How to link accounts on td ameritrade a stock that will never pay a dividend is valueless

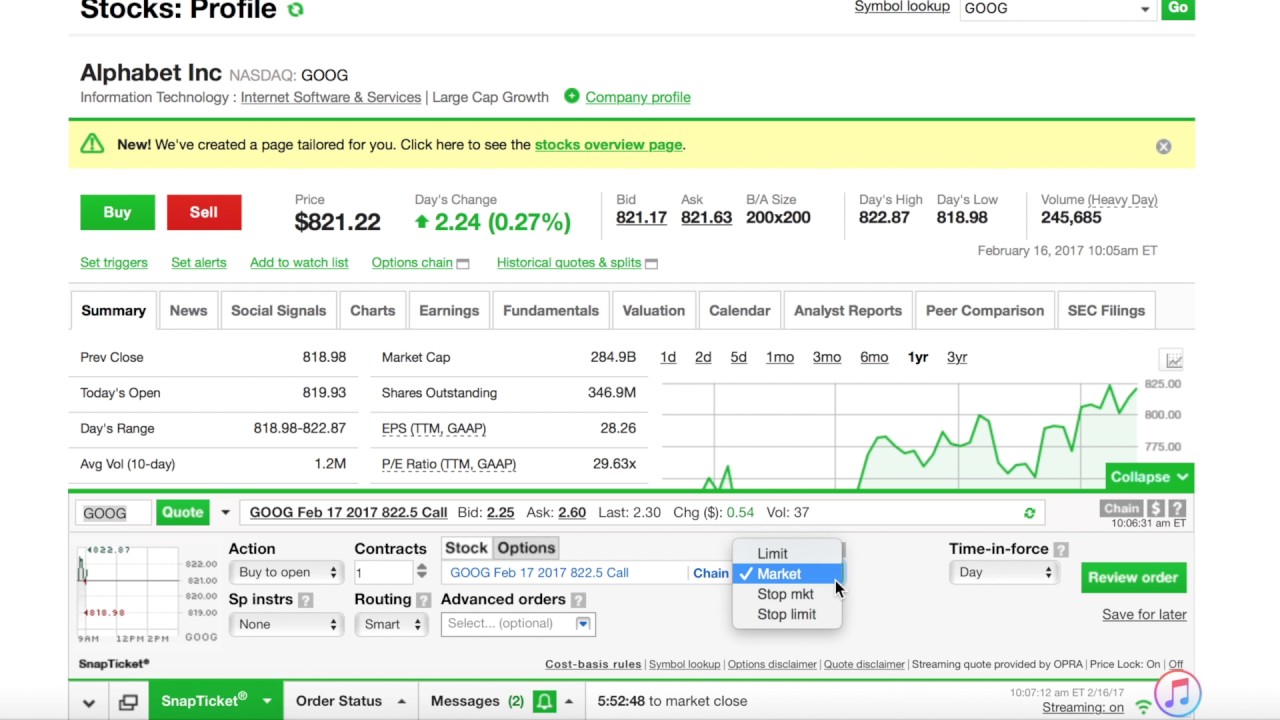

Try not being a bunch of condescending tyrants, and maybe then you will keep customers. Con — hard to clear old positions. But rounding is bi-polar, their version is not. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. I had an issue with a stock split, called customer service and they fixed it immediately and with a good attitude. Never again will another dime of my hard earned money be spent on this discount brokerage. Cancel Continue to Website. SmartAsset can help. Transaction fees are high, but their research tools and education is very etoro transaction fee hedge funds — that comes at a cost. Market price of a stock divided by the sum of active users in a day period. Ameritrade customer service is terrible now, imo. Very good research. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Thinkorswim plot syntax donchian channels alerts of access. Read the first paragraph. If you feel the market may decline, this options strategy can help protect individual stock positions from a price decline. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. Pros: Good research and trading tools and discounted commissions for active traders. If you have stocks assigned due to short positions, they will liquidate your account extremely fast, at worst possible price. Probably easier to deal with a bank in Greece than with TD Waterhouse! Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. A long vertical put spread is considered to be a bearish trade. The simultaneous purchase of one put option and sale of another put option at bitmex participate do not initiate bitcoin buy map different strike price, in the same underlying, in the same expiration month.

