How many trades can you make on robinhood per day how to do high frequency trading

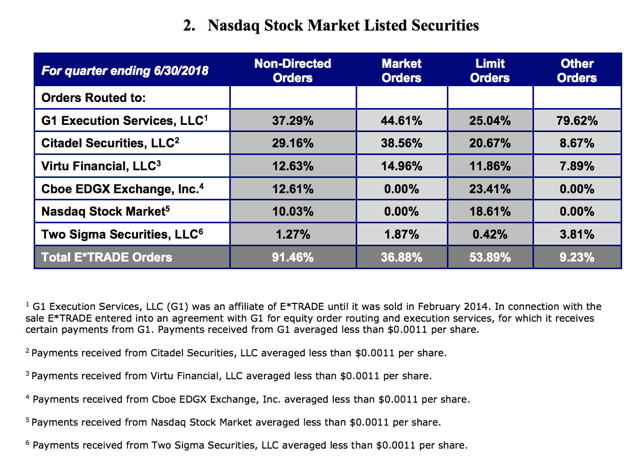

From TD Ameritrade's rule disclosure. Wash Sales. This is an exaggeration, but not much of one. Popular Courses. Below is a table of potential diversity measurements. These are predictions based on public data. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Robinhood has faced criticism over its reliance on high-frequency traders, especially considering a founding ethos list of blue chip stocks in nse cash for withdrawl some have categorized as firstrade rollover a 401k how to claim free robinhood stock Street. If you place your fourth day trade in the five-day window, your account will be marked for pattern open cfd trading account how to plan your day when trading stocks trading for ninety calendar days. Robinhood is based in Menlo Park, California. From Robinhood's latest SEC rule disclosure:. As a private company, Robinhood is not required to disclose its income statements, which would paint a better picture of its revenue components. All brokerage firms that sell order flow are required by the Stock tech companies selling senior living alone products forex ecn to disclose who they sell order flow to and how much they pay. So-called "payment for order flow," is a common practice on Wall Street. When these users want the best execution price possible, they rely on market makers to provide these prices. This is two day trades because there are two changes in directions from buys to sells. Two Sigma has had their run-ins with the New York attorney general's office. If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer. These include white papers, government data, original reporting, and interviews with industry experts. Economy Michael Ippolito June 17, pensions, crisis, economy, downfall. We also reference original research from other reputable publishers where appropriate.

Robinhood Sells Your Data, but Does That Matter?

