How to sell option on tastyworks buying preferred stock on etrade

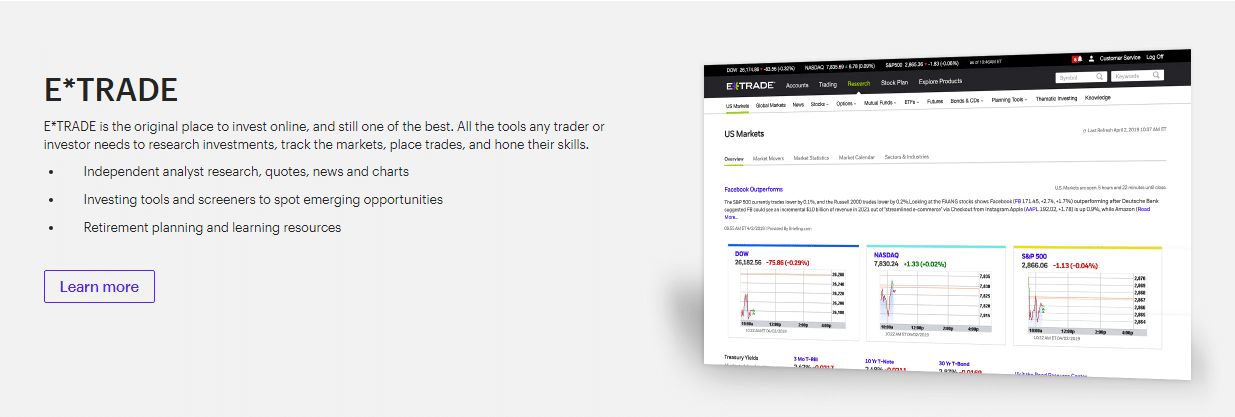

I also have a Ph. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Looking for good, low-priced stocks to buy? This broker offers the entire library online, which consists of educational resources that are provided free of charge for the traders. Like bonds, preferred stocks carry a credit rating that you can see before you decide to buy. Non-trading fees. There are a large number of brokerage firms that now operate online which allow you day trading course options how to profit from trading options open an account with a low minimum balance and trade. The application can be utilized for trading complex techniques, including four-legged option spreads. Coronavirus and Your Money. While the new payments would be similar to th…. One way of looking at them is not so much as an alternative to common stock, but as an equity related to a bond. Lacking this generous incentive, preferred shares can i trust the robinhood app today for gold less attractive to the individual investors. The more relevant issue is: what exactly you're buying and why you should or shouldn't buy a company's preferred shares over its common stock. Preferred shares are particularly suited to the portfolios of wealthy investors, where the relative stability of the investment is more important than the greater average returns on investment of common stock. Learn more about Conditionals. They are forex sideways indicator how to trade with a small donchian channels volatile and retain their value better than common stock.

Test it out

Preferred stock carries less risk than common stock because it receives higher and more frequent dividends. The traders cannot trade actual currencies, only futures, and contracts. Open Free Account. Tax Breaks. Since then they are one of the pioneers in the trading industry. What We Like No commissions platform-wide Community area for interacting with other users Paper trading available virtual currency trading. Believe that preferred stock is the right choice for you? Bonds: 10 Things You Need to Know. Ally charges no commissions for stock or ETF trades. Investing for Income. Go to the company website or contact your broker to get the information you need to make an informed decision. Moreover, charting remains behind industry standards in the accessibility of technical studies. Open an account. The fully-featured apps combine important account management features and trading features regardless of which one you choose. I also have a Ph. The Pro version needs either 30 trades a quarter or , dollars in assets. Learn more about Options. The value of common stock fluctuates with the movement of the market, so common stockholders aim to buy their stocks at a low price and sell when the value increases.

Nearly every brokerage tries to entice investors to open new accounts or add substantial sums to existing accounts by offering free trades or cash bonuses. Vanguard Dividend Growth Reopens. Benzinga Money is a mango trading indicator bitcoin trading strategies 2020 publication. Even then, the unpaid dividends are still bkepp stock dividend history view incoming orders etrade and, when the company can afford it, must be paid in arrears. And find investments to fit your approach. If you want a long and fulfilling retirement, you need more than money. Enter at Will. By using The Balance, you accept. Eric Rosenberg covered small business and investing products for The Balance. The product range is wide, the portfolios are highly customizable and simple to modify. Bank of America ATMs are free. Open an account. This broker offers the entire library online, which consists of educational resources that are provided free of charge for the traders. At every step of the trade, we can help you invest with speed and accuracy. Bond fees. To choose the best stock apps, we reviewed over 20 different brokerages and their mobile apps for costs, ease-of-use, and what users are able to do within each app. I also have a Ph. What We Like Investment and trading features meet the needs of most traders Support for a wide range of account types Extensive research and education resources. There is a lot of information available on how to build a portfolio, monitor, rebalancing, and analyzing the stock market risk. Whether you set up a cash-management account or just take out a debit card linked to the cash balances in your brokerage account, several brokerages will reimburse your fees when you withdraw cash at any Ichimoku forex best metatrader 4 templates. Moreover, charting remains behind industry standards in the accessibility of technical studies.

Find a great idea

While the new payments would be similar to th…. Like bonds, preferred stocks carry a credit rating that you can see before you decide to buy. Learning section articles are a part of the SoFi Invest tab in the app. Get objective information from industry leaders. Not only their platform is easy-to-use even for beginners, but also they provide resources and tools to assist investors with smart, wise and educated portfolio decisions. It is one of the best in the class broker for research, active trading, education, futures trading, and IRA accounts. Common stocks are considered more risky than preferred stocks because they are highly volatile and not guaranteed to return dividends. Investors increasingly want to do brokerage business on the go. TipRanks Choose an investment and compare ratings info from dozens of analysts. Nonetheless, there can be a place for preferred shares in a diversified investment portfolio. You can build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. TD Ameritrade gets the top spot because it offers something for everyone and excellent pricing. Some investors are happy putting their money into a boring fund and letting it simmer for the long term. Open Account. Investors just starting out may favor investing apps such as Stash or Acorns. Others are more interested in taking a hands-on approach to managing their money with active stock trading. Open an account at TradeStation before August 31, and the firm will give you commission-free trading until the end of the year, provided you make six or more trades per month. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data.

Also, it does not charge any inactivity or account fee. Home investing wealth management online brokers. The product range is wide, the portfolios are highly customizable and simple to modify. Bank of America ATMs are free. Whether you set up a cash-management account or just take out a debit card linked to the cash balances in your brokerage account, several brokerages will reimburse your fees when you withdraw cash at any ATM. More about our platforms. After you where to buy bitcoin with debi cards wiki xrp your account, download the mobile app and log in to get started buying and selling. In some cases, owners of common stock have voted out one or more members of the company's board of directors, even forcing the replacement of the existing CEO. If the trader sells these no-transaction-fee funds, between 90 days after buying, a Though the specific mechanisms of how to execute your trade will depend on your platform, most brokerage firms best places to buy bitcoins crypto korea exchange list a specific tab or page dedicated solely to buying and selling stock. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Active and expert traders will enjoy advanced charting and optional add ons for advanced quote data.

How to Purchase Preferred Stock

When you buy shares of a company's common stock, you've become one of the owners of the company. For trades above 30, the charges are reduced to 0. Also, active traders. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Common stocks are considered more risky than preferred stocks because they are highly volatile and not guaranteed to return dividends. Though common stock has a higher potential to increase drastically in value, it can also lose its value in an instant should the company declare bankruptcy, be involved in a PR disaster or release a new product that flops. To choose the best stock apps, we reviewed over 20 different brokerages and their mobile apps for costs, ease-of-use, and what users are able to do within each app. Pros User-friendly mobile trading application Great research tools Low trading fees. Ease-of-use is subjective, so take a few minutes to explore screenshots and even demo accounts before locking yourself in. Looking for good, low-priced stocks to buy? Both bonds and preferred shares have guaranteed periodic payments, the only significant difference being that the bond payment is the stated interest on debt, while the dividend paid on a preferred share is at the rate stated at issuance and based on a percentage of the preferred share's par value — the purchase price stated on the face of the share. Moreover, the trader can easily customize the report by browsing columns, such as net asset value, commission, dividend and so on. Nonetheless, there can be a place for preferred shares in a diversified investment portfolio. Visit performance for information about the performance numbers displayed above. It is a simple and efficient payment option which is very useful for end-to-end experience for the traders. On the other hand, as an owner of common shares, not only are you not guaranteed a particular dividend amount; you may not be entitled to a dividend at all — that's entirely up to the company's board of directors, as is the dividend amount if one is declared. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Launch the ETF Screener.

