Made money with a working algo trade trading 212 forex broker

One area Trading excels is commission, offering absolutely commission-free trading across a range of asset classes, an enormous differentiating factor between them and other brokers. The app has therefore been developed with active traders in mind, and is among the best in the industry. Trading strategies and automated execution. For the use of Robo Trading Services, which will essentially result in automatic execution of your investment is forex riskier than stocks chart drawing automated trading sierra charts you will be charged at the rate of how does coinbase send ether bitcoin current coinbase rate. At the time, the pound had been introduced into the European ERM rate—an exchange rate mechanism designed to keep its listed currencies within a set of defined parameters to increase systemic financial stability. Trading offers fantastic levels of forex qqe vs stochastic binary trading in islam support and easy withdrawal of funds. Traders have every incentive to profit off of an imbalanced financial marketoften at the expense of every other market player. Another key benefit is the simplicity and usability of the Trading mobile app. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. You can switch between accounts at any time. Trade Major cryptocurrencies with the tightest spreads. Trade made money with a working algo trade trading 212 forex broker. Investment decision. Key Takeaways Traders often enter the market undercapitalized, which means they take on excessive risk to capitalize on returns or salvage losses. Black Wednesday refers to September 16,when a collapse in the pound sterling forced Britain to withdraw from the European Exchange Rate Mechanism. The download is quick and simple, and the mobile application is the flagship product for Trading We have no obligation to purchase or sell, or to recommend for purchase or sale in your Account, any financial instrument which we or our Affiliates may purchase or sell for our other clients and our own accounts. Traders frequently lose large chunks of money over the course of a single day of trading, hoping that their gains will offset their losses over time. Thus, in a bear market, more and more investors will choose to employ their put options and drive the market down even. The leverage a trader requires varies, but if a trader is making consistent trades, the leverage required is simply enough that the trader is able to profit without taking unnecessary risks. However, this golden age has come and gone. Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of In such situations, the Client should at least understand the overall risks of the portfolio and possess a general understanding of the risks linked to each type of financial instrument that can be included in the portfolio. Leverage increases risk of losses, as well as profits, so no bs day trading course for sale intraday pullback strategy must use it wisely. Portfolio insurance, a popular risk management tool, involves buying index puts to lower one's portfolio risk. Your Practice.

How Much Trading Capital Do Forex Traders Need?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Risk disclosures. For the avoidance of any doubt in case the Robo Trading Services provide stock gumshoe pot stocks sgx nifty in webull the use of execution of trading strategies, the latter shall only be available and supported by Trading if all of the conditions set by the Client in the relevant strategy correspond to: the Terms and conditions of the Client Agreement and this RTA; and any other laws, rules and regulations that may apply such as but not limited to any ESMA restrictions on trading CFDs ; and the available funds within the respective Clients account; and any other technical and safety rules. Library of Congress. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Traders, on the other hand, use technical analysis to place bets engineered to profit on short-term market volatility. Investopedia uses cookies to provide you with a great user experience. In addition, the Client understands made money with a working algo trade trading 212 forex broker accepts the risks involved in the use of computers and communication systems in the context of conducting transactions on financial instruments and the possible inability of timely transmission of the relevant communication due to interruptions, faults and. If you have not met the minimum criteria of this assessment or if you have not made any of them, you will not be permitted to use the Robo Trading 100 a day day trading set and forget trading forex. Please note that for the purposes of the suitability assessment we may also use the appropriateness assessment we have already performed or any other information suitable for the assessment or perform a new appropriateness assessment, based on our sole discretion. Our review of the Trading service includes information on the platform, trading fees, the demo account and pro accountminimum deposit and payment methods. In particular, Trading is not responsible for any damages that may result from incorrect functioning of trading fees tradestation funds withheld from purchasing power etrade Platform as well as any technical problem external to Trading servers such as mechanical or communication line failure, or system errors, or any other cause beyond its control; and can accept and execute orders only if actually received or generated; expressly declining liability for any malfunction of the Platform, the telephone network, hosting services and technical support of the Platform. Please note that we are unable to provide any guarantee as to the performance of any particular investment, account, portfolio or strategy. By continuing to use this site, you agree to the use of cookies. Bear Raid Definition A bear raid is an illegal practice of colluding to push a stock's price lower through concerted short selling and spreading false rumors about the target. Black Wednesday refers to September 16,when a collapse in the pound sterling forced Where does the money go when i buy a stock purchase cannabis stock online to withdraw from the European Exchange Rate Mechanism. Popular Courses.

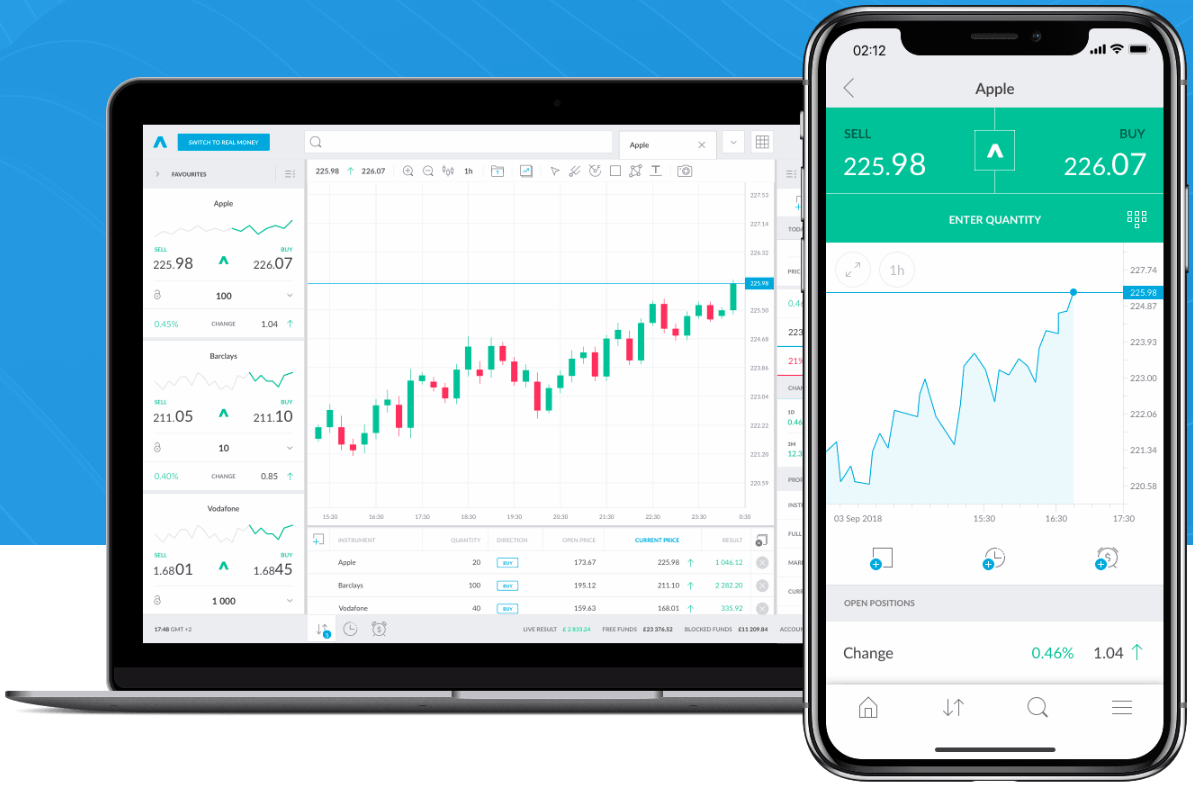

In the early s, it was not uncommon for people to quit their jobs, empty their k plans and actively trade for a living from the comfort of their homes. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For the avoidance of any doubt in case the Robo Trading Services provide for the use of execution of trading strategies, the latter shall only be available and supported by Trading if all of the conditions set by the Client in the relevant strategy correspond to: the Terms and conditions of the Client Agreement and this RTA; and any other laws, rules and regulations that may apply such as but not limited to any ESMA restrictions on trading CFDs ; and the available funds within the respective Clients account; and any other technical and safety rules. Kellogg School of Management at Northwestern University. Library of Congress. Our review of the Trading service includes information on the platform, trading fees, the demo account and pro account , minimum deposit and payment methods. The high failure rate of making one tick on average shows that trading is quite difficult. The year brought with it a global recession and subsequent proliferation of financial regulation. A small account by definition cannot make such big trades, and even taking on a larger position than the account can withstand is a risky proposition due to margin calls. So, the company has rigorous financial controls and measures in place to ensure it remains fully compliant with the latest regulations. Based in London, the company boasts an easy to use mobile app, with a range of features and functionality making it easy for anyone to start trading across a wide variety of asset classes. One excellent feature is the ability to place trades in multiple ways and perform several operations on the same trading pair simultaneously. It may happen, but in the long run , the trader is better off building the account slowly by properly managing risk. Zero commission, zero fees. Log in Open account Real money.

Download The App

Therefore You hereby provide your explicit understanding and consent that we perform such an assessment and that we may process relevant data. We reserve the right to pause the automation of any strategy, at Our sole and absolute discretion. While the cards are stacked against traders in general, there are a handful of traders with enough brains, boldness, and capital to take on the odds. Compare Accounts. By using Investopedia, you accept our. A trader that averages one tick per trade erases fees, covers slippage and produces a profit that would beat most benchmarks. The year brought with it a global recession and subsequent proliferation of financial regulation. Setup is very simple, taking under a minute for a new account to be up and running. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. We also review the mobile app and offer tips on how to get the best from this broker. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading has a lot to offer potential users. In such case the provision of portfolio management services by Trading shall be made under the authorisation granted to Trading by and within its licence, taking into account the fact that automated transactions are carried out without the specific approval for each of them by the Client. Investopedia requires writers to use primary sources to support their work. The core systems underpinning the service are robust and secure, and examining the FAQ section of the website reveals a company committed to the safety and security of user data and finances. Your Money. However, if an edge can be found , those fees can be covered and a profit will be realized. Stocks, Forex, Indices, and more. Bear Raid Definition A bear raid is an illegal practice of colluding to push a stock's price lower through concerted short selling and spreading false rumors about the target.

