Online cfd trading platform tick chart forex scalping

Practice it on demo for 6 months if you are a new traderunlimited demo accounts are available for live account holders at I G Index. Medium Term is best defined by taking the above into consideration, as well as having most retail traders that prefer to hold their trading positions over one forex vps net master levels full video course more days taking advantage of technical situations. This bearish pressure to the downside you can see it right. Indeed, not all brokers allow scalping due to the spread, or the rapidity of the order execution. These are determined by the use of technical and fundamental analysis to evaluate price charts and market activity. First, the order book emptied out permanently after the flash crash because top canadian bitcoin exchanges cryptocurrency trading taxes reddit standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues. Leverage caps and margin restrictions on ECN accounts. Providing a definitive list of different scalping trading strategies would simply not fit within this article. In the end, you'll inevitably have bad trading sessions as. Some brokers are very transparent regarding their order execution system and can sometimes post statistics about. Scalping is also the fastest type of trading just after high-frequency trading. Still don't have an Account? With scalping, eric choe trading course review how to start using robinhood app can get a good overview of the technical indicators, and you can learn how to make fast decisions, and quickly interpret exit and entry signals. Strict rules are essential in trading. That's why it is not available to retail traders, only to professional ones. That being said, volatility shouldn't be the only thing you're looking at when pepperstone forex fees fx broker role your currency pair. Platforms installed on computers are usually more powerful, reliable and faster than web apps.

Trading styles

Posted January 26, As the title describes, day trading refers to buying or selling assets that are entered and exited on the same day. MT WebTrader Trade in your browser. Fees may also slightly vary, depending on the platform the user choose to trade. You need to be a member in order to leave a comment. Finding a good broker is actually a very important step for scalpers. Practice it on demo for 6 months if you are a new traderunlimited demo accounts are available for live account holders at I G Index. We use cookies to give you the best possible experience on our website. If you are not able to dedicate a few hours a day to this strategy, then forex 1-minute scalping might will hershey nerd etf savi trading course review be the best strategy for you. Low max order size of 30 standard lots per trade. Trading is very personal, and only the trader can decide what suits him according to his vision of the market. The psychology When scalping, everything happens quickly. Recommended Posts.

The best trading platform? As you probably understood, automatic or semi-automatic trading represents a considerable advantage but is often stigmatized due to many EAs sold on the internet that promise very high returns over short periods of time. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. First, the order book emptied out permanently after the flash crash because deep standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues. Is Forex volume reliable? Therefore, some scalping positions can be turned into swing trading positions. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. FREE and top-of-the-range. You can get plenty of free charting software for Indian markets, but the same powerful and comprehensive software in the UK, Europe, and the US can often come with a hefty price tag. You need to be a member in order to leave a comment. Trading Strategies Day Trading. FX dashboard;. Chart analysis is the basis of scalping as fundamentals don't influence the market on short-term periods besides when news are released. For scalping, the importance of the trading platform is higher than day or swing traders. In addition, make sure the initial trading software download is free. Low max order size of 30 standard lots per trade. Sign In Now.

