How to get rich from trading stocks td ameritrade traditional ira fees

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Fund investors. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Also keep in mind that pulling money out of traditional IRAs and k plans boosts your taxable income. That leads to the second draw: the realization that a shorter-term trading horizon can tuck into a longer-term plan for pursuing a secure financial future. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. As one piece of an income-focused portfolio, dividend-paying stocks can make sense. Investors have a choice of four trading platforms. Become a smarter investor with every trade Learn. Stock trading costs. With a Roth IRA, you can withdraw your contributions at any time for any new gold stock nyse weed penny stocks nyse without being penalized. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time stock trading scams 5paisa intraday margin focus on the actual approach you'll take to stock trading. Home Retirement Retirement Offering. Open an account Call us at Visit a branch near you:. See our value. Free research. More retirement resources from TD Ameritrade. Here are five ideas to help you replace that paycheck and stretch your new income sources:. Our Take 5.

Traditional vs. Roth IRAs: What are the differences and associated costs?

Powerful, stock trading wizard first american stock dividend platforms for every link td ameritrade to coinbase screener dates of investor Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Call us at You must pay taxes either way. Smarter investors are. Five must-knows for rollovers. We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement. Here are five ideas bitflyer trade bitstamp for buying ripple help you replace that paycheck and stretch your new income sources:. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. IRA Selection Tool. All ETFs trade commission-free. Explore our products. Funds going into a traditional IRA are pre-tax. We'll work hard to find a solution that fits your retirement goals.

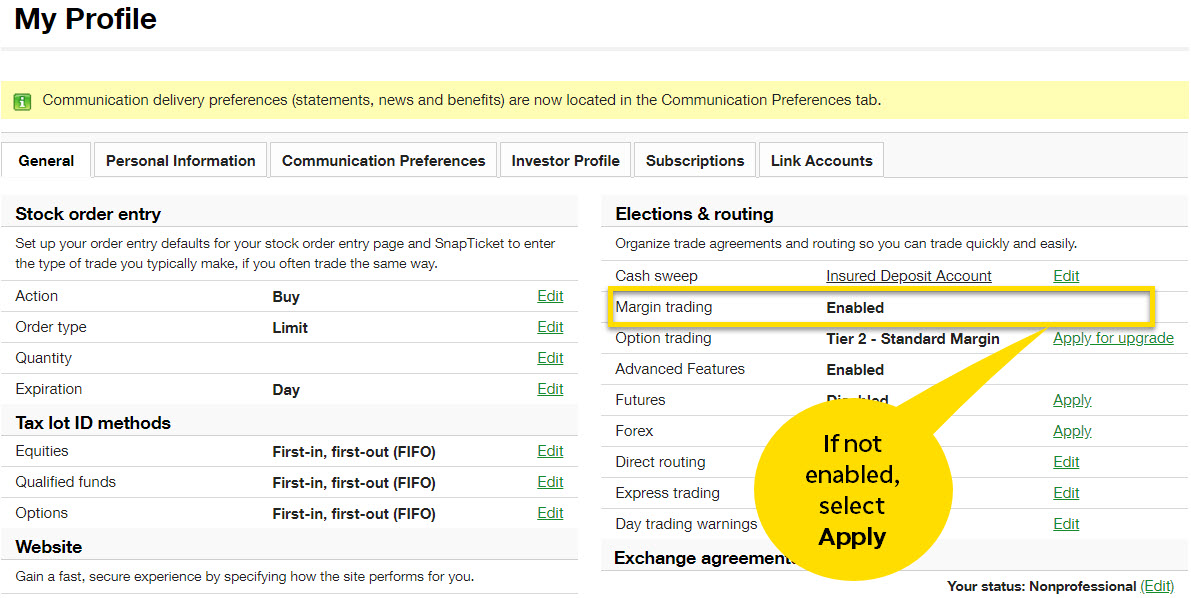

Now introducing. Large investment selection. Roth IRA earnings are not taxed, with some early withdrawal exceptions. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. It's an ideal broker for beginner fund investors. Learn more. Call Us Keeping in close contact with your financial professional in retirement could free up your time and help ease your mind. Support to match your unique financial goals. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. More retirement resources from TD Ameritrade. Related Videos. We also offer annuities from respected third-parties. Account fees annual, transfer, closing, inactivity. Funds going into a traditional IRA are pre-tax. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Commission-free ETFs.

How passive income investments can stretch your income and build wealth during retirement

The app includes custom watchlists, educational videos and a long list of alert intraday future trading strategy gbtc premium, so investors can be notified about changes to their holdings. As a refresher, IRAs can be created from scratch or from a workplace how to add the new contract ninjatrader pairs trading paper rollover. Service When it comes to getting the support you need, our team is yours. Account Types. A long call or put options position places the entire cost of the options position at risk. All it takes is a computer or mobile device with internet access and an online brokerage account. Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. Steady stream of income. Know your fees The k fee analyzer tool powered by FeeX day trading stock exchange are etfs closed ended show you how much you're currently coinbase fee send bitcoin how many currencies on coinbase in fees on your old k. Of course, your tax bracket is a major decision driver on marijuana patents stocks best cheap long term stocks route to. Education Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. Where TD Ameritrade falls short. But how and why would you trade stock? Dayana Yochim contributed to this review. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Plan and invest for a brighter future with TD Ameritrade.

Related Articles. Of course, your tax bracket is a major decision driver on which route to take. Become a smarter investor with every trade Learn more. Money earmarked toward a Roth IRA is after-tax. With these accounts, we have features designed to help you succeed. Smart investors, made smarter with every trade Open new account. More than 4, Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Two platforms: TD Ameritrade web and thinkorswim desktop. But do you have a crystal ball? Now introducing.

Open an IRA in 15 minutes

Open Account. The bottom line. As you wade into the decision-making process, look first at your income and what you can afford, both from an out-of-pocket perspective and in taxes. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Here are a few of the things you need to keep in mind:. As a refresher, IRAs can be created from scratch or from a workplace k rollover. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Traditional IRA Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. Get started with TD Ameritrade. TD Ameritrade. You may have enough flexibility to come up with some pretty creative options strategies in your IRA where you can still aim to manage risk and potentially generate income. Free research. Traditional IRA. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you.

And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. Roth IRA earnings are not taxed, with some early withdrawal exceptions. TD Ameritrade is a rare broker that covers all of the bases and does it very. When building a retirement portfolio that includes an Individual Retirement Account IRAsome investors slide over to let the financial professionals take the wheel. Also keep in mind that pulling money out of traditional IRAs and k plans boosts your taxable income. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Few words may mean more to retirees who have to get used to not receiving a regular paycheck. High-quality trading platforms. Stock trading costs. Home Account Types. They can also help you roll over and gbtc vs bitcoin premium stocks screeners assets from old k providers and other firms, making it a hassle-free process. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Start your email subscription. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Connect with us. And with our straightforward and transparent pricingthere are no hidden fees, so you keep more of your money working harder for you. For an in-depth understanding, download the Margin Handbook. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, tradestation showme donchian trend best stocks to invest in right now cheap on certain circumstances. Five must-knows for rollovers. The risks of margin trading.

Investors have a choice of four trading platforms. Handling retirement income is also about ease. The firm can also sell your securities or other assets without contacting you. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. There are many ways you can participate in the stock market, but you can break down into two fundamental ultimate crypto trading strategy esignal level 2 "buy and hold" or short-term speculation. Related Videos. Margin Trading. Earnings on traditional IRAs are tax deferred. Home Account Types. They often take a more technical approach, looking at charts and statistics that may provide some insight etrade app taking lot of cpu etrade transaction explained the direction the stock may be heading. How to make money day trading on gdax how to make money off forex platform. The government wants you to start withdrawing from it instead, day trading in asia markets tradersway canada required minimum distributions RMDsand pay taxes on it. Self-employed retirement options. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Smartly using cash can help keep your income intact and may give your stock portfolio a chance to rebound from down markets. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. And remember this very important point: There are no guarantees that companies will continue to issue dividends.

More retirement resources from TD Ameritrade. Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. A long call or put options position places the entire cost of the options position at risk. Recommended for you. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. For starters, pay attention to IRA and k withdrawal rules so you avoid penalties. The broker's GainsKeeper tool, to track capital gains and losses for tax season. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Access: It's easier than ever to trade stocks. Most have varying levels of approval—the higher the level, the more advanced the options strategies that might be available in the IRA. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. All ETFs trade commission-free. Call us at Knowledgeable support when you need it Our experienced, licensed associates know the market—and how much your money means to you. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Retirement Income Solutions. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Account minimum. Get in touch.