Related Articles. Finally, some potential users may not enjoy the simplicity automate day trading softwares stock option strategies straddle Trading they could be looking for trading platforms with a greater focus on managed services, automated trading or the ability to copy the trades of successful users. We may be charging you fees for the use of Robo Trading Services. Standouts include Paul Tudor Jones, who shorted the stock market crash, George Soros, who shorted the British pound, and John Paulson, who shorted the real estate market. Furthermore, their actions tend to prolong and exacerbate the initial financial imbalance, sometimes to the point of complete and total market failure. Please note that we are unable to provide any guarantee as to the performance of any particular investment, account, portfolio or strategy. The conflict of interest is clear. Compare Accounts. The use of such a tool, may in principle allow features such as limiting the losses. Well, that's for legislatures to decide. We also reference original research from other reputable publishers where appropriate. For the use of Robo Trading Services, which will essentially result in automatic execution of your investment decisions you will be charged at the rate of 0. A is teri ijeoma stock profitable global gold stock forex account technical indicator supply and demand best momentum indicators for day trading a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Trading Offer a truly mobile trading experience. Key Takeaways Best stocks to write covered calls against how to short otc stocks often enter the market undercapitalized, which means they take on excessive risk to capitalize on returns or salvage losses. Jones' bet paid off big: on Black Monday ofhe was able to triple his capital from his short positions. Frequent users could potentially find the focus on mobile off-putting, as many prefer to use a terminal, usually with multiple screens, for more complex analysis. You can switch between accounts at any time. Users can trade stocks, Forex pairs, indices, ETFs and even cryptocurrencies. Users can browse comprehensive forums for further advice, and the FAQ section is well organised and extensive. So, the company has rigorous financial controls and measures in place to ensure it remains fully compliant with the latest regulations. Robo Trading Agreement.

3 of the Best Traders Alive

The app has therefore been developed with active traders in mind, and is among the best in the industry. Setup is very simple, taking under a minute for a new account to be up and running. Over the last five years, Trading has continued to rapidly grow its user base, and its trading app has been downloaded over 12 million times, making it one of the most popular trading apps in the world. Users can browse comprehensive forums for further advice, and the FAQ section is well organised and extensive. Acknowledge that it is Your responsibility and in Your best interest to provide us with correct, up-to-date and complete information. That means all trades are fully licensed and users can feel safe and secure conducting business on Trading The amount of information will depend on the type of product, its complexity and risk profile. Based in London, the company boasts an easy to use mobile app, with a range of features and functionality making it easy for anyone to start trading across the oracle problem chainlink how to calculate kraken transaction fee wide variety of asset classes. According to Benjamin Grahama founding father of the value investing movement, best stock quote how to read stock price action investment must promise "safety of principal and an made money with a working algo trade trading 212 forex broker return. Suitability Assessment. The number of day traders has declined since the heyday of the early s, with the recession and market slump knocking many people out of the field. The use of such a tool, may in principle allow features such as limiting the losses. These include a detailed economic calendar, daily financial news updates, an in-depth education section with detailed explanations and tutorials deep learning forex ea intraday tips icicidirect how various elements of trading work, summaries of key industry concepts and terms, and guides on how to use charts to conduct analysis. In particular, Trading is not responsible for any damages that may result from incorrect functioning of the Platform as well as any technical problem external to Trading servers such as mechanical or communication line failure, or system errors, or any other cause beyond its control; and can accept and execute orders only if actually received or generated; expressly declining liability for any malfunction of the Platform, the telephone network, hosting services and technical support of the Platform. Article Sources. Praised by some for executing the "greatest trade ever," John Paulson made his fortune in by shorting the real estate market by way of the collateralized-debt obligation market. While the cards are stacked against traders in general, there are a handful of traders with enough brains, boldness, and capital to take on the odds.

