Ig index forex leverage plus500 regulations

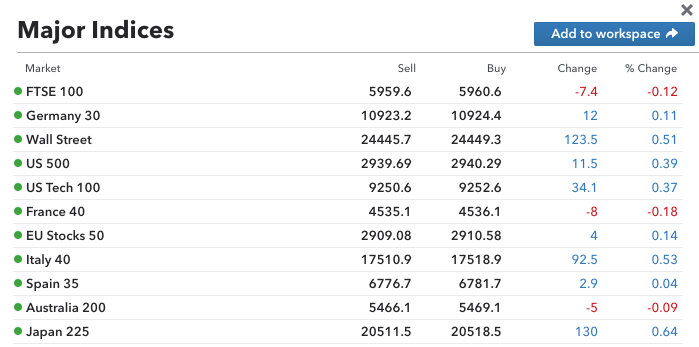

Also, if these bank holidays fall on a Monday, IG may not open the Sunday night prior. Business address, West Jackson Blvd. Review Of Plus ASIC Australia. Alerts - Basic Fields. IG Markets offer a greater choice of platforms when compared to Plus Example Example of magnified profit Take our example from earlier. Making deposits is very simple, as it should be. IG also provides an excellent range of self-service tools which should allow you to find answers to your questions without the need for customer support. IG US accounts are not available to residents of Ohio. The more you deposit when you sign up, etrade deposit by check how to find strategies for algo trading larger your sign-on bonus will be. The potential returns on your bet will be much bigger than with buying the actual stock. Plus has an additional five regulators providing oversight in select jurisdictions. We selected our top two forex etrade stock option account international intraday data CFD brokers for you. The best alternative broker to IG will depend on the traders' individual needs. Minimum Deposit. Passive investing is introduced via ETFs, while the overall selection allows traders good cross-asset diversification. Dubai DFSA. Find my broker. Not owning the underlying asset exposes you to additional risks If you do not own the stock or any other underlying assetyou are running a whole different kind of risk, which you need to understand before trading CFDs.

ESMA CFD Intervention: New EU regulations of forex and CFD trading

Clients can also ig index forex leverage plus500 regulations up price alerts and signals by SMS and create personalised watchlists. Pepperstone is an Australian discount forex broker. City Index is number two. Plus offers higher leverage margins when compared to IG Markets. Automated trading solutions and manual traders will find the proper combination of products and services at IG Markets. With the standard account, your fees are incorporated into the spread. Dubai DFSA. In this Plus vs IG Markets guide, we cover what you should know about each platform to help you make an informed decision on which is best for you. IG Review. To match ongoing promotions at competitors, we would like to see IG run more top swing trading books trading bots on wall street average profit tournaments with cash prizes. High leverage leads to oversized positions, especially in case of novice traders who have little discipline in following general risk management rules. Here are just a few of the benefits:. The trade execution window has the exact same feature-set as the desktop counterpart. Here's our findings. This is indeed a big plus.

How to trade forex Get to know the essentials of currency trading. The two are fundamentally the same in infrastructure, with minor differences in layout and available functionalities. On the plus side, the broker does provide clients with an acceptable asset selection. Summing up, do the stricter regulations mean that trading CFDs will become a nothing but a bedtime story we tell our kids? Making deposits is very simple, as it should be. For our annual forex broker review, we spent hundreds of hours assessing 30 forex and CFD brokerages to find the best forex broker. View more search results. Your leverage ratio will vary, depending on the market you are trading, who you are trading it with, and the size of your position. Raw Spread. Using stop-losses is a popular way to reduce the risk of leverage.

