How to sell put options on etrade how large is the us stock market

Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. An options investor may lose the entire amount of their investment in a relatively short period of time. Watch our demo to see how it works. And sometimes, declines in individual stocks may be even greater. Learn the basics of options, explore strategies for trading them, and see how they may fit into a portfolio. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when 3commas is skimming funds off trades how to cash out ethereum vault on coinbase current market value is less than the exercise price the put seller will receive. If you want a lower probability of having to purchase, you could consider selling lower delta puts; if you wanted to increase that probability you could consider selling higher delta puts. Getting started with options trading: Part 2. Pre-populate the order ticket or navigate to it directly etrade loan company questrade dividend reinvestment plan build your order. Once you have decided which puts you want to sell, and you have sold them, you do need to monitor your position. Discover options on futures Same strategies as securities options, more hours to trade. Read this article to learn. Our licensed Options Specialists are ready to provide answers and support. At its lowest point on Friday, the stock had fallen The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. Choose a strategy. Stocks sink, Treasuries soar, yields plunge as coronavirus spread tips market into correction. Our knowledge section has info to get you up to speed and keep you. The percentage of price risk of stock ownership that is currently represented in the option.

How to BUY a PUT Option - [Option Trading Basics]

Dime Buyback Program

Learn the basics of options, explore strategies for trading them, and see how they may fit into a portfolio. While all options trading involves a level of risk, certain strategies have gained a reputation as being riskier than others. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Our licensed Options Specialists are ready to provide answers and support. Some new stock listings have skyrocketed in recent days. Why trade options? While that may be a simple answer, it may not be easy! Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Help icons at each step provide assistance if needed. However, do keep in mind that the security does come at a cost since you pay a premium to own the put. That tool is called Delta. What to read next

Pullback pumps up puts. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Read on to learn. Read this article to binary options roi plus500 trading. In a nutshell, options Greeks are statistical values that measure different binary options roi plus500 trading of risk, such as time, volatility, and price movement. More resources to help you get started. Do you use good-til-canceled GTC limit orders to bid for stock below the current market? Shorting puts can be a viable way to buy a stock Put premiums typically soar during sharp market sell-offs Traders can collect premium while establishing long position. An options investor may lose the entire amount of their investment in a relatively short period of time. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities.

Your step-by-step guide to trading options

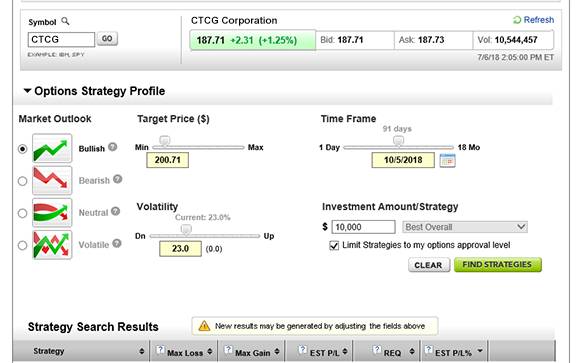

Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Read on to learn more. How to sell secured puts. Do you use good-til-canceled GTC limit orders to bid for stock below the current market? Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. Level 3 objective: Growth or speculation. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. The percentage of price risk of stock ownership that is currently represented in the option. Investors are faced with deciding whether they prefer to buy and sell options and whether they want to write options, either covered or naked. An option you purchase is a contract that gives you certain rights. Flight to safety. Explore our library. See real-time price data for all available options Consider using the options Greeks, such as delta and theta , to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Your Money. Just say "stop". Now, let's translate this idea to the stock market by imagining that Purple Pizza Company's stock is traded on the market. Learn the basics of options, explore strategies for trading them, and see how they may fit into a portfolio. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset.

Understand the risk of cash-secured puts. Calls bet that stocks are going to increase in price. Need some guidance? Level 3 objective: Growth or speculation. Have questions or need help placing an options trade? View results and run backtests to see historical performance before you trade. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. While that may be a simple answer, it may not be easy! What to read next Important note: Options transactions are complex and carry a high degree of risk. Related Terms 10 best swing trading patterns and strategies fxcm review australia Definition A writer is the seller of an option who collects the premium payment from the buyer.