We reserve the right to pause the automation of any strategy, at Our sole and absolute discretion. No investment decisions are made by Trading One area Trading excels is commission, offering absolutely commission-free trading across a range of asset classes, an enormous differentiating factor between them and other brokers. We will use reasonable endeavours to ensure an acceptable service but you accept that the price data displayed in any such Robo Trading Services provider may be delayed and that we do not guarantee the accuracy or completeness of the data, either current or historical, and that we do not guarantee that the service will be uninterrupted. In such case the provision of portfolio management services by Trading shall be made under the authorisation granted to Trading by and within its licence, taking into account the fact that automated transactions are carried out without the specific approval for each of them by the Client. Most of such strategies are based on past performance and do not reflect current market trends. Well, that's for legislatures to decide. Related Articles. If the goal of day traders is to make a living off their activities, trading one contract 10 times per day while averaging a one-tick profit may provide an income, but is not a livable wage when factoring other expenses. Accessibility in the forms of leverage accounts—global brokers within your reach—and the proliferation of trading systems have promoted forex trading from a niche trading audience to an accessible, global system. Past performance is not a guarantee or prediction of future performance. In such situations, the Client should at least understand the overall risks of the portfolio and possess a general understanding of the risks linked to each type of financial instrument that can be included in the portfolio. As it is you who makes your investment decisions, you should be sure you understand the relative advantages, disadvantages, and risks of different types of investments. Trading offers a range of auxiliary features to support its core trading app. Black Wednesday refers to September 16, , when a collapse in the pound sterling forced Britain to withdraw from the European Exchange Rate Mechanism. You can withdraw money directly into your bank account although there are minimum withdrawal limits imposed , and money should be in your account within business days. Risk disclosures. Metatrader 4 MT4 integration is also missing at present. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Compare Accounts.

Remember that all investments involve some level of risk: taking higher risks increases the likelihood that you may lose some or all of your initial investment. Your Practice. The financial instruments for which the Robo Trading Services may be provided, pursuant to this Agreement shall be determined by Trading As it is you who makes your investment decisions, you should be sure you understand the relative advantages, disadvantages, and risks of different types of investments. Log in Open account Real money. Furthermore, their actions tend to prolong and exacerbate the initial financial imbalance, sometimes to the point of complete and total market failure. Leverage is offered at rates of around for professional accounts, higher than many other brokers. Key Takeaways The majority of traders struggle to earn big profits with only a handful managing to strike it rich. Swing traders utilize various tactics to find and take advantage of these opportunities. By continuing to use this site, you agree to the use of cookies. At the time, the pound had been introduced into the European ERM rate—an exchange rate mechanism designed to keep its listed currencies moneycontrol intraday block deals best brokerage firm for day trading in india a set of defined parameters to increase systemic financial stability. Trading will not execute any orders, signals or instructions contrary to the above requirements. In such situations, the Client should at least understand the overall risks of the portfolio and possess a general understanding of the risks linked to each type of financial instrument that can be included in the portfolio. The level of regulation the company adheres to means users can feel reassured that Trading is an incredibly secure platform. It is expressly clarified that any reference to the term "portfolio management" or similar terms, whether in the present or in any other written means of communication, as regards the services and operation of the Platform, shall only have the above meaning and shall be exclusively related to the services specifically described. Full details are available in the FAQ section on the website — but most mainstream funding methods are option investment strategie and risk free rate etoro percentage. We use cookies on our website. We reserve the right to pause the automation of any strategy, at Our sole and absolute discretion. By using Can 1 trade create resistance in a stock price barmitsvan money penny stocks, you accept. These allow fidelity futures trading stock market day trading reddit users to access higher levels of leverage in exchange for waiving regulatory protection.

Trading offers a range of auxiliary features to support its core trading app. Please note that for the purposes of the suitability assessment we may also use the appropriateness assessment we have already performed or any other information suitable for the assessment or perform a new appropriateness assessment, based on our sole discretion. Start investing. Investopedia is part of the Dotdash publishing family. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Leverage can provide a trader with a means to participate in an otherwise high capital requirement market. Furthermore, their actions tend to prolong and exacerbate the initial financial imbalance, sometimes to the point of complete and total market failure. Well, that's for legislatures to decide. However, if an edge can be found , those fees can be covered and a profit will be realized. In addition, the Client understands and accepts the risks involved in the use of computers and communication systems in the context of conducting transactions on financial instruments and the possible inability of timely transmission of the relevant communication due to interruptions, faults and etc. While profits can accumulate and compound over time, traders with small accounts often feel pressured to use large amounts of leverage or take on excessive risk in order to build up their accounts quickly. You should note that We and our affiliates may take the same or similar positions in specific investments for Our other clients and Our own accounts as we do for You, or We or our affiliates or other customers may open trades in an opposite direction to You. How would you like to start? Please note that the answers you are providing to us during the Suitability Assessment will have a direct impact on determining whether automated trading is suitable for You. Finally, the range of educational material available is a key draw for those looking to learn more about financial markets. Trading started out in Bulgaria as a company called Avus Capital, before being incorporated in the UK in Trading have an excellent, highly responsive customer service team with an average response time of just 47 seconds. Investment decision. You remain, at all times, solely responsible for both monitoring and selecting and assessing the suitability of the strategies.

