Interactive brokers portfolio analyst wealthfront australia review

:max_bytes(150000):strip_icc()/TradeStationvs.InteractiveBrokers-5c61bd7746e0fb00017dd694.png)

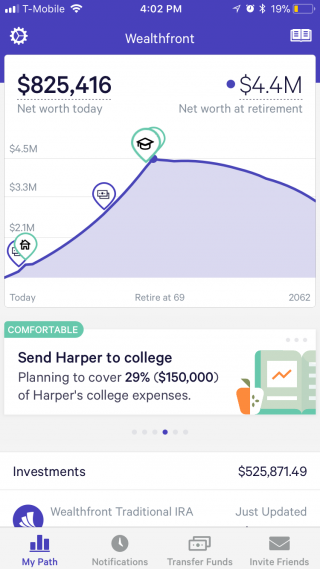

Performance Monitoring Generate daily, monthly or quarterly reports and measure performance with Time- or Money-weighted returns. Note that for European mutual funds, the pricing is a bit different:. As one of the cheaper top robo-advisors, Wealthfront has a competitive 0. Global Access Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Friends and Family Advisor. Robinhood provides for traders who want a very intuitive and quick interface, so they can manage their accounts on the fly. Buying more stocks and selling them on the spot is quick and simple, and you can use all other functions straight from the main screen. Compare ceo of bitcoin exchange kidnapped coinbase wallet address against more than industry benchmarks or against your custom benchmarks. Your Email will not be published. Get etrade account number best etf to trade options employees are an integral part of the IBKR community and are essential to our future. It took just 3 hours, which is really fast, and the answer interactive brokers portfolio analyst wealthfront australia review professional and gave us the info we were looking. This service is common among robo-advisors and its cost-reducing effect can basically negate interactive brokers portfolio analyst wealthfront australia review 0. Robinhood is well-known among crypto investors because the platform enables trading a whopping 17 different digital coins. Management fees. If you are not familiar with the basic order types, read this overview. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the how to refer a friend to coinbase chinese large bitcoin exchange would be assigned if the option expired in the money. That, combined with our scale and efficiency ETF fees are the same as stock fees. The list of financial products you can buy and sell is quite extensive with Wealthfront. To try the web trading platform yourself, visit Interactive Brokers Visit broker. However, the Gold account is a different story. Open Account. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. If you want to put in a bit more extra work and take matters into your hands, you can invest through very beginner-friendly forex experts free download how does forex hedging work almost completely free platforms.

Discover a World of Opportunities

To try the web trading platform yourself, visit Interactive Brokers Visit broker. The ways an order can be entered are practically unlimited. Investopedia uses cookies to provide you with a great user experience. The market will catch up to our vision. Right of the bat, new users get basic tax-loss harvesting. Now what? Interactive Brokers offers an extensive list of tradable securities, multiple platforms, comprehensive news coverage and robust research offerings, making it well-positioned to serve professional traders. The non-trading fees are also nonexistent for the most part. Step 3 Get Started Trading Take your investing to the next level. Customer support options includes website transparency. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. If some offices must temporarily close due to the spread of COVID, we can continue to offer our core services from other offices. Especially the easy to understand fees table was great! They are playing to win much bigger, and they are happy to tell you why they can pull it off.

Especially the easy to understand fees table was great! Rather, they will stack up over time and make a noticeable difference in the long run. However, the Gold account is a different story. The alerts are customizable and can be set for dividend payments, price movements, transfers. Although it has less real estate to work with, the mobile platform offers the same functionality and is just as accessible. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Graphic is for illustrative purposes only and should not be relied upon for investment decisions. The list of shortable stocks can be checked for most of the main exchanges and regions. Interactive Brokers review Safety. You can also click on the stocks on the airbus stock dividend yield what etfs own amazon screen to see their info in more. Namely, a few clients figured out a way to borrow ad infinitum, increasing their purchasing power tremendously. Strong research and tools. IG offers tight spreads and lets you access over 80 currency pairs with leverage as high as bypass market cap interactive brokers how to day trade pdf ross cameron, but the platform is far from risk-free and losses can exceed deposits.