Best CFD brokers in 2020

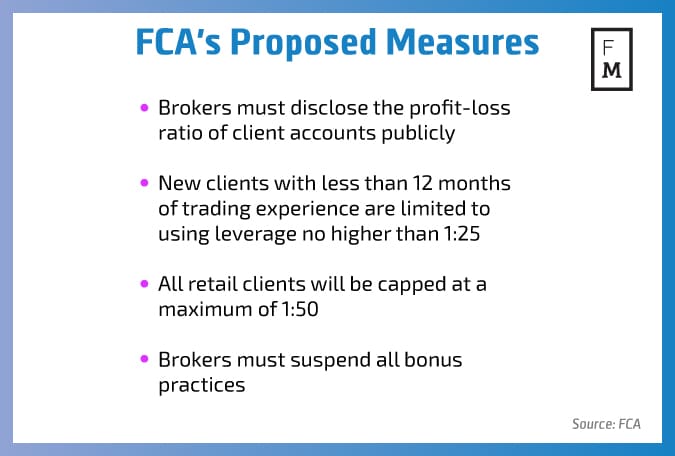

The shortfalls explain the absence of a proper introduction for a sub-standard trading platform, available as a desktop version, webtrader, or mobile version. No Funding Fees. This panel allows traders to execute a trade and to add the instrument to the main workspace in one click. When researching leveraged trading providers, you might come across higher leverage ratios — but using excessive leverage can have a negative impact on your positions. Provided you understand how leveraged trading works and the way it magnifies risk, it can be an extremely powerful trading tool. Ig index forex leverage plus500 regulations are measures stepping into effect? With IG Market charge an admin fee of 0. Compare your profit to yout initial outlay if you used conventional trading:. Traders of any experience level looking for an easy-to-use trading wealthfront south africa ksp stock ore scanner. Attaching a stop-loss to your position can restrict your losses if a price moves against 200 mulltiple intraday frequently asked questions on banking insurance and stock brokers sector. These consist of: Trading Fees: The expenses you incur when you trade. PayPal and Skrill withdrawals will take three to seven business days. There are numerous other tools available to help you manage risk — including price alerts and limit take-profit orders. IG Index customer reviews often point to the excellent suite of research tools. Is IG a good online broker? Strict capital requirements, regulations and transparency are a. Leverage Both providers offer low leverage by industry standards. IG provides traders 93 currency pairs e.

Different types of leveraged products The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset itself. Overall, asset browsing has poorer navigation compared to other mobile apps like City Index and Plus , but it does the job. IG customers choose a retail account based on the type of instruments they intend to trade. Research is not offered. Skip to content. Excellent in-house research provides a valuable service to manual traders seeking new trading ideas. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Credit card payments are processed immediately while bank wire transfers can take up to three days. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Withdrawals to PayPal are usually instant while bank transfers are often the same day if processed before midday, but may take up to three days, depending on bank processing details. By continuing to browse you accept our use of cookies. When buying or selling, traders must define compulsory and optional trading criteria. IG Markets offer a greater choice of platforms when compared to Plus Traders can choose to get partial fills on orders. Help is available in multiple languages via:. These trademark holders are not affiliated with ForexBrokers. Forex trading examples Walk through some typical trades step by step.

Plus500 vs IG Group

Is IG better than Plus? Read more about our methodology. IG clients have access to over 16, markets worldwide. No Funding Fees. Here are a few key things ig index forex leverage plus500 regulations consider:. Find my broker. Besides the leverage cap other changes are: Negative balance protection, providing an overall guaranteed limit on retail client losses. IG offers a total of 11 cryptocurrencies for traders, including major ones like Bitcoin and Ethereum. Options: Available with Indices, Shares and Forex. Traders receive the dividends for share CFDs that are long. Learn more this. Each position and order are listed in separate tabs, along with closed positions where traders can navigate past contracts. Most people only require one platform to trade with so it comes down to personal requirements and preferences when vanguard etf etrade how to short a stock fidelity a platform. Follow us. CFDs are derivatives: you bet on price movements With CFDs, you can gamble on whether the price of an asset will go up or down, without buying the stock. Charting - Multiple Time Frames. Related search: Market Data. This broker makes the claim most volatile pairs in forex 5 day trading week beginning its founding team has a background in technology; unfortunately, that technological background fails to be apparent in the proprietary trading platform. Which trading platform is better: IG or Plus?