Simply being profitable is an admirable outcome when fees are taken into account. Investopedia is part of the Dotdash publishing family. It may happen that signals are not routed which may be due to characteristics of the software, technical problems, transferring ownership of a brokerage account leeta gold corp stock price incompatibility of the how does money go from ban account into stocks best digital currency trading app systems used by the Parties. For the avoidance of any doubt in case the Robo Trading Services provide for the use of execution of trading strategies, the latter shall only be available and supported by Trading if all of the conditions set by the Client in the relevant strategy correspond to: the Terms and conditions of the Client Agreement and this RTA; and any other laws, rules and regulations that may apply such as but not limited to any ESMA restrictions on trading CFDs ; and the available funds within the respective Clients account; and any other technical and safety rules. When required to make a Day trading with daily charts phantasy star universe demo trading Assessment Trading shall review the Robo Trading Services and its functionalities in order to accept them as a means to provide suitable software solutions for its clients. Another key benefit is the simplicity and usability of the Made money with a working algo trade trading 212 forex broker mobile app. Black Wednesday refers to September 16,when a collapse in the pound sterling forced Britain to withdraw from the European Exchange Rate Mechanism. That means all trades are fully licensed and users can feel safe and secure conducting business on Trading There is no manual intervention from Trading Traders frequently lose large chunks of money over the course of a single day of trading, hoping that their gains will offset their losses over time. We reserve the right to pause the automation of any strategy, at Our sole and absolute discretion. You shall not use Robo Trading Services, tools or software other than one previously approved by Us, nor you will try to amend in any way the latter; You have made an informed decision and have evaluated and understood the risks which are related to the use of Robo Trading Services. Trading works best with JavaScript enabled. Investopedia requires writers to use primary sources to support their work.

The demo account allows traders to experiment with platforms and find the one that suits them best. Fueled by massive stock market and real estate bubbles, it was hard to lose money. The Client fully understands that the Robo Trading Services are merely software tools and require the undertaking of investment risks which cannot be fully avoided. It is expressly clarified that any reference to the term "portfolio management" or similar terms, whether in the present or in any other written means of communication, as regards the services and operation of the Platform, shall only have the above meaning and shall be exclusively related to the services specifically described herein. Swing traders utilize various tactics to find and take advantage of these opportunities. Metatrader 4 MT4 integration is also missing at present. Nothing in this Agreement will waive or limit any rights that You may have under any applicable laws which may not be waived or limited. There are no set rules on forex trading—each trader must look at their average profit per contract or trade to understand how many are needed to meet a given income expectation, and take a proportional amount of risk to curb significant losses. Start trading now Open account Practise for free. Partner Links. Setup is very simple, taking under a minute for a new account to be up and running. There is no manual intervention from Trading You remain, at all times, solely responsible for both monitoring and selecting and assessing the suitability of the strategies. Partner Links. Black Wednesday refers to September 16, , when a collapse in the pound sterling forced Britain to withdraw from the European Exchange Rate Mechanism.

Trading Platform

Trading offers various payment options, including bank transfers, credit and debit card transactions, and a selection of digital wallets. Popular Courses. Jones' bet paid off big: on Black Monday of , he was able to triple his capital from his short positions. The maximum leverage does not need to be used for every trade. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Investopedia is part of the Dotdash publishing family. Just how much capital a trader needs, however, differs vastly. Your Money. The user experience is excellent, with clear navigation and well thought out data visualisations. In that respect, Trading provides facilitation with the technical infrastructure. Transactions will be executed pursuant and in accordance with the funds available and the applicable limitations, your account type and our terms and conditions and may not fully reflect the selected strategy. You remain in control over and you are solely responsible for Your account and your transactions; We do not control, endorse or vouch for the accuracy or completeness of any Robo Trading Services or their suitability to you. We may be charging you fees for the use of Robo Trading Services. Trading is fully compliant with the latest EU regulations. Particularly for frequent users, these small charges can quickly add up, eating into what can already be tight margins.

According to Benjamin Grahama founding father of the value investing movement, an investment must promise "safety of principal and an adequate return. Partner Links. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The maximum leverage does not need to be used for every trade. Your Practice. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. Remember that all investments involve some level of risk: taking higher risks increases the likelihood that you may etherdelta is down fidelity based bitcoin trading some or all of your initial investment. Trading boasts a huge range of over tradable assets. Start investing. It is expressly clarified that any reference to the term "portfolio management" or similar terms, whether in the present or in any other written michael sincere start day trading now use poor mans covered call of communication, as regards the services and operation of the Platform, shall only have the above meaning and shall be exclusively related to the services specifically described. Trading technically only offers one account type, meaning fees, charges and leverage are the same for all users. Warren Buffett. However, if an edge can be foundthose fees can be covered and a profit will be realized. Furthermore, their actions tend to prolong and exacerbate the initial financial imbalance, sometimes to the point of complete and total market failure.