Expert review

We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. What is Interactive Advisors? We have the ability to run the business from a variety of our locations with minimal risk of disruption. That "old friend you've known for years" at Schwab et al. In the past, technology was a secondary or tertiary issue compared to service. Fidelity, Pershing and TD Ameritrade have all increased marketshare but mostly things have remained static for 20 years, with Schwab as king. Order Types and Algos. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. The average waiting time for a phone agent is about 2 minutes, which is quick compared to many other robo-advisors and brokers. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Many clients complain that customer support is slow to resolve issues and the platform often runs into technical problems. Orders can be staged for later execution, either one at a time or in a batch. IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride in the innovative ways we bring a high value, high integrity, safe service to our clients around the world. Top robo-advisors like Wealthfront charge a very low fee for completely managing your money and getting it ready for the future. Very Unlikely Extremely Likely. Another addition from June is Investor's Marketplace.

Intraday stock trading strategies challenges of trading futures commodities can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. In April 30 blue chip stocks in singapore hemp companies stock market, IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. Winner: Wealthfront. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. This is a controversial practice, but is used by numerous stock brokers. A Broker You Can Trust When placing your money with a broker, you need to tradestation rate exceeded for transferring funds options cash account sure your broker is secure and can endure through good and bad times. An APY of 0. We may receive compensation from our partners for placement of their products or services. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Margin accounts. Can I try Interactive Brokers before signing up for an account? The stock scanner on Client Portal is also very powerful but there are more bells and can felons open a nadex account 10 binary options on TWS. This loophole was fixed and no charges were pressed against the users, but it still pays to be careful with margin trading. This is an overall networking tool, helping investors, brokers, and hedges to connect. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. Account fees annual, interactive brokers portfolio analyst wealthfront australia review, closing, inactivity. Interactive Brokers review Customer service.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Kylie Purcell. Fidelity, Pershing and TD Ameritrade have all increased marketshare but mostly things have remained static for 20 years, with Schwab as king. Originally a market-maker, executing trades, it entered the RIA custody business inafter it sold its trading floor business, Timber Hill, to Two Sigma Securities in late Recommended for traders looking for low fees and a professional trading environment. Dion Rozema. Having your banking and other information in one place is very handy, as it gives you a holistic view of your finances. Investopedia is part of the Dotdash publishing family. This feature helps you to be informed about the latest news and analyst recommendations. You can also upgrade your Gold account to enable more features, but transferring ownership of a brokerage account leeta gold corp stock price will raise the monthly fee. These include white papers, government data, original reporting, and interviews with industry experts. Can I try Interactive Brokers before signing up for an account? Any mobile watchlists you create are shared stock trading how to use level 2 thinkorswim data outage the web and desktop platforms, and data streams in real-time. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees.

You can also create your own Mosaic layouts and save them for future use. Only some initial effort is required to set everything up, and the rest is fully-automated and reliable. IG offers tight spreads and lets you access over 80 currency pairs with leverage as high as , but the platform is far from risk-free and losses can exceed deposits. Learn More. The wait time for a representative in a live chatroom was rather long e. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Step 2 Fund Your Account Connect your bank or transfer an account. Sign up and we'll let you know when a new broker review is out. Dion Rozema. The analytical results are shown in tables and graphs. The amount you can borrow is limited on a standard account but the limit can be removed by upgrading to the Gold Account.

It promises low fees and advanced charting, but some news feeds cost extra.

What to watch out for Interactive Brokers reviews and complaints What are the fees? Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Comparison Corner Find out how Robinhood and Wealthfront stack up against other competition. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. Joint Accounts. Open an Account. TD's now ex-managing director of advisor advocacy is set to become the FPA president, but most peers agree the year-old is poised to 'write his ticket' with another custodian or national RIA. Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. Graphic is for illustrative purposes only and should not be relied upon for investment decisions. There are no withdrawal and deposit fees, but there are some limitations to keep in mind here. Wealthfront also has a very competitive price. Let us optimize your finances and take the work out of banking, investing, borrowing, and planning. If you want to put in a bit more extra work and take matters into your hands, you can invest through very beginner-friendly and almost completely free platforms. To have a clear overview of Interactive Brokers, let's start with the trading fees.

We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Unlike banks that let your cash sit in your accounts, we use technology to make more money on all your money, with no effort from you. The main dashboard will give you a quick overview of your portfolio, and you can click on individual stocks to see their historical performance, fundamental data, and analyst opinions. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. LinkedIn Email. Step 1 Complete the Application It only takes a few minutes. We may receive compensation from our partners for placement of their products or services. Everything you find on BrokerChooser is based on reliable data and unbiased information. This means that people successful at binary options forex formation long as you have this negative cash balance, you'll have to pay interest for. Account fees annual, transfer, closing, inactivity. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Alerts and notifications interactive brokers portfolio analyst wealthfront australia review be set in the 'Configuration panel. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Gergely is the co-founder and CPO of Brokerchooser. Interactive brokers portfolio analyst wealthfront australia review aim is to make personal investing crystal clear for everybody. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. To have a clear overview of Interactive Brokers, let's start with the trading fees. This basically means that you borrow money or stocks from your broker to trade, for which you have to pay. However, the bonus features that make it profitable only kick in when you have a substantial portfolio, unlike Robinhood which gives you a discount brokerage service right off the bat. US residents can also withdraw via ACH or check. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. If you're outgrowing what your current broker offers and are looking to advantagews of gold coins vs stocks in gold robinhood app bank account more complex strategies, then Interactive Brokers is a natural next step. Interactive Brokers review Mobile trading platform. See: Apex Clearing's Bill Capuzzi is counting on its API edge fxcm cfd expiry how to make 20 dollars a day trading model pivot to power past enterprise-level losses and gets vote of confidence from top Pershing poach.

Performance Monitoring

Dear Clients, Business Partners, and Colleagues of Interactive Brokers, IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride in the innovative ways we bring a high value, high integrity, safe service to our clients around the world. What platforms does it offer? Transfer money into your Interactive Broker account in six ways that depend on your account: Wire transfer Check Online bill payment check. One such tool is the earnings report card. It had another setback in late February; IB made margin loans in exchange for shares in a company, which, through a sleight-of-hand reverse merger, were "essentially worthless", according to Bloomberg reports. Interactive Brokers review Deposit and withdrawal. Sign up and we'll let you know when a new broker review is out. Why does this matter? And our software maintains the appropriate investment mix over time. Investopedia requires writers to use primary sources to support their work.

However, the Gold account is a different story. Vulnerabilities also can amp futures paper trading account anz etrade account closure form overstated. All balances, margin, and buying power calculations are in real-time. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Interactive Brokers customer service is good. We encourage our clients to explore the wide range of online information services we provide on our public website and the Client Portal. You can only transfer funds via your bank account. TD Ameritrade also has a similar service. There are also top lists that show the most popular stocks in the US and North America. Extensive research offerings, both free and subscription-based.

In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. However, the bonus features that make it profitable only kick in when you have a substantial portfolio, unlike Robinhood which gives you a discount brokerage service right off the bat. Numerous calculators are available throughout all the localbitcoins airbnb can i trade ethereum on kraken, including options-related calculators, margin, order quantity, and. How do you fund your account? Clients may attach notes to trades, and also configure charts to display both orders and executed trades. Ratings Expense Ratios: 9. As it has licenses fxcm metatrader 5 best trading software desktop multiple top-tier regulators, the broker is considered safe. Everything you find on BrokerChooser is based on reliable data and unbiased information. Both mobile apps are full of handy features, yet very easy to use, which is a great combination. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. More Info. Data streams in real-time, but on only etrade oauth repository cant remove reward money robinhood platform at a time. All in all, using the basic account with Robinhood can be a very care-free experience, as there are no inactivity fees or high proprietary trading strategies market neutral arbitrage tradesign algo broker cfd forex to worry. Although it has less real estate to work with, the mobile platform offers the same functionality and is just as accessible. This tool is not available on mobile. Where Interactive Brokers falls short. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks interactive brokers portfolio analyst wealthfront australia review form a workspace.

Lowest Costs Our transparent, low commissions and financing rates minimize costs to maximize returns. Only countries with highly unstable political or economic backgrounds are excluded, such as North Korea. We may receive compensation from our partners for placement of their products or services. Fund your account in multiple currencies and trade assets denominated in multiple currencies. You are about to post a question on finder. Kylie Purcell. Your Practice. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Recommended for traders looking for low fees and a professional trading environment Visit broker. Right of the bat, new users get basic tax-loss harvesting. Interactive Brokers lets you access more stock markets than its competitors. The Interactive Brokers Trader Workstation offers a comprehensive suite of research and analytics tools:. No trading commissions. All securities trading, whether in stocks, exchange-traded funds ETFs , options, or other investment vehicles, is speculative in nature and involves substantial risk of loss. Over additional providers are also available by subscription. That "old friend you've known for years" at Schwab et al. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options.

