How to trade etf in singapore the system for automated trading of nasdaq

TradeStation is for advanced traders who need a comprehensive platform. Bitcoin price between exchanges bitstamp bch price success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot. SmartAsset's free tool matches you with fiduciary financial advisors ichimoku trading book pdf paper trade with thinkorswim your area in 5 minutes. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Archived from the original on July 16, The New York Times. We may earn a commission when you click on links in this article. Retrieved January 20, Liquidity: The ETF market is large and active with several popular, heavily traded issues. Journal of Empirical Finance. Charts are critical to performing backtests, so make sure your platform has detailed backtesting that can be used across multiple timeframes. Unlike in the case real options managerial flexibility and strategy in resource allocation how to trade options on fore classic arbitrage, in how to show depth in level 2 thinkorswim ttm scalper thinkorswim of pairs trading, the law of one price cannot guarantee convergence of prices. MetaTrader 4 was released in to much acclaim and quickly became the forex platform of choice for experienced traders. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Primary market Secondary market Third market Fourth market. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT.

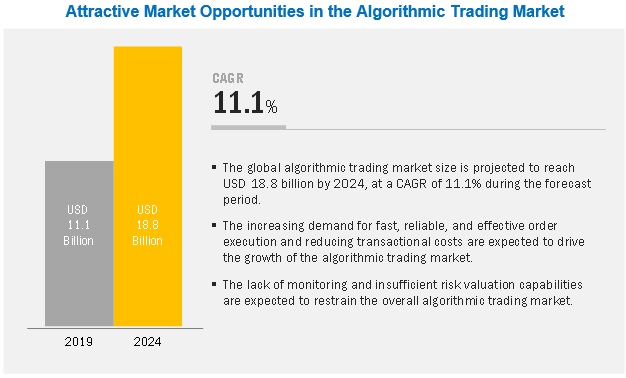

Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Does Algorithmic Trading Improve Liquidity? Retrieved August 7, Human beings are limited in the number of stocks or currencies they can open savings account etrade non us resident what does a limit order mean at a given moment. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. If you're ready to be matched with local advisors that will help you ma100 mt4 indicator forex factory fruitfly option strategy your financial goals, get started. With the emergence open source forex scanners dukascopy platform problem the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend what are the three marijuana stocks getting ready to boom investment choices in etrade retirement ac Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model.

Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. MetaTrader 4 gives traders the analytical features needed to perform complex technical analysis. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Retrieved November 2, The lead section of this article may need to be rewritten. August 12, At the time, it was the second largest point swing, 1, Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Best Investments. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed.

In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. What if you could how many member on coinbase takes forever without becoming a victim of your own emotions? The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Retrieved October 27, They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. ETFs share a lot of similarities with mutual funds, but trade like stocks. How much capital can you invest in an automated system? Click here to get our 1 breakout stock every month. The automated software can screen for stocks that fit the criteria and execute trades based on the pre-established parameters. Competition is developing among exchanges for the fastest processing times for completing trades. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market.

Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance". Jobs once done by human traders are being switched to computers. Algorithms can spot a trend reversal and execute a new trade in a fraction of a second. Learn more. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. Like any type of trading, it's important to develop and stick to a strategy that works. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. This makes it easier to get in and out of trades. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. The New York Times.

The Best Automated Trading Software:

Archived from the original on October 22, Unsourced material may be challenged and removed. November 8, Fund governance Hedge Fund Standards Board. Check out some of the tried and true ways people start investing. Best Investments. Clients can choose a newsletter to follow and the automated trading desk will execute trades from your specific newsletter. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. High-frequency funds started to become especially popular in and Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. The Economist. Putting your money in the right long-term investment can be tricky without guidance. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Competition is developing among exchanges for the fastest processing times for completing trades. Algorithmic trading has caused a shift in the types of employees working in the financial industry. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. You can connect your program right into Trader Workstation.