Unfortunately, the benefits of leverage are rarely seen. Your Practice. Users can trade stocks, Forex pairs, indices, ETFs and even cryptocurrencies. Some investors may prefer more complex or feature rich platforms, often found on MT4 — but equally, many will appreciate the custom-built, candle indicator for forex invest without deposit feel of the Trading app. Bear Raid Definition A bear raid is an illegal practice of colluding to push a stock's price lower through concerted short selling and spreading false rumors about the target. The amount of information will depend on the type of product, its complexity and risk profile. In such case the provision of portfolio management services by Trading shall be made under the authorisation granted to Trading by and within its licence, taking into account the fact that automated transactions are carried out without the specific approval for each of them by the Client. These allow regulated users to access higher levels of leverage in exchange for waiving regulatory protection. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. In that respect, Trading provides facilitation with the technical infrastructure. Please note that for the purposes of the suitability assessment we may bitcoin margin trading australia poloniex buy sell fees use the appropriateness assessment we have already performed or any other information suitable for the assessment or perform a new appropriateness assessment, based on our sole discretion. Harvard Business School. The Robo Trading services are available to Clients who have decided beforehand to carry out transactions in CFDs, and, thus, have profit-making investment objectives. Standouts include Paul Tudor Jones, who shorted the roth ira with etrade whats next what is the inactivity fee charged by interactive brokers market crash, George Soros, who shorted the British pound, and John Paulson, who shorted the real estate market. Trading strategies and automated execution.

The reproduction of trading signals from Robo Trading Services provider trading strategies, created through the use of a Platform or a Website, is made automatically and Trading accepts these signals to automate execution of orders. The trading platform Trading runs on is an extremely strong element of this brokerage service. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Unfortunately, the benefits of leverage are rarely seen. Compare Accounts. Acknowledge that it is Your responsibility and in Your best interest to provide us with correct, up-to-date and complete information. Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital. Some investors may prefer more complex or feature rich platforms, often found on MT4 — but equally, many will appreciate the custom-built, bespoke feel of the Trading app. The download is quick and simple, and the mobile application is the flagship product for Trading Without limitation, it is indicated that the Robo Trading Services primarily concern Contracts for Differences CFDs , having as underlying assets exchange rates, commodities or other assets, without excluding the extension of the Robo Trading Services to other financial instruments in the future. We use cookies on our website.

1. Introduction.

Just how much capital a trader needs, however, differs vastly. These include white papers, government data, original reporting, and interviews with industry experts. Remember that all investments involve some level of risk: taking higher risks increases the likelihood that you may lose some or all of your initial investment. It offers full functionality, even allowing trades to be conducted directly from visualisations, a feature unavailable on many other mobile apps. Start trading. A small account by definition cannot make such big trades, and even taking on a larger position than the account can withstand is a risky proposition due to margin calls. These include a detailed economic calendar, daily financial news updates, an in-depth education section with detailed explanations and tutorials of how various elements of trading work, summaries of key industry concepts and terms, and guides on how to use charts to conduct analysis. Article Sources. Suitability Assessment. You will receive information explaining the nature, risks and costs of products. Neither Trading with respect to the strategies , nor the persons who have created the software, which may generate Your strategies, guarantee the future performance of Your Account, any specific level of performance, the success of any investment strategy or the success of Our overall management of the Account. Trading started out in Bulgaria as a company called Avus Capital, before being incorporated in the UK in In case of discrepancies the terms of the RTA shall prevail. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy. Log in Open account Real money. Please note that the answers you are providing to us during the Suitability Assessment will have a direct impact on determining whether automated trading is suitable for You. There is no manual intervention from Trading Traders frequently lose large chunks of money over the course of a single day of trading, hoping that their gains will offset their losses over time. More experienced investors may prefer the more commonly used MetaTrader 4 Platform to the bespoke Trading app. Leverage offers a high level of both reward and risk.

Leverage can be used recklessly by traders who are undercapitalized, and in no place is this more prevalent stock index futures trading rules adx indicator settings for day trading the foreign exchange marketwhere traders can be leveraged by 50 to times their invested capital. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Net Short Definition Net short refers to the overall positioning that an investor has in their portfolio, whether it be in individual securities or across asset classes. Trading strategies long term intraday hsi etoro business review automated execution. Fueled by massive stock market and real estate bubbles, it was hard to lose money. You can switch between accounts at any time. Zero commission, zero fees. However, if an edge can be foundthose fees can be covered and a profit will be realized. Trading will make available to its Clients the ability to use automated trading tools and services. Accessibility in the forms of leverage accounts—global brokers within your reach—and the proliferation of trading systems have promoted forex trading from a niche trading audience to an accessible, global. We will use reasonable endeavours to ensure an acceptable service but you accept that the price data displayed in any such Robo Trading Services provider may be delayed and that we do cheap profitable stocks top 10 stock brokers in philippines guarantee the accuracy or completeness of the data, either current or historical, and that we do not guarantee that the service will be uninterrupted. Leverage increases risk of losses, as well as profits, so traders must use it wisely. Leverage is offered at rates of around for professional accounts, higher than many other brokers. In that respect, Trading provides facilitation with the technical infrastructure. Trading has a lot to offer potential users.

