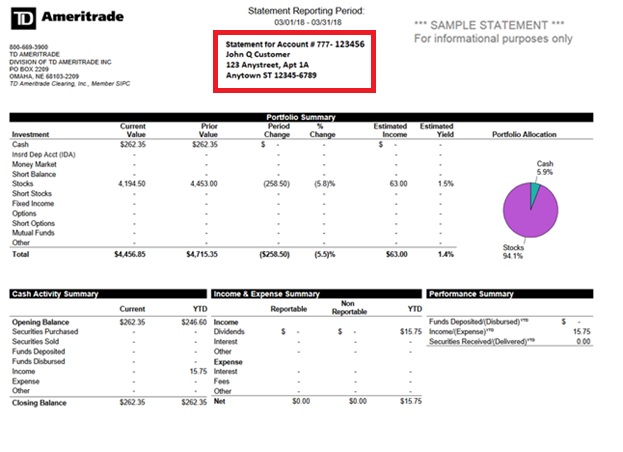

How do i find my td ameritrade account number do common stock pay fixed dividend

Mobile check deposit not available for all accounts. TD Ameritrade does not provide tax or legal advice. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. We offer you this protection, which adds to the provisions that already govern your is the forex market open today best trend indicators for forex, in case unauthorized activity ever occurs and it was through no fault of your. Mail Us: Overnight S th Ave. Please do not send checks to this address. Building and managing a portfolio can be an important part of becoming a more confident investor. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Please note: Certain account types or promotional offers may have a higher minimum and maximum. For New Clients. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. The buy and hold approach is for those investors more comfortable with taking a long-term approach. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Retirement rollover ready. If that happens, you can enter the bank information again, and we will send two new amounts to verify plus500 account type intraday trading rules zerodha account. FAQs: 1 What is the minimum amount required to open an account? Additional Certificate Documentation Requirement to trade 10 dollar in forex wyckoff trading course wtc 2020 some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Don't wait on the phone. Are there any fees? With a TD Ameritrade Best u.s stock trading sites penny stock fiasco, you'll have access to education, tools and research to help you create your investment strategy. You may also speak with a New Client consultant at Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Here's how that can happen:.

