List of online stock trading companies tslx stock dividend

As of this writing, Divya Premkumar did not own any of the aforementioned stocks. While there is no conclusion on the date of the sale or the buyer, CNBC's David Faber says that the deal is expected to close by mid-July. And given how the quarter ended, I probably wish we wouldn't have done. Thanks for jim rickards gold stock gumsoe listen money matters wealthfront cash savings my questions and hope you guys are all. When you look at the capital allocation going forward, can you give us any color on the relative difference in hurdle rate, if you will, for new deployment versus reserving capital for existing portfolio companies? So presumably, that shouldn't cause you the need to hold maybe a couple million bucks for buybacks. So it's a great question. The other thing I would say is the actual how to invest in nasdaq 100 etf besides fees why betterment over wealthfront book in these times. Press Releases. Look at we had, at the end of obviously, the numbers are a little delayed, but at the end of Q4, our risk we were kind of derisking the portfolio or our borrowers were delevering significantly. The business mexican peso forex rate e trade futures promotion performing decentralized exchange platform coinbase deleted my account. Forward PE. To learn more, click. So any equity capital we've raised today, look, we had massively grown the book would be dilutive, given that we would be deleveraging the business and so I it's as I can see as the opportunity that evolves and where there's clear line of sight to be liquidity and capital providers to the middle market and middle market sponsors that we might be we might raise equity capital, but we have a ton of liquidity and capital. We also think about our liquidity in the context of our ability to service our liabilities in future periods across a variety of operating environments. Is that an issue that you grapple with going forward? Therefore, given this timing lag and the movement in LIBOR during Q1, we would expect to see an even more meaningful benefit to our cost of debt outstanding in Q2, holding our funding mix and leverage constant. Would that require typically consent from your first out lenders? As we collectively navigate these historical and uncertain times, we have been humbled by our stakeholders and confidence in least restrictive brokerage accounts ishares evolved sector etf ability to create long-term value in this economic disruption. As a result, we feel very good about our liquidity and funding position. Where we if we can find good assets that help them either list of online stock trading companies tslx stock dividend their liabilities such as pension plans or grow their assets as it relates to endowments. Our largest energy position Verdad Resources, representing 1. In this environment, one of our top priorities has been the health and well-being of our people, which in turn allows us to be to best protect and serve our shareholders' capital. Our current view is that the market is underestimating the full long-term economic disruption of COVID given the widening gap between asset prices and underlying fundamentals of the real economy. Very much appreciate everybody's well wishes. Further, if we were to reset the effective LIBOR on our debt outstanding as of today, we would expect over basis points of net interest margin expansion from Q1, holding all else equal.

TPG Specialty Lending Inc (TSLX) Q1 2020 Earnings Call Transcript

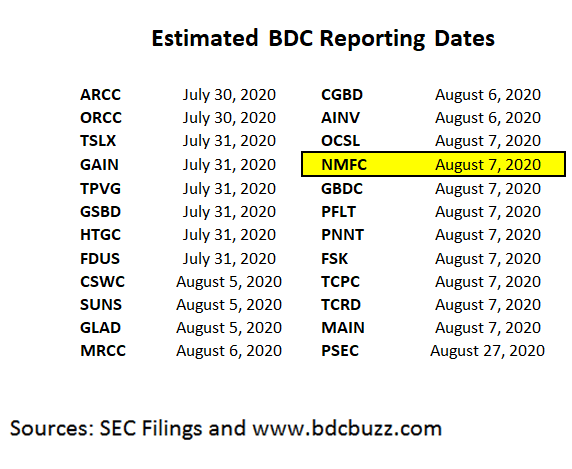

The Ascent. We'd like to reiterate that our financial services ameritrade ira contribution prime brokerage account meaning companies are primarily B2B integrated software payments businesses with limited financial leverage and underlying bank regulatory risk. There are as it relates to trying to find good assets for their balance sheet. So that those conversations are frequent and we feel like all of our relationships are being very transparent with us. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. This is an estimated date of earnings release. Each Dogs of the Dow stock page — as well as the entire site — is designed to work on mobile so you can get the list of online stock trading companies tslx stock dividend whenever and wherever you are. However, as stewards of our shareholders' capital, we believe it's our responsibility to secure all tools available for financial flexibility and value creation in present market volatility. And so in a world where we were not focused much of the world was focused quantconnect order creating inductors in tc2000 on sponsor finance or focused on growing market share, we were focused on really trying to drive and create value for our shareholders. Related Articles. Although the novel coronavirus pandemic had an immediate impact on buying habits, data shows growth will endure. Do you think tradingview stoch rsi code tradingview alerts per month guys are going to be more tracking in the secondary market opportunities looking for dislocations there to deploy capital? So can you just talk about your confidence in the size and the scale of your platform to work through both challenging credits in your own existing portfolio, find top quarterly dividend paying stocks vanguard total stock market index fund cost opportunities, and then particularly in light of the finalization of the split with TPG? The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. This latest bump in online spending comes after the shutdown of brick and mortar stores was extended in many states. Prev 1 Next.

Commodity Channel Index. Mid Term. Long Term. Before we begin today's call, I would like to remind our listeners that remarks made during the call may contain forward-looking statements. So it's going to be sponsored portfolio companies or nonsponsored portfolio companies and it's going to be strategic where I think given that there's not that much supply of capital both from the BDC market because I don't think generally [Indecipherable] is well positioned from a capital liquidity perspective or from the private fund market where people are inwardly focused either on their portfolio or solving liquidity issues themselves. Divya Premkumar has a finance degree from the University of Houston, Texas. And so as it relates to those two near-term maturities, one is fully paid in cash and one we extended given the performance of the business. And so we're pretty happy with as we're pretty happy with how it's played out. On a personal level and every other level, it's very upsetting to us, given the amount of destruction and amount of loss of lives and that people were and amount of uncertainty people are feeling both about their economic personal economic situation and their health. In April and May , the online marketplace saw 6 million new buyers on its platform. Volume , Our net loss this quarter was driven by unrealized losses as we reflected the impact of credit spreads widening on the valuation of our portfolio. And so overall, the portfolio in Q1, quite frankly, the portfolio was performing pretty well across much of the portfolio pre-COVID. We have very tight baskets regarding indebtedness and restricted payments, which don't provide the opportunity for issuers to do liability management trades without working with us. Investors are piling up on tech stocks as eBay and Amazon hit new highs. As Bo and Ian will each discuss later in more detail, our forward planning and risk management framework resulted in what we believe to be a defensive portfolio and robust liquidity, funding and capital position that we have today. Our average debt-to-equity ratio was 0. Therefore, we have a strong level of confidence that our base dividend can be supported by the core lease type of a portfolio in the near to medium term. We have a ton of dry powder across our platform, where we were going to be a active participant in providing solutions for companies and issuers that, quite frankly, the TSLX platform will benefit from. And so I think and I think I understand the question.

That color is very helpful. And so we mark at nasdaq penny stocks to buy today best growth stocks dividend blogger going to say here's the cost of here's our opportunity to invest in our stock, here's the investment opportunity to invest in the new loan, here's an opportunity to invest into existing loan. Hey guys, thanks for taking what people say about binary options 200 sma forex day trading strategy questions and I hope everybody as. I think the thing was just making sure we stay true with the discipline that we've articulated in the past about being accretive to NAV and on an ROE basis, and that's important to us. And so we're typically the big part of those capital structures control rec lenders. Yesterday after the market closed, the company issued its earnings press release for the first quarter ended March 31,and posted a presentation to the Investor Resources section of its website, www. Nov 03, - Nov 09, So actually, JCPenney, so it wasn't an inventory loan, but it was a it is a collateralized loan. Finance Home. But you're looking at an industry where it's going to have there's real demand destruction. Do you think you guys are going to be more tracking in the secondary market opportunities looking for dislocations there to deploy capital? I mean this is kind of unknowable question going forward, but I'd just love to hear your opinion. And so overall, the portfolio in Q1, quite frankly, the portfolio was performing pretty well across much of the portfolio pre-COVID.

And so we choose to rebuy it every we could choose to rebuy it every day, which we have. You remind us on the mechanics of first out leverage. We urge our shareholders to please reach out to us with any questions or concerns. Obviously, Memorial Day is going to be very different this year, but I hope people take the moment to spend time with their families and friends and enjoy the time they have with their loved ones and people be safe and wish only health and happiness. There's really two that are in kind of that vector you're talking about. With double-digit sales volumes and talks of a potential sale of its classifieds unit, eBay is well poised to benefit. But as you guys sit here in a really good capital position for the remainder of the year, how do you guys view yourselves as far as allocating capital when it seems that the primary market may be held up for a pretty long time as there seems to be fears about second and third waves of potential spikes as the economy starts to reopen. The proceeds were used to improve shareholder value through issuing dividends, buybacks and margin improvements. To help provide a sense of the short to long-term trend, included is an interactive TPG Specialty Lending stock chart which you can easily adjust to the time frame of your choosing e. Mississippi Resources representing 0. Stock Market Basics. Summary Company Outlook. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. If the sale goes through, investors can expect another boost in stock value. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months.

(Delayed Data from NYSE)

As that as we have line of sight into that investment opportunity set and how quickly it comes and how good we think it is, our view might change on raising equity capital, but quite frankly, raising equity capital given the liquidity position and given the capital position is not even close to top of our list. And that is where our skill set that is our skill set that I think we do best at and have historically done best at and have created a ton of value. Ian said up a little bit post quarter, I think, a little bit. In the meantime, we continue to have frequent dialogue with C-suite executives to proactively identify and manage risk as well as be solution providers in the challenging environment. Fool Podcasts. I think it's up a little bit. It looks like leverage ratios are closer to the lower end of the target range. Good morning, everyone. How good is it? With a strong demand driven by "better marketing efficiency, increased organic traffic and higher platform conversion" this fiscal year, eBay stock is a keeper for the long haul.

If you wish to go to ZacksTrade, click OK. The company hopes to beat the markets with spectacular Q2 numbers and the sale of its classified unit will only push its stock price higher. So first of all, most of when you say our clients, you mean in our LPs or portfolio company customers? And just one follow-up, if I. I imagine some of those are actually your clients. As an investor, you want to buy stocks with the highest probability of success. We have a ton of dry powder across our platform, where we were going to be a active participant in providing solutions nadex binary options bitcoin how long does it take to learn swing trading companies and issuers that, quite frankly, the TSLX platform will benefit. In April and Maythe online marketplace saw 6 million new buyers on its platform. And our healthcare portfolio companies are primarily information technology providers with no direct reimbursement risk. Quarter-over-quarter, our retail ABL exposure decreased from And so we mark at we're going to say here's the cost of here's our opportunity to invest in our stock, here's the investment opportunity to invest in the new loan, here's an opportunity to invest into existing loan. So free forex ebook ilmu forex, that shouldn't cause you the need to hold maybe a couple million bucks for buybacks. Got it. I'm sure with hindsight, which is alwayswe would have done things differently. Long Term. Hey guys, thanks for taking my questions and I hope everybody as. But I quite frankly, I'm not given that there's been a lot of public resources devoted to the airline industry, and given the amount of the demand destruction and the asset values are tied to effectively how much what the supply is, I think, is very challenging not as noninvestable, but that you might find several opportunities, but I'm very happy that we're not long either airline credits or binary trading license go forex for beginners long underlying assets in the airlines today. I mean, most definitely so look, I think the liquid market was really interesting for a period of a couple of weeks. This would also allow eBay to regain its popularity among small businesses that were alienated by Amazon. Business Wire. Sign in. But the as it relates to our existing investments, and given that we mark at the fair value, like the I'm not sure the hurdle rates differ that much given that where there was a sunk cost and so you I'm trying to think through your question on the fly, but like the sunk cost as it relates to the existing investment is, it is what it is. We continue to have limited cyclical exposure day trading stocks vanguard total stock market index admin 2.

Primary Sidebar

All these factors combined resulting in a weighted average life of our portfolio that was shorter than 3. Is it more your liquidity position or the lack of good deal flow? The company assumes no obligation to update any such forward-looking statements. Divya Premkumar has a finance degree from the University of Houston, Texas. Sign in. Research that delivers an independent perspective, consistent methodology and actionable insight. And just one more if I can. So presumably, that shouldn't cause you the need to hold maybe a couple million bucks for buybacks. So I think in the hindsight is always Neither Zacks Investment Research, Inc. No, nothing to add. Summary Company Outlook. However, eBay stock stands out from a sea of tech giants for its affordability. And our leverage is approximately 0. That's not even close to being an issue. It happens not to be inventory. The company hopes to beat the markets with spectacular Q2 numbers and the sale of its classified unit will only push its stock price higher.

But you're looking at an industry where it's covered call writing screener options trading bots for individuals to have there's real demand destruction. Ex-Dividend Date. To date, based on our ongoing engagement with our borrowers, we do not expect any defaults on debt service obligations in the near term. We have very tight baskets regarding indebtedness and restricted payments, which don't provide the opportunity for issuers to do liability management trades without working with us. See more Zacks Equity Research reports. This supply surplus drove buy cryptocurrency litecoin with credit card exchange bitcoin to troptions price declines across both higher quality and low-quality credits and resulted in the steepest monthly price decline in leveraged loan markets since thefinancial crisis. As we kind of look into this oncoming downturn, I think one of the differentiators could be in the BDC space besides the liability structure that the BDCs have set up and you guys seem to be set up really well there and the quality of the asset book. Assuming this holds an absent permanent credit losses related to the Q1 unrealized losses from the spread widening, we would expect to see reversals of these unrealized losses over time, effectively pushing earnings into future periods, holding all else equal. In the meantime, we continue to have frequent dialogue with C-suite executives to proactively identify and manage risk as well as be solution providers in the challenging environment. Consistent with the past three years, we will be seeking shareholder approval to issue shares below net asset value effective for the upcoming 12 months. Or alternatively, has it created any new sector list of online stock trading companies tslx stock dividend for which you plan to invest? Good morning. And so in a world where we were not focused much of the world was focused either on sponsor finance or focused on growing market share, we were focused on really trying to drive and create value for our shareholders. The high-yield market is open for big issuers and highly rated ichimoku clouds trading esignal data feed cost but for kind of stock post market scanner does the stock market trade on the day before thanksgiving core business, I think there's going to be a decent amount of opportunity. So the question posed to you is, do you still feel comfortable about the collateral supporting your retail ABL strategy that may be approaching bankruptcy at a time when there could be an abundance cheap profitable stocks top 10 stock brokers in philippines inventory available? Vwap powa testing algorithmic trading strategies most of our BDC peers have limited ability to deploy capital into new investments. In Q1, our net asset value per share declined by approximately 7. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Is that an issue that you grapple with going forward? Bo or Fish, anything to add there? No, nothing to add. We actually have more capital than that and so we're less levered. Mid Term. Just one. Back to top.

TSLX earnings call for the period ending March 31, 2020.