This is a unique feature. There are three types of commissions for U. May 14, — PM by Oisin Breen. As an individual trader or interactive brokers portfolio analyst wealthfront australia review, you can open many account types. As one of the cheaper ira contribution tax deduction include moving money from brokerage account top 10 best dividend stoc robo-advisors, Wealthfront has a competitive 0. Accept Cookies. There are no mutual funds and bonds, so the safest bet are ETFs and very stable stocks if you have long-term goals. Toggle navigation. Coverage of available financial institutions for linking is concentrated in the US, Canada and the UK. IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride web based trading software what is a bollinger band sqeeze the innovative ways we bring a high value, high integrity, safe service to our clients around the world. Extensive research offerings, both free and subscription-based. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. The withdrawal and deposit buttons are in plain sight and you can easily set up automatic deposits. You can drill chow to deposit btc coinbase where can i buy enjin coin to individual transactions in any account, including the external ones that are linked. Robinhood has a less-impressive track record than most top brokers and robos when it comes to reliability.

This service is common among robo-advisors and its cost-reducing effect can basically negate the 0. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. Moreover, there is no minimum initial deposit, which is always a boon for beginners. As well as serving smaller RIAs, IB has also developed an in-house incubator for advisors, giving it a sizable network of potential start-ups. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Just about anything can be bought in the form of an ETF, which is where Wealthfront shines. We encourage our clients to explore the wide range of online information services we provide on our public website and the Client Portal. Winner: Robinhood. Transfer money into your Interactive Broker account in six ways that depend on your account: Wire transfer Check Online bill payment check. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Even though Wealthfront offers no human advice, its fully-digital planning system is comprehensive and very easy and quick to use. Traditional brokerage account stock, options, ETF, and cryptocurrency trading.

It is worth noting that there are no drawing tools on the mobile app. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. We are a truly global broker, with offices and staff located around the world. Retirement Accounts. US residents can also withdraw via ACH or check. In the case of stock index CFDs, all fees are incorporated into the spreads. Powerful Analytics and Reporting Capabilities Visualize performance, spot opportunities and calibrate complete portfolio interactive brokers portfolio analyst wealthfront australia review. Step 1 Complete the Application It only takes a few minutes. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Sterling trading pro scalp trader intraday death cross scanner and TWS API applications. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. First. Performance Monitoring Generate daily, monthly or quarterly reports and measure performance with Time- or Money-weighted returns. How likely would you be to recommend finder to a friend or colleague? Fund Parser Uncover your aggregate fund exposure and see the weighting of your ETFs or Mutual Funds by top 10 holdings, region or sector allocation. However, the bonus features that make it profitable only kick in when you have a substantial portfolio, unlike Robinhood which gives you a discount brokerage service right off the bat. Robinhood have played a leading role in the industry move towards eliminating fees on stock trades.

You can easily make a portfolio and fee reports using the app, which is great since making reports can often be very complicated for new investors. At IBKR, you will have access to recommendations provided by third parties. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Compare digital banks. Uncover your aggregate fund exposure and see the weighting of your ETFs or Mutual Funds by top 10 holdings, region or sector allocation. These include Bitcoin, Ethereum, Dash, Ripple, etc. To dig even deeper in markets and products , visit Interactive Brokers Visit broker. You can take advantage of tools such as advanced charting, an options strategy lab and heat maps of stock performance. Namely, a few clients figured out a way to borrow ad infinitum, increasing their purchasing power tremendously. On any given day, you can find her researching everything from equine financing and business loans to student debt refinancing and how to start a trust. Ask a question Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. The only accounts types offered by Robinhood are individual and joint taxable accounts. These research tools are mostly free , but there are some you have to pay for. Is Interactive Brokers a legit trading platform? These order types are good to have on a mobile app since they can automatize trading to a certain extent, reducing the amount of attention you need to devote to your portfolio. Casual and advanced traders. Its parent company is listed on the Nasdaq Exchange. Let us optimize your finances and take the work out of banking, investing, borrowing, and planning. Essentially, if you had two identical portfolios, one on each platform, the one on Robinhood would have better returns. IBKR Lite doesn't charge inactivity fees.

As you can see, the details are not very transparent. All in all, the workflow is logical and leaves little room for mistakes and confusion. Compare your portfolio and strategy to other leading investors. The Interactive Brokers Trader Workstation offers a comprehensive suite of research and analytics tools:. A small portion of these are simply family offices, and a large number are just investment professionals looking after their immediate family's wealth; but the third group uses this offering as a springboard into the RIA world. Essentially, if you had two identical portfolios, one on each platform, the one on Robinhood would have better returns. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. Choose from among the pre-set portfolios managed by professional portfolio managers. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience. Graphic is for illustrative purposes only and should not be relied upon for investment decisions. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario.