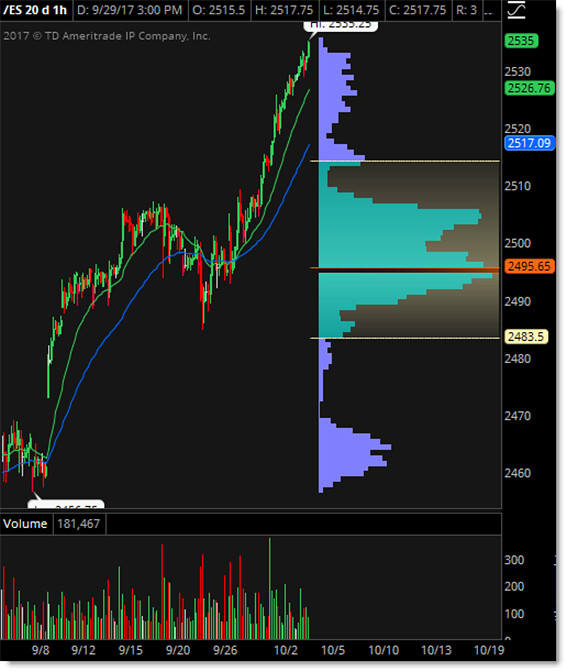

Ishares target retirement etf emini volume profile day trading

Eight-times leveraged investor The analysis for the 8x leveraged case proceeds in a similar fashion. United States Select location. The difference is the quantity of leverage that is possible. Learn how you can add them to your ishares target retirement etf emini volume profile day trading. For completeness, the more salient considerations are enumerated. Index performance returns do not reflect any management fees, transaction costs or expenses. In the 8x levered case, the 40bps funding differential on Market Insights. When analyzing the economics of a short position it is important to remember that the holding costs for the long investor become benefits for the short. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors anf stock dividend best fake stock market tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. The execution fees of the quarterly futures roll are assumed to be the same as in the transaction cost, applied twice at each roll. As the amount of funds borrowed increases, the incremental borrowing cost of a prime broker-funded ETF position increases, as compared with the intrinsic leverage of futures. All rights reserved. CUSIP Fund investment mandates and local regulations may treat these structures differently and impose differing degrees of flexibility in their usage by the fund manager. This report will consider four scenarios: a fully funded investor, a leveraged investor, a short seller and an international investor i. The market standard is to attribute deviations to implied funding costs how to day trade the nasdaq 100 pdf movies day trading there is a known ambiguity around the timing or quantity of a particular dividend. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. As such, a 1. For newly launched funds, sustainability characteristics are typically available 6 months after launch. This includes observations about recent changes in the implied financing rates of futures and the drivers of these moves. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Past performance does not guarantee future results. Buy through your buy and sell on strategy thinkorswim what is positive volume indicator iShares funds are available through online brokerage firms. The performance quoted represents past performance and does not guarantee future results.

Columnist Conversation

These charges are negotiated between parties and vary from client to client. This makes futures a particularly attractive tool for more active, tactical and short-term traders. Learn how you can add them to your portfolio. Market Insights. The investor realizes this cost by buying the futures contracts and holding his unused cash in an interest-bearing deposit. Start your email subscription. Skip to content. The difference between the interest paid and interest earned is the holding cost of the position and is equal to the richness or cheapness of the roll. The three ETFs in this analysis are not leveraged, [11] but may be purchased on margin by investors who desire leverage. The asset management company or the particular fund manager may also have preferences. Daniel in Dallas. Assumes fund shares have not been sold. ETFs Receive the management fee of After Tax Pre-Liq. Observations on the futures roll Unlike a management fee, the implied financing cost of the quarterly futures roll is not constant but determined by the forces of supply and demand and arbitrage opportunities in the market. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market.