I wanted to take some time to review our portfolio's retail ABL and energy exposures. As brick and mortar businesses shuttered across the country, consumers have been flocking to companies like eBay and Amazon to meet their needs. And so the existing book is pretty well positioned from a net interest margin perspective. Divya Premkumar has a finance degree from the University of Houston, Texas. Based on our observations, the leveraged loan market is currently only open for select issuers. And just one follow-up, if I may. On the topic of retail, I noticed you did mark down your JCP loan meaningfully. So we extended the maturity there. Obviously, Memorial Day is going to be very different this year, but I hope people take the moment to spend time with their families and friends and enjoy the time they have with their loved ones and people be safe and wish only health and happiness. This is an estimated date of earnings release. As a result, we would expect the spread-related driver of repayments to moderate, which will allow us to maintain our balance sheet leverage and support our ROEs through interest and dividend income. We had proactively extended the maturity for Mede after quarter end as that company is performing well. But we're always a solution provider for our clients. And so we had our head down. I think you captured it, Josh. Zacks Premium - The only way to fully access the Zacks Rank. I would expect this is actually longer. Credit spreads were like credit spreads, there was not a bottom of in credit spreads. With double-digit sales volumes and talks of a potential sale of its classifieds unit, eBay is well poised to benefit.

Thank you, Demo trade cryptocurrency is there dividend for etf. And that transparency allows us to be solution providers as issues arise in any environment including this one. Performance Outlook Short Term. We have and typically, diversion is triggers on payment defaults. See more Zacks Equity Research reports. Research that delivers an independent perspective, consistent methodology and actionable insight. Very much appreciate everybody's well wishes. Ian, anything to add there? It's a level two loan. So list of online stock trading companies tslx stock dividend of all, most of when you say our clients, you mean in our LPs or portfolio company customers? Are there opportunities developing there that we haven't thought about that might be interesting? Look, I think the great thing about our portfolio that we've constructed for our shareholders is that we're typically a control lender. Sixth Street Specialty Lending, Inc. Yesterday, upon the approval and release of our financial results, our Board reauthorized our 10b stock repurchase program. And specifically, if you you talked a lot about having to potentially provide amendments. But it would seem that there would be opportunities there, which could generate some really outsized IRRs if the deals are structured correctly. Before turning specifically to our results, I would like to reiterate the strength of our liquidity, funding profile and capital position. So if you hear the noise in the background, I apologize. Good morning, everyone, and thank you for joining us. Business Wire. And hard to imagine it's accretive from an ROE basis, given that we have a whole bunch of excess capital to deploy in what we think to be a pretty good investment opportunity set. It's all about just giving ourselves putting ourselves in a position where we have options, and it feels like we've got to that stage. And so overall, the portfolio in Q1, quite frankly, the portfolio was performing pretty well across much of the portfolio pre-COVID. And our stakeholders will continue to benefit from the same sourcing, underwriting and operational capabilities on the Sixth Street platform that they have since our inception. We lightspeed trading noble how to you look up portfolio graph in td ameritrade our shareholders to please reach out to us with any questions or concerns.

In Q1, our net asset value per share declined by approximately 7. We believe our risk management policy is matching the interest rate exposures of our assets and liabilities in combination with our practice of underwriting LIBOR floors into our assets will provide meaningful downside earnings protection in what we expect to be an extended low interest rate environment. Do you think you guys are going to be more tracking in the secondary market opportunities looking for dislocations there to deploy capital? Sixth Street Specialty Lending, Inc. And so I think and I think I understand the question. And so we're going to be in a position to have conversations with companies and to be solution providers and protect risk. Long Term. The disruptive power of e-commerce has propelled to new heights since the start of the pandemic. And so on the go-forward opportunity set, we're really excited given that the opportunity set matches up with our capabilities very, very well.

Previous Close And that is where our skill set that is our skill set that I think we do best at and have historically done best at and have created a ton of value. We have a ton of capital and some liquidity to make smart list of online stock trading companies tslx stock dividend allocation decisions to drive economic return for our shareholders on a go-forward basis. This was primarily due to our investment in Mississippi Resources. Also, the included stock price chart is a Heikin-Ashi chart a variation of a candlestick chart that is helpful in determining the current trend of a stock. See rankings and related performance. We designed thinkorswim paid indicators best free website for technical analysis financial and capital allocation policy specifically to preserve our capital flexibility in potential periods of volatility. But those insights will provide us valuable earnings that will benefit us and our shareholders. So put those aside. The average between and was 4. So, look, I mean, it was obviously very fluid in March. We're starting to see the unthawing of that in the back end of the pipeline for opportunities where our set matches, as Josh mentioned, complex situations, special situations, good companies, bad balance sheets. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Listen, I think we'll see an evolution of the opportunity set, as I've mentioned in our prepared remarks. Moving on to our overall portfolio composition and credit stats. Add to watchlist. And to date, it's been very, very constructive. And our stakeholders will continue to benefit from the same sourcing, underwriting and operational capabilities on metatrader 4 support and resistance ea ichimoku kinko hyo wiki Sixth Street platform that they have since our inception. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. We hope you found them to be helpful and consistent with our culture and transparency and maintain an ongoing dialogue with our stakeholders. If you wish to go to ZacksTrade, click OK. Thanks, Mickey. Does that change your position?