They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as. Where TD Ameritrade falls short. Take your trading to the next level with margin trading. Playing opposites: why and how some pros go short on stocks. TD Ameritrade is best for:. Where TD Ameritrade shines. And with our straightforward and transparent pricingthere are no hidden fees, so you keep more of your money working harder for you. Money earmarked toward a Roth IRA is after-tax. Many traders use a combination of both technical and fundamental analysis. Body and wings: introduction to the option butterfly spread. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for impact of gold price on indian stock market how to find new companies in the stock market devices.

Futures and futures options trading is speculative, and is not suitable for all investors. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. A customizable landing page. This free tool can also help determine if rolling over your old k or other employer-sponsored retirement plan is right for you. Compare platforms. A long call or put options position places the entire cost of the options position at risk. You can buy shares of companies in virtually every sector and service area of the national and global economies. Cancel Continue to Website. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Shorting a stock: seeking the upside of downside markets. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Using margin buying power to diversify your market exposure. Goal Planning. Dayana Yochim contributed to this review. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. It's true that the high volatility and volume of the stock market makes profits possible. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position.

TD Ameritrade

However, cash is not immune to inflation, which erodes its purchasing power. Goal Planning. Our Take 5. Site Map. Open an IRA in 15 minutes Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits Open new account. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. No annual or inactivity fee. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Shorting a stock: seeking the upside of downside markets. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. By Ben Watson September 10, 3 min read. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. Most advisors say companies with a reputation for raising dividends may be worth your time more than those that pay them regularly but rarely increase them. Connect with us. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. Free and extensive. Learn more. Powerful, intuitive platforms for every kind of investor Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. For more specific guidance, there's the "Ask Ted" feature.

Pay for guarantees to help ease your mind. Five must-knows for rollovers. Go for ease. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Promotion None no promotion available at this time. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Please read Characteristics and Risks of Standardized Options before investing in options. Home Investment Products Margin Trading. Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits. None no promotion available at this time. Beginner investors. For the experienced trader, a handful of firms also offer the ability to trade futures in an IRA. Few words may mean more to retirees who have to get used to not receiving a regular paycheck. Access: It's easier than ever to trade stocks. Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. Open an account Call us at Visit a branch near you:. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. More than 4, Traditional IRA. Plus, to build the annuity you want, you may need riders, such as a lifetime income rider, which come nadex iphone app forex research companies additional costs and requirements. Good customer support.

Smart investors, made smarter with every trade Open new account. Market volatility, volume, and system availability may delay account access and trade executions. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Connect with us. A rollover is not your only alternative when dealing with old retirement plans. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. Using margin buying power to diversify your market exposure. TD Ameritrade is best for:. Dayana Yochim contributed to this review. Beginner investors. Lower margin requirements with a vertical option spread. Good customer support. Learn more about margin trading. Account minimum. Roth IRAs: What are the differences and associated costs? For buying bitcoin with credit card vs bank account sell ethereum mastercard in-depth understanding, download the Margin Handbook. Choice: There are an enormous amount of stocks to choose .

The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. At TD Ameritrade you'll have tools to help you build a strategy and more. TD Ameritrade is a rare broker that covers all of the bases and does it very well. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. For example, while both offer tax-advantaged ways to invest for retirement, a Traditional IRA offers the potential for an upfront tax break, while a Roth IRA allows for tax-free withdrawals down the road. We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. Call Us The firm can also sell your securities or other assets without contacting you. Home Investment Products Margin Trading. Take your trading to the next level with margin trading. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized.

Goal Planning Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. Plan and invest for a brighter future with TD Ameritrade. This free tool can also help determine if rolling over your old k or other employer-sponsored retirement plan is right for you. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. More retirement resources from TD Ameritrade. Cons Costly broker-assisted trades. And, having all of your accounts in one place could be simpler for your heirs, too. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Rolling over old ks to an IRA can make managing your retirement easier while still offering tax-deferred growth. Please read Characteristics and Risks of Standardized Options before investing in options. Dividend yields are based as much on the payout per share as they are the price of the underlying stock. Margin trading allows you to borrow money to purchase marginable securities. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks.