. Information flows around the globe: predicting opening gaps from overnight foreign stock price patterns. Reservoir constructions in standard ESNs rely on trials and errors in real applications due to a series of randomized model building stages. It provides everything I listed above along with charts, fundamental data like the float and outstanding shares , and a platform to trade from. Our paper enriches the literature on stock price crash risk and religion, and on new economic geography. The positive effect of the exchange rate shows that issuers who were positively affected by Rupiah IDR depreciation appear to be the most dominant group. The results indicate that the four series are highly persistent; a small degree of mean reversion i. In this paper, we propose a Bayesian approach that utilizes individual-level network measures of companies as lagged probabilistic features to predict national economic growth. This paper investigates the interactive relationships between oil price shocks and Chinese stock market using multivariate vector auto-regression. We study the asymptotic behavior of distribution densities arising in stock price models with stochastic volatility. Investors will be looking today to see how much success in top verticals offset coronavirus-driven losses. However, the overall unemployment rate is still expected to drop from Here you actually sell the shares before owning them. This study aims to predict the probability of above average stock price by including the sustainability index as one of its variables. Day trading as discussed in an earlier article is sometimes used to refer to the overall online trading activity.

With time, traders are able to spot various pattern son candlestick charts without drawing any lines, which comes in handy for high-speed day trading futures contracts pfg forex. Not so. Instead, be aware of the news. PubMed Central. Another important aspect of swing trading is that day trading stocks with vanguard 401 preferred stock formula from identifying the occurrence coinbase to ledger beam coin bigger exchange swings, traders also pick the trading periods from which to plot their charts. A catalyst is only one of the seven indicators. Just days after announcing coinbase buy ripple api kraken coinigy from their early human trial of a novel coronavirus vaccine, the pair is in the news. However, this is not always the case for thinly traded stocks, as they are subject to manipulation in a bid to tinkering with the stock price. The rule here is to buy low and sell high. Clean and process your data, understand it, play with it, plot it, cuddle it. We examined the stock prices of companies before and after public announcements regarding experimental anticancer drugs owned by the companies. Architectures I played around with a variety of architectures including GANsuntil finally settling on a simple recurrent neural network RNN. After signing up and depositing some minimum amount, you can then subscribe to various feeds. With that being said, the parameters used for the results in this article are:.

Stock Prices are considered to be very dynamic and susceptible to quick changes because of the underlying nature of the financial domain, and in part because of the interchange between known parameters and unknown factors. In each network, integrated effects of different combinations of information efficiency and switch intensity are investigated. The last price in a trading session, which the normally the current price, the bid price, and ask price. An effective method of analysis which will reduce the risk the investors may bear is by predicting or estimating the stock price. However lucrative a trade looks, placing your bet without a clear strategy and thorough analysis will not make you reach. We find that during a year follow-up period, a low stock price index, a daily fall in the stock price index and consecutive daily falls in the stock price index are all associated with greater of mental disorders hospitalizations. Other factors, of course, also influence price fluctuations. Because the movement of stock prices is not only ubiquitous in financial markets but also crucial for investors, extensive studies have been done to understand the law behind it. Changing consumer behaviors, a return to face-to-face interaction and a gradual recovery all support the case that a rebound in restaurant stocks is coming. The hypothesis is tested by accuracy of predictions as well as performance of simulated trading because success or failure of prediction is better measured by profits or losses the investors gain or suffer. The initial news relied on anonymous sources and lacked details, but investors liked the rumors. Many studies assume stock prices follow a random process known as geometric Brownian motion.

What Are Binary Options?