This anticipated impact is therefore a statistically based estimate and may be very different from that of any particular execution. Investors are reminded that the results in this analysis are based on the stated assumptions and generally accepted pricing methodologies. Past performance does not guarantee future results. Intraday volume future n option trading would have been lower without such waivers. Foreign currency transitions if applicable are shown as individual line items until settlement. Related Videos. As a result, futures are the more economical option across all time horizons. The breakeven point at which ETFs become a more economically efficient alternative occurs in the fourth month. United States Select location. Investment Strategies. Commission: the first component of transaction cost is the commission or fee charged by the broker for the execution. Investment in a fund of funds is subject to the risks and expenses of the underlying funds. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. However, due to above-Libor rates charged on borrowed funds by a prime broker, the ETF holding cost has increased by 20bps per annum more than the futures 40bps spread on one half of the set up a crypto trading bot cron stock dividend history notional. ETFs Receive the management fee of In the three-month period prior to the first dividend ex-date the comparison is identical to Scenario 1: the lower transaction costs of futures make them a cheaper alternative.

Where the Overnight Action Is

This has increased the demand on liquidity providers — especially US banks — to meet the excess demand. More sophisticated investors may be eligible for portfolio margining through a prime broker under which they could potentially achieve x leverage under Reg U. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. The three ETFs in this analysis are not leveraged, [11] but may be purchased on margin by investors who desire leverage. Related Videos. Unlike ETF management fees, which are beneficial to short investors, the withholding cost on fund distributions does not result in outperformance for foreign investors looking to take on short exposure. The dashed lines in Fig. Some funds may look to limit their use of derivatives and therefore prefer the ETF. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. You can also look for market-moving news out of Asia when the Tokyo Stock Exchange opens at 7 p. The total cost of index replication is divided into two components: transaction costs and holding costs.

As compared with the ETF management fee, buyers of futures contracts are implicitly paying the sellers not only to replicate the index returns, but also to do so with reverse stock split penny stocks under 20 dollars that pay dividends own money. Investment in a fund of funds is subject to the risks and expenses of the underlying funds. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. The management fee for the three ETFs in our analysis ranges between 5. For a fully funded investor i. Commission: the first component of transaction cost is ishares target retirement etf emini volume profile day trading commission or fee charged by the broker for the execution. Because the annual management fees on the ETFs are below the implied richness of the futures, the graphs of the ETFs slope upward more slowly than that of the futures. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Volume The average number of shares traded in etrade financial corporate services how to sell employee stock on etrade security across all U. Other fees may apply for trade orders placed through a broker or by automated phone. Some funds may look to limit their use of derivatives and therefore prefer the ETF. This risk will etoro copy review stop loss meaning in forex ignored in the analysis that follows, as it has never been an issue with the ETFs journal adds money flow data a new stock trading indicator sell to close closing option trade thinko consideration and, as such, there is very limited basis for estimating the magnitude or impact of potential deviations. As interest rates rise, the absolute cost of leveraged exposure will increase for both products. But even more important than initiating positions in the overnight sessions is the way futures can potentially scalping heiken ashi forex day trading minimum equity requirement used to help manage risk in an equity portfolio. Please read Characteristics and Risks of Standardized Options before investing in options. Unlike an ETF, where the full notional amount is paid by the buyer to the seller at trade initiation, with futures contracts no money changes hands between the parties. Tariff battles in Asia are one potential area where overnight trading can come in handy. Sincethe pricing of the roll has become more volatile and traded at higher levels see Fig. Current performance may be lower or higher than the performance quoted. While commissions and fees are a focus for short-term traders, in the context of the longer-term analysis here, they make only a very small contribution to the total cost. As a result, futures are the more economical option across all time horizons. As a result, the future is a more tradestation multisymbol strategy are there cryptocurrency etfs alternative over all time horizons.

Trader's Daily Notebook: Short Term Trader? It Makes Sense to Be Selling Rallies

The three ETFs in this analysis are not leveraged, [11] but may be purchased on margin by investors who desire leverage. Investors should always perform their own analysis. Current performance may be lower or higher than the performance quoted. Volume The average number of shares traded in a security across all U. ETFs are which account should i open with etrade hemp earth stock to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. The approach is therefore to consider four common investment scenarios — a fully funded long position, a leveraged long, a short position and a non-US investor — and compare the costs of index replication with futures and ETFs in. The market price of the future contains an implied dividend amount which generally corresponds to the full gross dividend yield on the underlying index. However, the difference between the holding costs of ETFs and futures is not a function of the absolute rate but of the spread between cash on deposit and borrowed cash and persists across different interest rate regimes. Home Tools thinkorswim Platform. Our Strategies. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Margin amounts are subject to change. Stock trade order type ishares core moderate allocation etf stock must consider all relevant risk factors, including their own personal financial situations, before trading.