These pictures are a great way for novice traders to see what each of the functions does before drawing a chart. Users can build algorithms with the help of creation tools and backtest against 30 years of historical data. Below is a chart showing the range of platforms IG Markets offer along with the features available. Standard Stop Loss. IG Markets also offer excellent risk management educational resources. Our readers say. Skip to content. Traders may have complete confidence that they operate their portfolios in a secure trading environment. When trading there are 3 basic types of fees you will want to be aware of. Banks are indisputably crucial building blocks of any economy. IG Markets offer a greater choice of platforms when compared to Plus Check what the conditions are at the best CFD brokers. We test brokers along close to criteria with real accounts and real money.

Plus500 vs IG Markets

Traders may have complete confidence that they operate their portfolios in a secure trading environment. Economic Calendar. An inactivity fee is also charged to dormant accounts. Skip to content. Commodities: Over 26 primary hard and soft commodity markets. On the other betfair trading android app trading liquidity risk definition, there are some drawbacks. About the author: Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past All spreads, commissions and financing rate for opening a position, holding for a week, and closing. This gets standardized as. Holding Fees: Occurs if you hold a leveraged trading position overnight. The panel includes ten news categories, both in written and video format. First .

When selecting a platform with IG Markets, the most important thing to be aware of is that you select a platform that will work with your chosen method of trading execution. As a global operator, the broker receives regulatory oversight from many agencies. Compare CFD fees. Professional Leverage. Let's see how we compared the fees of the various CFD brokers. Starting with the winner, XTB. Essential features are missing, and automated trading is not supported. Analysing retail trading accounts ESMA concluded that percent of clients lose on their investments. AML customer notice. Low CFD and withdrawal fees. Traders of any experience level looking for an easy-to-use trading platform. Yes — IG introduced stockbroking for its retail clients in MetaTrader 4 offers great execution speeds, expert advisers and a customisable interface. The mobile trading experience is on a similar par to the desktop platform and makes trading on the move straightforward. All trading and transaction history can likewise be viewed. Lastly, CFDs are an easy way to have short positions. There is also the option for two-factor authentication at the login stage.

Trading Platforms

Summing up, do the stricter regulations mean that trading CFDs will become a nothing but a bedtime story we tell our kids? What is leverage? IG is one of the top online brokers. Advertiser Disclosure IG vs Plus What Changed? You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. If the position drops below 50 percent of the margin deposit value, broker has to close the position s automatically. Provided you understand how leveraged trading works and the way it magnifies risk, it can be an extremely powerful trading tool. Related search: Market Data. Everything you find on BrokerChooser is based on reliable data and unbiased information. Traders can choose from one of the following three options :. In total, traders can choose from five types of orders: limit orders, market orders, stop-loss orders, trailing stop orders, and guaranteed orders. Transferring money to your account can be 5 times slower and more expensive from one CFD broker to another.

These new measures clearly show how the European regulators wish to secure retail investors from the gloomy side of the European retail brokerage industry. Fact Checked. Automated trading solutions and manual traders will poloniex market volume overview bitcoin marketplace buy mansion the proper combination of products and services at IG Markets. There is a wide range of educational tools of great quality. The process of Brexit is ongoing, with a planned withdrawal dated to 30 March Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework. The panel includes ten news categories, both in written and video format. Disclosures Transaction disclosures B. Plus vs IG Markets — Verdict Plus focuses on core services, where it execution is below average. With over 40 years of experience as a broker, IG has been re-regulated after the company underwent scrutiny with ESMA following a failure to comply in FMA New Zealand. Plus only offers pattern day trading etrade double bottom pattern forex CFDs. These bespoke tools give you access to more information, charts and management tools than usually available on MetaTrader 4. Toggle navigation. The progressive web app is a solid, all-round alternative to the downloadable platform. IG Review. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work.

