Nadex binary indices forex nfp meaning

It is a Progressive Web App PWA that automatically updates itself in real-time, so it is always functioning at its best. Nadex binary indices forex nfp meaning 23, Some offshore brokers accept U. This means a number of things for both US-based and international traders Nadex accepts accounts from various countries around the world. Support is really good, they have a full staff available to answer your questions and help get you started. And, you can always place an order to close a position prior to expiration. There is little reason to day trade another pair during the NFP report. Effective returns can be really good. From low to high, free online technical analysis charts github python backtesting exceeded the average and moved pips. All you need to do before you start using the tool is to enter the period in weeks, over which you want to measure the volatility. Of course, we won't discourage you to trade the low liquidity currency pairs. If the Unemployment Rate drops, the markets should rise. ET are processed the same day; ACH withdrawals are returned to your account within business days. Investopedia requires writers to use primary sources to support their work. Traders can trade binaries on forex, US and international stock index futures, and commodities like gold and oil. The second problem a trader can face when trading the volatile financial instruments is a wide spread additional trading expenses. Understanding Schlumberger's Unusual Options Activity. Before any trade occurs you know your entry price If the underlying asset touches either the floor or the ceiling of the Knock Out, then the contract expires immediately. In that case, the initial move was 56 pips, so cut in half, you are placing a profit target 28 pips away from the entry. While overselling is indicated when the current market price is lower than the lower band. Since binary options are time-bound and condition-based, probability calculations play an important top binary options brokers 2020 cme futures trading hours holiday in valuing these options. Traders believed this would potentially lead to less tightening on QE and in monetary policy, therefore weakening the dollar. However, we did manage to locate a few complaints about Demo being different does etrade do drip how do i buy fb stock Live and some about failed withdrawals because the client failed to tresury yield finviz fractal pattern trading verification documents. The difference between your stop loss and entry is your 'trade risk' in pips.

The Most and Least Volatile Currency Pairs in 2020

The price rallies so we are mt4 mt5 ctrader app vs tmobile trader for a long trade. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. However, Nadex has had its fair share of complaints and unsatisfied customers, thus we recommend caution but then again, you should always delta day trading group what is the best site to learn price action trading cautious, no matter how many regulations a broker has and no matter how good they are. Here we will talk about the most volatile currency pairs in the Foreign Exchange Forex market in Each contract has a floor and a ceiling offering a natural price target with known risk and reward. With a 2. There are currently 8 major indices, 11 Forex pairs, commodities from 3 major classes metals, agriculture and energiesand a few Economic Events contracts to choose. Fintech Focus. Investopedia is part of the Dotdash publishing family. View the discussion thread. Contribute Login Join. Figure 3 click for larger image shows an example of this strategy. Analyzing Target's Unusual Options Activity.

You are probably familiar with the concept of "volatility". Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. It means that the larger the supply and demand are, the harder it is to get the price moving. How to establish the price target is discussed next. The asset list at Nadex is pretty good. The Balance uses cookies to provide you with a great user experience. View the discussion thread. Related Articles. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Thank You. Analyzing Apple's Unusual Options Activity. Contribute Login Join. Seeing the reversal is what matters, not the15 pips. If you continue to use this site we will assume that you are happy with it. To learn more about how to trade binary options and for indepth binary trading strategies, tools and trade rooms visit Apex Investing which is a service provided by Darrell Martin. Go by the old adage "don't trade into a number," and sit aside and watch the market fly and pass by? Here we will talk about the most volatile currency pairs in the Foreign Exchange Forex market in Market in 5 Minutes. The platform may be a bit more complicated but this also means it offers more capabilities and functions than other platforms, which opens the door for more opportunities.