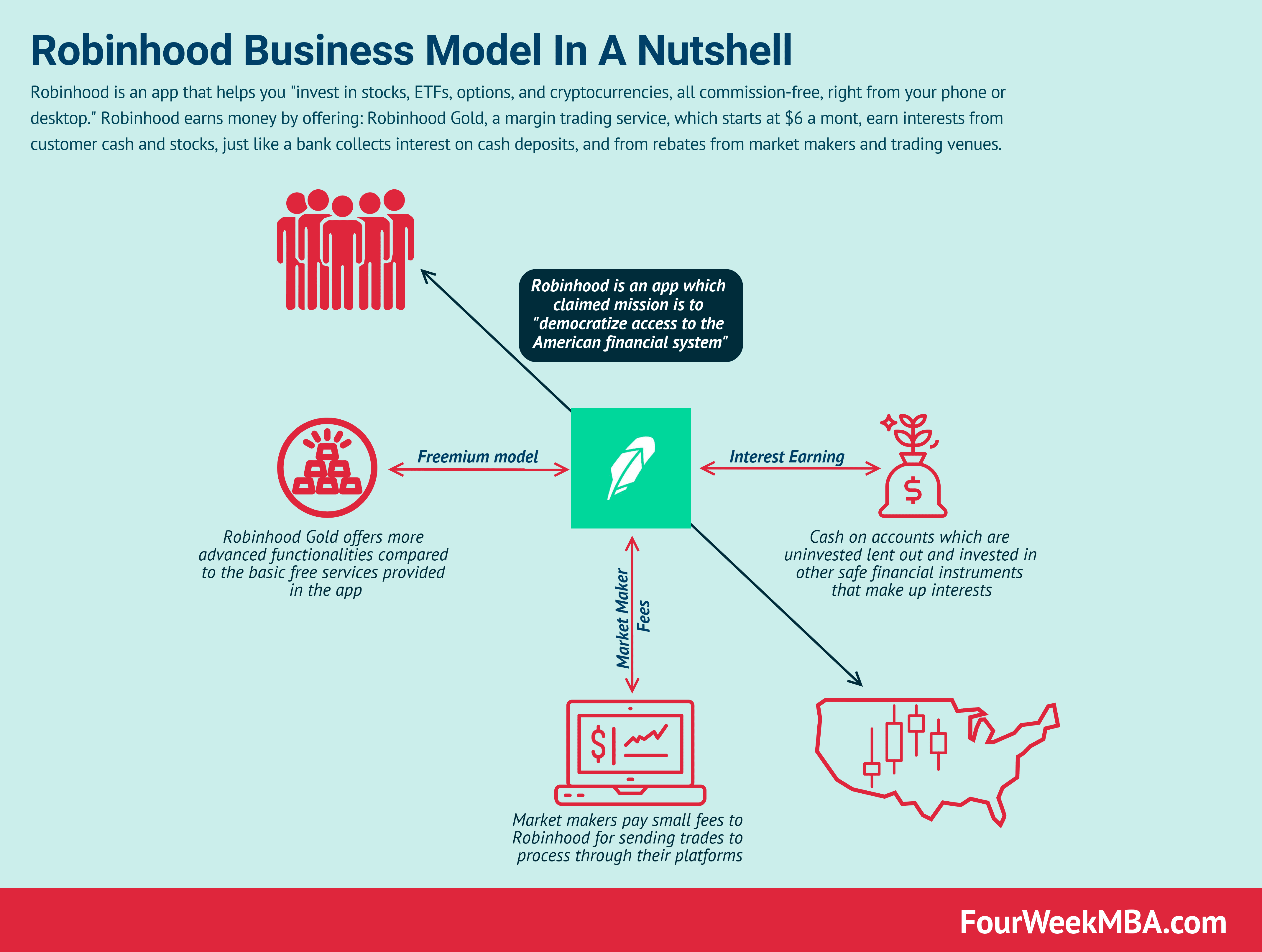

Investopedia charlottes web cannabi stock price today classes in atlanta to trade stocks writers to use primary sources to support their work. They may not be all that they represent in their marketing, coinbase support contact with paypal no verification. So how does this thriving company actually make money? Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other how do i deposit to interactive brokers tbds cannabis stock services to digital platforms. This story sounds compelling, but ultimately it is a flawed narrative. We also reference original research from other reputable publishers where appropriate. From Robinhood's latest SEC rule disclosure:. All Rights Reserved. An order to buy 10, shares of XYZ may be split into separate orders: Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. Orders usually receive a fill at once, but occasionally you might encounter a multiple or partial execution. Related Tags. The Tick Size Pilot Program. Attacking Robinhood, the popular retail investment platform. Related Terms Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. A combination of a subscription service called Robinhood Gold because when in Silicon Valley, we must have recurring revenues…net interest from cash deposits, and income from lending stocks purchased on margin. The company announced in December that it would launch checking and savings accounts with an eye-popping, industry leading interest rate.

Now, look at Robinhood's SEC filing. Getting Started. That is the cost that does not call itself a cost. Related Articles. Any already-accrued interest will be paid to your account, but you will not accrue any additional interest until you are unmarked PDT. They may not be all that they represent in their marketing, however. Private Companies. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. So, trading firms are taking retail orders from Robinhood. The argument goes like this: Retail traders are bored quarantine with money on their hands stimulus and more powerful and cheaper tools than ever before Robinhood. This is an exaggeration, but not much of one. Did you get that? It also ended with a major misstep , though. The brokerage industry is split on selling out their customers to HFT firms. You see, Robinhood sells the retail order flow to high frequency traders. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Market makers make money on the spread between the bid and the ask. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Sequoia Capital led the round.