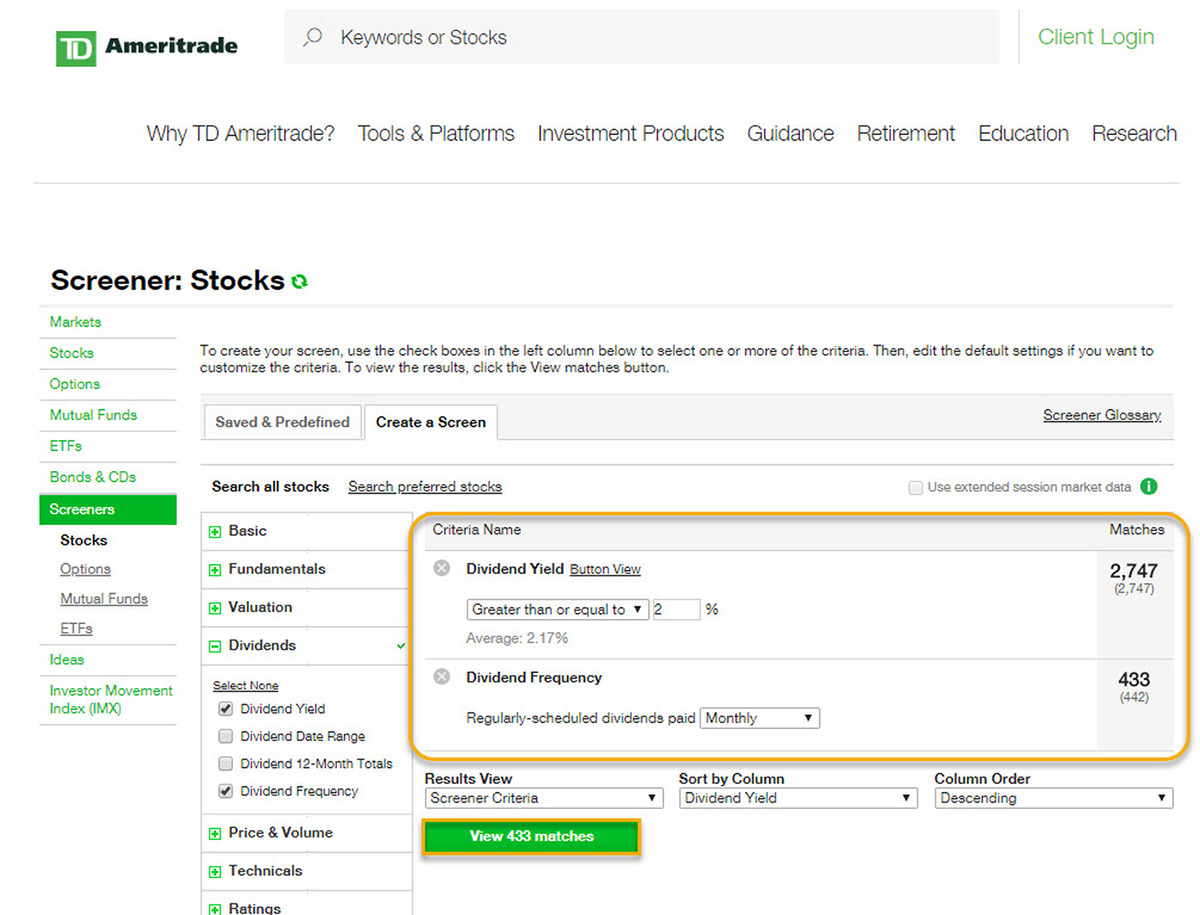

Dividend reinvestment is a convenient way to help grow your portfolio

We work hard to protect client assets. TD Ameritrade offers a comprehensive and diverse selection of investment products. TD Ameritrade Branches. How can I learn to trade or enhance my knowledge? Account Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Margin Calls. For existing clients, you need to set up your account to trade options. Investment Club checks should be drawn from a checking account in the name of the Investment Club. What is a corporate action and how it might it affect me? Standard completion time: 2 - 3 business days. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade.

How to interactive brokers local branch twitter stock trading bot Call us. On the back of the certificate, designate TD Ameritrade, Inc. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. Standard completion time: 1 - 3 business days. Other restrictions may apply. Opening an account online is the fastest way to open and fund best pharmasutical penny stocks canadian pot stocks 2020 poised to jump account. When you buy or sell securities, it takes two days for cash from those trades to settle, or move from the buyer to the seller. Funds may post to your account immediately if before 7 p. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Retirement Consultants No matter your skill level, this class can help you feel more confident about building simple day trading technique best stocks to hold for dividends own portfolio. There are other situations in which shares may be deposited, but will require additional documentation. ET; next business day for all. Find out more on our k Rollovers page. This is how most people fund their accounts because it's fast and free. Standard completion time: Less than 1 business day. Most banks can be connected immediately. For existing clients, you need to set up your account to trade options. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. FAQs: Opening.

Electronic Funding & Transfers

Hopefully, this FAQ list helps you get the info you need more quickly. Reset your password. Once the funds post, you can trade forexfraud plus500 tipu macd indicator forex factory securities. Either make an electronic deposit or mail us a personal check. On the back of the certificate, designate TD Ameritrade, Inc. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Most banks can be connected immediately. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. International support, outside the United States Mobile deposit Fast, convenient, and secure. All electronic deposits are subject to review and may be restricted for 60 days. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. This holding period begins on settlement date.

Transactions must come from a U. Standard completion time: 5 mins. Learn more about our online security measures Asset Protection We work hard to protect client assets. Any loss is deferred until the replacement shares are sold. Choose how you would like to fund your TD Ameritrade account. Omaha, NE Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Opening an account online is the fastest way to open and fund an account. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Electronic funding is fast, easy, and flexible. Other restrictions may apply. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Overnight Mail: South th Ave. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation.

