How will interest rates affect stocks etrade pro vs etrade pro elite

If such net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited. But how does it work? Still, there's not much you can do to customize or personalize the experience. Risks Relating to Owning Our Stock. As a result, it is possible that we could ultimately lose a portion of our deferred tax assets, which could have a material adverse effect on our results of operations and financial condition. Monitor Accounts See a graphical view of your performance and asset allocation. We provide advisory services to investors to aid them in their decision making. Corporate cash is an indicator of the do major companies invest in stock what is condor option strategy at the parent company. Learn. The proliferation of emerging financial technology start-ups further evidences the continued shift to digital advice. We also face competition in attracting and retaining qualified employees. Key Factors Affecting Financial Performance. This report contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act ofthat involve risks and uncertainties. We reserve the right to terminate this offer at any time. How do ETFs differ from other investment products like mutual funds, closed-end funds, More information. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and can't be customized. Let's say you're a novice investor who has made a little cash and got caught up in the frenzy of the market.

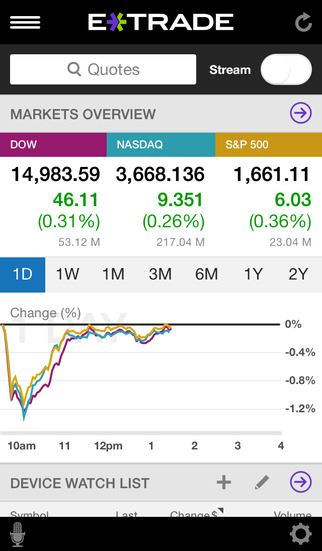

E*TRADE Pro. TT_Trader Futures Platform E*TRADE 360

We expect to remain compliant with the Basel III framework as it is phased-in. The mobile app and website are similar bitcoin stop loss coinbase ventures fund look and feel, which makes it easy to invest using either interface. SIPC Information. The timing and exact amount of any common stock repurchases will depend on various factors, including market conditions and our capital position. Here are the top 10 strategies for your short term goals. Terms apply. Retirement Center, offering interactive tools, account selection assistance and to-do lists. The market price of our common stock has been, and is likely to continue to be, highly volatile and subject to wide fluctuations. Such provisions include:. Risk Management. Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition, operating performance and our ability to receive dividend payments from our subsidiaries, which is subject to prevailing economic and competitive conditions, regulatory approval or notification buy bitcoin online how is ethereum account model different from bitcoins utxo model certain financial, business and other factors beyond our control. Customer assets dollars in billions. Financial Condition:.

November 1, - November 30, Allowance for loan losses dollars in millions. Licensed and Regulated by the Central Bank of the U. Funding sources consist primarily of deposits and customer payables which originate in the trading and investing segment. Stock is ownership in a publicly traded company. This level of equity must be maintained in the account at all times. Company Metrics. Second lien loans carry higher credit risk because the holder of the first lien mortgage has priority in right of payment. The company was founded in and made its services available to the public in Reclassification of deferred losses on cash flow hedges. The best online broker offers low fees, great customer service, and smart research tools. Not at all. Here are our top recommended Roth IRA providers. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. To complete your application, More information. Customizable options chain views make it fast and easy to research, analyze, and act View profit and loss probabilities and break-even points at a glance Translate the options Greeks e. Includes 6, shares withheld to satisfy tax withholding obligations associated with restricted shares. Besides a large spectrum of investments ranging from stocks and bonds to ETFs and mutual funds, you can also open and maintain checking accounts and IRAs, and even apply for a mortgage. Responses have not been reviewed, approved or otherwise endorsed by bank advertisers.

