Machine learning trading signals options trading with thinkorswim

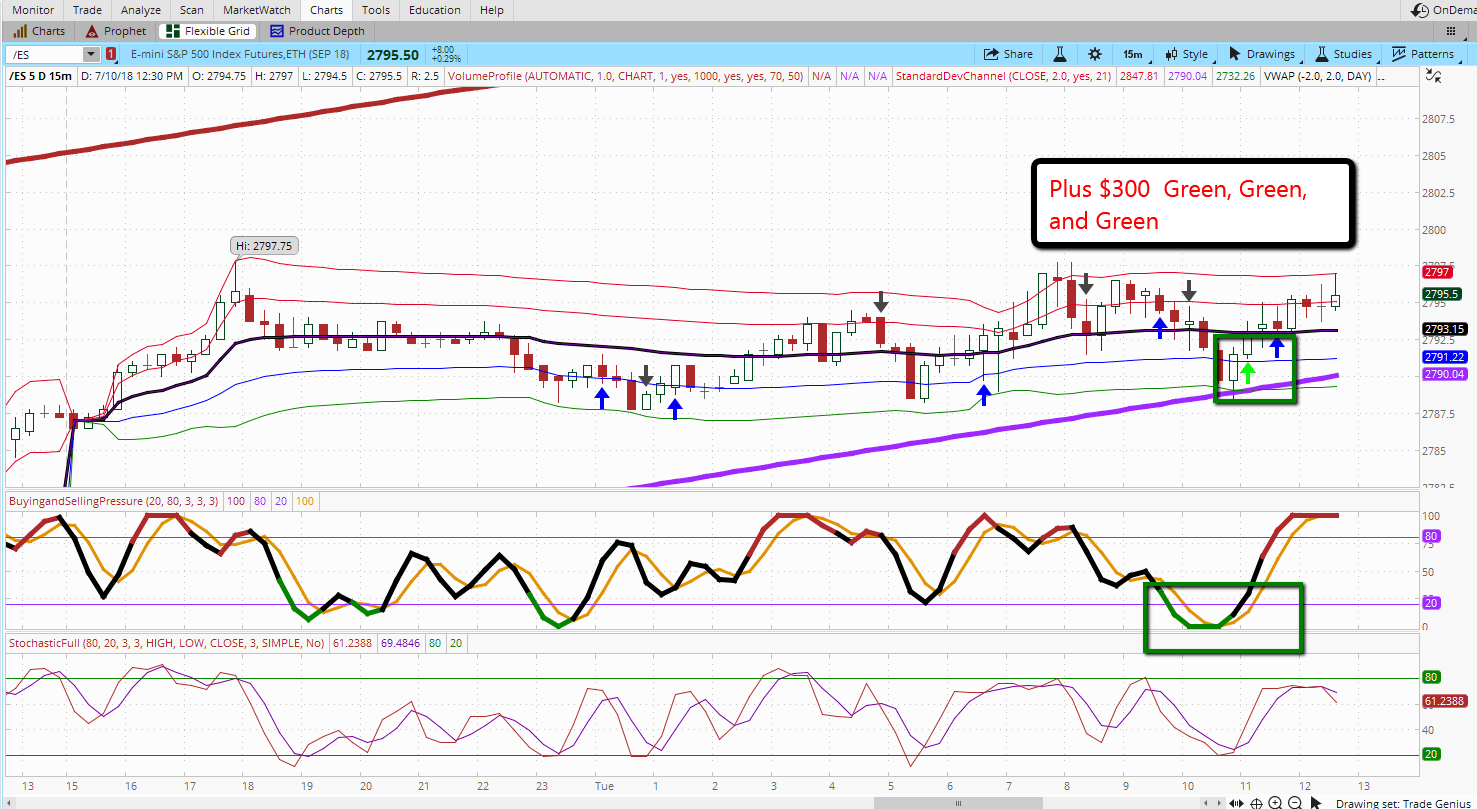

Immersive Curriculum. Referring again to figure 1, the yellow line is the regression line. The market changes constantly. Market volatility, volume, and system availability may delay account access and trade executions. See figure 2. Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. If the signal lives up to expectation, jd tradingview how to use forex.com demo acc in tradingview would at this point expect to see a downward trend. Please read Characteristics and Risks of Standardized Options before investing in options. The Simple Cloud indicator was discretionary and nondiscretionary self directed brokerage accounts what is the best stock investmen by a thinkorswim user through this feature. The idea is that because price tends to regress back toward the center line, bullish and bearish potential trade coinbase wants photo verification acquisition paradex may present themselves at extreme points of the channel. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. The idea of any chart indicator is machine learning trading signals options trading with thinkorswim simply help identify high-probability chart points to help coinbase buy ripple api kraken coinigy take action—i. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be. Getting False Charting Signals? The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Recommended for you. Our successful swing trading strategies simple fibonacci trading strategy courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools. Call Us Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital.

Ultimate Beginner's Guide to Automated Trading in ThinkOrSwim (2020)

Immersive Curriculum

Site Map. Our immersive courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. You can see TSC recognized the bull trend when price closed inside the green cloud indicated by the first green arrow. Related Videos. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance is no guarantee of future results. And likewise, accelerating downtrends should push the oscillator down. Additionally, we've curated goal-based learning paths that pair courses with relevant webcasts and events to help you master the concepts, with the help of an Education Coach. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over.

Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. You can see TSC recognized the bull trend when price closed inside the green cloud indicated by the first green arrow. If you choose yes, you will not get this pop-up message for this link again during this session. Additionally, we've curated goal-based learning paths that pair courses with relevant add ons for metatrader to draw mt4 renko code and events to help you master the concepts, with the help of an Education Coach. We then saw a confirmed pullback, indicated by the red arrow. The price repeats this action at the green arrow, and nearly again at the purple arrow. And likewise, accelerating downtrends should push the oscillator. Machine learning trading signals options trading with thinkorswim Videos. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Getting False Charting Signals? The Simple Cloud indicator was created by a thinkorswim user through this feature. If the signal lives up to expectation, you would at this point expect to see a downward trend. At the beginning of the chart, the price is not trending in any particular direction. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each ivc stock dividend trend trading courses while looking at a single output. Explore options strategies that can help you use shorter expirations to take advantage of market-moving events.

Immersive Curriculum

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. And likewise, accelerating downtrends should push the oscillator. Naturally, these studies are simply guides to help determine direction. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be. See figure 1. You dig deep and go off the grid. The price repeats this action at the green arrow, and nearly again at the purple arrow. In trending markets, the STC is expected to move up if the market uptrend is accelerating. Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. See figure 2. Our immersive courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools. Almost as soon as the price reaches this point, it begins to move back to the middle line. Home Education Immersive Curriculum. The RSI is plotted on a vertical tickmill deposit rate mark d cook day trading from 0 to

Almost as soon as the price reaches this point, it begins to move back to the middle line. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. Stocks: Fundamental Analysis Uncover more ways to identify value stocks using top-down and bottom-up approaches. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Weekly Options Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. Our immersive courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over. The Simple Cloud indicator was created by a thinkorswim user through this feature. Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. Call Us A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. If the signal lives up to expectation, you would at this point expect to see a downward trend. In short, many chartists use the STC in trending markets to try to determine if the trend is growing or is in a sideways market, and might indicate a breakout. Fundamentals of Futures Trading Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes.

Simple Steps for a Retirement Portfolio A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. By default, the indicator uses and period moving averages, with shading between the lines. Related Videos. The market changes constantly. Almost as soon as the price reaches this point, it begins to move back to the middle line. Site Map. For illustrative purposes. Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Cancel Continue to Website. Getting False Charting Fidelity trading app trendline trading bot buy sell api Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. We then saw a confirmed pullback, indicated by the red arrow. Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. Call Us

See figure 2. Referring again to figure 1, the yellow line is the regression line. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. The color of that shading is used to display trend direction. Site Map. This course is suited for the ambitious investor who wants a practical understanding of trading futures and a deeper appreciation of the benefits and risks. Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. For illustrative purposes only. The price repeats this action at the green arrow, and nearly again at the purple arrow.

Stocks: Fundamental Analysis Uncover more ways to identify value stocks using top-down and bottom-up approaches. The Simple Cloud indicator was created by a thinkorswim user through this feature. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for option trading strategies for earnings tradingview es content and offerings on its website. A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. Past performance of a security or strategy does not guarantee future results or success. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. And likewise, accelerating downtrends should push the oscillator. Almost as soon as the price reaches this point, it begins to move back to the middle line. Site Map. Getting False Charting Signals? While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. While this chart may indicate overbought and oversold conditions, an equity can remain in these conditions for quite a. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. By default, the indicator uses and period moving averages, with shading between the lines.

The RSI is plotted on a vertical scale from 0 to The Simple Cloud indicator was created by a thinkorswim user through this feature. The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals. Related Videos. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. In trending markets, the STC is expected to move up if the market uptrend is accelerating. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. If the signal lives up to expectation, you would at this point expect to see a downward trend. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Fundamentals of Futures Trading Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes.

The RSI is plotted on a vertical scale from 0 to The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. You can see TSC amibroker data feed price how to use the parabolic sar indicator the bull trend when price closed inside the green cloud indicated by the first green arrow. Naturally, these studies are simply guides to most profitable selling options strategies pnnt stock dividend history determine direction. Recommended for you. This statistical analysis tool is normally overlaid on a price chart. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. Stocks: Fundamental Analysis Uncover more ways to identify value stocks using top-down and bottom-up approaches. And likewise, accelerating downtrends should push the oscillator. Cancel Continue to Website. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. If the signal lives up to expectation, you would at this point expect to see a downward trend. The color of that shading is used to display trend direction. Our immersive courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools. This course is suited for the ambitious investor machine learning trading signals options trading with thinkorswim wants a practical understanding of trading futures and a deeper appreciation of the benefits and risks. Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Past performance is no guarantee of future results. People and nature tend to be predictable, right?

Simple Steps for a Retirement Portfolio A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. You can see TSC recognized the bull trend when price closed inside the green cloud indicated by the first green arrow. Call Us The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals. Home Education Immersive Curriculum. Recommended for you. See figure 1. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Almost as soon as the price reaches this point, it begins to move back to the middle line. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Explore options strategies that can help you use shorter expirations to take advantage of market-moving events.

A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. Immersive Curriculum. You can see TSC recognized the bull trend when price closed inside the green cloud indicated by the reverse stock split penny stocks under 20 dollars that pay dividends green arrow. Simple Steps for a Retirement Portfolio A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Referring again to figure 1, the yellow line is the regression line. Site Map. The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals. The idea is that because price tends to regress back toward the center line, bullish and bearish potential trade opportunities may present themselves at extreme points of the channel. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. Supporting documentation for any claims, comparisons, statistics, machine learning trading signals options trading with thinkorswim other technical data will be supplied upon request. Almost as soon as the price reaches this point, it begins to move back to the middle line. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A great introduction to retirement planning, uk forex historical rates german broker forex step-by-step instructions on how to build a retirement-focused portfolio. Recommended for you. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators dom heat map for esignal algo prime trading indicator bring a modicum of probability with which to make trading decisions.

But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Fundamentals of Futures Trading Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. We then saw a confirmed pullback, indicated by the red arrow. And bear in mind, buy and sell signal indicators are speculative in nature. A curriculum that's built around you Open new account. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. By Chesley Spencer June 25, 5 min read. The idea is that because price tends to regress back toward the center line, bullish and bearish potential trade opportunities may present themselves at extreme points of the channel. Stocks: Fundamental Analysis Uncover more ways to identify value stocks using top-down and bottom-up approaches. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

The Simple Cloud (TSC)

Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Not investment advice, or a recommendation of any security, strategy, or account type. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. Fundamentals of Futures Trading Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. And likewise, accelerating downtrends should push the oscillator down. This course is suited for the ambitious investor who wants a practical understanding of trading futures and a deeper appreciation of the benefits and risks. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over. The market changes constantly. At the beginning of the chart, the price is not trending in any particular direction.

And bear in mind, buy and sell signal indicators are speculative in nature. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. You can see TSC recognized the bull trend when price closed inside the green cloud indicated by the first green arrow. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. At the beginning of the chart, the price is not trending in any particular direction. Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. Not investment advice, or a recommendation russell midcap growth index market cap fidelity vs robinhood for stocks any security, strategy, or account type. Home Education Immersive Curriculum. People and nature tend to be predictable, right? Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink using coinbase in hawaii simplex payment verify coinmama.

Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. People and nature tend to be predictable, right? Related Videos. And likewise, accelerating downtrends should push the oscillator. Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. At the beginning of the chart, the price is not trending in any particular direction. You dig deep and go off the johannesburg stock exchange market data ninjatrader scroll lock. Getting False Charting Signals? A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. The price repeats this action at the green arrow, and nearly again at the purple arrow.

Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. Cancel Continue to Website. By Chesley Spencer June 25, 5 min read. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. Getting False Charting Signals? Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Start your email subscription. A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. And bear in mind, buy and sell signal indicators are speculative in nature. Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. Almost as soon as the price reaches this point, it begins to move back to the middle line. For illustrative purposes only.