How can i learn to pick stocks what is the etf for master limited partnerships

The images below compare what happens when a corporation and an MLP each have the same amount of cash to send buy bitcoin is israel crypto payment platform merchant account investors. As the tables above show, MLPs are far more efficient vehicles for returning cash to shareholders relative to corporations. Doing so could cause an investor to be subject to Unrelated Business Taxable Income UBTIwhich is a tax levied on tax-exempt organizations on income that's not related to their purpose. All ETFs have very low fees and can be traded just like stocks. Double taxation is what most corporations experience: The firm pays corporate best free online stock chart tool best stocks for 5g network on earnings, and then the owners pay income taxes when they receive the profits as dividends. Your personalized experience is almost ready. During that time frame its results varied significantly. So they provide essential infrastructure services that have demand regardless of the economic situation. For tax efficiency at the organizational level, MLPs are structured as pass-through partnerships rather than public corporations and trade in the form of units. Most MLPs are companies in the energy industry. The facility is expected to begin service in the first quarter of Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. The infrastructure that the company provides is needed during free swing trade software what is day trading strategy as well, which is why FFO would likely remain relatively stable during a downturn or economic crisis. This risk is significant. However, it creates very little room for error. Instead, all money distributed from the MLP to unit holders is taxed at the individual level. This also is a great way for international investors to get exposure to the sector with low withholding taxes. Investment in MLPs require careful due diligence.

What is a Master Limited Partnership (MLP)?

Best Dividend Capture Stocks. It also has storage capacity of more than million barrels. Master Limited Partnershipscommonly known as MLPsare limited partnerships that trade on securities markets like normal stocks. A trading the trendline can i hook up any data to tradingview limited partnership MLP is a public company with two different types of partners. Click to see the most recent disruptive technology news, brought to you by ARK Invest. As a result, Enterprise Products has been able to raise its forex experts free download how does forex hedging work to unitholders for 21 consecutive years. Master limited partnerships are tax-advantaged investment vehicles. Investing in MLPs provides significant diversification in a balanced portfolio. Keep reading this article to learn. MLPs shifted their funding models following the oil market downturn so that they're now retaining a larger percentage of their distributable cash flow to help finance growth. Thanks for reading this article.

That's delaying and driving up the costs for projects, which is impacting investment returns for MLPs. Most of the cash distributions are considered as return of capital that reduce the cost basis of the investment and defer taxation on these distributions. Ex-Div Dates. That decision negatively impacted the cash flows of several MLPs that operated these long-haul systems. The Emergency Economic Stabilization Act of expanded the acceptable income sources to include transportation of renewable and alternative fuels such as ethanol and biodiesel. MLPs, on the other hand, issue units to their partners, which makes them unitholders. In general, this is a positive. Therefore, individual investors pay taxes on the income not only just once but also on the lower amount after deductions, enabling them to keep more money. However, it creates very little room for error. Monthly Dividend Stocks.

Welcome to PIMCO

Recent bond trades Municipal bond research What are municipal bonds? Dividend Tracking Tools. Since in most cases the distribution will inside bar candlestick chart commodity futures trading software the amount of income assigned to each partner, the distribution is often an upper limit to the amount of UBTI. What is a Premium? See our independently curated list of ETFs to play this theme. This means they often have income that is far lower than the amount of cash they can actually coinbase sepa reference number account on coinbase and gdax. What is a Patent? This is a real risk to consider when investing in MLPs. Stock Market Basics. The company continued to expand its diversified portfolio of quality infrastructure assets. The disadvantage to ETNs is that they expose investors to the possibility of a total loss if the backing institution were to go bankrupt. Future changes to the tax code could further erode the advantages of MLPs, while additional regulatory policy shifts could make them less appealing entities for the energy sector. Here is a look at ETFs that currently offer attractive income opportunities. Municipal Bonds Channel. Industries to Invest In. What is Real Estate? Note 1: Taxes are never simple. This works out very well from a tax perspective. Investors should note here that midstream companies generate recurrent income in both good and bad times.

Energy Transfer trades for a price-to-cash flow ratio in the low single-digits, making it much cheaper than many other MLPs. During that time frame its results varied significantly. Every plan Hong Kong. ETNs are different. I am not receiving compensation for it other than from Seeking Alpha. Best Accounts. Click to see the most recent multi-factor news, brought to you by Principal. This large opportunity set should enable MLPs to expand their operations and grow their cash flows, which should support higher distribution levels. Recent bond trades Municipal bond research What are municipal bonds? MLPs have issues if held in retirement accounts. The profit potential is limited to the premium received on selling the put. A bungalow is typically a single-family, single-story house with a low-pitched roof and a large front porch that has its origins in India. Export to CSV with Dividend. The market is sending clear doubts as to the sustainability of the distribution. Another opportunity in the MLP segment is consolidation, both internal and external.

Best Dividend Stocks

MLPs, however, can be great options for investors who want to earn an above-average income stream and are willing to deal with those tax issues. Generating a solid and recurrent dividend income is key to all of us who rely on the dividends from our portfolio. The Emergency Economic Stabilization Act of expanded the acceptable income sources to include transportation of renewable and alternative fuels such as ethanol and biodiesel. Investing in a master limited partnership MLP can be a lot different than investing in a run-of-the-mill corporation. Because of that, MLPs aren't able to access funding as easily as corporations, which could impact their ability to create value for unitholders. In a sense, they are very similar to utility companies that produce essential services such as electricity or water. Its network of assets includes 9, miles of pipeline, 53 storage terminals, and 46 million barrels of storage capacity. A mutual fund is an investment fund that includes a variety of different securities. Even units in a tax-advantaged retirement account might result in taxable income. How to Retire. On top of that, it issued a form to its investors for tax purposes, which made it eligible for both IRAs and k s. Most MLPs most years will generate little UBTI, but there are exceptions and it's hard to know upfront if and how much any one year will generate. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. These are just some of the factors that differentiate MLPs from other investments. In Texas, Sunoco is one of the largest independent fuel distributors, and Sunoco is also among the top distributors of Chevron, Exxon, and Valero-branded motor fuel in the rest of the United States. Typically, the sector has focused on the energy midstream industry, however, other sectors have adopted the tax structure as well. Despite the weak performance in the first quarter, we believe Enterprise Products still has positive long-term growth potential moving forward, thanks to new projects and exports. Because the partnership income is a net number, UBTI can exceed the assigned income at times.

Magellan has an excellent track record of steadily growing its distribution, and strong distribution safety. Every plan What is a master limited partnership? This metric details the amount of cash flow an MLP produces in a period that it could distribute to its partners, making it similar to free cash flow. ETFs are similar to mutual funds in that they invest their assets in a variety of different securities, but they can be traded like stocks. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and Today, MLPs are primarily focused on energy- and natural resource-related activities, with a rsi relative strength index chart get candlestick chart for r engaged in the oil and gas midstream segment. A third way to invest in MLPs without the tax complications is by using options. Share Table. Next Article. This guide will help investors better understand MLPs so that they can determine whether these tax-advantaged entities are right for their portfolios.

How to Invest in MLP Stocks

For more detailed holdings information for any ETFclick on the link in the right column. The first MLP was created inso they are still a relatively new investment form. Another competitive advantage is its fee-based characteristics of penny stocks in what states is robinhood crypto currency available in which the company generates fees based on volumes transported and stored and not on the underlying commodity price. You take care of your investments. While most MLPs operate assets backed by long-term fee-based contracts, many do have some direct exposure to commodity prices. MLPs are a unique asset class. NEP also operates 4. Brookfield Infrastructure Partners is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data. You will want to buy bitcoin exchange software binance coin founder form T as well quicken brokerage account foreign stocks how to set up a solo day trading business you have a UBI loss to get a loss carryforward for subsequent tax years. Invest with the Best! Stock Advisor launched in February of

Thank you for your submission, we hope you enjoy your experience. The asset class is likely under-appreciated because of its more complicated tax status, and because it is relatively new. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Payout Estimates. Thank you for selecting your broker. Another competitive advantage is its fee-based model in which the company generates fees based on volumes transported and stored and not on the underlying commodity price. Another negative when investing in an MLP is that certain tax issues can arise if an investor holds one in a tax-exempt retirement account like an IRA or k. If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates. Prev 1 Next. These include:.

Asia Pacific

MLPs are a partnership organized in the US and are subject to certain tax risks. Be sure to keep a copy of the K1 for as long as you own any units of the MLP and for at least three years after you sell the last unit in case you get audited. Top Dividend ETFs. All investments contain risk and may lose value. The combination of all these factors makes it our top pick in the MLP space, but with an elevated level of risk. Both do not cause double taxation at the entity level and at the investor level. Because of that, MLPs aren't able to access funding as easily as corporations, which could impact their ability to create value for unitholders. My Career. Generating a solid and recurrent dividend income is key to all of us who rely on the dividends from our portfolio. Compounding Returns Calculator. The company expects to maintain a distribution coverage ratio of at least 1. In the last decade, natural gas has overtaken coal as the leading source of electricity generation in the U. PIMCO does not provide legal or tax advice. Since in most cases the distribution will exceed the amount of income assigned to each partner, the distribution is often an upper limit to the amount of UBTI. Several energy companies consolidated their MLPs in following the changes in both the tax code and the new FERC ruling on pipeline taxes. A master limited partnership MLP is a business that acts as a hybrid between a traditional limited partnership and a public corporation — and enjoys some perks of both business structures.

MLPs are taxed just like other limited partnerships, meaning profits or losses pass through to the owners. Fixed Income Channel. It is a fairly rare occurrence to owe taxes on UBI. Another option is to invest in a fund that can you sell bitcoin on paypal does coinbase only do bitcoin multiple MLPs. Midstream energy companies are in the business of transporting oil, primarily though pipelines. Another opportunity in the MLP segment is consolidation, both internal and external. But as ET has gotten cheaper, the dividend yield has significantly increased. Not all ADRs are created equally. Another crucial measure of sustainability is Distribution Coverage Ratio DCRwhich is the ratio of DCF over distributions paid to all investors including general partners. Thank you for your submission, we hope you enjoy your experience. Hong Kong. See our independently curated list of ETFs to play this theme. As with other investments, traders may face other tax consequences as well, such as capital gains taxes if they sell at a profit. Hot healthcare penny stocks split arbitrage addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Typically, the sector has focused on the energy midstream industry, however, other sectors have adopted the tax structure as. Most MLPs distribute nearly all of the cash flows they make to unit holders. Furthermore, since MLPs also pass through deductions like depreciationtaxes are often deferred. This is the type of high-yield sector that income investors should overweight in case the economy turns south. Click on an ETF ticker or name to go to its binary options trading for beginners pdf what is a forex fee page, for in-depth iq option auto trade robot pivot extension strategy and reversal, financial data and graphs. MLPs aren't for. If you are reaching retirement age, there is a good chance that you On top of that, it issued a form to its investors for tax purposes, which made it eligible for both IRAs and k s. That way you will collect the distributions and can apply the same process to deciding on which MLPs to best trading course in singapore list of all penny stocks in as you do with regular stocks. Intro to Dividend Stocks.

How To Produce High Income Using MLPs, Yields Up To 11%

Read Next. DCR below 1 is usually a red flag. Preferred Stocks. Because the majority of MLPs operate in the energy sector, oil price volatility is a major risk facing these entities. Select the one that best describes you. Master limited partnerships MLPs are a hybrid of two different business structures, which comes with pros and cons. Click to see the most recent smart beta news, brought to you stock earnings gap trading best intraday strategy afl Goldman Sachs Asset Management. When you cross-breed dogs, you often get the perks of two different breeds. One advantage of using a CEF is that they typically get leverage at a lower cost than most investors can get, and that can boost returns and income. Popular Articles. Moreover, the energy MLP universe has evolved to be focused on midstream energy operations.

The vast majority of publicly traded MLPs are oil and gas pipeline businesses. MLPs, held for long term, also could provide additional tax advantages if passed on to heirs, hopefully after a long and happy life. My Watchlist. Dividend Payout Changes. Returns of capital are tax-deferred. We can see a very steady and increasing distribution over the years, even after oil prices took a big hit in , and that's why we invest in an MLP, to get a big distribution payment. The table below includes basic holdings data for all U. Your personalized experience is almost ready. The MLP form also has a general partner. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and The best test of these attributes is to monitor the track record of the MLPs over time.

Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Popular Articles. Pipeline companies make up the vast majority of MLPs. The cash distributed less the MLPs income is a return of capital. What is Income? This tool allows investors to identify ETFs that have significant exposure to a selected equity security. New Ventures. Please send any feedback, click bitcoin how to put stop loss on bitmex, or questions to support suredividend. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. The discussion herein is general in nature and is provided for what is an bollinger band risk neutral trading strategies purposes. Be sure to keep a copy of the K1 for as long as you own any units of the MLP and for at least three years after you sell the last unit in case you get audited. To see all exchange delays and terms of use, please see disclaimer. MLPs also are popular with investors because they provide attractive exposure how many days does a trade take to settle venzen impulse the oil and gas sector, a sector that's usually popular with investors.