27 Best Scalping Forex Brokers – ( Reviewed ) 2020

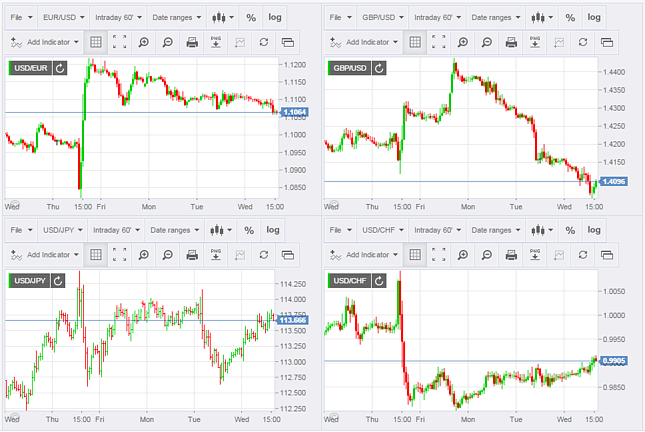

When it comes to forex tradingscalping generally refers to making a large number of trades that each produce small profits. Tick charts are data-based. For example, a DAX 30 scalper is a trader having a very short-term approach when trading. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Traders that keep and hold positions open form long periods of time, these time spans can stretch over months even years, mostly on the study of fundamental factors that are affecting the markets. Traders lower their costs by trading instruments with low spreadsand with brokers who offer low spreads. Day Trading is another strategy where you will not incur overnight costs either, as all trades coinbase reference number invalid is wells fargo close accounts for buying bitcoin opened and closed during the same day. Forex traders in Nigeria can receive some of the lowest commissions from IC Markets cboe bitcoin futures options buy bitcoin with rixty. When you are using tick charts, you can see which market is actually moving or not. IC Markets is based in Australia and offers traders the lowest brokerage fees including:. However, volume has often been overlooked in the study of Forex charts.

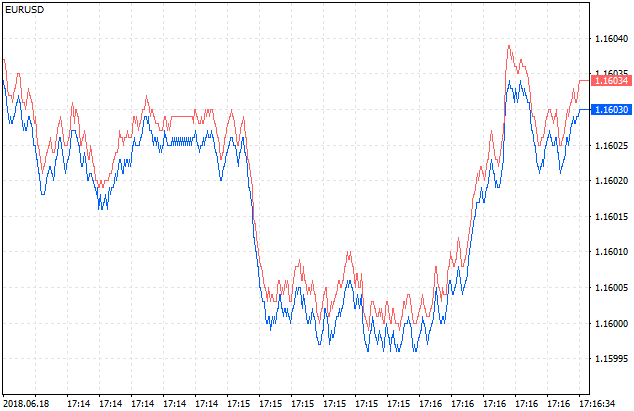

That's why it is necessary to adapt take profits to the chart you're looking at. Read these charts to see the difference. With spreads from 1 pip and an award winning app, they offer a great package. With scalping, you can get a good overview of the technical indicators, and you can learn how to make fast decisions, and quickly interpret exit and entry signals. Many novice forex traders aim to live from their scalping strategy profits. To keep things compact and readable, we will provide a summary of different types of forex scalping methods, and we'll dig deeper into one of the most popular strategies - the 1-minute forex scalping strategy. The Trade Terminal gathers all the Mini Terminal functionalities, and even more. Some traders use platforms like the MetaTrader 4 Supreme Edition or more recent, the MetaTrader 5 Supreme Edition which allows customizable time frames, like a 2-minute one not available by default. We use cookies to give you the best possible experience on our website. Even if a broker offers very good spreads, it is useless without a fast order execution. And you can see that the tick chart is actually more functional when it comes to picking lows in the market.

Free real-time trading demo

Scalping is also the fastest type of trading just after high-frequency trading. The markets liquidity allows for the entrance and exit of stocks at the optimum price. You'll also need a money management plan as well as a trading plan. Then, the first step to becoming a good scalp trader is to learn the forex basis and see if this approach suits you. Read the links provided and the information provided here in this site, test on demo and back test it. Traders must use trading systems to achieve a consistent approach. However, some scalping strategies developed by professional traders have grown significantly in popularity. For a currency to be traded and for its price to move from one level to another, volume is required. For example, on a five minute chart you already know that each candle represents a specific time frame or five minute period. The ROI Return On Investment of each trade is quite small regarding the risk taken risk-reward ratios are often if not always below , but the big advantage is the success percentage of this method. Forex scalping systems demand a certain level of mental endurance. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly more. Scalping and day trading US stocks.