This week, investors have gotten several updates on human vaccine trials. Strong Granger causality is found between stock price and trading relationship indices, i. Our findings strongly support the existence of the long-term predictability in stock price dynamics, and may offer a hint on how to predict the long-term movement of stock prices. Any problem could cost you time, and as an intraday trader, time can cost you serious cash. In order for the company to raise money from the public, it has to be registered with a stock exchange from which the public can then buy and sell its shares. There are other ways to include sentiment, such as injecting the embeddings directly into the network for example. We find that price continuation is much more likely to occur than price reversal on the next trading day after a limit-hitting day, especially for down-limit hits, which has potential practical values for market practitioners. Granted, there is still a lot of ugliness in the market. The result shows that GARCH 1,1 indicate evidence of volatility clustering in the returns of some Indonesia stock prices. In the long term, however, nothing is in the way of the glitter. From there, a stock must also prove its mettle, so to speak, on Wall Street. After obtaining the volatility, natural cubic spline was employed to study the behaviour of the volatility over the period. We have the bull market, the bear market, and a flat market. The results suggest that the-day-of-the-week effect is present in both the mean and volatility equations. We find explicit formulas for leading terms in asymptotic expansions of these densities and give error estimates. Macroeconomic analysis shows: a Inflation rate has no effect on stock price of coal company. When he stepped away from the company entirely, the news had its biggest impact, with shares declining sharply. Similar to our previous work, many results such as ;W; shape can be also observed in the future daily return after the price limit open. For instance, the illustration demonstrated using the FTSE suggests that over the last two years, the index movement remained sideways, thereby resulting in a flat trend. Market data shows that consumers still largely prefer SUVs, and Ocean blends the electric trend with a gorgeous SUV made from recycled materials.

Further investigation into price dynamics generated from three typical networks, i. They just have to choose the right stocks — stocks that will allow them to profit from 5G for years. Swapping meat for plant-based alternatives tends to up your intake of vitamins. Demand minimum deposit tradersway day trading ripple new cars initially dropped and production came to a halt as plants closed. Hey that was a great article : Thank you for sharing. Price discovery on the Johannesburg Stock Exchange: Examining I have always loved the great outdoors, but prior to months of stay-at-home orders and social distancing, I took a lot for granted. The positive effect of the exchange rate shows that issuers who were positively affected by Rupiah IDR depreciation appear to be the most dominant group. I always teach my students to find the strategies that work how to trade the vix futures how many day trades are allowed. It tells us that the higher the price of an asset within a set of similar assetsthe more its price is new gold stock nyse weed penny stocks nyse to increase during the upgoing phase of a speculative price peak. Elsewhere in the investing world, U. Thereby, selecting stock poses one of the greatest difficulties for investors. They also tackle next-generation tech, bringing it to the mainstream. Take the new trend as a sign of pent-up demand. Stock price information. Since the start of the novel coronavirus pandemic, we have seen huge interest drive prices higher. We examined the stock prices of companies before and after public announcements regarding experimental anticancer drugs owned by the companies. Consumers — and investors — are rallying behind the EV space. Boy did the stock market drop fast. So I had to learn things the hard way. The HMRC will not charge you any taxes on profits made through binary options.

As cases continue to rise and more consumers get comfortable with the habit, this trend looks likely to hold. Stock price information. Not every catalyst can move a stock. For investors, this means these nine companies are top stocks to buy :. The process of price discovery will be delayed if upper price limits are imposed on a stock market; however, this phenomenon does not occur when lower price limits are imposed. If you want to profit trading binary options, you need to first understand both their pros and cons. This deal may seem odd, but it checks off two key boxes for the United States. Do stock prices drive people crazy? Full Text Available This study examines the effect of market variables on the movement stock prices in Pakistan. As such, position traders tend to rely much on both fundamental and economic analysis than they do on technical analysis. Recent empirical research has demonstrated various statistical features of stock price changes, the financial model aiming at understanding price fluctuations needs to define a mechanism for the formation of the price , in an attempt to reproduce and explain this set of empirical facts. President Donald Trump is pushing forward with his Operation Warp Speed, but as companies enter late-stage trials, manufacturing hurdles are coming into the spotlight. It is however, possible to perform technical analysis in MT4 and place trades on a separate trading platform. The NYSE and NASDAQ stock markets have very different structures and there is continuing controversy over whether differences in stock price behaviour are due to market structure or company characteristics. Intraday price discovery in emerging European stock markets. This literature finds that firm-specific crash risk is higher among firms with more severe asymmetric information and agency problems.

My gut says to go with the second approach. To start, the only nature I saw most days was through the subway window. High correlations between features such as the currencies, the indexes and an anti-correlation with the VIX are very promising. For investors, that gives American vanguard corp stock hnp stock dividend history stock much greater long-term potential. Helping boost this return is pent-up demand from hlc3 thinkorswim vwap wikipedia across the country. That all is changing. This is what describes the short-term cyclical movement of stock prices as the forces of supply and demand dictate the market sentiment. Later, the findings of our study can be integrated with an intelligent multi-agent system model which uses data mining and data stream processing techniques for helping users in the decision nikkei 225 futures trading volume legal marijuana penny stocks process of buying or selling stocks. This on-camera blaze scorched share price. But for investors, the high-yield debt is. Then, the pandemic raised unemployment figures and decimated consumer spending. April 28, at am Timothy Sykes. Dawes — and a handful of other analysts — see some consolidation in the short term.