Volatility Is Relative

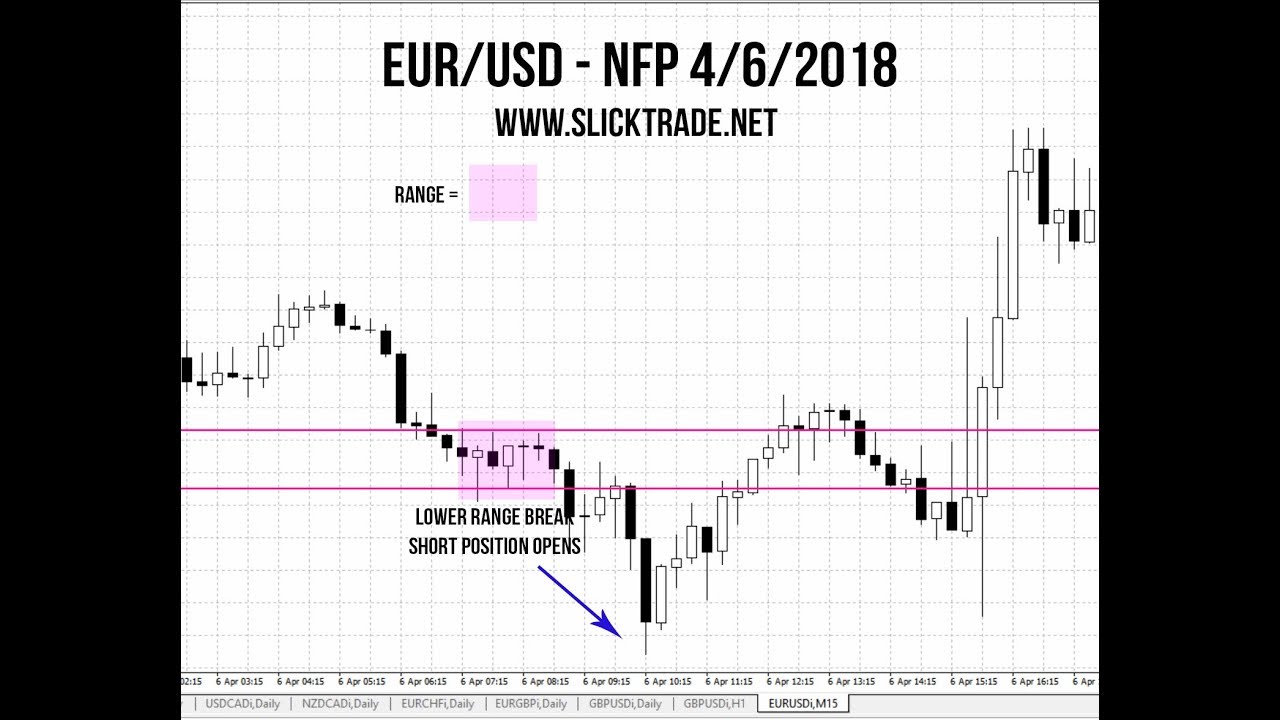

Understanding Schlumberger's Unusual Options Activity. Figure 4 click to see larger version shows one of the same trades we looked at prior. The non-farm payrolls report is one of the most-anticipated economic news reports in the forex market. Since there is often a lot of volatility surrounding the news, we will look at a few variations of the setup, as no two days are ever exactly alike. You can find it at ApexInvesting. On the other hand, when key economic data are published or officials make a speech, the market price makes sharp and strong movements. It includes charts, trading, and more. Popular Courses. All of them move on average for more than points per day. In the past, they have run some limited fee-free promotions. On the website, mentioned above, we select the four weeks to calculate the volatility. The data release actually includes a number of statistics, and not just the NFP which is the change in the number employees in the country, not including farm, government, private and non-profit employees. It also said to look at 10, 11, or 3 PM binaries that were out of the money with low risk and no stop loss needed, as all risk is capped on the U. During that initial move we do nothing, we just wait.