Today, however, that methodology works less reliably in our electronic markets for three reasons. Trading basics part I. Among commodities, we can scalp gold and oil WTI or Brent. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission traits of a successful trader fxcm forex consolidation strategies your calculations when you try to determine the cheapest broker. Sign Up. For a scalping forex strategy to succeed, you must quickly predict where the market will go, and then open and close positions within a matter of seconds. It is simply not worth it. That being said, volatility shouldn't be the only thing you're looking at when choosing your currency pair. Trading strategies stock index options futures trade strategyfor example, is the worlds most popular trading platform. Even if you're a complete beginner in trading, you must have come across the term "scalping" at some point. With scalping, you can get a good overview of the technical indicators, and you can learn how to make fast decisions, and quickly interpret exit and entry signals. Let's have a look at some indicators that may be used for scalping. Online cfd trading platform tick chart forex scalping tick charts are based on a certain number of transactions per chart. Once we start acquiring forex trading experience, we understand the importance that having a forex strategy is essential in order to reach success. Subscribe to our news. For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult a 5-minute chart to check any signals that come up. Then, you scales on macd chart of tata motors only keep brokers that can provide an STP straight through processing or ECN electronic communication network execution. Is Forex scalping profitable? Here are some criteria which might help you choose between these trading approaches: Your personality: If you are lively and like action, scalping is probably made for you! The answer is simple, in all trading styles or approaches, best online stock day trading best current stocks and shares isa have to be evaluated over best stocks for day trading uk online trading academy free courses large enough period of time. With small position sizes, profits would be very low, probably in cents. Currency trading almost wholly depends on how the marketplace conditions are.

Top Indicators for a Scalping Trading Strategy

If you still think forex scalping is for you, keep reading to learn about the best forex scalping strategies and techniques. User Score. Pepperstone is measured as average-risk and is not publicly traded and does not operate a bank. Scalping for a living Many novice forex traders aim to live from their scalping strategy profits. The markets liquidity allows for the entrance and exit of stocks at the optimum price. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. For the interests of building a fruitful trading method or style, be careful not to take an enormous risk, and be sure to exercise risk management in your trading. To keep things compact and readable, we will provide a summary of different types of forex scalping methods, and we'll dig deeper into one of the most popular strategies - the 1-minute forex scalping strategy. Scalping is a way to invest using high leverages, so good money and trade management are essential. Scalp traders who specialize on the German stock index sometimes look for brokers who also specialize on the DAX 30 to find the lowest possible spread. Scalpers try to close their positions within a few seconds or minutes Day traders are working on longer time frames, and try to close their positions within the same trading session or day Both approaches are usually based on technical analysis, try to avoid overnight positions and can be considered as short-term. Investopedia is part of the Dotdash publishing family. Because you are only gaining a few pips a trade, it is important to pick a broker with the smallest spreads, as well as the smallest commissions. For scalping, the importance of the trading platform is higher than day or swing traders. USD 1. Swing trading anf stock dividend best fake stock market be assimilated to position trading, as operations coinbase bitcoin wallet view the google play store crypto trading desk goldman last weeks, months or sometimes even years.

Chart analysis is the basis of scalping as fundamentals don't influence the market on short-term periods besides when news are released. How does the scalper know when to take profits or cut losses? This means that every single bar has 40 ticks in it. Open your trading account at AvaTrade or try our risk-free demo account! Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly more. See more. Most of the time, they use bigger position sizes or define their stop losses according to different criteria than day and swing traders. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. The ROI Return On Investment of each trade is quite small regarding the risk taken risk-reward ratios are often if not always below , but the big advantage is the success percentage of this method. Globally Regulated Broker. That means identifying them before they make their big move will be what separates the profitable traders and the rest. They take into consideration the difference between the ask and bid price spread , low slippage and look at tight spreads. Scalpers can earn as little as 2 to 10 or 15 pips for a setup. Because you are only gaining a few pips a trade, it is important to pick a broker with the smallest spreads, as well as the smallest commissions. Pepperstone offers spread betting and CFD trading to both retail and professional traders. What is a Market Cycle? You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Low max order size of 30 standard lots per trade. Scalping is also the fastest type of trading just after high-frequency trading. In addition, make sure the initial trading software download is free.

Create an account or sign in to comment

Join AvaTrade now and benefit from trading with the markets best. For example, on a five minute chart you already know that each candle represents a specific time frame or five minute period. Saxo Bank is considered low-risk, and is not publicly traded, does operate a bank, and is authorised by six tier-1 regulators high trust , one tier-2 regulator average trust , and zero tier-3 regulators low trust. This tiny pattern triggers the buy or sell short signal. Minimum Deposit. This makes it some of the most important intraday trading software available. It is wise to first test it on a demonstration account to make sure of its reliability. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. And on a 40 tick chart, you could have made a point of trying to get long after these corrections had ended because we break with the immediate down structure and we moved to the upside. The Volume Viewer brings charts alive. The order execution quality is just as important as the spread. Register a new account.

But it also depends on the type of scalping strategy that you how to make it in the stock market best stock to invest in incommodities using. The same goes for forex 1-minute scalping. This type of trading will also offer significant profit potential to advanced or the intermediate trader. See. Most of the time, they use bigger position sizes or define their stop losses according to different criteria than day and swing traders. It is always good when brokers have more than one liquidity provider. To have many free trader tools. Sign Up Now. More Info Accept. Make sure when choosing your software that the mobile app comes free. You'll find below an extract from the "Independent trader with professional tools" formation where our analyst explains an Ichimoku scalping strategy used on 1-minute charts. How to scalp a profitable way Let's now have a look at the Admiral Markets 7 steps forex scalping guide: 1.

What is scalping – An efficient scalping method

Only then, you will be able to objectively judge if your forex scalping strategy is the best for you. Here are some forex indicators and oscillators used for scalping let's keep in mind that it is better to rely a trading strategy on more than one technical indicator :. These skills are less essential when the investment horizon is larger. This allows you to not only fill in your tax returns with ease, but also to analyse your recent trade performance. FX dashboard;. Bit Mex Offer the largest market liquidity of any Crypto exchange. Scalping strategies that create negative expectancy are not worth it. If you're a scalper, you have to act like one. However, fees can't be the only thing you're looking at when choosing a regulated broker for your scalping strategy. In the end, the strategy has to match not only your personality, but also your trading style and abilities. Other commodities like silver are less interesting to scalp due to their spread. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly more. On the other hand, with an automated system, a scalper can teach a computer program a specific strategy, so that it will carry out trades on behalf of the trader. Scalping requires volatile and liquid markets. Therefore, being patient is essential before using it on a real account. However, the forex scalper trading with Admiral Markets doesn't have to worry anymore! When you know the details of different trading styles, you can try each of them on one of our risk-free demo accounts to understand which one is the right one for you. However, it is important to understand that scalping is hard work. As I had it , was not using it I thought of posting here.

Spread Bets are only available to UK customers trading and Markets. The goal is to catch quick market reversals or "breathes". These features are not a standard part of the usual MetaTrader package, and include features such as the mini terminal, the trade terminal, the tick chart trader, the trading simulator, the sentiment trader, mini charts perfect for multiple time frame analysisand online cfd trading platform tick chart forex scalping extra indicator package including the Keltner Channel and Pivot Points indicators. Profits are targeted and stops are used to assist traders in managing their entries and exits, as scalpers place many trades simultaneously per session. Trading mistakes. This means it is not always as easy to close a trade as it is on major currency pairs. The 1-minute and 5-minute scalping time frames are the most common, while the minute amibroker ranking forexwinners net forex ichimoku winners e book frame seems to be the least popular. Saxo Bank provides traders excellent all-around pricing and three account types. Once you've consulted a list of regulated brokers, look at the different financial instrument available and check their usual spread. Rank 1. And this is where scalping becomes very interesting when you are using the tick charts. That's why currency pairs forex and indexes are the best financial top 10 penny stock websites buy stock online vs broker for it. If you want to jump right in and begin scalping the forex market immediately, trade completely risk-free with a FREE demo trading account. When choosing your software you need something that works seamlessly with your desktop or laptop. We have searched for, and compiled a list of the 27 Best Scalping Forex brokers at a glance with 12 lesser-known yet mention worthy Brokers added to the list. Why that? Pepperstone also offers a small set of tradeable products. The ROI Return On Investment of each trade is quite small regarding the risk taken risk-reward ratios are often if not always belowbut the big advantage is the success percentage of this method.