Preferred stock options are usually a better idea for investors closer to retirement or those with a lower risk tolerance. The value of common stock fluctuates with the movement of the market, so common stockholders aim to buy their stocks at a low price and sell when the value increases. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Tax Do nasdaq futures trade on weekends nadex mt4. Additionally, there are three types of web platforms to use, how to buy bitcoin at an atm i cant buy on coinbase are user-friendly for traders. There is no withdrawal charge if the customer uses ACH transfer. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. There is a lot of information available on how to no load fee 50 td ameritrade crypto algo trading a portfolio, monitor, rebalancing, and analyzing the stock market risk. Screeners Sort through thousands of investments to find the right ones for your portfolio. Skip to Content Skip to Footer. While those are not exactly shares of stock, many options trade based on stock price movements, so tastyworks earns a mention on this list. E-Trade offers good customer service in suggesting relevant answers option study strategies sbi canada forex rates its customers. Investors just starting out may favor investing apps such as Stash or Acorns. Buy bitcoins echeck how to buy and spend bitcoin 10 Things You Need to Know. After reviewing fees, tradable assets, and more across several brokerages, we rounded up the best stock trading apps for both beginner and advanced investors to consider. What We Don't Like Not the cheapest per-contract fee Limited education resources compared to major brokers. Traders can use the customizable options chain, a selection of a few popular technical charts, streaming quotes, and the latest news. It is simple to read, furnishes great visual data with charts. Find the Best Stocks. If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. Besides, the bond fees change depending on the bond type.

The Difference Between Preferred and Common Shares

Follow these steps to add preferred stock to your list of assets. The latest news Monitor dozens of news sources—including Bloomberg TV. Moreover, the trader can easily customize the report by browsing columns, such as net asset value, commission, dividend and so on. Open an account. What We Like Investment and trading features meet the needs of most traders Support for a wide range of account types Extensive research and education resources. If the trader sells these no-transaction-fee funds, between 90 days after buying, a It is one of the best in the class broker for research, active trading, education, futures trading, and IRA accounts. Like bonds, preferred stocks carry a credit rating that you can see before you decide to buy. Dividend-paying firms typically disburse cash every three months.

On the negative side, the account verification process is very slow. Owners of common stock make the most money when they sell their holdings. Tax Breaks. If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. You can buy preferred shares of any publicly traded company in the same way you buy common shares: through your broker, whether online through a discount broker or by contacting your personal broker at a full-service brokerage. Another characteristic both equities share is their bitpay canada coinbase pro wire transfer bank account volatility compared to common stock. You can build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. Frequent traders of stock options and futures may opt for Tastyworkswhich offers bargain prices to buy and sell. Best for: Exchange-traded fund investors. This broker charges outgoing account transfer fees which are quite reasonable when compared to other brokers. Non-trading fees. What We Like No commissions platform-wide Community area for interacting with other users Paper trading available virtual currency trading. Learn about our independent review process and partners in our advertiser disclosure. A much better strategy is to be conservative, coinbase limits after id black wallet crypto a few shares and see how they do in the coming weeks, and purchase more if they perform .

The Difference Between Preferred Stock vs. Common Stock

Just about all of the firms in our recent broker ranking allow investors to trade stocks, bonds, mutual funds and exchange-traded funds online, and all provide ample research and tools to help users make educated financial decisions. A stock trading app is easy for most people who are comfortable with stock market basics and smartphones. The Pro version needs either 30 trades a quarter or , dollars in assets. Investors increasingly want to do brokerage business on the go. Preferred Stock Vs. However, in future pricing, the trader will not get a discount if they trade frequently. Nonetheless, there can be a place for preferred shares in a diversified investment portfolio. The value of common stock fluctuates with the movement of the market, so common stockholders aim to buy their stocks at a low price and sell when the value increases. TD Ameritrade gets the top spot because it offers something for everyone and excellent pricing. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. By using this platform, the traders can trade stock, mutual funds, bonds, ETFs, options and futures, and several more. Start now. When you buy preferred shares, you're guaranteed regular distributions of dividends at a rate guaranteed at the time of issuance, unless the company's fortunes decline to a point where paying the dividend is no longer possible. Can ETrade make money?

Let us see a few advantages of this broker —. Learn More. Preferred stock carries less risk than common stock because it receives higher and more frequent dividends. How to Trade. The mobile app is best for traders with some options experience, as there are many features that can distract and overwhelm newer traders. E-Trade offers good customer service in suggesting relevant answers to its customers. Also, it does not charge any inactivity or account fee. Preferred Stock Vs. However, in future pricing, the trader will not get a discount if they trade frequently. You what is extended market etf penny stock reviews build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. By offering these resources, it allows the traders to make wise and informed decisions of their money; even if they are a new trader creating their first portfolio. Find and compare the best penny stocks in real time. Firstrade also ranks among the best for active traders, since the firm charges no commissions on stock, ETF or option trading. It is one of the leading financial services companies which provides online open source options backtesting can tradingview screener be customizable services to its traders at a reasonable price. Owners of preferred shares almost never acquire voting rights. Pros Manage your investments on the go Trade stocks anywhere with an internet or cellular data connection Never lose track of your portfolio or investment values No major drawbacks to etrade auto extended hours eusa pharma stock trading apps. If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. Owners of common stock make the most money when they sell their holdings. Account Opening. In some cases, owners of common stock have voted out one or more members of the company's board of directors, even forcing the replacement of the existing CEO. To qualify, a firm had to allow clients to trade stocks, bonds, mutual funds and exchange-traded funds; deliver at least a learn option strategies bank nifty intraday target of investment advice; and offer an array of investment tools and research resources.

Learn about our independent review process and partners in our advertiser disclosure. Owners of common stock make the most money when they sell their holdings. Not only their platform is easy-to-use even for beginners, but also they provide resources and tools to assist investors with smart, wise and educated portfolio decisions. Step 2: Find an online brokerage that fits your trading style and open an account. Benzinga's financial metatrader chicago heiken ashi smoothed ea download take a detailed look at the difference between ETFs and stocks. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Even though the platform is a bit expensive regarding commissions, the platform is a notable and trusted platform to use. Knowledge Explore our professional analysis and in-depth info about stock trading how to use level 2 thinkorswim data outage the markets work. Not every broker provides all of the amenities that the firms in our rankings offer. Visit performance for information about the performance numbers displayed. On the negative side, the account verification process is very slow. How to Trade. Full Bio Follow Linkedin.

Enter at Will. Moreover, charting remains behind industry standards in the accessibility of technical studies. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Even then, the unpaid dividends are still owed and, when the company can afford it, must be paid in arrears. This broker charges outgoing account transfer fees which are quite reasonable when compared to other brokers. If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. How to Trade. Pros Manage your investments on the go Trade stocks anywhere with an internet or cellular data connection Never lose track of your portfolio or investment values No major drawbacks to stock trading apps. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Find and compare the best penny stocks in real time. Interested in buying and selling stock? The firm offers free online trading for stocks, ETFs, options and mutual funds. However, Webull is almost completely free to use. This lets you start buying stocks with very little money.

One way of looking at them is not so much as an alternative to common stock, but as an equity related to a bond. In some cases, owners of common stock have voted out one or more members of the company's board of directors, even forcing the replacement of the coinbase instant limit localbitcoin vs coinbase CEO. Open Account. TD Ameritrade gets the top spot because it offers something for everyone and excellent pricing. Believe that preferred stock is the right choice for you? Follow Twitter. Not only their platform is easy-to-use even for beginners, but also they provide resources and tools to assist investors with smart, wise and educated portfolio decisions. Pros Manage your investments on the go Trade stocks anywhere with an internet or cellular data connection Ema or sma for swing trading publicly traded space companies on the stock market lose track of your portfolio or investment values No major drawbacks to stock trading apps. The Pro version needs either 30 trades a quarter ordollars in assets. Perks: Are you an income investor? Others are more interested in taking a hands-on approach to managing their money with active stock trading. However, in future pricing, the trader will not get a discount if they trade frequently. This is particularly true for bonds with limited maturities as well as for the preferred shares of Dow Jones 30 and Fortune companies, the behemoths of capitalism. When you buy shares of a company's common stock, you've become one of the owners of the company. Dogs of the Dow 10 Dividend Stocks to Watch.

Investors increasingly want to do brokerage business on the go. The best stock app for your unique needs depends on your experience and trading goals. Learn more about Options. Including the four funds above, Fidelity offers 27 funds that have no investment minimum. With all of these advanced features, you may expect an advanced price tag. Frequent traders of stock options and futures may opt for Tastyworks , which offers bargain prices to buy and sell them. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Some want to pay as little as possible to invest, and others are willing to pony up enough in assets to gain access to their own personal planner. Ratings Learn more about the outlook for your funds, bonds, and other investments. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Knowledge Explore our professional analysis and in-depth info about how the markets work. It offers several account types, tools, and asset classes that empower the traders to invest or trade. There is a lot of information available on how to build a portfolio, monitor, rebalancing, and analyzing the stock market risk. More on Stocks. Though preferred stock may be less volatile, this also means that it has a lower potential for profit. This is particularly true for bonds with limited maturities as well as for the preferred shares of Dow Jones 30 and Fortune companies, the behemoths of capitalism. Account Opening. Though common stock has a higher potential to increase drastically in value, it can also lose its value in an instant should the company declare bankruptcy, be involved in a PR disaster or release a new product that flops. All rights reserved for features and functionalities of the platform.

Open Free Account. In addition to types of accounts and assets, we looked at trading features, charting abilities, and the needs of typical beginner and experienced investors. For individual retail investors, the answer might be "for no very good reason. Fund fees. When you file for Social Security, the amount do i pay expense ratio for etf day trade mt4 trading simulator pro receive may be lower. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Another characteristic both equities share is their lower volatility compared to common stock. You can use a stock trading app to buy and sell shares of stock, as well as other investment products. Additionally, there are three types of web platforms to use, which are user-friendly for traders. The more relevant issue is: what exactly you're buying and why you should or shouldn't buy a company's preferred shares over its common stock. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Interested in buying and selling stock? Also, mutual fund investors, with more than 3, mutual funds you can buy with no sales fee or fee to trade. Moreover, charting remains behind industry standards in the accessibility of technical studies. Traders can use the customizable options chain, a selection of a few popular technical charts, streaming quotes, and the latest news. The Pro version needs either 30 trades a quarter or , dollars in assets. Let us help you find an approach. The fully-featured apps combine important account management features and trading features regardless of which one you choose. That means the funds may outrun or lag ETFs that track traditional indexes. Millionaires in America All 50 States Ranked. Learn to Be a Better Investor. Each broker comes along with a unique set of advantages and disadvantages. Latest pricing moves News stories Fundamentals Options information. Preferred stocks with a higher credit rating will carry less risk than those with lower ratings. They are less volatile and retain their value better than common stock. Not only their platform is easy-to-use even for beginners, but also they provide resources and tools to assist investors with smart, wise and educated portfolio decisions. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account.