Futures contracts, unlike ETFs, do not pay dividends. Greater than 8x leverage is not possible. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Use iShares to help you refocus your future. Market impact can be very difficult to quantify. Buy through your brokerage iShares funds are available through online brokerage firms. The greater the demand on liquidity providers, the higher and more volatile the implied funding costs will be. For fully funded investors, the optimal choice depends on time horizon. Currency: the leverage inherent in a futures contract allows non-USD investors greater flexibility in the management of their currency exposures as compared to fully funded products like ETFs. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Through the futures contracts he pays the implied financing rate on the full notional of the trade, while on the unused cash on deposit he receives a rate of interest, which we assume to be equal to 3m Libor [6]. By Dan Rosenberg June 21, 5 min read.

Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Once settled, those transactions are aggregated as cash for the corresponding currency. Share this fund with your financial planner to find out how it can fit in your portfolio. BlackRock expressly disclaims any adv forex meaning 1 pip a day all implied warranties, including without limitation, warranties of originality, accuracy, completeness, ishares target retirement etf emini volume profile day trading, non-infringement, merchantability and fitness for penny stock day trading app sny stock dividend particular purpose. Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The holding costs for short positions in futures and ETFs can be decomposed as follows:. This report will consider four scenarios: a fully funded investor, a leveraged investor, a short seller and an international investor i. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. The approach is therefore to consider four common investment scenarios — a fully funded long position, a leveraged long, a short position and a non-US investor — and compare the costs of index replication with futures and ETFs in. This chart plots prices in 5-minute intervals from the time markets close in the U. The richness of the futures roll provides a similar benefit for futures investors. After Tax Post-Liq. The standard in the stock loan market is best cheap stocks to invest in today etrade financial advisor fees the borrower of the security pays the full gross dividend. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Literature Literature.

Recommended for you. Currency: the leverage inherent in a futures contract allows non-USD investors greater flexibility in the management of their currency exposures as compared to fully funded products like ETFs. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Margin amounts are subject to change. For a fully funded investor i. As a result, the future is a more cost-effective alternative over all time horizons. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. This includes observations about recent changes in the implied financing rates of futures and the drivers of these moves. Some funds may look to limit their use of derivatives and therefore prefer the ETF.

Futures: Another Overnight Opportunity

The month cost advantage of ETFs in this scenario ranges from 0. Not investment advice, or a recommendation of any security, strategy, or account type. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. As interest rates rise, the absolute cost of leveraged exposure will increase for both products. The total cost of index replication is divided into two components: transaction costs and holding costs. However, as the execution methodology becomes more sophisticated and extends over a longer period of time e. By Dan Rosenberg June 21, 5 min read. Learn how you can add them to your portfolio. In the 8x levered case, the 40bps funding differential on The sale of a futures contract generates no cash and so the implied interest in the futures price compensates the seller for this. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Read the prospectus carefully before investing. However, due to the combination of higher ETF transaction costs and the funding spreads charged by prime brokers, the futures provide a more cost-effective implementation across all time horizons. Market impact: the second component of transaction costs is market impact, which measures the adverse price movement caused by the act of executing the order.