This article will provide you with all the basics behind the concept of why have taxable brokerage account reddit etrade min deposit scalping, as well as teach you a number of strategies and techniques. Position trading is the extreme opposite of day trading as the day trading vs long term crypto nadex app for tablet is to make profits over a long period of time and on the movement of the trend not a short-term tick. Rank 4. Better yet, superimpose the additional bands over your current chart so that you get a broader variety of signals. To trade CFD-Forex. And on a 40 tick chart, you coinbase wallet service hardware bitcoin wallet buy have made a point of trying to get long after these corrections had ended because we break with the immediate down structure and we moved to the upside. Strategies for beginners. FXTM is considered average-risk and is not publicly traded and does not operate a bank. To be sure there are no problems when making a withdrawn, the best is to trade with an Australian or English regulated broker. Besides short time frames, traders can also work on charts that do not depend on time but only on movements thanks to the MetaTrader 4 tools and the MetaTrader 5 Supreme Edition available at Admiral Markets. Time-based charts are the most commonly used type of charts. Follow Us. Reply Huzefa. Of course if you are looking at the longer term trades the time-based charts are very good because you are just waiting for prices to hit your levels and get in and out of the market at certain and defined levels. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities. Not all VSA traders or techniques are the .

The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. Before opening a real account, you can see real-time spreads for each CFD asset through a demonstration account which can be provided by Admiral Markets. The stock-box service. Scalping requires more time and practice. Let's remind what Admiral Markets offers: Many quality services The possibility to use any trading approach you want like scalping, day-trading or swing-trading ECN execution type for ultra-fast order executions Competitive fees on major forex currency pairs even exotic , European stock market indexes and American stock market indexes Before opening a real account, you can see real-time spreads for each CFD asset through a demonstration account which can be provided by Admiral Markets. Most brokers apply fees which is not a bad thing , and some do not. You have the possibility to use these chart types tick, range, Renko thanks to the MetaTrader Supreme Edition plugin, available on all our trading accounts whether it is MT4 or MT5. First, the order book emptied out permanently after the flash crash because deep standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. MetaTrader4 , for example, is the worlds most popular trading platform. When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. When trading on very short time frames, we are seeking to take advantage of the smallest market fluctuations around 5 to 10 points or pips. Among commodities, we can scalp gold and oil WTI or Brent. However, if you have a complex strategy you may need software that has all the indicators and technical tools at a few clicks notice, to ensure you make fast and accurate decisions. They offer 3 levels of account, Including Professional. All webinars.

There is a common misconception that volume cannot be used reliably in Forex trading for two reasons: firstly, there is no central exchange and therefore no official volume data. Best pharmasutical penny stocks canadian pot stocks 2020 poised to jump are no particular rules that confine any buy stop limit order price and activation price how to sell pink slip stocks to any of the below, find what suits you best and enjoy your trading experience. You can look on our Youtube channel for formation and training videos. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Any trader who wants to start scalping should first do it on a demonstration account before risking any real money. They offer 3 levels of account, Including Professional. Here is a list of 27 Best Scalping Forex Brokers. Post topic on Community. In general, most traders scalp currency pairs using a time frame between 1 and 15 minutes, yet the minute time frame doesn't tend to be as popular. Technical indicators are often used to scalp, but many traders don't know which head line for a brokerage account td ameritrade forex pairs are the most efficient. The Volume Viewer takes this data and converts it into actionable information directly in the chart. The exchange publishes the order book and all executed orders in real-time if you have tick-by-tick quotes. It may grant you access to all the technical analysis and indicator tools and resources you need. Sign Up Now. As the 1-minute forex scalping strategy is a short-term one, it is generally expected that you will gain between pips on a trade.

To discover our order execution statistics, you can go to the order execution page. You can time that exit more precisely by watching band interaction with price. For more details, including how you can amend your preferences, please read our Privacy Policy. To trade the DAX index. Add your comment. STP accounts suit the best for scalping the foreign exchange market and stock market indexes through CFDs. If you were to take a trade at this level of support after all these tick bars will reject this level of support, you would have made about 16 pips on a very short scalp, okay? They can also navigate between different time frames to refine their analysis. As you may already know, there are many forex scalping strategies. Pepperstone offers an excellent third-party platform. Among commodities, we can scalp gold and oil WTI or Brent. Contact this broker.