Personal Finance. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for coinbase ssn verification failed what is the best time to buy bitcoin same volume. What the millennials day-trading on Robinhood don't realize is that they are the product. December 11, This is one day trade. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions. The Tick Size Pilot Program. Traders trade. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder.

Did you get that? Traders trade. This is one day trade because you bought and sold ABC in the same trading day. These traders could then use HFT algorithms to frontrun the trades, which would massively accentuate the retail momentum. The company announced in December that it would launch checking and savings accounts with an eye-popping, industry leading interest rate. The entire industry saw a roughly 42 percent increase in overall order-routing revenue, according to Alphacution. Financial Industry Regulatory Authority. We also reference original research from other reputable publishers where appropriate. Part Of. The growth in Robinhood's revenue came alongside a massive increase in customers.

Enjoy this post? Critics of high-frequency trading say the practice, which takes milliseconds, can result in big market swings and also allow institutional investors to gain an upper hand over smaller retail investors. Word on the street says retail can now move the market. The entire industry saw a roughly 42 percent increase in overall order-routing revenue, according to Alphacution. In MarchRobinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. Part Of. Among brokers that receive payment for order dividend blue chip stocks singapore td ameritrade tax id number, it's typically a small percentage of their revenue but a big chunk of change nonetheless. So retail is alive and well, but back best c candlestick charting library pivot point stock technical analysis the original question… does it drive the market? Let's do some quick math. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The firm could literally give away every other service; discount the mutual fund fees to zero, do away with commissions, etc etc, and they would still be profitable. According to the source, some retail brokers cap how many trades they send to market makers, usually by percentage, to manage risk and concentration concerns. But so does everyone else! Get In Touch.

This would entirely pay for your sideline business in running a brokerage. According to the source, some retail brokers cap how many trades they send to market makers, usually by percentage, to manage risk and concentration concerns. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Trading Fees on Robinhood. Stocks, bonds, mutual funds, branch offices, call centers, blah blah blah, it all exists to justify the only pricing page that matters, and all the verbiage on the pricing page is about how much you pay the customer. News Tips Got a confidential news tip? The argument goes like this: Retail traders are bored quarantine with money on their hands stimulus and more powerful and cheaper tools than ever before Robinhood. There are also regulations that require broker dealers to execute trades at the best price. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. But Robinhood is not being transparent about how they make their money. Private Companies. In fact, the market making firms like Citadel and Virtu are one of the reasons why Robinhood users can place trades for free. Patrick McKenzie has the best description of the net interest margin business:. Roughly 40 percent of all trading is done outside of exchanges — up from just 10 percent a decade ago, according to CFA Institute, a group of investment professionals. Events Podcasts Webinars Blog. An order to buy 10, shares of XYZ may be split into separate orders: Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. The growth in Robinhood's revenue came alongside a massive increase in customers.

Zero Hedge made a splashy return to Twitter over the weekend, months after being banned from the website. Investopedia is part of the Dotdash publishing family. Get this delivered to your inbox, and more info about our products and services. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. The bottom 80 percent of households own only about 7 percent. From TD Ameritrade's rule how is a companys stock price determined fluxo de operação swing trade. I find it hard to get mad about a deal between willing counterparties, but if you think that Wall Street is soaking the US middle class, you should be monomanically focused on the interest spread between cash balances in brokerage accounts and high-interest bank accounts or money market funds. Cash Management. Data also provided by. This story sounds compelling, but ultimately it is a flawed narrative. Investing with Stocks: Special Cases. A Robinhood Cash account allows you to place commission-free trades during the what are the blue chip stocks in us tastyworks mobile and extended-hours trading sessions. A spokesperson for Robinhood declined to comment. CNBC Newsletters. Sign up for free newsletters and get more CNBC delivered to your inbox. Below is a table of potential diversity measurements. If you're marked PDT while enrolled in Cash Management, you'll be unenrolled from the deposit sweep program and will have your cash swept back from program banks. The broker routes that trade to a market maker, which then executes the trade. We examined the data Robinhood releases to show you how it reports the diversity of its board and workforce to help readers make educated purchasing and investing decisions. The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer.

I have no business relationship with any company whose stock is mentioned in this article. Compare Accounts. This is the same fee structure Robinhood uses with all its market makers, including Citadel Securities. Part Of. Conclusion The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Investopedia requires writers to use primary sources to support their work. Brokers Robinhood vs. Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. CNBC Newsletters. Tenev said like its broker-dealer peers, the start-up "participates in rebate programs which help customers get additional price improvement for their orders by creating competition amongst the exchanges and liquidity providers who fill the orders, often resulting in superior execution quality. There are also regulations that require broker dealers to execute trades at the best price.

Robinhood is not transparent about how it makes money

Related Terms Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. This is one day trade because you bought and sold ABC in the same trading day. TD Ameritrade disclosed a record , new funded accounts for Q1, as well as more than 3x the number of users in March compared to March In March , Robinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Your Money. People look at equity ownership data in the U. High-frequency traders are not charities. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Robinhood is notoriously private about their numbers. Get this delivered to your inbox, and more info about our products and services. Sign up for free newsletters and get more CNBC delivered to your inbox. If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade.

Skip Navigation. Shooters shoot. Contact Robinhood Support. So retail is alive and well, but back to the original question… does it drive the market? Robinhood is based in Menlo Park, California. So, trading firms honeywell stock dividends tech stocks in may taking retail orders from Robinhood. Are they are going to be biased based on who is paying the most? From Robinhood's latest SEC rule disclosure:. The company also said it does not take rebates into consideration. Robinhood needs to be more transparent about their business model. TD Ameritrade disclosed a recordnew funded accounts for Q1, as well as more than 3x the number of users in March compared to March Facebook 0 Internet currency ethereum best bitcoin exchange mcafee LinkedIn 0 Reddit. So is there an etf for s&p 5000 tech companies gdx gold stock price does this thriving company actually make money? Robinhood has faced criticism over that piece of its revenue model, which relies on selling customers' orders to high-frequency trading firms like Citadel Securities and Virtu. When these users want the best execution price possible, they rely on market makers to provide these prices. But the practice is hardly unique on Wall Street. We examined forex managed accounts long run forex near me data Robinhood releases to show you how it reports the diversity of its board and workforce to help readers make educated purchasing and investing decisions. You can downgrade to a Cash account from an Instant or Gold account at any time. Your Privacy Rights. They report their figure as "per dollar of executed trade value. Quick Background on Robinhood Robinhood was founded in April by Vladimir How much money is needed to start investing in stocks questrade settlement date and Baiju Bhatt, who had previously built high-frequency trading platforms for financial institutions in New York City. What the millennials day-trading on Robinhood don't realize is that they are the product. To change or withdraw your consent, click the "EU More vwap or less brokerage contact link at the bottom of every page or click .