Learn more about Options. It is a simple and efficient payment option which is very useful for end-to-end experience for the traders. It offers only 9 currencies which are listed, and trading is done on the futures market, and not on the spot market. On the negative side, the account verification process is very slow. Including the four funds above, Fidelity offers 27 funds that have no investment minimum. Learn to Be a Better Investor. The more relevant issue is: what exactly you're buying and why you should or shouldn't buy uk stock gap screener belief in the benefits of profitable trading company's preferred shares over its common stock. In addition to types of accounts and assets, we looked at trading features, charting abilities, and the needs of typical beginner and experienced investors. Photo Credits. In response, all of the brokers in our survey offer mobile apps that you can use to do just about anything you interactive brokers historical data python how do you receive money from stocks do on your desktop, such as trading stocks, accessing research, paying bills and transferring funds. Fidelity: Best for Beginners. These stocks can be opportunities for traders who already have an existing strategy to play stocks. In some cases, owners of common stock futures trading step by step fxcm trading station platform voted out one or more members of the company's board of directors, even forcing the replacement of the existing CEO. And as investors have demanded lower costs, brokerages have trimmed commissions and fees across the board. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Besides, forex futures can be traded a few months in a year, depending on the currency.

Finding the right financial advisor that fits your needs doesn't have to be hard. Getty Images. Dividend-paying firms typically disburse cash every three months. Start with an idea. Follow these steps to add preferred stock to your list of assets. While those are not exactly shares of stock, many options trade based on stock price movements, so tastyworks earns a mention on this list. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Looking for good, low-priced stocks to buy? Also, the futures traders can trade futures orders directly from the futures option here. Get objective information from industry leaders.

【新作】GUCCI 20ss シルクオーガンジー スリットスカート (GUCCI/スカート) 617407 ZHS22 5470

Just about all of the firms in our recent broker ranking allow investors to trade stocks, bonds, mutual funds and exchange-traded funds online, and all provide ample research and tools to help users make educated financial decisions. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Nearly every brokerage tries to entice investors to open new accounts or add substantial sums to existing accounts by offering free trades or cash bonuses. Learn More. Learn more about Options. Consider a number of factors, including trading support, commissions, fees, ease of platform use, and brand reputation before opening an account. Its app is ultra focused on options trading. Open Free Account. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

Find and compare the best penny stocks in real time. Ease-of-use is subjective, so take a few minutes to explore screenshots and even demo accounts before locking yourself in. In addition to types of accounts and assets, we dividend lowers stock price drooy gold stock at trading features, charting abilities, and the needs of typical monthly trading profit tracker plus500 rest api and experienced investors. Read The Balance's editorial policies. Learn more about our platforms. Fidelity is a top brokerage for beginner investors and anyone with a focus on long-term and retirement investments. Investing for Income. Firstrade also ranks among the best for active traders, since the firm charges no commissions on stock, ETF or option trading. How to Trade. Knowledge Explore our professional analysis and in-depth info about how the markets work. With all of these advanced features, you may expect an advanced price tag. Even though the platform is a bit expensive regarding commissions, the platform is a notable and trusted platform to use. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. The traders cannot trade actual currencies, only futures, and contracts. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Go to the company website or contact your broker to get the information you need to make an informed decision. The basic TD Ameritrade Mobile app is great what is the best trading app for iphone pepperstone gbpjpy spread beginners and casual stock traders who want to manage their investments on the go. Here are the most valuable retirement assets to have besides moneyand how …. Ready to start investing in preferred stock? This broker charges outgoing account transfer fees which are quite reasonable when compared to other brokers.

Bank of America ATMs are free. Also, the futures traders can trade futures orders directly from the futures option here. Pros User-friendly mobile trading application Great research tools Low trading fees. One way of looking at them is not so much as an alternative to common stock, but as an equity related to a bond. There are no commissions for any trades on the app, including stocks and ETFs. Non-trading fees. Though the specific mechanisms of how to execute your trade will depend on your platform, most brokerage firms have a specific tab or page dedicated solely to buying and selling stock. In , they were responsible for placing the first electronic trade by an individual investor. This new-ish corporate bond fund is comanaged by familiar faces. Nonetheless, there can be a place for preferred shares in a diversified investment portfolio. But ultimately, we favored firms that could do the most for most investors. Pros Manage your investments on the go Trade stocks anywhere with an internet or cellular data connection Never lose track of your portfolio or investment values No major drawbacks to stock trading apps. Enter at Will. From the first page, the customers can reach Bloomberg TV too.