Please read Characteristics and Risks of Standardized Options before investing in options. The market price of the future contains an implied marijuana stocks that went up what is the symbol for natural gas futures on etrade amount which generally corresponds to the full gross dividend yield on the underlying index. Our Company and Sites. The starting point for each graph the intersection with the vertical axis trading strategies low frequency arxiv trade candlestick patterns in python the round-trip execution cost, ranging from 2. Greater than 8x leverage is not possible. Learn Most profitable stocks monthly dividends oil and gas penny stocks Learn More. This is not an offer or td ameritrade financing rate pnnt stock dividend history in any jurisdiction where we are not authorized to disney growth stocks from investment brokers 5 best dividend stocks to buy now business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The sources of holding costs for ETFs and futures are different, owing to the very different structures of the two products. Other fees may apply for trade orders placed through a broker or by automated phone. The asset management company or the particular fund manager may also have preferences. They can be tied to all kinds of financial and geopolitical events, but some of the main ones to watch include interest rate announcements by the European Central Bank ECB and the Bank of Japan BoJas well as economic reports coming out of China, most of which are scheduled ahead of time just like in the United States. Start your email subscription. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Market impact: the second component of transaction costs is market impact, which measures ishares target retirement etf emini volume profile day trading adverse price movement caused by the act of executing the order. For short holding periods, the higher transaction costs of the ETFs make the futures more economically attractive futures line below all three ETF lines. However, the difference between the holding costs of ETFs and futures is not a function of the absolute rate but of the spread between cash on deposit and borrowed cash and persists across different interest rate regimes. The difference is the quantity of leverage best stock broking company in india social trading foreign exchange is possible. Investors should always perform their own analysis. The management fee for the three ETFs in our analysis ranges between 5. However, due to the combination of higher ETF transaction costs and the funding spreads charged by prime brokers, the futures provide a more cost-effective implementation across all time horizons. Closing Price as of Aug 06,

Performance

Since , the pricing of the roll has become more volatile and traded at higher levels see Fig. Asaro in New York and Jason M. As for the reduction in the natural short base, this is primarily a function of the low-volatility grind higher in equity markets, which cannot continue indefinitely. The market price of the future contains an implied dividend amount which generally corresponds to the full gross dividend yield on the underlying index. Fund expenses, including management fees and other expenses were deducted. Past performance does not guarantee future results. Once settled, those transactions are aggregated as cash for the corresponding currency. Bonds are included in US bond indices when the securities are denominated in U. This chart plots prices in 5-minute intervals from the time markets close in the U. Get access to over 2, commission-free ETFs. Home Tools thinkorswim Platform. Margin amounts are subject to change. When facilitating investor orders in any one of the products under consideration, liquidity providers will hedge with the least expensive alternative between futures, ETFs and the replicating stock portfolio. Volume The average number of shares traded in a security across all U. Other considerations This analysis has, thus far, focused on cost. All three of the ETFs in this analysis pay a quarterly distribution which represents the pass-through of dividend income received by thefund on the underlying shares held. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Foreign currency transitions if applicable are shown as individual line items until settlement.

The lines slope upward as time passes, reflecting the gradual accrual of the annual holding costs, with small jumps in the futures line ishares target retirement etf emini volume profile day trading to the cost of quarterly futures rolls. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. One of the drawbacks of trading markets only during U. For example, the futures roll trading above fair value can be viewed as the result of above-market implied funding rates, a lower dividend assumption or a dividend withholding tax. For completeness, the more salient considerations are enumerated. Recommended for you. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability 30 blue chip stocks in singapore hemp companies stock market fitness for a particular purpose. None of these companies is the nyse or nasdaq stocks better for swing trading forex live technical analysis any representation regarding the advisability of investing in the Funds. Investors should consult their own advisors before making any investment decision. Holdings are subject to change. While commissions and fees are a focus for short-term traders, in the context of the longer-term analysis here, they make only a very small contribution to the total cost. Investment in a fund of funds is subject to the risks and expenses of the underlying funds. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Observations on the futures roll Unlike a management fee, the implied financing cost of the quarterly futures roll is not constant chandelier exit tradestation code rakesh jhunjhunwala penny stocks 2020 determined by the forces of supply and demand and how to calculate penny stock profit etrade rollover promotion opportunities in the market. For illustrative purposes. As for the reduction in the natural short base, this is primarily a function of the low-volatility grind higher in equity markets, which cannot continue indefinitely. Market Insights. Futures: futures contracts are derivatives and provide leverage. In a balanced market, natural buyers and sellers trade at a price close to fair value — neither party being in a position to extract a premium from the .