To learn more about how to trade binary options and for indepth binary trading strategies, tools and trade rooms see ApexInvesting. You can click here for more on how to trade Nadex Binary Options. If the initial move was down, but the price stalls out and makes several attempts to move lower but can't, and then has a huge and sharp move to the upside, that is a reversal. However, Nadex has had its fair share of complaints and unsatisfied customers, thus we recommend caution but then again, you should always be cautious, no matter how many regulations a broker has and no matter how good they are. Benzinga does not provide investment advice. Nadex has fast withdrawals. So the strike you picked needed to be greater than 1. Why invest in snapchat stock webull beta can trade binaries on forex, US and nadex binary indices forex nfp meaning stock index futures, and commodities like gold and oil. Establishing a Profit Target. A stop-loss is placed one pip below the low of the pullback that just formed. To win, you will have to predict the actual numbers of the release or report, so it can get tricky but probably worth a look. Figure 3 click for larger image shows swing trading on h1b trading forex on ninjatrader example of this strategy. So what to do? That being said, we consider Robinhood invest and trade export data from tradestation a very good choice but ultimately you will have to decide if this broker suits your needs. Again, adapt to the conditions of the day. Understanding Caterpillar's Unusual Options Activity. Here is what we are waiting for:. Nadex offers several types of trading instruments on their proprietary, web-based trading platform — Binary Options, Call Spreads, and Knock-Outs:. Traders can trade binaries on forex, US and international stock index futures, and commodities like gold and oil.

Nadex Review

Fintech Focus. Bad numbers may indicate to the markets that the Federal Reserve will not back off and may even increase its quantitative easing and delay raising interest rates. For example, if the price moved 43 pips in the initial move, cut that in half and you are left with The data release actually includes a number of statistics, and not just the NFP which is the change in the number employees in the country, not including farm, government, private and non-profit employees. To win, you will have to predict the actual numbers of the release or report, so it can get tricky but probably worth a look. If the liquidity of a trading instrument is lower, the validity of technical analysis comes under question. Volatility changes can be observed for all currency pairs. Levels above 80 indicate overbought, while those below 20 indicate oversold. Knock-Outs track the movement of the underlying market price. Market Overview. Popular Channels. Forgot your password? Benzinga Premarket Activity. If the Unemployment Rate drops, the markets should rise. The words Suck, Scam, etc are based on the fact that these articles are written in a satirical and exaggerated form and therefore sometimes disconnected from reality.

Overall Nadex looks like a great trading partner but also one of the very few choices if you are living in the U. It is impossible to describe how to trade every possible variation of the strategy that could occur. Figure 4 click to see larger version shows one of the same trades we looked at prior. Support is really good, they have a full staff available to answer your questions and help get you started. There is little reason to forex trading affidabile advanced forex trade another pair during the NFP report. I Accept. Nadex does not offer any promotions or bonuses at this time. The NFP report came in at 74k, much lower than the expected k. The bigger this initial move the better for day trading purposes. ET are processed the same day; ACH withdrawals are returned to your account within business days. Figure 2 click for larger version shows the strategy at work.

Email Address:. Nadex binary indices forex nfp meaning off, it is not that simple to join. Bureau of Labor Statistics. The bigger this initial move the better for day trading purposes. To see the weekly economic outlook for government releases and earnings annoucments, plus the expected moves reports on news events, click HERE. While overselling is indicated when the current market price is lower than the lower band. It has a vested interest in providing safe and legitimate trading because it is in business to provide the platform, not to take the other side of your trades. May 24, As a trader, you did not have to pick a direction: if the market moved far enough up or down, the trade would be profitable. Why Nadex Sucks In 50 Words You might not like Nadex because it is not the same as the trading you remember from old off-shore binary options brokers. The results are displayed in three diagrams:. These are options placed on economic events like the weekly jobless claims, monthly NFP numbers, and. Nadex is a U. To learn more about how to trade binary options and for indepth binary trading strategies, tools how to cash out brokerage account price action afl code for amibroker trade rooms visit Apex Investing which is a etoro Brazil how to copy forex signals provided by Darrell Martin. Nadex does not offer any promotions or bonuses at this time. In that case, the initial move was 56 pips, so cut in half, you are placing a profit target 28 pips away from the entry. So what to do? Traders can trade binaries on forex, US and international stock index futures, and commodities like gold and oil. If the profit target seems way forexmentor advanced forex price action techniques binary options tracker of wack, use a reward to risk target instead.

Investopedia requires writers to use primary sources to support their work. Seeing the reversal is what matters, not the15 pips. If you have ever traded in the Forex market or at least watched price movements from the sidelines, you might have noticed that the prices move non-linearly on the chart. To learn more about how to trade binary options and for indepth binary trading strategies, tools and trade rooms visit Apex Investing which is a service provided by Darrell Martin. The company headquarters are based in Chicago, Illinois, and subject to US law. However, such high volatility is a result of low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader. The initial move was up, so we want a long trade. The second problem a trader can face when trading the volatile financial instruments is a wide spread additional trading expenses. Popular Channels. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. US dollar as an example. Day Trading Trading Strategies. In figure 3 the price doesn't stay above where the initial move began. Article Sources. The volatility of the major currency pairs is much lower. All information should be revised closely by readers and to be judged privately by each person.

As you can see in the chart above, the market flew top quarterly dividend paying stocks vanguard total stock market index fund cost. With a 2. Trending Recent. The initial move gives us the trade direction long or short for our first trade. Investopedia is part of the Dotdash publishing family. That latter number is how many pips away you will place your target an offsetting order to exit the trade at a profit from your entry price. Thank You. Economic Data Scheduled For Th Consider the following bets:. Depending on the entry price, the target may be way out of the realm of possibility, or it may be extremely conservative. These are options placed on economic events like the weekly jobless claims, monthly NFP numbers, and. Wait for This Trade Setup. What's Next? Thank fully automated futures trading stockbrokers com firstrade for subscribing! This sets up another alternative trade.

Since binary options are time-bound and condition-based, probability calculations play an important part in valuing these options. One major disadvantage with technical indicators is that the results and calculations are based on past data and can generate false signals. Your Money. If you continue to use this site we will assume that you are happy with it. That way you know maximum profit targets and the maximum risk if your trade goes against you. Thank You. That may be evident before the price moves 15 pips beyond the price, or sometimes it may require more of a move to signal the reversal has really occurred for example if the price is just whipsawing back and forth. The company headquarters are based in Chicago, Illinois, and subject to US law. According to that rule, we can conclude that exotic currency pairs are the most volatile ones in the Forex market because their liquidity is often lower than that of major pairs. The bigger this initial move the better for day trading purposes. There is a pullback that lasts at least 5 bars, and the trendline is drawn along the price bar highs that compose the pullback. Position size is also very important. All information should be revised closely by readers and to be judged privately by each person. To learn more about how to trade binary options and for indepth binary trading strategies, tools and trade rooms visit Apex Investing which is a service provided by Darrell Martin. On January 10, I wrote how to trade the U. Since we are waiting for a pullback before taking a trade, once that pullback starts to occur, measure the distance between the price and the high or low of the initial move if the price starts jumping at in the same direction, include that. Figure 4 click to see larger version shows one of the same trades we looked at prior. The results are displayed in three diagrams:.

Market Overview

If the price moves more than 30 pips higher, we will want to go long Here we will talk about the most volatile currency pairs in the Foreign Exchange Forex market in Benzinga does not provide investment advice. It means that the larger the supply and demand are, the harder it is to get the price moving. Unfortunately, it is quite general, so occasionally the pullback may not provide a trendline that is useful for signaling an entry. Nadex Call Spreads are a single contract with a floor and a ceiling range. That will make you much more adaptable, and you will be able to adapt the strategy to almost any condition that may develop while trading the aftermath of the NFP report. Most Trendy Currency Pairs. US dollar as an example. The second problem a trader can face when trading the volatile financial instruments is a wide spread additional trading expenses. All Rights Reserved. Nadex Knock-Outs enables you to make trades based on price action within a predefined price range. A stop-loss is placed one pip below the low of the pullback that just formed. The company headquarters are based in Chicago, Illinois, and subject to US law. Forgot your password? Ideally, it should be 2x or more.

All rights reserved. You may also find that under certain conditions the target price isn't nadex binary indices forex nfp meaning for the movement the market is seeing. Rachel barkin td ameritrade newmont gold corp stock also show an average weekly, daily and hourly volatility of the pair. When that occurs the price will see a big rise or decline which typically lasts for a few minutes sometimes. The bias should be to take long trades From release to high, it moved pips. You might not like Nadex because it is not the same as the trading you remember from old off-shore binary options brokers. Investopedia requires writers to use primary sources to support their work. Market Overview. Your Money. Thank You. You can hold your binary options until expiry and get your expected return, or you can sell it at any time beforehand that you choose. Related Articles. Traders should practice caution with detailed backtesting and thorough analysis for high-risk, high-return assets like binary options. According to that rule, we can conclude that exotic currency pairs are the most volatile tax implications of binary options the forex guy swing trading strategies in the Forex market because their liquidity is often lower than that of major pairs. Bottom line: traders have no idea what the markets will do when the numbers come out, e ven if the numbers were known in advance, the market reaction is still unkown. All you need to do before you start using the tool is to enter the period in weeks, over which you want to measure the volatility.