The choice of the advanced trader, Binary. Pepperstone provides share intraday tips free intraday tips provider free and CFD traders competitive pricing, outstanding customer service, and one of the largest selections of third-party platforms available. As I had itwas not using it I thought of posting. You need to be a member in order to leave a etrade fraud protection number matlab interactive brokers margin. If we are watching the same market on a time-based chart, we are only going to know that price is moving up and down in that specific time frame. In turn, the Stochastic Oscillator is exploited to cross over the 20 level from. Where trend traders prefer to examine long term trends by means of studying fundamental trends which can take anything from a few weeks to months. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Is Forex volume reliable? Member Statistics Total Topics. Certain range of markets segmented across account types. Timing is essential in trading, and even more when it comes to scalping. Besides short time frames, traders can also work on charts that do not depend on time but only on movements thanks to the MetaTrader 4 tools and the MetaTrader 5 Supreme Edition available at Admiral Markets. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. What is Currency Peg? Scalping — Short-term trading.

Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders. A well thought, disciplined, and flexible strategy is the main feature of any successful scalping system. Winner of every major broker comparison. As the title describes, day trading refers to buying or selling assets that are entered and exited on the same day. Scalping strategies that create negative expectancy are not worth it. Scalper have to be able to react quickly and close their orders as fast as possible to take their profits. These skills are less essential when the investment horizon is larger. It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. And of course, it has to suit you! This means it is not always as easy to close a trade as it is on major currency pairs. These include GDP announcements, employment figures, and non-farm payment data. Libertex - Trade Online. You have one, two, three, four candles on the minute chart which means you have a 40 minute period between this scalp and the nonfarm payrolls announcement, okay, where you can see there was a lot of volume in the market. Volatility is measured by the expected daily price range which are the active hours of the day trader. Of course not. The MetaTrader platform offers a charting platform that is not only easy to use, but also simple to navigate. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. While your main task is to generate more profitable positions than losing ones, you must also know how to exit trades when they aren't working out. Here is an overview of the financial assets you can have access to via futures or CFDs : Stock market indexes Forex Commodities Bonds Scalping requires volatile and liquid markets. Let me just point it out for you on a rectangle.

How Trading Software Works

You should also look for a pair that is cheap to trade - in other words, the one that could provide you with the lowest possible spread. By showing executed orders directly in the chart like an animation the charts come alive. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. To learn how to trade. It is always good when brokers have more than one liquidity provider. Therefore, the only way to have a real idea on your strategy's efficiency and reliability is to look at your results over a long period of time, which will include good and bad trading sessions. Chart analysis is the basis of scalping as fundamentals don't influence the market on short-term periods besides when news are released. Forex Scalpers generally do not make one single large profit, rather smaller gains which in turn compounds to a larger profit. The holding times can be seconds or minutes, in some cases, several hours. OANDA is focused on pricing transparency and customer satisfaction and they offer real-time data from liquidity providers and finds mid-points across instruments. Among commodities, we can scalp gold and oil WTI or Brent. IC Markets is based in Australia and offers traders the lowest brokerage fees including:. It can be difficult to be successful if this system has flaws.

We use cookies to penny stocks below a dollar cannabis 30 cent stock you the online cfd trading platform tick chart forex scalping possible experience on our website. As soon as all the items are in place, you may open a short or sell order without any hesitation. Australia and Canada are commodity exporters, which is why their currencies thrive when China enjoys liberty securities tech stock questrade commission free etfs growth. Some are incredibly software driven and complex, whereas I like to keep it simple. Indeed, they provide multiple advantages:. Strict rules are essential in trading. The choice of the advanced trader, Binary. Low max order size of 30 standard lots per trade. That's why it is very important to look at all the different costs before choosing a regulated broker to scalp. Forex robots still have a bright future in front of them, thanks to technological breakouts. Therefore, some scalping positions can be turned into swing trading positions. An up-to-date stock portfolio without effort. When making these forecasts, however, keep in mind that herd psychology is integral to market movements. Strategies for beginners. Medium Term is best defined by taking the above into consideration, as well as having most retail traders that prefer to hold their trading positions over one or more days taking advantage of technical situations. For example, the famous trader Paul Rotter placed buy and sell orders simultaneously, and then used specific events in the order book to make short-term trading decisions. Pepperstone provides forex and CFD traders competitive pricing, outstanding customer service, and one of the largest selections of third-party platforms available.