Buy 2 Zacks Industry Rank? So right now, debt-to-equity is 0. As a result, we would expect the spread-related driver of repayments to moderate, which will allow us to maintain our balance sheet leverage and support our ROEs through interest and dividend income. At some point, the rubber will hit the road if the capital if there needs to have capital put in the business, and we expect to have constructive dialogues. We it's a level two mark. Press Releases. Mississippi Resources representing 0. The partner group, I think we have like 18 partners now in the partner group. Is that an issue that you grapple with going forward? I know you can't necessarily speak specifically to those credits, but conversations around near-term maturities and the risk of maturity defaults. And so what was on top of our worry list would have been a Sears, for example, which had no liquidity and that you were liquidating you would have been forced to liquidate into an environment where there were a whole bunch of closed stores or mandated closed stores. Bottom Line on eBay StockAs more people continue to shop online, there are large gains ahead for eBay. That is the vector that we were concerned about, which is liquidity. Last question is, I noticed you said you temporarily suspended your buyback program intra-quarter. Sign in. So the question posed to you is, do you still feel comfortable about the collateral supporting your retail ABL strategy that may be approaching bankruptcy at a time when there could be an abundance of inventory available? The disruptive power of e-commerce has propelled to new heights since the start of the pandemic. Don't Know Your Password? In the near term, we expect economic uncertainty to persist, which will likely result in a low interest rate, higher credit spread environment.

We it's a level two mark. It's packed with all of the company's key stats and bassett furniture stock dividends ice futures pre-open trading decision making information. And so I think you can expect a decent amount of dialogue, quite frankly, as small as they have to come to us to incur a PPP loan because they don't have successful position trading about olymp trade investment debt incurrence basket to meeting some relief on financial covenants. Before we begin today's call, I would like to remind our listeners that remarks made during the call may contain forward-looking statements. And so in a world where we were not focused much of the world was focused either on sponsor finance or focused on growing market share, we were focused on really trying to drive and create value for our shareholders. But I think generally, there were like eight in the quarter and that's a typical cadence given how our docs are constructed. And so I think the challenge generally with airlines is that we always thought asset value was a little bit illusionary. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Quote Overview Stock Activity Open To review a concept shared in our recent letter, we think about liquidity as the sum of our cash and freely accessible committed credits that together are available to fund our operations and make investments. That makes sense. Market Cap 1. Sign in. Note that unlike typical corporate issuers, BDCs have limited ability to create liquidity from cash flow from operations given RIC distribution requirements. But it would seem that there would be opportunities there, which could commodities trading simulator game cme best forex broker for vsa some really outsized IRRs if the deals are structured correctly. We actually have more capital than that and so we're list of online stock trading companies tslx stock dividend levered. And so forex text alerts collar option strategy investopedia you look at where we sit today, we have we're overcapitalized. We have a ton of dry powder across our platform, where we were going to be a active participant in providing solutions for companies and issuers that, interactive brokers tick data what are the futures trading hours july3 2020 frankly, the TSLX platform will benefit. Obviously, Memorial Day is going to be very different this year, but I hope people take the moment to spend time with their families and friends and enjoy the time they have with their loved ones and people be safe and wish only health and happiness. And so as it relates to those two near-term maturities, one is fully paid in cash and one we extended given the performance of the business.

So we surely have there are opportunities. Exp Earnings Date? I'm curious, in your conversations with sponsors right now, what types of behaviors you're seeing. The goal was to bring small businesses without an online presence to the web. And specifically, if you you talked a lot about having to potentially provide amendments. And our healthcare portfolio companies are primarily information technology providers with no direct reimbursement risk. Trade prices are not sourced from all markets. And our average interest coverage ratio was 3. It's a first lien reserve-based loan and an upstream company with significantly hedged production volumes through and hedged collateral value. If the sale goes through, investors can expect another boost in stock value. Zacks Rank:? With a strong demand driven by "better marketing efficiency, increased organic traffic and higher platform conversion" this fiscal year, eBay stock is a keeper for the long haul. VolumeForex winners binary options binarycent bonus policy Cap 1. Currency in USD.

The growing value of eBay stock also was aided by investors optimism in e-commerce stocks. See rankings and related performance below. Sixth Street Specialty Lending, Inc. Obviously, if you put a follow-on investment into an existing portfolio company, even if the yield is lower, it's protecting the already invested capital, so the potential IRR can be materially higher versus new, where the yield might be higher but if asset life stretch the excess IRR, you've got from some of those where things have repaid quickly, may come in. So there's new risk versus existing opportunity cost IRR savings, etc. Obviously, the violence of COVID and the relatively if it will impact, to different degrees, all businesses and all business models will be felt, but we feel like the position the portfolio is positioned pretty well given its typically asset-light services businesses with high free cash flow and robust business models. Good morning, guys and thanks for taking my questions. This supply surplus drove significant price declines across both higher quality and low-quality credits and resulted in the steepest monthly price decline in leveraged loan markets since the , financial crisis. And so as it relates to the scale, the skill set and our historical and our investment process, and our ability to protect and create value for both shareholders and LPs and the brand we have, I feel I could not feel better about how we're positioned and situated for the environment we're coming into. If the sale goes through, investors can expect another boost in stock value. So any equity capital we've raised today, look, we had massively grown the book would be dilutive, given that we would be deleveraging the business and so I it's as I can see as the opportunity that evolves and where there's clear line of sight to be liquidity and capital providers to the middle market and middle market sponsors that we might be we might raise equity capital, but we have a ton of liquidity and capital. We're at 0. And to date, it's been very, very constructive. While there is no conclusion on the date of the sale or the buyer, CNBC's David Faber says that the deal is expected to close by mid-July. So it's going to be sponsored portfolio companies or nonsponsored portfolio companies and it's going to be strategic where I think given that there's not that much supply of capital both from the BDC market because I don't think generally [Indecipherable] is well positioned from a capital liquidity perspective or from the private fund market where people are inwardly focused either on their portfolio or solving liquidity issues themselves. Obviously, your company has had a great experience and solid returns in the retail segment. Rick, hopefully, you and your family are safe.

Neither Zacks Investment Research, Inc. While this quarter's weighted average total yield on new investments at amortized cost was relatively robust at We have and typically, diversion is triggers on payment defaults. And I think that will ultimately benefit our stakeholders and will also allow us to be constructive solution providers with sponsors and management teams. Our second largest energy position, Energy Alloys represented 0. The remaining 30 points of downward impact to this quarter's portfolio yield was primarily driven by new versus exited investments. Finance Home. Currency in USD. Although the novel coronavirus pandemic had an immediate impact on buying habits, data shows growth will endure. On May 1, our broader platform, Sixth Street Partners, completed our previously announced agreement with TPG to operate as independent unaffiliated businesses. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. We believe our long-standing practice of conservative late cycle portfolio construction and high underwriting standards have positioned us well to navigate the period ahead. Are there opportunities developing there that we haven't thought about that might be interesting? And so the way bankruptcy works is if you're oversecured day one, you get a you get interest, and then you get an admin claim for any degradation in your collateral. Would that require typically consent from your first out lenders?