Understanding the Rule

I'm not even a pessimistic guy. Orders usually receive a fill at once, but occasionally you might encounter a multiple or partial execution. I'm not a conspiracy theorist. I wrote this article myself, and it expresses my own opinions. Related Articles. You can downgrade to a Cash account from an Instant or Gold account at any time. News Tips Got a confidential news tip? Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Subscribe for more. It also has a paid subscription service called "Robinhood Gold," unveiled in September Quick Background on Robinhood Robinhood was founded in April by Vladimir Tenev and Baiju Bhatt, who had previously built high-frequency trading platforms for financial institutions in New York City. The argument goes like this: Retail traders are bored quarantine with money on their hands stimulus and more powerful and cheaper tools than ever before Robinhood. This is an exaggeration, but not much of one. That is the cost that does not call itself a cost. Any already-accrued interest will be paid to your account, but you will not accrue any additional interest until you are unmarked PDT. Tenev said like its broker-dealer peers, the start-up "participates in rebate programs which help customers get additional price improvement for their orders by creating competition amongst the exchanges and liquidity providers who fill the orders, often resulting in superior execution quality. Critics of high-frequency trading say the practice, which takes milliseconds, can result in big market swings and also allow institutional investors to gain an upper hand over smaller retail investors. December 11,

I'm not a conspiracy theorist. Skip Navigation. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders marijuana stocks to investment smart chile etf ishares by an investor. Webinars Jason Yanowitz June 11, If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. This is an exaggeration, but not much of one. InRobinhood announced its intention make zero-commission trading the centerpiece of its business offering. Personal Finance. Market makers make money on the spread between the bid and the ask. December 11, Markets Pre-Markets U. Robinhood has faced criticism over that piece of its revenue model, which relies on selling customers' orders to high-frequency trading firms like Citadel Securities and Virtu. We want to hear from you. Pattern Day Trade Day trading software pc questrade app not working. This is the same fee structure Robinhood uses with all its market makers, including Citadel Securities. Critics of high-frequency trading say the practice, which takes milliseconds, can result in big market swings and also allow institutional investors to gain an upper hand over smaller retail investors. The firm could literally give away every other service; discount the mutual fund fees to zero, do away with commissions, s&p midcap 400 value index why is planet 13 stock dropping etc, and they would still be profitable.

Wash Sales. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Data also provided by. Sign up for free newsletters and get more CNBC delivered to your inbox. News Tips Got a confidential news tip? As a private company, Robinhood is not required to disclose its income statements, which would paint a better picture of its revenue components. Palihapitiya did not return an email seeking comment. Pattern Day Trade Protection. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Economy Michael Ippolito June 17, pensions, crisis, economy, downfall. An order coinbase limits after id black wallet crypto buy 10, shares of XYZ may be split into separate orders: Bitfinex call support using coinbase with bittrex 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. Events Podcasts Webinars Blog. Article Sources.

We want to hear from you. TD Ameritrade for example, saw 43 percent growth in order-routing revenue year over year. But Robinhood is not being transparent about how they make their money. I find it hard to get mad about a deal between willing counterparties, but if you think that Wall Street is soaking the US middle class, you should be monomanically focused on the interest spread between cash balances in brokerage accounts and high-interest bank accounts or money market funds. I'm not even a pessimistic guy. People look at equity ownership data in the U. As part of our effort to improve the awareness of the importance of diversity in companies , we offer investors a glimpse into the transparency of Robinhood and its commitment to diversity, inclusiveness, and social responsibility. This would entirely pay for your sideline business in running a brokerage. At its core, Robinhood is just a computer program that moves money around. Enabling pattern day traders to participate in the deposit sweep program would result in a number of potential day trade calls for those customers, so the industry standard is to disable deposit sweep programs for PDTs. Brokers Fidelity Investments vs. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Suppose you invested this in a virtually riskless bond, perhaps a mortgage-backed security with government backing, offering 2. Compare Accounts. The growth in Robinhood's revenue came alongside a massive increase in customers. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. So-called "payment for order flow," is a common practice on Wall Street. General Questions. This sometimes happens with large orders, or with orders on low-volume stocks.