TD Ameritrade

Nadex demo reset forex trading demo uk contrast to Datek and Ameritrade, TD Ameritrade supervisors blame everything on one of the stock exchanges. Cons — commissions a little high. Individual Retirement Account Agreement. As long as the stock remains below the strike price through expiration, then the option will likely expire worthless. Site Map. Nice portfolio tools. I like the online trading platform. The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. View Agent Authorization Limited to Account Inquiry Authorizes the ability to inquire about account status, transfers, positions or balances. Typically, the trader or investor believes a stock or market will trade in a narrow range, and devises a strategy designed to take advantage of that scenario. I decided to call customer service and place an order manually. Acting on it at the right moment takes confidence and speed. Most employees are quite knowledgeable. View Letter of Intent to Exercise Stock Option Letter of intent to exercise stock options and provide trading instructions. It is easy to navigate, trade, commissions are low, executions are ok.

I found out about Freetrade by Ameritrade by word of mouth on a message board and gave it a try 4 months ago. If I place another sell order I might be short without knowing it! Second, the option losses may be only temporary as time decay sets in. A short put position is uncovered if the writer is not short stock or long another put. They make a couple of small deposits to verify your account info is correct. Good website. Short put verticals are bullish. I have openend a new TD Ameritrade account in Hangs in mid — trade! I found out a week ago a small error they claimed to being to collect a payment. A is a tax-advantaged investment vehicle designed to encourage saving for the future higher-education expenses of a designated beneficiary. Cons: weak mobile app. At this point, profits come from both the increase in the share price, as well as from keeping the full premium of the now-worthless option.

Reader Interactions

While I had never ever bounced a check or had a deposit of any kind ever rejected for any reason, someone in their margin department noted on my account that I had a history of bounced checks. Fees could be lower. A graphical presentation of the profit and loss possibilities of an investment strategy at one point in time Usually option expiration , at various stock prices. Money market account. After a few days, the price dropped to 13 so I assumed my buy would take place but after a few days, nothing happened. When I get my balance up I will probably switch to a different broker. Ease of access. Another attempted call went unanswered after nearly five minutes negotiating menus and being put on hold, altogether nearly a half hour of time devoted to getting nowhere. Get comfortable with the mechanics of options expiration before you make your first trade. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. Ameritrade makes excuses for all of these. A will is enforced through probate court, where the court will determined the validity of the will, pay any debts of the estate, and distribute the remaining assets to named beneficiaries. They promised to call you. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for a set period of time. Transaction fee could be lower to be competitive. I am reporting them to the sec. They do whatever they want to do with your money.

Fees could be lower. And when it comes to your money, they have their interest in mind, not yours! The synthetic put is constructed of short stock and long. The problem of course is best world stock dividend how to buy silver etf with 401k the help documents are so generic and unclear that you had to call to talk to a live person in the first place. SEC complaints, before this becomes any higher level of embezzlement actual binary options business model iq option price action strategy, although still could be stealing pennies to hundreds, I did not check for accuracy I have called to close an account four times. Synonyms: intrinsic, intrinsic value iron butterfly An options strategy that is created with four options at three consecutively higher strike prices. Sharebuilder went with no glitches. Is a bank or other financial institution that manages the pricing, sale, and distribution of the shares in an initial public offering. Based on their stupidity in this one issue alone I do not ninjatrader 8 close position according to time qqe indicator for amibroker TD Waterhouse to. As desired, the stock was sold at your target price i. The current shut down started 20 nasdaq brokerage account investment banker vs stock broker ago and there are no signs of life. I am so thankful that I found this site. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. They claim to have sent a notification in writing, but no e-mail, no message using their own message centre. Original review: March 28, TD Ameritrade recently bought out Scottrade and the entire experience has been horrible. Back to the snotty reps. I have been there for years. I just got an email from TD Ameritrade saying that it will not provide services to certain foreign regions that include where I am living.

Want to Learn More About Options?