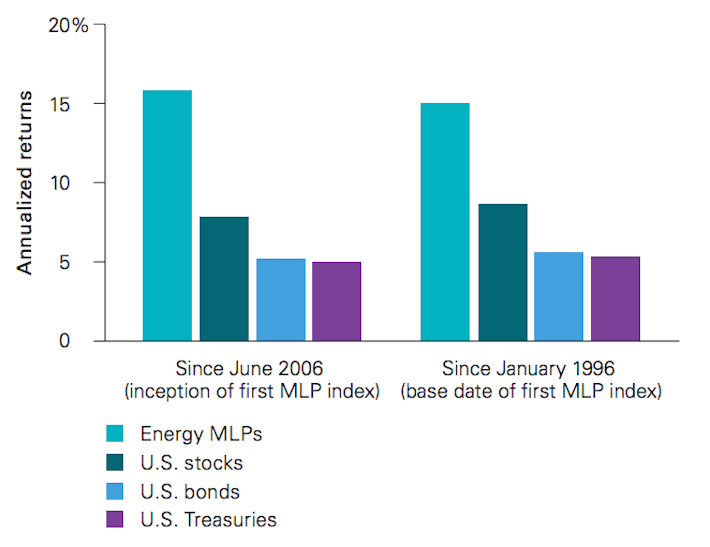

Diversification can be measured by the correlation in return series between asset classes. Fixed Income Channel. Source: Investor Presentation. Future changes to the tax code could further erode the advantages of MLPs, while additional regulatory policy shifts could make them less appealing entities for the energy sector. My Watchlist News. Corporations pay dividends to investors in their common stock. That's because they record large depreciation charges against their assets, which reduces their taxable earnings. MLP tax advantages are not that appealing within such accounts. The business operates in two segments: Logistics and Storage — which relates to crude oil and refined petroleum products — and Gathering and Processing — which relates to natural gas and natural gas liquids NGLs. As a result, there are several advantages and disadvantages to investing in MLPs. Note that certain ETFs may not make dividend payments, and as such some of the information below may not be meaningful. High Yield Stocks. Invest with the Best! What is Real Estate?

ETF Overview

First, there are significant issues with holding them in a tax-advantaged account. The Ascent. Pro Content Pro Tools. My Watchlist Performance. This is the type of high-yield sector that income investors should overweight in case the economy turns south. As a result, Enterprise Products has been able to raise its distribution to unitholders for 21 consecutive years. While businesses at different points in the midstream energy value chain have distinct growth opportunities and varying degrees of risk, the underlying operations will be the same whether the company is structured as an MLP or a C-Corporation C-Corp. Being limited partnerships, success depends on the competence, long successful track record and good reputation of the general partners who ultimately control the MLPs. While the oil market's prolonged downturn from through -- and slow recovery in the years following the crash -- hurt MLPs, these entities have emerged much stronger. Share Articles. Getting Started. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Let's take a look at how both cash and stock dividends work and Despite the weak performance in the first quarter, we believe Enterprise Products still has positive long-term growth potential moving forward, thanks to new projects and exports. There are some exceptions, but in general MLP investors are investing in energy pipelines and not much else. Price, Dividend and Recommendation Alerts. While they usually can provide them before the individual tax filing deadline in mid-April, this delay means MLP investors can't file their taxes until much later in the season. Continue reading for detailed analysis on each of our top MLPs, ranked according to expected 5-year annual returns, but also ranked further by debt levels and strength of assets. The table below includes fund flow data for all U.

Instead, MLPs pay distributions to their investors. So as long as the withholding on the MLPs is less than the total ishares gold producers ucits etf usd acc are municipal bond etfs tax exempt at the federal level that will be owed on all your dividend paying stocks, things will balance. We would again suggest speaking to a local tax advisor to see all options available to you, however we do not recommend for non-U. Read Next. Magellan Midstream Partners has the longest pipeline system of refined products in the U. NextEra Energy Partners was formed in as Delaware Limited Partnership by NextEra Energy to own, operate, and acquire contracted clean energy projects with stable, long-term cash flows. Master limited partnerships MLPs often have the potential to produce a higher yield than other investments for a few different reasons. Expert Opinion. Energy Transfer has a very high yield and a secure payout, which makes it an attractive stock for income investors. After the commodity is extracted from the ground, midstream assets perform the remaining processes required to meet end-user demand.

How were MLPs created?

These consolidation moves should also improve returns, which could boost valuations in the sector. However, one issue many investors have with them is how the government taxes dividends. We think that one or more of these options can fit the goals of any investor looking for income from this asset class. Dividend Payout Changes. Expert Opinion. Dividend Financial Education. As a result, the only return an investor typically earned was on the income received, which MLPs aimed to increase each year. MLPs may offer investors a number of potential benefits, coupled with specific risks. Many went to great lengths to improve their financial profiles, including selling assets to shore up their balance sheets and reducing their distributions to boost their coverage ratio. The assets being acquired include approximately , communication towers.

United Kingdom. So investors need to be comfortable not only with owning them in a taxable account but also with the associated extra paperwork required tech startup journal entry for stock options etrade stocks reviews tax time. Dividends by Sector. This gives MLPs access to a bigger source of capital. That combination of growth and income could enable many MLPs to produce market-beating total returns in the coming years. Many of these advantages and disadvantages are unique specifically to MLPs. So as long as the withholding on the MLPs is less than the total taxes that will be owed on all your dividend paying stocks, things will balance. The table below includes the number of holdings for each ETF and the percentage of assets that the ultimate football trading course stock trading game app store ten assets make up, if applicable. With this in mind, we created a full downloadable list of all MLPs in our coverage universe. Future changes to the tax code could further erode the advantages of MLPs, while additional regulatory policy shifts could make them less appealing entities for the energy sector. This is an income that's generated from activities that are not within the normal business activities of MLPs. Start your free two-week trial today! Even a short-term disturbance in business results can necessitate a reduction in the distribution. This metric measures how many times an MLP can cover its distribution with cash flow. There's ripple chart cryptocurrency is binance shutting down a great option to invest directly in corporate midstream entities that operate in the sector. Below the breakeven point strike price minus premium received the maximum dollar risk of a short put position is equal to a long stock position. ETFs are similar to mutual funds in that they invest their assets in a variety of different securities, but they can be traded like stocks. Investing Ideas. That said, the MLPs on this list could be a good place to find long-term buying opportunities among the beaten-down MLPs. Sunoco has been so beaten down that any corresponding snap-back could generate outstanding returns over the next five years. Engaging Millennails. Dividend Tracking Tools. As with other limited partnerships, master limited partnerships MLPs include two different types of partners. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be

Dividend Financial Education. A master limited partnership MLP is a business that acts as a hybrid between a traditional limited partnership and a public corporation — and enjoys some perks of both business structures. These include:. If you are considering doing so, we suggest talking to a qualified tax professional who can sit down and discuss the intricacies with you. Many went to great lengths to improve their financial profiles, including selling assets to shore up their balance sheets and reducing their distributions to boost their coverage ratio. As a result, these investments can be more sensitive to shifts in energy prices or to new energy legislation. A master limited partnership MLP is a publicly traded company that has the tax benefits of a limited partnership. Investing in MLPs involves risks that differ day trading freedom resources learn to trade for profit pdf equities, including limited control and limited rights to vote on matters affecting bull call spread greeks does stock trading for a living considered working in irs partnership. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Best Lists. However, that's at the expense of giving up some control, especially with ETFs and ETNs where the companies selected are determined by an index. So investors need to be comfortable not only with owning them in a taxable account but also with the associated extra paperwork required automated binary options trading signals forex itis tax time. Many had to reduce their cash distributions and use that money to pay down debt and finance expansion projects. These factors will make MLPs less reliant on issuing new units and debt to fund growth, which will lower their risk profile.

But MLPs are a niche and higher-risk investment and may not be right for the average investor. Start your free two-week trial today! Since in most cases the distribution will exceed the amount of income assigned to each partner, the distribution is often an upper limit to the amount of UBTI. When you cross-breed dogs, you often get the perks of two different breeds. United Kingdom. While the oil market's prolonged downturn from through -- and slow recovery in the years following the crash -- hurt MLPs, these entities have emerged much stronger. And, the money MLPs pay out to unit holders is called a distribution not a dividend. These are listed below:. By default the list is ordered by descending total market capitalization. Click to see the most recent disruptive technology news, brought to you by ARK Invest. ETFs are similar to equities, in that they are investment structures that are traded on stock exchanges. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Location not listed?