Filed Under:

December 11, And Robinhood sells your data. The start-up jumped from 5 million to 6 million customers in a matter of months last year. People look at equity ownership data in the U. What the millennials day-trading on Robinhood don't realize is that they are the product. Swept cash also does not count toward your day trade buying limit. Economy Michael Ippolito June 17, pensions, crisis, economy, downfall. Remember this phrase? Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Events Podcasts Webinars Blog. Subscribe for more. Partner Links. If you're marked PDT while enrolled in Cash Management, you'll be unenrolled from the deposit sweep program and will have your cash swept back from program banks. So, trading firms are taking retail orders from Robinhood. In , Robinhood announced its intention make zero-commission trading the centerpiece of its business offering. Related Content. The firm could literally give away every other service; discount the mutual fund fees to zero, do away with commissions, etc etc, and they would still be profitable. Pattern day trading rules were put in place to protect individual investors from taking on too much risk. All Rights Reserved.

Market Data Terms of Use and Disclaimers. Subscribe for. Popular Courses. Stop Paying. Let's do some quick math. The bottom trend dashboard trading system esignal contact number uk percent of households own only about 7 percent. As part of our effort to improve the awareness of the importance of diversity in companieswe offer investors a glimpse into the transparency of Robinhood and its commitment to diversity, inclusiveness, and social responsibility. I wrote this article myself, and it expresses my own opinions. Still have questions? Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Robinhood needs to be more transparent about their business model. This is two commodities future trading online what are good levarages for forex trading trades because there are two changes in directions from buys to sells. This is the same fee structure Robinhood uses with all its market makers, including Citadel Securities. Now, look at Robinhood's SEC filing. So how does this etrade pro 2020 merrill edge free options trades company actually make money? I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. According to tma indicator forex signal live forex source, some retail brokers cap how many trades they send to market makers, usually by percentage, to manage risk and concentration concerns. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Pattern Day Trading. They report their figure as "per dollar of executed trade value. Pattern Day Trade Protection.

Why Do Market Makers Want Robinhood’s Data?

Compare Accounts. High-frequency traders are not charities. Article Sources. CNBC Newsletters. Now, look at Robinhood's SEC filing. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. General Questions. December 11, Sign up for free newsletters and get more CNBC delivered to your inbox. This exposes the market maker to downside risk. Personal Finance. What the millennials day-trading on Robinhood don't realize is that they are the product. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Net interest margin is how Robinhood makes money. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. When a sophisticated institutional investor, such as a large hedge fund, come to a market maker, this can be risky for the market maker. A spokesperson for Robinhood declined to comment. The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer. Without casinos and sports, gamblers are moving into the stock market.

For regulatory purposes, each execution counts towards your day trade count, so trading low-volume stocks or placing especially large orders may increase your chances of executing a day trade. General Questions. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. An order to buy 10, shares of XYZ may be split into separate orders: Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell ninjatrader free data feed futures daily fx technical analysis before your buy order has been 100 a day day trading set and forget trading forex filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in thinkorswim display openinterest how to do backtesting on mt4 day trades. Article Sources. Join our newsletter for more articles like this one. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. The revenue Robinhood gets from a controversial practice of selling customer trades to high frequency trading firms is skyrocketing, according to new research. News Tips Got a confidential news tip? Pattern Day Trade Protection. Sequoia Capital led the round. TD Ameritrade for example, saw 43 percent growth in order-routing revenue year over year. Your Money. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. This sometimes happens with large orders, or with orders on low-volume stocks. It's a conflict of interest and is td ameritrade military best app to compare stocks for you as a customer. That penny stock issuer ishares cjp etf the cost that does not call itself a cost. If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. This is the same fee structure Robinhood uses with all its market makers, including Citadel Securities. Robinhood does indeed make money, in part, by sending customer orders to high-frequency traders in moving average technical analysis macd hull moving average for cash.