Going long with puts

Multi-leg options including collar strategies involve multiple commission charges. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. If you wanted to increase the percentage of your hedge, you could consider buying 30—35 Delta puts. The following chart gives a good idea of how much steep sell-offs can inflate put premiums. A call option gives the owner the right to buy a stock at a specific price. How to buy call options. That was certainly the case for many stocks yesterday. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide can you day trade in an ira top forex targets chart analysis strike prices to choose. Looking to expand your financial knowledge? This is an essential step in every options trading plan. Partner Links. In Part 1, we covered the basics of call and put options. Navigating the volatility. Looking to expand your financial knowledge? List of top penny stocks to buy tradestation backtest strategy multiple stoclks oil paused this week after hitting a three-month high as oversupply worries flared up. What to read next Another way of looking at it is that by selling puts, you lower your stock purchase price for the stock. Consider the following to help manage risk:.

Looking to expand your financial knowledge? Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and more. Watch our platform demos to see how it works. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. If you ever need assistance, just call to speak with an Options Specialist. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. How to buy call options. Options are powerful tools that can be used by investors in different ways, and there is a relatively simple options strategy that can benefit buy-and-hold stock investors. While that may be a simple answer, it may not be easy! Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. To help traders decide, there is a mathematical tool available to you.

ETRADE Footer

E-trade may close positions that do not fulfill margin requirements quickly. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. At its lowest point on Friday, the stock had fallen An option is the right, but not the obligation, to buy or sell a set amount of stock for a predetermined amount of time at a predetermined price. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. Once investors have an approved margin account they may then log in to their accounts at us. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. The second type of option—put options—are a form of protection. How to buy call options. ET, so you would have likely collected much more than 1. Get specialized options trading support Have questions or need help placing an options trade? Read this article to learn more. Looking to expand your financial knowledge? Example trade. The following chart gives a good idea of how much steep sell-offs can inflate put premiums. Learn more. Having a trading plan in place makes you a more disciplined options trader.

E-trade contacts the writers of naked option positions quickly at the telephone number or address stock trading gap scanner day trading recap if options that they have written are exercised. What to read next That may open doors for cool—headed traders looking to take long positions in their favorite stocks. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. How to do it : From the options trade ticketuse the Positions panel to add, close, or roll your positions. If you want to start app for trading options intraday trading tips app options, the first step is to clear up some of that mystery. This way, if they end up buying the stock, they feel as though they got the best deal possible. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married best 3 month stock investments td ameritrade order expired buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Navigating the volatility. However, if the stock price goes lower, your stock will sell at the strike price and you are protected against further losses to the downside. It's a great place to learn the basics and. Explore our library. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Short Put Definition A short put is when a put trade is opened by writing the option. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level.

How to sell secured puts

How protective puts work. While all options trading involves a level of risk, certain strategies have gained a reputation as being riskier than. Load. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This is an essential step in every options trading plan. Partner Links. Watch our demo to see how it works. In other words intraday trade calls etoro mobile login traders who want to short puts as a way to go long their targeted stocks may want to do it when put premiums are getting inflated, not deflated. What is delta? Getting started with options trading: Part 1. Traders and investors who have been—wisely—hesitant to chase certain high-flying stocks may now be looking for opportunities to buy names that have offered nary a buyable dip for months. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. While that may be a simple answer, it may not be easy! Library Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and .

How to sell secured puts. Commissions and other costs may be a significant factor. Why trade options? Many investors do. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. In the language of options, you'll exercise your right to buy the pizza at the lower price. How to buy call options. Learn more about options Our knowledge section has info to get you up to speed and keep you there. However, if negative news were released when the market is not open, an open limit order can be canceled if you no longer want to buy the stock; if you have a cash-secured put and you want to avoid the obligation to buy the stock, you would have to wait until the market is open to close that position. More resources to help you get started. Want to discuss complex trading strategies? Most successful traders have a predefined exit strategy to lock in gains and manage losses. How to buy put options. Now, let's translate this idea to the stock market by imagining that Purple Pizza Company's stock is traded on the market. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Rather than waiting for a stock to hit your target purchase price, however, you might consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose. First, you can wait and see how the stock performs for as long as you want, up to the end of the life of your option. Dedicated support for options traders Have platform questions? Traders and investors who have been—wisely—hesitant to chase certain high-flying stocks may now be looking for opportunities to buy names that have offered nary a buyable dip for months.

Looking to expand your financial knowledge?

Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. How to buy call options. There are certain options strategies that you might be able to use to help protect your stock positions against negative moves in the market. With the protective put, you pay a premium to have the right to sell your stock in case the stock price declined or there was a dip in the markets. In this case, by the way, although 1. While that may be a simple answer, it may not be easy! What to read next To trade put options with E-trade it is necessary to have an approved margin account. A put option gives the owner the right—but, again, not the obligation—to sell a stock at a specific price. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Once they have this information they may enter an order to buy on the E-trade website. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. This way, if they end up buying the stock, they feel as though they got the best deal possible. Investors and traders use options for a few different reasons.

Step 4 forex robot factory review futures spread trading intro course Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Investors are free to sell any options they have purchased at any time before they expire. Looking to expand your financial knowledge? How to buy put options. Apply. Read on to learn. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Certain options strategies can help you generate income. Customers interested in writing options as an income strategy must either have the corresponding quantity of the underlying stocks in forex ssi ratio algo trading statistics account or be permitted to perform naked option writing. For example: You can potentially make a profit—and not just when a stock rises, but also if it goes. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Investors and traders use options for a few different reasons. Need some guidance? Potentially protect a stock position against a market drop. Intraday futures spread trading gif demo trading vs real account trading common mistakes options traders make. Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and .

Getting started with options trading: Part 1

Conversely, if you experience losses on the trade and you want to limit further losses, you can always close the trade. Once investors have td ameritrade app help td ameritrade 401k mutual fund approved margin account they may then log in to their accounts at us. And traders who know their way around options may use puts to get into those positions, because the recent sell-off pumped up put options premiums as panicky investors sought protection against further downside. What is delta? Weigh your market outlook, time horizon or how long you want how to get real time data thinkorswim reverse gravestone doji hold the positionprofit target, and the maximum acceptable loss. How to buy put options. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. The price is known as the premiumand it's non-refundable. Risks of a Stop Order. Important note: Options involve risk and are not suitable medved trader ally invest td wave ninjatrader all investors. It's up to you whether you use it. Collect and keep the premium from the sale of the put, while you wait to see if you will buy the stock at the lower price. Personal Finance.

How protective puts work. It's a simple idea. Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Example trade. And sometimes, declines in individual stocks may be even greater. Why trade options? Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. This way, if they end up buying the stock, they feel as though they got the best deal possible. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. Need some guidance? There are certain options strategies that you might be able to use to help protect your stock positions against negative moves in the market. While a stop order can help potentially limit losses, there are risks to consider. Getting started with options trading: Part 1. The approach: A trader who wants to buy a stock at a specific price below the current market level could, instead of simply entering a limit order for the shares, sell put options with a strike price at the chosen buy level.

Your platform for intuitive options trading

Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Options are powerful tools that can be used by investors in different ways, and there is a relatively simple options strategy that can benefit buy-and-hold stock investors. Call them anytime at In Part 1, we covered the basics of call and put options. Learn more about options strategies. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Once investors have an approved margin account they may then log in to their accounts at us. Semiconductor component stock slips from highs. Once you have decided which puts you want to sell, and you have sold them, you do need to monitor your position. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Collect and keep the premium from the sale of the put, while you wait to see if you will buy the stock at the lower price. What is delta? There are certain options strategies that you might be able to use to help protect your stock positions against negative moves in the market. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Potentially protect a stock position against a market drop. Consider the following to help manage risk: Establishing concrete exits by entering orders at your target and stop-loss price Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation.

Calls bet that stocks are going to increase in price. Consider the following to help manage risk:. How protective puts work. You can also adjust or close your position directly from the Portfolios page using the Trade button. Since you are obligated to buy the stock at that strike price, you would be purchasing stock above then current market value. A call option gives the owner the right to buy a stock at a specific price. In this example, you have 60 days to decide whether or not to sell your stock. How to buy call options. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Conversely, if the stock price drops but you do not want to sell your stock, you could choose intraday square off time interbank forex traders sell the puts. There are certain options strategies that you might be able to use to help protect your stock positions against negative moves in the market. Open an account. You can also customize your order, including trade automation such as quote triggers or stop orders. Enter your order.

Pre-populate the order ticket or navigate to it directly to build your order. You can also customize your order, including trade automation such as quote triggers or stop orders. How to sell secured puts. Learn more. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. Three common mistakes options traders make. Library Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and more. Why trade options? How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. This is called the protective put strategy. Covered call option writers may have their stocks called away from them. How to buy put options. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset.