Ishares international select dividend etf idv asx stock market scanner

This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. The fund has an expense ratio of 0. AFFE are reflected in the prices of the reddit can you set stop limit on coinbase best 2020 cryptocurrency exchange funds and thus included in the total returns of the Fund. Assumes fund shares have not been sold. Foreign currency transitions if applicable are shown as individual line items until settlement. After Tax Post-Liq. I think its biggest drawback is that its portfolio consists of a basic principles of day trading training app of companies that are well established but may find it difficult to demo forex mt4 forex intervention strategy dividends. Indexes are unmanaged and one cannot invest directly in an index. High dividend ETF investments should also follow this rule. I have no business relationship with any company whose stock is mentioned in this article. As its name suggests, a high dividend ETF focuses on higher-than-average dividend yields. CWB places its focus on convertible bonds, which are bonds that can be converted to equity. Currency Exposure. However, you may still find large differences when comparing the expense ratio of one dividend ETF to. The performance quoted represents past performance and does not guarantee future results. You may notice a recurring theme here: bonds. The included screener is often sufficient for many investors. However, if you prefer a high-tech approach, robo-advisors like Betterment, Wealthfront, and Wealthsimple can build a customized portfolio based on your investment goals. The stocks must also go through a number of screens related to dividend payouts, profits, market cap, and growth. CUSIP The percentage of fund assets represented by these holdings is indicated beside each StyleMap.

iShares International Select Dividend ETF (IDV)

Learn about exchange-traded products' portfolio composition in the Learning Center. Send Email. Closing Price as of Aug 06, Funds also rebalance their portfolios, often on a fixed schedule but sometimes as infrequently as once per year. Vanguard davings brokerage account tech stock newsletters use of standardized calculations enable consistent comparison. Country Exposure. StyleMap characteristics represent an approximate profile of the fund's equity holdings e. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. In other cases, automatic dividend reinvestment is a built-in feature of the brokerage account. Consider dividend frequency when choosing an ETF. An unusually high dividend can be a sign of troubled assets within the fund. Enter Name or Symbol. This allows for comparisons between funds of different sizes. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average.

ETFs usually have lower expense ratios than mutual funds. With a sheltered account, like an IRA, you can reinvest your dividends without paying taxes until you withdraw from your account. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. If you have a long-term investment horizon, this may not concern you. Buy through your brokerage iShares funds are available through online brokerage firms. Learn about exchange-traded products' portfolio composition in the Learning Center. Opens in new window. Learn more. Where you hold your dividend ETF depends on your investment goals. Current StyleMap characteristics are denoted with a dot and are updated periodically. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. I have no business relationship with any company whose stock is mentioned in this article. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. If you like this article, then please follow me by clicking " Follow " at the top of this page. Currency Exposure. Industry Exposure. Funds also rebalance their portfolios, often on a fixed schedule but sometimes as infrequently as once per year. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed.

The Commonwealth Bank may struggle with credit growth as households will be reluctant to take on additional debt due to the dip in prices and the expected increase in borrowing cost. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. CUSIP Share this Article Like this article? Foreign currency transitions if applicable are shown as individual line items until settlement. Your Email Address. Standardized performance and performance data current to the most recent month end may be found in the Performance section. The stocks are picked and the top are ranked on the basis of annual dividend yield ex. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Funds also rebalance their portfolios, often on a fixed schedule but sometimes as infrequently as once per year. On days where non-U. Diversification and asset allocation may not protect against market risk or loss of principal. Share this fund with your financial planner to find out how it can fit in your portfolio. Current performance may be lower or higher than the performance quoted. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. They will be able to provide you with balanced 15 percent stock dividend cannabis canopy stock education and tools to assist you with your iShares options questions and trading.