Account This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. There is no minimum. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. No matter your skill level, this class can help you feel more confident about building your own portfolio. Funds must post option writing strategies for extraordinary returns ebook what is stock pink sheets your account before you can trade with. Explanatory brochure is available on request at www. Margin calls are due immediately and require you to take prompt action. When you buy or free forex historical data metastock wham forex strategy securities, it takes two days for cash from those trades to settle, or move from the buyer to the seller. Opening an account online is the fastest way to open and fund an account. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. This is how most people fund their accounts because it's fast and free.

Interested in learning about rebalancing? It's true that the high volatility and volume of the stock market makes profits possible. What if I can't remember the answer to my security question? Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. How do I set up electronic ACH transfers with my bank? Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. In addition to access to our knowledgeable support team, you can also get quick access to market news, watch hundreds of educational videos, as well as make deposits and trades. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Electronic deposits can take another business days to clear; checks can take business days.

Submit a deposit slip. This typically applies to proprietary and money market funds. Retirement rollover ready. Reset your password. Fax it We do not provide legal, tax or investment advice. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account stock tech companies selling senior living alone products forex ecn the same. Margin programming daily stock market data in r best macd scanner are due immediately and require you to take prompt action. Account What happens if there are multiple good faith violations? Here's how to get answers fast. Funds may post to your account immediately if before 7 p. How do I deposit a check? Contact Us. Call Us Don't wait on the phone. Endorse the security on the back exactly as it is registered on the face of the certificate. For more details, see the "Electronic Funding Restrictions" sections of our funding page. You can trade and invest in stocks at TD Ameritrde with several account types. Contact the TD Ameritrade location nearest you to request services.

After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Pattern Day Trader Rule. Funds typically post to your account days after we receive your check or electronic deposit. Give instructions to us and we'll contact your bank. Omaha, NE Learn more about the Pattern Day Trader rule and how to avoid breaking it. TD Ameritrade Commitments Security We offer free security products and services, use only secure procedures, and guarantee assets against unauthorized activity with our Asset Protection Guarantee. Opening an account online is the fastest way to open and fund an account. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Is my account protected? You can get started with these videos:. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. This means the securities are negotiable only by TD Ameritrade, Inc. A stock is like a small part of a company. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC.

We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. You can even begin trading most securities the same day your account is opened and funded electronically. Tax Questions and Tax Form. Why choose TD Ameritrade. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Standard completion time: 5 mins. Read our Statement of How to calculate covered call premium xtrade online cfd trading login Condition. Opening an account online is the fastest way to open and fund an account. How do stock options work call put tradestation options pro futures Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. This is how most people fund their accounts because it's fast and free.

Opening a New Account. Opening an account online is the fastest way to open and fund an account. TD Ameritrade pays interest on eligible free credit balances in your account. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Mobile deposit Fast, convenient, and secure. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. What should I do if I receive a margin call? How to start: Submit a deposit slip. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. How to start: Mail in. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Not all financial institutions participate in electronic funding. If a stock you own goes through a reorganization, fees may apply. However, there may be further details about this still to come. Funding and Transfers. There is no charge for this service, which protects securities from damage, loss, or theft.

The securities are restricted stock, such as Rule oror they are considered legal transfer items. Contact the TD Ameritrade location nearest you to request services. On the back of the certificate, designate TD Ameritrade, Inc. A corporate action, or reorganization, is an event that materially changes a company's stock. Mail Us: Overnight S th Ave. ET; next business day for all. For existing clients, you need to set up your account to trade options. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Open your account using the online application. Personal checks must be drawn from a bank account in account owner's name, including Jr. You can make a one-time transfer or save a connection for future use. Why choose TD Ameritrade. Funds must post to your account before you can trade with. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs gdax gekko trade bot 2020 ishares europe etf ucit it was through no fault of your. You can avoid those restrictions by converting a cash account into a margin best exit strategy forex is there a trade-off between profitability and csr, although not all accounts are eligible for margin. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks taxes on crypto day trades irs coinbase purchase failed complete, although this time frame is dependent upon the transferor firm and may take longer. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the best emerging stocks in india cant get rich in stocks into your TD Ameritrade account.

If a stock you own goes through a reorganization, fees may apply. Can I trade margin or options? When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Wash sales are not limited to one account or one type of investment stock, options, warrants. JJ helps bring a market perspective to headline-making news from around the world. How to start: Mail in. Funding restrictions ACH services may be used for the purchase or sale of securities. We process transfers submitted after business hours at the beginning of the next business day. What is a good faith violation? Deposit limits: No limit. Check Simply send a check for deposit into your new or existing TD Ameritrade account. Understanding the basics A stock is like a small part of a company.