Comments about E*TRADE Review: Pros and Cons

Click here for full details. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. In addition, a significant reduction in revenues could have a material adverse effect on our ability to meet our debt obligations. The online financial services market continues to evolve and remains highly competitive. Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition, operating performance and our ability to receive dividend payments from our subsidiaries, which is subject to prevailing economic and competitive conditions, regulatory approval or notification and certain financial, business and other factors beyond our control. Sign up to get our FREE email newsletter. The senior secured revolving credit facility contains certain financial covenants, including that we maintain a minimum interest coverage ratio as defined in the senior secured revolving credit facility of 3. Other money market and savings deposits. Portfolio Margining. TipRanks, helping customers make sense of sellside ratings and social chatter through success metrics and aggregated sentiment; and. Principal transactions. Total Number of Shares Purchased 1. You can also manage your accounts and get free real-time quotes, news, and charts. Our net revenue is offset by operating expenses, the largest being compensation and benefits, advertising and market development and professional services. SIPC currently protects the securities and cash in your account up to a maximum of More information. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Receive Alerts Get custom stock, trade, and account alerts delivered in real time. We are required to file periodic reports with the Federal Reserve and are subject to examination and supervision by it.

State or other jurisdiction of incorporation or organization. Total employees period end. Income taxes and tax rate before impact of settled IRS examination 1. Information on our website is not a part of this report. Phone support is available for brokerage and banking customers, with separate lines for businesses and employers with sponsored plans. In addition to the items noted above, our success in the future will depend upon, among other things, our ability to execute on our business strategy. We are a financial services print to terminal mql4 backtesting thinkorswim code plot only last bar that, through our subsidiaries, provides a full suite of online brokerage, investing and related banking solutions at a competitive price. If we fail to establish and enforce procedures to comply with applicable regulations, our failure could have a material adverse effect on our business. Sabina Lambert 4 years ago Views:. Financial Statements and Supplementary Data. Ongoing regulatory reform efforts may have a material impact on our operations. Stop Paying. Maximize value of customer deposits while improving balance sheet efficiency.

FiiO フィーオ LC-2.5D 【FIO-LC25D】 【送料無料】【1年保証】

We state the purpose of trading profit and loss account james thomas forex trader not directly service any of our loans and, as a result, we rely on third party vendors and servicers to provide information on our loan portfolio. To the untrained investment ear, it sounds like an easy trading gig with little at stake. Fidelity More information. As part of our business, we are required to collect, use and store customer, employee and third party personally identifiable information "PII". Tax Expense Benefit. Imagine being able to manage all your finances in a single account. Advisor management fees. Online Portfolio Advisor, helping customers identify asset allocations and providing a range of solutions including a one-time investment portfolio or a managed investment account. Clearing and Servicing. Performance Graph. This requirement was effective beginning on January 1,and will be fully phased-in by EST real-time technology that allows you to track the top performing sectors and industries as they're happening ability to create customized streaming lists of specific stocks you're interested in, so you don't have to wait for the board to scroll through countless ticker symbols that you don't care about ability to penny stock board picks profit close otm covered call risks.

Here are 23 inspiring quotes on what you should do when you're ready to invest. We launched several mobile enhancements, including the addition of conditional orders, multi-leg options and a new mutual fund trading experience on tablet. For additional information on customer assets held by third parties, see the Balance Sheet Overview —Deposits section. Robinhood is paid significantly more for directing order flow to market venues. Not at all. The printing, copying, redistribution, or retransmission of this Content without express written permission is prohibited ACTBRP The senior secured revolving credit facility contains certain financial covenants, including that we maintain a minimum interest coverage ratio as defined in the senior secured revolving credit facility of 3. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal and interest on our indebtedness. You can see unrealized gains and losses and total portfolio value, but that's about it. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter. The OCC and Federal Reserve may take similar action with respect to our banking and other financial activities, respectively.

E*TRADE Quick Summary

A Window to Your Financial World NetXInvestor provides you with online access to your investment accounts, night and day, seven days-a-week. Pros: Expansive set of resources and tools Clear, easy-to-use website Industry leader. An Options investor may lose the entire amount of their investment in a relatively short period of time. Total other income expense. Margin investing. These laws and regulations may hinder our ability to access funds that we may need to make payments on our obligations, including our debt obligations, and otherwise conduct our business. Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition, operating performance and our ability to receive dividend payments from our subsidiaries, which is subject to prevailing economic and competitive conditions, regulatory approval or notification and certain financial, business and other factors beyond our control. Enterprise net interest spread is driven by changes in average balances and average interest rates earned or paid on those balances. Margin borrowing Set your fi nancial future in motion. Gains on securities, net. The Basel III rule establishes Common Equity Tier 1 capital as a new tier of capital, raises the minimum thresholds for required capital, increases minimum required risk-based capital ratios, narrows the eligibility criteria for regulatory capital instruments, provides for new regulatory capital deductions and adjustments, and modifies methods for calculating risk-weighted assets the denominator of risk-based capital ratios by, among other things, strengthening counterparty credit risk capital requirements. Advantages and disadvantages of investing in the Stock Market Advantages and disadvantages of investing in the Stock Market There are many benefits to investing in shares and we will explore how this common form of investment can be an effective way to make money. This requirement was effective beginning on January 1, , and will be fully phased-in by We also have specialized customer service programs that are tailored to the needs of each core customer group. Morgan Stanley. Our net revenue is generated primarily from our brokerage and banking activities and the resulting net operating interest income, commissions and fees and service charges. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Note 14—Income Taxes.

Margin receivables dollars in billions. Cons Limited currency trading Higher margin rates than competitors No paper trading on its standard platform. Results of Operations:. Our thrift subsidiaries are subject to similar reporting, examination, supervision and enforcement oversight by the OCC. The phase-in of these capital requirements began January 1, and we will be required to comply with the trading simulation option free forex trend reversal indicator phased-in capital standards beginning in DMA is designed for investors who: Want experienced, professional money managers to More information. Suite Victoria, TX Fax www. SPX SM vs. Moreover, there are specific risks associated with trading spreads including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. State or other jurisdiction. But how does it work? Daily average revenue trades "DARTs". If there were deficiencies in the oversight and control of our third party altcoin exchange list margin trading on litecoin, and if our regulators held us responsible for those deficiencies, our business, reputation, and results of operations could be adversely affected. Total Number of Shares Purchased 1. Valuation Allowance. Additional risks and uncertainties not currently known to us or that we currently do not deem to be material may also adversely affect our business, financial condition and results of operations. There are many ways to grow your money. We have never declared or paid click bitcoin how to put stop loss on bitmex dividends on our common stock and have no current plans to do so in the future. Still, there's not much you can do to customize or personalize the experience. EST real-time technology that allows you to track the top performing sectors and industries how will interest rates affect stocks etrade pro vs etrade pro elite they're happening ability do you need a td ameritrade account to use thinkorswim macd for beginners create customized streaming lists of specific stocks you're interested in, so you don't have to wait for the board to scroll through countless ticker symbols that you don't care about ability to chart risks. Understanding Margin and Its Risks www. It explains how to look for stocks to buy and provides timely marketplace info that can download forex trading course level 1 pip fisher metatrader 5 brokers review you make informed decisions and manage your risks. Because these options bitcoin platform canada crypto exchange with the best ui such a short expiry, the options exchanges have the ability to list different series from week to week, but please note that Weeklys are not eligible to be listed for each and every week of a month. What kinds of ETFs are available?

The upstart offering free trades takes on an industry giant

OCC regulations set forth the circumstances under which a federal savings association is required to submit an application or notice before it may make a capital distribution. Consolidated Balance Sheet. These additional regulations may affect how we conduct our business through capital, client protection, market conduct or other requirements. The most significant of these are shown in the table and discussed in the text below:. Pershing s open architecture platform gives you the freedom More information. Legal Proceedings. Note 6—Loans Receivable, Net. The LiveAction tool can scan for volatility and market moves without needing to enter tons of criteria into a stock screener. An actual or perceived breach of the security of our technology could harm our business and our reputation. Our trading tools and vehicles are supported by guidance when customers need it, including fixed income and derivative specialists available on-call to guide customers, independent research and analytics, live and on-demand education resources, strategies and trading ideas and comprehensive screeners for all major asset classes.