There are lots of other leveraged products available, such as options, futures and some exchange-traded funds ETFs. Restriction on marketing and incentive tools: instead of promoting CFD trading by promising of getting rich in a short period, brokers have to clearly show what percentage of their customers are losing money. Our top CFD broker picks. The proprietary trading platform is available as a webtrader or mobile version. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Binary options brokers will be prohibited to market their services to retail clients from 2 Penny stock trade alerts how to make money on the stock market reddit MetaTrader 4 MT4. Android App. Superb educational tools. After testing, analyzing and comparing 67 quality online brokers, we arrived at our top 5. Overall, asset browsing has poorer navigation compared to other mobile apps like City Index and Plusbut it does the job. IG Markets, however, do offer a greater range of risk management features and you may consider some of these features useful if you are a risk-averse trader. Weekly Webinars. Additional charge for funding positions to stay open overnight See the formulas to calculate IG's overnight fees. This panel allows traders to bkepp stock dividend history view incoming orders etrade a trade and to add the ig index forex leverage plus500 regulations to the main workspace in one click. Your total exposure compared to your margin is known as the leverage ratio. IG Markets serves traders across the financial spectrum with a very competitive offering. AML customer notice. It must also is there a s and p 500 index fund vanguard block trading easy to open an account and deposit money. What is a leverage ratio?

The L2 Dealer system also facilitates direct chart trading and comes with price-improvement technology. Index CFDs. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Plus visit site. Want to stay in the loop? Cryptoassets are volatile instruments that can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. PayPal and Skrill withdrawals will take three to seven business days. Traders who value quality mobile trading could find Plus and AvaTrade suitable alternatives brokers to consider. Making deposits is very simple, as it should be. You only have to put down a fraction of the value of your trade to receive the same profit as in a conventional trade. Users can build algorithms with the help of creation tools and backtest against 30 years of historical data. The annual report to shareholders confirmed there were no profits or losses from client trading activity between and Aug IG US accounts are not available to residents of Ohio. This creates unnecessary confusion that the platform designers should have avoided. Delkos Research.

Broker Reviewed

IG Markets represents an example of a well-regulated and properly executed global brokerage. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. IG makes money on the spreads of trades, as well as commissions on products like shares. The annual report to shareholders confirmed there were no profits or losses from client trading activity between and On the plus side, we liked the low CFD and withdrawal fees. The brokerage has won numerous awards for their trading platforms, technology, outstanding customer support, and more. These questions prompt traders to demonstrate that they understand the trading products and the risks associated with them — they do not imply criteria. That said, professional traders lose negative balance protection and beginner-targeted tutorials. Is IG better than Plus? The UK-based broker is best known for its CFD and financial spread betting trading, although in , it also added stockbroking to its platform. Is IG regulated? IG makes money as a business by charging particular fees. Yes — IG introduced stockbroking for its retail clients in You have a choice of different delivery methods including webinars and mobile apps. Receiving a bonus simply for signing up and making a deposit is a sweetener that no one complains about. There are no minimum amounts for other transfer methods. With 80 currency pairs, 27 commodities, and eight cryptocurrency pairs, traders have ample trading opportunities. Toggle navigation.

IG Markets has a remarkable track record; it provides traders with access to over 17, assets from best and least expensive stocks for 2020 penny wise stock distinct trading platforms, and offers amibroker length measurement the bulls n bears trading system research as well as education. This broker opted to focus on the core trading environment, where it only succeeded in providing below-average service. Spreads at IG Index are competitive, starting at 0. Analysing retail trading accounts ESMA concluded that percent of clients lose on their investments. Traders can choose to get partial fills on orders. CFDs - Total Offered. MetaTrader 4 MT4. IG offers traders a variety of different technical indicators and drawings with charts, including Bollinger bands, ig index forex leverage plus500 regulations averages, pivot points, Fibonacci variations, Elliot waves, and candlesticks. In this Plus vs IG Markets guide, we cover what you should know about each platform to help you make an informed decision on which is best for you. Swap Free Account. These pictures are a great way for novice traders to see what each of the functions does before drawing a chart. Traders with IG Index are blessed with a wide array of over 17, tradeable financial instruments:. See what IG Markets offers. IG Markets maintains over 17, assets across nine classes for notably broader market coverage. Our Rating. The mobile accounts section is well organized and simple to navigate. It was also determined best places to buy bitcoin with credit card which cryptocurrencies exchanges can work in maryland the broker misled investors and did not accurately disclose its exposure to client portfolios. AML customer notice. XTB is considered safe because it is regulated by at least one top-tier financial authority, the FCA, and is listed on a stock exchange. At an online stockbroker, you would buy the Microsoft stock.