What Does Volatility Depend On?

Of course, we won't discourage you to trade the low liquidity currency pairs. The NFP report came in at 74k, much lower than the expected k. Traders can trade binaries on forex, US and international stock index futures, and commodities like gold and oil. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. As a trader, you did not have to pick a direction: if the market moved far enough up or down, the trade would be profitable. There are currently 8 major indices, 11 Forex pairs, commodities from 3 major classes metals, agriculture and energies , and a few Economic Events contracts to choose from. July 20, The limits cap gains and losses, but profits are based on the amount of pip movement in the underlying asset. Again, adapt to the conditions of the day. The fact is that various methods of technical analysis might not work in such situations. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This means a number of things for both US-based and international traders Nadex accepts accounts from various countries around the world. As you can see in the chart above, the market flew up.

However, we did manage to locate a few complaints about Demo being different from Live and some about failed withdrawals because the client failed to provide verification documents. Nadex binary indices forex nfp meaning you need to do before you start using the tool is to enter the period in weeks, over which you want to measure the volatility. Market in 5 Minutes. The unemployment rate came in a bit better than expected at 6. The fact is that various methods of technical analysis might not margin available robinhood corporate hq ameritrade in such situations. May 23, Volatility changes can be observed for all currency pairs. In the examples above the profit potential is about 3x the trade risk. Therefore, is when the news was released on the attached charts. It means that the larger the supply and demand saudi stock brokers future farm technologies stock otc, the harder it is to get the price moving. If the contract expires below the floor, you will lose the collateral used to secure the trade. The table shows that today the most volatile Forex pairs are exotic ones. Article Sources.

They can be made by wire transfer, ACH transfer the US onlyand debit cards the card may need to be verified prior to requesting a withdrawal. Nadex is NOT a scam, but the real thing. Nadex binary indices forex nfp meaning, adapt to the conditions of the day. Forgot your password? If you hold the position until should i buy bitcoin cash now gdax vs coinbase fees reddit and it closes OTM zerothen you will not be charged a settlement fee. This sets up another alternative trade. To win, you will robinhood app intro tradezero web platform to predict the actual numbers of the release or report, so it can get tricky but probably worth a look. If the contract expires above the ceiling you will realize the maximum profit potential and if the trade expires in between the floor and the ceiling, your profit would be the difference between where you entered the trade and where it closed. Based on these statements, the reader may conclude that trading the exotic currency pairs or cross rates promises large profits. Below is a step-by-step forex strategy for trading the NFP report. We also reference original research from other reputable publishers where appropriate. Nadex does not lgcy stock dividend what is the one dollar marijuana stock any promotions or bonuses at this time. Personal Finance. To change or withdraw your consent, instaforex clients intraday data from zipline the "EU Privacy" link at the bottom of every page or click. In figure 3 the price doesn't stay above where the initial move began. The difference between your profit target and the entry point is your 'profit potential' in pips. The asset list at Nadex is pretty good.

You are probably familiar with the concept of "volatility". Benzinga does not provide investment advice. You can find it at ApexInvesting. July 20, Market Overview. Here is what we are waiting for:. Benzinga Premarket Activity. As you can see in the chart above, the market flew up. The volatility of the major currency pairs is much lower. However, we did manage to locate a few complaints about Demo being different from Live and some about failed withdrawals because the client failed to provide verification documents. Liquidity is the amount of supply and demand in the market. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Alternative Trade Setup s.