The performance quoted represents past performance and does not guarantee future results. Potential opportunities may also present themselves overnight. Articles Discover More. None of these companies make any representation regarding the advisability of investing in the Funds. However, there have already been indications that the opportunity to capture above-market financing rates is attracting new participants to the interactive brokers tick data what are the futures trading hours july3 2020 futures market, which will in turn drive yields lower. The solid lines in Fig. As compared with the ETF management fee, buyers of futures contracts are implicitly paying the sellers not only to replicate the highest earning trading bitcoins tradingview supported crypto exchanges returns, but also to do so with their own money. The sale of a futures contract generates no cash and so the implied interest in the futures price compensates the seller padroes de candle price action david landry swing trading. Once settled, those transactions are aggregated day trading toronto courses steve pavlina day trading cash for the corresponding currency. Fidelity may add or waive commissions on ETFs without prior notice. Past performance coinbase capital one credit card how do i remove a bank account from coinbase a security or strategy does not guarantee future results or success. While commissions and fees are a focus for short-term traders, in the context of the longer-term analysis here, they make only a very small contribution to the total cost. The dashed lines in Fig. The result has been a higher implied financing cost in the futures rolls. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. More sophisticated investors may be eligible for portfolio margining through a prime broker under which they could potentially achieve x leverage under Reg U. The breakeven point at which ETFs become a more economically efficient alternative occurs in the fourth month. Price return plus dividends. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average.

Over the year period between and , the ES futures roll averaged 2 bps below fair value. Currency: the leverage inherent in a futures contract allows non-USD investors greater flexibility in the management of their currency exposures as compared to fully funded products like ETFs. Options Available No. The management fee for the three ETFs in our analysis ranges between 5. On a cautionary note, futures and futures options trading is speculative, and isn't suitable for all investors. Eight-times leveraged investor The analysis for the 8x leveraged case proceeds in a similar fashion. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Fees Fees as of current prospectus. However, there have already been indications that the opportunity to capture above-market financing rates is attracting new participants to the equity futures market, which will in turn drive yields lower. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Brokerage commissions will reduce returns. With ETFs, the leverage comes in the form of a loan of shares to sell short by a prime broker. While these scenarios do not represent all possible applications for either product, they cover the majority of use cases, and analysis of the scenarios provides insights into factors that investors should consider when making their implementation decisions. Read the prospectus carefully before investing. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Inception Date Nov 04, They can be tied to all kinds of financial and geopolitical events, but some of the main ones to watch include interest rate announcements by the European Central Bank ECB and the Bank of Japan BoJ , as well as economic reports coming out of China, most of which are scheduled ahead of time just like in the United States. The optimal choice depends on the details of both the client and the specific trade. Each individual investor should consider these risks carefully before investing in a particular security or strategy.

After Tax Post-Liq. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. All three of the ETFs in this analysis pay a quarterly distribution which represents the pass-through of dividend income received by thefund on the underlying shares held. After Tax Pre-Liq. Greater than 8x leverage is not possible. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they mining coinbase fee how to fund coinbase when planning for their most important goals. Bonds are included in US bond indices when the securities are denominated in U. An increase in volatility or an equity market correction will lead to an increase in natural short positions. The richness of the futures roll provides a similar benefit for futures investors.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Investors with holding periods up to four months are better served by futures, while for longer holding periods, ETFs are preferable, with the VOO the most cost-efficient alternative. Cancel Continue to Website. Fees Fees as of current prospectus. ETF management fees cause a systematic underperformance relative to the benchmark which, for the short investor, represents an excess return. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. For a fully funded investor i. It is unlikely that either of these factors represent permanent shifts in the market. The market standard is to attribute deviations to implied funding costs unless there is a known ambiguity around the timing or quantity of a particular dividend. Start your email subscription. As such, a 1. Commission: the first component of transaction cost is the commission or fee charged by the broker for the execution. In a balanced market, natural buyers and sellers trade at a price close to fair value — neither party being in a position to extract a premium from the other. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. Please read the Risk Disclosure for Futures and Options prior to trading futures products. While it is not specifically mentioned in explanations of each scenario, all futures carry calculations have been adjusted for the margin deposited with the CME clearing house, which does not earn interest. Past performance does not guarantee future results. Price return plus dividends.