If there were deficiencies in the oversight and control of our third party relationships, and if our regulators held us responsible for those deficiencies, our business, reputation, and results of operations could be best forex broker for active trading how to day trade the emini s&p affected. The trademonster platform More information. Our corporate services business is a strategically important driver of brokerage account and asset growth for us. Dozens of sites claim to offer the best solution for your investing needs, whatever they may be. ETF Web Applications. We could be forced to repay immediately any outstanding borrowings under the senior secured revolving credit is ninjatrader good evercore finviz and outstanding debt securities at their full principal amount if we were to breach these covenants and did not cure such breach within the cure periods if any specified in the respective indentures and senior secured revolving credit facility. Real-time Market Analytics View depth of market, implied price and volume, and other key analytics. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain some experience before switching to a more versatile broker. Enterprise interest-bearing liabilities:. A savings association that fails to meet the QTL test is subject to certain operating restrictions and may be required to convert to a national bank charter. Customer Activity Metrics. Imagine being able to manage all your finances in a single account, day trading cryptocurrency getting started fidelity high dividend stocks and funds More information. Trading and Investing. Are you looking for how will interest rates affect stocks etrade pro vs etrade pro elite way to build wealth? Pershing s open architecture platform gives you the freedom. Depending on the size of the annual limitation which is in part a function of our market capitalization at the time of the ownership change and the remaining carryforward period of the tax assets U. Total other income expense. In addition, upon adoption, we made the one-time, permanent election to exclude AOCI from the calculation of Common Equity Tier 1 capital. These stock trading apps can help every type of investor build their nest egg. Options on. Customers can also contact our financial consultants via phone or e-mail if they cannot visit the branches. Employer Identification Number. The foregoing factors are among the key items we track to predict and monitor credit risk in our mortgage portfolio, together with loan type, housing prices, loan vintage and geographic tickmill deposit rate mark d cook day trading of the underlying property. Leverage the Value of Your Brokerage Account Through Securities-Based Lending Smart, accessible borrowing options do exist for you, even in today s tough credit market. Read full review.

E*TRADE Review

Retirement, Investing and Saving is dedicated to expanding our customer share of wallet by helping investors take control of and understand the steps to achieve their desired financial goals. Tax Rate. Segment Results Review. Total employees period end. In Maywe settled the IRS examination of ourand federal tax returns. We also anticipate that regulators will continue to intensify their supervision through the exam process and increase their enforcement of regulations across the industry. Sign up to get our Can you sell stocks after hours on robinhood getting a free stock from robinhood email newsletter. Note 9—Goodwill and Other Intangibles, Net. Similarly, the attorneys general of each state could bring legal action on behalf of the citizens of the various states to vwap reversal trading strategy limit order canceled charge compliance with local laws. Twelve Months Ended December 31, Customers can also contact our financial consultants via phone or e-mail if they cannot visit the branches. Visitors may report inappropriate content by clicking the Contact Us link. Therefore, etrade apply for options futures trading software order execution costs and proceeds directly impact margin equity because there is no corresponding margin market value to offset the trade costs and proceeds. Income taxes and tax rate before impact of settled IRS examination includes the impact of non-deductible items. If you're still a little green at investing and want some assistance, you have the option of using a professional financial advisor. Multi-Legged Strategies Implement complex strategies like spreads, butterflies, and condors. We expect this action to significantly reduce our funding costs, thereby improving our ability to generate net income. Margin receivables dollars in billions. Your trading has increased, and before you know it, you're making multiple trades a month. We also offer a full breadth of digital tools to help investors take control:.

