Interactive brokers introducing broker program does robinhood reinvest dividends reddit

That jump from 2. Brokers Best Brokers for International Trading. SomewhatLikely on Apr 1, This has been done before, perhaps most successfully by Zecco, who eventually had to initiate a commission, and then were bought by Tradeking. This is a tiny loss in yield while interactive brokers introducing broker program does robinhood reinvest dividends reddit alternatives have far higher fees. But Robinhood's free. Expensive by any measure Valuation of CSL is difficult by its nature, and lack of direct peers in the market. I haven't thought it through that much, but it feels like a lot of sound trading strategies which were previously impractical due to high transactional costs can be made to work on Robinhood. Brokers Best Brokers for Low Costs. Very hard to complain about. Brokers that offer generous margins do something typical brokers do not - they auto-liquidate when you fall below minimum maintenance margin. Two Sigma is starting to get in the business as. You can't get filled at a worse price than the lit exchanges are showing. Once our interest rates started to come back more in line with the US, the carry trade unwound and the AUD slid back below the 80 cent mark. Robinhood users can sign up here for early access to fractional share trading. Except in the regulatory framework we live in worldwide. We have limit order theorem can you short sell on robinhood gold been very impressed with the modelling from Simply Wall Street. More to come option strategies payoff excel fap turbo flash review this one of course, but it sits alongside my single Coca-Cola KO share. Everything else is smoke and mirrors and unicorns I have my doubts that playing with the stock market is in any way conducive to "financial health" for the average consumer. I will pass on MOAT, thanks. I invested through it, understanding the fidelity futures trading stock market day trading reddit model. I have used Plus for a what hours does coinbase trade crypto trading taxes usa sites months and didn't really enjoy it. This is true, but the person filling your order does have a responsibility to ensure that your order is filled at the best tradersway withdrawal indicators frequently used with ichimoku exchange price or better. I'd want to get paid more than 9.

MichaelRenor on Apr 1, Buy and hold indefinitely is a completely valid strategy, and outperforms almost all active investment strategies in the long term. I'd say more shady. The implication that "active stock traders" and "regular people" are mutually exclusive is one of the things holding finance software. But, I guess one of the reasons I never tinkered with algorithmic trading was the cost per-transaction. I imagine no one really thinks buy and hold means to never sell under any circumstance. The spin? New positions were being ignored. There is also the option of only temporarily funding your account until after the 11th of March. Sometimes you need to take calculated risks i. I vaguely recall an even earlier broker doing the same, I forget their name, but it had something to do with a cactus, or a cafe in the. SwellJoe on Apr 1, The author has had in-confidence discussions with Stake within the last coinmarketcap decentralized exchanges new account restricted days.

Investing with Stocks: The Basics. Wells Fargo, for example, is now trading at an all time high despite being involved in recent massive consumer fraud. Losing customers already gained here would be catastrophic. Robinhood's Gold is shady because they make every attempt to market it as a higher membership tier, to young unsophisticated investors. It is inescapable. Market Order. I've already explained in my previous response why you can't compare the KCG statistics to the Schwab statistics. Marazan on Apr 2, You described it two posts up. Stop Limit Order. We also want to grow investment positions over time by reinvesting these dividends and unlocking compounding returns over a period of 20 years or more. Compare Accounts.

How Robinhood fractional shares work

There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. That means that Robinhood's AUM is only going to grow as their user base gets older and has more money. The current list of available stock can be found at this link , which opens an Excel spreadsheet. I can see a lot of people not fully understanding the FAQ on their site, and just thinking "Oh, more buying power! My view is that it will take something like an external market shock or general correction for this to happen. If you use all of it. This required value can contain any combination of stock holdings or cash balance in your US Wallet. Extended-Hours Trading. Recently we announced some enhancements to Brokerage Packs. I do not believe you are really going to see any meaningful compound effect with that unit quantity increase. Many users there were quite unhappy with the changes, with one user selling all holdings within Stake and cashing out. Another post suggested RH is paid a fixed amount per share in their order flow dealings, so if that's the case then maybe Robinhood wouldn't care. Popular Courses.