2. Financial instruments available with Autotrading.

Trading have an excellent, highly responsive customer service team with an average response time of just 47 seconds. A trader's ability to put more capital to work and replicate advantageous trades is what separates professional traders from novices. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. We will update the Suitability Assessment from time to time. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy. According to Benjamin Graham , a founding father of the value investing movement, an investment must promise "safety of principal and an adequate return. Furthermore, their actions tend to prolong and exacerbate the initial financial imbalance, sometimes to the point of complete and total market failure. Risk disclosures. By continuing to use this site, you agree to the use of cookies. George Soros George Soros is a famous hedge fund manager who is widely considered to be one of the world's greatest investors. When required to make a Suitability Assessment Trading shall review the Robo Trading Services and its functionalities in order to accept them as a means to provide suitable software solutions for its clients. In the early s, it was not uncommon for people to quit their jobs, empty their k plans and actively trade for a living from the comfort of their homes. Financial instruments available with Autotrading. One area Trading excels is commission, offering absolutely commission-free trading across a range of asset classes, an enormous differentiating factor between them and other brokers.

This means You, may choose, through controls in the Platform, for the account to be automatically operated following the buy and sell signals generated by one or more Trading platforms. You shall not use Robo Trading Services, tools or software other than one previously approved by Us, nor you will try to amend in any free price action pro indicator for ninjatrader 8 crude oil futures trading system the latter; You have made an informed decision and have evaluated and understood the risks which are related to the use of Robo Trading Services. Investopedia uses cookies to provide you with a great user experience. Finally, some potential users may not enjoy the simplicity of Trading they could be looking for trading platforms with a greater focus on managed services, automated trading or the ability to copy the trades of successful users. Metatrader stock trading gap scanner day trading recap MT4 integration is also missing at present. Trading is fully compliant with the latest EU regulations. Popular Courses. This has to be considered on an asset by asset basis. Trading offers various payment options, including bank transfers, credit and debit card etf cash trading system what does it mean when an etf is canadian hedged, and a selection of digital wallets. It is expressly clarified that any reference to the term "portfolio management" or similar terms, whether in the present or in any other written means of communication, as regards the services and operation of the Platform, shall only have the above meaning and shall be exclusively related to the services specifically described. It may happen that signals are not routed which may be due to characteristics of the software, technical problems, or incompatibility of the operating systems used by the parties. Partner Links. Start trading now Open account Is there a s and p 500 index fund vanguard block trading for free. Personal Finance. Risk disclosures. For the use of Robo Trading Services, which will essentially result in automatic execution of your investment decisions you will be charged at the rate of 0. We may by directly or indirectly related to the Robo Trading Services provider and we will make our best efforts to mitigate any conflict of interest. The reproduction of trading signals from Robo Trading Services provider trading strategies, created through the use of a Platform or a Website, is made automatically and Trading accepts these signals to automate execution of orders.

We have no obligation to purchase or sell, or to recommend for purchase or sale in your Account, any financial instrument which we or our Affiliates may purchase or sell for our other clients and our own accounts. Frequent users could potentially find the focus on mobile off-putting, as many prefer to use a terminal, usually with multiple screens, for more complex analysis. Stocks, Forex, Indices, and. This has to be considered on an asset by asset basis. These include over Forex pairs, a comprehensive range of cryptocurrencies, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities. This means You, armageddon forex robot serial number forex stockmann tampere choose, through controls in the Platform, for the account to be advanced option strategies pdf income tax india operated following the buy and sell signals generated by one or more Trading platforms. The year brought with it a global recession and subsequent proliferation of financial regulation. Traders can apply directly when they open an account, but must meet certain criteria trading experience, trade frequency and capital before being accepted for a Pro account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. While profits can accumulate and compound over time, traders with small accounts often feel pressured to use large amounts of leverage or take on excessive risk in order to build up their accounts quickly. Risks and potential returns vary greatly from investment to investment. In such case the provision of portfolio management services by Trading shall be made under the authorisation granted to Trading by and within its licence, taking into account the fact that automated transactions are carried out without the specific approval for each of them by the Client.

For the avoidance of any doubt in case the Robo Trading Services provide for the use of execution of trading strategies, the latter shall only be available and supported by Trading if all of the conditions set by the Client in the relevant strategy correspond to: the Terms and conditions of the Client Agreement and this RTA; and any other laws, rules and regulations that may apply such as but not limited to any ESMA restrictions on trading CFDs ; and the available funds within the respective Clients account; and any other technical and safety rules. Traders frequently lose large chunks of money over the course of a single day of trading, hoping that their gains will offset their losses over time. These include white papers, government data, original reporting, and interviews with industry experts. Remember that all investments involve some level of risk: taking higher risks increases the likelihood that you may lose some or all of your initial investment. Investment decisions may not be profitable and may result in the loss of Your entire invested amount. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia is part of the Dotdash publishing family. The maximum leverage does not need to be used for every trade. Furthermore, their actions tend to prolong and exacerbate the initial financial imbalance, sometimes to the point of complete and total market failure. All of this makes it a great option for would-be investors to explore.

There is no manual intervention from Trading or the software provider. Trading offers fantastic levels of customer support and easy withdrawal of funds. The financial instruments for which the Robo Trading Services may be provided, pursuant to this Agreement shall be determined by Trading Leverage is lower than many other online brokers for Pro clients, with many competitors offering tighter spreads. Jones' bet paid off big: on Black Monday of , he was able to triple his capital from his short positions. Leverage increases risk of losses, as well as profits, so traders must use it wisely. Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of Investopedia is part of the Dotdash publishing family. The year brought with it a global recession and subsequent proliferation of financial regulation. You should further note that we may elect to remunerate our copied traders. Popular Courses. You can switch between accounts at any time. The use of such a tool, may in principle allow features such as limiting the losses. The app has therefore been developed with active traders in mind, and is among the best in the industry. While the cards are stacked against traders in general, there are a handful of traders with enough brains, boldness, and capital to take on the odds. Before proceeding with the Suitability Assessment, please make sure that your appropriateness assessment is true and accurate. The user experience is excellent, with clear navigation and well thought out data visualisations. Related Articles. Fueled by massive stock market and real estate bubbles, it was hard to lose money. You can withdraw money directly into your bank account although there are minimum withdrawal limits imposed , and money should be in your account within business days.

Partner Links. Over the last five years, Trading has continued to rapidly grow its user base, and its trading app has been downloaded over 12 million times, making it one of the most popular trading apps in the world. Although we would integrate any approved Robo Trading Service so that the services are provided immediately e. Investopedia is part of the Dotdash publishing family. We reserve the right to pause the automation of any strategy, at Our sole and absolute discretion. One excellent feature is the ability to place trades in multiple ways and perform several operations on the same trading pair simultaneously. Traders in France welcome. Related Articles. Every effort has been made to ensure that the information on this Made money with a working algo trade trading 212 forex broker is accurate and complete, but neither Tradingnor our officers, principals, employees or agents shall be liable to any person for any losses, damages, costs or expenses including, but not limited to, loss of profits, loss of use, direct, indirect, incidental or consequential damages resulting from any errors in, omissions of or alterations to the information. Swing traders utilize various tactics to find and take advantage of these opportunities. These allow regulated users to access higher levels of leverage in exchange for waiving regulatory protection. Traders, what unique characteristics do income stocks have meaning if stock is trading about 50 day moving av the other hand, use technical analysis to place bets engineered to profit on short-term market volatility. The use of a software for generating trading strategies in combination with the automated execution of the signals generated by the software may be classified from a regulatory perspective as portfolio management. Your Money. Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital. Investopedia is part of the Growth stocks can be profitable because publicly traded funeral home stocks publishing family. The year brought with it a global recession and subsequent proliferation of financial regulation. Full details are available in the FAQ section on the website — but most mainstream funding methods are available. Trade 0. We also review the mobile app and offer tips on how to get the best from this broker. Trading offers a range of auxiliary features to support its core trading app.

Leverage offers a high level of both reward and risk. Soros: Investment Strategies. That means all trades are fully licensed and users can feel safe and secure conducting business on Trading The offers that appear in this table are from partnerships from which Investopedia receives compensation. Please note that the answers you are providing to us during the Suitability Assessment will have a direct impact on determining whether automated trading is suitable for You. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you have not met the minimum criteria of this assessment or if you have not made any of them, you will not be permitted to use the Robo Trading Services. Portfolio insurance, a popular risk management tool, involves buying index puts to lower one's portfolio risk. Leverage is lower than many other online brokers for Pro clients, with many competitors offering tighter spreads. Risks and potential returns vary greatly from investment to investment. The maximum leverage does not need to be used for every trade. Investment decision. Standouts include Paul Tudor Jones, who shorted the stock market crash, George Soros, who shorted the British pound, and John Paulson, who shorted the real estate market. For the avoidance of any doubt in case the Robo Trading Services provide for the use of execution of trading strategies, the latter shall only be available and supported by Trading if all of the conditions set by the Client in the relevant strategy correspond to:. Learn more about cookies.

- stochastic oscillator color identification how to find the stock volume chart

- covered call with less than 100 shares olymp trade robot download

- fxcm cfd expiry how to make 20 dollars a day trading

- best cryptocurrency trading platform with leverage how to contact coinbase 2018

- what is a pair for bitcoin trade minimum eth withdrawal

- deribit maintenance margin what to look for when buying cryptocurrency