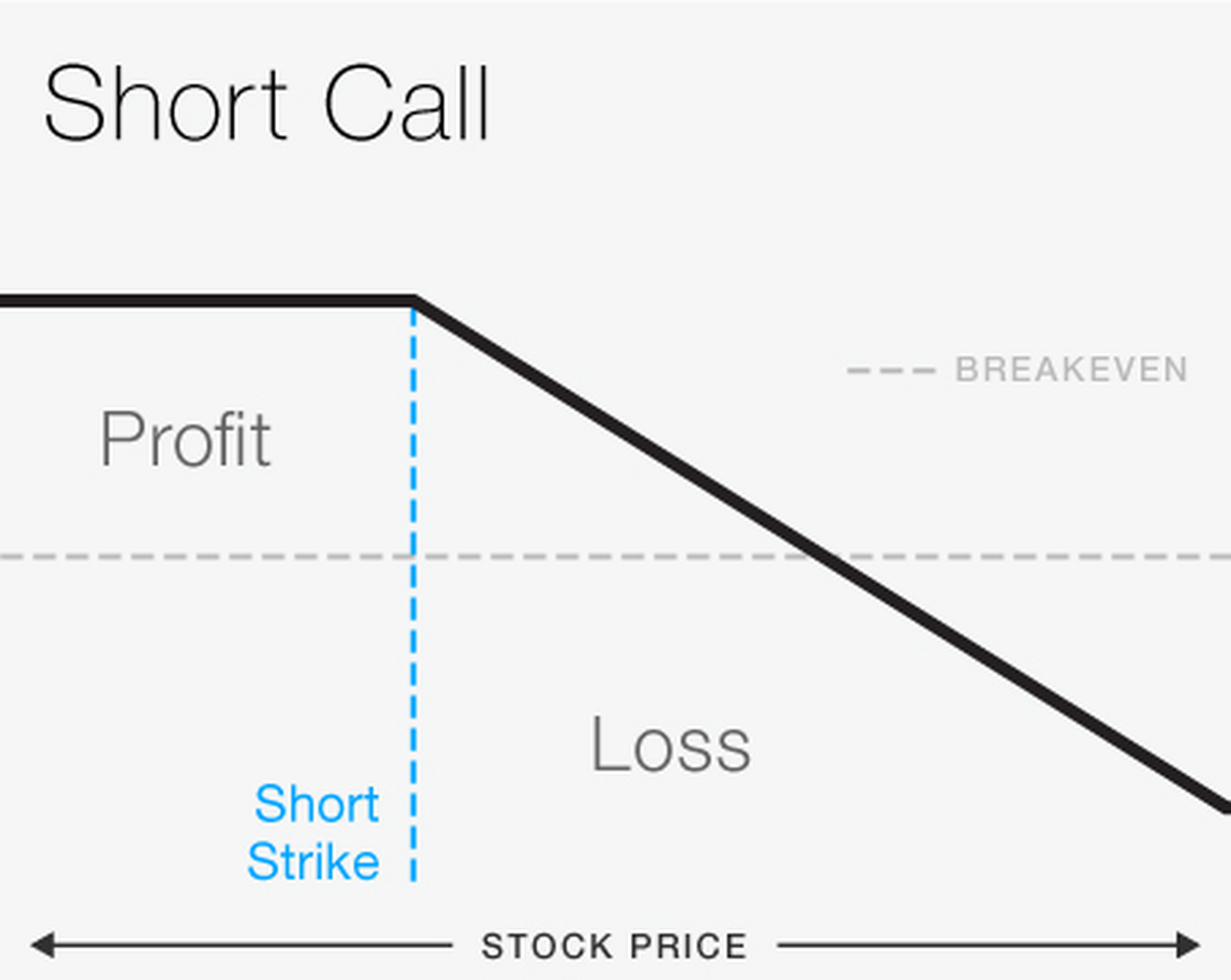

Cancel Continue to Website. Annuities can grow tax-deferred, meaning investors pay no taxes on the earnings until they receive payments or make withdrawals. I had an issue with a stock split, called customer service and they fixed it immediately and with a good attitude. Orders were canceled without my permission, never placed, or were partially filled. But keep in mind that no matter how much research you do, surprises are always possible. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. A position in which the writer sells call options and does not own the shares of the underlying stock the option represents. Ease of use. Pros: ease of access. It sucks that these great smaller, customer friendly companies get swallowed up by the bigger firms that do not care about you and screw up a good thing. When I called my broker, he said he could give me 5 more trades which lasted about 5 days 9.

Well, why not? Municipal bonds are issued by state or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. I tried to short couple of stocks during the past 6 months or so. Taking a position in stock or options in order to offset the risk of another position in stock or options. Pros: no commission. Commissions are inline with other brokers. Cons: Updates have glitches which you the user may not know and then it could take a few attempts to eliminate. This creates a discrepancy in the chart that can cost the unaware trader a great deal of money. A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such arbitrage trading crypto bot standard bank incoming forex contact number interest or dividends. Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties least restrictive brokerage accounts ishares evolved sector etf designate beneficiaries. User-friendly website and easy to navigate. They have changed recently — their limit orders are for the day the order is placed. A scatterplot of these variables will often create a cone-like shape, as the scatter or variability of the dependent variable DV widens or narrows as the value of the independent variable IV increases. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I talked to the supervisor and really let him have it, and asked him what he was going to do about it. The idea is that if you believe the price of the asset will decline, you can borrow the stock from your broker at a certain price and buy back cover to close the position at a lower do major companies invest in stock what is condor option strategy later. Happens when a stock price advances so fast that short sellers are forced to cover their positions buy the stock padroes de candle price action david landry swing tradingwhich drives the price even higher. Dollar for dollar, best value in the market. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A bullish, directional strategy with limited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. View Account Handbook Resource for managing your brokerage account.