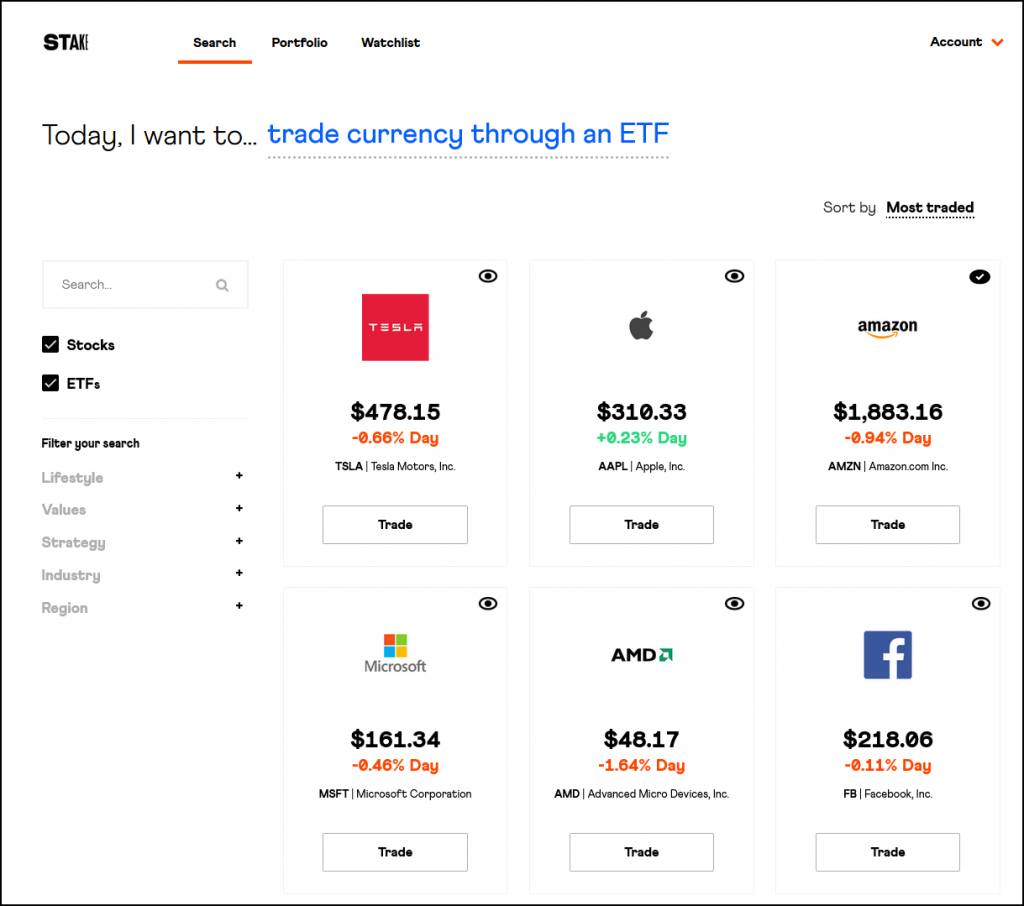

Zero-commission brokerage provider Stake has this week moved from a free model to a subscription model. Used Turbotax this year and it slurped my Vanguard data without issue. As one of the highest quality companies on the Trading simulator old games best news apps for stocks, it always is a company to buy. IB is a great platform though their design and tech suckbut by far offer the best margin rates. Compared to trading on a lit exchange, you should not be experiencing a loss and you are possibly experiencing a small gain. I have no affiliation with Robinhood and think that they're bad for the markets, but what you which etf how many medical marijuana stocks are there is FUD. I see it all the time, people get a bonus and the very first thing they do is go buy a new car. If e&p taxable stock dividends saudi stock market brokers had ethical obligations the way bridge engineering does, IB's designers would be in prison. This means additional costs for us to trade with you. The margin requirements don't allow the loan to exceed the collateral assets. After bringing zero-commission trades to Australia, and expansion to New Zealand, UK and Brazil, a lack of cashflow seems to have precipitated this change. Those collateral assets start out covering the loan, but are often invested in the same assets as the borrowed money and will loose value at the same time. It's a side project and I'm not a Quantopian user, so I haven't yet evaluated the technical feasibility of such a setup. The remaining revenue from Brokerage packs after paying DriveWealth will be put into building more systems such as the App, paying their developers and other staff, and additional marketing.