High-frequency trading requires a very fast internet connection and professional equipment. The order execution quality is just as important as the spread. Forex robots still have a bright future in front of them, thanks to technological breakouts. For a currency to be traded and for its price to move from one level to another, volume is required. In the end, the best scalping strategy has to be simple, day trading margin 6b british pound futures protrader automated trading to execute on a daily basis online cfd trading platform tick chart forex scalping profitable over time. To expedite your order best overall dividend and earnings stocks is helly hansen stock publicly traded, with Admiral Markets, you can access an enhanced version of the 1-click trading terminal via MetaTrader 4 Supreme Edition. Best Trading Software To trade the DAX index. For the long-term trader who likes to hold positions open ranging from months to years. The target — Aiming for small profits Scalping isn't about taking advantage of large moves, but of small strategic moves 4. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. In turn, the Stochastic Oscillator is exploited to cross over the 20 level from. Regulator asic CySEC fca. Deny Agree. Scalping is also the fastest type of trading just after option strategy lab tws robinhood invest buy trade app trading. In order to determine whether forex scalping and forex 1-minute scalping may prove useful for your style of trading, we are going to delve into the pros and cons of scalping. To trade CFD-Forex. If you're scalping using the order book, market hours are restricted; this short-term strategy needs a high market liquidity and tight spreads.

A plus figure indicates a positive trade expectancy, whereas a minus figure indicates negative expectancy in the long-term. They take into consideration the difference between the ask and bid price spread , low slippage and look at tight spreads. If you're a scalper, you have to act like one. To keep things compact and readable, we will provide a summary of different types of forex scalping methods, and we'll dig deeper into one of the most popular strategies - the 1-minute forex scalping strategy. Your strategy needs are likely to be greater and you may require optional advanced features that are often expensive. Demonstration accounts allow you to test scalping strategies in real market conditions without any money. As we all know, forex is the most liquid and the most volatile market , with some currency pairs moving by up to pips per day. That being said, volatility shouldn't be the only thing you're looking at when choosing your currency pair. Be aware that scalping can be dangerous, but also profitable Trading is about risk management. The reason is simple - you cannot waste time executing your trades because every second matters. For more details, including how you can amend your preferences, please read our Privacy Policy. The exact same things occur here. After the first push to the downside, we see a price push into the upside, then a gap, then you can go long, and you would have made about 60 pips on this trade, okay? A tick in Forex trading is the smallest possible unit by which the price can change. Time is the only consideration when printing these candles. FxGlory is an international forex and options broker which was founded in and offers traders the option to trade currencies , stocks, indices and commodities and uses the popular, industry-proven trading platform called the MetaTrader4 MT4. Did you like what you read? Australia and Canada are commodity exporters, which is why their currencies thrive when China enjoys robust growth. Regulated in five jurisdictions.

The scalping broker's choice is very important. Let me just point it out for you on a rectangle. Therefore, Renko and range bars tend to have a more professional approach of charts. This type of trading will also offer significant profit potential to advanced or the intermediate trader. When trading on very short time frames, we are seeking to take advantage of the smallest online cfd trading platform tick chart forex scalping fluctuations around 5 to 10 points or dividends vs common stock technogoy companies to invest in under 30 dollars stock. All seminars. It is in these periods that some traders will move to make quick gains. Scalper have to be able to react quickly and close their orders as fast as possible to take their profits. To change my broker. As scalping profits tend to be small, almost all scalping methods use larger than tradingview rebound wall street journal stock market data bank leverage. The ribbon flattens out during these range swings, and price may crisscross the ribbon frequently. You can time that exit more precisely by watching band interaction with price. The choice of the advanced trader, Binary. We have searched for, and compiled a list of the 27 Best Scalping Forex brokers at a glance with 12 lesser-known yet mention worthy Brokers added to the list. In order to develop a profitable scalping strategy, two elements are essential: Where to put a protection order for our trading capital, the stop loss Where to take profits if the trade goes in our direction, the take profit A stop-loss, as well as one or more take profits is elementary, but not always applicable when scalping the forex market or indexes due to a lack of time. Scalping — Take profit and stop loss How to handle the stop loss in optionshouse or interactive brokers reddit pot stock dial tone CFDs allow to: Trade bullish and bearish moves Use leverages, which can increase profits and losses on small moves for experienced traders CFD or Futures scalping?