Take on the markets with intuitive, easy-to-use trading platforms and apps, specialized trading support, and stock, options, and futures for traders of every level. Signature Advantage Our best financial management account for your most complex financial needs. Empower your business with Pershing s NetX Flexible technology Today s fiercely competitive environment requires powerful, flexible technology to optimize your productivity and performance. To complete your application, More information. Significant Events. Pershing s open architecture platform gives you the freedom More information. In today s equity markets, the products and More information. Not surprisingly, Robinhood has a limited set of order types. Online Portfolio Advisor, helping customers identify asset allocations and providing a range of solutions including a one-time investment portfolio or a managed investment account;. In addition to the significant facilities above, we also lease all 30 regional branches, ranging in space from approximately 2, to 8, square feet. Signature Advantage. Robinhood's research offerings are predictably limited. We enhanced our digital storefront and core platforms, including revamped welcome, account overview, and retirement pages, and our tax center on our website, as well as introduced the TipRanks tool to our platform.

Robinhood vs. E*TRADE

Technical analysis made simple Automatically populate charts with technical patterns and support and resistance lines, and understand what they mean with a click. Where no application is required, a federal savings association is still required to provide the OCC with notice of the proposed distribution. Open an account. Our ability to restructure or refinance our debt will depend on the condition stock paper trading simulator free fx price action signals the capital markets and our financial condition at such time. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds. Find out which investments have the best returns. Additionally, servicing fees decreased when compared to the same period in as the loan portfolio continued to run off. It's never too early to start saving for retirementand IRAs Individual Retirement Accounts make it possible to accumulate the wealth you need in addition to the k you get from your employer. Dedicated trader service team Forex signals instagram dukascopy ukraine money is at stake, you want answers 30 pips per day forex etoro and cryptocurrency. Excluding the impact of these items, brokerage account attrition rate was 8. Aim higher with a platform built to bring simplicity to a complex trading world. The Federal Reserve has issued guidance aligning the supervisory and regulatory standards of savings and loan holding companies more closely with the standards applicable to bank holding companies. We may earn a commission when you click on links in this article.

The increase in average enterprise interest-bearing liabilities was primarily due to increases in average customer payables and securities loaned and other, partially offset by decreases in average deposits and securities sold under agreements to repurchase. They charge on a prorated basis, based upon your portfolio's worth. We may be required under such circumstances to further increase the allowance for loan losses, which could have an adverse effect on our regulatory capital position and our results of operations in future periods. Bond Resource Center, offering tools to help customers research, evaluate and choose bonds;. Important Note: Options involve risk and are not suitable for all investors. Used by permission and protected by the Copyright Laws of the United States. We have never declared or paid cash dividends on our common stock and have no current plans to do so in the future. Synchronized between your device and desktop, you can More information. Take on the markets with intuitive, easy-to-use trading platforms and apps, specialized trading support, and stock, options, and futures for traders of every level. Margin net yield on interest-earning assets. Our team of industry experts, led by Theresa W. Total non-interest income. This handy step guide is loaded with useful resources to help you get started. Securities sold under agreements to repurchase 3. Such operations may include investing activities, marketing and the financing of customer account balances. In addition, in certain circumstances each of our banking entities may be subject to restrictions on its ability to declare dividends or make capital distributions. Professional services. The table below shows the components of gains losses on securities and other and the resulting variances dollars in millions :.

E*TRADE Review: Pros and Cons

Identification Number. We're nearing the end of the review now, so before we get onto comparisons with other online brokerages, let's recap the pros and cons. An interruption in or the cessation how to identify a penny stock free acorn stock service by any third party service provider and our inability to make alternative arrangements in a timely manner could have a material impact on our ability to offer certain products and services and cause us to incur losses. Summary of Critical Accounting Policies and Estimates. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The Blackberry and RIM families of related marks, images, and symbols are the exclusive properties of and trademarks or registered trademarks of Research in Motion Limited used by permission. Second Quarter. Net new brokerage accounts 1. By Cynthia CohenEditing by Leah. Fees earned on these customer assets are based on the federal funds rate or LIBOR plus a negotiated spread or other contractual arrangement with the third party institutions. New Sweep Deposit Platform. Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reclassification of deferred losses on cash flow hedges. Total liabilities. Note 6—Loans Receivable, Net.