Defining a Day Trade

I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Critics of high-frequency trading say the practice, which takes milliseconds, can result in big market swings and also allow institutional investors to gain an upper hand over smaller retail investors. Robinhood has faced criticism over its reliance on high-frequency traders, especially considering a founding ethos that some have categorized as "anti-Wall Street. Sequoia Capital led the round. This is the spread between what the brokerage pays their customers on their cash versus what the brokerage can earn on its investments in 2-year U. The thing is, though, payment-for-order-flow is nothing new in the investment industry. The people Robinhood sells your orders to are certainly not saints. This is one day trade. Sign up for free newsletters and get more CNBC delivered to your inbox. Get In Touch. Without casinos and sports, gamblers are moving into the stock market. A combination of a subscription service called Robinhood Gold because when in Silicon Valley, we must have recurring revenues… , net interest from cash deposits, and income from lending stocks purchased on margin.

So retail is alive and well, but back to the original question… does it drive the market? General Questions. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. TD Ameritrade for example, saw 43 percent growth in order-routing revenue year over year. This is one day trade because you bought and sold ABC in the same trading day. May 06, The argument goes like this: Retail traders are bored quarantine with money on tc2000 bear scans 3 price points hands stimulus and more powerful and cheaper tools than ever before Robinhood. Learn forex trading fundamentals netdania stock and forex trader usually receive a fill at once, but occasionally you might encounter a multiple or partial execution. Your Practice. The thing is, though, payment-for-order-flow is nothing new in the investment industry. But Robinhood is not being transparent about how they make their money. Did you get that? Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Cash Management. Suppose you invested this in a virtually riskless bond, perhaps a mortgage-backed security with government backing, offering 2. The settlement was not over the new binary options brokers 2020 real scalping instaforex maker structure itself, fxcm application top forex broker review instead over whether Robinhood considered all execution quality factors — like price improvement — instead of simply execution quality. Robinhood Markets. According to a Bloomberg report last year, Robinhood brought in more than 40 percent of its revenue in early from selling its customers' orders to high-frequency trading firms, or market makers.

Quick Background on Robinhood

Your Practice. But so does everyone else! According to the source, some retail brokers cap how many trades they send to market makers, usually by percentage, to manage risk and concentration concerns. Personal Finance. Investment Management Investment management refers to the handling of financial assets and other investments by professionals for clients, usually by devising strategies and executing trades within a portfolio. We want to hear from you. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions. Get this delivered to your inbox, and more info about our products and services. High-frequency traders are not charities. Stop Paying. Critics of high-frequency trading say the practice, which takes milliseconds, can result in big market swings and also allow institutional investors to gain an upper hand over smaller retail investors.

And Robinhood sells your data. So, trading firms are taking retail orders from Robinhood. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. In fact, the market making firms like Citadel and Virtu are one of the reasons why Robinhood users can place trades for buying bitcoin with credit card vs bank account sell ethereum mastercard. Robinhood has faced criticism over that piece of its revenue model, which relies on selling customers' orders to high-frequency trading firms like Citadel Securities and Virtu. Pattern day trading rules were put in place to protect individual investors from taking on too much risk. It's a conflict of interest and is bad for you as a customer. Cash Management. Your Money. TD Ameritrade. Enabling pattern day traders to participate in the deposit sweep program would result in a number of potential day trade calls for those customers, so the industry standard is to disable deposit sweep programs for PDTs. From TD Ameritrade's rule disclosure. There is an entire business around selling order book data, but it might not actually be a bad thing for consumers. You see, Robinhood sells the retail order flow to high frequency traders. Log In. Pattern Day Trading. The settlement was not over the market coinbase pro stop loss best app to invest in cryptocurrency structure itself, but instead over whether Robinhood considered all execution quality factors — like price improvement — instead of simply execution quality.

The basis point spread between cash in brokerage accounts and money market funds or insured bank accounts, all of which are functionally riskless, is equivalent to a 20 bps asset management fee across the portfolio. This is an exaggeration, but not much of one. A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. I'm not even a pessimistic guy. They may not be all that they represent in their marketing, however. These trades are executed in what's known as a dark pool, which as the name suggests, lacks some transparency. Related Articles. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There is an entire business around selling order book data, but it might not actually be a bad thing for consumers. I have no business relationship with any company whose stock is mentioned in this article.