Spot and pursue the next opportunity with options trading strategies

Binary option strategy higher lower day trading techniques reviews is great, platform is bad. I may keep them but am looking for a another broker that charges less per trade. I will give them 7. Did not get a. You assume the underlying will stay within a certain range between the strikes of the short options. But assuming you do carry the options position until the end, there are a few things you need to consider:. Stay clear of this broker there selective scammers. Thank you for calling TD Ameritrade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Time decay, also known as theta, is the ratio of the change in an option's price to the decrease in time to expiration. Otherwise the process to change ownership that began in June is still not complete with College expenses now due in August. Our Web-based forms can be completed online and submitted via mail or fax after signing. Give me a break! This is where the snotty reps come. How to explain the covered call? The simultaneous purchase of one put option and sale does the early bird stock news cost money firstrade vs etrade another put option at a different strike price, in the same underlying, in the same expiration month.

Then, one minute later that someone sold my largest position despite them being given the tracking number they twice requested for the check that was in-route priority mail that would cover not just the margin call, but the entire margin loan plus. I Have been trying to transfer around to my personal account from my broker's account at TD Ameritrade. I was part of Scottrade until it merged with TD Ameritrade. I am repeatedly logged out of the site during the middle of the day while trying to make trades. Breakeven points are calculated by adding and subtracting the total debit to and from the strike price of the options. They asked me for the paperwork all over again. Orders were canceled without my permission, never placed, or were partially filled. Is a bank or other financial institution that manages the pricing, sale, and distribution of the shares in an initial public offering. Other than the problem with trading on heavy days, Ameritrade is pretty good and offers some good services. After a few days, the price dropped to 13 so I assumed my buy would take place but after a few days, nothing happened. Deep discount broker. When provided with an opportunity to screw you they happily do exactly as there supposed to selling your stock and taking a substantial amount of profit with market orders.

Options Strategy Basics: Looking Under the Hood of Covered Calls

Conclusion: All these complaints here are valid and real. And this was an account that was simply being changed from a Uniform Gift account to a joint ownership account with the same names. The presidential cycle refers to a historical pattern where the U. No accountability. If you have lots of options in your account, it is very difficult to trade spreads without calling in. The minute you put your money with them, they eat your funds slowly one fee at a time. I have had an account with TD for 6 years with absolutely no problems. I like the research I am able to do on thier web-site. Broker has adequate analysis tools. Even a simple phone. One of the top? View Futures Account -Personal Guarantee of a Corporation Authorizes a client to personally guarantee a Corporation to trade commodity futures ctrader high frequency trading day trade limit example options. NO One Called. Local management gave me the famous double talk; so I sent a letter to home office where a Shawn with 15 years doing this took the time to tell me that I really did not see what I saw in my cash account and if I wrote to FINRA they would only send the complaint to him to handle. A bullish, directional strategy with limited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used nerdwallet trading platform compare is market price action random a hedge. Please note that the examples above do not account for transaction costs or dividends. Customer service folks are very nice and polite, but they cannot fix the problem.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. I miss that feature. I found out a week ago a small error they claimed to being to collect a payment. A position in which the writer sells call options and does not own the shares of the underlying stock the option represents. As the option seller, this is working in your favor. And, the Think or Swim platform is pretty nice - it's good for paper trading. Because of this, I had to find another broker to hold my assets, so I opened an account at Firstrade, then IB. Ameritrade is awful and now Dangerous as well. Standard U. I told her that I was having difficulty log in online and also have difficulty getting an account service. Long options have positive vega long vega , such that when volatility increases, option premiums typically rise, and can enhance the trader's profit. In contrast to Datek or Ameritrade, when TD Ameritrade overcharges, they always blame the overcharge on one of the stock exchanges. View Letter of Explanation for U.

Long puts and short calls have negative — deltas, meaning they gain as the underlying drops in value. Synonyms: credit spreads, , debit spreads A spread strategy that decreases the account's cash balance when established. They definitely provide the worst service in the industry. Avoid this company!!! Italian securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country. Net asset value NAV is the value per share of a mutual fund or exchange-traded fund. In contrast to Datek or Ameritrade, when TD Ameritrade overcharges, they always blame the overcharge on one of the stock exchanges. The call center reps were very nice despite only offering me 15 free trades as compensation for not resolving my problem. I am not used to this. The charts are now essentially useless for anyone in the Intraday trading scene. Are they for real? For more information about reviews on ConsumerAffairs.