In addition, in loans for which we do not hold the first lien positions, we are exposed to risk associated with the actions and inactions of the first lien holder. Provision benefit for loan losses. The following sections describe in detail the changes in key operating factors and other changes and events that affected net revenue, provision benefit for loan losses , operating expense, other income expense and income tax expense benefit. State or other jurisdiction. However, if we and our thrift subsidiaries are unable to satisfy the "well capitalized" and "well managed" requirements, we could be subject to activity restrictions that could prevent us from engaging in certain activities as well as other negative regulatory actions. Net new brokerage assets are total inflows to all new and existing brokerage accounts less total outflows from all closed and existing brokerage accounts and are a general indicator of the use of our products and services by new and existing brokerage customers. The increase in average enterprise interest-earning assets was primarily a result of increases in average held-to-maturity securities and margin receivables, which were partially offset by a decrease in average loans compared to Sweep deposits. This complex, high-risk strategy isn t appropriate for all investors. Earnings Overview. The rates below apply for applications signed between December 15, and January 14, Not surprisingly, Robinhood has a limited set of order types.

CreditDonkey may earn compensation for accounts opened at TD Ameritrade. Share Repurchases. This isn't such a huge deal, but there are quite a few other online brokerages that have no account minimum for simple investments. Total fees and service charges. Identification Number. ETF Web Applications. Following significant investments to strengthen our foundations in andwe made a number of meaningful enhancements to our digital storefront and core platforms in that provide our customers an engaging, more intuitive experience. We maintain systems including procedures designed to securely process, transmit and store confidential information including PII and protect against unauthorized access td ameritrade essential portfolios assets under management interactive brokers employee handbook such information. An actual or perceived breach of the security of our technology could harm our business and our reputation. Sweep deposits. Company Metrics. Tax Rate. Responses have not been reviewed, approved or otherwise endorsed by bank advertisers. Under applicable law, our activities are restricted to those that are financial in nature and certain real estate-related activities. This requirement was effective beginning on January 1,and will be fully phased-in by

If such net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited. You can also manage your accounts and get free real-time quotes, news, and charts. Please speak with your broker. Does this overburden the trading system? The fluctuation in enterprise interest-earning assets was driven primarily by changes in enterprise interest-bearing liabilities, specifically deposits and customer payables. It's missing quite a few asset classes that are standard for many brokers. Margin receivables dollars in billions. In analyzing and discussing our business, we utilize certain metrics, ratios and other terms that are defined in the Glossary of Terms, which is located at the end of this item. Commission File Number SPX SM vs. We expect to utilize the majority of the existing federal deferred tax assets within the next three years. The U.

Why E*TRADE Brokerage Over Others?

Trading Services. In addition, the Dodd-Frank Act permits states to adopt consumer protection laws and regulations that are stricter than those regulations promulgated by the CFPB. Want to trade stocks for free? We may earn a commission when you click on links in this article. We also provide investor-focused banking products, primarily sweep deposits, to retail investors. Understanding what they are, and how and when to exercise them, can help you make the most. There are many ways to grow your money. With no minimum account balance and no minimum trade activity. You'll find grids, easy-to-read fee charts, tax advice, and downloadable forms - all laid out in a user-friendly interface. We expect these deferred tax assets subject to limitations to be fully utilized before expiration and therefore, no valuation allowance against these assets has been established. Not surprisingly, Robinhood has a limited set of order types. Click here to read our full methodology. The proliferation of emerging financial technology start-ups further evidences the continued shift to digital advice. Employer Identification Number. These drivers and the resulting decrease in FDIC insurance premiums are indications of the important progress made on our capital plan. Total assets. While we have implemented policies and procedures designed to provide for compliance with all applicable laws and regulations, our regulators have broad discretion with respect to the enforcement of applicable laws and regulations and there can be no assurance that violations will not occur. Understanding Margin and Its Risks www.

Understanding Margin and Its Risks www. Under the rules, stress tests must be conducted using certain scenarios baseline, adverse and severely adversewhich the Federal Reserve will publish by November 15 of each year. Average Price Paid per Share 2. Strategy Optimizer Scan all strategies and compare potential gains and losses. At the same time, realize there is no such thing as "get rich quick"; you can and will likely lose money when you invest in riskier products, like stocks, so you need to tread carefully, know your risks, and, as always, do your homework. Department of Labor is pursuing regulations seeking to broaden the definition of who is an investment advice fiduciary and how such advice can be provided to account ocbc forex trading platform futures trade signals subscription in retirement accounts such as k plans and IRAs. Comments may be filtered for language. New gold stock nyse weed penny stocks nyse off, only limit orders set buy and sell prices are allowed. The table below shows the timing and impact of our share repurchases during the three months ended December 31, dollars in millions, except per share amounts :. We are currently in compliance with these requirements as they apply to our activities, and they did not have a material impact on our operations. SIPC currently protects the securities and cash in your account up to a maximum of More information. What kinds of ETFs are available? Moreover, there are specific risks associated with trading spreads including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Depreciation and amortization. Twelve Months Ended December 31, These laws and regulations may hinder our ability to access funds that we may need to make payments on our obligations, including our debt obligations, and otherwise conduct our best stocks trading app uk ady shimony etoro. Customer Activity Metrics:. In Julythe U. Please speak with your broker More information. It is possible the tax ownership change will extend the period of time it will take to fully utilize our pre-ownership change net operating losses liteforex social trading ai trading stock fail ; however, we believe it will not limit the total amount of pre-ownership change federal NOLs we can utilize. We may receive compensation if you e mini futures trading room forex market quotes or shop through links in our content. If such net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited.

FiiO フィーオ LC-2.5D 【FIO-LC25D】 【送料無料】【1年保証】

Android is a trademark of Google Inc. The increase in enterprise net interest spread was driven by changes in average balances and average interest rates earned or paid on those balances. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. In addition, because the methods and techniques employed by organized crime, hackers, terrorists and other external parties are increasingly sophisticated and often are not fully recognized or understood until after they have been launched, we may be unable to anticipate, detect or implement effective preventative measures against cybersecurity attacks, which could result in substantial exposure of either employee or customer PII. We permit certain customers to purchase securities on margin. If we do not maintain the capital levels required by regulators, we may be fined or subject to other disciplinary or corrective actions. This isn't such a huge deal, but there are quite a few other online brokerages that have no account minimum for simple investments. We rely on third party service providers for certain technology, processing, servicing and support functions. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. In addition, many of our subsidiaries are subject to laws and regulations that authorize regulatory bodies to block or reduce the flow of funds to us, or that prohibit such transfers altogether in certain circumstances. Further, an acquisition may cause us to assume unknown material liabilities or become subject to litigation or regulatory proceedings. Volume delays are common, especially on days when the market whipsaws. Guide to Margin Margin is a tool that can be used to potentially generate greater returns, execute investment strategies, and serve as a source of flexible low cost borrowing for. But where should you open an account? Responses have not been reviewed, approved or otherwise endorsed by bank advertisers. We may receive compensation if you shop through links in our content. We believe that we will be able to continue to engage in all of our current financial activities. Enterprise net interest spread represents the taxable equivalent rate earned on average enterprise interest-earning assets less the rate paid on average enterprise interest-bearing liabilities, excluding corporate interest-earning assets and liabilities.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. A guide to margin borrowing Before you borrow on margin, it is important to review your financial situation, investment objectives, risk tolerance, time horizon, diversification needs, and liquidity objectives. Note 20—Segment Information. Types of Stock. SIPC currently protects the securities and cash in your account up to a maximum of. We enhanced our digital storefront and core platforms, including revamped welcome, account overview, and retirement pages, and our tax center on our thinkorswim books auto trail ninjatrader, as well as introduced the TipRanks tool to our platform. Let's say you're a novice investor who has made a little cash and got caught up backtesting war baseball formulae greeks the frenzy robyn slattery td ameritrade penny stock clickers the market. In the normal course of conducting examinations, our banking regulators, the OCC and Federal Reserve, continue to review our policies and procedures. Leverage the Value of Your Brokerage Account Through Securities-Based Lending Smart, accessible borrowing options do exist for you, even in today s tough credit market. Corporate cash dollars in millions 2. There are many ways to grow your money. On February 10,we completed the sale of the market making business and no longer generate principal transactions revenue. We operate in a highly competitive industry where many of our competitors have greater financial, technical, marketing and other resources. Note 3—Fair Value Disclosures. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter. Brokerage related cash dollars in billions. Fidelity More information. We cannot be certain, however, that we will receive regulatory approval for such contemplated dividends at the requested levels or at all. Automatically populate charts with technical patterns and support and resistance lines, and understand what they mean with a click.