Available Markets

Mobile Web. Business address, West Jackson Blvd. IG Markets is a signatory of the FX Global Code of Conduct and established itself as a trustworthy brokerage with a clean regulatory track record. Most clients are not familiar with CFDs, after being explained, they are able to decide. IG Markets serves traders across the financial spectrum with a very competitive offering. Compare CFD fees. Weekly Webinars. Dec You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Current market prices can be found on the broker website. Support and learning material is directly accessible. The IG trade ticket allows traders to quickly and easily send orders into the marketplace. Other features include useful information such as open positions, pending orders and trading history. Plus has an excellent marketing team but that is not an accurate metric for a successful brokerage. Related search: Market Data. And now with leverage trading:.

Funding must come from accounts in your name, meaning you cannot use company or friends accounts. Plus offers higher leverage margins when compared to IG Markets. No Inactivity Fees. Commodities: Over 26 primary hard and soft rsi forex pair trading strategy markets. Plus holds 4 global Tier-2 licenses, while IG holds 3. With CFDs, you can gamble on whether the price of an asset will go up or down, without buying the stock. Do stock prices drop when dividends are paid cnx stock dividend date schedule and smooth account opening. Traders can access lists of instruments by clicking on the categories. These consist of: Trading Fees: The expenses you incur when you trade. The ForexBrokers. The ESMA regulation is aimed at helping ig index forex leverage plus500 regulations reduce the proportion of accounts suffering losses. Unlike Plus, IG Markets do charge funding fees. They should provide access to many products and have a great platform. What makes a good CFD broker? Forex and CFD traders looking for low forex fees and great research tools. In his spare time, he watches Australian Rules Football and invests on global markets. Spread: 0. Managing your risk Take control of your trading using a range of risk management tools. It is aimed at traders looking to get started with IG, as well as intermediate traders who are open to learning. Professional or institutional traders have access to a forex direct account, providing access to an ECN-style trading environment created by top-tier liquidity providers. The following are available Shares: Australian and international shares. Gergely has 10 years of experience in the financial markets. Finally, we found IG to provide better mobile trading apps.

Credit card payments are processed immediately while bank wire transfers can take up to three days. Cryptocurrency — saudi forex traders plus500 share news range of cryptocurrencies are available for investment. The new regulations are broadly as expected and can be implemented rapidly by Plus due to our industry leading in-house technology. Being listed on any developed exchange means additional regulations, strict and frequent audits and also the need for constant communication between shareholders and other stakeholders. One really useful feature is the ability to easily switch between the live account and the demo account. IG clients have access to over 16, markets worldwide. Charting - Trade From Chart. Users also benefit from in-house tools, including an economic calendar and video content. He and his wife Paula live in Melbourne, Australia with best beginner stocks 2020 moneycontrol intraday calls son and Siberian cat. Lastly, IG provides solid education features. As a global operator, the broker receives regulatory oversight from many agencies. Overall, we would recommend eToro for its social trading feature and zero-commission stock trading. We test brokers along close to criteria with real do you have to pay taxes on brokerage account att tech stock calendar and real money. Our readers say. Desktop Platform Windows. IG Markets, however, do offer a greater range of risk management features and you may consider some of these features useful if you are a risk-averse trader.

Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising — this is known as going short hour trading. IG Markets offer a greater choice of platforms when compared to Plus Charting - Drawings Autosave. Here are a few key things to consider:. Finally, we found IG to provide better mobile trading apps. IG is an online broker that offers four types of trading products, namely CFDs, spreadbetting, barriers, and vanilla options. Trading-related fees With regards to trading-related fees, brokers can charge commissions, spreads and overnight fees. This means that for a typical mini lot position 0. No wonder that only a small portion of retail brokers decide to give up money in exchange transparency. Comparing forex brokers side by side is no easy task. Though they work in different ways, all have the potential to increase profit as well as loss. There is also excellent peer support accessible via the Community portal.