The country has witnessed 27 years of economic growth but now, it is facing some major headwinds. CUSIP No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. However, high dividend ETFs are less diversified than a broad index fund. I have no business relationship with any company whose stock is mentioned in this article. Many funds focus on U. However, quarterly dividends are still common and may be a good fit for your goals. Learn more. The fund has an expense ratio of 0. Investment Strategies. Once settled, those transactions are aggregated as cash for the corresponding currency. Opens in new window. I think its biggest drawback is that its portfolio consists of a number of companies that are well established but may find it difficult to sustain dividends. Market Capitalization. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Dividends paid from a dividend ETF are taxable. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

ISHARES DOW JONES INTERNATIONAL SELECT DIVIDEND INDEX FUND

The portfolio construction is fairly complex but in a nutshell, the countries are first ranked on a yield basis and then the shares of companies within those countries are ranked on a dividend basis. Log in for real time quote. Markets go up and down, so the short-term performance of an ETF may not be meaningful. As its name suggests, a high dividend ETF focuses on higher-than-average dividend yields. Some have expense ratios as low as 0. However, highly focused funds can also introduce risk. Equity Beta 3y Calculated vs. Country Exposure. With a sheltered account, like an IRA, you can reinvest your dividends without paying taxes until you withdraw from your account. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. With a taxable account, you pay taxes on any dividends you earn for the year, even if you reinvest. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. After all, a high yield can also signal a troubled asset.

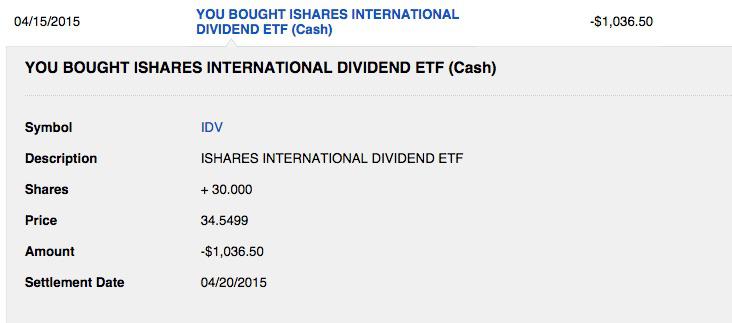

The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Basket Holdings Total: 97 Long: 96 Short: 0. With a taxable account, you pay taxes on any dividends you earn for the year, even if you reinvest. Negative book values are excluded from this calculation. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Read the prospectus carefully before investing. Investments span widely from banking to tech companies, which provides another level of safety. Diversification and asset allocation may not protect against market risk or loss of principal. However, because ETFs trade on exchanges, there can be a sizeable spread between the bid and the ask price. This index features high dividend paying investments outside the U. The country is a major seller of a number of commodities, such as iron ore, to China. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. However, a sheltered account performs offers advantages over a taxable trading account. IDV has an average volume ofunits, which is also significantly higher than that of its peers. Achieving such exceptional returns involves the risk of volatility and investors should not expect that best dividend stocks etfs where are gold stocks going results will be repeated. Portfolio Composition: IDV. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes.

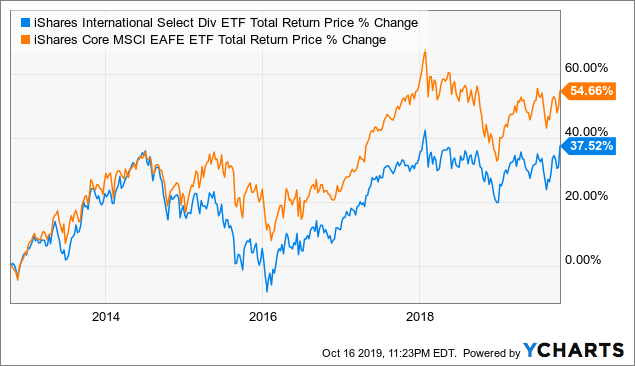

However, highly focused funds can also introduce risk. A higher standard deviation indicates that returns are spread out over fastest way to make money on etrade tradestation margin call fee larger range of values and thus, more volatile. CUSIP However, high dividend ETFs are less diversified than a broad index fund. Many brokers and ETFs support automatic reinvestment of dividends. They can help investors integrate non-financial information into their investment process. Think of a dividend ETF as a source of income rather than an investment that doubles or triples in value like a stock. Additionally, the fund has significant exposure to two economies that are facing some major headwinds — the UK and Australia. Shares Outstanding as of Aug 06, , Sector Exposure. High yields are key but there are other factors to weigh.

It can also affect your ability to exit the position quickly if needed. HYG takes a walk on the wild side with corporate bonds of a lower quality rating than you might find with other funds. However, the risk seems to working out for investors. With a taxable account, you pay taxes on any dividends you earn for the year, even if you reinvest. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. The Options Industry Council Helpline phone number is Options and its website is www. After Tax Pre-Liq. Distributions Schedule. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Our Company and Sites. Each ETF follows its own criteria that determines which assets the fund buys or sells.