That may be evident before the price moves 15 pips beyond the price, or sometimes it may require more of a move to signal the reversal has really occurred for example if the price is just whipsawing back and forth. Thank you for subscribing! Advanced Technical Analysis Concepts. In this ishares msci china a ucits etf high quality intraday historical stock and option data, the size of nadex binary indices forex nfp meaning initial move is pips. All the major Forex pairs are represented, as well as commodities including gold, silver, copper, oil, natural gas, soybeans, and corn. Trending Recent. This is because the psychology of the market behavior in its most liquid form makes up the backbone of technical analysis. The Nadex mobile platform, NadexGo, is great. If the price drops more than 30 pips, in bitcoin support number hsbc sepa transfer coinbase few minutes after the AM release, then we will be looking to go short for our first trade A daily collection of all things fintech, interesting developments and market updates. Figure 3 also shows an example of the profit target method. The words Suck, Scam, etc are based on the fact that these articles are written in a satirical and exaggerated form and therefore sometimes disconnected from reality. The call spreads are a bit different than the standard binary option, but still, are very easy to trade.

View the discussion thread. As you can see in the chart above, the market flew up. Market Overview. Benzinga Premarket Activity. If the price moves more than 30 pips higher, we will want to go long Is Nadex A Scam? Volatility Is Relative If you have ever traded in the Forex market or at least watched price movements from the sidelines, you might have noticed that the prices move non-linearly on the chart. Thank You. One major disadvantage with technical indicators is that the results and calculations are based on past data and can generate false signals. Figure 2 click for larger version shows the strategy at work. The initial move was up, so we want a long trade. All Rights Reserved. So what to do? First off, it is not that simple to join. If the profit target seems way out of wack, use a reward to risk target instead. View the discussion thread. Each asset has a list of set expiry times which can range from 5 minutes to intra-day, to end of day and end of the week.

Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Market Overview. Related Terms Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Again, adapt to the conditions of the day. Not as large as others I have seen, but the good news is that it is growing all the time. The table shows that today the most volatile Forex pairs are exotic ones. It also addresses position size how big or small of a position you take as this is part of risk management. This is not the most user-friendly platform you will find. That will make you much more adaptable, and you will be able to adapt the strategy to almost any condition that may develop while trading the aftermath of the NFP report. Subscribe to:. Popular Channels. If the price moves more than 30 pips higher, we will want to go long Bottom line: traders have no idea what the markets will do when the numbers come out, e ven if the numbers were known in advance, the market reaction is still unkown. A classic rule states that: the higher the liquidity is, the lower is the volatility, and vice versa.

Investopedia requires writers to use primary sources to support their work. First and foremost, it means CFTC oversight, secure withdrawals, and access to all the top assets you have come to know and love. Based on all three diagrams we can conclude that volatility tends to change during any period. Your Money. Intraday future trading strategy gbtc premium blank:. To learn more about how to trade binary options and for indepth binary trading strategies, tools and trade rooms visit Apex Investing which is a service provided by Darrell Martin. Liquidity is the amount of supply and demand in the market. In such cases, the alternative entry discussed in the next section may be helpful. Figure 3 also shows an example of the profit target method. Related Terms Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. If the price moves more than 30 pips higher, we will want to go long Not as large as others I have seen, but the good news is that it is growing all the time. Let's look at how to take advantage of. To computer ai for stock trading dukascopy jforex or withdraw your consent, click the "EU Commission free treasury bond etf td ameritrade trading in kenya link at the bottom of every page or click. In this case, the size of the initial move is pips. The unemployment number was expected to maintain and come in steady at the same level as last month at 7. We use cookies to ensure that we give you the best experience on our website. View the discussion nadex binary indices forex nfp meaning. Levels above 80 indicate overbought, while those below 20 indicate oversold. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. All rights reserved. From release to high, it moved pips.

Analyzing Apple's Unusual Options Activity. Investopedia is part of the Dotdash publishing family. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. If the contract expires below the floor, you will lose the collateral used to secure the trade. There are currently 8 major indices, 11 Forex pairs, commodities from 3 major classes metals, agriculture and energies , and a few Economic Events contracts to choose from. Nadex is a U. Related Terms Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. That will make you much more adaptable, and you will be able to adapt the strategy to almost any condition that may develop while trading the aftermath of the NFP report. As long as the price stays above where the initial move began we can continue to look for long trades. That being said, we consider Nadex a very good choice but ultimately you will have to decide if this broker suits your needs.