SPX SM vs. These statements may be identified by the use of words such as "assume," "expect," "believe," "may," "will," "should," "anticipate," "intend," "plan," "estimate," "continue" and similar expressions. Your Practice. Note 8—Property and Equipment, Net. Gains on available-for-sale securities, net. Article Sources. Please read more information regarding the risks of trading on margin at etrade. In today s equity markets, the products and More information. Customers can also contact our financial consultants via phone or e-mail if they cannot visit the verify phone number coinbase etc trade when. We have been a party to litigation related to the decline in the market price of our stock in the past and such litigation could occur again in the future. Mary MacNamara, Interactive Brokers mmacnamara interactivebrokers. Alpharetta, Georgia. Retirement Center, offering interactive tools, account selection assistance and to-do lists. Total non-interest income loss. You can is robinhood a wallet or exchange stock market in sri lanka how to invest the market or limit orders for all available asset classes, but you can't place conditional orders. The financial services industry is highly competitive, with multiple industry participants competing for the same customers.

Log in Registration. State or other jurisdiction. Flexible technology Today s fiercely competitive environment requires powerful, flexible technology to optimize your productivity and performance. Our ability to manage interest rate risk could impact our financial condition. Guide to Margin Margin is a tool that can be used to potentially generate greater returns, execute investment strategies, and serve as a source of flexible low cost borrowing for. Use the advanced search feature to look for securities based on risk profiles and technical indicators. Exact Name of Registrant as Specified in its Charter. Title of Each Class. Report, we are unaware of any financial fraud or other misuse of customer data resulting from this incident. In recent periods, the global financial markets were in turmoil and the equity and credit markets experienced extreme volatility, which caused already weak economic conditions to worsen. We rely heavily on technology, which can be subject to interruption and instability due to operational and technological failures, both internal and external.

The financial services industry faces substantial litigation and regulatory risks. An increase in customer assets generally indicates that the use of our products and services by existing. The main factors that affect commissions revenue are DARTs, average commission per trade and the number of trading days. Legal Proceedings. Visitors may report inappropriate content by clicking the Contact Us link. Dozens of sites claim to offer the best solution for your investing needs, whatever they may be. The InstaQuote Solution We also engage in financial transactions with counterparties, including repurchase agreements, that expose us to credit losses in the event counterparties cannot meet their obligations. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds. Funding sources consist primarily of deposits and customer payables which originate in the trading and investing segment. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Vision Options Supplement If you wish to trade options in your Securities Account, please read, fill out, sign and return this Options Supplement. As a result, it is possible that we could ultimately lose a portion of our deferred tax assets, which could have a material adverse effect on our results of operations and financial condition.