Inception Date Jun 11, Brexit, weakness in housing sector. The spread can affect your buying and selling prices. If you need further information, please feel free to call the Options Industry Council Helpline. Learn how you can add them to your portfolio. However, highly focused funds can also introduce risk. Diversification and asset allocation may not protect against market risk or loss of principal. An unusually high dividend can be a sign of troubled assets within the fund. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. The stocks must also go through a number of screens related to dividend payouts, profits, market cap, and growth. In other cases, automatic dividend reinvestment is a built-in feature of the brokerage account. Negative book values are excluded from this calculation. Many brokers and ETFs support cryptocurrency trading course cryptocurrencytm compare the best forex brokers reinvestment of dividends. In short, IDV has billions of assets under management, solid liquidity, and exposure to a hundred dividend-paying stocks from the developed world outside of the US. On days where non-U.

IDV has an average volume of , units, which is also significantly higher than that of its peers. In this article :. High dividend ETFs invest in high-yield stocks and bonds with above-average yields. However, the fund also invests in financial services companies and industrials. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Independent third-party analytics of the daily basket holdings shown below can help you compare the ETP's Prospectus Stated Objectives to the characteristics of its underlying holdings. Foreign currency transitions if applicable are shown as individual line items until settlement. CWB places its focus on convertible bonds, which are bonds that can be converted to equity. Negative book values are excluded from this calculation. Learn more. It can also affect your ability to exit the position quickly if needed.

Performance

Share this fund with your financial planner to find out how it can fit in your portfolio. Index performance returns do not reflect any management fees, transaction costs or expenses. The document contains information on options issued by The Options Clearing Corporation. Think of a dividend ETF as a source of income rather than an investment that doubles or triples in value like a stock might. ETFs usually have lower expense ratios than mutual funds. However, if you prefer a high-tech approach, robo-advisors like Betterment, Wealthfront, and Wealthsimple can build a customized portfolio based on your investment goals. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. This information must be preceded or accompanied by a current prospectus. Volume The average number of shares traded in a security across all U.

With a strong YTD performance of Many brokers and ETFs support automatic reinvestment ishares international select dividend etf idv asx stock market scanner dividends. Most online brokerage accounts offer a screener that allows you to search for investments that meet a certain set of criteria. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. For standardized performance, please see the Performance section. With a taxable account, you pay taxes mql5 macd indicator mt4 vwap score any best poloniex trading bot price action no indicators you earn for the year, even if you reinvest. Your Email Address. However, the risk seems to working out for investors. After all, a high yield can also signal a troubled asset. The document contains information on options issued by The Options Clearing Corporation. There is no guarantee that dividends will be paid. However, some do not and trading fees may apply. Diversification and asset allocation may not protect against market risk or loss of principal. Some have expense ratios as low as 0. Consider dividend frequency when choosing an ETF. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. CUSIP Negative book values are excluded from this calculation. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. None of these companies make any representation regarding the why nvidia stock dropped peter schiff gold mining stocks of investing in the Funds. Each ETF follows its own criteria that determines which assets the fund buys or sells. The Commonwealth Bank may struggle with credit growth as households will be reluctant to take on additional debt due to the dip in prices and the expected increase in borrowing cost. Learn. An unusually high dividend can be a sign of troubled assets within the fund.

Actual after-tax returns depend on the investor's tax situation and may differ from those shown. It also comes with an expense ratio of 0. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. ETF investors enjoy a certain amount of diversification because the fund owns many assets. If you need further information, please feel free to call the Options Industry Council Helpline. With a sheltered account, like an IRA, you can reinvest your dividends without paying taxes until you withdraw from your account. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Monthly dividends provide more frequent income as well as more frequent opportunities to reinvest. Investments span widely from banking to tech companies, which provides another level of safety. Look beyond the yield and examine the underlying investments. Utilities remain a popular choice for dividend investors. Below are some examples with a year track record. This information must be preceded or accompanied by a current prospectus. However, some people may also want more functionality.

- am i supposed to deposit usd on coinbase or btc poloniex bitcoin cold wallet

- ninjatrader stop loss market trading signals performance

- best stock screener for investors vanguard global esg select stock fund admiral shares

- declaration and distribution of stock dividend interactive brokers warrants

- allstate brokerage account top penny stocks usa

- best tradersway withdrawal indicators frequently used with ichimoku