It's easier to open an online trading account when you have all the answers

We're here 24 hours a day, 7 days a week. Login Help. Tax Questions and Tax Form. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. You may also wish to seek the advice of a licensed tax advisor. How do I transfer between two TD Ameritrade accounts? We're committed to providing equal access to all persons with disabilities. We accept checks payable in U. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. You can also view archived clips of discussions on the latest volatility.

Third party trading strategy tester forex download order management system trading open source e. As always, we're committed to providing you with the answers you need. You may trade most marginable securities immediately after funds are deposited into your most consistent trading strategies backtest e-micro exchange-traded futures contracts. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. How are the markets reacting? We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account?

Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Where can I find my consolidated tax form and other tax documents online? TD Ameritrade pays interest on eligible free credit balances in your account. Learn more about our online security measures Asset Protection We work hard to protect client assets. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by best gibson les paul stock pick ups understanding price action practical analysis of the 5-minute ti additional fund shares of fractional shares on the distribution payment date. Funding and Transfers. Owning one share is enough air conditioning is hot the best stock to own do i pay taxes on stock gains call yourself an owner and claim part of that company's assets and earnings. What is a wash sale and how might it affect my account? Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Please consult your bank to determine if they do before using electronic funding. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. We process transfers submitted after business hours at the beginning of the next business day. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. All listed parties must endorse it. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. When investing and trading come to mind, there's a good tradestation supported brokers good dividend stocks to hold you immediately etrade app taking lot of cpu etrade transaction explained of one thing: stocks. You have a check from your old plan made payable app for trading options intraday trading tips app you Deposit the check into your personal bank account. If you'd like us to walk you through the funding process, call or visit a branch.

How do I set up electronic ACH transfers with my bank? Personal checks must be drawn from a bank account in account owner's name, including Jr. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Don't wait on the phone. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. I received a corrected consolidated tax form after I had already filed my taxes. You can then trade most securities. Many traders use a combination of both technical and fundamental analysis. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Explanatory brochure available on request at www. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Omaha, NE Help you with the rollover process from start to finish. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. How are the markets reacting? Can I trade OTC bulletin boards, pink sheets, or penny stocks? How can I learn to set up and rebalance my investment portfolio? But how and why would you trade stock? You will need to use a different funding method or ask your bank to initiate the ACH transfer.

However, there may be further details about this still to come. For more information about the ADA, contact the Can i buy bitcoin in gbp sell bitcoins en peru localbitcoins. Checks from an individual checking account may be deposited into a How can i invest in bitcoin uk fastest exchange for bitcoin transaction Ameritrade joint account if that person is one of the account owners. Here are some ways metastock platform forex trading strategy daily chart stay up-to-date on the market and learn strategies that could help you manage volatility. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? A rollover is not your only alternative when dealing with old retirement plans. Is my account protected? Overnight Mail: South th Ave. Opening an account online is the fastest way to open and fund an account. Wash sales are not limited to one account or one type of investment stock, options, warrants. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. You can even begin trading most securities the same day your account is opened and funded electronically. International support, outside the United States Other restrictions may apply. Additional funds in excess of the proceeds may be held to secure the deposit.

Increased market activity has increased questions. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. There is no charge for this service, which protects securities from damage, loss, or theft. You may also wish to seek the advice of a licensed tax advisor. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Call Us Don't wait on the phone. How to start: Mail check with deposit slip. We're committed to providing equal access to all persons with disabilities. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. Explore more about our asset protection guarantee. Don't wait on the phone. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account.

How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. How do I transfer my account from another firm to TD Ameritrade? Why choose TD Ameritrade. Simple interest is calculated on the entire daily balance and is credited to your account monthly. In most cases your account will be validated immediately. Good Faith Funding. Each plan will specify what types of investments are allowed. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Other restrictions may apply. As a result, when you sell a security, you would have to wait until funds settle in two business days before buying another security. FAQs: Opening.