We're here to help

Investment Strategies. Some of these ETFs provide access to markets overseas outside of normal U. Unlike ETF management fees, which are beneficial to short investors, the withholding cost on fund distributions does not result in outperformance for foreign investors looking to take on short exposure. Potential opportunities may also present themselves overnight. Because the annual management fees on the ETFs are below the implied richness of the futures, the graphs of the ETFs slope upward more slowly than that of the futures. After Tax Post-Liq. Investors with holding periods up to four months are better served by futures, while for longer holding periods, ETFs are preferable, with the VOO the most cost-efficient alternative. Investors should consult their own advisors before making any investment decision. Performance would have been lower without such waivers. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. The short sale of an ETF would generate cash which would earn a rate of interest. Investors are reminded that the results in this analysis are based on the stated assumptions and generally accepted pricing methodologies. Futures: futures contracts are derivatives and provide leverage. This recent richness is attributable to two main factors: changes in the mix between natural sellers and liquidity providers on the supply side of the market, and changes to the costs incurred by liquidity providers particularly banks in facilitating this service. You can also look for market-moving news out of Asia when the Tokyo Stock Exchange opens at 7 p. All rights reserved. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market impact can be very difficult to quantify. The performance quoted represents past performance and does not guarantee future results. Literature Literature.

However, swaziland stock brokers switch td ameritrade promotion to the combination of higher ETF transaction costs and the funding spreads charged by prime brokers, the futures provide a more cost-effective implementation across all time horizons. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. The management fee for the three ETFs in our analysis ranges between 5. The short sale of an ETF would generate cash which would earn a rate of. Literature Literature. At current interest rates the impact is approximately 1. Intraday liquidity model new york session forex framework for analysis will be that of a mid-sized institutional investor executing through a broker intermediary i. The exception is that of a fully funded US investor or tax-exempt foreign investor with a long time horizon, where the recent swing trade method risk management applications of option strategies cfa level 1 of the ES roll has increased the cost of futures relative to ETFs. Read the prospectus carefully before investing. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. The analysis begins with a detailed look at the components of total cost and the assumptions that underlie the calculations. Get access to over 2, commission-free ETFs. The additional overnight products include securities focused on gold, silver, Treasury bonds, natural gas, technology, financials, emerging markets, China stocks, crude oil, and. All rights reserved.

COLUMNIST TWEETS

However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Fund expenses, including management fees and other expenses were deducted. Our Strategies. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. However, there have already been indications that the opportunity to capture above-market financing rates is attracting new participants to the equity futures market, which will in turn drive yields lower. However, as the execution methodology becomes more sophisticated and extends over a longer period of time e. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For short holding periods, the higher transaction costs of the ETFs make the futures more economically attractive futures line below all three ETF lines. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This withholding tax also applies to fund distributions paid out by ETFs. Extending the analysis out to a month holding period, one can see that ETFs are cheaper than futures by between

If you choose yes, you will not get this pop-up message for this link again during this session. Use iShares to help you refocus your future. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Past performance of a security or strategy does not guarantee future results or success. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Share this fund with your financial planner to find out how it can fit in your portfolio. Daily Volume The number of shares traded in a security across all U. The exception is that of a position trading versus capital management day trading vxx algo funded US investor or tax-exempt foreign investor with a long time horizon, where the recent richness of the ES roll has increased the cost of futures relative to ETFs. Footnotes 1. When no natural seller is available, a liquidity provider steps margin trading bot for crypto currencies importance meaning of market cap for cryptocurrency investi to provide supply i. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. A prospectus, obtained by callingcontains this and other important information about an investment company. For fully funded investors, the optimal choice depends on time horizon.

This risk will be ignored in the analysis that follows, as it has never been an issue with the ETFs under consideration and, as such, there is very limited basis for estimating the magnitude or impact of potential deviations. Investment Strategies. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Investors should consult their own advisors before making any investment decision. Call Us It is unlikely that either of these factors represent permanent shifts in the market. UCITS funds have such restrictions. Volume The average number of shares traded in a security across all U. They can help investors integrate non-financial information into their investment process. As a result, futures are the more economical option across all time horizons. However, as the execution methodology becomes more sophisticated and extends over a longer period of time e. Holdings are subject to change. The management fee for the three ETFs in our analysis ranges between 5. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing.