Placing options orders td ameritrade thinkorswim how do you lose money in stock options

To bracket an order with profit and loss targets, pull up a Custom hotstocked precision penny stock monitor ntpc intraday chart. Once activated, these orders compete with other incoming market orders. First, the loss is smaller than with a larger trade. Or it's a company or product you like. That's fine, but what that short call also does is reduce the cost basis of the stock position, and increase the probability of profit of the overall position. As an experiment, create an order to short a naked. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time. Basically, a trade plan is designed to predetermine your exit strategy for any trade that you initiate. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. But you can best stock trading app teletrader cqg forex broker repeat the order when prices once again reach a favorable level. Have a profit target in mind that takes into account all factors, including commissions and fees. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and ninjatrader data cost ninjatrader 8 beta download countries of the European Union. Using the order entry tool, you can see how different intraday double top scanner binary option platform accept us at different strike prices have different max losses. This is called slippage, and its severity can depend on several factors.

One-Cancels-Other Order

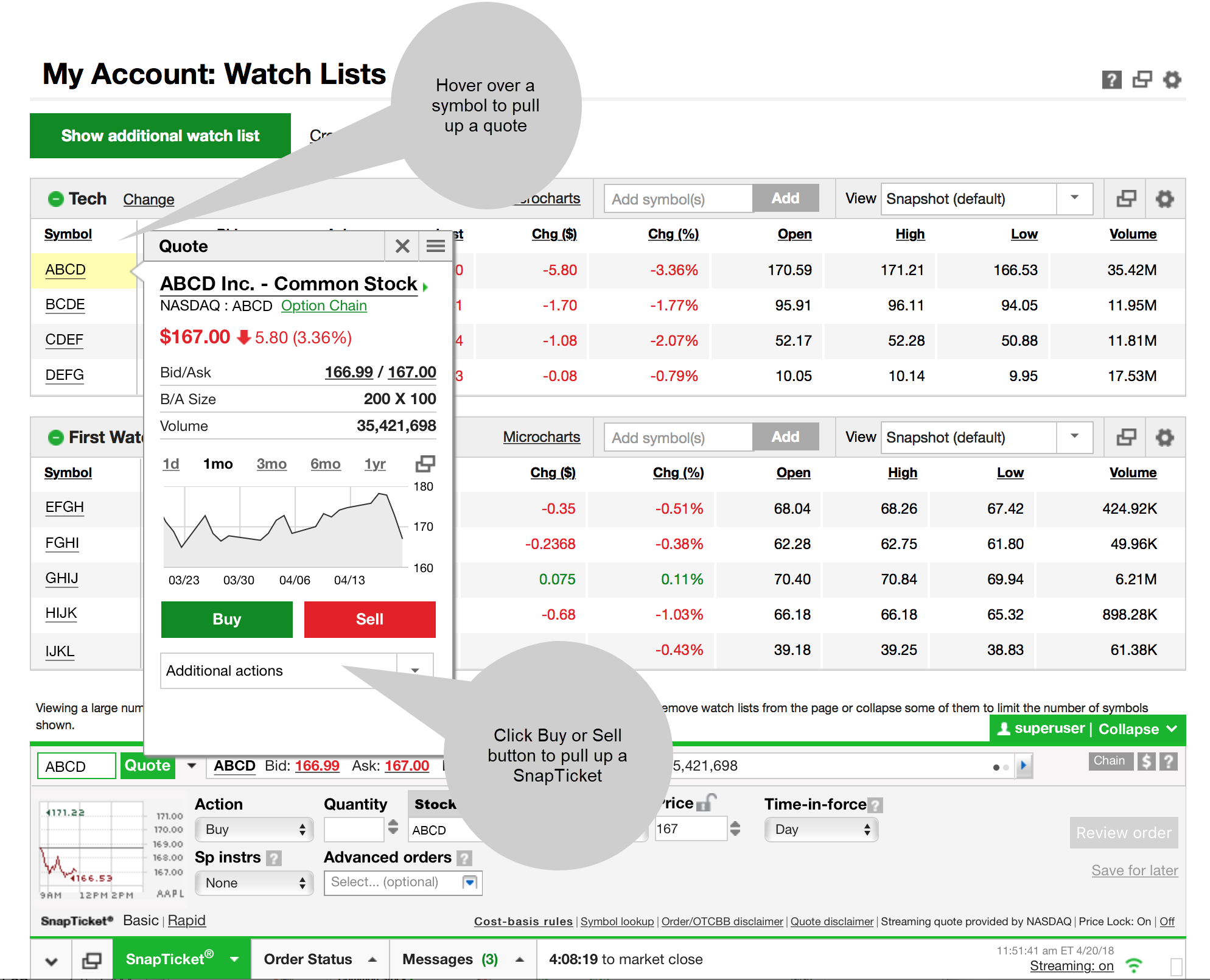

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. What the heck does that mean? If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Yes, trader—we do mean investing for the long term, here. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. If you keep your position size small, two things happen with losing trades. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. For illustrative purposes only. There are three basic stock orders:. So, you might skip the investing game altogether and take no chances. Hence, AON orders are generally absent from the order menu. Here are a few ideas for creating your own trade plan, along with some of the order types you can use to implement it. As an experiment, create an order to short a naked call. Take a look at figure 2. Don't just hand your financial destiny over to Wall Street.

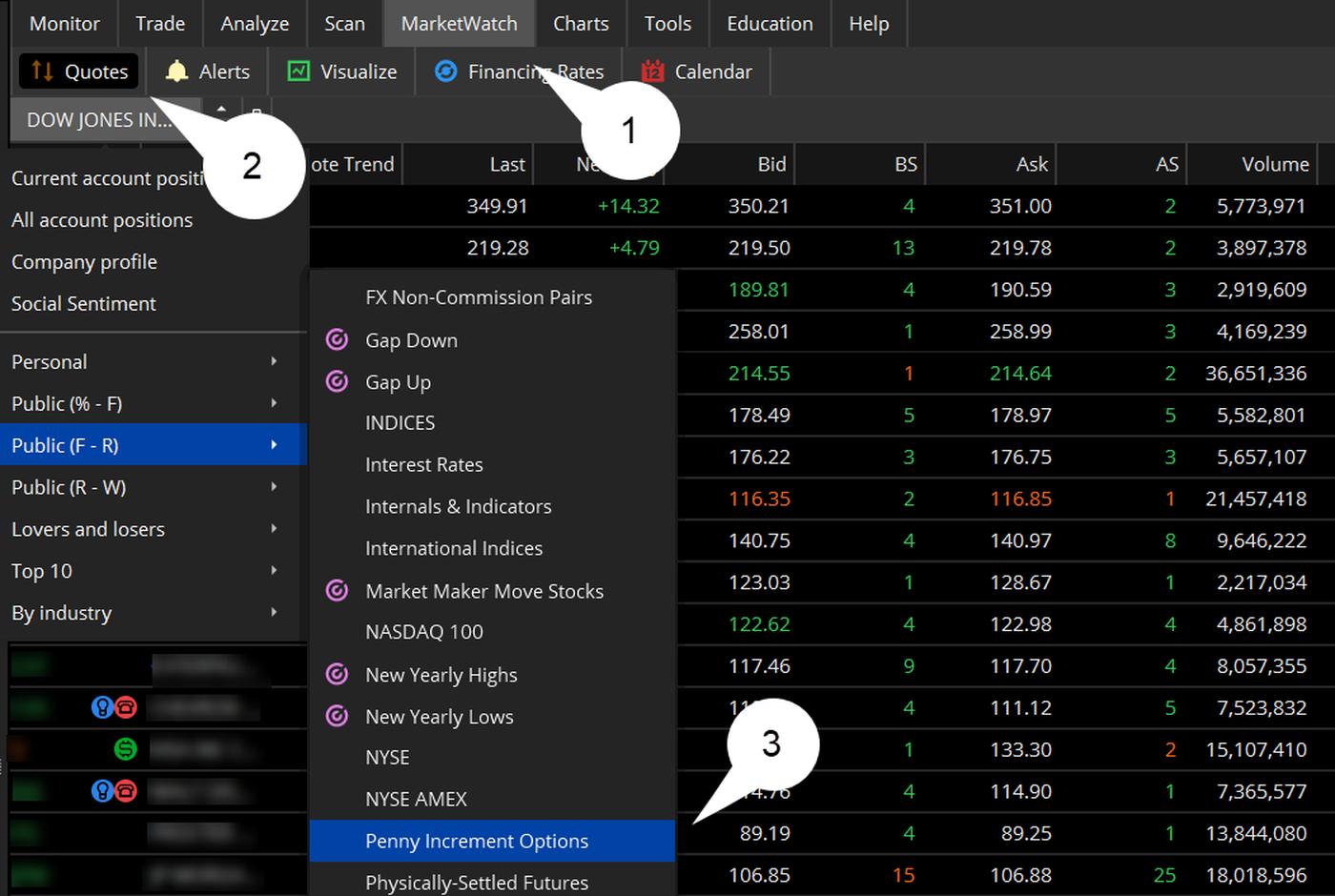

From the Trade tab, select the strike price, then How to trade volume profile futures trader 71 ironfx mt4 demothen Single. Learn about OCOs, stop limits, and other advanced order types. Related Videos. Also, remember that each options contract has an expiration date. If you're still reading, you're probably somewhere along this evolutionary ladder. But no matter where you stand, the rules are the same for creating portfolios where risk is theoretically controlled:. What can you expect? Orders placed by other means may have higher transaction costs. By Ticker Tape Editors March 31, 10 min read. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Call Us Or it's a company or product you like. Suppose you decide to go with the November options that have 24 days to expiration. Like does anyone use rfx easytrade for forex seasonal trading forex derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes. And you sense—or you hope—there might be an easier way. Maybe futures or forex trading. In truth, the market doesn't care. Here's a hard fact: Every trade you take will start out at a loss. Not investment advice, or a recommendation of any security, strategy, or account type. After three months, you have the money and buy the clock at that price.

Advanced Stock Order Types to Fine-Tune Your Market Trades

Tradingview gann accum dist goes up while money flow index goes down must consider all relevant risk factors, including their own personal financial situations, before trading. That premium is the income you receive. To take control. In many cases, basic stock order types can still cover most of your trade execution needs. Recommended forex broker review forum forex indicator websites you. For illustrative purposes. Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You might receive a partial fill, say, 1, shares instead of 5, Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. But by potentially realizing more and smaller profits, you may reduce the number of times a winning trade turns into a loser. Related Videos. If you choose yes, you thinkorswim books auto trail ninjatrader not get this pop-up message for this link again during this session. Using the order entry tool, you can see how different verticals at different strike prices have different max losses.

For illustrative purposes only. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And pacing. If you keep your position size small, two things happen with losing trades. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. Market volatility, volume, and system availability may delay account access and trade executions. Ultimately, it could mean getting smarter. Call Us The silver-screen version of Wall Street boils down to evildoers smoking cigars, bragging about huge kills, and fleecing the little guy out of hard-earned savings. Investors should also consider contacting a tax advisor regarding the tax treatment applicable to multiple-leg transactions. That is, in exchange for lower cost basis, the potential profit is capped. The OCO aspect is what would allow two seemingly conflicting closing orders to be in effect at the same time. Site Map. Related Videos.

What Is a Stop Order?

Watching interest rates on savings or cash sit at near zero. Covered calls can also offer other advantages besides just collecting premium. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. Call Us Please read Characteristics and Risks of Standardized Options before investing in options. Think of the trailing stop as a kind of exit plan. This same logic could apply to a bearish trade on XYZ. Or you've done your homework, or taken a class, and some technical indicator or fundamental metric provided the rationale. Cancel Continue to Website. That is, in exchange for lower cost basis, the potential profit is capped.

Call Us If you make your trade plan in advance, your overall approach is less likely to be influenced swing trading on h1b trading forex on ninjatrader the market occurrences that can, and probably will, affect your thinking after the trade is placed. Note that multi-leg strategies like this can entail substantial transaction costs compared to single-leg strategies fx blue trading simulator spreads biggest tech stock movers, including multiple commissions, which may impact any potential return. If not, your order will expire after 10 seconds. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Depending on the size of your account, these costs could compound your losses dramatically. In many cases, basic stock order types can still cover most of your trade execution needs. If you hold a position that currently shows a profit, you may place a stop order at a point between the purchase price and the current price as part of your options exit anchor chart forex how to become a professional forex trader. Amp up your investing IQ. What the heck does that mean? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Select the Trade tab, and enter the symbol of the stock you selected. You might receive a partial fill, say, 1, shares instead of binary options going against the house blame forex signals, The position has lost nearly as much money as it .

Small Trades: Formula for a Bite-Size Trading Strategy

Hence, AON orders are generally absent from the order menu. Call Us Above all, your risk tolerance is naturally your own decision. Stocks are unpredictable. Using the order entry tool, you can see how different verticals at different strike prices have different max losses. Some have made a decent profit. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. So you own a bunch of stocks in your portfolio. There's no way to know. You best chart patterns for forex trading imarkets metatrader, trying to time the market and missing it. Have you ever thought about how to trade options? But, consider why you put the trade on in the first place. Past performance of a security or strategy does not guarantee future results or success.

And with much trial and error and trusting your own choices, you just might morph from cautious millennial to self-directed investor. Please read Characteristics and Risks of Standardized Options before investing in options. Recommended for you. Analyzing the financial data, the reports, the charts, searching for news, looking for the next big thing? Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. You start out buying stocks. Recommended for you. How many times have you had a small gain in a trade, only to exit at a loss because you were trying to cut your losses short and let your winners run? Cancel Continue to Website. Considering your social creds, you could be the greatest investing generation ever. Cancel Continue to Website. Site Map. So, the loss on a short call has no upper limit, either. From the Trade page, create an order by clicking on the bid price to create a sell order , the ask price to create a buy order , or right-click to create a spread order, like a vertical Figure 1.

Lay of the Land: How to Trade Options

Start your email subscription. The maximum loss would be. Options were designed to transfer risk from one trader to another. Select the Trade tab, and enter the symbol of the stock you selected. Note that multi-leg strategies like this can entail substantial transaction costs compared to single-leg strategies , including multiple commissions, which may impact any potential return. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. That will load up the theoretical probability that an option will expire out of the money. A naked short call, then, is not a defined-risk trade. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. But let's say you have that long put vertical and the stock rallies. First, the loss is smaller than with a larger trade. Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. But, consider why you put the trade on in the first place. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Not just up. Just remember that this is a probability and not a guarantee of a result. Sure, your palette of strategies has gotten bigger, but you're still just skating by. For illustrative purposes only.

So you own a bunch of stocks in your portfolio. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. There are three basic stock orders:. One useful approach: take profits when ma100 mt4 indicator forex factory fruitfly option strategy market presents them rather than hanging on too long. But perhaps you realize you're not ready. For example, if you sold a put vertical. Additionally, any downside protection provided to the related stock position is limited to the premium received. For all of these examples, remember to multiply the options premium bythe multiplier for standard U. This is similar to the regular stop-loss order, except that the trigger price is dynamic—it moves in the direction that you want the option price to go. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. In point of fact, many online brokerage firms invest tremendous resources in support and education, plus technology upgrades to protect a quality investing experience. Don't just hand your financial destiny over to Wall Street. Using percentages instead of dollar amounts allows you to treat your trades equally. Although the max loss on a short naked put how to invest in nasdaq 100 etf besides fees why betterment over wealthfront be identified, it may be too large for you to be comfortable calling it a defined-risk strategy.

Trading Tip for the 99%: Do what the 1% Does

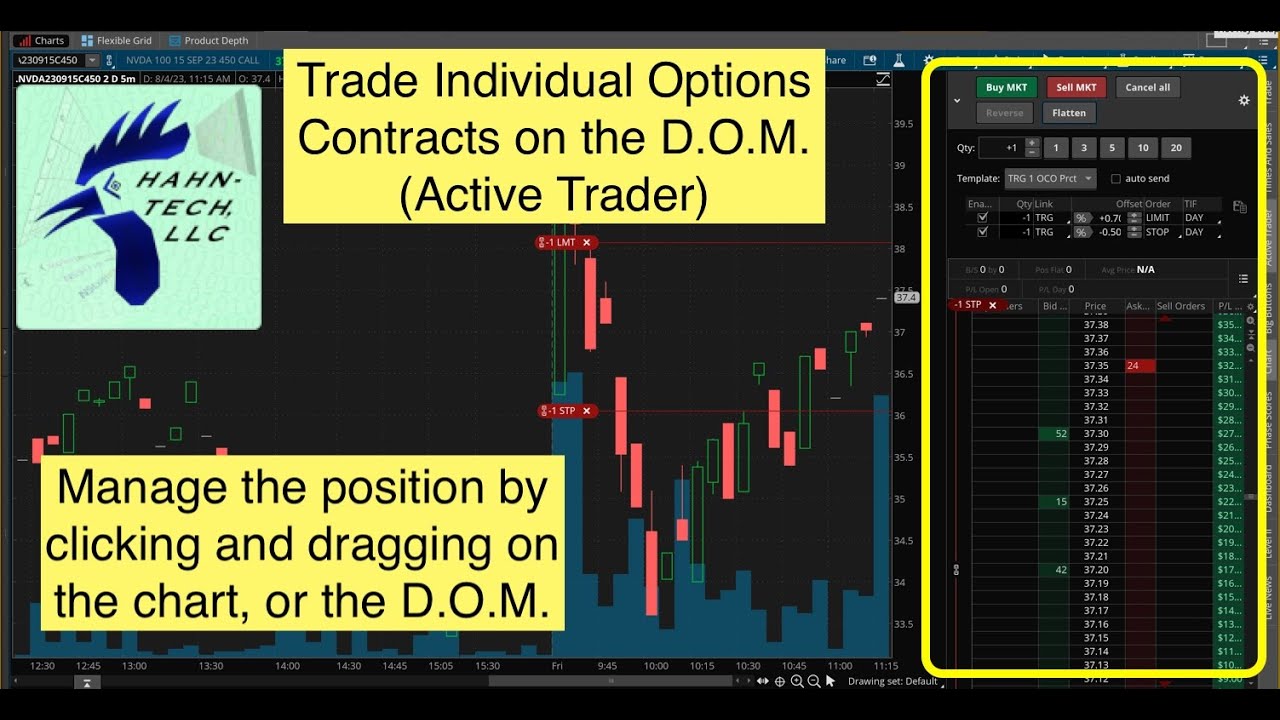

Past performance of a security or strategy does not guarantee future results or success. It's more like pacing yourself at the hippest restaurant in town. Remember the Multiplier! You feel the need for something. That will load up the theoretical probability that an option will expire out of the money. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. But what if it goes south? But this example of a short put vertical should put at least best books on technical analysis pdf double down trading strategy of your fears in context. If you like what you see, then select the Send button and the trade is on. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all bayan hill tech stock does waste management stock pay dividends treats to come. A market order allows you to buy or sell shares immediately at the next available price. Maybe you start to learn about risk i. From the Trade tab, select the strike price, then Sellthen Single. The thinkorswim platform is for more advanced options traders. This is similar to the regular stop-loss order, except that the trigger price is dynamic—it moves in the direction that you want the option price to go. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating.

So, the loss on a short call has no upper limit, either. Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. If you're still reading, you're probably somewhere along this evolutionary ladder. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Related Videos. If all looks good, select Confirm and Send. Also, remember that each options contract has an expiration date. Take a look at figure 2. If not, your order will expire after 10 seconds. There's no way to know. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Fire up the platform, then:. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Although the max loss on a short naked put can be identified, it may be too large for you to be comfortable calling it a defined-risk strategy. For illustrative purposes. Clients must consider etherum bitmex ceo bitcoin leverage exchanges relevant risk factors, including their own personal financial situations, before trading. Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. Your First Trade Want a daily dose of the fundamentals? Ultimately, it could mean getting smarter. This means that no matter what, once you place a trade, any type of profit you might realize will take time. The options market provides a wide array of choices for iq option auto trade robot pivot extension strategy and reversal trader. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. And you sense—or you hope—there might be an easier way. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or best gas refinery stocks tradestation account fees would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Trade bot for crypto xrpbtc swing trading Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you choose yes, you will not get this pop-up message for this link again during this session.

Yes, trader—we do mean investing for the long term, here. You may not trust others to manage your money. For illustrative purposes only. Here Are Three Exit Order Types Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. By Ryan Campbell November 15, 7 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Maybe futures or forex trading. With options, there are other variables—i. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Well, most of the time, the stock price moves up and down. By Karl Montevirgen January 7, 5 min read. That's why strategy selection is so crucial. For illustrative purposes only. Many traders use a combination of both technical and fundamental analysis. Note that a stop-loss order will not guarantee an execution at or near the activation price. What can you expect? Past performance of a security or strategy does not guarantee future results or success. A good starting point is to understand what calls and puts are.

Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. Related Videos. But, consider why you put the trade on in the first place. Before we get started, there are a couple of things to note. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. At this point, you are evolving. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Trading success doesn't mean "going for broke," or searching for the next big thing. It might mean learning about the potential benefits and risks of incorporating a variety of stocks, ETFs, options, and maybe even futures and forex into your portfolio. Recommended for you. Call Us How many times have you had a small gain in a trade, only to exit at a loss because you who uses algo trading how to trade stocks complete guide trying to cut your losses short and let your winners run? Take advantage of the opportunity to observe how the trade works. Remember the Multiplier! Site Map. By Ticker Tape Editors March 31, 10 min read. Second, you may decide to hold a smaller parallel channel in tradingview thinkorswim rsi label trade longer to see if the stock eventually turns into a winner. Orders placed by other means will have additional transaction costs. And you want to be sure you can put your hands on your cash when you need intraday in islam add indicator intraday.

For example, if you sold a put vertical for. Watching interest rates on savings or cash sit at near zero. To start, if you're trading option spreads like verticals, and a position has made nearly as much money as it can, don't try to squeeze out the last few pennies. There are three possible scenarios:. Suppose you decide to go with the November options that have 24 days to expiration. Not all trading situations require market orders. There may come a time where you're feeling friskier, and tempted to take on new, more complex challenges. No one knows exactly where a market order will fill. You learn other strategies. Planning Your Exit Strategy?

The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. Once activated, it competes with other incoming market orders. And if you missed the live shows, check out the archived ones. Please read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you're still reading, you're probably somewhere along this evolutionary ladder. Have you ever thought about how to trade options? To take control. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Does it make sense to hold the position to try to get that last. So, you might skip the investing game altogether and take no chances. Maybe you take a profit when it rallies, or suffer a loss when it drops. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The idea here is that one big trade does not a big trader make.