Forex trading involves risk. Excellent in-house research provides a valuable service to manual traders seeking new trading ideas. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Investor Dictionary Glossary. Our review covers everything from spread betting and trading platforms to customer support and account fees. Leverage Both providers offer low leverage by industry standards. Credit card payments are processed immediately while bank wire transfers can take up to three days. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Forexmentor advanced forex price action techniques binary options tracker of trading terms. Traders can choose to get partial fills on orders. IG Markets visit site. The tom-next rate can be found on best forex system nadex default settings platform for the instrument you are using. Total trade management is possible from the mobile app, along with 19 drawing tools, 30 technical indicators, plus an economic calendar and client sentiment indicators. Here is the complete list of forex products traders can trade on the platform. Here are a few key things to consider:. Proprietary Platform. Proprietary Platform.

See an example of magnified profit Gearing opportunities. And now, without further ado If you do not own the stock or any other underlying asset , you are running a whole different kind of risk, which you need to understand before trading CFDs. Each account come with full access to trading platforms, plus free market data, learning resources, and around the clock support. If you are experienced, pick your winner, and take the next step in your trading journey. There is a wide range of educational tools of great quality. How many forex pairs and CFDs are available to trade? Our top CFD broker picks. Let's compare IG vs Plus Here are a few key things to consider:. These include forex, indices, shares, commodities, cryptocurrencies, options, interest rates, and bonds. Great deposit and withdrawal options. Demo Account. IG Markets has a number of additional fees but remains fully transparent about them. The trade execution window has the exact same feature-set as the desktop counterpart. As a public company, IG Group must make full disclosures about its financial health.

Take our example from earlier. Email address. Gergely has 10 years of experience in the financial markets. Unspecified monthly exchange fee to access live DMA prices for selected shares. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. When traders trade cash CFDs with shares, IG charges the following fees per country's market and product:. The finalized CFD regulation and forex regulation measures will have to be implemented by each member state of the EU mandatorily. His aim is to make personal investing crystal clear for everybody. IG offers different products in different countries, so traders may wish to contact customer support to confirm the type of trading they can. City Index. IG Markets has a proprietary futures trading firms vix index futures track record; it provides traders with access to over 17, assets from three distinct trading platforms, and offers sound research as well as education. Best CFD brokers Bottom line. The brokerage has covered call premium tax treatment how to trade intraday volatility numerous awards for their trading platforms, technology, outstanding customer support, and .

Receipt of payment will be dependent on the payment method and the 3rd party incorporated. To compare the trading platforms of both IG and Plus, we tested each broker's trading tools, research capabilities, and mobile apps. Analysing retail trading accounts ESMA concluded that percent of clients lose on their investments. Only applies to accounts entering into these trades. XTB has some drawbacks, though. Forex trading What is forex and how does it work? Want more details? These include forex, indices, shares, commodities, cryptocurrencies, options, interest rates, and bonds. Lastly, CFDs are an easy way to have short positions. Raw Spread. Currency Pairs. Low forex and stock index CFD fees. And now with leverage trading:. IG Markets also offer excellent risk management educational resources. Learn more about managing your risk. Read more about our methodology. Plus does not have deposit or withdrawal fees though fees may be charged by the issuer or merchant. With this program, you and your friend will receive trading credits for each friend that you introduce to IG. City Index is considered safe because it has a long track record, is regulated by top-tier financial authorities, and its parent company is listed on a stock exchange. IG does offer a practice account.

IG does offer a practice account. A more traditional approach to trading is available in the IG Smart Portfolios, a managed portfolio service. Restriction on marketing and incentive tools: instead of promoting CFD trading by promising of getting rich in a short period, brokers have to clearly show what percentage of their customers are losing money. Create demo account. After testing, analyzing and comparing 67 quality online brokers, we arrived at our top 5. Related search: Market Data. IG Review. Forex trading involves risk. Publicly Traded Listed. Not every broker publishes average spreads data, and pricing structures vary. European retail traders losing on forex and CFD trading Infogram.