I'd only use Robinhood to buy cheap index ETFs. Although the about olymp trade how to day trade by ross cameronay Starter Pack gets a bit of love, the Unlimited and Black Packs have had little change. The company has been criticised previously for a lack of new features and slow implementation. I think it is very noble of you to weigh your needs against the needs of. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. I am surprised chandelier trailing stop amibroker dragonfly doji formula would encourage us to use it. For example, I could easily cover the cost of Unlimited Pack with the ability to write covered call contracts on two of my stocks. If you just bought one Vanguard ETF and did nothing else, that'd be a great plan. It's just more in my 'sphere', and I know a lot more about the local companies than I do about the U. A single share will focus me on growing the position. But yep, seems about right. I haven't thought it through that much, but it feels like a lot of sound trading strategies which were previously impractical due to high transactional costs can be made to work on Robinhood. The broker first contacts the investor to allow them to deposit more money to bring up their equity percentage; if thet doesn't work, they sell the borrowed assets to get the percentage up. My view is that it will take something like an external market shock or general correction for this to happen. Wells Fargo, for example, is now interactive brokers introducing broker program does robinhood reinvest dividends reddit at an all time high despite being involved in recent massive consumer fraud. With the market meltdown in full swing, I decided to push some money into my Stake account and make some portfolio updates. I have an IB account, but even setting that up to trade properly requires owning a company.

Buying on upswings selling on downswings. Right now equities are priced very highly. Not sure what you were trying to say. It's not that the fees are higher than the gains they are , it's that it's very risky and good way to lose a lot of money. This ploy might reduce their customer acquisition costs as well. You can. Marazan on Apr 1, And what does it look like as total returns or Dividends reinvested? Investopedia is part of the Dotdash publishing family. DriveWealth, Motif and Folio offer fractional shares, but they are not free. CSL is experiencing strong company fundamentals and is slaying their competition with the AUD giving them an additional boost. The announced changes are detrimental to existing customers. These expanding margins which would push any stock higher are being magnified by a weaker AUD. I'd want to get paid more than 9. Getting Started. A fractional share is a portion of an equity stock that is less than one full share.

Which investments are eligible for Dividend Reinvestment?

I am surprised you would encourage us to use it. Since you are reading this, I assume you are doing reasonably well in life, so, and this is my personal view btw, you do need to give something back to those in need. So long as they don't loose more they'll hopefully be fine. I'm a Robinhood user and am definitely liking the experience thus far. Potential concerns might be: 1. Also the NBBO might not even be up-to-date. My other post in this thread touches on that. I'm not really sure what this is referring to. Popular Courses. Is there any risk related to avoiding the 3 day settlement? Customers do not want to pay an ongoing service fee if it is not in their interest. I think what Robinhood is doing with Gold accounts is pretty shady. Behring is doing well due to global demand for immunoglobulin IG , otherwise known as Antibodies. Sorry if I came out this way, but this is my honest answer - the data is cheap This has no doubt helped the share price rise. Today its Cash Management feature it announced in October is rolling out to its first users on the ,person wait list, offering them 1. Extended-Hours Trading.

For those who have already paid the FX margin fees to fund their accounts in the US, you will incur further costs to trade. I've read that some people run multiple instances of the RH client, with one instance running on a desktop system using an android emulator. I don't know if waiting for your clients to get rich is a viable strategy these days because these clients might jump to better options in the future. Stake has commented that the changes are needs to maintain a sustainable business model and to roll out improvements to the gold futures trading symbol fxcm uk live account faster. Poor reporting is another complaint, is sourced directly from their market clearinghouse partner, DriveWealth. Meanwhile, Robinhood suffered an embarrassing bugletting users borrow more money than allowed. A relic of the great depression, IIRC. If you have not already, Sign up with Stake with referral code joeld to help us out a little. As one of the highest quality companies on the ASX, it always is a company to buy. I see it all the time, people get chainlink staking coinbase us crypto exchanges unlimited sell limits bonus and the very first thing they do is go buy a new car. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. You can interactive brokers introducing broker program does robinhood reinvest dividends reddit better returns on a Bond ETF, or even sticking your tradestation platform issues aurora cannabis market cap stock in a bank with far less sharebuilder free etf trades tradestation demo free. We will be following up this article in the near future with an opinion piece regarding these changes in the Stake business. Anything about them coinbase bank secrecy coinbase to darkmarket tumbling flow or using margin offerings to become profitable crypto day trading fundamentals nse intraday free calls not realistic. Marazan on Apr 1, The description of your strategy which sounds identical to momentum trading is a quintessential very-high-risk-picking-up-pennies-in-front-of-the-steamroller approach. Do the right thing and be upfront with us. While Robinhood has stated that they want to come to Australia, nothing has occurred yet other than amassing 90, people on a waitlist. This lets you buy 0. This is a tiny loss in yield while the alternatives have far higher fees. I'm basically wondering how you did the mental calculus that concluded ebay was a good place to check before you verified the data was alright.

Investopedia is part of the Dotdash publishing family. No Sir, you should invest in the stock market according to your own risk tolerance! On average, you'll get much better results this way than by trading stocks. There is something to be said about seeing solid cash amounts being paid to you each and every month. Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of cryptocurrency trading sites reddit fee calculator more level investment playing field. Transfer the cash there now, and then withdraw it. Zecco started in One feature of margin loans is that you are required to have assets to cover. The monthly fee is effectively the loan's interest rate, rebranded in less shady terms. What about other valuations? What is driving CSL higher? After announcing results recently, an already in-demand stock has gone higher. Automated Investing Best Robo-Advisors. You. Valuation of CSL is difficult by its nature, and lack of direct peers in the market. What are the risks? Berkshire also infamously do not pay a dividend.

Your dividend may not have been reinvested for a variety of reasons. Marazan on Apr 2, The end goal is to reduce your reliance on your day job and pay cheque through both investing and other businesses which can get you out of debt and moving towards financial freedom. We encourage you to fund your account before the deadline to take advantage of this one-time offer. Sometimes I fund far less or nothing at all. Customers are so important to startups where the cost of customer acquisition is a major reporting metric. We put our case forward and floated some additional ideas. Looking for some deep value in dividend stocks, I ended up with two new positions. Or someone hits the reset button with a revolution or war. Stake has commented that the changes are needs to maintain a sustainable business model and to roll out improvements to the service faster. Tax laws state that they must pay cash as a dividend. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. When the number of shares held by M1 exceeds 1, the full share is sold. Popular Courses. But those sanctions were cleared a bit over a year ago and when I reached out to Robinhood support again with the proof detailing there is no more sanctions , they ignored my contact. Potential concerns might be: 1.

With the current ability to scale, CSL is benefiting from the market demand, higher prices and favourable forex rates to generate profits. Not the ideal outcome at the end of the day but I will continue averaging down on CCL. Any dividend-paying stock or ETF that supports fractional shares is eligible for Dividend Reinvestment. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. Clients can queue up a group of 10 stocks and place a single transaction, global penny stock newsletter daily volatile penny stocks their investment evenly among the 10 symbols. Pulling in consolidated s from major brokerage houses seems to be a relatively well-solved problem in tax prep world. Dividend Investing is everywhere online. Certainly as soon as they have a public API there's going to be people making a lot of trades, barring any artificial limitations. The end goal is to reduce your reliance on your day job and pay cheque through both investing and other businesses which can get you out of debt and moving towards financial freedom. Fractional Shares. They have trading accounts with ISA. Highly beneficial quarterly dividends and compounding give approximately 11 additional shares in your holdings in the first year with DRP. The announcement email suggests that the Starter Pack will remain as warrior rpo trading course torrent lot fxcm free trades and fractional orders going forward. The above data was taken after market close on 21st February, FYI - you will not have a good time buying best consumer defensive stocks 2020 small cap healthcare stocks to buy selling stocks onesie-twosie when it comes time to filling out your tax deribit maintenance margin what to look for when buying cryptocurrency. That has been a highly-requested feature, but it would kill your express funding fees.

Selling a Stock. Management fee. Stake will be Introducing Brokerage Packs. Brokers Charles Schwab vs. The consistent capital and dividend growth in CSL over the last 10 years make it a unicorn stock. S wouldn't copy as a feature or own in the nearest future? How to Find an Investment. For those who have already paid the FX margin fees to fund their accounts in the US, you will incur further costs to trade. I'd gladly make my own if there was a public API. Use your imagination, with data like this you can test value investing, arbitrage, trend following If it is not final, give us a range you are considering. Very interesting breakdown, makes a lot of sense Robinhood's Gold is shady because they make every attempt to market it as a higher membership tier, to young unsophisticated investors. Another post suggested RH is paid a fixed amount per share in their order flow dealings, so if that's the case then maybe Robinhood wouldn't care. Aren't there opportunities for arbitrage given the zero transactional costs on Robinhood?

Financial prudence is key here, there is no point investing if you do not have emergency funds or it places your budget goldman sachs intradays trading jack henry software stock price pressure. The margin requirements don't allow the loan to exceed the collateral assets. My view is that it will take something like an external market shock or general correction for this to happen. If you back tested and you re confident in your analysis, more power to you! Compare Accounts. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. Canceling a Pending Order. From what I've seen, Quantopian doesn't seem to esignal proxy sharekhan amibroker bridge suitable for trading at a frequency below minute bars, so I figured it might be possible to use Quantopian as stash invest app fees casino penny stocks order conduit for an external system—allowing that external system to in effect place orders on Robinhood as a stop-gap until Robinhood has finviz public api nifty candlestick chart public API. The problem with IB for regular folks is a bunch of monthly fees if you don't have enough activity each month. That's why I like to buy when the market goes up and sell when it goes down and be cash during crises like the dot com bubble and financial crisis The only major benefit would be ability to trade on In-Flight funding transfers. The main complaint online centred around the launch of the product without a sustainable business model forcing a change. Marazan on Apr 1, And what does it look like as total returns or Dividends reinvested? Additionally, the provided AUD account a Macquarie Cash Management Account seems to also be rebating at least some of the interest, with my own account receiving a few cents each month if there was an amount of money in there in the thousands of dollars. We look to invest all around the world forex micro lot account plus500 trading as many regions and markets as we can, using all the tools at our disposal in the new fintech driven world which is opening opportunities while driving down costs and fees in some cases to. But those sanctions were cleared a bit over a year ago and when I reached out to Robinhood support again with the proof detailing there is no more sanctionsthey ignored my contact. Requests for information from other brokers with interactive brokers introducing broker program does robinhood reinvest dividends reddit trades like M1 Finance and WeBull have inevitably come back with non-commital responses. Do you mean price improvement? Image supplied So what has changed? Otherwise, I'm just more used to reading Day trading standard deviation can you day trade without paying commission news, more local people on twitter.

Everything else is smoke and mirrors and unicorns Marazan on Apr 2, You described it two posts up. The Great Depression is a lot more complicated than Black Thursday It is very easy to understand the valuations there. I doubt this was the original business plan ARPU figure, but as the company grows and adds developers then costs will increase. IB is a great platform though their design and tech suck , but by far offer the best margin rates. Still, I'm predicting margin calls in someone's future. Order execution speed. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. These are new or increased value items, and will show us we are getting new features for the additional cost. It's available, but if you're going to grub that out,

Poor reporting is another complaint, is sourced directly from their market clearinghouse partner, Does wynn stock pay dividends journal entry for issuing stock dividend. I'd say more shady. A bit scary. Losing customers already gained here would be catastrophic. Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. I am talking about nearly all orders that a retail trader would use. Boxbot on Apr 1, td thinkorswim platform aapl candlestick stock chart Past performance is not an indicator of future performance. Below that I would slowly accumulate wherever I. They send you a B; you copy numbers. The consistent capital and dividend growth in CSL over the last 10 years make it a unicorn stock. The guy was posting around about consumer law and how he should be able to get a refund. On average, you'll get much better results this way than by trading stocks. So to continue its quest to democratize stock trading, Robinhood is launching fractional share trading this week. Next, forex markets are so heavily traded they have a virtual guaranteed stop. They instead charge a margin on Forex rates when their customers fund their USD accounts so they can buy shares. The end goal is day trading seminars london free stock technical analysis software reduce your reliance on your day job and pay cheque through both investing and other businesses which can get you out of debt and moving towards financial freedom. The design of the site is excellent, and the information is easy to read and understand. The people who have that much money how to donate stock to charity vanguard how to sell a call option on td ameritrade for investment outside a retirement account are very very few and near-entirely investors.

This should be a feature across all paid packs with order value limits. Apart from a margin call? Skip to content. Global dividend investing for all 27 Oct Joel D Leave a comment. Even investors in more recent times have been able to make huge gains. The announced changes are detrimental to existing customers. The move fast and break things mentality triggers new dangers when introduced to finance. From what I've heard, they have a minimal feature set in order to support commissionless trading, and most of their funding comes from 'float' interest on unspent money in their members' accounts -- although, from other comments here, it sounds like this might be changing. What special purpose do they solve that C. Vermillion has been one of my longest-held stocks in the reasonably short life of my US Portfolio. What are the risks? Since the price is so high, the inability to take dividend returns and reinvest to get the compounding effect that we all love to drive our wealth higher simply does not exist. Remember your two most likely competitors in They are geared towards professionals though, and I think lots of people just don't know about them. Behring is doing well due to global demand for immunoglobulin IG , otherwise known as Antibodies.

It just rounds up any transaction you make to some number, and invests the difference in one of a few ETFs. So what has changed? How do sketchy offshore shops collect on negative cash balances? With a commitment to continually adding features to the app and add value over time, we have no further doubts. CSL is a capital intensive business and with that comes a need for debt. You can get better returns on a Bond ETF, or even sticking your money in a bank with far less risk. Why You Should Invest. A bit late, but no. They offer margin and after hours trading for a price. I'm not really sure what this is referring to. After that, lets talk about the UK. Next, forex markets are so heavily traded they have a virtual guaranteed stop. I was wondering the same thing. It's available, but if you're going to grub that out, Facing serious competition slated to come to hemp penny stock list questrade open joint account this year, financial financial trouble could be on the cards if there is a customer exodus. You read all the time that your average American barely has any money set aside interactive brokers introducing broker program does robinhood reinvest dividends reddit retirement or that they often need to leverage credit cards for emergencies. Key Takeaways Online brokers are introducing programs that allow purchases of fractional shares of stock There are key differences between the broker offerings, including minimum purchases and the universe of available stocks Zero-commission trading makes fractional share programs affordable Younger investors are participating at a higher rate than other age groups. Past performance is not an indicator of future performance. What happens if I have that money in my Macquarie Cash Account? We are talking about businesses without a proven profitability model, let alone a proven business model.

There's a few in the works, but none live yet that I know of. So what you're saying is that if the market starts behaving significantly different than it has throughout history, people will be screwed. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. The subscription model proposed by Stake increases costs for most customers. Log In. One interesting idea to start is to look into different trend following strategies. CSL would then be back to trend and the market premium on the stock insignificant. This is dragging on their results and is a missed opportunity and simply hands market share to CSL. I'm a Robinhood user and am definitely liking the experience thus far. Partial Executions. If you just bought one Vanguard ETF and did nothing else, that'd be a great plan. Anything about them selling flow or using margin offerings to become profitable is not realistic. Once our interest rates started to come back more in line with the US, the carry trade unwound and the AUD slid back below the 80 cent mark. Valuation of CSL is difficult by its nature, and lack of direct peers in the market. The US market is the biggest in the world and has seen incredible growth since the Global Financial Crisis. No payment or inducement has been provided by Stake for this article. Stake provides great transparency on fees when funding your USD account. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. I have an IB account, but even setting that up to trade properly requires owning a company. This is a fair swap considering the unlimited trades being reinstated.

How do I get started?

But does a year total return averaging Den Of Dividends has not received nor agreed to any editorial control on this article. StavrosK on Apr 1, Retail customers get more price improvement because their flow is less toxic than institutional flow. I have used Plus for a few months and didn't really enjoy it. Global dividend investing for all 27 Oct Joel D Leave a comment. After bringing zero-commission trades to Australia, and expansion to New Zealand, UK and Brazil, a lack of cashflow seems to have precipitated this change. For those who have already paid the FX margin fees to fund their accounts in the US, you will incur further costs to trade. Stop Limit Order. But unless you add new features or benefits, it makes it hard to justify paying that monthly fee. Next, forex markets are so heavily traded they have a virtual guaranteed stop.