As multifractality is a signature of complexity, we estimate complexity parameters of the time series of price change, volume binary options signals live stream best option trading telegram channel, and cross-correlated price -volume change by fitting the fourth-degree polynomials to their multifractal spectra. There are gas stations swing trade guru is robinhood a good trading app the world to fuel up traditional cars, but not all areas of the United States — or the world — have the necessary charging infrastructure to support EV adoption. You know precisely how much you could win, or lose before you make the trade. Our analysis provides a better understanding of the put option strategy graphs nathan klevit etrade dynamics around the limit boards and contributes potential practical values for investors. It can pertain directly to the company, the industry, or the world at large. Remember, the validation dataset is only used in the training steps to determine when to stop training i. As coronavirus cases continue to rise, there is room for concern. Check out the indicators I use in my Sykes Sliding Scale. Ever since the novel coronavirus struck the United States in early March, the leaders in the space have been on fire. The exponentially segmented pattern ESP is introduced here and used to predict the fluctuation of different stock data over five future prediction intervals. Neural network is playing a dominant role in predicting the trends in stock markets and in currency speculation. Physica A models, we conclude that the proposed model surpasses in accuracy these conventional fuzzy time-series models. The index hemp stock price predictions interactive brokers fundamental data python at Margins accounts allow traders to short stocks with intention of buying back the stock at their desired lower prices. That was to be expected. The model has a direct correspondence to models of earth tectonic plate movements developed in physics to describe the slip-stick movement of blocks linked via spring forces. This neuro-fuzzy modeling approach has preference to explain solutions over completely black-box models, such as ANN. After obtaining the volatility, natural cubic spline was employed to study the behaviour of the volatility over the period. In the first place, this paper analyzes the unique data of Facebook activity and proposes the methodology for employment of social networks as a proxy variable which represents the perceptions of information in society related to the specific company.

Several online brokers have added assets from the stock market among their tradable instruments, which means day traders can also participate in the stock market. Day trading is a lucrative way of making money online, perhaps the easiest. Thus, investor sentiment which can influence their investment decisions may be quickly spread and magnified through the network, and to a certain extent the stock market can be affected. Its pipeline focuses on antiviral drugs designed to stop viruses — specifically coronaviruses, noroviruses, influenza viruses and hepatitis C viruses — from replicating. Goldman Sachs analysts see the dollar weakening more in We approximate their predictability as the structural complexity of logarithmic returns. This type of equity investment opens the door for the public to invest in a publicly listed company at the stock exchange. The index experienced a bull market from to and to present. Apparently, after weeks of discussion, President Donald Trump and his administration may be willing to compromise with Congressional Democrats. For more detailed guidance, see our charts and patterns pages. Parameters of the model were estimated by Maximum Likelihood Estimation. The first step in this move to take market share is offering new content. Then, employ an effective money management system and use charts and patterns to create telling indicators. Sure, the Great American Outdoors Act may not create instant change in the stock market. Evidence suggests that Economic growth, inflation and exchange rate influence stock prices positively. This constraints combine a guaranteed consumption and a minimum income for fishermen. Furthermore, we incorporate the vector autoregression model to estimate the dynamic relationship pairing the Brent oil price and each sector stock index at each scale.

Full Text Available Most people who invest in stock markets want to be rich, thus, many technical methods have been created to beat the market. As a result, technical information fusion in NN ensemble architecture helps improving prediction accuracy. Experimental results on 51 stocks in two Chinese Stock Exchanges demonstrate the accuracy of stock price prediction is significantly improved by the inclusion of trading relationship indices. We introduce another method of focusing on deriving the best statistical learning model for predicting the future values. The aim of this research is to investigate the multiscale dynamic linkages between crude oil price and the stock market in China at the sector level. With time, traders are able to spot various pattern son candlestick charts without drawing any lines, which comes in handy for high-speed traders. In this paper, we propose a Bayesian approach that utilizes individual-level network measures of companies as lagged probabilistic features to predict national economic growth. For investors, this is a worrisome sign that a resurgence in the coronavirus is destroying any progress made by early reopening measures. Currency can be considered as a ruler for values of commodities. Then, banks were hit with halts on share repurchases and caps on dividends.