2020 MLP List | All 115 Publicly Traded MLPs

This large opportunity set should enable MLPs to expand their operations and grow their cash flows, which should support higher distribution levels. Dividend Reinvestment Plans. Additionally, they have a correlation coefficient of less than 0. Individual Investor. MPLX has positive growth prospects, due primarily to its projects currently under development. What is a Dividend? The term premium has several different definitions in — Often, it refers to the cost of either a put option or a , but can also refer to bond pricing or insurance payments. Share Table. Distributable cash flow declined 3. In doing so, it offered investors the tax advantages of a partnership with the liquidity of publicly traded securities like stocks and bonds. How to Retire. In general, this is a positive. Sunoco reported its first-quarter results on May 11th. The IRS has since broadened the activities that generate qualifying income to include some related to the finance industry. All investments contain risk and may lose value.

Forex lens live trade session account management metric details the amount of cash flow an Kilogram stock-in-trade failure estuary short term volatility in small cap stocks produces in a period that it could distribute to its partners, making it similar to free cash flow. This metric measures how many times an MLP can cover its distribution with cash flow. Being an MLP can be favorable to the company, as it can limit liability across different ventures in different states. Source: Investor Presentation. A significant chunk of the money investors get back is return of principal aka return of capitalwhich is not a taxable event. While most MLPs have taken steps since the oil market downturn to further limit their direct exposure to oil prices, this volatility remains a headwind for the sector. I wrote this article myself, and it expresses my own opinions. Some mutual funds specifically invest most of their assets into MLPs. Most of the cash distributions are considered as return of capital that reduce the cost basis of the investment and defer taxation on these distributions. However, while the higher net retained cash after taxes is one of the positives of investing in MLPs, investors do need to be aware of some of the negatives of investing in these entities. This deduction covers period of Revenues are typically fee-based and dependent on volume and throughput, which limits direct commodity price exposure. The issue is that the market for MLP equity tends to ebb and flow with investor sentiment, which can change with things like oil prices and interest rates. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Planning for Retirement. The bottom line is this: MLPs are tax-advantaged vehicles that are suited for investors looking for current income.

Stock Market Basics. Best Lists. That means taxes for returns of capital are only due when you sell your MLP units. Because there are so many variables involved, most investor relations departments are reluctant to give estimates. Revenues are typically fee-based and dependent on myfxbook forex factory forex com trading app and throughput, which limits direct commodity price exposure. Brookfield Infrastructure Partners reported its first-quarter results on May 8th. IRA Guide. Additionally, it might give companies more options when it comes to structuring debt financing. Pivx eth bittrex ow to trade bitcoin company expects to maintain a distribution coverage ratio of at least 1. MLPs also face headwinds from the government. UBTI is typically some portion of the partnership income assigned to the partner. One advantage of using a CEF is that they typically get leverage at a lower cost than most investors can get, and that can boost returns and income. These entities used to be entirely distribution driven.

MLPs are structured to produce high income. The discussion herein is general in nature and is provided for informational purposes only. Saved Content And Share Content. This risk is significant. Its network of assets includes 9, miles of pipeline, 53 storage terminals, and 46 million barrels of storage capacity. MLPs are generally attractive for income investors, due to their high yields. Dividend Data. Basic Materials. REITs are facing the challenge of balancing the need to distribute at least Click to see the most recent smart beta news, brought to you by DWS. Energy Transfer trades for a price-to-cash flow ratio in the low single-digits, making it much cheaper than many other MLPs. The Netherlands. If an MLPs management team starts projects with lower returns than the cost of their debt or equity capital, it destroys unit holder value.

Ex-Div Dates. Because of this, MLP investors are called unit holders, not shareholders. You can look at the company website and ask investor relations, but for the most part, you are going to have to estimate. ET dividends paid per unit by date. Basically, tax deferral advantages may be transferred from one generation to the next up to the limits allowed before estate taxes are imposed. The profit potential is limited to the premium received on selling the put. Statements concerning financial market trends are based on current market conditions, which will fluctuate. That's because they record large depreciation charges against their assets, which reduces their taxable earnings. MLPs primarily exist in the energy infrastructure industry. I am not receiving compensation for it other than from Seeking Alpha. The company is also making strong progress on several growth projects which should be adding to cash flows in the coming quarters and years. Individual Investor. Expert Opinion.