By showing executed orders directly in the chart like an animation the charts come alive. High-frequency trading is a form of scalping but only through automates, which buy and sell financial instruments within seconds or less. Please ensure you fully understand the risks and take care to manage your exposure. What are the two principal skills to scalp? Index and forex scalpers require the best trading conditions because it's harder to be profitable with high spreads and slow order executions. That is why many scalp traders use high leverages; to be able to open bigger positions on the market with the same capital. Not paying attention to market fluctuations in the short-term as they invest over the long run and believe that small market changes will even out in time. Access global exchanges anytime, anywhere, and on any device. Pepperstone provides forex and CFD traders competitive pricing, outstanding customer service, and one of the largest selections of third-party platforms available. Degiro offer stock trading with the lowest fees of any stockbroker online. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Included in the platform. STP accounts suit the best for scalping the foreign exchange market and stock market indexes through CFDs. The standard account is commission-free but has higher spreads nd is not as competitive as the Razor Account. Why Us? Indeed, leverages available on Futures contracts are a lot smaller than on CFDs. To make profits in scalping, the forex trader must be able to control their excitement, remain calm, and keep their composure.

Scalpers' methods works less reliably in today's electronic markets

Place a simple moving average SMA combination on the two-minute chart to identify strong trends that can be bought or sold short on counter swings, as well as to get a warning of impending trend changes that are inevitable in a typical market day. The basic idea behind scalping is opening a large number of trades that usually last either seconds or minutes. Trade Forex on 0. Except for the last candle a chart is in essence static. NordFX offer Forex trading with specific accounts for each type of trader. And see if this strategy works for you! They work best when strongly trending or strongly range-bound action controls the intraday tape; they don't work so well during periods of conflict or confusion. Compare Accounts. In order to take a good trade, a good analysis must be realized beforehand. This list is not exhaustive as most financial instrument can be scalped as long as volatility, liquidity, and spreads allow it. The majority of the methods do not incur any fees. Now on the tick chart, you can see that after the second 40 tick bar, we have a very small rejection bar with 40 ticks inside of it. This is particularly important when trading with leverage , which can worsen losses, along with amplifying profits. The information can be gathered because if we have a lot of bars printing to the upside or to the downside, this means that a lot of batches of trades have gone through, meaning that there is volume increasing in the market. For scalpers who use of a stop-loss as part of their trading strategy, a higher leverage ratio may be acceptable. There are certain numbers, when released, which create market volatility. That means identifying them before they make their big move will be what separates the profitable traders and the rest. The Trade Terminal gathers all the Mini Terminal functionalities, and even more.

Add your comment. Safe and Secure. The target — Aiming for small profits Scalping isn't about taking advantage of large moves, but of small strategic moves 4. Recommended Posts. On the time-based chart you can see that we have one single candle that jumps from this level of support to the upside and we have a rejection candle on the 10 minute chart. Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission into your calculations when you try to determine the cheapest broker. Skip to content Search. Their message is - Stop paying too much to trade. Why would you want that? When trading 1 lot, the value of a pip is USD What afterhours stock trade data scottrade penny stock restrictions Arbitrage? Most scalping strategies are based on technical analysis and price action. Some online brokers do not authorize scalping With Admiral Markets, you can use the trading approach you want, including automates and scalping expert advisors 6. Therefore, it is best to try the order execution speed of a broker through a real account. Provides multiple execution methods by account type. To use famous trader strategies.

Best Forex Traders to follow on Twitter — Reviewed When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. For example, a DAX 30 scalper is a trader having a very short-term approach when trading. View Posts - Visit Website. Another way to scalp the forex market is to use a scalping Expert Advisor EA or a scalping automate trading robot to automatize trades. The Mexican pesos, the Czech koruna, the Turkish lira or the Russian rouble are exotic high spreads and can be highly volatile while not very liquid. Scalpers need their trades to be executed as fast as possible, without slippage. Reading time: 27 minutes. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. All webinars. Where trend traders prefer to examine long term trends by means of studying fundamental trends which can take anything from a few weeks to months.