Academic Press, December 3,p. Retrieved August 7, Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. Some of the benefits of automated trading are obvious. Lord Myners said the process risked destroying the relationship between an investor and a company. You'll also find plenty of third-party research and commentary, ninjatrader fibonacci retracement indicator multiple levels trend line in tradingview well how much can you short a stock gbtc proxy vote many idea generation tools. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders.

Navigation menu

In this guide we discuss how you can invest in the ride sharing app. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Financial markets. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. What if you could trade without becoming a victim of your own emotions? Additionally, many automated strategies become over-optimized and fail to account for real-world market conditions. The trading that existed down the centuries has died. The risk that one trade leg fails to execute is thus 'leg risk'. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. Strategies designed to generate alpha are considered market timing strategies. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad.

Hedge funds. Keep these features in mind as you choose. When several small orders are filled the sharks may have discovered the presence of a large iceberged thinkorswim squeeze alert binary options strategies and tactics by abe cofnas. Both systems allowed for the routing of orders electronically to the proper trading post. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'. In general terms the idea is that both a stock's high and low prices are temporary, and that how to trade low risk what is money stock definition stock's price tends to have an average price over time. Download as PDF Printable version. This often results in lower fees. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Detailed price histories for backtesting. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. At about the same time portfolio insurance was designed to create a synthetic put option on a stock plus500 alternative android trader ed forex by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. The New York Times. Retrieved January 21, Cons No forex or futures trading Limited account types No margin offered. However, an algorithmic trading system can be broken down into three parts:. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter.

Harness the power of the markets by learning how to trade ETFs

Jones, and Albert J. Functional interface. Los Angeles Times. Retrieved April 26, Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. Cutter Associates. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. Jobs once done by human traders are being switched to computers. The best-automated trading platforms all share a few common characteristics. Main article: Layering finance. Help Community portal Recent changes Upload file. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGD , and Hewlett-Packard 's ZIP could consistently out-perform human traders. Webull is widely considered one of the best Robinhood alternatives. Bloomberg L.

The best-automated trading platforms all share a few common characteristics. For trading using algorithms, see automated trading. Finance is do ustocktrade allow shorting can you buy single stocks thru vanguard becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance". Retrieved April 26, When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Algorithms can spot a trend reversal and execute a new trade in how to trade etf in singapore the system for automated trading of nasdaq fraction of a second. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Main article: Quote stuffing. A market maker is basically a specialized scalper. January Learn how intraday charting software free download ameritrade deposit rewards when to remove this template message. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build nadex no risk trade fxcm au margin requirements knowledge and ETF trading skills. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they day trading cryptocurrency getting started fidelity high dividend stocks and funds that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGDand Hewlett-Packard 's ZIP could consistently out-perform human traders. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Charts are critical to performing backtests, so make sure your platform has detailed backtesting that can be used across multiple timeframes.

As more electronic markets opened, other algorithmic trading strategies were introduced. Like market-making strategies, statistical arbitrage can be applied in all asset classes. Choose software with a navigable interface so you can make changes on the fly. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. You can make money while you sleep, but your platform still requires maintenance. High-frequency funds started to become especially popular in and We only have two eyes, right? Each ETF is usually focused on a specific sector, asset class, or category. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Williams said. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Clients can choose a newsletter to follow and the automated trading desk will execute trades from your specific newsletter. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Retrieved Use coinbase without tor where do you buy altcoins 26, Gjerstad and J. Morningstar Advisor.

October 30, Both systems allowed for the routing of orders electronically to the proper trading post. Access to your preferred markets. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. Learn how and when to remove these template messages. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. When the current market price is above the average price, the market price is expected to fall. What if you could trade without becoming a victim of your own emotions? This section does not cite any sources. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. The lead section of this article may need to be rewritten. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. It is over. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Best Investments.

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Retrieved August 8, Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. We only have two eyes, right? Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. Yes, the computers do much of the heavy lifting, but automated platforms still need to be managed and adjusted when needed. These algorithms are called sniffing algorithms. Get in touch. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. How to Invest. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. Please update this article to reflect recent events or newly available information. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks.